Coin Metrics’ State of the Network: Issue 208

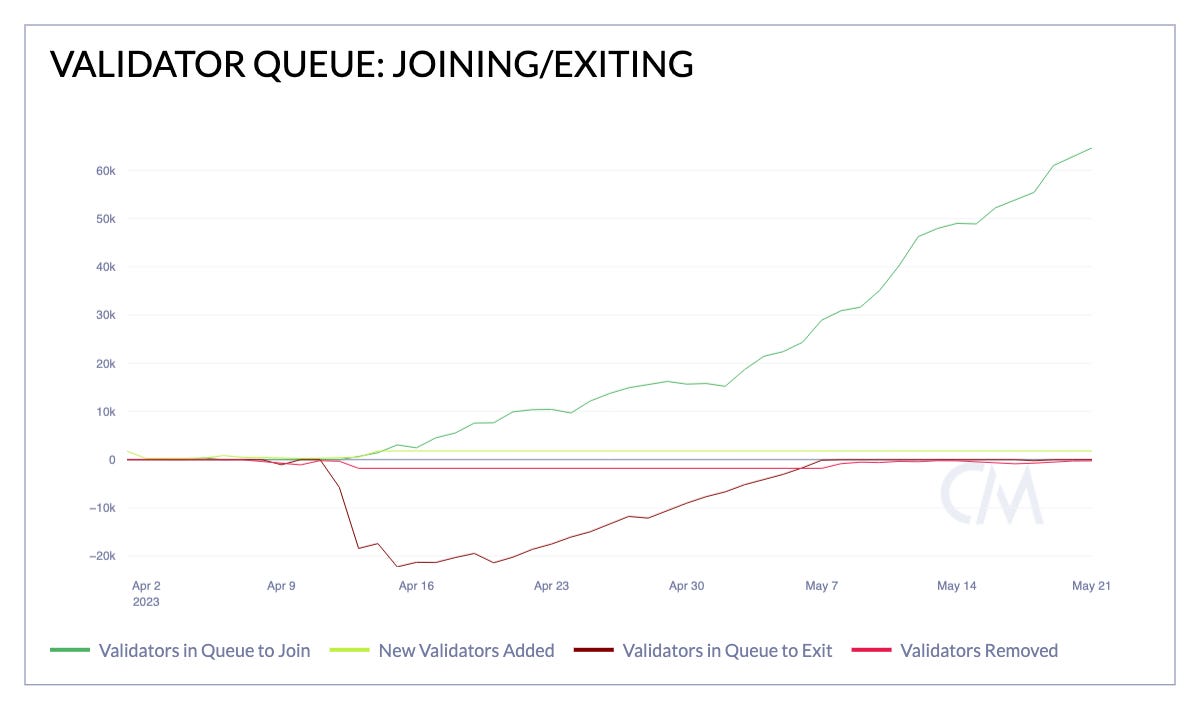

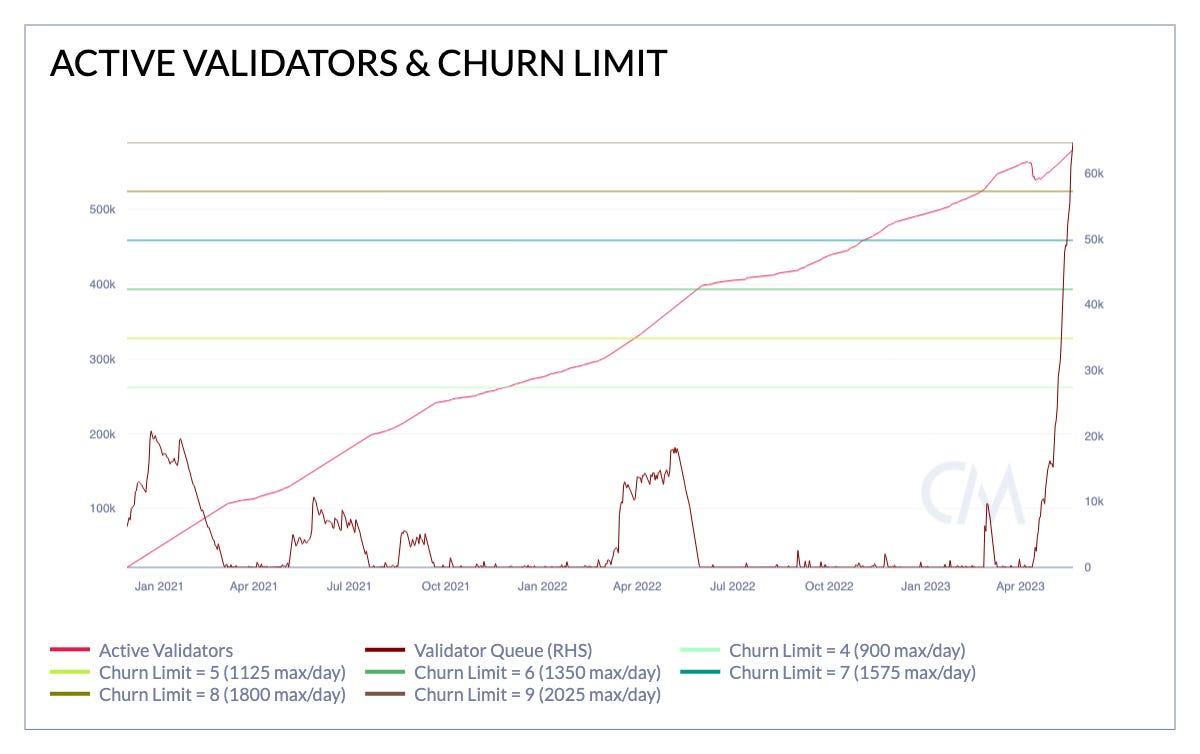

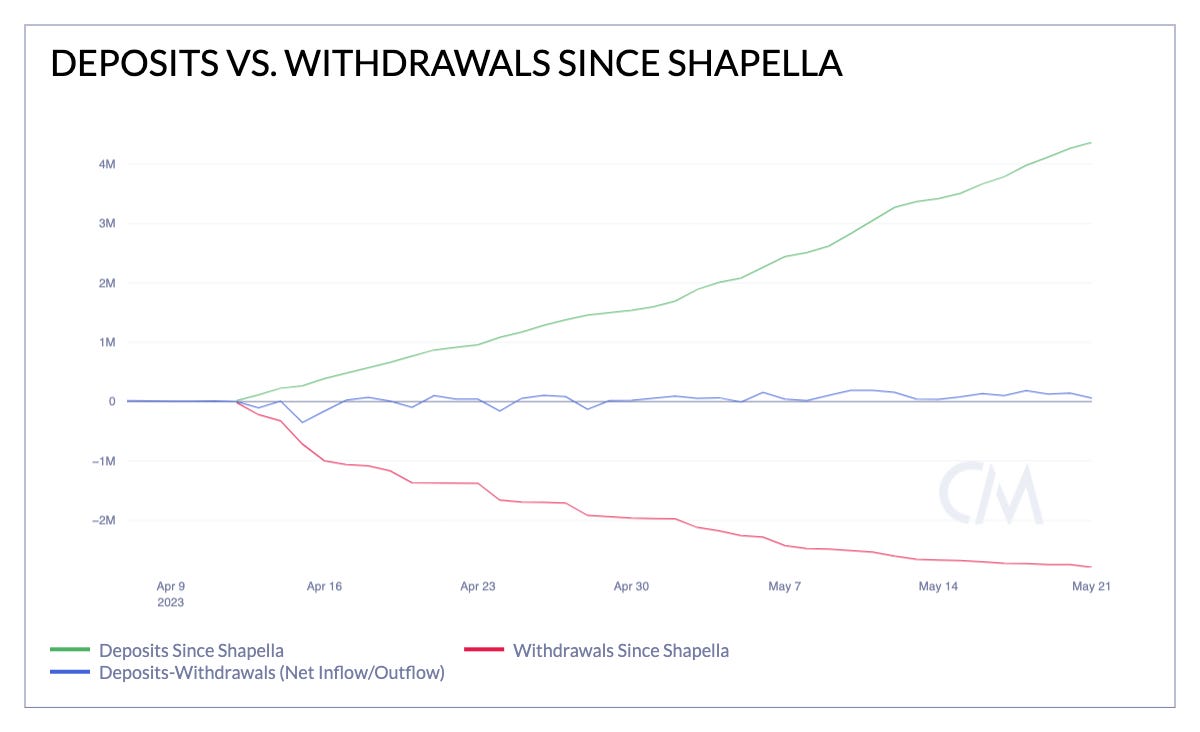

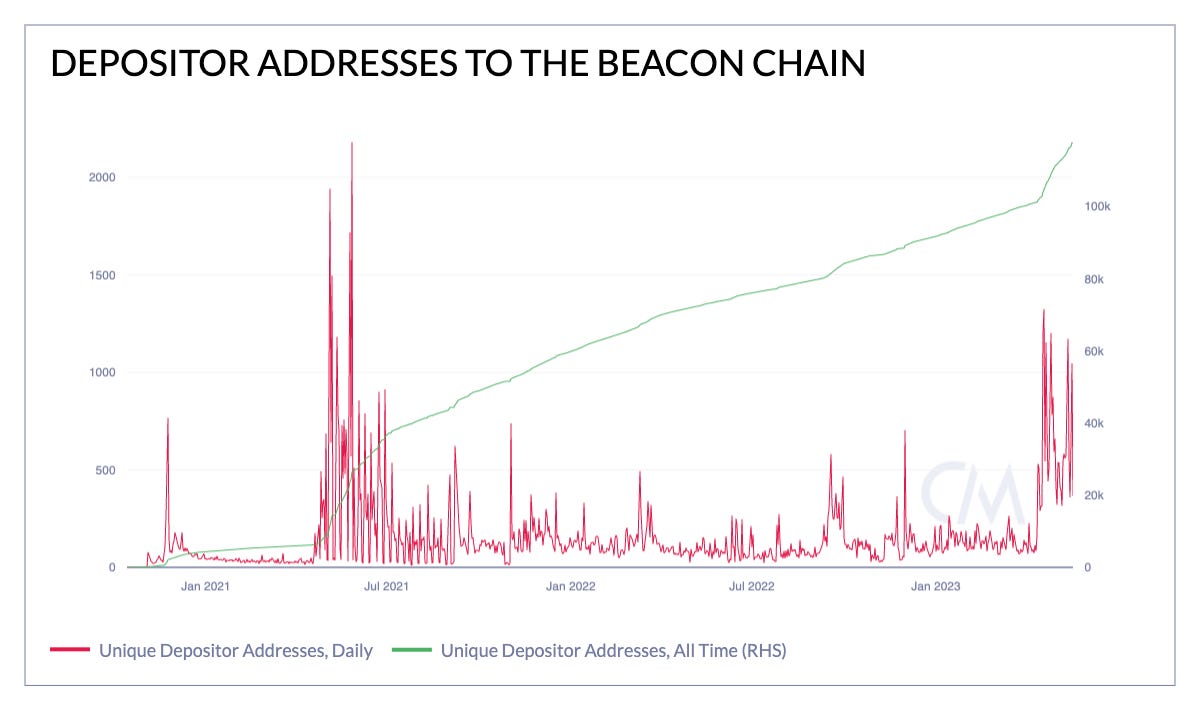

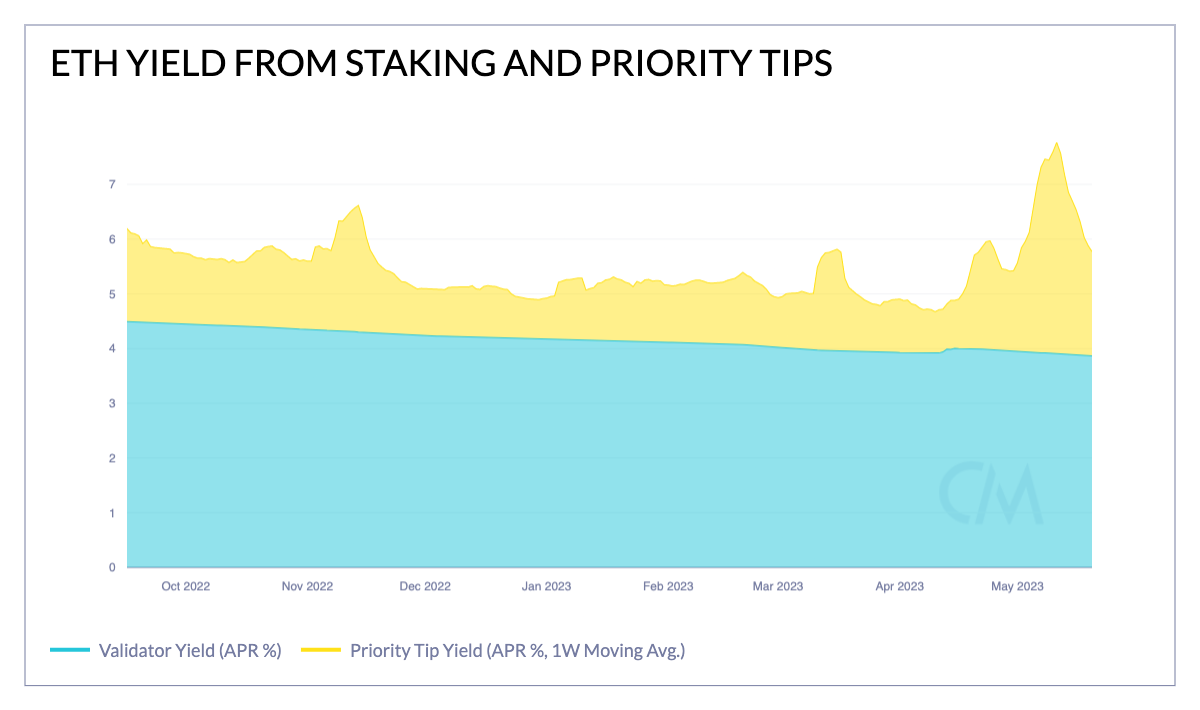

Get the best data-drive crypto insights and analysis every week: A Claim in the Ether: Tracking the Soaring Demand for Ethereum StakingBy: Kyle Waters & Tanay Ved Two hundred and fifty days have now passed since Ethereum’s transition to Proof-of-Stake via The Merge, and demand for staking ether (ETH) has never been higher. Buoyed by the successful launch of staked ETH withdrawals last month in the “Shapella” network upgrade, the line to become an Ethereum validator is out the door. In this week’s issue of State of the Network, we examine essential data and metrics highlighting the current state of the Ethereum staking ecosystem. Queuing UpPrior to the April 12th activation of Shapella, joining Ethereum’s validator set was a one-way street: once becoming an active participant, the lack of any withdrawal function restricted validators from accessing their originally staked ETH and accrued rewards. However, the implementation of withdrawals last month provided the final piece to the life cycle of an Ethereum validator. As noted in our post-Shapella review from last month, we initially observed strong demand for un-staking. Shortly after the upgrade’s activation, we observed a significant withdrawal of over 1M ETH (around $1.8B) from the Beacon Chain. Validators, who had been eagerly waiting for access to liquidity, took advantage of the opportunity to complete full withdrawals. Within the first two weeks, more than 20K validators requested full withdrawals, allowing them to reclaim their initial 32 ETH stake along with the accumulated rewards. Consequently, these validators ended their participation in Ethereum staking. To ensure stability in the total number of validators and the amount of ETH securing the network, both full exits and entries are subject to rate limitations. If more validators would like to join or exit than is permissible in a given day, a queue is formed. The chart below illustrates the formation of such a queue. Currently, the network allows for only 1,800 validators to enter or exit per day. In the days following the Shapella upgrade, the exit queue reached as high as 20K validators. Source: Coin Metrics Network Data Pro But the tide has shifted dramatically since early May, with a new rush of deposits and validators waiting to be activated and the exit queue clearing out. The entry queue has reached its highest level since the Beacon Chain’s genesis in December 2020, with a total of 64K validators eagerly waiting to participate. The surge of new validators has helped push the active validator count to a new high of 580K. This count has more than compensated for the short-lived dip in full exits at the onset of withdrawals. As the active validator count nears the threshold of 589K, an in-protocol variable known as the Churn Limit will increase, permitting the activation of an additional 225 new validators each day. However, despite the rate increase, it will still take about 33.5 days to become a validator if you deposit 32 ETH and join the queue today. Source: Coin Metrics Network Data Pro To be sure, some of this newly staked ETH represents a re-shuffling of capital between staking operators—especially given the regulatory posture towards “staking as a service” in the US following the SEC’s enforcement action against US exchange Kraken this past February. But since Shapella, the total 4.3M ETH staked has bested the opposing 2.8M total ETH withdrawn for a net positive flow of 1.5M ETH deposited. Source: Coin Metrics Network Data Pro Looking at the unique depositor addresses can offer some insight into the source of the new ETH deposits. There has been a rise in the number of unique depositor addresses staking their ETH, perhaps signifying a tick up in demand from a new segment of the market. Source: Coin Metrics Network Data Pro Validator Yields Rise Amid Fee Market ManiaThe success of Shapella was widely seen as a boost for staking demand. This perception largely stems from the mitigation of risks associated with the upgrade and the new exit liquidity available to potential stakers. However, at the same time the yields offered by staking activities have reached their highest levels since The Merge thanks to a surge in demand for Ethereum blockspace and subsequent fees paid by users. As we explained in our report Mapping Out The Merge, validator returns are decomposed into rewards from staking activities (e.g., attestations, proposals, etc.) and priority fees or “tips” paid by users when making a transaction (in addition to MEV). While the yield from staking activities is a relatively stable component scaling up and down with the number of active validators, the fee component can vary significantly with the fee market. The recent rise in fees on Ethereum pushed the annualized percentage yield expected from tips to nearly 4%, matching the yield from staking alone. The combined effect of staking rewards and fees has created an attractive overall yield for validators. Source: Coin Metrics Network Data Pro Although the fee market appears to be cooling off, the average performing validator can still expect returns of 5–6% at current fee rates. But with 1-year US Treasury rates earning a similar level (albeit in dollars), there is still high competition for capital in today’s macro environment. Nevertheless, long-term ETH holders are likely poised to keep staking at current rates to avoid their share of supply being diluted away—especially as the liquid staking ecosystem receives a big boost with the launch of Lido’s v2. Lido Shuffle – Lido v2 Goes Live with WithdrawalsLido—the largest player in Ethereum’s liquid staking landscape—went live with Lido v2, the second iteration of its protocol. This upgrade serves the dual purpose of enabling stETH withdrawals along with the introduction of Lido’s staking router, creating an onramp for a more diverse set of node operators. Withdrawals of stETH marked a crucial event due to Lido’s dominant position of underlying pooled ETH held among its validators—commanding a 31% share of staked ETH—a move highly anticipated by stakeholders and participants of the Ethereum ecosystem alike. Keeping withdrawals in focus, Lido’s design is informed by Ethereum’s async nature of processing withdrawals thus utilizing a queue within the protocol to fulfill stETH redemption requests sequentially. The main operational flow of withdrawals from a user-perspective is designed to follow a 3-step process in the order of request, fulfillment, and claim.

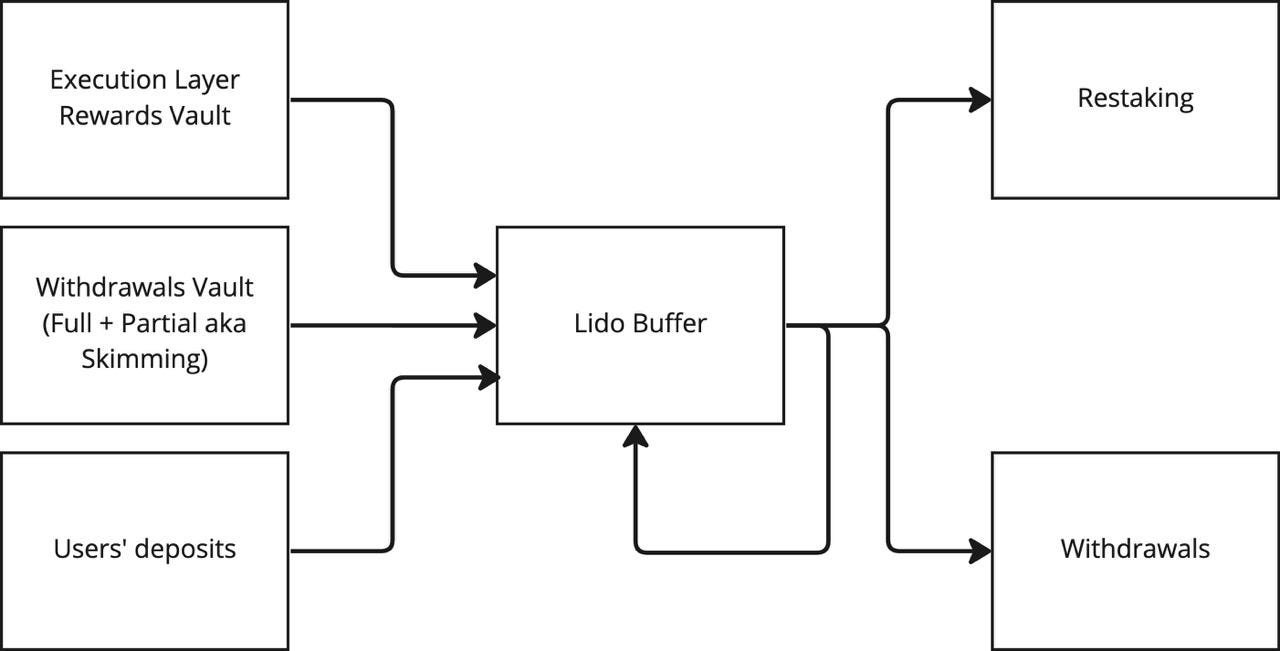

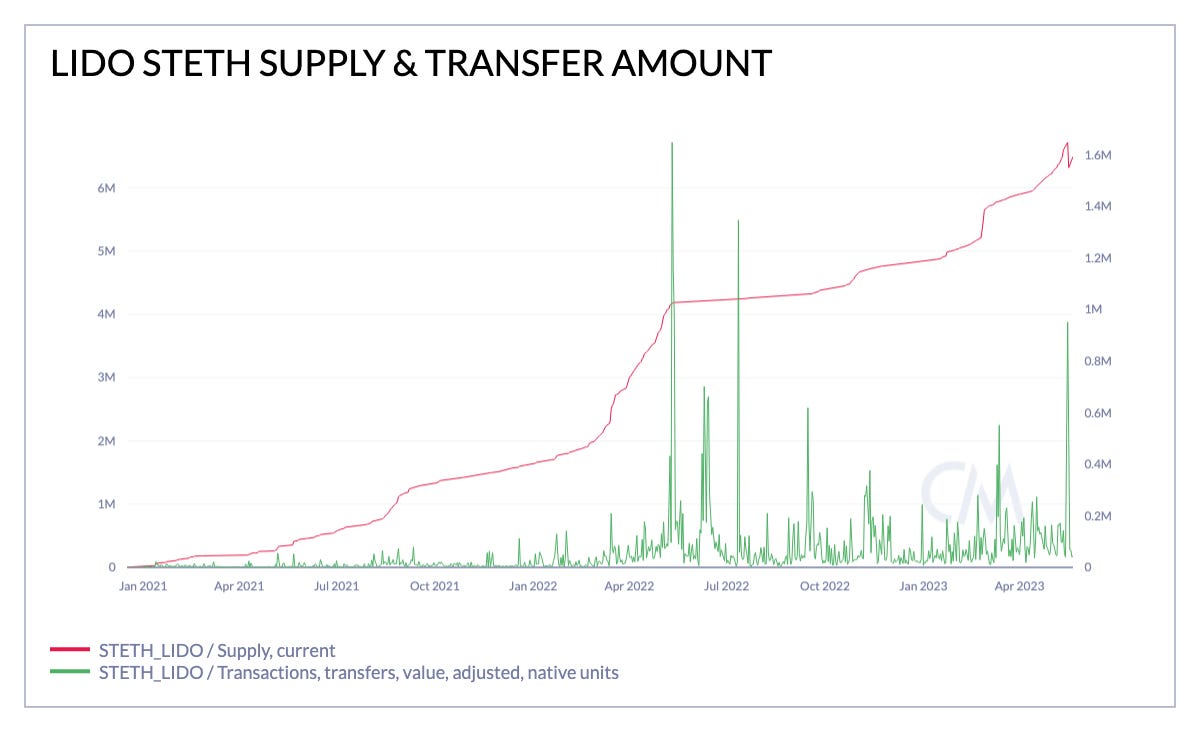

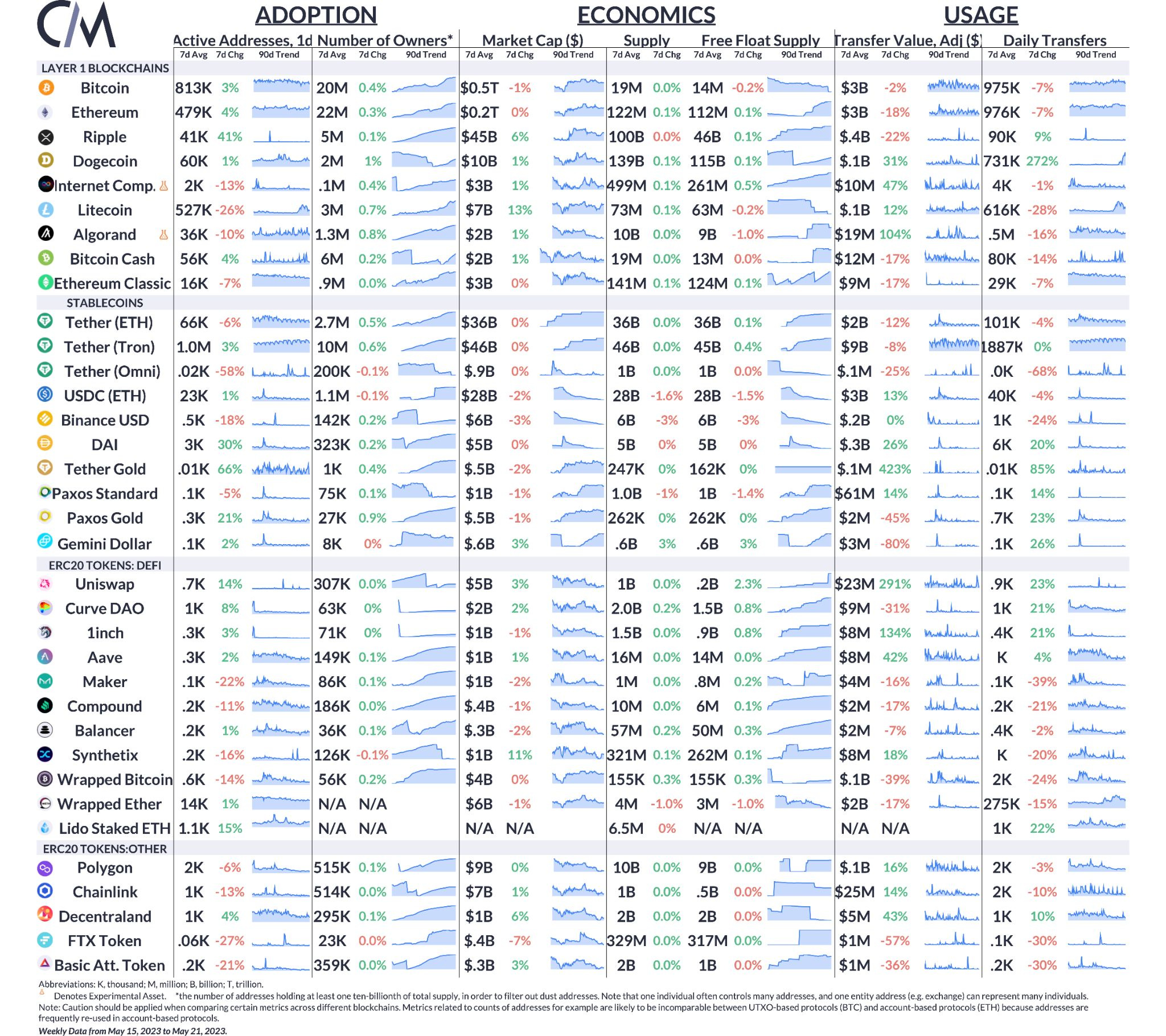

This three-step process ensures a systematic and secure approach to stETH withdrawals, enabling users to regain liquidity of their staked position. Lido’s commitment to designing a withdrawal mechanism that aligns with the Ethereum network’s design is a reflection of their dedication to the health of the ecosystem. Indeed, Lido is expected to contribute no full-validator exits thanks to their ample buffer and staked pool management. Source: Lido Withdrawals Documentation The buffer utilized by Lido pools together accrued staking rewards, execution layer rewards and deposits to handle incoming requests efficiently—evident in the changing balances of the deposit contract. This mechanism played a crucial role in successfully completing Celsius’ 428k stETH withdrawal, by having over 450k ETH available in the buffer to absorb the impact. Source: Coin Metrics Network Data The change in stETH supply above represents ~280K net withdrawals on Lido as a result of stETH being burned since the upgrade went live on May 15th. With the majority of withdrawals coming from Celsius, demand for staking on Lido still remains high due to the benefits realized by holding its liquid staking token. At large, the prevalence of stETH in secondary markets is also evident through its growing use as collateral—currently representing 50% of Aave V2’s TVL, rising 11% since the beginning of the year ($1.74B). This is reflective of the winner-takes-all dynamic further increasing the liquidity and usage of the token. ConclusionAs the Ethereum ecosystem continues to evolve, it is crucial to monitor market dynamics, macroeconomic factors, and further upgrades to the Ethereum protocol. Staking is also not without its share of risks, ranging from regulatory to technical and operational risk. Indeed, the first ever inactivity leak period—an effective emergency state that kicks in when more than ⅓ of validators suddenly go offline preventing finality for more than 4 epochs—was just recorded earlier this month. Although the issue resolved quickly, it serves as a reminder that validators must always be monitoring for unforeseen events. Despite these complexities, the transition to Proof of Stake and the successful launch of the Shapella upgrade have bolstered confidence in the Ethereum ecosystem. The future looks promising for Ethereum staking, offering participants the potential for both financial rewards and active involvement in securing and supporting the network. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Tether (USDT) continued its upsurge in activity and total supply last week, with active addresses on Tron reaching nearly 1M/day and USDT free float supply topping $46B on Tron, $35.7B on Ethereum, and holding at $850M on Omni. This comes as Tether indicated last week it will “regularly allocate up to 15%” of its realized profits towards buying bitcoin (BTC). Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 207

Tuesday, May 16, 2023

Reviewing the liquidity landscape of the digital assets market

Coin Metrics’ State of the Network: Issue 206

Tuesday, May 9, 2023

Fee Market Mania Hits Bitcoin & Ethereum

Coin Metrics’ State of the Network: Issue 205

Tuesday, May 2, 2023

A data-driven update on MakerDAO & Dai

Coin Metrics’ State of the Network: Issue 204

Tuesday, April 25, 2023

Breaking down blockchain addresses

Coin Metrics’ State of the Network: Issue 203

Wednesday, April 19, 2023

Review of Ethereum's 'Shapella' Upgrade

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏