Bloomberg - Evening Briefing - It’s finally over

|

||||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

Older messages

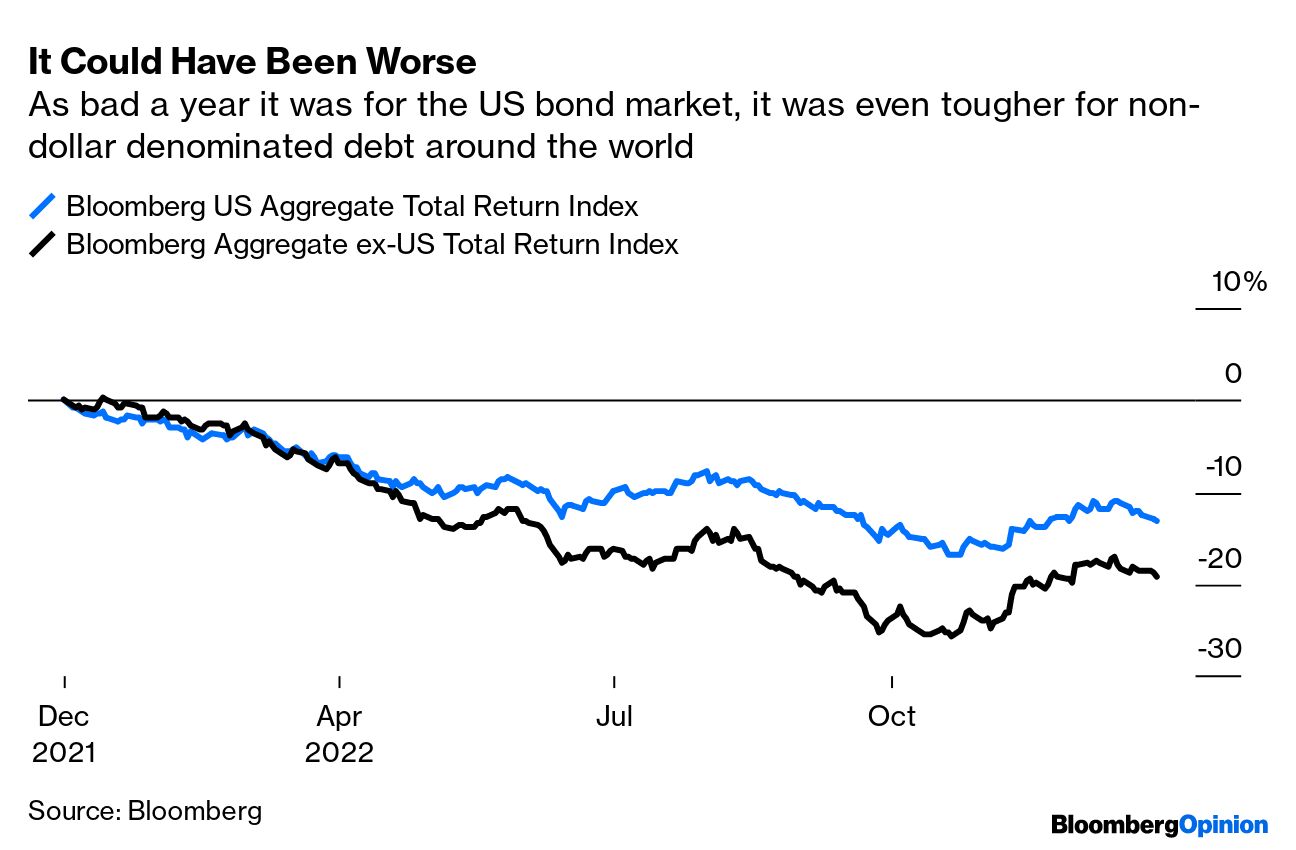

Wall Street got it wrong

Thursday, December 29, 2022

Bloomberg Evening Briefing View in browser Bloomberg With few exceptions, the best and brightest in stock and bond markets failed to appreciate how the outbreak of inflation would upend the investing

Fear of a new variant

Wednesday, December 28, 2022

Bloomberg Evening Briefing View in browser Bloomberg The US will require airline passengers coming from China to show negative Covid-19 tests as health experts fear the virus's unchecked spread

Tesla in a tailspin

Tuesday, December 27, 2022

Bloomberg Evening Briefing View in browser Bloomberg The Tesla nosedive accelerated Tuesday, its shares plummeting 11% in just one session. The terrible showing was the latest in a seven-day losing

The world’s fight

Saturday, December 24, 2022

Bloomberg Weekend Reading View in browser Bloomberg With Russia's war on Ukraine raging for 10 months, Volodymyr Zelenskiy left his country for the first time since Vladimir Putin ordered the

Worst since 2008

Friday, December 23, 2022

Bloomberg Evening Briefing View in browser Bloomberg Investors have dumped equities at a record pace in the days since major central banks signaled they won't be deterred in their fight against

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏