DeFi Rate - This Week In DeFi – November 18

This Week In DeFi – November 18This week, more details are revealed about the FTX collapse, Genesis and Gemini suspend redemptions for some users, users flock to safety in DeFi and StarkWare deploys $STRK.To the DeFi community, This week, FTX stays plastered across the news as details continue to emerge from bankruptcy filings, on-chain data and other sources connected to the situation. Most interestingly, it was alleged that Bahamian regulators directed ex-CEO Sam Bankman-Fried to hack into the exchange and transfer remaining assets to the Bahamian government. The allegations were made by FTX in a motion in the US Bankruptcy Court in Delaware – and explains the so-called “FTX accounts drainer” who made off with customer funds, completing the exchange’s fateful collapse.  🚨Bombshell court filing by FTX, claims that after the bankruptcy was filed, evidence suggests SBF was directed by regulators in the Bahamas to gain “unauthorized access” to FTX’s digital assets and then transferred them to the Bahamian govt. - CNBC

The contagion from FTX’s downfall has also spread to Genesis and Gemini, who both suspended redemptions for customers. For Genesis, this applied to their lending arm Genesis Global Capital, citing “extreme market dislocation and loss of industry confidence caused by the FTX implosion.” In the case of Gemini, the exchange suspended withdrawals from their interest-earning platform Gemini Earn – explaining that they could no longer fulfill redemptions within their service-level agreement promise of five business days. Genesis has since sought an emergency loan of $1 billion, which it says it needs by Monday.  If this is really the end for Genesis, this could be more impactful than FTX.

FTX hurt liquid funds and consumers. Genesis impacts nearly every company in crypto.

Let's dig in.

On the decentralized side of things, DeFi protocols have seen a significant uptick in users and user activity, as the community flocks to safety away from troubled centralized entities. Data from Nansen shows double-digit percentage growth in users and transactions over the last week for a huge range of platforms, with Aave seeing a 70% increase in users and a doubling of transactions. Additional data from Token Terminal says that decentralized exchanges dealing in perpetual swap contracts reached $5 billion in daily trading volume – the largest trading volume since the Terra implosion in May of this year.  Most DeFi protocols are up double digits in users and transactions this week; centralized exchanges have huge outflows

"Crypto" as measured by onchain activity is doing great despite FTX fraud

From a PR angle I know nobody cares abt nuance right now, but it's not complicated  Joe Weisenthal @TheStalwart

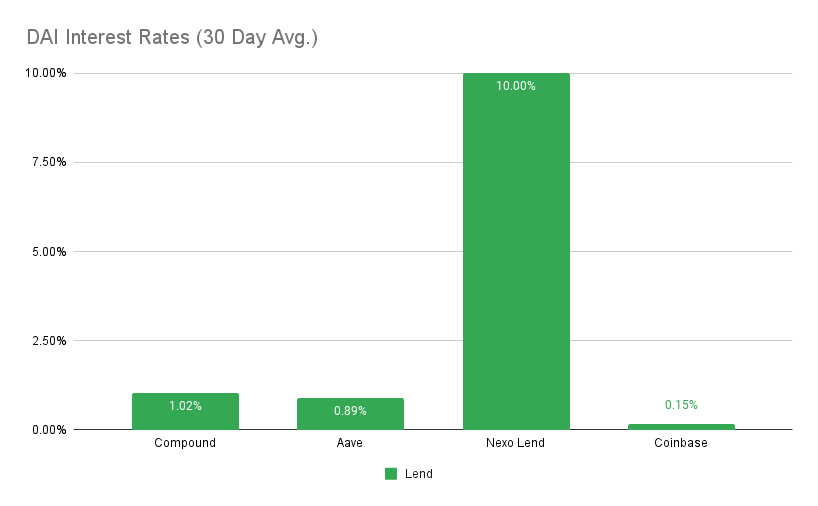

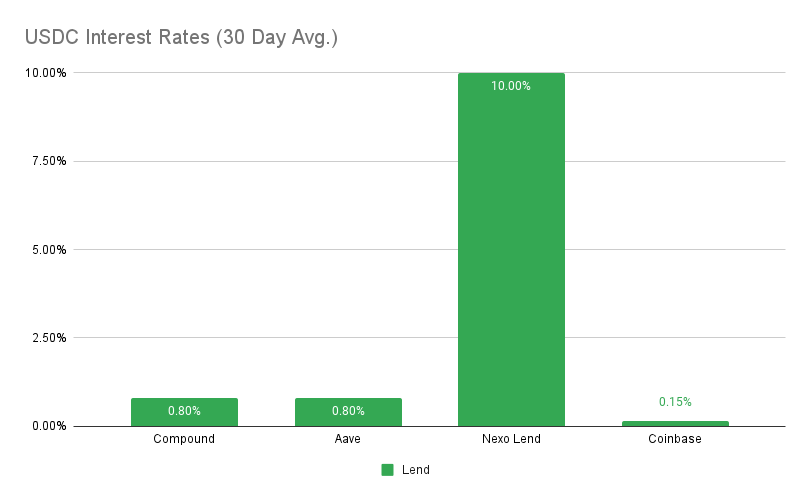

StarkWare has deployed a token for Ethereum Layer-2 StarkNet, known as StarkNet Token or “STRK”. The token is not yet tradable, however details have been revealed including its distribution and vesting schedules. The maximum supply of STRK will be 10 billion tokens, with 5.01 billion being allocated to the StarkNet foundation. Tokens held by shareholders, employees and independent partners will be unlocked over the course of four years, beginning after one year. “CeFi” continues to dominate the headlines this week as the crypto community pieces together the complete story, while second-order effects on the ecosystem begin to surface. DeFi is not completely unaffected, with the news continuing to dampen the public’s wider perspective of crypto, and therefore prices. On the plus side, there has been an apparent exodus of users from centralized platforms – now looking rather risky – to DeFi, which is now looking like the much safer bet. Although it was important that the bad actors were eventually flushed out of the ecosystem, it has proven more disastrous than expected, especially with such a major (and trusted) platform biting the dust. It may take time to rebuild and build confidence back up in the industry as a whole, but DeFi is standing strong and showing its strengths – eliminating centralized risk associated with human error. Plenty of further bad actors and risks still remain to be removed from DeFi and crypto, however we are on the right path, however painful that may be. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.02% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 0.8% APY Top StoriesEU Moving to Ban Privacy Coins: ReportEther staking withdrawal schedule removal faces harsh criticismBinance to Relaunch Bid for Bankrupt Lender Voyager: SourceBusinesses Can Now Accept USDC With Apple PayStat BoxTotal Value Locked: $42.88B (down 5.2% since last week) DeFi Market Cap: $38.07B (down 4.2%) DEX Weekly Volume: $15B (down 46%) Bonus Reads[Samuel Haig – The Defiant] – MakerDAO Releases Speedy DAI Transfers and Tightens Controls on Vaults [Kyle White – Cointelegraph] – Arbitrum sees steady growth as airdrop speculation leads to increased earnings [Coinbase – Twitter] – Coinbase Wallet now simulates the outcome of your dapp transactions [Judith Bannermanquist – Cointelegraph] – 1inch seeks to optimize gas costs with its new v5 router |

Older messages

This Week In DeFi – November 11

Friday, November 11, 2022

This week, FTX and Alameda Research go under, BlockFi halts customer withdrawals, Solana takes a huge hit and Wintermute's Bebop DEX launches on Polygon.

This Week In DeFi – November 4

Friday, November 4, 2022

This week, Meta officially integrates Polygon, Solana and Arweave for NFTs, Alameda Research worries some with its financials, and GALA has a $2B hack-scare.

This Week In DeFi – October 28

Friday, October 28, 2022

This week, MakerDAO approves up to $1.6 billion in USDC deposits into Coinbase Custody, FTX looks to launch its own stablecoin and zkSync drops zkSync 2.0 with smart contracts.

This Week In DeFi – October 14

Friday, October 21, 2022

This week, Aptos goes live and airdrops 20M APT, Frax Finance announces liquid staking, Edge Capital Management raises $67M for DeFi funds and Ripple plans an EVM sidechain.

This Week In DeFi – October 14

Friday, October 14, 2022

This week, Uniswap raises $165M in Series B funding, Solana's Mango Markets is exploited for $100M and ETH becomes deflationary.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏