Bitdeer IPO: How Competitive? Comparative Research with Marathon and Riot, Two Major Mining Giants

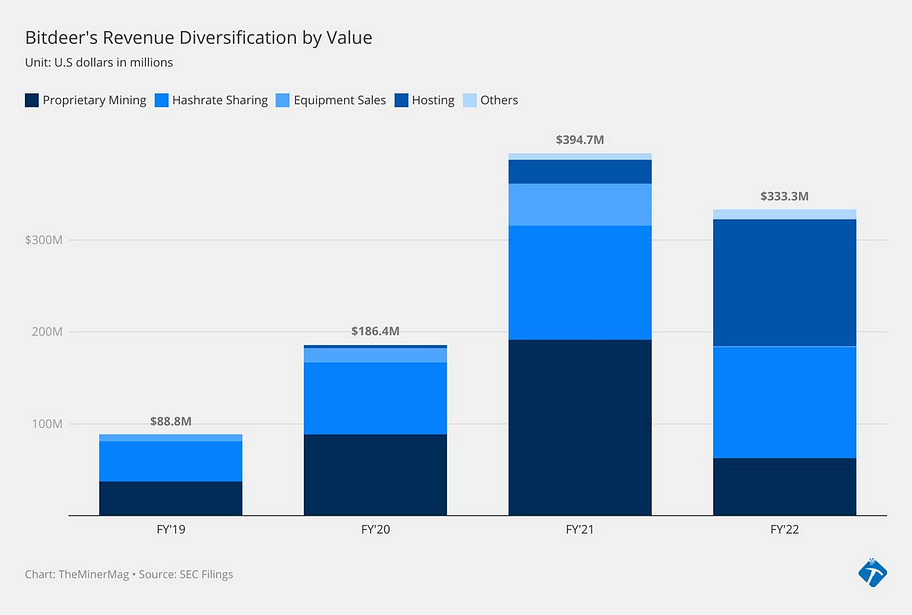

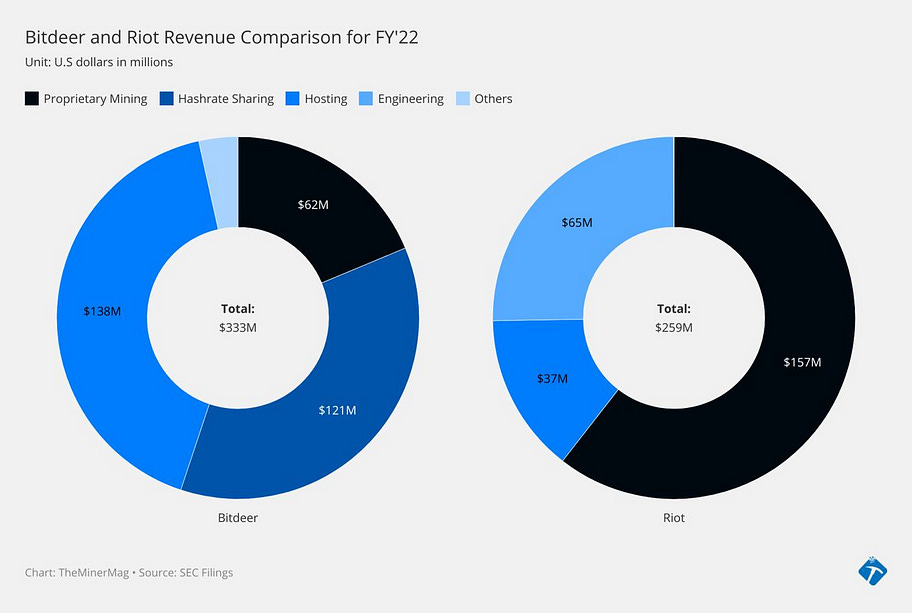

WuBlockchain Author: Joey Wu WuBlockchain Editor: Colin Wu Disclaimer: This article does not constitute financial investment advice, and the author has no vested interest in the companies mentioned. This article will analyze and compare the profitability, hashrate, electrical power, and number of mining machines of Bitdeer, Marathon Digital Holdings, and Riot Blockchain to present their competitive positions in the market. Profitability: Bitdeer achieved a net profit of $113.8 million in the six months ending June 30, 2021, and a net profit of $82.6 million for the year ending December 31, 2021. However, in the six months ending June 30, 2022, the company had a net loss of $25.2 million, with an annual loss of $60.4 million (mainly due to pre-IPO stock option expenses, etc.). As of December 31, 2022, the revenue proportions were: 18.7% for proprietary mining, 36.4% for cloud hashrate, 3.8% for cloud hosting, 29.8% for general hosting, 7.8% for membership hosting, and 0.2% for mining machine sales. In contrast, Marathon had a net loss of $37.1 million in 2021 and a net loss of $686.7 million in 2022. Among them, impairments related to prepayments for mining equipment and suppliers amounted to $332.9 million, and the book value of digital assets declined by $317.6 million. Riot, on the other hand, had a net loss of $509.6 million for the same year, a significant increase from the net loss of $15.4 million in 2021. Bitcoin mining revenue was $156.9 million, down from $184.4 million in 2021; data center hosting revenue was $36.9 million, up from $24.5 million in 2021. The losses mainly reflected impairments, including $335.6 million in goodwill impairments and $55.5 million in mining machine impairments, which had a significant impact on the reported net loss. (Source: TheMinerMag) Hashrate: Riot has the highest proprietary mining hashrate capacity among the three companies, with a 213% increase in hashrate capacity in 2022, reaching 9.7 EH/s, a significant increase from 3.1 EH/s in 2021, accounting for approximately 4.2% of the total Bitcoin network’s hashrate. Additionally, due to severe winter storms in Texas causing delays, Riot expects to reach its proprietary mining hashrate capacity target of 12.5 EH/s in the second half of 2023. As for Bitdeer, as of June 30, 2022, the proprietary mining business hashrate capacity was 4.2 EH/s, accounting for 1.8% of the total Bitcoin network’s hashrate. Adding the 6.3 EH/s of hosted hashrate generated by mining machines hosted in its mining data centers, the company has a total managed hashrate of 10.5 EH/s, accounting for approximately 4.6% of the total Bitcoin network’s hashrate. On the other hand, Marathon had 7.0 EH/s of proprietary mining hashrate and 9.1 EH/s of total hosted hashrate in 2022. (Source: TheMinerMag) Electrical Power: In terms of total power, Bitdeer leads. As of June 30, 2022, the company’s power capacity was 522 megawatts, increasing to 775 megawatts by the end of 2022. Bitdeer successfully reduced the average power cost of its mining data centers to $40 per megawatt-hour in 2021, lower than the estimated global average of $49 per megawatt-hour. Currently, Bitdeer owns five proprietary mining data centers and plans to expand to six globally. Riot has an advantage in production efficiency, as the company received $27.3 million in power subsidies in 2022, equivalent to about 1,815 Bitcoins. The cost of mining Bitcoins for Riot was $11,225 per Bitcoin, a 6% decrease from $11,939 in 2021. Riot terminated its hosting agreement with Coinmint LLC at the Massena NY facility and moved all mining machines to its Rockdale facility, reducing power costs and eliminating third-party hosting fees. Based on available data, Riot has the lowest proportion of electricity costs, indicating the highest production efficiency. Comprehensive information on Marathon’s power usage is lacking. Bitcoin Production: In terms of Bitcoin production, Riot has the most significant growth among the three companies, producing 5,554 Bitcoins in 2022, a 46% increase from 3,812 Bitcoins in 2021. Marathon produced 4,144 Bitcoins in the 2022 fiscal year, a 30% increase from the previous year. In the fourth quarter of 2022, 1,562 Bitcoins were produced, averaging 17 per day, a 42% increase from the fourth quarter of 2021. Bitdeer did not disclose annual Bitcoin production. Financial reports show that Bitcoin mining revenue was $185 million for the full year of 2021 and $39 million for the first half of 2022. Conclusion: In summary, the three companies rank in total hashrate as follows: Riot, Bitdeer, and Marathon. However, Riot and Marathon have much higher proprietary computing power than Bitdeer. The higher the proportion of proprietary computing power, the more net profit is affected by Bitcoin prices, which is why these two companies suffered significant losses in 2022. Bitdeer, on the other hand, has a smaller risk due to its higher proportion of hosting business, and its net profit is less affected by price fluctuations. Additionally, Bitdeer has an advantage in controlling electrical power costs, making its financial situation noticeably better than the other two companies. As of 2022, the company had $321.8 million in working capital, of which $231.4 million was in cash and cash equivalents. It is worth mentioning that the three companies’ proprietary mining revenues were all around $200 million in 2021. However, entering 2022, Riot and Marathon’s proprietary proportions remained roughly unchanged, while Bitdeer’s plummeted to $60 million. This indicates that Bitdeer significantly reduced its proprietary mining business before the bear market began, demonstrating the rich experience of the veteran mining team from the original Bitmain in adapting to the crypto market cycles. On the other hand, Bitdeer’s current market value is only about 1/3 of the two North American-listed giants mentioned above, which puzzles the outside world and shows that the US capital market seems to have not yet recognized Bitdeer, possibly due to various reasons. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Sleep-to-Eearn Project Gosleep Intro: Great UI/UX but Insufficient Model Innovation

Wednesday, April 19, 2023

Author: @0xMavWisdom Recently, Gosleep has gained attention due to its listing on Bitget Launchpad. It is a Sleep to Earn application based on the Arbitrum blockchain and has previously secured $2

CEX Data Report in Mar: Both Spot and Derivatives Volumes Rose Sharply

Wednesday, April 19, 2023

Data compiled by the WuBlockchain shows that: Spot trading volumes on major exchanges rose by 9.6% month-over-month in March. The top three increases were Gate +117%, Bybit +113% and Bitfinex +61%. The

Valued at $3 billion: A brief introduction to LayerZero's main ecosystem projects

Wednesday, April 19, 2023

Author: @0xMavWisdom LayerZero, also known as the “king of the full-chain,” completed a $120 million Series B financing on April 4th, led by a16z Crypto and Sequoia Capital, bringing its valuation to

Hong Kong Securities Regulatory Commission official original text: If DeFi involves securities and futures trading…

Wednesday, April 19, 2023

Speecher:Keith Choy, Interim Head of Intermedlaries Division, Hong Kong Securities and Futures Commison(Chairman of Fintech Advisory Group) Editor:@null_aez, WuBlockchain Link: https://www.web3festival

WuBlockchain Weekly:ETH Shanghai Upgrade、Web3.0 Association formed in HK、HashKey launches HSK and Top10 News

Wednesday, April 19, 2023

Top10 News 1. Ethereum completed the Shapella upgrade link On April 13, Ethereum completed the Shapella upgrade at block height 6209536, and validator withdrawals are now enabled. Nearly 30 hours after

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏