TECHFLOW: Exploring the Real Japanese Crypto Market: Coexistence of Isolation and Contradiction, Where are the Opp…

When you think of Japan, what comes to mind first? Cherry blossoms, anime, Mount Fuji, Nintendo...? Thanks for reading TechFlow’s Substack! Subscribe for free to receive new posts and support my work. Subscribe However, when it comes to the connection between Japan and crypto, many cryptocurrency professionals have limited awareness. Despite the legal status of crypto trading and exchanges in Japan since 2017, the Japanese market has always had a weak presence, and many people have the impression that it is closed off and independent. What is the actual state of the crypto market in Japan? Who are the key players currently involved? How can one participate in the Japanese crypto market? With curiosity in mind, TechFlow journalist delved into Tokyo, Japan in April to engage with local crypto professionals and gather valuable insights. In this article, we aim to share this information without lengthy digressions, providing practical knowledge. Joining us as a co-author is a venture partner from Emoote, and we pay tribute to their contribution. *This excerpt is taken from the "Web3 Truth in the Asia-Pacific Market" report by TechFlow 深潮, focusing on the Japanese market. Overview of the Japanese Cryptocurrency Market Based on discussions with friends and data from third-party organizations, Japanese cryptocurrency investors can be divided into three layers, and the lower layer is a complete subset of the upper layer. Overall, there are over 5 million local cryptocurrency users in Japan. The Japanese market is full of peculiarities and contradictions, mainly in the following three aspects: 1. Compliant but lacking vitality In Japan, trading in cryptocurrency assets and operating cryptocurrency exchanges can be carried out within a legal and compliant framework, mainly regulated by the Japanese Financial Services Agency and the Japan Virtual Currency Exchange Association (self-regulatory organization). The overall principle is to prioritize anti-money laundering/counter-terrorism financing regulations and then regulate trading platforms to protect user interests. For example, exchanges are required to separate customer assets from their operating funds, and at least 95% of assets held by exchanges must be stored in cold wallets, fully ensuring the safety of individual investors. However, heavy regulation also brings many restrictions that make the Japanese cryptocurrency market lack vitality. All tokens listed on compliant exchanges in Japan require approval from the Japan Virtual Currency Exchange Association (JVCEA), which takes at least 6 months to a year. In addition, Japan has a high tax burden. According to current rules in Japan, the tax rate for cryptocurrency-related income depends on the individual's total income, and for high-income earners, the tax rate for cryptocurrency may rise to around 50%. This has led to a phenomenon where, despite the ability to legally convert crypto assets into Japanese yen, there is still a significant demand for over-the-counter (OTC) transactions, resulting in many OTC practitioners. 2. Mismatched hotspots, strong purchasing power The Japanese market is a relatively independent and closed market, which also means that its market hotspots may not completely match those of the global mainstream market, resulting in a certain degree of mismatch and delay. For example, when the NFT craze in China and the US passed, various types of NFT in Japan experienced a price surge. Moreover, the Japanese market still has strong purchasing power. Two of the most direct examples are:

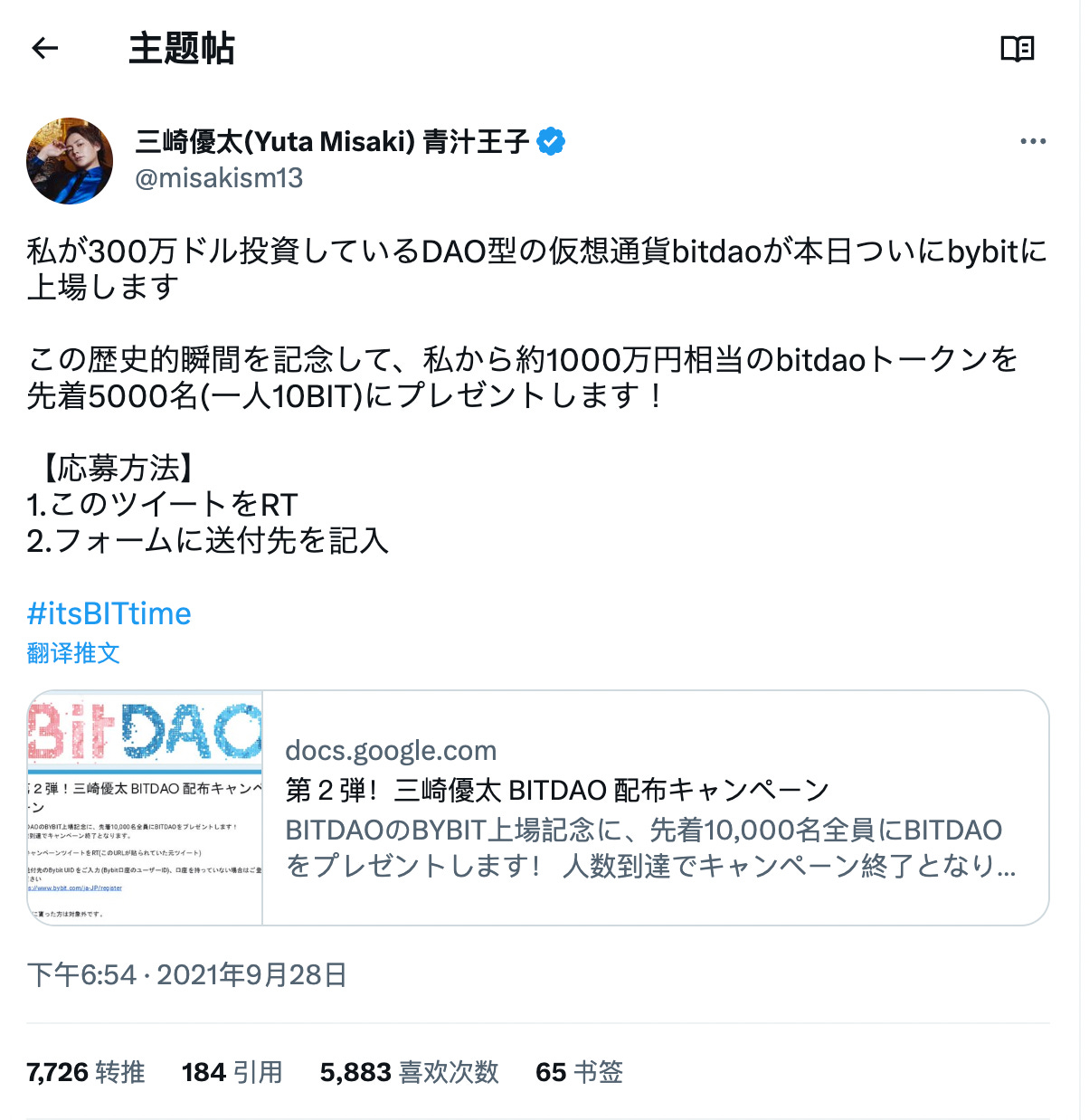

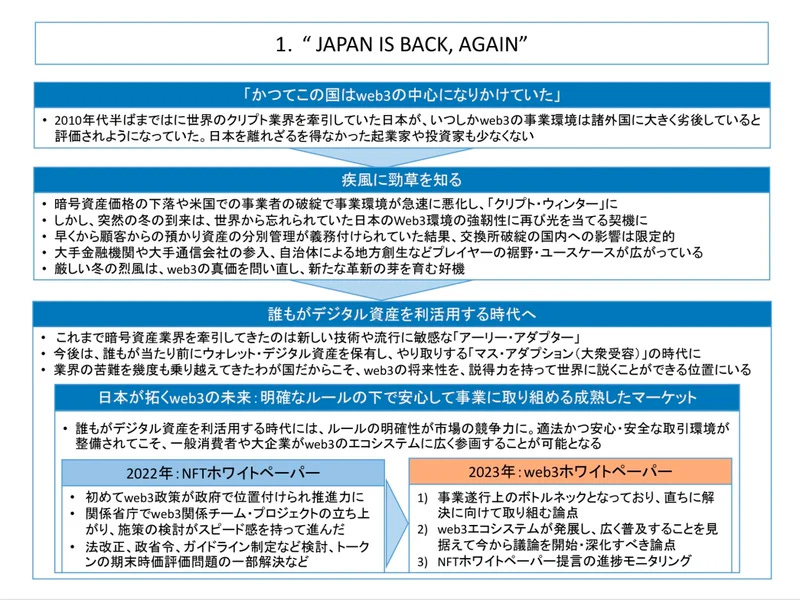

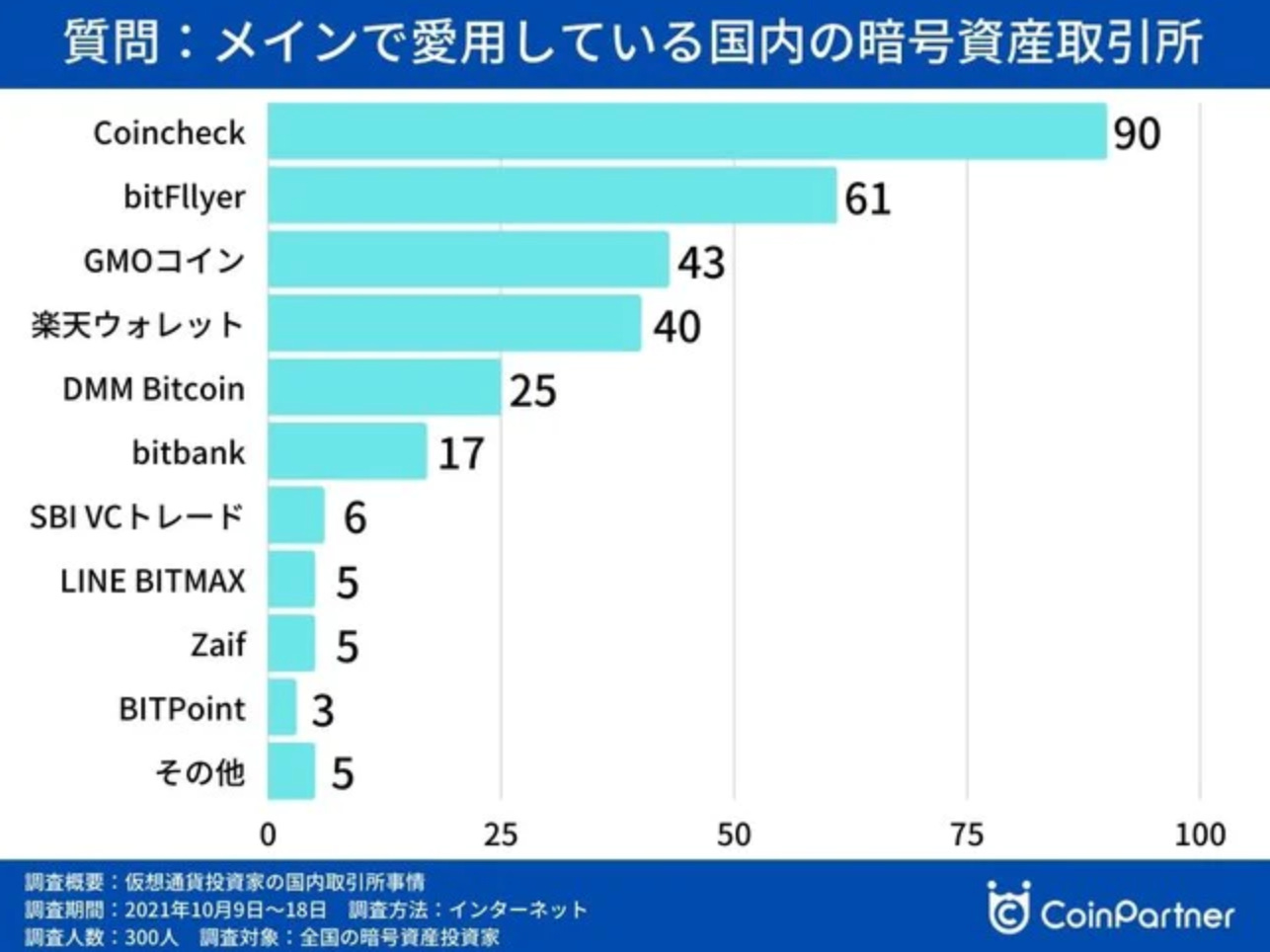

Later, Bitget entered the Japanese market and provided better commission conditions, poaching KOLs from other platforms. Compared to compliant domestic exchanges with few coins, high taxes, and no leverage, offshore exchanges with many coins, no taxes, and 100x contracts are very tempting to retail investors. Although the Japanese Financial Services Agency has issued warnings to Bybit, MEXC, Bitget, and Bitforex, completely abandoning the Japanese market or being completely compliant is not possible. Coinbase and Kraken, which are compliant, have both withdrawn from the Japanese market at the beginning of 2023, serving as a warning to others. In the Japanese market, many practitioners have reached a politically incorrect consensus in private: if you want to make money, you can't be too compliant. 3. Transition: Japanese Ministry of Finance relaxes some regulations Through communication with personnel from the Japanese Ministry of Finance, it was discovered that they have mixed feelings about the matter. On the positive side, despite the bankruptcy of FTX, which dealt a heavy blow to the entire cryptocurrency industry, and the billions of dollars misappropriated by the founder SBF that have evaporated, Japan's strict regulations on cryptocurrencies have protected the country's individual investors, which they take great pride in. Therefore, Mamoru Yanase, Deputy Director of the Strategic Development and Management Bureau (SDMB), a department under the Japanese Ministry of Finance responsible for handling cryptocurrency and financial technology issues, stated that Japanese regulatory agencies have begun urging regulators in the United States, Europe, and other regions to implement regulatory measures on cryptocurrency exchanges similar to those applied to banks and brokerages. On the negative side, the Japanese cryptocurrency market lacks vitality, especially with Coinbase and Kraken previously withdrawing from the Japanese market. On the contrary, offshore exchanges have thrived in Japan. Consequently, they are also attempting to make some adjustments. In April 2023, the Liberal Democratic Party, Japan's largest party, released the "Japan 2023 Web3 White Paper" with the slogan "JAPAN IS BACK, AGAIN." They aimed to loosen regulations in various aspects, primarily in the following areas: Tax reform: Previously, investors were subject to high-income taxes of up to 55% due to token appreciation. After tax reform, holding tokens issued by one's own company would be exempted. Additionally, holding tokens issued by other companies would also be exempt from taxation if they were not intended for short-term trading. Token review/issuance/circulation: The Ministry of Finance would assist in reviewing overseas token trading for listing, increasing listing efficiency, and establishing regulations for the issuance and circulation of stablecoins. NFTs: Restrictions would be imposed on the use of NFTs for gambling, money laundering, etc., and regulations regarding the rights and returns associated with NFTs would be clarified. Japanese 2023 Web3 Whitepaper Japanese User Profile According to a survey of 300 Japanese exchange users, the most popular exchanges in Japan include Coincheck, bitFlyer, GMO Coin, Rakuten Wallet, DMM Bitcoin, and bitbank. Regarding unlicensed exchanges in Japan, the most commonly used exchanges are Binance and Bybit, both of which have received warnings from the Financial Services Agency. Japan has relatively few well-known native cryptocurrency projects, especially lacking self-made grassroots heroes. Most projects have deep traditional resource backgrounds. Currently, some of the more prominent projects include Astar Network, Oasys, HashPort, Jasmy, and others. Regarding social media, Twitter remains the primary source of information and communication in Japan, followed by Instagram and Facebook. Some users also use LINE Open Chat (similar to QQ chat rooms) to collect and exchange information about virtual currencies, although this channel is not mainstream, and the largest chat room has only 5000 participants. In Japan, there are several vertical media outlets for the general public, including CoinPost, CoinTelegraph JP, CoinDesk JP, 仮想通貨Watch、あたらしい経済 and Bitpress. In terms of influence and traffic, the largest Japanese cryptocurrency media outlet is currently Coinpost, which is well ahead of the others. Tokyo-based cryptocurrency practitioners have reported that Coinpost has received investment from Chinese cryptocurrency capital. Although all of the above media outlets have news services, the only one that specializes in news and is used by all Japanese companies (including non-blockchain-related companies) is PRTimes, which is well-known among Japanese office workers. There are also some self-media outlets on Twitter that collect blockchain-related information from Japan and abroad and translate it into Japanese. Of course, many vertical media outlets also create accounts on Twitter to increase their visibility. Some of the more famous ones include dAppsMarket, CRYPTO TIMES, BlockchainGame Info, and NFT JPN. In addition, CoinGecko Japan is also not to be underestimated. In terms of in-depth research (similar to Messari's service), HashHub Research is the leader, with an interface and layout that is similar to Messari. In addition to the above types of media, there are numerous affiliate media (such as Kasobu), newsletters, and personal blogs that make a living through SEO. The most famous newsletters are CoffeeTimes, のぶめい、マナブ, and Ikehaya. In terms of KOLs, we have attempted to categorize and list representative accounts for each type (not an exhaustive list), with analysis focused mainly on Twitter, where there are some KOLs that span several types.

Shingen: Mainly analyzes ETH-related technologies and projects Arata: Founder of the Japanese blockchain media CryptoTimes. やす@暗号通貨: An all-around player whose research covers all aspects of virtual currency.

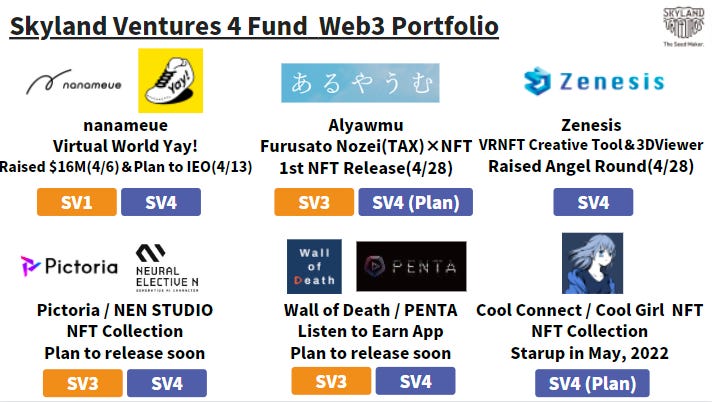

Many influencers operate their own communities, and choosing the right influencers in corresponding niche areas, such as Gamefi/Defi/investment research/airdrops, will significantly enhance the effectiveness of communication. Japanese Local Crypto VC According to our understanding, traditional local venture capital (VC) in Japan is not particularly active, and there are very few Japanese VCs that are fully dedicated to Crypto and Web3. Moreover, most of them are only able to make equity investments. Skyland Ventures is one of the more active crypto funds in Japan and has established a seed fund focused on Web3 investments as part of its fourth fund. On April 13th, Skyland Ventures announced the completion of fundraising for its Web3 fund, "Skyland Ventures No.4 Fund," totaling 5 billion Japanese yen (approximately 38 million USD). They also announced an investment in Takio, an Ethereum ZK-EVM solution. Emoote is a Web3 fund established by the Japanese gaming company Akatsuki. The initial fund size is 20 million USD, and it is currently invested in a total of 24 projects, including STEPN, BreederDAO, ETHSign, Akinetwork, and others. Miss Bitcoin, a well-known Japanese KOL, serves as an advisor to Emoote. Z Ventures, a joint venture between SoftBank and Line, has also set its sights on the Web3 field and made some strategic investments. They have invested in the NFT trading platform X2Y2, and blockchain game development platform double jump.tokyo, encrypted live-streaming platform Stacked, and others, all in the form of equity investments. The SBI Group, a Japanese financial conglomerate, has also made significant strides in the cryptocurrency field. They are a core investor and spokesperson for Ripple in Asia and have invested in numerous local trading platforms. Among the incubators primarily operated by Japanese individuals or with Japan as their primary activity center, Fracton Ventures is the most prominent. While Fracton Ventures itself does not conduct investment operations, the team recently raised funds from various Japanese VCs and established Next Web Capital, which participated in investments in projects like EthSign. Among other notable VCs operated by Japanese individuals or centered around Japan, Gumi Cryptos is the most well-known. Kazuki Morishita founded Gumi in 2007 and led the company to a successful IPO in 2014. It's worth mentioning that Kazuki Morishita studied at Fudan University in Shanghai for four years in 1996, but his Chinese language skills have significantly deteriorated since then. In 2021, Kazuki Morishita retired from Gumi and went all-in on blockchain and VR but still retains significant influence over Gumi. Currently, Gumi Cryptos has invested in dozens of crypto projects such as Opensea and YGG. However, 国光宏尚(Kunimitsu Hironao) is also concerned that many of these overseas projects are unable to launch in the Japanese market or drive market development. In the Japanese market, another notable figure is the billionaire and self-proclaimed "Japanese Musk," 前泽友作(Yusaku Maezawa). With millions of followers on Twitter, he is considered the largest KOL in Japan. He established the Web3 fund MZ Fund using his name initials, with investment amounts ranging from 1 to 5 million USD. Under MZ Fund, he owns the largest Web3 guild in Japan called Web3 Club, which has 30,000 native crypto users as members. He also operates MZ DAO, the largest "crypto education platform" in Japan, boasting a non-crypto native user base of 300,000. Currently, MZ Fund has invested in various projects, including some with Chinese backgrounds, such as MetaOasis, Akiprotocol, SINSO, and others. Additionally, there are local VCs in Japan such as Headline Asia (and its subsidiary crypto fund Infinity Ventures Crypto), Akatsuki Crypto, i-nest Capital, and THE SEED. Japanese Marketing Strategy The previous successful case of STEPN in Japan showcased the potential of the Japanese market. As of February 25th last year, 35% of its 21,000 active users were from Japan. Analyzing its promotional strategy, it can be observed that many top KOLs participated in Giveaway campaigns, with some even purchasing shoes at their own expense for the Giveaway. This indicates that as long as multiple top KOLs participate and the token model has good sustainability, Japan remains a market with considerable purchasing power. However, considering the user base and the cautious tendencies of Japanese KOLs, it is advisable not to initially focus solely on Japan. But if a certain level of popularity can be gathered in Japan, it will make it easier for the project to expand into surrounding markets, especially Southeast Asia. Furthermore, Japan as a whole is a challenging market to penetrate. Although language barriers (the well-known fact that Japanese people have psychological barriers toward English) and the cautious tendencies of Japanese KOLs make market promotion more difficult, on the flip side, if the project team remains active and committed, Japanese users are more tolerant and understanding compared to users in some other markets. This helps in creating a positive community atmosphere. Another interesting observation is that initially, it was assumed that Japanese people would be more proud of domestic projects and have a higher level of wariness toward Chinese projects. However, according to the author's research on Japanese users, Japanese people have complex feelings toward Japanese projects, and some even consider the Chinese origin of a project as a bonus because many excellent projects come from Chinese creators (not to mention the added appeal of European and American projects). In contrast, due to the numerous successful cases in China and the West, people who pay attention to this field for a longer period of time and have a more rational mindset consider this attribute as a bonus. However, it should be noted that the number of people fitting this user profile is limited. Overall, in terms of localization, the author believes that it is necessary to have community managers who are native Japanese speakers and have an understanding of Japanese culture (knowing what Japanese comedy is like, being familiar with sports and political references, popular slang, and youth language, and being able to skillfully use popular catchphrases like "全米が泣いた" etc.). Of course, if there is a good fit and rapport with a community manager, it may be worth considering bringing them into the team, as there is a significant difference between core members and external collaborators from the perspective of user mentality. This way, having a Japanese team member can provide a sense of reassurance to Japanese users, facilitate closer engagement, and at the same time, the team remains sufficiently global, giving Japanese people a sense of the project's "future prospects." The above is the full content of the Japanese market. "Web3 Truth in the Asia-Pacific Market" is a special report produced by TechFlow that focuses on insights into the current state of the cryptocurrency market, user profiles, and industry participants across various regions in the Asia-Pacific. We will continue to publish market research for multiple regions and consult experienced local professionals to provide comprehensive and truly informative research for the Web3 community. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Analyzing Historical Returns of BNB Launchpad and Comparing with ETH Staking Yield

Wednesday, May 17, 2023

Source: https://twitter.com/NintendoDoomed/status/1658052950336614405 WuBlockchain is authorized by the author to translate and publish This article provides statistical data on BNB Launchpad

Bitcoin developers discuss network congestion caused by BRC-20s.

Tuesday, May 16, 2023

Editor: WuBlockchain The issue of high transaction fees and network congestion in the Bitcoin network caused by the popularity of Inscription and BRC-20 has been discussed in the Bitcoin developer

Global Crypto Mining News (May 8 to May 14)

Monday, May 15, 2023

1. On May 7th, Bitfarms mined 21000th BTC with renewable power, representing 1/1000 of all BTC to ever be mined. Bitfarms' mining operations began in Quebec, Canada, and are expanding to Washington

Asia's weekly TOP10 crypto news (May 8 to May 14)

Sunday, May 14, 2023

Author:Lily Editor:Colin Wu 1. South Korea's weekly summary 1.1 Kaiko: Bitcoin Kimchi Premium declines since 2021 link According to Kaiko, Bitcoin Kimchi Premium — the difference between the price

Weekly project updates: MakerDAO's "Endgame", Solana's mobile Saga public sale, Chiliz's mainnet launch, etc

Saturday, May 13, 2023

1. BTC's weekly summary a. Interlay founder Alexei Zamyatin proposes BRC-21 standard link On May 8, Alexei Zamyatin, the founder of Interlay, proposed the introduction of the BRC-21 standard to

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏