Valued at $3 billion: A brief introduction to LayerZero's main ecosystem projects

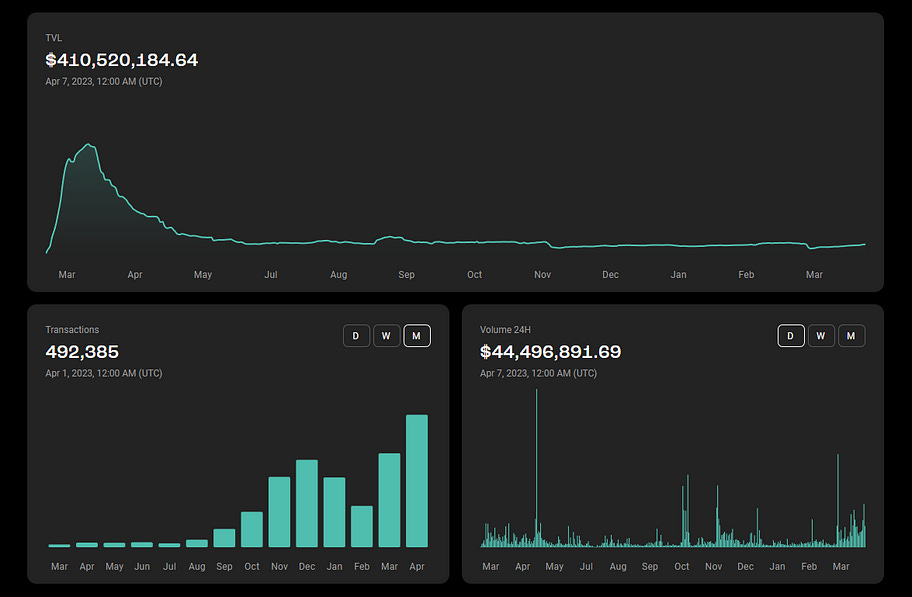

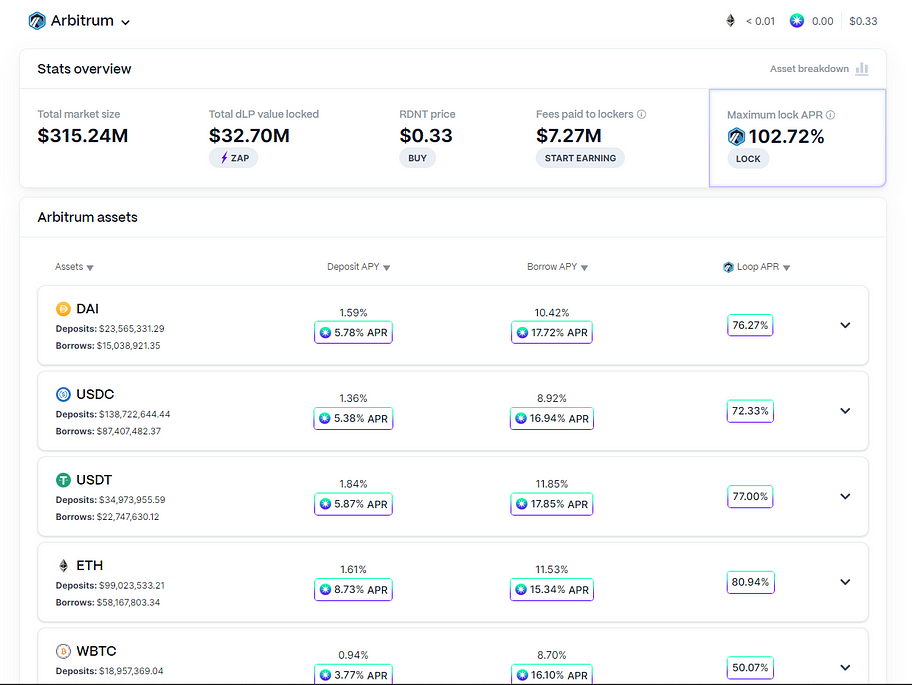

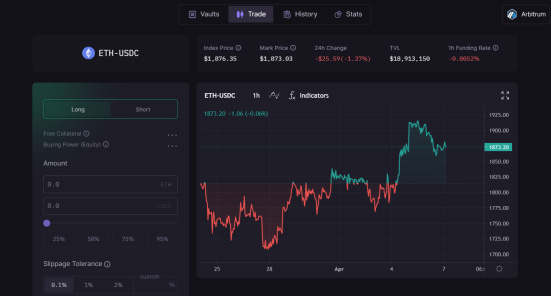

Author: @0xMavWisdom LayerZero, also known as the “king of the full-chain,” completed a $120 million Series B financing on April 4th, led by a16z Crypto and Sequoia Capital, bringing its valuation to $3 billion. As a full-chain interoperability protocol, LayerZero has integrated with multiple protocols in the DeFi and NFT fields, including some excellent projects. This article will introduce LayerZero’s main projects. Bridge Stargate Stargate is the first dApp built on LayerZero and also a fully composable native asset bridge. With LayerZero’s Series B funding, Stargate’s daily interactions have surged. Currently, users can transfer various assets, including USDC, USDT, DAI, STG, RDNT, FRAX, and more, across 8 public chains that including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Fantom, Metis, and Avalanche. A 0.06% fee will be charged for non-STG asset transfers. Additionally, users can provide liquidity on different public chains through Stargate and receive staking rewards. Stargate has issued the STG Token, and holders can stake their STG to not only receive protocol revenue sharing but also exchange their shares for veSTG based on their staking duration, which allows them to participate in proposals, voting, and other community governance activities. Currently, holders can stake for periods ranging from 1 to 36 months. As of April 7th, Stargate’s TVL exceeded $410 million, and the number of transactions in April has exceeded 470,000, setting a new record for monthly transactions. Aptos Bridge Aptos Bridge supports multiple assets, including ETH, USDC, USDT, WETH, USDD, CAKE, BTC.b, and more, as well as bridging 6 EVM-compatible chains, including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, and Avalanche to the Aptos network. It is important to note that there is a 2–3 day waiting period for users to withdraw assets from Aptos. USDC Bridge The USDC Bridge is a cross-chain bridge for USDC created by Circle in collaboration with LayerZero. Currently, it supports cross-chain testing of USDC testnet tokens between Avalanche’s Fuji testnet and Ethereum’s Goerli testnet. Users can obtain testnet tokens from the faucet to participate in cross-chain activities. Holograph Holograph is an NFT cross-chain bridge that currently allows users to bridge NFTs across Ethereum, Polygon, and Avalanche. In addition to cross-chain NFT transfers, users can also create their own NFTs on the Holograph platform. BTC.b(Bitcoin Bridge) BTC.b is a bridge created specifically for BTC assets, utilizing the LayerZero Omnichain Fungible Token (OFT) standard to seamlessly integrate BTC across all LayerZero-supported networks. This allows users to transfer BTC assets across Ethereum, BSC, Arbitrum, Optimism, Fantom, Avalanche, and Aptos. Testnet Bridge The Testnet Bridge is a public product launched by LayerZero for developers. Developers can exchange GETH on the Ethereum Goerli testnet for ETH on Ethereum, or exchange GETH on Ethereum, Arbitrum, and Optimism for GETH on the Goerli testnet. The exchange via Testnet Bridge solves the problem of developers not having enough GETH to conduct project testing. DEX Hashflow Hashflow is a decentralized exchange that aims to achieve interoperability, zero slippage, and MEV protection. Users can experience cross-chain trading on Hashflow, exchanging various assets such as ETH, MATIC, and USDT across 6 public chains including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, and Avalanche. Sushiswap Sushiswap is one of the veteran DeFi projects but also a rising star in LayerZero’s cross-chain asset protocol. Users can use this platform for cross-chain asset trading on Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Avalanche, and Fantom. The supported cross-chain trading assets include ARB, ETH, USDT, DAI, and more. Lending Radiant Capital Radiant is a full-chain lending platform that has integrated with Arbitrum and BNB Chain. Users can deposit or borrow 5 assets, including ETH, USDT, DAI, USDC, and WBTC on Arbitrum, and 6 assets, including ETH, USDT, USDC, BTCB, BUSD, and BNB on BNB Chain. According to official data, Radiant’s assets on Arbitrum currently total $315 million, making it the largest lending protocol on Arbitrum; assets on BNB Chain exceed $160 million. Radiant has issued RDNT Token, which is mainly used to incentivize liquidity provision and governance, and supports RDNT bridging between BNB Chain and Arbitrum. Perpetual contract Rage Trade Rage Trade is a derivatives exchange built on LayerZero, where users can trade futures or options. Rage Trade generates revenue by bridging the ETH/USD pool of protocols such as GMX and Sushiswap, and provides cyclic liquidity. Rage Trade can use LP tokens from other blockchains such as Polygon, Avalanche, and Solana as liquidity for the protocol on the Arbitrum chain. For example, when 3CRV LP tokens are used as collateral on Chain A, they can also provide virtual liquidity for Rage Trade on Chain B. Currently, Rage Trade has not issued tokens. NFT Omni X Omni X is a full-chain NFT platform built on LayerZero, supporting NFT trading on 8 public chains, including Ethereum, Arbitrum, Optimism, BNB Chain, Avalanche, Moonbeam, Polygon, and Fantom. In the future, it will expand to integrate with Solana and other non-EVM chains. Currently, Omni X has not yet opened its mainnet and is still in testing. Gh0stly Gh0sts Gh0stly Gh0sts is the first full-chain NFT on LayerZero, with a total supply of 7710. The current floor price is 0.195 ETH, and it is also regarded by the community as the NFT most likely to receive potential airdrop weight in the future on LayerZero. Domain name LayerZero Name Service LayerZero Name Service is a domain name service designed specifically for multi-chain use. After completing registration with LayerZero Name Service, users can display their on-chain domain name identity on 8 public chains including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Fantom, Metis, and Avalanche. Currently, the registration fee for domain names with five or more digits is $5 per year, $30 per year for domain names with four digits, and $100 per year for domain names with three digits. Users can choose to register for 1 year, 2 years, 5 years, or 10 years. Currently, user registration can only be done on Ethereum. As of April 7th, there are 9,500 addresses registered with LayerZero Name Service. Reference: https://bixinventures.medium.com/portfolio-insights-layerzero-fdda888c5188 Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Hong Kong Securities Regulatory Commission official original text: If DeFi involves securities and futures trading…

Wednesday, April 19, 2023

Speecher:Keith Choy, Interim Head of Intermedlaries Division, Hong Kong Securities and Futures Commison(Chairman of Fintech Advisory Group) Editor:@null_aez, WuBlockchain Link: https://www.web3festival

WuBlockchain Weekly:ETH Shanghai Upgrade、Web3.0 Association formed in HK、HashKey launches HSK and Top10 News

Wednesday, April 19, 2023

Top10 News 1. Ethereum completed the Shapella upgrade link On April 13, Ethereum completed the Shapella upgrade at block height 6209536, and validator withdrawals are now enabled. Nearly 30 hours after

Weekly project updates: ConsenSys free NFT, Uniswap Wallet on App Store, Solana phone Saga public sale, etc

Wednesday, April 19, 2023

1. ETH's weekly summary a. ConsenSys launches NFT collection to commemorate Shanghai upgrade link On April 12, ConsenSys announced the launch of its NFT collection “Ethereum, Evolved: Shanghai” to

Asia’s weekly TOP10 crypto news (Apr 10 to Apr 16)

Wednesday, April 19, 2023

Author:Lily Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong's ZA Bank offers crypto conversions, accounts in city's push link On April 12, according to Bloomberg, Hong

Global Crypto Mining News (Apr 10 to Apr 16)

Wednesday, April 19, 2023

1. Bitdeer and Blue Safari's merger was approved at a shareholders meeting, and Bitdeer shares started trading on NASDAQ under the symbol "BTDR". Bitdeer has six mining data centres with

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏