| 👉 2022 Healthcare Predictions (Bessemer Venture Partners) ❓ Why am I sharing this article? Companies able to unlock non-obvious types of workers and a new supply of practitioners. How to present better the clinical outcomes of Alan. I really believe on the omnichannel experience we can provide as an health insurance company. “Benefits that support diversity, equity and inclusion” is an interesting trend.

We expect healthcare companies that provide an omnichannel patient experience, integrating online and offline care, will more likely succeed longer term compared to one-modality options. As the digital health field becomes more crowded, clinical outcomes will become a key competitive differentiator. We expect the narrative in mental health to shift focus from access to quality. In 2021, we saw a tidal wave of resignations across employment categories, sending shockwaves throughout healthcare. The pandemic has led to an increase in workloads and burnout among clinicians. Providers like nurse practitioners, physician assistants, health coaches, nutritionists, counselors, and pharmacists have served as critical providers in the healthcare system given the physician shortage and the high cost of hiring a large physician team. Companies able to unlock non-obvious types of workers and a new supply of practitioners are well-positioned to scale in a world of limited clinician supply. Some studies even estimate that 30% of the remaining healthcare workforce are considering leaving their full-time hospital jobs in the next two years. This exodus from traditional healthcare settings can be an opportunity for digital health.

Increasingly, benefit managers are now looking at social factors as well when making purchasing decisions. They are beginning to place a premium on benefits that support diversity, equity and inclusion, as well as employee satisfaction and productivity. We first saw this shift from a business case to a wellness case in mental health, caregiving, and maternal health. In a tight labor market, employers are keen to attract and retain the best and most diverse workforce and many employees expect certain benefits as part of the compensation package. We believe that digital health solutions that can address and service these ESG or social aspects in the employer-psyche will stand out from the noise in the employer channel. For example, our portfolio company Folx began selling to employers a LGBTQ+ employees requested these services.

The market has seen an influx of healthcare point solutions over the past few years. In 2022, HR Benefits leaders will feel heightened pressure from their finance departments to demonstrate the value of these point solutions. It is incumbent upon these solutions to demonstrate value on investment or risk losing market share to higher-impact offerings.

👉 B2C2B in Digital Health, a founder’s playbook (Future from a16z) ❓ Why am I sharing this article? Answers to why focusing on bundle instead of usage pricing in healthcare? I loved “people and organizations buy with their heart and rationalize with their brain.” Never losing focus on the end user. Even when we are selling to enterprise, end user product engagement is our advantage.

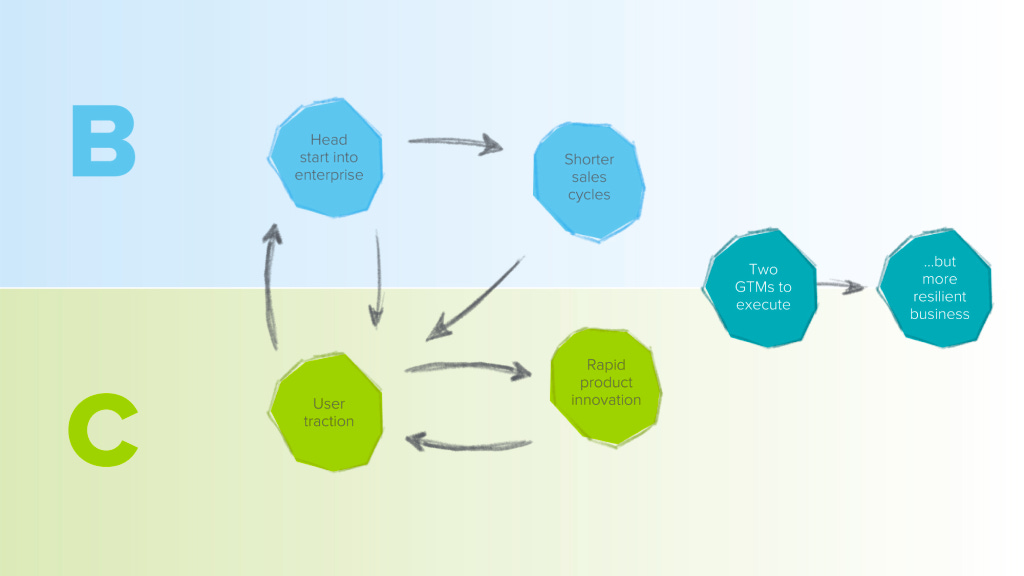

Now the biggest challenge we hear about with B2C2B is that you’re signing yourself up to execute two GTM motions in parallel, with the limited resources of a startup. The upside, though, is that if you achieve high engagement and stickiness in both motions, you’re unlocking a more resilient business model with greater long-term defensibility.

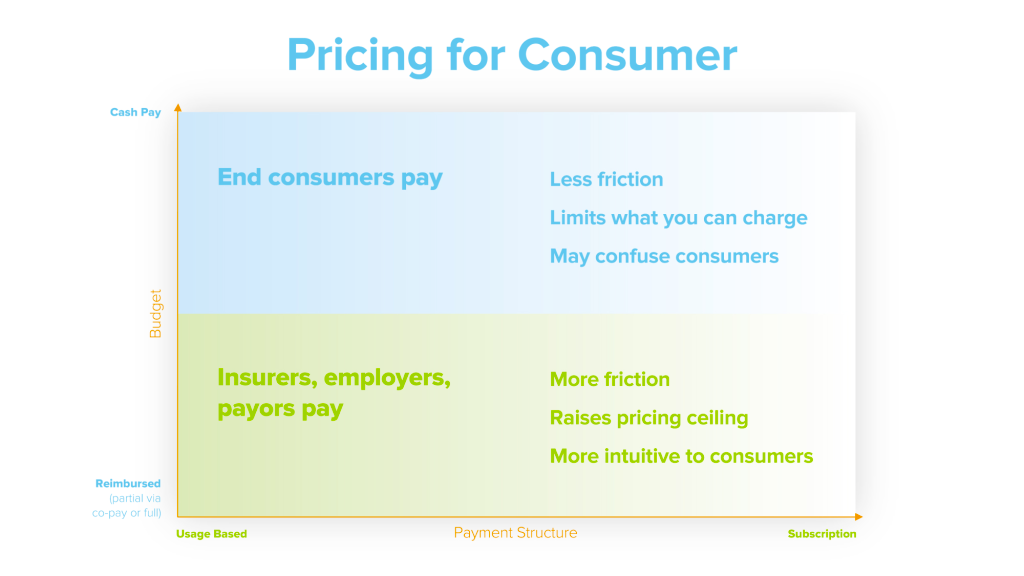

Pricing: The second tradeoff is around how you structure your pricing, whether you price for usage or in a bundled offer. If you do usage-based pricing, that might seem fairer: you pay for what you use. But you may discourage usage and, more importantly, the user feedback that is super informative to your early product development. Alternatively, you can structure your pricing in a subscription, such as a monthly fee. That may allow for a more natural usage pattern — customers can use as much as they want for a fixed fee — but it does add more friction for the initial purchase. When it comes to B2B pricing, we heard from founders that most business buyers preferred simplicity, but that really it was a matter of aligning incentives with the business you were selling into. For instance, payors are used to a per member per month [PMPM] model, so that tends to be their preference, while most employers would rather have the simplicity of an annual license.

How do you sell B2B? One of the things I deeply believe is that people and organizations buy with their heart and rationalize with their brain. That storytelling about what this device can enable using it at scale and how it’s integrated into care and to care pathways is why people are buying it. You then just simply need to justify the ROI on the backend as to why that makes sense for an organization. Throughout the conversations with founders who have successfully gone B2C2B, we heard about the importance of never losing focus on the end user. Even when you are selling to enterprise, end user product engagement is your advantage.

👉 Amazon CEO Andy Jassy Shares Bold Vision for Healthcare (Business Insider) ❓ Why am I sharing this article? Amazon just shut down Amazon Care, but their vision is to become the one-stop shop. I think that without the insurance component it is impossible to get to that position, and that has been our thesis since the beginning of Alan.

Amazon's healthcare business largely consists of three main components: primary care, online pharmacy, and health diagnostics. The company has a grand vision of ultimately blending the three separate entities into a one-stop shop for all things health-related, one person said. At this point, the teams themselves mostly aren't working together, two people said. We are excited by the potential to bring together at-home testing, telemedicine, and pharmacy offerings as three legs of the stool for a far superior customer/patient experience than most are accustomed to in primary care, and at a much better value. Amazon Care is off to a somewhat slow start, with just a handful of clients, beginning with the Peloton company Precor, as Insider exclusively reported. Amazon Care is already using the health startup SteadyMD to supply the bulk of its clinical workforce — supplementing Care Medical, a medical practice that exclusively works with Amazon — for the ongoing national expansion, the employees said.

👉 Internal memo: Amazon Care to shut down, ‘not a complete enough offering’ for corporate customers (Geek Wire) ❓ Why am I sharing this article? It is interesting to understand why Amazon Care is stopping. Is it not complete enough because they don’t have the insurance in the bundle? (highly probable in my point of view) We will see what they will come back with after the acquisition of One Medical.

Amazon will stop offering its Amazon Care primary health-care services at the end of this year, according to an internal memo, after determining that it wasn’t “the right long-term solution for our enterprise customers.” “Although our enrolled members have loved many aspects of Amazon Care, it is not a complete enough offering for the large enterprise customers we have been targeting, and wasn’t going to work long-term.” It is a hybrid of virtual, in-home primary care and urgent care services, without brick-and-mortar clinics or physical locations.

👉 From Cedar to Ro, here’s every digital-health startup that’s cut workers so far this year (Business Insider) Cedar had cut 24% of its staff. Sidecar Health: LinkedIn posts by former employees claim 110 workers were let go, about 40% of Sidecar Health's workforce. Ro: Number of employees laid off = 18% of workforce, specific number of employees undisclosed.

👉 Weekly Health Tech Reads 8/28 (Health Tech Nerds) ❓ Why am I sharing this article? It is a very US-centric approach on benefits, but still it is interesting to see if the work market is going to change and how it is going to affect our arguments. There will always be requirements to keep your best employees, to find alternatives to salary increases to make employees happy. That is also why we need to build a strong business case on how we increase productivity and reduce absenteeism in companies.

New data suggests that employers are rolling back parental leave benefits. Companies offering maternity leave above what is required by law dropped from 53% to 35% since 2020, and companies offering any paternity leave has fallen from 44% to 27%. As one would expect, companies generally expand benefits when it is hard to hire people (i.e. at the beginning of the pandemic) and take away those benefits when they don't need to offer them. Link (WSJ paywalled).

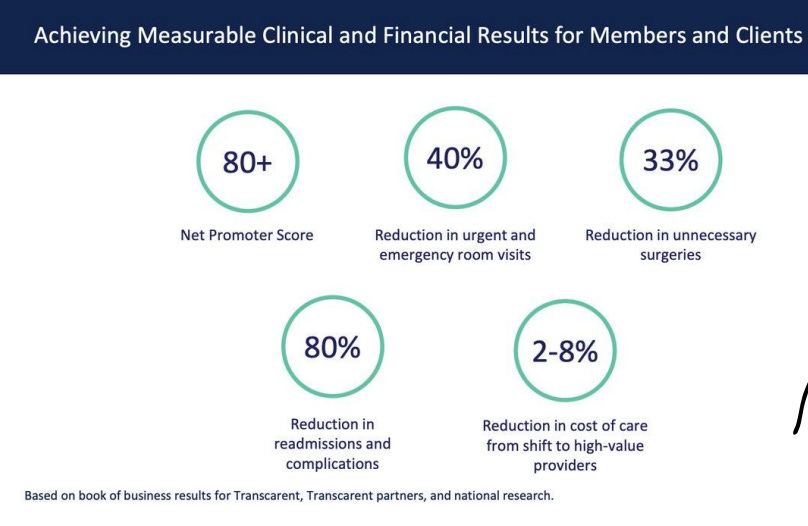

👉 Transcarent: See the presentation digital-health veteran Glen Tullman used to raise $200 million for his new billion-dollar startup (Business Insider) ❓ Why am I sharing this article? They also used “one-stop shop”. They don’t have many customers though. I don’t think their strategy with many partnerships will work. For their focus on MSK and what we can learn from it. How they link pricing to outcomes. I don’t know how we could do that. It would be great if we could show similar numbers (see image). The list of topics they want to tackle (see image) for our health stories.

To be a "one-stop shop" for healthcare, the company works with various partners like CirrusMD for telehealth, Walmart for prescriptions, and provider systems for surgeries. Musculoskeletal Care: Complete virtual physical therapy from comfort of home. Surgery Care: High-quality surgical care and coordination support Hospital at Home: At-home care for post-acute needs

Many of Transcarent's roughly 80 clients were established through BridgeHealth, a company Transcarent acquired in 2020. Today the company's core business is surgeries, physical therapy, and home care.

👉 Completely new healthcare markets and what to build for them (Out-of-Pocket Health) ❓ Why am I sharing this article? Remote first companies: Setting up wallets or payments for employees in different states and countries to get their own health insurance in their locale. Lunchbox and SafetyWing are creating products for this. Designing virtual enrollment and awareness campaigns for employees that aren’t in the office. Companies like Fertu are tackling this. Healthcare AI startups: Data pre-processing and standardization is a huge part of the data janitorial work that AI startups have to do and many end up building their own custom ontologies. Tuva is building opensource software to standardize some of those ontologies. Clinician Influencers: Clinicians really leaned into social media during COVID, for better or worse. People like Peter Attia, Eric Topol, Tiffany Moon, Austin Chiang, etc. all have hundreds of thousands of followers.

👉 Les dépenses de santé en 2021 - édition 2022 - Résultats des comptes de la santé (Drees Solidarités Santé) ❓ Why am I sharing this article? Les soins de dentistes augmentent ainsi de 22,5 %, portés par la consommation de prothèses dentaires et plus particulièrement les prothèses du panier 100 % santé, en hausse de près de 40 % en 2021. En nombre d’équipements consommés, le panier 100 % santé devient majoritaire dès 2020 avec 54 % des équipements vendus. Également soutenue par la progression des appareils auditifs du 100 % santé, la consommation d’audioprothèses augmente dans des proportions importantes (+60,0 %).

En revanche, le redémarrage de la consommation d’optique médicale (+15,8 % en 2021) est majoritairement porté par le panier au « tarif libre ». L’offre 100 % santé en optique ne connaît pas un essor comparable à celle des prothèses dentaires et des audioprothèses. Elle ne représente en 2021 que 5 % de la dépense d’optique médicale. Les soins des médecins spécialistes bondissent. Pour les spécialistes, la consommation atteint un niveau très largement supérieur à celui de 2019. La part des Organismes Complémentaires augmente de 0,6 point en 2021, à 12,9 % après 12,2 %, sous l’effet de la reprise d’activité et du développement du 100 % santé. En 2021, l’Allemagne et la France consacrent à la santé les parts de PIB les plus élevées de l’UE-15, juste derrière les États-Unis. L’Allemagne et la France dépensent environ 12,5 % de leur PIB pour la santé, au-dessus des autres pays de l’UE-15.

👉 Weekly Health Tech Reads 7/24 (Health Tech Nerds) ❓ Why am I sharing this article? Elevance, the company formerly known as Anthem, reported Q2 earnings. It's worth noting their comments about the commercial selling environment and how conversations with employers are shifting insurance conversations to think about it as a piece of their human capital strategy to attract and retain talent. Link

👉 Weekly Health Tech Reads 10/16 (Health Tech Nerds) ❓ Why am I sharing this article? Bright Health announced that it is exiting its core insurance business, the exchanges. This move to focus on Medicare Advantage represents the most viable path forward for Bright, which didn't appear to have many good options. As Bright pitched in the investor update call, this move will allow them to focus on the senior population, which certainly has proven to be a profitable line of business for other organizations. It does not appear that Cigna invested in the $175 million capital raise that Bright announced as part of this release. Keep in mind that Cigna led a $750 million funding round in Bright less than a year ago. Bright shared with analysts that it expects the new business to generate $3 billion of revenue and be profitable on an Adjusted EBITDA basis next year. Link (Bright Presentation)

Babylon Health announced this week it will be selling Meritage Medical Group, an IPA with 1,800 clinicians that it acquired in California last year. While Babylon shares in the press release that it grew Meritage's revenue from $111 million in 2021 to $400 million in 2022, it appears Meritage didn't grow its patient volume at all over that time - Babylon's press releases last year announcing the acquisition and this week both cite Meritage as having 90,000 patients. Pretty eye-opening that a primary care org can apparently grow revenue by 4x while serving the same amount of patients, right? For Babylon, this seems like a move made by a company struggling to raise capital to stay afloat - why else sell an organization growing revenue by 4x when costs should stay relatively flat (which seems like it should be true if you're treating the same # of patients)? Link.

👉 Weekly Health Tech Reads 9/4 (Health Tech Nerds) ❓ Why am I sharing this article? Virtual primary care startup 98point6 announced it is pivoting to sell its platform to incumbent care delivery providers and raised $20 million to execute on the pivot. Its first customer is Indigo Health, an urgent care model within MultiCare Health System. It's a fascinating change in strategy for 98point6, which has previously raised $247 million to sell its virtual primary care model to employers and others. It seems indicative of the broader challenge we're seeing in the space - we're past the peak virtual primary care hype cycle and the promise of scale is looking like more like a mirage for many of these companies. So, if you've spent hundreds of millions of dollars building a new tech platform for primary care, why not at least try licensing that tech platform to incumbent providers, who at least theoretically have the opposite problem of these startups - they have the patient populations, but don't have the nice tech experience. Seems like we're going to see many companies making this pivot over the next 12 - 18 months as they struggle to grow care delivery models. Link

Ari Gottleib suggested on LinkedIn this week that Bright has been misleading investors regarding its liquidity, pointing to Georgia and Texas as two states in particular where it appears to have problems. He suggests that without additional capital, regulators should be stepping in to transfer Bright's membership to other insurers that are on surer financial footing and can reliably pay claims for members. Similar to Oscar above, Bright seems to be in a really tough position at the moment. It's hard to imagine any capital raise for them at the moment coming with anything other than some really draconian terms. Link

👉 US health insurance prices went up nearly 30% over the past year (Quartz) ❓ Why am I sharing this article? Health insurance prices reported their highest yearly annual increase since the US Bureau of Labor Statistics (BLS) began posting them in 2005. Still, according to the latest predictions by the consulting firm Mercer, health insurance prices are not done rising, and will go up even more significantly in 2023. Employer-based coverage especially, which has so far only had moderate increases (4.4%) is expected to go up by an additional 5% in the coming year.

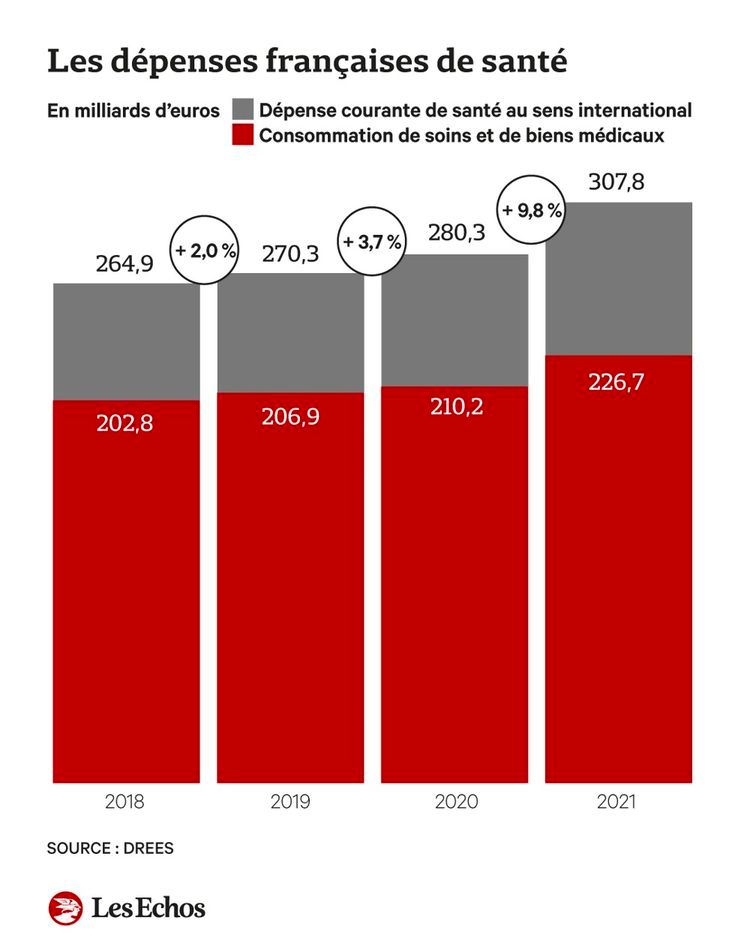

👉 Les dépenses de santé enregistrent un bond exceptionnel en 2021 (Les Echos) Selon la DREES, ces dépenses ont connu leur plus forte augmentation depuis 30 ans. Si tous les secteurs de soins contribuent à cette hausse, les dentistes ainsi que les services hospitaliers et les laboratoires d'analyse en sont les principaux moteurs. Les dépenses françaises de santé ont augmenté de 7,9 % en 2021. Avec un montant total de 226,7 milliards d'euros, il s'agit de la plus forte augmentation des dépenses observée depuis 30 ans.

Les soins de dentistes ont ainsi bondi de 22,5 %, portés par la consommation de prothèses (près de 40 % d'augmentation). La consommation d'audioprothèses a, elle, augmenté de 60 % tandis que la consommation d'optique médicale a progressé de 15,8 %, « malgré un effet d'entraînement plus faible du 100 % santé que pour les prothèses dentaires et les audioprothèses », souligne la DREES.

👉 Inside Amazon Care’s downfall: Employees reveal how Amazon got in its own way when it tried to take on the healthcare industry (Business Insider) ❓ Why am I sharing this article? Description of Amazon Care: Born out of a pilot in Grand Challenge, Amazon's secretive incubator for big ideas, the app-based service could get people in contact with clinicians in 60 seconds, 24/7, preventing urgent care visits — but also potentially catching other issues before they became unmanageable. That could save money for the self-insured employers footing employees' medical bills, Amazon Care's eventual customers. It's a nice idea, but the business model fell flat. The venture made a big push to become patients' primary care provider over the past few months, so those patients are now having to find new doctors, too. Four current and former employees said that Amazon Care's patients loved the product. Many of its clients had double-digit enrollment rates, meaning that 10% or more of their eligible employees signed up for the app, one of the current employees said — not terrible in healthcare.

Culture in large companies: Many of the current and former employees believe the failure boils down to the same culture clash that's plagued other health bets at Apple and Google, where healthcare issues that require meticulous solutions bore and frustrate engineers that want to move quickly and hit the business metrics that lead to short-term wins and promotions. "Most product managers coming in at Amazon don't really care about, you know, changing the world," a former employee said. "And when your business KPIs [key performance indicators] don't really line up with what's best for the customer, you have Amazon Care, basically." There was a constant burden of explaining concepts in healthcare to company leaders without healthcare backgrounds, the five people said.

Scaling the medical offer: Back when Amazon Care was in Grand Challenge, Jassy, who was then heading up the cloud business, was skeptical of how it would grow, a former employee said. He thought it would be difficult to hire the number of clinicians needed across the country, plus the business had dismal profit margins, the employee said.

Sales number: Amazon Care is overseeing roughly 100,000 patients, two current employees told Insider. Interest from companies was shockingly lackluster. Roughly 20 companies signed up, including Hilton, the hotel chain, the employee said. But that was far short of the goal set for Amazon Care by its leaders and Amazon's upper management: 140 clients by the end of 2022.

Why Sales were lackluster? Benefits executives weren't eager to offer their employee population disparate services, with only workers in the right locations getting in-person care, and the rest only getting telehealth, the current employee said. Even now, Amazon Care can only vaccinate employees of its enterprise clients in the state of Washington due to the in-person infrastructure and licensing required to administer them, the two employees said.

"Although our enrolled members have loved many aspects of Amazon Care, it is not a complete enough offering for the large enterprise customers we have been targeting, and wasn't going to work long-term." Sales and client relations were awkward. The product was expensive, priced for double-digit profit margins, which is unusual in the benefits space, a former employee said. Amazon struggled to get health plans on board with its offering because it didn't have enough data to show that it was effective and lowered the cost of care for patients, as Insider reported. The former employee told Insider that the venture would've needed years to prove that, though it was part of the pitch to clients. To make up for Amazon Care's slow sales, it hired more sales people instead of investing in product development, three current and former employees said. Yet companies were asking for specific improvements like website functions that never happened, one of the current employees said. Improvements that did gain traction had to face skeptical security officials in AWS, which powered Amazon Care, that saw everything as a potential threat to Amazon's reputation, three former employees said. "Every security meeting started with 'What is that headline going to look like?'" one of them said. Amazon tried and failed to build its own electronic medical record for Amazon Care, one of the former employees said. Getting permission to use one made by Athenahealth required a months-long back and forth with the security folks, multiple memos, and ultimately approval by Jassy himself that came with several stipulations, two of the former employees said. On the other hand, two former employees said that Amazon physicians tended to be rigid and ask for things that were too specific instead of explaining what they needed.

👉 Amazon is secretly testing another virtual-care venture that aims to treat common conditions online (Business Insider) ❓ Why am I sharing this article? The latest project, code-named Katara, is a virtual-care effort that's being tested on Amazon's workers, two current employees said. It's designed to offer people online care for common conditions such as acne or hair loss, according to one of the employees. Katara's approach could create a potent challenge to direct-to-consumer healthcare companies like Hims and Ro, which similarly sell treatment plans for health issues like erectile dysfunction over the internet. Katara is overseen by Aaron Martin, the two employees said. He sits under Neil Lindsay, the boss of Amazon Health Services. Amazon Health is a growing umbrella of health bets, not least of which include One Medical, the primary-care startup Amazon is buying for $3.9 billion.

👉 Prime Health (No Mercy / No Malice) ❓ Why am I sharing this article?

👉 Babylon Disrupted the UK’s Health System. Then It Left (Wired) ❓ Why am I sharing this article? Babylon is focusing on the US. We have a big opportunity to be the biggest European player. We will need to manage the “image” that those tech companies give and show we are different.

Earlier this month, Babylon Health canceled its last hospital contract with the UK National Health Service (NHS) eight years early, with CEO Ali Parsa calling such projects “a distraction” that aren't lucrative enough to bother with as the company seeks to cut costs. The use of Babylon triggered complaints from health regulator MHRA, and clinicians reported that the AI was missing signs of serious illness. One complaint even questioned whether the AI symptoms app even works. Babylon offered two main services in the UK: An AI-based chatbot used for triaging patients, as well as a digital-first medical practice called GP at Hand, in which registered patients can chat to a doctor via video calls. It has sold off its Canadian business in favor of a local licensing agreement. Babylon is retaining GP at Hand, though it's not making a profit. In the NHS, GP practices are run as private businesses and doled out a flat fee per patient that works out to an average £155 per capita annually. Earlier this year, NHS-embedded AI health care company, Sensyne, slashed staff numbers to stave off collapse, and Google shut down its AI-based Streams clinical app last year.

👉 Wearables market sees first ever decline in Q1 (Mobi Health News) ❓ Why am I sharing this article? Always interesting to have a view of the progress of the wearable markets, as it might be “mature” enough somedays for us to try to work more with wearable technology. I’m not sure it is the case yet.

Declined 3% year-over-year. Wristband wearables declined 40.5%. Watches actually grew 9.1% during the quarter, making up more than a quarter of the overall market. Apple now boasts 30.5% market share. The report attributes Apple's performances to its Apple Watches, as shipments of its AirPods were flat.

👉 Blood oxygen sensing is finally rolling out on the Oura Ring (The Verge) ❓ Why am I sharing this article? We should compare the $6 per month of Oura with the membership fee and see what the membership fee gives you access too. The sleep health story is interesting, but I don’t know what we can do without hardware.

Blood oxygen metrics have become increasingly popular when it comes to sleep tracking. It generally works by shining a red LED onto your skin. The amount of light that’s then reflected back is used to estimate how much oxygen is in your blood. The Oura Ring will take continuous SpO2 measurements during sleep. Oura says users will see their blood oxygen data in the form of two new metrics: average blood oxygen and breathing regularity. The former is a straightforward percentage, while the latter is meant to track “observable drops in average blood oxygen levels.” That, in turn, is meant to help users see how many sleep disturbances were detected in a single night. Oura introduced a new $6 monthly subscription for the Gen 3, and as you might expect, it wasn’t a popular decision among long-time customers.

👉 Top Teams in Biopharma (Healthcare Insights) ❓ Why am I sharing this article? Ultimate genomics funding: Ultima Genomics emerged from stealth after raising a $600M Series A round from investors including Andreessen Horowitz, Founders Fund, and Khosla Ventures. The company claims that it has the capability to sequence the human genome for $100, compared to a $500 price tag from competitor Illumina.

👉 Tencent Health Game

👉 ‘Move-to-earn’ Solana app StepN is latest crypto gaming craze (Tech Crunch) ❓ Why am I sharing this article? StepN, an app that lets users walk and run to earn tokens, has quickly become a household name in the play-to-earn blockchain gaming, or GameFi, world. Two to three million users worldwide are now active on the app every month. As of May 22, the market cap of StepN’s native token GMT stood at around $860 million. It’s generating $3 million-$5 million in net profit from trading fees a day and earning up to $100 million every month. To start earning tokens and logging one’s mileage on StepN, users need to first spend at least 12 sol or around $600 on a pair of virtual shoes at the current market rate. The digital shoes are in the form of a non-fungible token (NFT) that runs on the Solana network and Binance’s smart chain so can be resold later, but the entry fee is still not a trivial amount for any casual player. Over time, StepN users will need to accumulate new kicks to level up. The usual return on investment requires about a month, upon which people can start generating income of up to several thousand dollars per day depending on their level, activeness and the current price of StepN tokens. In other words, the game can be quite lucrative. Other critics question the financial sustainability of play-to-earn. Maintaining such a business model means the gameplay needs to be either so addictive that users continue to play without cashing out their coins, or that the app continues to attract new users who buy in only to replace those who cash out. Critics have even drawn parallels between play-to-earn to pyramid schemes. Huang also argued StepN’s fitness component makes it fundamentally different from Axie Infinity. “Yes, users can make money from StepN in the early stage, but over time they will also grow accustomed to staying active, so they will continue to walk or run regardless of financial rewards.”

➡️ Is that true ?

It’s already over! Please share JC’s Newsletter with your friends, and subscribe 👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! | |