DeFi Rate - This Week In DeFi – March 24

This Week In DeFi – March 24This week, Arbitrum's $ARB goes live, Celsius custody will return 72.5% of assets, Coinbase gets a warning from the SEC and DRPC launches decentralized RPCs for Ethereum.To the DeFi community, This week, Ethereum Layer-2 scaling platform Arbitrum has enabled claims for its recently-announced token, $ARB. 1.16 billion ARB tokens have been made available for early users, representing 11.6% of the total token supply. The claims website crashed as recipients rushed to collect their airdrops, with transaction fees spiked during the frenzy. Through the token release, Arbitrum will be transitioning to a self-executing DAO and handing over control of governance decisions to ARB token holders. A 12-member council will be able to intervene in emergencies. ARB is already trading on several centralized exchanges, including Coinbase, Binance, KuCoin, Bybit and OKX. Celsius custody account holders will be able to retrieve 72.5% of their cryptocurrency assets, after a federal judge approved a settlement in the defunct crypto lender's bankruptcy case. The settlement is between Celsius debtors, the unsecured creditors committee, and an ad hoc group of custodial account holders. Individual custody account holders must opt-into the settlement. The 72.5% return would come over time and does not include transaction fees, and the settlement does not release any rights or causes of action related to assets held in the Celsius Earn program.  Bankruptcy Court: The #Celsius Custody settlement is approved. Will be optional for customers. 30 days to review. Those who opt in will get 72.5% of their claim in two distributions 36.25% up front and 36.25% upon plan resolution (or at end of year). Coinbase has been slapped with a Wells notice from the US Securities and Exchange Commission (SEC), threatening to sue the exchange over certain products. The potential enforcement action is likely to be tied to aspects of Coinbase's spot markets, as well as its staking service Earn, Prime, and Wallet products. Shares of Coinbase Global Inc. have fallen dramatically upon the news. CEO Brian Armstrong took to Twitter to explain the notice, as well as the company’s journey with regulators thusfar.  1/ Today Coinbase received a Wells notice from the SEC focused on staking and asset listings. A Wells notice typically precedes an enforcement action. Ethereum infrastructure provider DRPC has launched a decentralized remote procedure call (RPC) network for Ethereum-based apps. The service is designed to enhance security, cost-efficiency, and reliability for decentralized applications in the crypto industry. RPCs are a crucial part of blockchain infrastructure, however are typically provided by centralized entities – a possible single point of failure for blockchain applications in case of outages. To address this, DRPC has launched a decentralized RPC stack, consisting of a network of globally distributed providers that can more efficiently share the RPC load of crypto apps among themselves. The project currently focuses on Ethereum, but aims to expand its coverage to networks including Arbitrum, Polygon, and Optimism in the coming months.  DRPC is now Live!🥳

DRPC is an Ethereum-based decentralized RPC network that enhances the following:

1. reliability

2. cost-efficiency

3. security

Get your first endpoint and make Ethereum more decentralized in just 30 secs - drpc.org

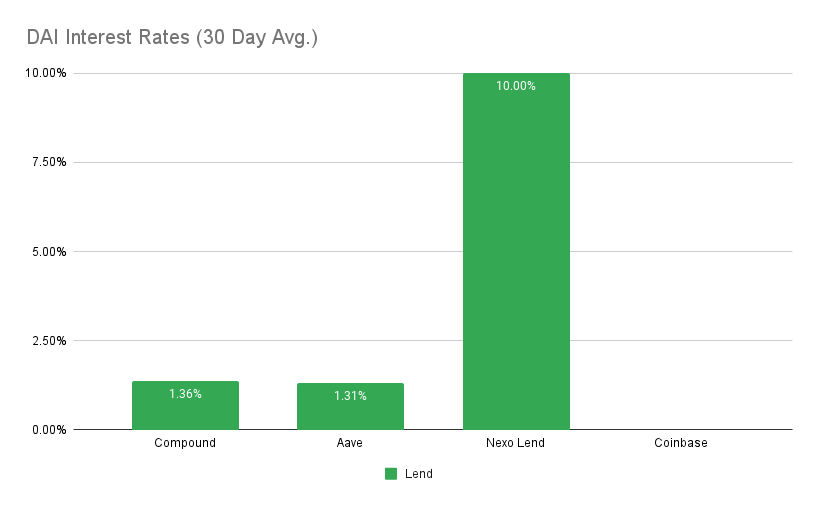

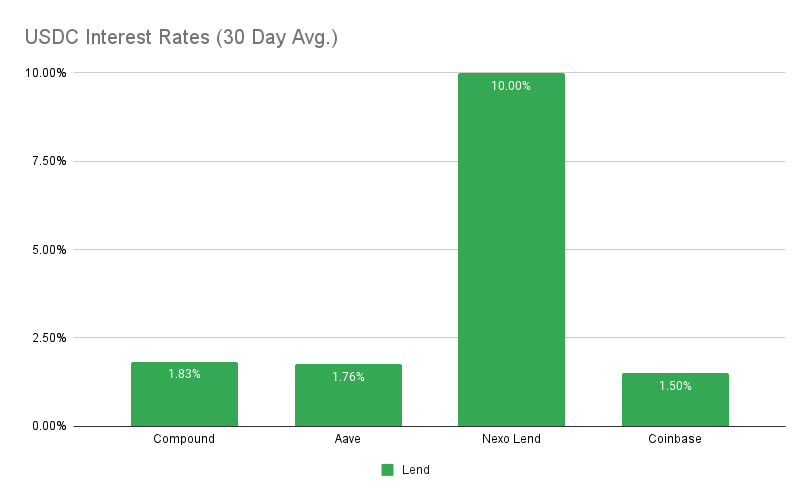

More details in the thread🧵  The Block @TheBlock__ The battle for the best Ethereum Layer-2 scaling platform is officially in full-swing as Arbitrum joins the race with its ARB governance token – the launch of which broke its claim website. ARB has already passed its closest competitor Optimism in terms of fully-diluted market cap, with a total valuation of around $14 billion vs $11 billion. Arbitrum also has more than twice the total value locked (TVL), with $2.11 billion of value sitting in its ecosystem vs Optimism’s $985 million. Arbitrum’s TVL is also almost double that of Polygon, which sits at $1.07 billion according to DefiLlama. Only the Ethereum mainnet, Tron and Binance Smart Chain have a higher TVL as of today. In other news, the SEC continues to issue Wells notices left, right and center, as Coinbase and Sushi become the latest recipients of the dreaded warning letters. While Coinbase isn’t a decentralized platform, the SEC’s potential action against the company is aimed not just at their staking platform, but also their asset listings. This has the potential to hurt DeFi tokens as the platform is a major source of trading volume and a gateway to investing in such projects. Sushi’s Wells notice may also be an interesting test, due to its positioning as one of the more decentralized exchanges available today. With almost $600 million in TVL, Sushi’s CEO Jared Grey is asking token holders for a $3 million allocation toward legal expenses to fight the battle. How will DeFi stand against SEC allegations? This battle may be one of the most important yet. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 1.8% APY Top StoriesTerraform Labs CEO Do Kwon believed to be arrested in Montenegro, Yonhap saysMicrosoft testing crypto wallet in its web browser EdgeRon DeSantis proposes law to ban a ‘centralized digital dollar’ in FloridaSushi Braces for Legal Fight After SEC SubpoenaStat BoxTotal Value Locked: $50.38B (up 6.9% since last week) DeFi Market Cap: $50.77B (up 1.8%) DEX Weekly Volume: $14.99B (down 69%) Bonus Reads[Vishal Chawla – The Block] – Gaming project Aavegotchi to release own blockchain with Polygon Supernets [Krisztian Sandor – CoinDesk] – Stablecoin Issuer MakerDAO Votes to Retain USDC as Primary Reserve Even After Depeg [Yogita Khatri – The Block] – Euler exploiter returns $5.4 million in ETH to DeFi protocol [Owen Fernau – The Defiant] – DeFi Llama Team Resolves Conflict Over Token Plans This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – March 17

Friday, March 17, 2023

This week, USDC loses and regains its dollar peg, Arbitrum finally announces a token and airdrop, Ethereum sets a target date for withdrawals and Euler Finance is hacked for $200M.

This Week In DeFi – March 3

Friday, March 10, 2023

Coinbase unveils "Wallet-as-a-Service," MolochDAO builds a regulation-friendly mixer, Violet launches a "compliant" DEX and ENS announces sub-domains.

This Week In DeFi – March 3

Friday, March 3, 2023

This week, Marker looks to add MKR as collateral for DAI, Robinhood launches a non-custodial wallet, Ethereum devs release EntryPoint for account abstraction, and Redeem sends NFTs to phone numbers

This Week In DeFi – February 24

Friday, February 24, 2023

This week, Coinbase launches its own L2 network and lists Euro Coin, Mastercard enables USDC purchases via Immersve and BUSD meets the end of the road across multiple platforms.

This Week In DeFi – February 17

Friday, February 17, 2023

This week, Paxos halts BUSD issuance, Nexo cuts off US users, Abu Dhabi pledges $2B to Web3 and the Blur NFT marketplace drops a token.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏