DeFi Rate - This Week In DeFi – March 17

This Week In DeFi – March 17This week, USDC loses and regains its dollar peg, Arbitrum finally announces a token and airdrop, Ethereum sets a target date for withdrawals and Euler Finance is hacked for $200M.To the DeFi community, This week, Decentralized exchanges saw record-highs in trading volume last weekend, primarily sparked by panic-trading caused by a de-pegging of USD Coin (USDC). The de-pegging of the renowned stablecoin was triggered by news of $3 billion of its reserves being trapped in Silicon Valley Bank, which collapsed. Despite the crisis, Circle (the company that issues USDC) confirmed that every USDC token remained backed by one U.S. dollar. Traders' confidence in USDC was demonstrated by a surge in on-chain leveraged positions. The highly-popular Ethereum Layer-2 scaling platform is at last distributing its governance token ARB to its community members, on March 23. ARB will enable the community to control the governance of the Arbitrum One and Nova networks through a self-executing DAO. The airdrop will represent 12.75% of the total supply and will be handed to those who have used the network over the last year, but it will not be used for paying transaction fees. Steven Goldfeder, CEO of Offchain Labs, the maker of Arbitrum, said the goal is to decentralize the network by giving governance power to community members who are active in the chain. Ethereum developers have set a target date of April 12 for the completion of the full transition to a proof-of-stake network, with the Shanghai upgrade – which will finally enable staked ETH withdrawals. The target date marks a slight delay from the developers' initial target for this month. Validators have had their funds locked up since December 2020, and will be able to decide after April 12 what they want to do with their stake. While the last testnet hard fork experienced low participation rates, Ethereum developers are confident that the mainnet upgrade will not be affected. DeFi lending protocol Euler Finance threatened its recent exploiter with legal consequences, if they did not return 90% of the stolen funds within 24 hours. The exploiter stole $196m from the protocol on March 13 and has not returned the funds before the deadline, leading the Euler Foundation to offer a $1 million reward for any information leading to the identification and arrest of the attacker.  A few words about recent events.

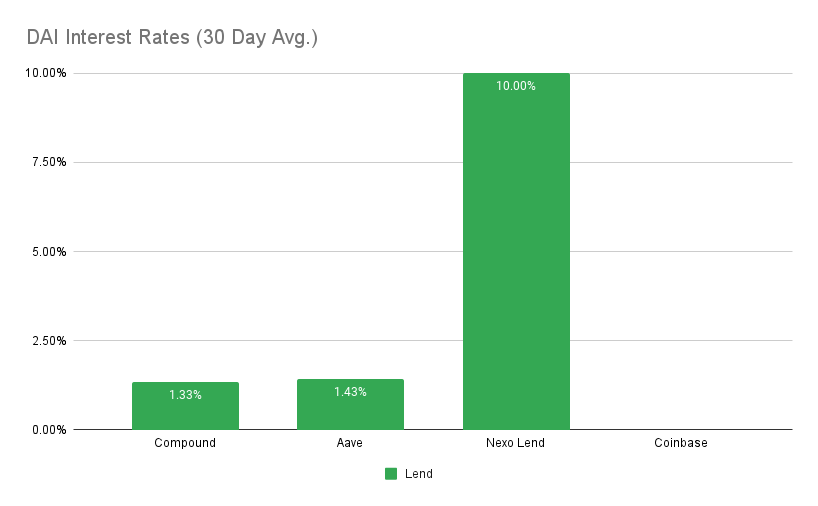

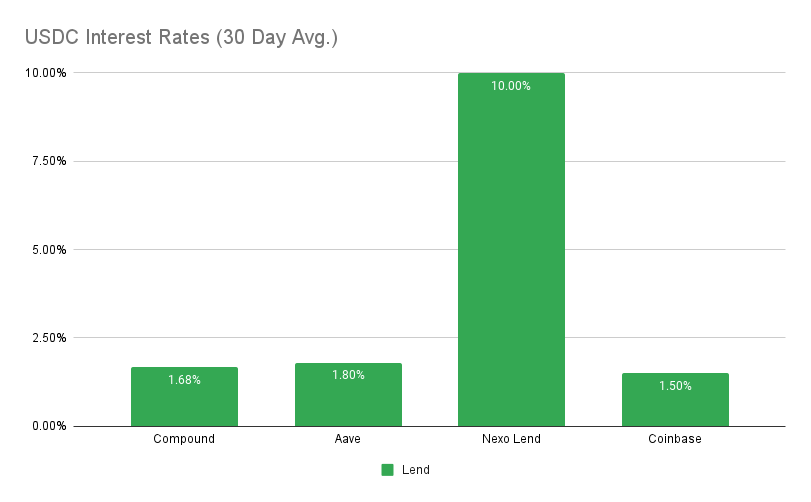

These have been the hardest days of my life and I’m absolutely devastated for everyone who’s been affected. Events over the last week took a fascinating turn, as failure in the traditional banking sector led to turbulence in the crypto markets – rather than the other way around. Silicon Valley Bank collapsed, taking $3 billion of USDC’s reserves along with it, resulting in chaos across the DeFi world. USDC was considered to be one of the safest stablecoins around, leading to widespread shock as the token plummeted in value to as low as 81 cents on some exchanges. Although USDC managed to successfully re-peg to the dollar, the event was just the latest example of centralized parties being a critical point of failure in crypto and DeFi. Centralized stablecoins should most likely be considered a temporary vehicle for storing value on-chain while native coins (BTC, ETH, etc.) are still reaching their saturation point, and eventual stability. Until then, it is important to remember that centralized stablecoins are at the mercy of those in charge of managing them and their reserves, as well as regulators who are defending the traditional financial system. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 1.8% APY Top StoriesEU Parliament Passes Bill Requiring Smart Contracts to Include Kill SwitchVoyager-Binance.US Pause Denied by Bankruptcy JudgePolygon Labs partners with Unstoppable Domains to launch top-level domainsUniswap officially expands exchange services to BNB ChainStat BoxTotal Value Locked: $47.12B (up 5.1% since last week) DeFi Market Cap: $49.88B (up 14%) DEX Weekly Volume: $47.85B (up 555%, not a typo!) Bonus Reads[Ian Allison – CoinDesk] – Coinbase Is Adding DeFi Apps Uniswap and Aave to Its Base Blockchain: Source [Robert Stevens – CoinDesk] – Uniswap's NFT Platform Shows DeFi's Reluctant Acceptance of Centralization [Aleksandar Gilbert – The Defiant] – Filecoin Launches Ethereum-compatible Smart Contracts [Danny Nelson – CoinDesk] – Crypto Exchange Orca to Block US Traders From Website This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – March 3

Friday, March 10, 2023

Coinbase unveils "Wallet-as-a-Service," MolochDAO builds a regulation-friendly mixer, Violet launches a "compliant" DEX and ENS announces sub-domains.

This Week In DeFi – March 3

Friday, March 3, 2023

This week, Marker looks to add MKR as collateral for DAI, Robinhood launches a non-custodial wallet, Ethereum devs release EntryPoint for account abstraction, and Redeem sends NFTs to phone numbers

This Week In DeFi – February 24

Friday, February 24, 2023

This week, Coinbase launches its own L2 network and lists Euro Coin, Mastercard enables USDC purchases via Immersve and BUSD meets the end of the road across multiple platforms.

This Week In DeFi – February 17

Friday, February 17, 2023

This week, Paxos halts BUSD issuance, Nexo cuts off US users, Abu Dhabi pledges $2B to Web3 and the Blur NFT marketplace drops a token.

February 10

Friday, February 10, 2023

This week, Aave launches its GHO stablecoin on testnet, the SEC cracks down on staking services, Metamask looks to go multi-chain and Salt Lending is revived with $64M in funding.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏