Earnings+More - PointsBet plunges on widening losses

PointsBet plunges on widening lossesPointsBet half-year results disappoint, Australian Betr raises cash, Ohio debut numbers, Las Vegas highs +MoreGood morning. On today’s agenda:

PointsBet plungeShares in PointsBet slumped over a quarter at one point on Tuesday as investors took fright at steepening losses. Point break: CEO Sam Swanell insisted the North America strategy was working, even as total H123 EBITDA losses rose 25% to A$163m on total revenues that rose 28% to $178m. Swanell said losses for H2 would be pared back to A$77m-A$82m.

😱 Pointsbet slumped over 10% on Tuesday The postman: US net win rose 81% while marketing expense was trimmed by 17% and Swanel said the focus on the super-user was “really delivering”. He added that “targeting these customers better” led to a 63% increase in US sportsbook revenue.

No mas: Swanell said Massacusetts was “one step too far” and it was the “prudent and balanced” decision not to enter the state despite having gone through the licensing process.

** SPONSOR’S MESSAGE: As a provider of organisational design services, we help you to achieve your purpose and solve business challenges through positioning and empowering people. Our ‘Culture of Belonging’ program is designed to build businesses people love through improving employee perception, performance, retention and diversity. Find out more about engaging and optimising your people for success: https://www.rokker.co.uk/insights/up-where-we-belong/ A Betr optionBetr has secured A$250m of funding for its bid for PointsBet’s Australian operations, according to reports. Tripp the light fantastic: As per the AFR, it is reported that Betr, which launched late last year, has secured funding for a bid for PointsBet with the help of advisory firm Barrenjoey. The paper reported that Betr founder Matthew Tripp was in London last week to discuss progress with stakeholders.

Bally closes MKFBally’s DFS operation Monkey Knife Fight has pulled down the shutters. Monkey gone to heaven: Monkey Knife Fight has told its players it has closed the operation as of yesterday, February 28, after five years of operations. In a Twitter posting, the company quoted Yogi Berra’s saying that the “future ain’t what it used to be”.

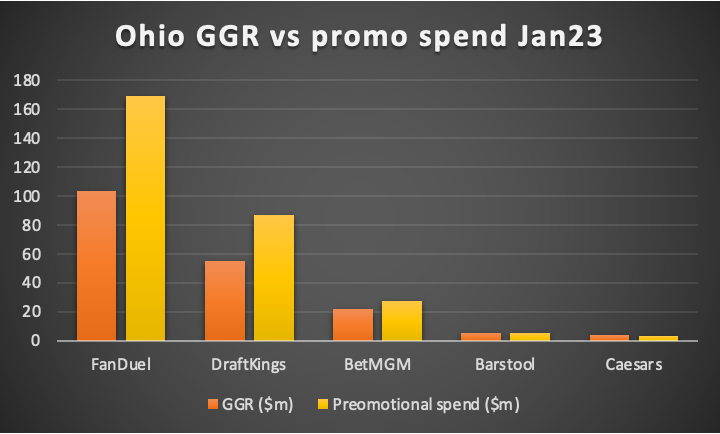

Datalines – OhioFanDuel and DraftKings early market share dominance comes at a price. The two of us: FanDuel grabbed 50% market share and DraftKings 27% in Ohio’s first full month of OSB operations in January, as the top two quickly raced into the lead in another new state. Add in BetMGM’s 8.5% of GGR and the top three secured 85.5% of the market.

🧐 Promotional spend outweighed GGR in Ohio Weighing machine: Total GGR was $206m, but this was outweighed by $320m of free bets and giveaways leading to negative NGR of $114m. The promo spend helped push handle (including retail) to $1.13bn, with online worth 98% of the total.

Las VegasI feel good: The juggernaut of joy continued into the New Year as the Strip enjoyed a record-breaking January with GGR up 26% to $713m, albeit up against an easy comp. Downtown and Locals ($273m) were also up, 25% and 15% respectively.

MacauHappy days: The recent improvement in the mood music in Macau was confirmed as the authorities said GGR climbed 33% YoY in February to $1.28bn. The total was lower than January, though that benefited from the Chinese New Year, and was 44% below the pre-pandemic levels of Feb19.

Earnings in briefIGT enjoyed a 7% same-store rise in global revenues to $1.1bn in Q4 and noted the 21% increase in gaming revenues and record contribution from PlayDigital. CEO Vince Sadusky said gaming sales had benefited from supply chain issues being “much better than in the first half of the year” and that IGT now had “good momentum” with the icasino studio iSoftBet.

Endeavor: Ahead of splitting out revenues from the sports-betting supply segment as of Q123 onwards, CFO Jason Lublin said on the Q4 call that the combined IMG Arena and OpenBet business would see double-digit top-line growth in 2023. But he added that revenue and EBITDA would be “back-end loaded”. Accel: The hyper-local gaming machine operator ended 2022 with a 39% uplift in terminal locations to over 3.5k and a 70% increase in machines to over 23k, as it reported revenues up 44% to $278m and adj. EBITDA up 30% to $43m. Codere Online: CFO Oscar Iglesias said the group expects to be EBITDA positive in 2024 as Q422 revenue rose 70% YoY to €35.6m but with net losses coming in at €17.4m. Iglesias restated 2023 NGR guidance of €140m-€150m and reduced adj. EBITDA of €20m-€30m. Playtika: Q4 revenues were down 3% to $631m but adj. EBITDA of $229m was ahead of expectations after what the company said was a “challenging year” for the mobile-games sector. BlueBet: The Australian-based bookmaker said H123 EBITDA plunged into the red at A$10.5m while net win dropped 5% to A$27m due to “mix shift” and a tougher promotional environment. The company’s ClutchBet launched in Iowa in August and will go live in Colorado imminently. Scout: Q4 revenues were down 4% to SEK8m driven by a 45% decline in B2C revenue, but B2B was up 70% to SEK5m after a reorganization. ** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. NewslinesEveri is consolidating the manufacturing of both its gaming and fintech products in Las Vegas. MGM Resorts has launched ticket sales for a “viewing experience” of the F1 Grand Prix in November. Er, are you sure about this? Penn has deployed an autonomous security robot at the M Resort in Las Vegas to patrol its car parking areas. What we’re readingRough diamond: The pending Diamond Sports liquidation is a warning to sports team owners. On social MonkeyKnifeFight just sent a formal termination letter to all affiliates, indicating outstanding commissions will be paid (that's a good sign). How do I know they sent this to all affiliates? They publicly CC'd the entire list :), oops. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

DraftKings’ hopes in the spotlight

Tuesday, February 28, 2023

Analysts at Roth look at DraftKings' long-term prospects, UK online for 2022 examined, Caesars' Illinois claims tested +More

Caesars’ $6m question

Monday, February 27, 2023

Caesars' promotional spend analyzed, Ohio debut apps tested, gaming REITS review, startup focus – Splash Tech +More

Weekend Edition #86

Friday, February 24, 2023

PointsBet says no to Mass, SIS sale, Bally's new broom, Churchill Downs focuses on HRMs, sector watch – affiliates +More

Caesars high on Vegas supply

Wednesday, February 22, 2023

Caesars confirms buoyant results, the super affiliates report, BetMGM remains on top in Michigan +More

A taxing issue – the New York debate

Tuesday, February 21, 2023

DraftKings' and FanDuel's New York tax arguments examined, recent analyst takes +More

You Might Also Like

Cash rich

Wednesday, January 15, 2025

Startups raised over $200m in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Hidden early stage growth hack of Airbnb

Wednesday, January 15, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Hidden early stage growth hack of Airbnb A script was scanning all new rental properties on

Big eCommerce Goals for 2025? We got you🎯

Wednesday, January 15, 2025

Essential Guides for eCommerce Success Hello Reader, Whether you're setting fresh goals or planning to build on last year's wins, we're here to help you achieve your eCommerce goals in 2025

Brand-new site gets 13 million monthly visits from Google!?

Tuesday, January 14, 2025

Content sites aren't dead yet

🆕 New Year, New Biz: Choose what to sell

Tuesday, January 14, 2025

Resources for picking your products. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

♦️ How the clash between business and customer goals kills brands

Tuesday, January 14, 2025

And how a small agency got a big account with an unusual pitch... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤑He Made $9K with Public Domain Books on Amazon

Tuesday, January 14, 2025

Income on autopilot

In 3 Days, Utopia 4.0 Goes Live

Tuesday, January 14, 2025

I've been gatekeeping this strategy for the last 5 years and...

SEO Mistakes That Could Lead to an Indexing Nightmare 😨

Tuesday, January 14, 2025

SEO Tip #69

2024’s top brands who stole the show on social

Tuesday, January 14, 2025

Be unforgettable in 2025 with inspiration from Canva, Away and more ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏