A Data-Driven Breakdown of the Labor Market

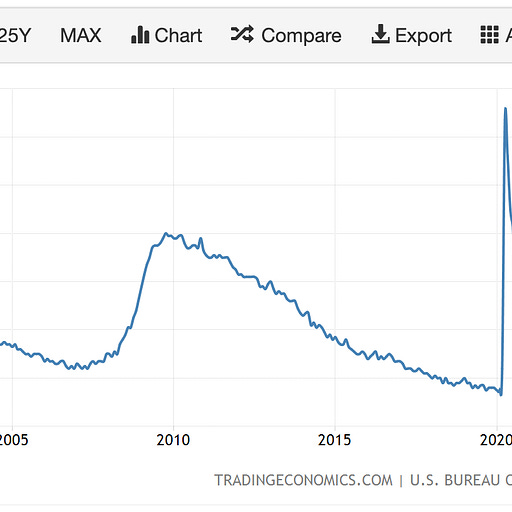

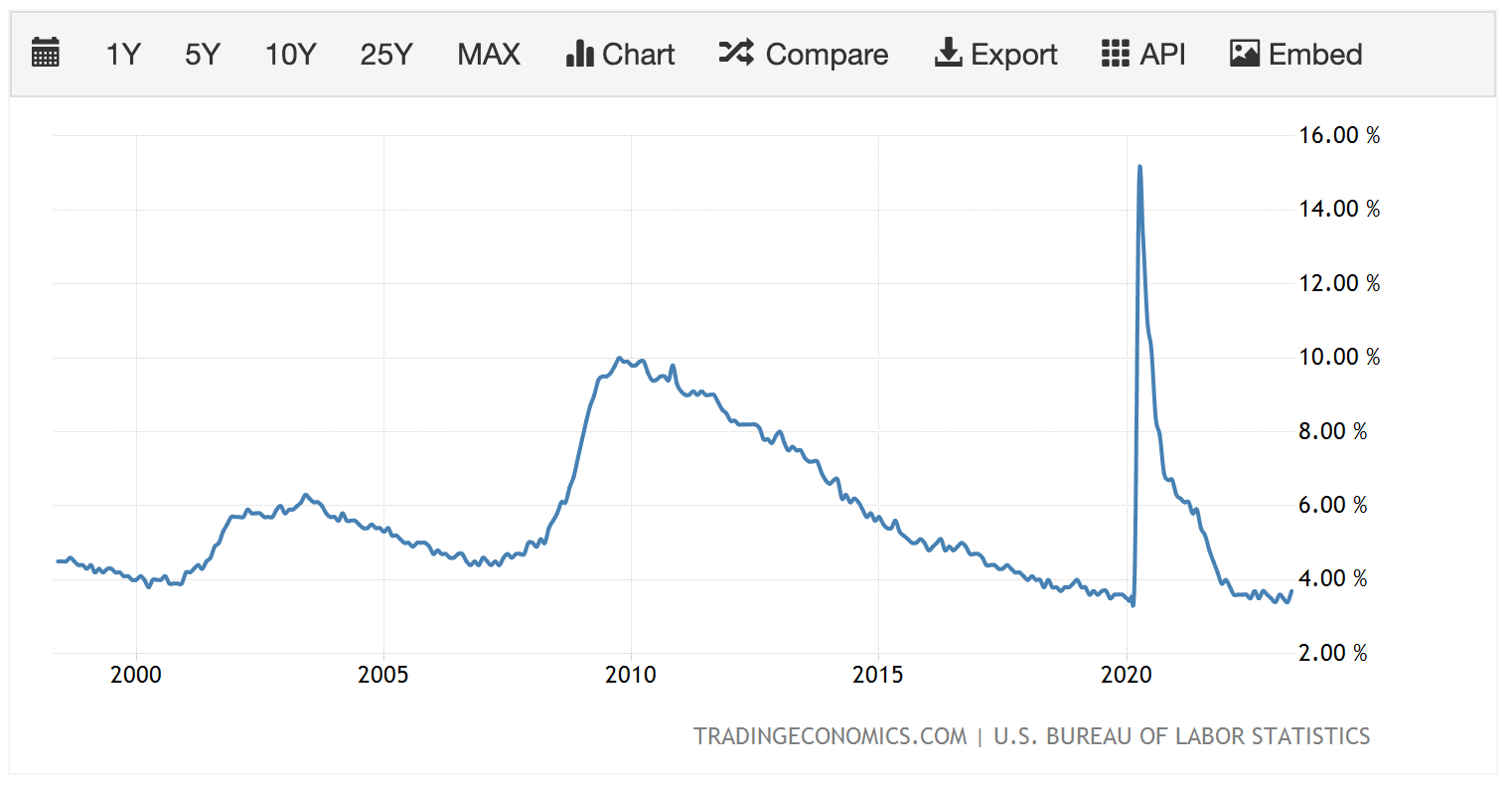

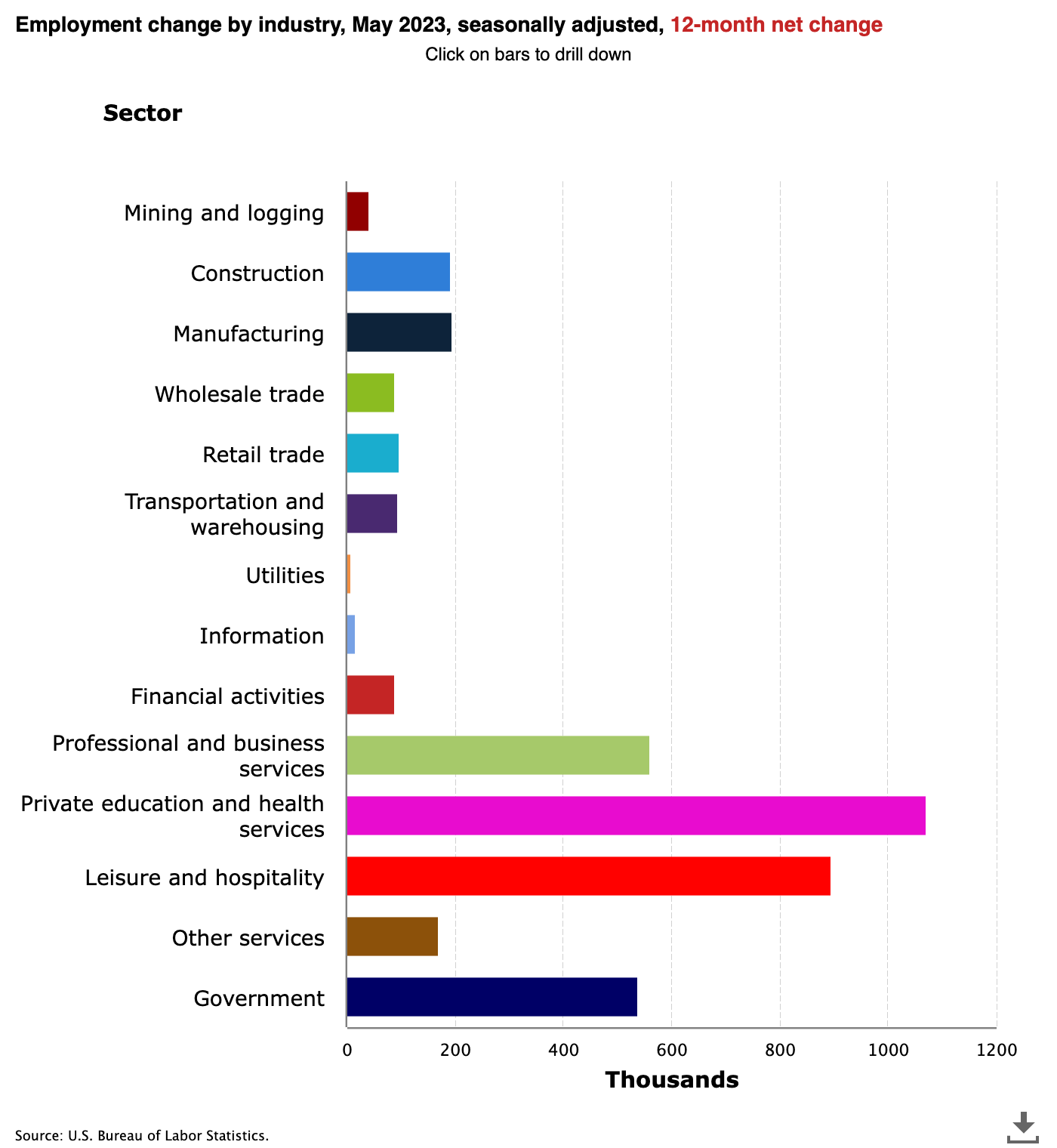

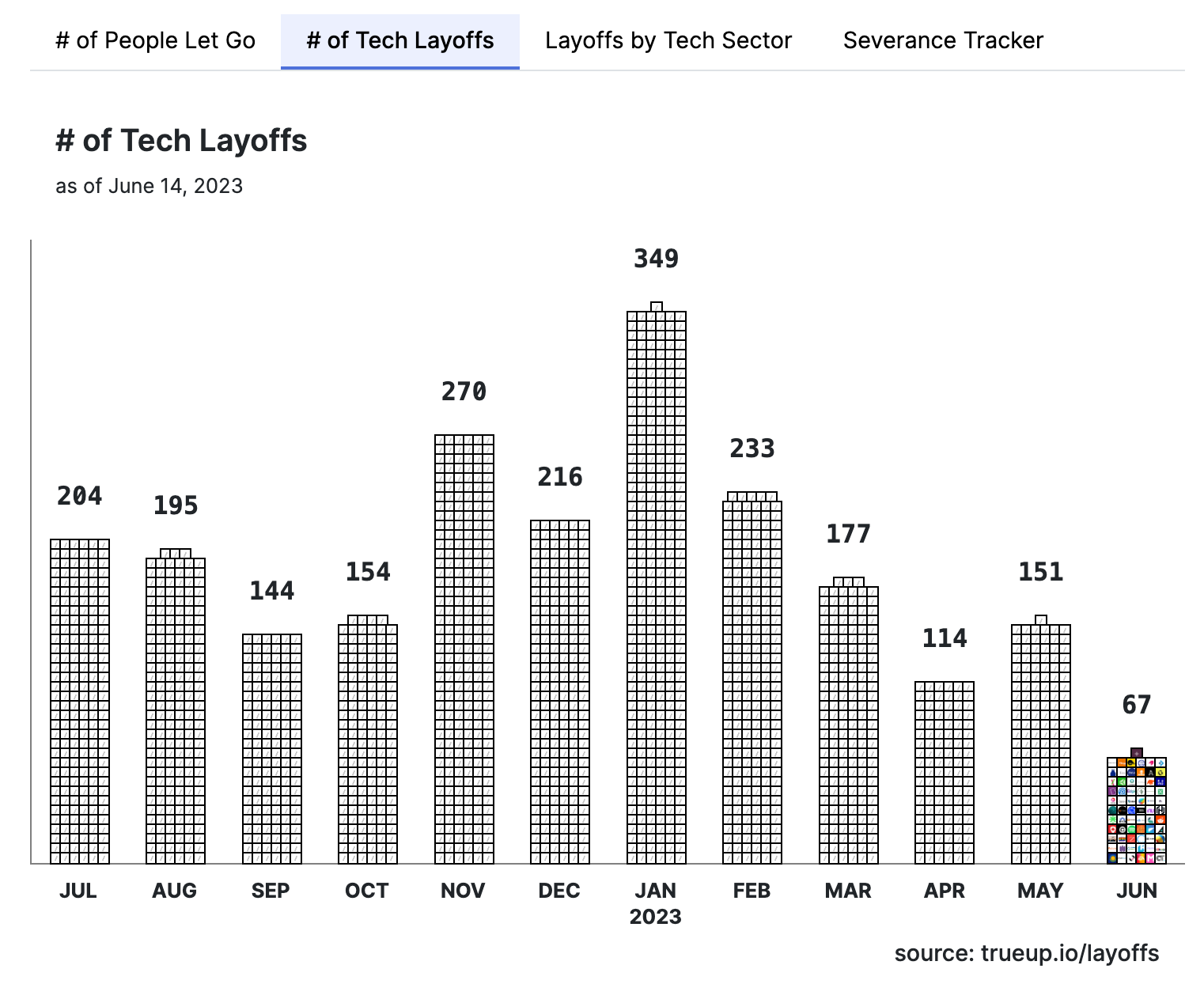

To investors, The Federal Reserve has been hiking interest rates aggressively for the last year and a half. Although multiple banks have failed and asset prices are down materially, the Fed has remained steadfast in their pursuit of tighter financial conditions. A key reason the Fed has not wavered is the labor market. We currently have an unemployment rate of 3.7%, which is low compared to the historical averages. The unemployment rate in the United States averaged 5.72% from 1948 until 2023, reaching a high of 14.70% in April 2020 and a record low of 2.50% in May 1953. South Dakota has the lowest unemployment rate at 1.9% and Nevada has the highest unemployment rate at 5.4%. According to the Bureau of Labor Statistics, there are 10.1 million open jobs in America and 6.1 million unemployed people, which means there is ~ 1.66 open jobs for each person looking for work. Although unemployment is low, there are still enough open jobs to employ every person who wants a job in America. Another important data point to evaluate the health of the labor market is the average hourly earnings for all employees on private nonfarm payrolls. The average is $33.44 today, which is significantly higher than the $7.25 federal minimum wage. Given that this is an average, the outliers in the data obviously skew the metric higher. Industry TrendsIf we dig deeper into the labor market, we can evaluate which industries are adding or losing jobs. One of the most surprising data points is that no industry saw a net loss in jobs in the past 12 months. The industry that saw the lowest growth is “Utilities,” which saw a net gain of 3,400 jobs (0.6%). The industry employs a total of 555,900 people. In the past 12 months, the “Private education and health services” industry gained the most new net jobs. The industry now employs a total of 25,254,000 people, a gain of 1,073,000 (4.4%) in the past 12 months. Another point to call out here is the resurgence of leisure and hospitality. This sector got decimated during the pandemic, but it has recovered nicely. There was an addition of just below 900,000 jobs in the last 12 months and more than 16.5 million people work in the sector currently. Remote WorkAccording to Forbes’ recent study, 12.7% of full-time employees work from home in 2023 and 28.2% of employees have adapted to a hybrid work model. The same report shows that approximately 16% of companies are fully remote, which means they are operating without any physical office. Tech LayoffsIf we drill into the tech layoffs, we can get a good sense for how certain industries are navigating the economic pain. Each layoff tracker has different data. They each agree directionally though. According to Layoffs.fyi, 785 tech companies have laid off 206,136 employees so far in 2023, which has already surpassed 2022’s 164,709 layoffs. There were more than 100,000 individual tech employees that were laid off in January of this year, according to TrueUp. We have seen three other months in 2023 with at least 50,000 people laid off. The current month of June appears to be on track for the lowest number of tech employees laid off in almost 9 months. It appears that the peak number of tech layoffs occurred in January, with 349 being reported that month, followed by a steady decline since. The month of June is not over so it is hard to predict if the trend will hold, but the significant decrease in recent months is encouraging. We are not out of the woods yet. The slowdown in layoffs across the tech sector will be important to watch. If we enter a deeper recession, it would not be surprising to see more layoffs occur. The tech industry has been a big beneficiary of the loose monetary policy era of the last decade — what the Fed gives, the Fed can take away. Overall, the labor market remains strong compared to historical trends. This strength is flashing a green light to the Fed to continue to keep financial conditions tight. It does not necessarily mean that the Fed will hike interest rates further, but we can’t discount that option either. We will find out more about the Fed’s plans later today — if they hike rates once more, then we have to believe that a recession is almost guaranteed. After talking to hundreds of people looking for a new job in the last few months, one of our companies has been diligently working to place these individuals in new opportunities. Thankfully, we have helped thousands of people find a job in the last two years, so the experience is paying off at the moment. We are hosting a free webinar on Monday June 19th at 6pm EST to teach people how to best position themselves to get a new job. We will focus on the bitcoin industry, but the lessons can be applied to any industry you are interested in. You can RSVP here. Hope you all have a great day. I’ll talk to everyone tomorrow. -Pomp The US Economy Just Got Stronger You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. |

Older messages

The Impending Collapse of Commercial Real Estate

Tuesday, June 20, 2023

Listen now (8 min) | To investors, The $20.7 trillion commercial real estate market is in big trouble. A few weeks ago Treasury Secretary Janet Yellen publicly stated “I do think that there will be

The State of Crypto Market Structure

Thursday, June 1, 2023

Listen now (4 min) | To investors, Today is a guest post from Will Clemente, co-founder of Reflexivity Research, on the current state of crypto market structure. You can subscribe to Reflexivity's

The AI Hype Cycle Learned From Bitcoin Hype Cycle

Tuesday, May 30, 2023

Listen now (4 min) | To investors, Artificial intelligence is now being talked about by the media as much as bitcoin was discussed during the all-time high run of 2021. This is noteworthy because the

Introducing the Bay Area Times

Monday, May 22, 2023

Listen now (2 min) | To investors, Today, we are publicly announcing the Bay Area Times — a new product that uses data and visuals to analyze what is happening across business, finance, and technology

Is Bitcoin The Largest Insurance Company In The World?

Friday, May 19, 2023

Listen now (5 min) | To investors, The concept of an insurance policy is straightforward. A contract is created between a policyholder and an insurer. The contract states that the insurer is legally

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these