Research on Survival of NFT Marketplaces (3) The Survival Strategy of Small Platforms in Their Niche

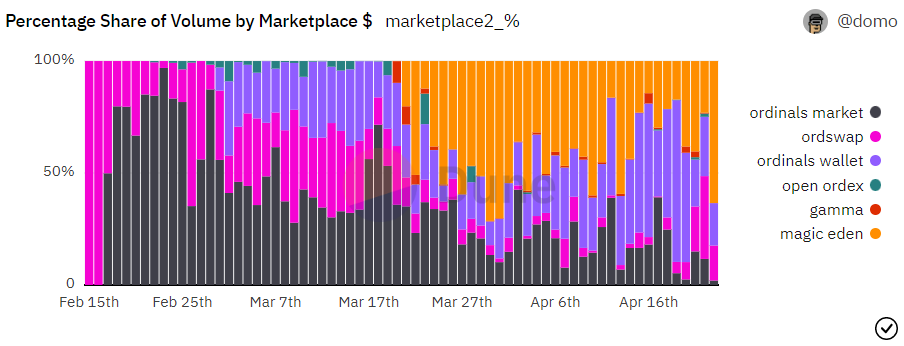

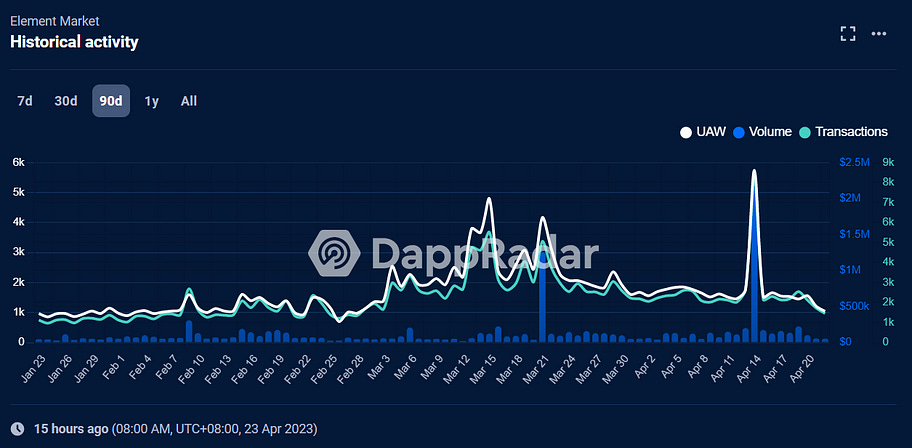

Author: @0xMavWisdom Disclosure: The author holds relevant assets such as NFT platform tokens as a personal investor and has no business dealings with any platform or project party. In the first two articles, we reviewed the four main platforms in the current mainstream NFT market. This article is the third in the study of the survival status of NFT marketplaces. In the aftermath of the post-royalty war, major platforms have fallen into difficulties, while small and beautiful platforms have shown their vitality. DappRadar shows that there are currently over 200 NFT marketplaces, and competition for the small NFT market is already very intense. However, most of the new platforms simply mechanically imitate the old path of their predecessors, becoming vampires of the pioneers. Therefore, in the small and beautiful chapter, the author mainly selected Magic Eden, Element, and OKX NFT Marketplace as examples. Magic Eden may have taken the lead in the potential new round of wars (multi-chain wars), Element has innovatively applied the equity NFT Pass card to the platform itself, and OKX NFT Marketplace, which is not considered a CEX, has benefited from the exchange’s built-in Web3 wallet entry. Magic Eden: A steadfast multi-chain ecological enthusiast Magic Eden originated from Solana, and in the early days, it supported volume for Solana OG level NFTs such as Degods and Solana Monkey Business. Later, the popularity of the Stepn game on the Solana chain, which used the Move-to-Earn model, and the strong wealth effect brought by Okay Bears, which was then called Solana BAYC, made more people aware of the Solana NFT ecosystem and the leading NFT marketplace, Magic Eden. Solana has also quickly formed an NFT ecosystem scale second only to Ethereum. In addition, with the strong developer community on Solana, Magic Eden has very complete tools for data analysis, Launchpad, on-chain whitelisting, and many third-party analysis websites, giving users an extraordinary user experience. The success on Solana led Magic Eden to pursue a larger market, and soon it integrated with Ethereum. However, due to strong competition on Ethereum and a lack of effective incentives, Magic Eden’s layout on Ethereum was not successful. In November of last year, the sudden collapse of Solana’s strongest supporters FTX and Alameda dealt a heavy blow to the Solana ecosystem, especially in the DeFi field, which almost completely collapsed. In contrast, although the NFT field also suffered a heavy blow, the cultural and spiritual attributes showed strength, and the NFT community became the cornerstone of Solana’s revival. However, although most NFTs survived and chose to continue building on Solana, the largest DeLabs series NFT in the Solana NFT ecosystem had the intention to withdraw. Degods and y00ts, as one of the most important trading volume components of Magic Eden, naturally did not want to give up this piece of cake. Soon, according to the voices circulating in the community, Polygon became one of the options for DeLabs migration, and Magic Eden quickly integrated with Polygon in December. Unlike some other NFT marketplaces that choose a multi-chain approach, Magic Eden’s multi-chain layout appeared more tragic due to the collapse of FTX and Alameda. The team behind it also learned from this experience and quickly integrated Bitcoin when Bitcoin Ordinal Inscription/NFT became popular. According to @domodata’s data, Magic Eden can account for about 30%-50% of the market share in Bitcoin Ordinals Inscriptions secondary market share. Although the overall contribution to trading volume is currently limited, it is expected to become an important part of Magic Eden’s multi-chain layout as the Bitcoin NFT ecosystem is recognized and developed. (Source: https://dune.com/domo/ordinals-marketplaces) Multi-chain will be an important narrative in the NFT bear market, and is likely to evolve into the next war after royalties, as a multi-chain strategy is one of the inevitable results of internal competition. When the competitiveness of the main chain is limited or insufficient, using the experience learned from the competition on the main chain to expand to other chains, using dimensionality reduction strategies (incentives and subsidies, etc.) and popularity to attack other native platforms on that chain and occupy market share. When more main chain platforms realize this, expand to other chains, and a war to compete for native users of the expansion chain will be inevitable. Currently, the chains with more opportunities to develop NFTs besides Bitcoin Ordinals Inscriptions mentioned above are L2 led by Arbitrum and Optimism, as well as StarkNet and zkSync Era, with airdrop expectations. These will be important choices for the multi-chain layout of NFT Marketplace. Element: Building around Equity Pass NFT, defining the collection of rights Element is an earlier aggregation trading platform than Blur, which briefly enabled trading mining, but has always been tepid on Ethereum, instead using its experience to win a good market share on multiple chains such as BNB Chain. Equity Pass NFT is not unfamiliar, essentially similar to passes, membership cards, etc., such as the Chinese community’s LaserCat NFT and the overseas community’s PROOF Collective, but it is not common to apply Pass cards to an NFT marketplace like Element. Element’s strategy may provide another option for the positioning of NFT Marketplace — the collection of rights. The issuance of Element Pass Genesis (EPG) and Element Pass Standard (EPS) briefly brought good incremental gains to Element. According to DappRadar, on March 21st, when EPG was released, and on April 14th, when EPS was released, Element’s volume and independent active wallet numbers both saw growth different from usual, but this growth did not spread or sustain. (Source: https://dappradar.com/multichain/marketplaces/element-market/) The primary purpose of EPG and EPS is to bring growth to NFT users, especially loyal users who grow with the platform, but the two have different positioning for users. EPG’s positioning is as an ecological card, leaning towards cooperation partners and project parties of ELEDAO and the platform ecosystem; EPS is a standard card for a wider range of ordinary users. Based on the difference in user positioning, Element’s empowerment and rewards for users also differ. Element will first empower EPG holders, and all incentives on Element in the future will be related to EPG holders. Project parties interested in cooperating with Element need to hold EPG to enjoy the platform’s traffic, brand, user support, etc., which in turn provides value support for EPG. The user increment brought to the platform through EPS also indirectly enhances the confidence of project parties holding EPG. Ordinary users can enjoy priority use and services of Element’s new products, as well as NFT airdrops driven by EPG’s project cooperation. Overall, EPG and EPS are like two gears on a machine, if they can operate, they can bring power to the machine (platform). Based on the Equity NFT Pass, Element actually provides a new NFT issuance model, creating an effective linkage between the platform, project parties, and ordinary users. When a new cooperative project party holding EPG launches Launchpad on Element, users holding EPS will have the opportunity to participate in the new project, similar to IEO on CEX, where EPS is like Binance’s BNB or OKX’s OKB. Whether it is OpenSea’s “Airdrop as NFT Drop” mentioned in the first article or Element’s NFT sales model based on Equity Pass NFT, the participation of NFT Marketplace in the Launchpad of the project will become a trend, which is essentially an endorsement of the quality of the project. Before the new project is launched, the platform provides brand exposure; after the new project is launched, the platform can also participate in the market-making of the project, enhancing the wealth effect. Of course, it should also be noted that whether it is March 21 or after April 14, Element’s trading data quickly returned to its previous level. This indicates that the growth of trading data mainly stays on the Equity Pass NFT itself, and has not driven Equity Pass holders and funds to other existing asset trades. Therefore, in the future, Element also needs some high-quality project Launchpad cooperation to demonstrate the wealth effect of this platform and create word-of-mouth. In addition, a relatively criticized issue is that Equity Pass is limited to a single chain, that is, there will be two EPGs with different but similar effects on Ethereum and BNB Chain. This seems unreasonable for a multi-chain platform, and concerns may arise in the future about whether the governance rights of different chains based on EPG-based DAO governance are equal and how platform resources are reasonably allocated among different chains. OKX NFT Marketplace: Enjoy the user increment bonus brought by the built-in wallet in the exchange The NFT market has always had a puzzling phenomenon: exchanges with annual revenues of hundreds of millions of dollars have been unable to build their own NFT marketplaces. The author believes that the main reason is that due to the limited scale of the NFT market, the returns are very low (and highly volatile), so the exchange’s investment in NFT (platform) will not be very high. In the case of low input and output, NFT is more like an accessory for exchanges to build their own on-chain empire. Therefore, for exchanges, building an NFT marketplace is part of constructing an on-chain empire, similar to creating a public chain or developing DeFi. Compared to protocols dedicated to trading platforms, its strategic importance and priority are relatively lower. The focus of exchanges is still on how to convert their massive off-chain user base to on-chain blockchain users. This process brings incremental growth, and the main challenge lies in the entry point, which includes both product and concept (education). Unlike most exchanges that incubate or acquire other wallets, OKX has created its own Web3 wallet and integrated it into the exchange website/app. Using the wallet as one function of the exchange platform, rather than two functions of two platforms, allows users to use the wallet as they would an exchange, which is easier for white users to accept and achieve the conversion to on-chain users. Combined with the exchange’s education on on-chain usage for users, as the base grows, more users will eventually learn about NFT and use the OKX NFT Marketplace, a trading aggregation platform, to trade NFT. These three articles mainly focus on strategies to study the mainstream and creative NFT Marketplace pattern in the recent cycle. Due to space limitations, for those not mentioned, such as AlienSwap and Tensor, which imitate blind box airdrops, as well as some vertical markets and art markets, have good niche tracks, but their strategic aspects do not have much innovation compared to their predecessors. For example, AMM-based marketplaces like Sudoswap and Hadeswap, the author’s judgment is that this floor-based, overly simplistic trading form is difficult to adapt to the current market, and Blur Bid Pool is to some extent a variant of the AMM type. Therefore, this model may be more suitable as a supplement rather than the mainstream, as well as how to better combine bid pool and AMM. Some regrets will be discussed in the subsequent article “Future Directions.” Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Research on Survival of NFT Marketplaces (2) The dead end of trading mining

Wednesday, May 3, 2023

Author: @0xMavWisdom Disclosure: The author holds relevant assets such as NFT platform tokens as a personal investor and has no business dealings with any platform or project party. This is the second

VC monthly report: the number and amount of financing increased slightly in April

Tuesday, May 2, 2023

Author: WuBlockchain According to RootData statistics, there were 101 publicly disclosed crypto VC investment projects in April, an 11% increase from the previous month (91 projects in March 2023) and

Global Crypto Mining News (Apr 24 to Apr 30)

Monday, May 1, 2023

1. The Bahamas is seeking to tighten its crypto laws in the wake of the collapse of FTX, according to a statement from the Securities Commission of the Bahamas Tuesday. The new bill will address

Asia's weekly TOP10 crypto news (Apr 24 to Apr 30)

Sunday, April 30, 2023

Author:Lily Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong SFC to issue crypto exchange license guidelines in May link Hong Kong's Securities and Futures Commission will release

Weekly project updates: StarkWare 2023 roadmap, Filecoin to launch FWS, Polygon Bridge, etc

Saturday, April 29, 2023

1. Solana's weekly summary a. Solana Labs announces open-source reference implementation for ChatGPT plugin link On April 26, Solana Labs announced an open-source reference implementation for the

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏