| 👉 How to design a referral program (Andrew Chen) ❓ Why am I sharing this article? We have good word of mouth but I’m not sure it is enough to have a great referral program, as I’m not sure if people know each other enough to push it. We need to define the sub-circles well. Are we too late for a referral program? At least I think we should focus on viral features first. I’m not aligned with his view to ask everywhere, as it kills product quality. I liked the idea of not making it look like an ad and of “holidizing”. Interesting angle on targeting new users instead of existing ones. How to do internal incentives and not $. How to think of cannibalization in CAC. How to push for bigger wins but for more actions (conversions for example).

Advantages: They have big advantages over paid marketing channels, in that you give your CAC to your users, who then spend it within your product, as opposed to handing it over to Google or Facebook. This is particularly useful for products that target high acquisition cost niches, whether that’s crypto users or on-demand drivers, whose CAC are often >$200, since the users often know each other.

When to do it? A successful referral program can be 20-30% of your acquisition mix, as one of several acquisition loops. It’s not a silver bullet, but it’s worth adding to complement other marketing efforts. CEO/cofounder Drew Houston’s made a very helpful presentation describing his journey towards referral programs, and the general trajectory was the following: First, do all the things you’re “supposed” to do : Big bang launch at a tech conference. Try some AdWords, hire a PR firm / VP of Marketing Paid marketing programs created a CAC of $233-388 for a $99 product Then trying affiliate programs, display ads, and many other things — which all failed

… but then failing! And realizing none of it works that well. Then realizing the key was to accelerate word-of-mouth and viral growth by offering a “give and get storage space” program. Boom. 100,000 users to 4 million in just 15 months, with 35% of daily signups. The entire deck is wonderful — created roughly a decade ago, but still very relevant — and I highly encourage you to check it out here.

➡️ Good deck Referral programs work very well for certain kinds of products, particularly ones that are already spreading via word of mouth. In Dropbox’s case, there is a natural use case between friends and colleagues — shared folders — which naturally complement the referral channel. Referrals drive that forward, providing an economic incentive to tell friends.

As another example, at Uber where I ran the referral programs for drivers and riders at various points (and spent >$300M/year on them), the program for driver referrals was naturally successful. Drivers were often from certain sub-communities, whether newly arrived immigrants or limo drivers, and people were naturally already talking about the earning opportunity.

➡️ People who really know each other ➡️ I’d like us to focus on this first Limits: Referral programs have their limits. Of course they don’t really work that well for products that have low LTV — that’s why we don’t see free social photo sharing apps reward their users for referrals. They also tend to decline in importance over time. Years after the rollout of Dropbox’s referral program, the natural virality of their core product — just the process of people sharing their folders and files with others — had come to completely dominate user acquisition. This had become the primary method of spread, and the referral program became much less important.

How to: The Ask

➡️ Optimizing for growth, not product quality Thus, make the referral ask part of the main flows. After the user is buying something within your app, ask them if they want $X cash back now, by inviting someone. Or if they interact with a friend within the app — assuming the product allows invitations of some sort — follow up by asking if they want to invite others. And add it to the onboarding flow, and at the end of key transactions when the user is otherwise done, and you might as well capture engagement.

And for god’s sake, don’t make it look like “an ad” with big splash text and graphics — make it plan, like something that’s part of the normal UI where the user can interact.

How to: Holidizing How to: The Target The headline best practice is that your referral program should target new users to refer their friends — this means prompting users during their initial onboarding flows, and adding emails as part of the onboarding, among other surface areas. This is in direct contradiction to folks who often argue to let users experience the product first, have a good experience, before they’re hit up to invite. Why focus on new users? First, mathematically, it’s easiest to make a big impact when you are hitting a cohort of 1000 new users when it’s as close to 1000 as possible, not in day 30 when the cohort will have churned and gotten down to 150. And in the math of the viral factor, you have a better chance to hit >1 when you have 1000 users invite 1000 users than to ask 150 to invite 1000. Second, new users generally have more friends who haven’t yet used the product, because they are new themselves. Once they have gone through the referral program a few times, then they will have naturally tapped out their networks.

How to: Incentives The simplest thing to do is a “give $5, get $5” and give that offer to everyone, in an untargeted fashion. But a product leader soon realizes that this is inefficient — perhaps it’s best to give some users $15 and others $5, depending on their value. You’ll note in the original Dropbox offer, the incentive itself was storage space not dollars. Many referral programs for mobile games tend towards intrinsic rewards as well, earning you points if you invite friends. The advantage of intrinsic rewards is that it’s particularly cost effective when the incentive is something you can control, like points. The problem with intrinsic rewards, of course, is that external users — people who have never heard of your product — are the least responsive to points or otherwise. Dropbox’s storage offer is maybe somewhere in the middle, since it’s at least a concrete form of value.

As a result, most referral programs have tended towards dollars over time, though I think the important idea is to prioritize new, outside users, and think about how to make the incentive as concrete as possible. There’s the basic question of how to set the incentive amount. Typically this is based on a basic calculation of CAC/LTV, which has major weaknesses as it doesn’t take into account cannibalization. Instead, the focus is often to pick a simple number — if you know that the average user who signs up spends $20, then you can create a referral program that rewards a $5 give/get with some margin of safety. But the big lever on the incentive, of course, is to increase the amount — and the largest amount generally comes from tiered offers that have some form of breakage. An example of this is to say, “$100 when you sign up and buy 5 things” rather than “$5 when you sign up.” Given that the difference between a signup and a repeat conversion rate might be 100x, you might be able to safely raise the amount 20x. At Uber, this went so far as to combine two distinct numbers: A headline number that combined both the initial signup conversion as well as the first month’s earnings (again, as long as you drove X trips in the first few weeks). This resulted in a $3000+ number, a huge upgrade from the initial $200 numbers we started with. These larger headline numbers always tested much better on A/B tests, whether in email marketing or banner form, and while it might feel like the reward becomes unattainable, it’s possible to create a second or third or fourth tier to go along with the big headline number. You could say, earn $X when you fulfill all the requirements, but then a smaller number, $Y, when you only fulfill a few. That way you get the marketing impact of the big number but still have a fallback for users who don’t hit all the milestones.

➡️ Good idea I’ve also seen B2B contexts where in a professional setting, people tend towards inviting more if they are perceived as altruistic, giving out a large $ discount to others. In the end, probably just worth A/B testing to see what works best.

How to: The Payback After all, if the lifetime value of these users exceeds the cost of acquiring them, shouldn’t you just go full steam ahead? Well, maybe. What if you can get much cheaper acquisition via another channel, like TikTok ads. Then any dollars that go to this might be better spent on ads. Or what if improving a referral program takes engineering team away from critical features? So yes, of course look at the CAC/LTV of your referral initiative, but think about how you might compare the tradeoffs against everything else. The trickier ROI question is cannibalization: How many of the users that you bring in via referrals would have come in through word of mouth anyway? If you spike the referral amounts, going from $5 to $20, are you just creating a “pull forward” effect where users that would have arrived for free a few months from now are coming in suddenly, but at a cost, and to the detriment of a later month?

➡️ Very important Generally, the goal is to measure something like “Cost Per Incremental Customer” by A/B testing offers to a control group that gets the standard number, and a test group that gets the elevated number. Because you’re trying to capture organic users, you often have to do this as a “twin cities” experiment, where we run one set of offers in Phoenix and another in Dallas — this is the Uber approach, and in B2B you might do it via one set of companies versus another. And then you measure what the uptick actually looks like. If there is a lot of cannibalization, then the CPIC number will be large — this is the true CAC, cannibalization aside.

👉 Harvard, a Media Company (Readthegeneralist) ❓ Why am I sharing this article? Media can turn expenses into revenue. Plenty of businesses devote time to content marketing. But by building a media arm worth paying for, companies are able to turn marketing expenses into a revenue stream. HBR has nailed a “make once, sell infinitely” approach. Case studies and courses are able to command a high price (can you imagine spending $18 for a single NYT article?), require little to no added maintenance, and are of effectively evergreen relevance.

👉 Instagram feed engagement down 44%: ❓ Why am I sharing this article? A study of 81 million Instagram posts found engagement on non-Reels posts were down 44% since 2019 (from 5.2% to 2.9%). Meanwhile, engagement on its TikTok-like full-screen Reels videos have increased 5x from 1.3% to 9.1% since late 2020. If not already anecdotally obvious to every user, Instagram continues heavily promoting its Reels feature in the app.

👉 Thread by Nathan Baugh about Tesla marketing (PingThread) ❓ Why am I sharing this article? What would our super fans want to see about Alan? How can we be more fun in terms of product drops? Are there videos we could product about Alan?

👉 Thread by Anand Sanwal: Hubspot, Stripe, and JP Morgan Chase all acquired similar companies recently (PingThread) Every SaaS company should have a media arm with a newsletter that gives industry news. Just acquire an influencer in your space with a solid following. Make them editor-in-chief. Bundle their content for free with your software subscription. Hubspot acq’d The Hustle - rumored valuation of $27M and price/revenue valuation multiple of 2.25x-2.7x. Robinhood acquired MarketSnacks. Stripe bought IndieHackers (and also owns/operates Stripe Press.

👉 Google Privacy Sandbox, SDK Runtimes, On-Device Targeting (Stratechery) ❓ Why am I sharing this article? I agree with this position and I think that mixing smart, relevant, and protective digital advertising will be important in the future of the industry and even of Alan. For us, it might not be advertising per se, but how to recommend the right service or product? Which is pretty close.

The final point is more of a fundamental one: a lot of the criticism of any of these initiatives from Google seems rooted in the belief that targeted advertising of any kind is fundamentally bad. I understand that position, although I would once again note that Apple clearly doesn’t have a problem with targeted advertising, as long as it is first party (which is great not only for Apple but also Google and Amazon). I also disagree with that position: I believe that targeted advertising is an essential part of realizing the long term positive upside of the Internet and is worth the tradeoff.

👉 How the Digital Markets Act could do some good (Platformer)

👉 An Interview with Michael Nathanson About Streaming and Digital Advertising (Stratechery) ❓ Why am I sharing this article? Interesting thinking on franchises. How does it apply to us? By thinking about having members use multiple services over time. If Alan is a brand they trust (built-in awareness), they will more probably leverage us for their next health & well-being service.

If you looked at the Walt Disney Studios and how much they spent on content and how their returns trended versus Paramount, Disney was a superior studio by 5-6x, the profit levels. It’s because they had franchises, they had recurring narratives, they had built-in awareness. About ten years ago, Disney made a decision to stop making general entertainment content in their films and focus on franchises. So just because Netflix spent more, didn’t mean they were going to win, that was one. Spending money on content doesn’t necessarily win.

👉 An Interview with Eric Seufert About the Post-ATT Landscape (Stratechery) ❓ Why am I sharing this article? Forget about the ability to do targeting, that’s gone or at least to the extent that they were able to do it before, that’s gone forever. When you go from individual level targeting to group level targeting, you just lose some precision and that’s gone forever. Whatever that delta is, that’s gone forever, but the measurement piece probably can be fixed. That’s just a modeling issue, that’s a data science issue and Facebook has made progress on that.

So the sense here is that basically games or e-commerce sites or whatever, they have a direct connection to Facebook and they’re sending that this person converted. The modeling is basically Facebook figures out a way this person converted from this IP address at this time of day in this location and Facebook’s like, “Well, we serve this ad to this IP address at this time of day at this location.” and they’re putting the pieces together.

CAPI was basically a tool for Shopify retailers, and Shopify had a one-click integration of CAPI. If you’re a Shopify retailer, you clicked a button when you set up your store and Shopify handled all that, but it was only for web originally. It took identifiers as the indexed identity component for the conversion so that was fully anchored to an identity. Now, with ATT, they can’t do that, and so what they did was they opened up CAPI to app advertisers. Originally, it was just for web advertisers and I think primarily the point was to service Shopify retailers, but now they opened it up to app advertisers and now you can send all this conversion signal back to Facebook and then they can absorb that into the model, and then try to credit the campaigns that they believe were responsible for those conversions. They’ve managed to claw back some of that measurement gap, not 100%, but I think at some point, they’ll get to 100%.

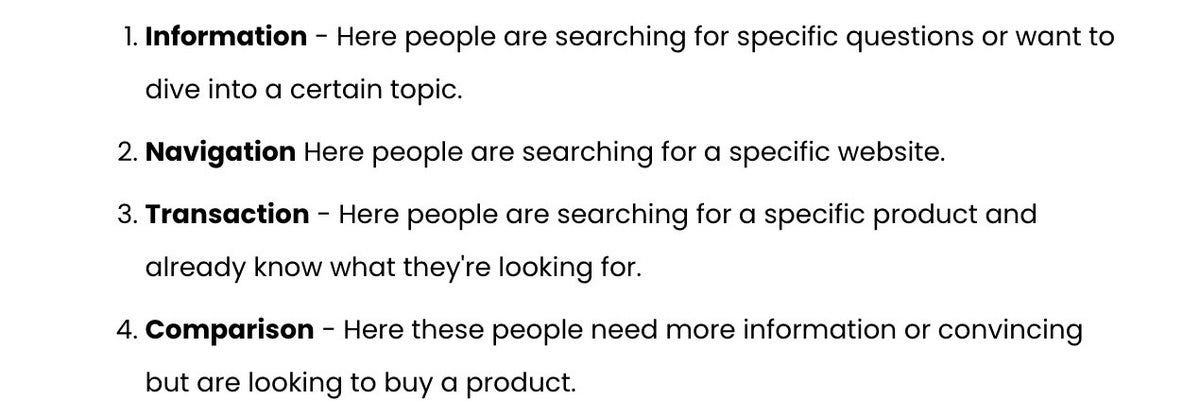

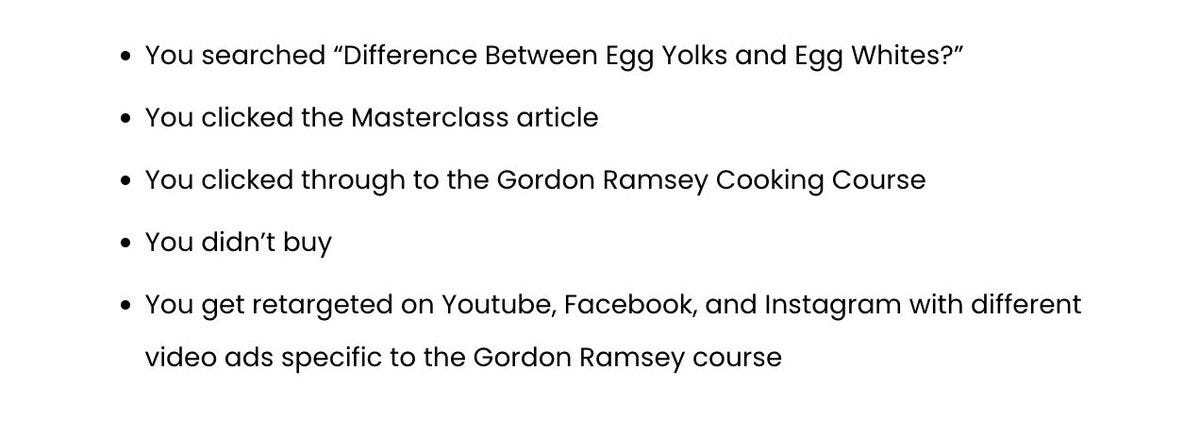

👉 MasterClass used SEO to build a $2.7B education empire. (Alex Garcia) ❓ Why am I sharing this article? Interesting perspective on SEO, the time (and investment) it takes. I liked the framework of what people search on google, allowing to have a bit more first principles in how to think about SEO.

Masterclass creates articles that help the user get things done with articles that provide them with the right information to do so. And they have 10,000+ articles doing this. Masterclass bridges each article to a specific course, taught by a specific instructor, centered around the topic that relates to the information they were looking for:

👉 Google’s head of search said in an interview that “almost 40 percent of young people” look for new restaurants on TikTok or Instagram. ❓ Why am I sharing this article? The future of SEO is likely not on Google. If we think about it, maybe we want to understand better how people search on instagram and tiktok. What do you think about this?

It’s very funny to me how executives at Google and Meta never talked about competition in this way until they were facing antitrust lawsuits around the world. Search is changing. The future of SEO is not Google.

👉 Lush, a $943 million cosmetics brand, quit Instagram and Facebook last year. Here’s how the company is tapping into 5 alternative marketing strategies. (Business Insider) ❓ Why am I sharing this article? Interesting how they approached their marketing strategy, and focused on platforms that were really linked to their brand. I don’t know how it would affect how we spend on marketing, but I think it is the right mindset to have.

Lush — which generated $943 million in revenue from July 2020 to June 2021 — announced last November that it would no longer be active on Instagram, Facebook, Snapchat, and TikTok. The company reinvented its marketing strategy with a greater focus on wellness — encouraging customers to log off and take a bath. Lush is still active on YouTube, Twitter, LinkedIn, and Pinterest and works with influencers to promote its products. "We're on YouTube because they don't use the same gambling algorithms as Facebook and Instagram." The company offers immersive bathing appointments at some locations, with each bathroom designed around featured bath bombs. "These are things that we're investing in as opposed to spending money on Instagram," Huxley said. "We want to offer people experiences and get them to really understand the brand." For customers bathing at home, Lush created Spotify playlists based on its bath bombs.

👉 The DTC model is failing to produce profits, and brands like Glossier are rushing to partner with retailers like Sephora after years of shunning them (Business Insider) ❓ Why am I sharing this article? You need to go physical retail only if your digital market is growing too slowly. I think also the problem of most DTC brands is that they have high costs of acquisition, and we are in a very different situation: we already have the relationship with members, and we know their needs. That is why I think we should push for digital-first (and even digital-only).

Digitally native brands embarking on retail partnerships isn't a new phenomenon. Harry's entered Target in 2016, paving the way for many DTC-first brands like Native and Quip that would follow the razor startup into big-box retailers. Dollar Shave Club did not start wholesaling until late 2020. Operating a direct-to-consumer e-commerce business "comes with its own set of expenses" that wholesale players don't have to contend with, including shipping, fulfillment, technology, and marketing, Siegel said in a January research note titled "DTC Isn't All It's Cracked Up to Be." "Companies are finally starting to acknowledge and realize that wholesale is not a bad channel," Siegel said. "The new line of thinking is very different. You have to be ubiquitous. You have to be everywhere. You can't look at it as a single channel," Brian Jeong, Hawthorne's CEO and cofounder, said. Some DTC brands are able to avoid going all in on wholesale partnerships until much later phases of growth. "By not entering those wholesale relationships, we're able to capture more margin, which is important to the business from a unit economics standpoint and in terms of customer experience," said Fulop. DTC brands chasing growth might be forced at some points if the digital market is growing too slowly to sustain their growth.

👉 Apple and Facebook’s Pre-ATT Negotiations, Timing and Documentation, ATT’s Impact (Stratechery) ❓ Why am I sharing this article? I have been recounting the stories over the last week of developers who have seen Apple over the last six months start blocking software-as-aservice (SaaS) apps that have been in the App Store for years until they added in-app purchase functionality; another story I have heard is that Apple has been communicating that it is time for the company to get what it claims is its fair share for apps that are “free”. Apple wants more money from developers, has the means to extract it because of App Store review, and is increasingly determined to do just that. Taken as a whole, it is very hard to come up with any explanation beyond the obvious: Apple embarked on an aggressive campaign to boost its App Store revenue. It started by looking for money from Facebook — the most obvious place to start given Facebook’s symbiotic relationship with the App Store. It extended that campaign to other ad-supported apps, then started cracking down on consumer SaaS companies. Finally, it announced ATT that kneecapped the entire ad-supported app economy.

👉 Inflation has come to app stores, with the average price of an in-app purchase in the United States rising 40 percent on iOS and 9 percent on Android. App Tracking Transparency seems to be behind the bigger increase on iOS, as it now costs developers much more to find new customers.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe 👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! | |