DeFi Rate - This Week In DeFi – June 1

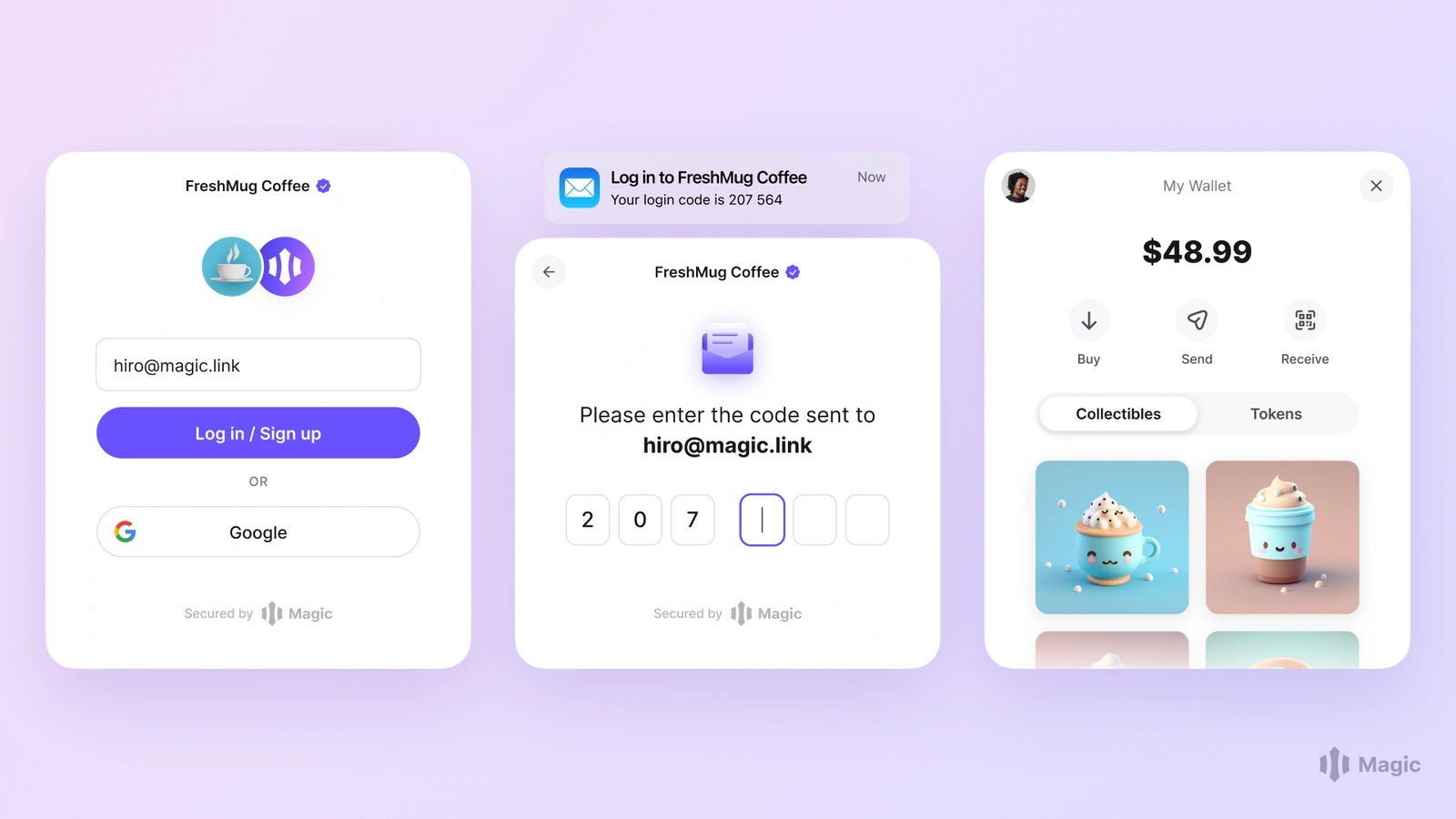

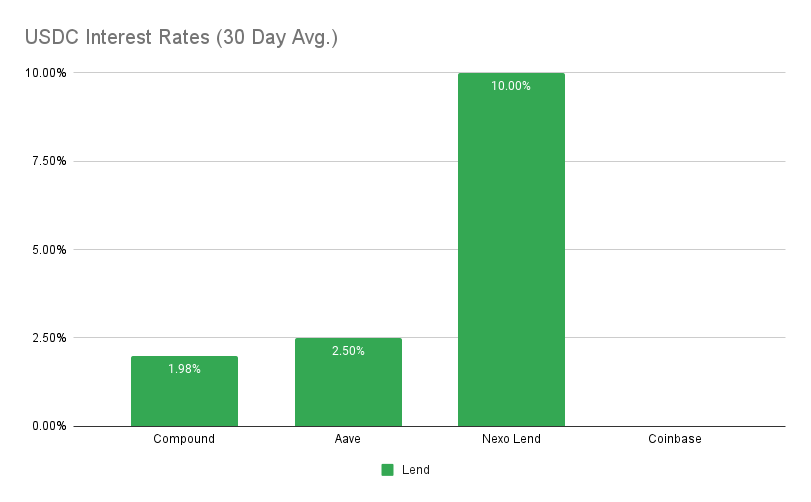

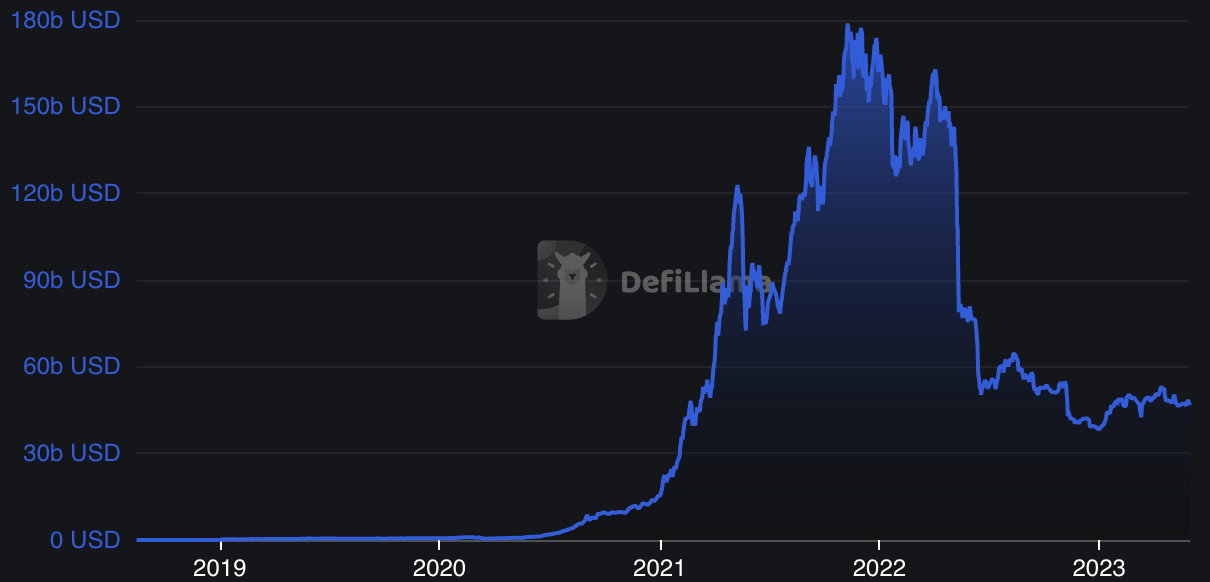

This Week In DeFi – June 1This week, MakerDAO looks to raise the DSR to 3.3%, the Tornado Cash hacker returns control of the protocol, Magic raises $52M for its wallet infrastructure and Multichain's CEO goes missing 👀To the DeFi Community, This week, MakerDAO, the protocol behind the Dai stablecoin, is considering a proposal to raise the DAI Savings Rate (DSR) to 3.33%. This adjustment is driven by the surging interest rate environment and the US Federal Reserve's efforts to combat inflation. The proposal, put forth by DeFi risk management firm Block Analitica, aims to increase the yield for DAI holders. The DSR is funded by the Stability Fee on the MakerDAO network and is paid when DAI is locked into a DSR contract. If approved, the increase in DSR could have significant implications for the broader DeFi ecosystem, increasing demand for holding DAI and potentially driving up borrowing rates across various lending platforms. The MakerDAO community has also voted for onboarding a new real-world asset vault, which will invest up to an additional $1.28 billion in US Treasury bonds. The DAO has also voted to remove $500M of the Paxos stablecoin from its reserve assets, and added RocketPool’s rETH as a collateral option. https://twitter.com/MakerDAO/status/1662161508716150785 The Tornado Cash attacker has decided to return control of the protocol’s governance to the community. A proposal to hand back control, proposed by the attacker themselves, has been passed with overwhelming support and implemented. The attacker had initially stolen a significant number of TORN tokens and converted a significant number of them into Ethereum, while retaining a controlling stake in the protocol’s governance. Although the takeover resulted in the theft of tokens, it did not affect the protocol’s primary functions. https://tornado.ws/governance/21 Magic, a crypto wallet-as-a-service provider, has raised $52 million in a strategic funding round led by PayPal Ventures. Magic's wallet creation service enables companies to onboard users to Web3 and reach millions of customers on their apps. Its non-custodial wallet creation infrastructure utilizes a software development kit (SDK) that allows users to create wallets instantly using their existing email, social media accounts, or SMS. Magic has already generated more than 20 million unique wallets and its SDK is utilized by over 130,000 developers. Clients of Magic include well-known brands such as Mattel, Macy's, Immutable, and others from various industries. https://twitter.com/magic_labs/status/1663909048922537987 Popular bridging protocol Multichain has announced the suspension of cross-chain routes and revealed that its CEO, Zhaojun, cannot be reached. The protocol has experienced various issues in the past two days, and despite the team's efforts to maintain it, they are currently unable to contact Zhaojun and access the necessary servers for maintenance. As a result, the bridges for several projects including Kekchain, PublicMint, Dyno Chain, Red Light Chain, Dexit, Ekta, HPB, ONUS, Omax, Findora, and Planq cannot be kept online without server access. The disclosure confirms part of the rumors that have been circulating since last week, indicating that at least one key team member is absent. https://twitter.com/MultichainOrg/status/1663941611380965376 DeFi yields are slowly climbing their way back into relevance behind rising Federal Reserve interest rates – with MakerDAO looking to increase its Dai Savings Rate (DSR) from 1% to 3.3% – more than triple its current return. If successful, the shift may trigger some interesting action as incentives shift and investors reallocate funds across the ecosystem. Other stablecoins have also had some interesting news this week, as Tether makes new all-time highs in terms of market cap (and therefore tokens in circulation) – despite the majority of its competitors seeing decreases in theirs. Circle’s USDC has also natively expanded into Arbitrum, which may provide an uptick in activity on the popular Layer-2 platform. Particular countries have taken big steps affecting Web3 this week, as the European Union finally signs its far-reaching MiCA framework into law. China, on the other hand has released a paper for innovation in the sector, calling it an “inevitable trend.” Beijing seeks to establish itself as a global innovation hub for the digital economy, with around $14 million in funding pledged each year until 2025. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.2% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 2.4% APY Top StoriesEU Formally Signs New Crypto Licensing, Money Laundering Rules Into LawBeijing releases white paper for web3 innovation and developmentTether (USDT) market cap breaks ATH, Binance CEO points at regulatory capsCircle's USDC Stablecoin Headed for Ethereum Scaling Network ArbitrumStat BoxTotal Value Locked: $46.66B (unchanged since last week) DeFi Market Cap: $47.61B (up 2.9%) DEX Weekly Volume: $6.69B (down 9.5%) Bonus Reads[Tim Copeland – The Block] – Ethereum liquid staking protocol Rocket Pool deploys on zkSync Era [Owen Fernau – The Defiant] – Optimism Sinks Ahead of Major Token Unlock [Samuel Haig – The Defiant] – Curve’s Stablecoin Trades Within 0.5% Range For First Month [Yogita Khatri – The Block] – Avalanche hits 1 million monthly active addresses for the first time This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – May 26

Friday, May 26, 2023

This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.

This Week In DeFi – May 19

Friday, May 19, 2023

This week, memecoins move to the Dogecoin chain, Uniswap expands to Polkadot, Hourglass launches trading for "time-bound tokens" and Ribbon Finance launches options trading for popular

This Week In DeFi – May 12

Friday, May 12, 2023

This week, a Uniswap clone launches on Bitcoin, trading volume on Uniswap itself exceeds that of Coinbase yet again, MakerDAO launches a new lending platform, and BlockFi can return $300M to customers

This Week In DeFi – May 5

Friday, May 5, 2023

This week, Curve launches its crvUSD stablecoin, the Sui mainnet goes live, Ethereum gas fees reach 1-year highs, and Coinbase discontinues its borrow program.

This Week In DeFi – April 28

Friday, April 28, 2023

This week, Binance launches a liquid staking token, Ethereum DEX unique users near 2-year highs, users seek an airdrop for LayerZero and Solana wallet Phantom expands to Ethereum & Polygon.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏