Earnings+More - NorthStar set for Toronto switch

NorthStar set for Toronto switchNorthStar sets seal on reverse takeover, FanDuel's MLB deal, GAN loses coverage, the week in shares, startup focus – Grin Gaming +MoreGood morning. On today’s agenda:

NorthStar completes reverseThe Canadian gaming group achieves reverse takeover and will shortly move its listing to Toronto. NorthStar Gaming is set to take its place on the Toronto Stock Exchange after completing its reverse into Baden Resources. The company, jointly owned by the Torstar media group and Playtech, operates under the NorthStar Bets name and will trade under the symbol BET.

Linchpin: Playtech bought C$12.3m of convertible debentures in December. NorthStar is another one of its “structured agreements” whereby it takes a financial stake in key partners. Another is CaliPlay, a JV with Caliente in Mexico, which is currently subject to a legal dispute over an ownership option.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com FanDuel MLB partnershipFanDuel and Major League Baseball have this morning announced a multi-year co-exclusive official betting partner deal across sports betting and DFS. As part of the new extended partnership, FanDuel will get to use official MLB branding and category designations. Further, the deal also sees FanDuel gain rights to stream MLB.TV’s free game of the day through the FanDuel app and its OTT platform FanDuel+.

GAN loses coverageJefferies drops coverage of the B2C/B2B operator/supplier. The sports-betting operator and supplier of backend tech has lost coverage from brokers at Jefferies, which said late last week it would no longer provide analysis of the firm due to a “reallocation of resources”.

Regionals canaryA predicted rise in February GGR masks a downward trend, suggests Wells Fargo. Analyzing visitation data, the team at Wells Fargo estimates the pace of growth in GGR slowed in February to 4.6% YoY from the 12%+ growth seen in January. The team viewed this ~5% growth rate as a more “normalized pace” given the ‘clean’ calendar comparison.

The week in sharesMGM and Caesars enjoy a good week as investors warm to the Vegas story. Riding the wave: Shares in the main Las Vegas Strip operators MGM Resorts and Caesars Entertainment benefitted with a 7% rise last week, helped by the continuing good news on revenues and visitation in Nevada. 🎉 All smiles: Caesars and MGM enjoy the share price boost Supplier boostIGT and Light & Wonder enjoy a positive start to the year. Supply side: The major gaming machine and online suppliers both reported positive earnings last week and were rewarded with each rising 5% over the week. The move helped cement a good start to the year for their shares, particularly IGT, which is up nearly 21% in the YTD, while LNW is up over 11%.

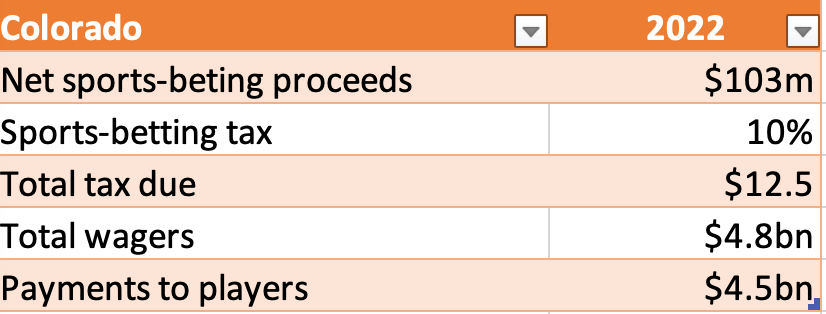

Rocky mountain lowsColorado received a mere $12.5m in sports-betting tax from operators in 2022. Rounding error: As was highlighted by Gambling Twitter over the weekend, revenues for the state of Colorado from sports betting amounted to “budget dust” in the fiscal year to June 2022, according to the recently released state revenue report.

🏔️ The tax take from sports betting in Colorado Newsletters this weekIn Compliance+More: Tomorrow we take a look at the news out of Brazil where the finance minister appears to have given a boost to moves to finally get sports-betting legislation through parliament.

In Earnings+More: Tomorrow sees edition #8 of the startup month released, which features an interview with Dean Sisun from the New Jersey-based betting exchange challenger Prophet Exchange.

Quarterly review: With the earnings season starting to wrap up, Thursday sees the release of a new E+M edition looking at the significant trends and key reaction from the reporting period just gone. Startup focus – Grin GamingWho, what, where and when: The LA-based micro-betting data provider was founded by Nick Bucheleres and serial entrepreneur Doug Kilponen in 2018 and launched two years later. Funding backgrounder: To date, Grin has raised $4.5m in Seed and pre-Seed from BAM Ventures, Operate, Nanban Ventures and a group of angels that includes Lyle Berman. The last round closed in Q3 last year and raised $3m on a $16m post-valuation. The pitch: Kilponen says the Grin idea is to bring the sophistication of high-frequency trading to sports gambling with real-time, in-play wagering, niche odds, the lowest latency and “narrative wagers to keep bettors engaged in every play”.

What will success look like? Kilponen believes GrinData can be a $300m business within the next three years, which would mean it is “well on our way to going public”. Medium-to-long-term goals are to continue to build out the company’s gaming catalog and expand its market presence via partnerships with leading operators. ** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. NewslinesKambi has signed a multi-channel and multi-year sportsbook partnership with Potawatomi Hotel & Casino, which runs casinos in Milwaukee and Carter, Wisconsin. Australian pubs and pokies tycoon Bruce Mathieson has built up a near 10% stake in troubled casino entity Star Entertainment. Sportradar has signed a sports-betting platform agreement with recently founded Puerto Rico-based Ballers Sportsbook. What we’re readingNow you see it, now you don’t: The Museum of Illusions has pushed back its Las Vegas opening to June. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekend Edition #87

Friday, March 3, 2023

Flutter going west, Wynn Macau's rebound, Rush Street shares drop, sector watch – payments, Jobsboard +More

Flutter looks beyond FanDuel ‘just being profitable’

Thursday, March 2, 2023

Flutter's profit leap, Rush Street's 'great strides', Light & Wonder on the up, bet365's Ohio progress +More

PointsBet plunges on widening losses

Wednesday, March 1, 2023

PointsBet half-year results disappoint, Australian Betr raises cash, Ohio debut numbers, Las Vegas highs +More

DraftKings’ hopes in the spotlight

Tuesday, February 28, 2023

Analysts at Roth look at DraftKings' long-term prospects, UK online for 2022 examined, Caesars' Illinois claims tested +More

Caesars’ $6m question

Monday, February 27, 2023

Caesars' promotional spend analyzed, Ohio debut apps tested, gaming REITS review, startup focus – Splash Tech +More

You Might Also Like

Hidden early stage growth hack of Airbnb

Wednesday, January 15, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Hidden early stage growth hack of Airbnb A script was scanning all new rental properties on

Big eCommerce Goals for 2025? We got you🎯

Wednesday, January 15, 2025

Essential Guides for eCommerce Success Hello Reader, Whether you're setting fresh goals or planning to build on last year's wins, we're here to help you achieve your eCommerce goals in 2025

Brand-new site gets 13 million monthly visits from Google!?

Tuesday, January 14, 2025

Content sites aren't dead yet

🆕 New Year, New Biz: Choose what to sell

Tuesday, January 14, 2025

Resources for picking your products. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

♦️ How the clash between business and customer goals kills brands

Tuesday, January 14, 2025

And how a small agency got a big account with an unusual pitch... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤑He Made $9K with Public Domain Books on Amazon

Tuesday, January 14, 2025

Income on autopilot

In 3 Days, Utopia 4.0 Goes Live

Tuesday, January 14, 2025

I've been gatekeeping this strategy for the last 5 years and...

SEO Mistakes That Could Lead to an Indexing Nightmare 😨

Tuesday, January 14, 2025

SEO Tip #69

2024’s top brands who stole the show on social

Tuesday, January 14, 2025

Be unforgettable in 2025 with inspiration from Canva, Away and more ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: January 14th 2025

Tuesday, January 14, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Panthenol Serum (trends) Chart Panthenol Serum