DeFi Rate - This Week In DeFi – March 3

This Week In DeFi – March 3Coinbase unveils "Wallet-as-a-Service," MolochDAO builds a regulation-friendly mixer, Violet launches a "compliant" DEX and ENS announces sub-domains.To the DeFi community, This week, Coinbase has launched a product called Wallet-as-a-Service (WaaS), which enables companies to create customisable Web3 wallets within their own apps. WaaS enables companies to build native wallets straight into their own applications, creating a more seamless experience without redirecting users to any external app. The service aims to make onboarding as simple as it is with Web2 applications, by getting rid of complicated 24-word recovery phrases. Instead, WaaS uses Multi-Party Computation (MPC) technology, allowing a key to be split between the end-user and Coinbase.  1/ Today, Coinbase is launching Wallet as a Service, a scalable and secure set of wallet infrastructure APIs, enabling companies to easily create fully customizable onchain wallets for their users and apps.

coinbase.com/blog/coinbase-… Ethereum infrastructure organization MolochDAO has revealed a demo of “Privacy Pools” – a new coin mixing service designed to preserve privacy but still comply with local regulations. Privacy Pools uses zero-knowledge proofs to enable users to blacklist sanctioned wallets, without revealing their identities. Tornado Cash contributor Ameen Soleimani says that MolochDAO's members "rage-built" the project in response to a proposal rejection. Although a demo has been released, the protocol is yet to launch on any mainnet.  1/ We fixed @TornadoCash 😇

v0 of privacypools.com is live on @optimismFND

test out the demo, but please note:

- this is experimental code

- it has not been audited

- the trusted setup is untrusted

read the full story anon 🧵👇

ameen.eth @ameensol In an interesting mash-up of decentralization and compliance, DeFi company Violet has announced Mauve, a “compliance-focused” decentralized exchange. Mauve requires users to pass rigorous compliance checks and offers transparent, audited smart contracts and instant settlement without intermediaries. The exchange has raised $15m in a funding round backed by investors including Coinbase Ventures and Brevan Howard.  Introducing Mauve, the first Decentralized Exchange (DEX), where you can trade trustless & fully compliant. It’s privacy-protective, non-custodial, and eliminates counterparty risk.

Why is this a big deal? A thread👇 1/7 The Ethereum Name Service (ENS) is releasing a new feature allowing users to create subdomains with pre-specified parameters, using its name wrapper smart contract. This will enable users to create subdomains such as abc.xyz.eth, which can be lent out to others, and manage permissions using a feature called "Fuses."  ENS subdomains eliminate the need for centralized subdomains such as email usernames

Decentralized subdomains are the future of digital identity🧵👇

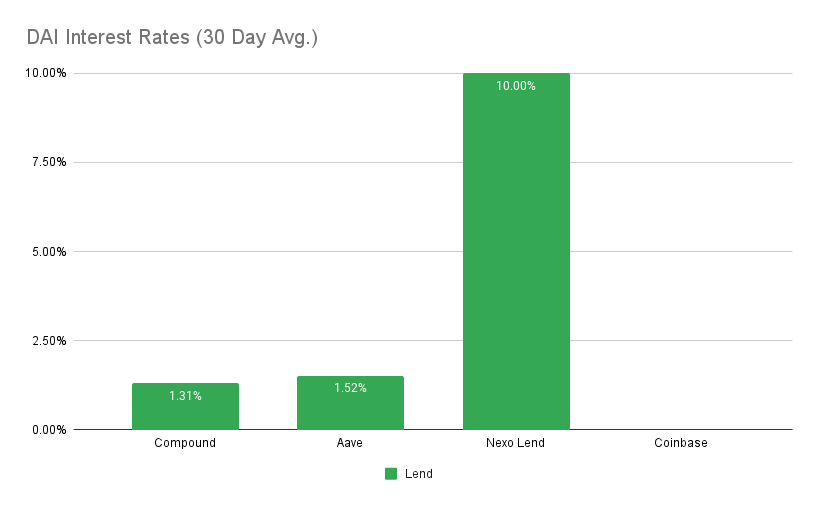

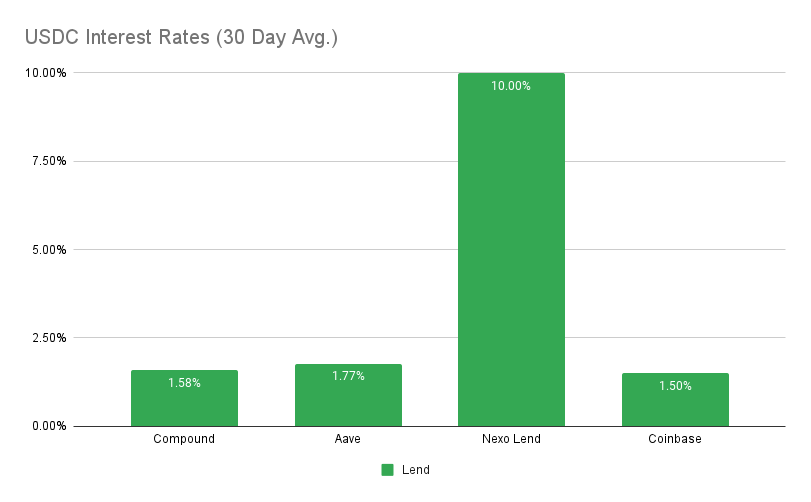

1/6 DeFi development has remained both productive and interesting over the last week, most notably with Coinbase’s Wallet-as-a-Service, which has the potential to assist with onboarding the next wave of users into the ecosystem. Since the beginnings of DeFi, one of the largest barriers to entry has been the wallet setup process; a typically tedious process that involves backing up a long seed phrase, or risking losing your assets forever. WaaS’s work-around using “multi-party computation” secures a users’ assets, while eliminating the cumbersome wallet setup procedure. This, combined with building native wallets into third-party applications, may finally be the seamless method needed to get new users into the ecosystem. Instead of being intimidated by new apps and foreign setup processes, new potential users will feel as though they’re using the Web2 processes that they’re used to – getting them straight through the door. We also have multiple improvements to existing platforms or protocols, such as Rocket Pool launching “minipools” and enabling ETH holders to stake with just 8 Ether, rather than the typical 32 or 16 ETH. The new MolochDAO Privacy Pools may also present a potentially non-sanctionable version of Tornado Cash, bringing functional privacy back to Ethereum. Several other interesting developments have also come to light this week, with too many to list here – a truly good sign for the adaptability of DeFi. On the other hand, we’re still battling regulators at full capacity. Some of these battles are worrying for the sector, especially in the US, which may drive innovation elsewhere on the planet. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.5% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 1.8% APY Top StoriesCFTC head says stablecoins are in agency's jurisdiction without 'clear direction from Congress'The U.S. Government Wants to Cut Off Crypto’s Access to Banks: Nic CarterBinance.US gets green light to buy Voyager Digital assetsSWIFT to Conduct More Tests With CBDC ProjectStat BoxTotal Value Locked: $44.85B (down 10% since last week) DeFi Market Cap: $43.59B (down 16%) DEX Weekly Volume: $7.31B (down 27%) Bonus Reads[Krisztian Sandor – CoinDesk] – DeFi Protocol Maverick Unveils UniSwap Rival Decentralized Exchange on Ethereum [Shaurya Malwa – CoinDesk] – Shiba Inu Layer 2 Blockchain Shibarium to Release Beta Version This Week [Aleksandar Gilbert – The Defiant] – Rocket Pool To Launch 8 ETH Minipools [Shaurya Malwa – CoinDesk] – Curve Yield Farmers Rush to Deploy $60M on Newly Launched Conic Finance, Capture 21% APY on USD Coin This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – March 3

Friday, March 3, 2023

This week, Marker looks to add MKR as collateral for DAI, Robinhood launches a non-custodial wallet, Ethereum devs release EntryPoint for account abstraction, and Redeem sends NFTs to phone numbers

This Week In DeFi – February 24

Friday, February 24, 2023

This week, Coinbase launches its own L2 network and lists Euro Coin, Mastercard enables USDC purchases via Immersve and BUSD meets the end of the road across multiple platforms.

This Week In DeFi – February 17

Friday, February 17, 2023

This week, Paxos halts BUSD issuance, Nexo cuts off US users, Abu Dhabi pledges $2B to Web3 and the Blur NFT marketplace drops a token.

February 10

Friday, February 10, 2023

This week, Aave launches its GHO stablecoin on testnet, the SEC cracks down on staking services, Metamask looks to go multi-chain and Salt Lending is revived with $64M in funding.

February 3

Friday, February 3, 2023

This week, Celsius releases a withdrawal process for users, a Cardano-based stablecoin launches, MetaMask has updates for privacy and a cross-chain brokerage appears on Arbitrum testnet.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏