DeFi Rate - This Week In DeFi – February 24

This Week In DeFi – February 24This week, Coinbase launches its own L2 network and lists Euro Coin, Mastercard enables USDC purchases via Immersve and BUSD meets the end of the road across multiple platforms.To the DeFi community, This week, Coinbase has launched Base, a layer 2 network built using Optimism's OP Stack, to provide a secure, low-cost and developer-friendly way to build decentralized apps. A testnet version of Base was launched on Thursday and will not be limited to Ethereum, providing easy access to other blockchain ecosystems including Solana. Coinbase plans to progressively decentralize the chain over time, but has been clear that it has no plans to issue a new network token. A Base Ecosystem Fund has also been announced to support early-stage projects building on the platform. Coinbase will allow developers to integrate their products with Base and provide fiat onramps, targeting an estimated 110 million verified users and $80 billion in assets on the platform.  1/ 🔵 We’re excited to announce @BuildOnBase.

Base is an Ethereum L2 that offers a secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized apps.

Our goal with Base is to make onchain the next online and onboard 1B+ users into the cryptoeconomy.

Coinbase has also announced support the euro-backed stablecoin Euro Coin (EUROC) on its platform in regions where trading is supported. EUROC will be supported as an ERC-20 token on the Ethereum network, but Coinbase has warned users to avoid sending the asset over other networks. Trading for EUROC will launch with the “Experimental” label, which is designated for new or low volume tokens on the exchange. The launch of EUROC-USD and EUROC-EUR pairs will continue in phases. The move comes right after Binance CEO Changpeng Zhao foreshadowed that non-USD stablecoins would become more prominent, as US regulators scrutinized Binance USD (BUSD).  Coinbase will add support for Euro Coin (EUROC) on the Ethereum network (ERC-20 token). Do not send this asset over other networks or your funds may be lost. Inbound transfers for this asset are available on @coinbase & @coinbaseExch in the regions where trading is supported.

Web3 tech innovator Immersve has partnered with Mastercard to enable users in Australia and New Zealand to spend cryptocurrency using the Mastercard network. The decentralized protocol will allow customers to remain in full control of their digital assets in a non-custodial wallet, while spending USDC for purchases on Mastercard’s network wherever the company is accepted. USDC spent on the network will then be converted to fiat and settled on the Mastercard network.  .@Mastercard has launched a crypto card with @immersve

This one is special

It's for self hosted wallets

Most crypto cards are linked to exchanges

Stablecoin issuer Paxos says that it is engaged in "constructive discussions" with the SEC over its Binance USD stablecoin, following a Wells notice. The firm has also announced that it will end its relationship with Binance, which it said no longer aligns with its current strategic priorities. Paxos has facilitated more than $2.8bn in BUSD redemptions since announcing that it would stop issuing the stablecoin. Both Aave and MakerDAO are distancing themselves from some Paxos-issued stablecoins following the news, as Aave freezes BUSD markets and MakerDAO appears to be hesitant to pursue a recently discussed deal with Paxos.  Capitalization of Binance USD ( $BUSD ) has decreased by $1 billion over the past days - Paxos is actively pursuing redemptions, burning stablecoins along the way.

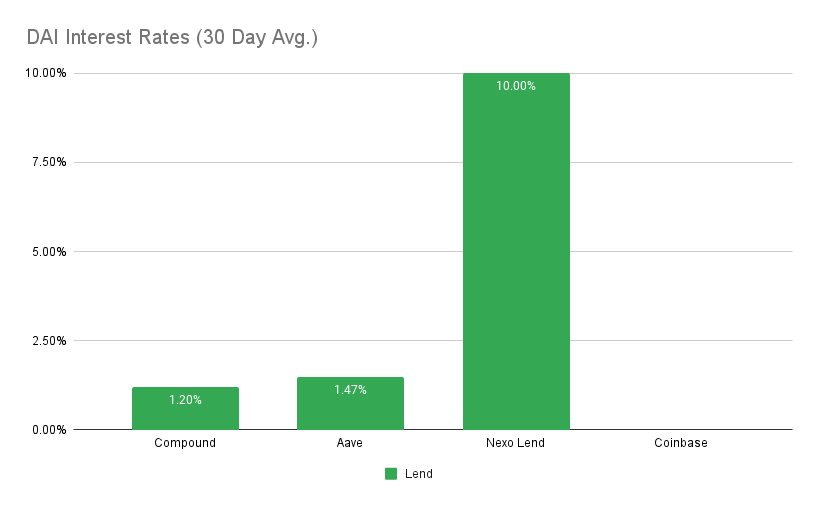

Meanwhile, $USDT volume & utilization has increased. Stablecoins have taken over the news this week, as platforms and protocols are further forced away from centralized stablecoins – this time predominantly BUSD. The popularity of USDC and newer stablecoins such as EUROC may be on the rise, as the ecosystem appears to be strengthening around those tokens. In particular, Mastercard’s new support of USDC purchases from non-custodial wallets may provide a significant boost to Centre’s dominance. Decentralization proponents are still anxiously anticipating the release of the non-centralized alternatives from Aave and Curve, which seemingly cannot come soon enough. Additionally, Frax’s shift away from algorithmic backing to full reserves will be an interesting one to watch. Scaling platforms are once again also an interesting an important topic, as Coinbase launches its own Optimism-based platform for Ethereum and other blockchains. With no plans for a token, it will be interesting to see what sort of incentives they’ll use to achieve their optimistic goals – let’s see if they can compete with their already-established competitors. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.5% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 1.6% APY Top StoriesSEC files objection to Binance.US bid for Voyager assetsSelf-hosted wallet ban avoided in new draft of EU’s anti-money laundering billNBA-Branded 'Top Shot Moments' NFTs May Be Securities, Judge Rules in Dapper Labs CaseEthereum developers schedule Shanghai upgrade on Sepolia testnet for Feb. 28Stat BoxTotal Value Locked: $49.67B (up 0.7% since last week) DeFi Market Cap: $52.10B (up 4.9%) DEX Weekly Volume: $11.47B (down 27%) Bonus Reads[Vishal Chawla – The Block] – Tezos signs up Google Cloud as a validator on its blockchain [Kari McMahon – The Block] – Binance Labs and Polychain co-lead ZK startup Polyhedra Network's $10 million raise [Oliver Knight – CoinDesk] – DeFi Protocol Ankr's Token Surged 73% on Microsoft and Tencent Partnerships [Martin Young - Cointelegraph] – Frax Finance to retire algorithmic backing amid stablecoin crackdown This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – February 17

Friday, February 17, 2023

This week, Paxos halts BUSD issuance, Nexo cuts off US users, Abu Dhabi pledges $2B to Web3 and the Blur NFT marketplace drops a token.

February 10

Friday, February 10, 2023

This week, Aave launches its GHO stablecoin on testnet, the SEC cracks down on staking services, Metamask looks to go multi-chain and Salt Lending is revived with $64M in funding.

February 3

Friday, February 3, 2023

This week, Celsius releases a withdrawal process for users, a Cardano-based stablecoin launches, MetaMask has updates for privacy and a cross-chain brokerage appears on Arbitrum testnet.

This Week In DeFi – January 26

Friday, January 27, 2023

This week, Uniswap looks to deploy on BNB Chain, Aave soon to launch v3 and GHO stablecoin on Ethereum, dYdX delays its token unlock and Moody's develops stablecoin ratings.

This Week In DeFi – January 20

Friday, January 20, 2023

This week, Shiba Inu announces its Layer-2 scaling platform Shibarium, SushiSwap will build a DEX aggregator, 1inch introduces a hardware wallet, and Swing rolls out a handy cross-chain developer kit.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏