Quick Analysis: Why did FTX sell to Binance? What other obstacles are there? What are the implications for the fut…

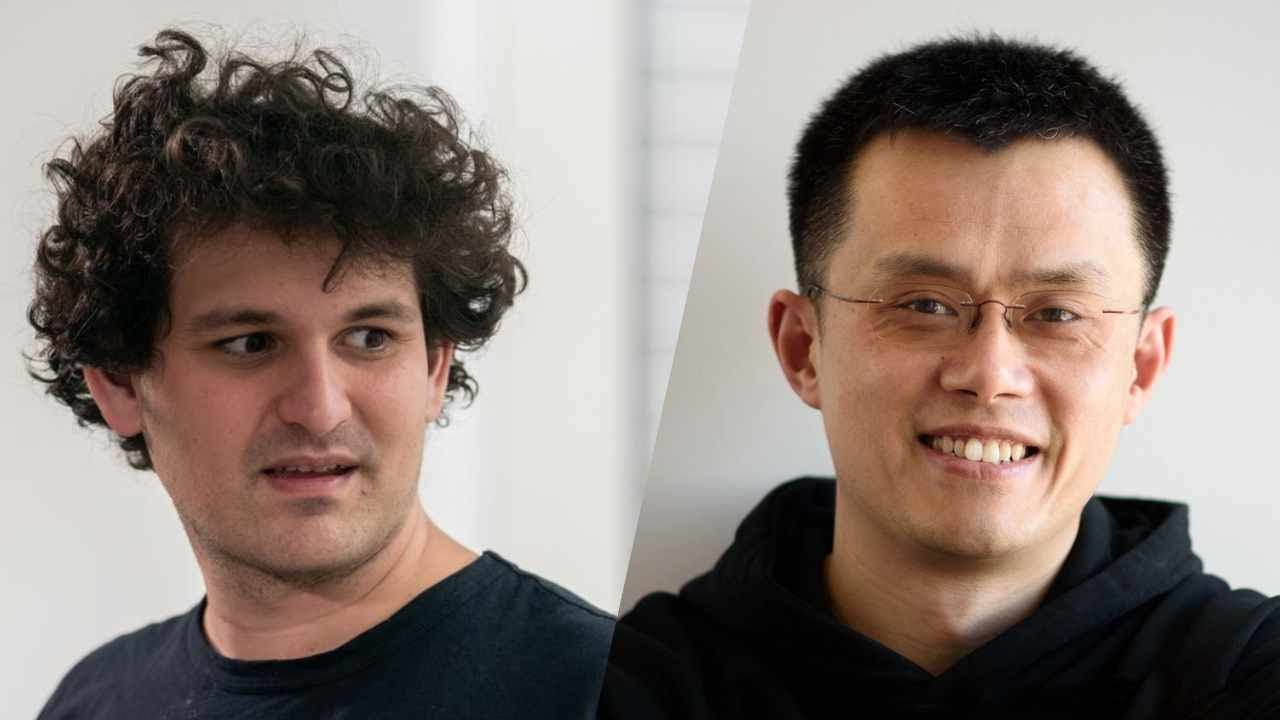

picture from bitcoin.com On the afternoon of November 8 (UTC+8), the related hot wallets of FTX suddenly appeared strange, and almost no coins were transferred out in the past several hours. At the same time, the hot wallet of FTX US continues to transfer coins. Some people say: Is FTX about to issue an announcement (stop withdrawal)? But an historical announcement happened. Binance founder CZ: This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire http://FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days. There is a lot to cover and will take some time. This is a highly dynamic situation, and we are assessing the situation in real time. Binance has the discretion to pull out from the deal at any time. We expect FTT to be highly volatile in the coming days as things develop.  This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days. SBF, founder of FTX, said: e have come to an agreement on a strategic transaction with Binance for FTX.com (pending DD etc.). Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in. It may take a bit to settle etc. -- we apologize for that. FTX.us is not included. At present, FTX is the second largest crypto ecosystem in the industry after Binance (even surpassing Binance in many places), but suddenly because of a report on Alameda + Binance’s announcement of selling FTT caused liquidity difficulties. The decision to sell the company to Binance greatly shocked the global industry and will become one of the most important and influential events in the history of cryptocurrency. Arthur, founder of DeFiance Capital, stated that Given how little time it took to close this deal. It's likely Binance acquire FTX for nominal/negligible amount and assume all the liabilities. if I am previous round investor of FTX, I will probably start engaging litigation lawyer now.  Yup, 100% acquisition.

Given how little time it took to close this deal. It's likely Binance acquire FTX for nominal/negligible amount and assume all the liabilities of FTX.  CZ 🔶 Binance @cz_binance What prompted FTX to make such an astonishing decision? There may only be one answer: FTX could not meet the user's withdrawal needs, FTX misappropriated the user's assets (such as short-term debt and long-term investment), and may even have caused it to fail to pay in large proportions. When the demand for coins withdrawal cannot be met, the misappropriation of assets or even the deficit is relatively confirmed. SBF's parents are professors at Stanford Law School, and he should be aware of the potential legal liability and the enormous impact on his personal reputation. SBF must not want to be the next SuZhu or Do Kwon. Compared with 3AC Babel Celsius AEX, etc., FTX is actually not very different. The first moment of encountering a liquidity crisis is the need for external rescue. Therefore, there are also many rumors in the market that "Wall Street" is the backer/background of FTX. This is also incomprehensible to the people. With the background and resources of SBF and his team, is it impossible to find the white knight? We can only guess that the time is too tight (too late for complex negotiations), the hole is too large (traditional institutions may not be willing to invest), and SBF's own decision-making (maximizing comprehensive interests, mutual understanding of business), there may be part of the reason. Of course, there are still many unknowns as to whether the acquisition will ultimately succeed. The first is whether the DD of Binance is successful, such as whether more problems will be found; the second is whether FTX will find other white knights while gaining time and confidence; the third is the US regulatory authorities and Whether regulatory authorities in other countries will take action, although both Binance and FTX theoretically have no US users, they are also under investigation by various US agencies. CoinDesk also pointed out that such acquisitions could violate antitrust laws. If according to normal progress, Binance successfully acquires FTX, and SBF still holds FTX US and Alameda, what will be the impact? (Although it's too early to talk about it at the moment) First of all, for Binance, the most powerful competitor is temporarily eliminated; OKX Huobi Bybit KuCoin, etc. will also benefit, and the global exchange is once again occupied by the Chinese(out of China). Competition will also continue to be fought among the Chinese; Secondly, there is great uncertainty in the future of SBF. Without FTX, we are not sure whether the Solana ecosystem he supports, as well as the current FTX US and Alameda can still show their strength in the industry. In the end, Binance’s bailout actually covered up the problems of FTX, and we may not see much progress in seeing better transparency, 100% reserves, etc. If you liked this post from Wu Blockchain, why not share it? |

Older messages

Follow-up: Does FTX keep user assets in cold wallets?

Tuesday, November 8, 2022

FTX has generally survived the withdrawal run on Nov. 7. Although many users took 2–3 hours to withdraw their assets, there were no significant withdrawals that took more than 12 to 24 hours. Today FTT

The battle between FTX and Binance: why, will FTX crash?

Monday, November 7, 2022

With CoinDesk's disclosure of Alameda's financial data, which had nothing to do with Binance, but Binance's attacks never stopped. Binance co-founder He Yi said to the event: “Binance does

Global Crypto Mining News (Oct 31 to Nov 6)

Monday, November 7, 2022

1. Bitcoin miner Argo Blockchain's previous $27 million funding plan has been announced as a failure. The Company sold 3843 new-in-box Bitmain S19J Pro machines for cash proceeds of $5.6 million.

Asia's weekly TOP 10 crypto news (Oct 31 to Nov 6)

Sunday, November 6, 2022

Author:Lily Editor:Colin Wu 1. HongKong's weekly summary 1.1 HK Government releases Policy Statement on the Development of Virtual Assets in Hong Kong Link The Hong Kong SAR Government issued a

Weekly project updates: NFT markets' competitive overview, Ethereum's new routes, Art Gobblers, etc

Saturday, November 5, 2022

1. Arweave's weekly summary a. Arweave works with Meta to give Instagram creators with storage. link Arweave, a blockchain storage platform, revealed on November 3 that it has been incorporated

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%