DeFi Rate - February 10

February 10This week, Aave launches its GHO stablecoin on testnet, the SEC cracks down on staking services, Metamask looks to go multi-chain and Salt Lending is revived with $64M in funding.To the DeFi community, This week, the CeFi world is under fire as the SEC cracks down on staking services, with Kraken having to settle with the agency for a $30 million fine, as well as shutting down its staking program. The move comes very shortly after Coinbase CEO Brian Armstrong warned that the SEC was going to take action on such services – which he says will hurt both Coinbase and the Ethereum network itself. Coinbase offers a staking service that lets investors stake smaller amounts of Ethereum, with no minimum amount required, and earns a fee of 25% of the Ethereum yields. Kraken co-founder and CEO Jesse Powell has reiterated that the settlement affects only US customers, while global customers are free to continue staking as usual.  Today @SECGov charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program.

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

DeFi giant Aave has deployed its native stablecoin, GHO, on the Ethereum Goerli testnet network with the stablecoin's codebase available on GitHub. GHO will be pegged to the US dollar and will be overcollateralized, meaning users must supply collateral in amounts exceeding the value of GHO they wish to mint. The Aave DAO will earn interest payments from borrowers of GHO and control the facilitator set for the stablecoin. The rollout of GHO on Ethereum mainnet is still yet to be approved by the Aave DAO at a later date. MetaMask Snaps is a new addition to the MetaMask ecosystem, aiming to facilitate a "multichain future" by allowing the Ethereum-based wallet to support non-native blockchains and tokens. MetaMask has already created a Bitcoin Snap, making it possible to incorporate all blockchain protocols. Snaps is currently available in the developer version of MetaMask Flask and is expected to be integrated with the main MetaMask by the end of 2023.  ***Just In***-🚨#MetaMask is aiming to go completely multichain friendly in the future with the development of 'Snaps' allowing support for all #crypto tokens #Bitcoin #ETH

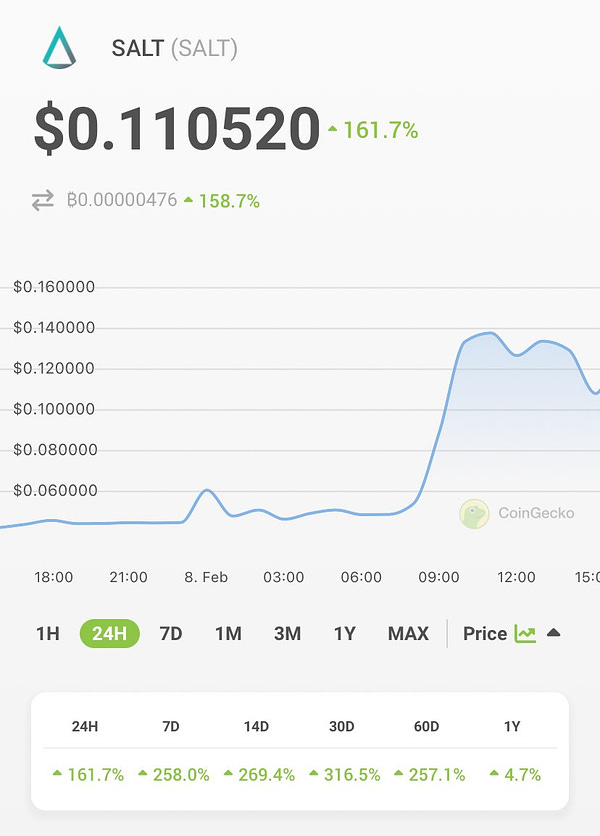

Salt Lending, one of the world's first cryptocurrency lenders, has closed a $64.4 million financing round to strengthen its balance sheet and replenish its capital reserves. Accredited investors will receive preferred stock in return for their funding, which is subject to approval by regulatory authorities. The company hopes to return to full operation in the first quarter. Salt Lending announced a freeze on withdrawals and deposits in November last year, due to the FTX crash. The company also lost its California lending license, but it is working with regulators to restore it.  $SALT, the native token of crypto lender @SALTLending, is up 161.7% following news that it has raised $64.4M to resume operations.

The company has initially paused business after the collapse of FTX.

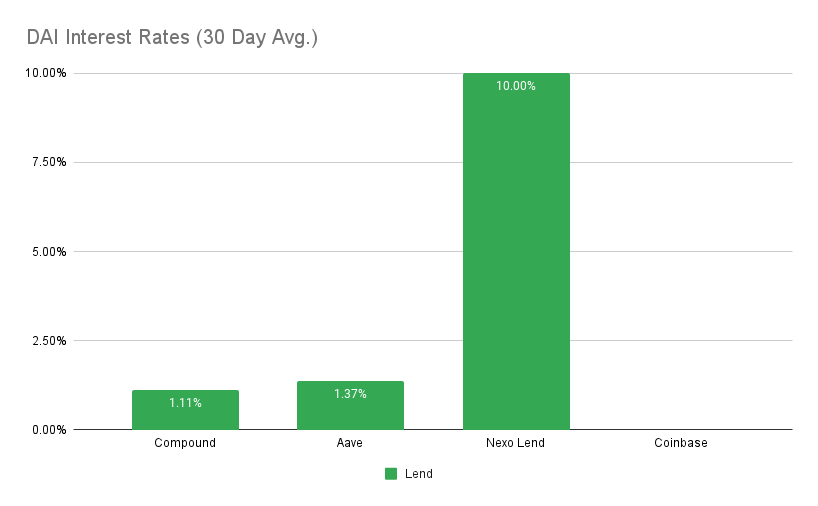

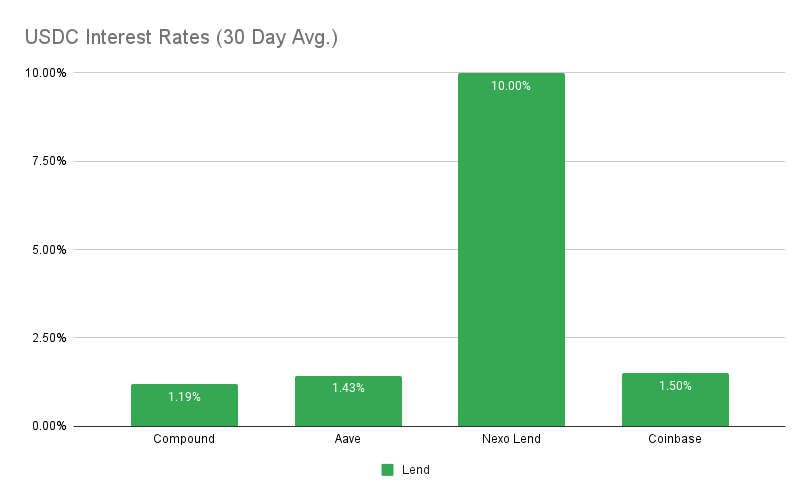

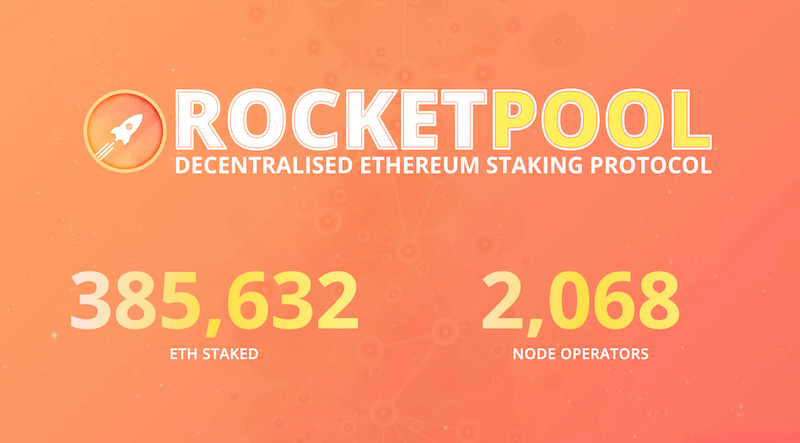

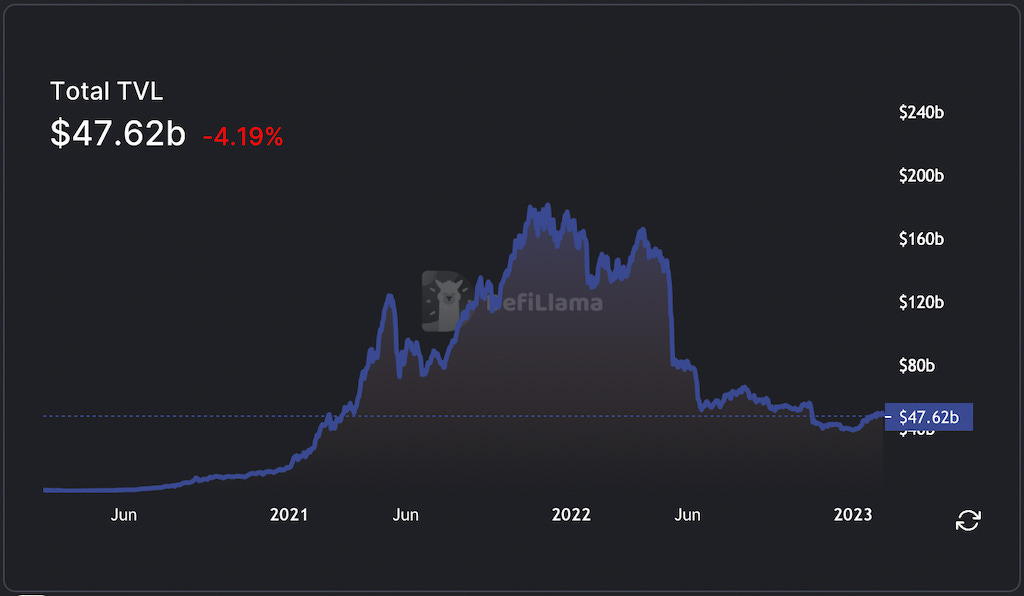

📈: coingecko.com/en/coins/salt?… US agencies are coming at centralized crypto platforms at a seemingly unprecedented rate, as the SEC goes after exchanges offering staking as a service – beginning with Kraken, with others soon to come. Paxos, the stablecoin issuer behind Binance’s BUSD, has also come under investigation by the NYDFS, while several other exchanges have been investigated in recent weeks or months. The moves from these authorities – targeting seemingly simple functions such as staking services, rather than more serious criminal activity – may truly drive activity further towards decentralized platforms, as customers look for alternatives to centralized providers. Unfortunately, the crackdown may also hamper new crypto adoption on a broader scale, at least in the United States. Stablecoins may also be on track to get some competition in the form of central bank digital currencies, as the Bank of England becomes the latest to announce their digital currency project. Right on cue, we have Aave finally taking action to deploy their decentralized rival, the GHO stablecoin, on Ethereum’s Goerli testnet – with a mainnet launch possibly around the corner. Another trend to keep an eye on is major projects going multi-chain: MetaMask, Uniswap, Trader Joe all being recent platforms expanding to multiple networks. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY Top StoriesGenesis and Gemini Reach Agreement in PrincipleUK's Bank of England launches digital pound project as 'new form' of moneyThree Arrows Capital Founders Launch Exchange Where You Can Trade 3AC Bankruptcy ClaimsValue locked in Rocketpool doubles in two months, rises to $1 billionStat BoxTotal Value Locked: $47.62B (down 2.8% since last week) DeFi Market Cap: $47.30B (down 3.1%) DEX Weekly Volume: $11.82B (up 22%) Bonus Reads[Osato Avan-Nomayo – The Block] – MakerDAO integrates Chainlink oracle to help maintain DAI stability [Brandy Betz – CoinDesk] – StarkWare Partnering With Chainlink for StarkNet Growth [Ezra Reguerra – Coin Telegraph] – CoW Swap hacker milks over 550 BNB using ‘solver’ exploit [Vishal Chawla - The Block] – Trader Joe's native token 'joe' goes omni-chain with LayerZero partnership [haurya Malwa - CoinDesk] – Umami Finance CEO Dumps All Tokens After Week-Long Drama, Leaving Crypto Hopefuls Stranded This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

February 3

Friday, February 3, 2023

This week, Celsius releases a withdrawal process for users, a Cardano-based stablecoin launches, MetaMask has updates for privacy and a cross-chain brokerage appears on Arbitrum testnet.

This Week In DeFi – January 26

Friday, January 27, 2023

This week, Uniswap looks to deploy on BNB Chain, Aave soon to launch v3 and GHO stablecoin on Ethereum, dYdX delays its token unlock and Moody's develops stablecoin ratings.

This Week In DeFi – January 20

Friday, January 20, 2023

This week, Shiba Inu announces its Layer-2 scaling platform Shibarium, SushiSwap will build a DEX aggregator, 1inch introduces a hardware wallet, and Swing rolls out a handy cross-chain developer kit.

This Week In DeFi – January 13

Friday, January 20, 2023

This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.

This Week In DeFi – January 6

Friday, January 6, 2023

This week, SushiSwap explores new tokenomics, Vauld rejects Nexo's final acquisition proposal, TON launches a data sharing solution and a judge rules that customer funds belong to Celsius.

You Might Also Like

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏