Why Is The Inflation Methodology Being Changed?!

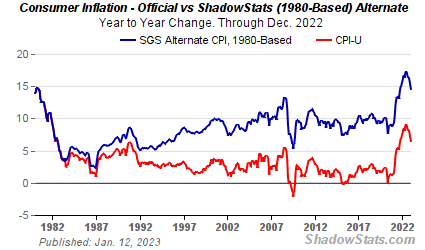

To investors, Finance and investing is based on numbers. Those numbers are used to create metrics. Metrics are put into models, which are used to create insights. Investors take the insights and make directional bets in the market based on their expectation of how the future will unfold. But what happens when people disagree on math? That may seem like an absurd question to pose, but let me explain. The Federal Reserve and other central banks around the world are actively engaged in a battle to get inflation under control. What exactly is inflation? It is a mathematical measurement of numbers and metrics. To be specific — inflation is “a general increase in prices and fall in the purchasing value of money” that is traditionally measured in year-over-year change. While you wouldn’t think that math would become controversial, the inflation measurement has long been debated. There is the macro argument of whether inflation should be calculated as a simple year-over-year change of prices (as it was before 1980s) or if inflation should be measured using a weighted basket of goods that is changed based on complex calculations (as it is done today). The difference between these two strategies creates a very different picture of inflation, which is illustrated here. The blue line is the old way of calculating inflation and the red line is the more modern way. Rather than debate the merits of each approach, I want to simply highlight that there is debate over how to calculate inflation through different methodology. This difference would currently produce one inflation number that is close to 14% and another that is closer to 6%. Obviously that is a big gap. But the inflation debate over numbers, metrics, models, and insights doesn’t stop there. The nuanced debates around inflation can be even more intense. Most people in financial markets have given up on the macro argument of new vs old methodology, so the new battle ground is on various details of the modern methodology. For example, the Bureau of Labor Statistics has recently announced that they are changing the methodology for calculating inflation. It isn’t a big change, which is why you probably haven’t heard about it, but the small changes could actually be more dangerous in a high inflation environment... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

How Good Profit Built A $125 Billion Business

Monday, January 9, 2023

Listen now (10 min) | Pomp's notes on Good Profit by Charles Koch

Grow or Die

Friday, January 6, 2023

Listen now (5 min) | The motto of America for the next 80 years

The Fed Has A Shotgun, Not A Sniper Rifle

Wednesday, January 4, 2023

Listen now (8 min) | Impact of the Fed's tighter financial conditions

Empire State of Mind -- Pomp's Notes

Monday, January 2, 2023

Listen now (11 min) | Pomp's Notes on Empire State of Mind by Zack O'Malley Greenburg

My Top 10 Books of 2022

Wednesday, December 28, 2022

Listen now (7 min) | To investors, I have read approximately one book per week during 2022. It started off as a personal challenge — could I stay disciplined enough to read consistently? But as with

You Might Also Like

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔