DeFi Rate - February 3

February 3This week, Celsius releases a withdrawal process for users, a Cardano-based stablecoin launches, MetaMask has updates for privacy and a cross-chain brokerage appears on Arbitrum testnet.To the DeFi community, This week, CeFi lending firm Celsius has released a withdrawal process for users who had their crypto in its custody when it halted withdrawals in June 2022. It has provided a list of eligible users who can withdraw 94% of the qualified custody assets, with the process laid out in a 1,411-page court filing with the US Bankruptcy Court for the Southern District of New York. Eligible users will be asked to update their Celsius account with AML and KYC information before withdrawals are processed, as well as details about the withdrawal destination. The remaining 6% of assets may be subject to a decision by the court at a later date. The news comes at the same time as a report emerges, that revealed that Celsius hid $800 million in losses, while making risky investment bets with customer funds.  Celsius provided an update on the upcoming withdrawal process for certain assets in certain Custody accounts. A new Cardano-based stablecoin, known as Djed, has attracted almost 30 million Cardano (ADA) tokens as collateral just days after launch. It has a reserve ratio of nearly 600%, meaning each Djed is backed by 6 times its value in ADA, worth over $10 million at current prices. Djed is a joint development by Cardano code maintainer IOG and Coti, a Layer-1 blockchain. Djed requires 400-800% collateral value to be posted before it can be issued to a user and is designed to be stable during market stress. It has a circulating supply of 1.7 million tokens, while its reserve token, Shen, has a supply of 20 million and is worth 38 cents each.  Djed is LIVE!!!

medium.com/@cotinetwork/a…

Visit djed.xyz

$DJED $SHEN $COTI @InputOutputHK @Cardano

@Cardano_CF MetaMask wallet has added its new security and privacy features, while making it easier to switch between Remote Procedure Call (RPC) providers. The new features give users more control over their data, with the ability to toggle on/off settings that control data transfer to third-party services and improved RPC provider switching. The update comes after ConsenSys, the owner of MetaMask and Infura (the default RPC provider on MetaMask), faced scrutiny over collecting user data.  Starting today, extension users will see an updated experience when creating a new wallet, as well as an update in their privacy and security settings.

We have updated the 🦊 extension to maximize the control you have over your data. Prime Protocol has launched its testnet on Arbitrum, becoming the first cross-chain brokerage that allows users to take out margin on their entire account, regardless of which chain they are on. The platform is designed to reduce liquidation and bridge hack risks. Prime Protocol uses Axelar's messaging technology to enable cross-chain transactions and is integrated with Wormhole for non-Ethereum based chains. The platform may launch a token in the future and run incentives to boost liquidity. Prime Protocol is integrated with Polygon, BNB Chain, Avalanche and Fantom.  🚨 Announcement 🚨

Prime Protocol is now supporting @arbitrum on Prime Testnet!

Adding Arbitrum to Prime provides users #CrossChain access to one of the top DeFi ecosystems in the space 🔥

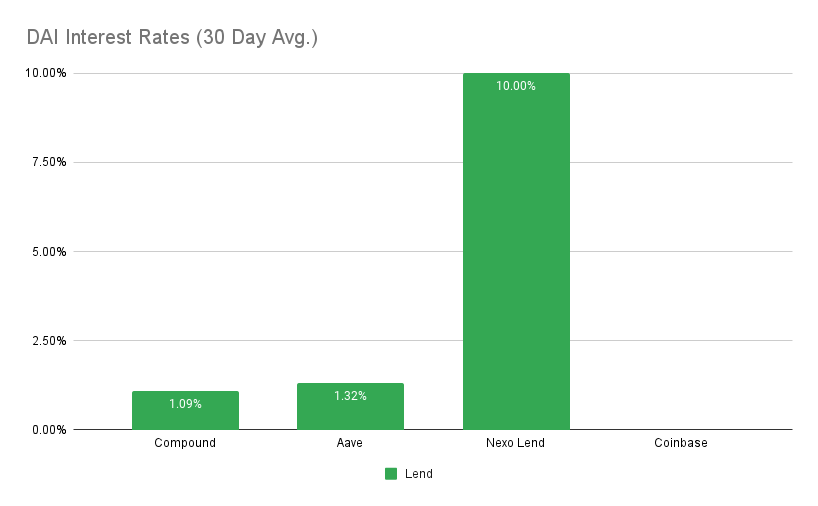

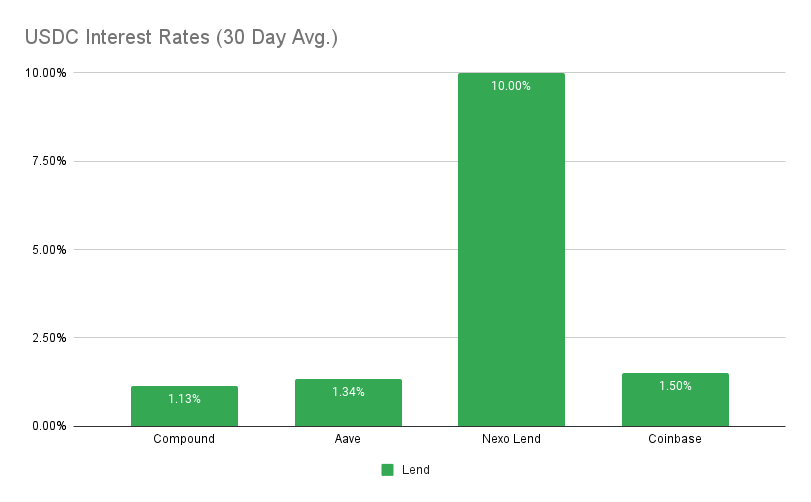

Read our Medium article below for more information about Arbitrum on Prime! Sentiment is becoming much more positive in the DeFi world, as development continues, prices rise and collapsed centralized platforms begin to find resolutions. Celsius’ release of withdrawal guidance to users has been a positive turn, as some users will be made almost whole after the platform went under, months ago. At the same time, staked ETH withdrawals on the Ethereum network are inching closer, with the Shanghai upgrade to be tried out on testnet in a matter of days. It is also great to see new and innovative projects continuing to emerge despite the recent bear market, in particular Prime Protocol experimenting with cross-chain margin positions on different networks. The cherry on top for this week is price action across the market looking much more positive, with a local bottom appearing to have formed on most tokens. This was especially true after the Federal Open Market Committee (FOMC) meeting earlier this week. Of course, we must also keep in mind that there are still some large centralized entities in the space that continue to make strange headlines – there is still some room for potential damage. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY Top StoriesEthereum Developers To Launch Testnet Supporting Staked ETH WithdrawalsCrypto Exchange Gemini Emphasized FDIC Insurance in Communications With Earn CustomersTether CTO denies borrowing from bankrupt lender CelsiusAxie Infinity users can now take loans against in-game assetsStat BoxTotal Value Locked: $48.99B (up 3.1% since last week) DeFi Market Cap: $48.83B (up 4.4%) DEX Weekly Volume: $9.71B (down 21%) Bonus Reads[Michael McSweeney – The Block] – Uniswap Foundation charts path forward amid cross-chain bridge governance debate [Nelson Wang – CoinDesk] – 86% of Stablecoin Issuer Tether Was Controlled by 4 People as of 2018: WSJ [Owen Fernau – The Defiant] – OlympusDAO Votes To Deposit $77M In MakerDAO [Danny Nelson - CoinDesk] – Orion Protocol Loses $3M of Crypto in Trading Pool Exploit This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – January 26

Friday, January 27, 2023

This week, Uniswap looks to deploy on BNB Chain, Aave soon to launch v3 and GHO stablecoin on Ethereum, dYdX delays its token unlock and Moody's develops stablecoin ratings.

This Week In DeFi – January 20

Friday, January 20, 2023

This week, Shiba Inu announces its Layer-2 scaling platform Shibarium, SushiSwap will build a DEX aggregator, 1inch introduces a hardware wallet, and Swing rolls out a handy cross-chain developer kit.

This Week In DeFi – January 13

Friday, January 20, 2023

This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.

This Week In DeFi – January 6

Friday, January 6, 2023

This week, SushiSwap explores new tokenomics, Vauld rejects Nexo's final acquisition proposal, TON launches a data sharing solution and a judge rules that customer funds belong to Celsius.

This Week In DeFi – December 30

Friday, December 30, 2022

This week, Alameda Research addresses continue to engage in shady behavior, 1inch releases its "Fusion" upgrade and Stacks looks to bring smart contract functionality to Bitcoin with sBTC.

You Might Also Like

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏