DeFi Rate - This Week In DeFi – February 17

This Week In DeFi – February 17This week, Paxos halts BUSD issuance, Nexo cuts off US users, Abu Dhabi pledges $2B to Web3 and the Blur NFT marketplace drops a token.To the DeFi community, This week, Binance USD (BUSD) issuer Paxos has been ordered by the New York Department of Financial Services (NYDFS) to stop issuing the stablecoin, following an investigation. Not only that, but the US Securities and Exchange Commission (SEC) is also planning to sue Paxos over BUSD for allegedly violating securities laws. Paxos has announced that it will cease the issuance of new BUSD stablecoins as of February 21, and will honor redemptions through at least February 2024. Almost $700 million BUSD has already been burned in exchange for US dollar redemptions since the news broke.  This week the NYDFS ordered US-based Paxos to stop issuing US dollar-denominated stablecoin BUSD and the SEC issued a Wells notice to Paxos. We don’t know what aspects of BUSD might be of interest to the SEC.

What we do know: stablecoins are not securities 🧵 Crypto lending platform Nexo will stop its Earn Interest Product for all US clients on April 1, following a settlement with the Securities and Exchange Commission (SEC) last month. Nexo was charged by the SEC for failing to register the retail crypto asset lending product in the US. Without admitting or denying the charges, Nexo agreed to pay $45 million and an order to block it from violating registration provisions under the Securities Act of 1933. International clients who believe their accounts have been wrongfully flagged must provide updated verification details.  @CoinDesk @SECGov @parikshitm899 The Earn Interest Product remains available for U.S. clients until April 1, 2023.

nexo.io/blog/update-fo… Abu Dhabi's tech ecosystem, Hub71, has launched a $2 billion initiative to support Web3 and blockchain technology startups in the region. The Hub71+ Digital Assets ecosystem will offer startups access to various programs and potential partners, promote startup growth in the Middle East and global markets, and support businesses relocating to Abu Dhabi. The initiative will be based at Hub71 in the Abu Dhabi Global Market financial district and is supported by the First Abu Dhabi Bank's research and development hub, FABRIC.  Abu Dhabi's @hub71ad has launched Hub71+ Digital Assets, an ecosystem focused on Web3 and blockchain startups, with over $2B committed funding from First Abu Dhabi Bank.

#startups #uae #funding @FABConnects

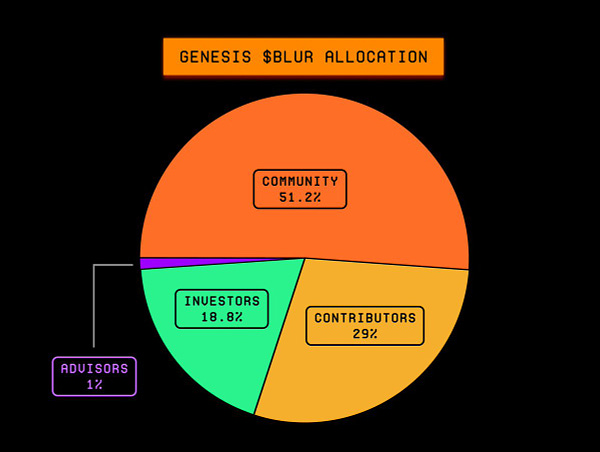

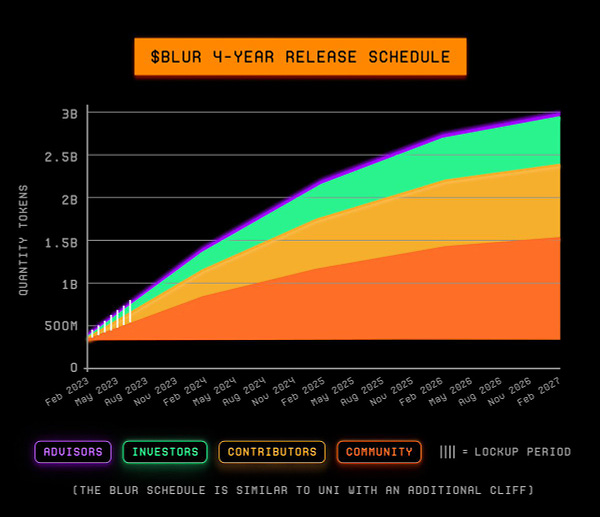

Blur, a new NFT marketplace, has finally launched its native token after recently delaying its unlocking for two weeks. The marketplace has already raised enough money to achieve “unicorn” status, with a valuation north of $1 billion. The total supply of Blur's native BLUR token is capped at three billion tokens, with 12% (360 million tokens) distributed during Tuesday's unlock. Blur overtook the established market leader, OpenSea, in NFT trading volume on Wednesday, according to data analytics platform Nansen.ai.  If you are looking for BLUR tokenomics, here you go.

TL;DR 🫵

- 12% airdrop can be claimed now by traders who used the platform through the box system

- 40% of all tokens will be released year 1. 30% year 2. 20% year 3 and 10% year 4.

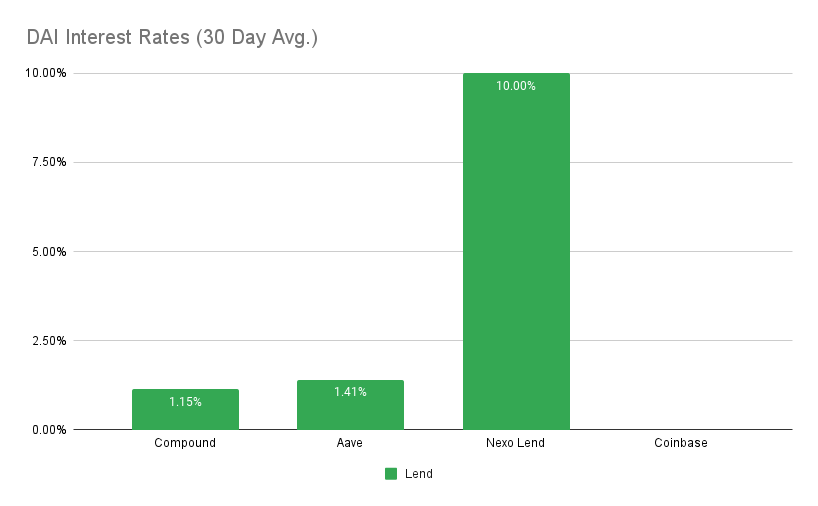

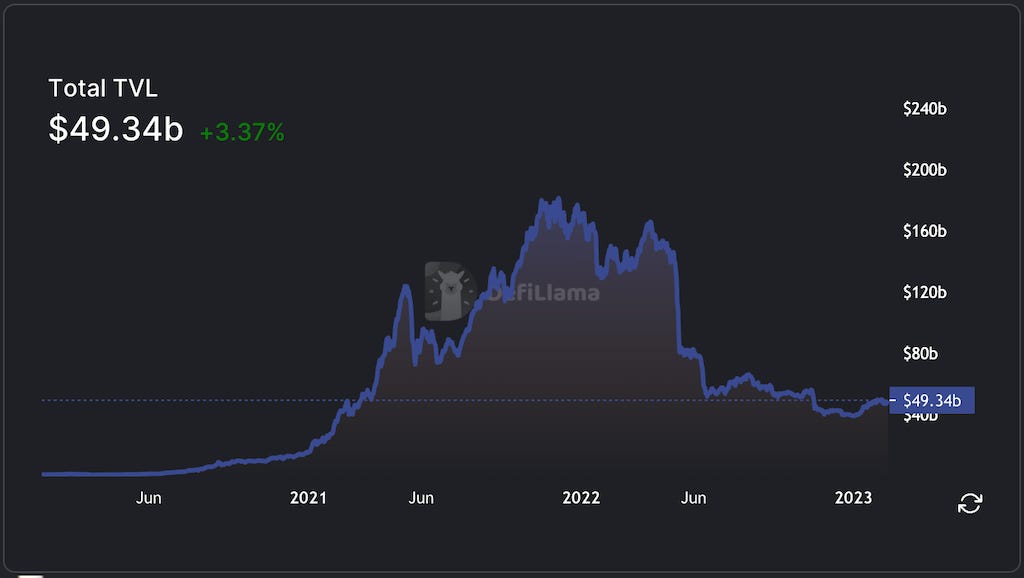

- 3B total supply The US regulator crackdown continues, as stablecoin issuer Paxos is forced to wind down BUSD – currently the third-largest stablecoin on the market. The news comes right as the Financial Stability Board (FSB) released a report on DeFi, discussing whether to subject stablecoins and centralized crypto platforms to greater regulation – a move that may further hamper the onboarding of users into the space. Coupled with Nexo’s recent settlement, it appears that centralized crypto platforms will continue to be impacted by US regulatory bodies for the foreseeable future. On the plus side, international investment into the Web3 and DeFi space continues to flourish as Abu Dhabi pledges $2 billion in investments, while Japanese financial giant Nomura also ventures into the industry via investment into Infinity Exchange. Development also continues to be exciting, especially in the scaling space as Polygon and zkSync battle for zero-knowledge territory – watch this space! Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY Top StoriesBIS-funded regulator to probe DeFi entry points like stablecoinsPolygon eyes mainnet beta release for zkEVM Layer 2 next monthzkSync Counters Polygon With ‘Mainnet’ RollupNomura's Laser Digital invests in DeFi protocol Infinity ExchangeStat BoxTotal Value Locked: $49.34B (up 3.6% since last week) DeFi Market Cap: $49.67B (up 5.0%) DEX Weekly Volume: $15.69B (up 33%) Bonus Reads[Osato Avan-Nomayo – The Block] – Lido DAO mulls proposals to sell or stake $30 million worth of ether [Jack Schickler – CoinDesk] – Tornado Cash Developer to Stay in Jail as Dutch Trial Continues [Amitoj Singh – CoinDesk] – Celsius Debtors Release Sale Plan, Choose NovaWulf as Plan Sponsor [Tarang Khaitan - The Defiant] – Siemens Issues €60M Digital Bond On Polygon This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

February 10

Friday, February 10, 2023

This week, Aave launches its GHO stablecoin on testnet, the SEC cracks down on staking services, Metamask looks to go multi-chain and Salt Lending is revived with $64M in funding.

February 3

Friday, February 3, 2023

This week, Celsius releases a withdrawal process for users, a Cardano-based stablecoin launches, MetaMask has updates for privacy and a cross-chain brokerage appears on Arbitrum testnet.

This Week In DeFi – January 26

Friday, January 27, 2023

This week, Uniswap looks to deploy on BNB Chain, Aave soon to launch v3 and GHO stablecoin on Ethereum, dYdX delays its token unlock and Moody's develops stablecoin ratings.

This Week In DeFi – January 20

Friday, January 20, 2023

This week, Shiba Inu announces its Layer-2 scaling platform Shibarium, SushiSwap will build a DEX aggregator, 1inch introduces a hardware wallet, and Swing rolls out a handy cross-chain developer kit.

This Week In DeFi – January 13

Friday, January 20, 2023

This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏