Coin Metrics’ State of the Network: Issue 212

Coin Metrics’ State of the Network: Issue 212The basics of hash functions and a toy model of Bitcoin MiningGet the best data-driven crypto insights and analysis every week: State of the Network Foundations: HashesBy Alex R. Mead & Kyle Waters IntroductionIn this week’s State of the Network we return with our Foundations series, which presents various “technical” aspects of blockchain technology in an approachable way. In this week’s issue, we turn to the concept of a hash, one of the core cryptographic elements enabling the cryptocurrency space as a whole. This issue is a follow-on topic from last week’s Bitcoin Nonce Analysis report. That report used a novel analysis of nonce data to infer the ASIC composition of the Bitcoin mining network. Nonces are the solution to a hash function used in mining, one of the key innovations that makes Bitcoin possible—Proof of Work. Here we’ll dive into some more details of these mathematical functions to give even more context to this cutting-edge report. What is a hash function?A hash function is a function that takes a sequence of bytes as input and, regardless of the length of that input, produces a fixed length sequence of bytes as an output. This output byte sequence is referred to as the hash of the original input sequence. But don’t get confused, often the function itself is referred to as a hash as well. A common example of a hash function is SHA3-256. It returns a 256 bit hash, or one of 2256 possible outputs. Practically speaking, this hash is stored on a computer as a sequence of 256 0’s and 1’s. Hence, any piece of information on a computer, for example a file, also has a SHA3-256 representation that is 256 bits, or 32 bytes in length. Properties of Hash FunctionsWhile many functions qualify as hashes, good hashes exhibit four properties: deterministic, non-colliding, irreversibility, and uniformity. If a particular hash function exhibits these properties it can be very useful from a cryptographic perspective. Let’s explore each property below. DeterministicDeterministic means the function will return the same output given the same input. That is, there is no “randomness” in the function. This is helpful, because if a hash function is deterministic, one then knows that if they use the same input, the same hash value will always come out.

Non-CollidingNon-colliding means that no two inputs will produce the same hash. Thus, every input sequence has a unique hash representation that it produces and no other input can make that same hash. So, if two files produce the same hash, they must be the exact same file.

IrreversibilityIrreversibly means that for any input sequence one can produce its hash, however, given a hash, one cannot reproduce the original input sequence. This is helpful because one can openly share the hash of some file without sharing any information that can be used to recreate the original file.

UniformityUniformity means that the hashes produced for a given input file are “randomly” distributed throughout the space of all possible hashes. To put this simply, a small change to the input, maybe only one letter difference, will completely change the hash produced. This is helpful because even small changes in the original input file are easy to spot when looking at the hash, because that new hash is very different from the original hash.

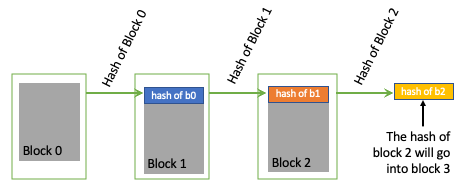

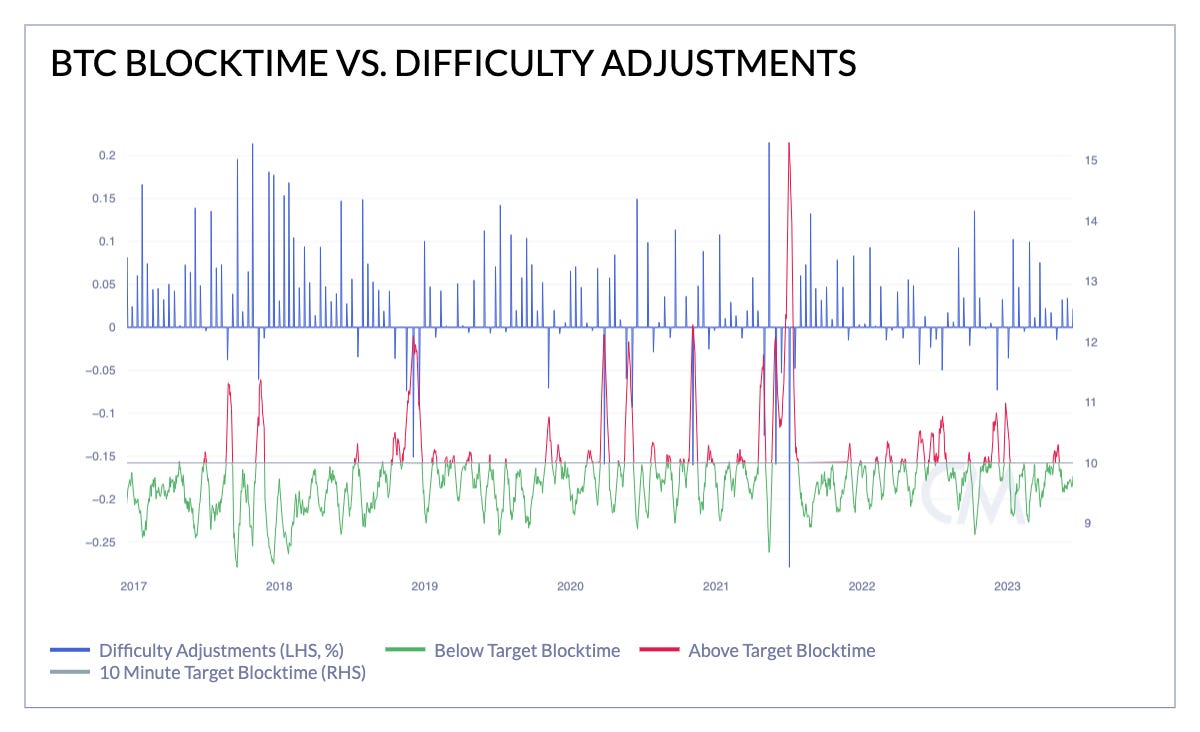

Hashes and BlockchainsHash functions, and the hashes they produce, are used extensively throughout the crypto-ecosystem. Perhaps the most fundamental use of hash functions is in the linking together of blocks into the blockchain itself. Let’s explore this concept a little deeper. Examining Figure 1 below, a simplified blockchain is presented. Notice, each block contains within itself the hash of the previous block. This hash is an unique identifier for each block’s parent block. Recalling the properties of a hash function above, the blockchain is thus a data structure consisting of a unique set of blocks. These blocks can be uniquely identified by following the linked hashes all the way from the head of the chain - the latest block to be produced - back to the genesis block - the first block produced. Due to non-collision and determinism, the chain of blocks can be traversed with complete accuracy down to a bit level. Blockchains can thus be thought of as special cases of the broader class of linked-lists, with the unique property of 100% data validation. By simply comparing the hash of any block data, verification can be undertaken by any individual user. Further, the blockchain is incorruptible, because any change at any block along the chain would “cascade” forward down all the way to the head. Thus, one can know with certainty if the hash they have matches the hash of the head of the chain the entire blockchain is accurate down to the bit. This is truly a unique and powerful property for a data structure and is one of the key innovations of blockchain and crypto in general. Figure 1: Simplified blockchain showing how hashes of each block both directly define the data structure as well as verify its content. Hash Functions in the Bitcoin Mining ProcessHash functions are at the heart of the Bitcoin mining process. Fundamentally, what Bitcoin miners are doing is generating a very high number of unique hashes as quickly as possible in the hopes of finding one that works. Miners use a hash function (specifically SHA-256) to generate a hash value from something called the block header. That is, the header is the input sequence of bytes described above. The header contains information about the current block (transactions to be included, timestamp, etc.) as well as information pointing back to the previous history of the blockchain - a previous block’s hash. It also contains the nonce, or “number used once”, which is an integer value used to generate new unique hashes, as the rest of the information stays constant in the block header. As we explained, the nonce served as the key ingredient to our report The Signal & the Nonce to fingerprint different mining hardware. The “work” element in Proof-of-Work mining directly refers to a hashing problem. This is explained in the Bitcoin whitepaper: “The proof-of-work involves scanning for a value that when hashed, such as with SHA-256, the hash begins with a number of zero bits.” The goal in Proof-of-Work is to find a hash that meets the criteria for a new block. A nice analogy to use is that of a large jigsaw puzzle (source). Jigsaw puzzles take a long time to piece together, but once complete, are easy to verify that they are in fact put together correctly. This is conceptually like the Bitcoin mining process. What constitutes a “valid” or “solved” block hash has changed over time. This is because of an important network variable known as the difficulty parameter. As the name suggests, the higher the difficulty, the more computationally challenging it is to generate a winning hash. Think of this like moving from a 1,000 piece puzzle to a 10,000 piece puzzle. The purpose of the difficulty parameter is to regulate competition between miners by moving up or down every 2,016 blocks (~2 weeks) so that the network maintains a targeted 10-minute average time between blocks. The chart below shows this in action. At the time of writing, Bitcoin’s difficulty sits at an all-time high after several upward difficulty adjustments in the last year. Source: Coin Metrics Network Data Difficulty is enforced by mandating the structure of the resulting hash begin with a specific number of "0" bits. As the number of required 0s increases, the hashes become harder to find, hence requiring more work. The higher difficulty is reflected in the “winning” block hashes over time. For example, we can look at the following block hashes for blocks in 2009, 2010, 2017, and today in 2023. You can see that the required number of leading zeros has increased over time, reflective of the higher difficulty.

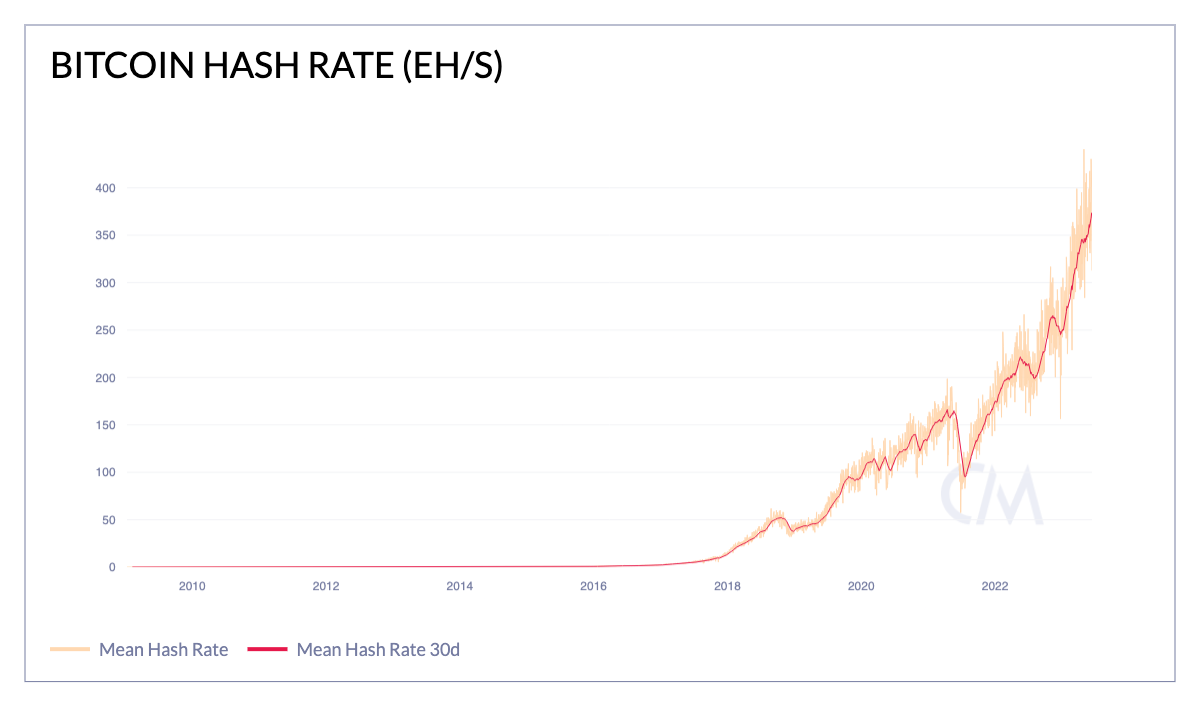

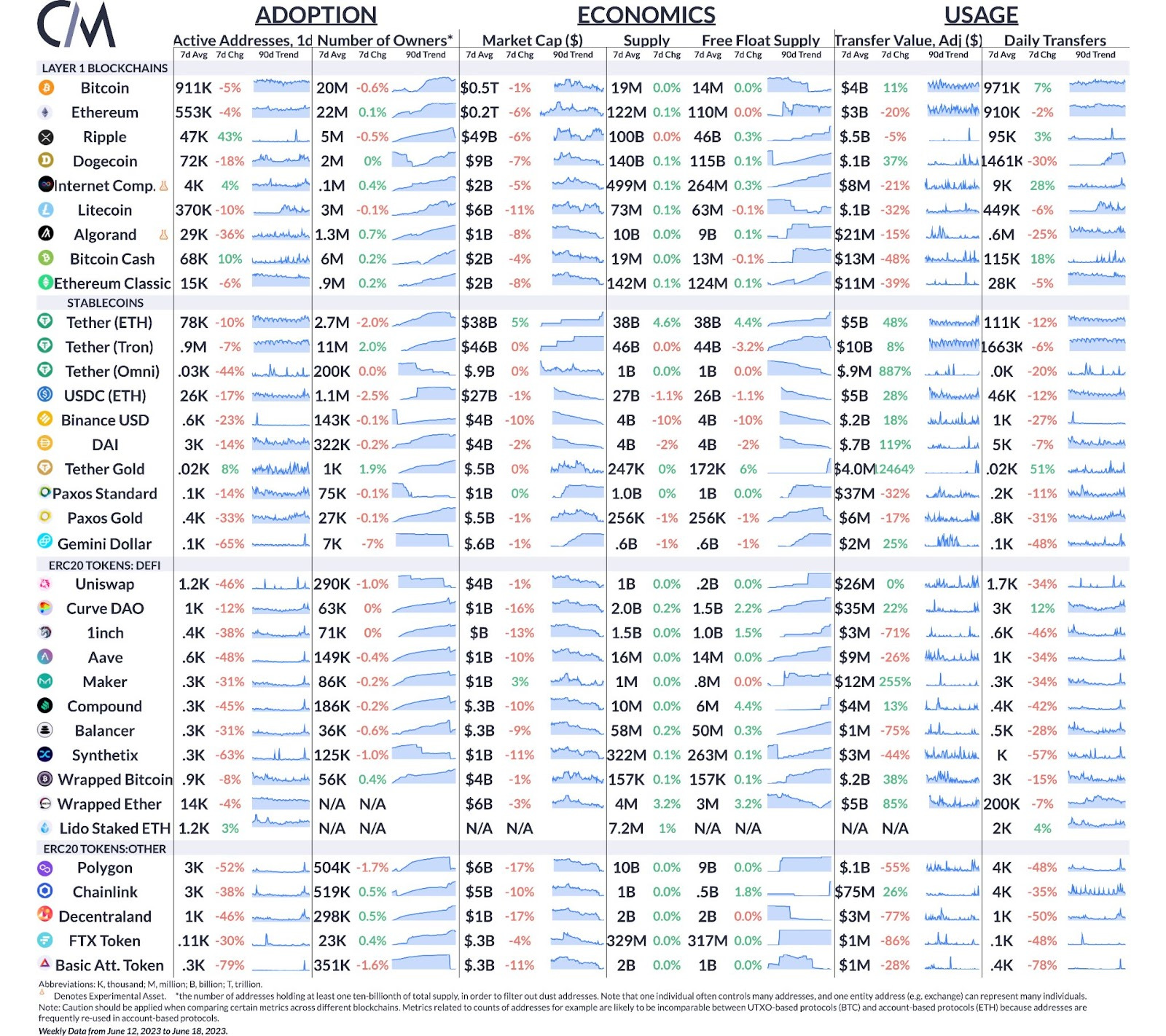

This is ultimately a reflection of more and more miners joining the network over time with better machines optimized to hash more quickly. This is shown by the network Hash Rate, a metric which is an estimate of the total aggregate rate of hashes on the network. Today, Bitcoin’s hash rate sits at around 350 EH/s (quintillion hashes per second). Source: Coin Metrics Network Data Bitcoin Mining: A Toy ModelA simplified model can help build intuition for this topic. Below, we’ve written a short Python script to simulate the mining process. Note this skips some nuance but hits on the major points. We can see the role of the hash function, the nonce, and the difficulty. Running on our local laptops, we can find a valid block with 6 leading zeros in a short amount of time (usually a few seconds to under a minute). But moving to 7 leading zeros, we see the average time jump considerably to find such a hash. Of course, if we were generating more hashes with a more powerful machine, we could lower these times considerably. This helps simulate some of the core concepts underpinning Proof-of-Work. Try it out yourself! ConclusionWhile much more could be said about hash functions, hashes, and hashing within the crypto-ecosystem, we’ve covered the basics and outlined hashing’s role in the Bitcoin Mining process as well as its role in the blockchain data structure itself. This issue is the second installment of the new “Foundations” series explaining technical topics related to crypto. Any feedback or thoughts are very welcome and can be submitted here. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro The market capitalization of stablecoin Tether (USDT) continues to grow, reaching $83B across Tron, Ethereum, and Omni. With 38B of USDT supply on Ethereum, this gives Tether a greater than 50% share of the market on ETH for the first time since March of 2021. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 211

Tuesday, June 13, 2023

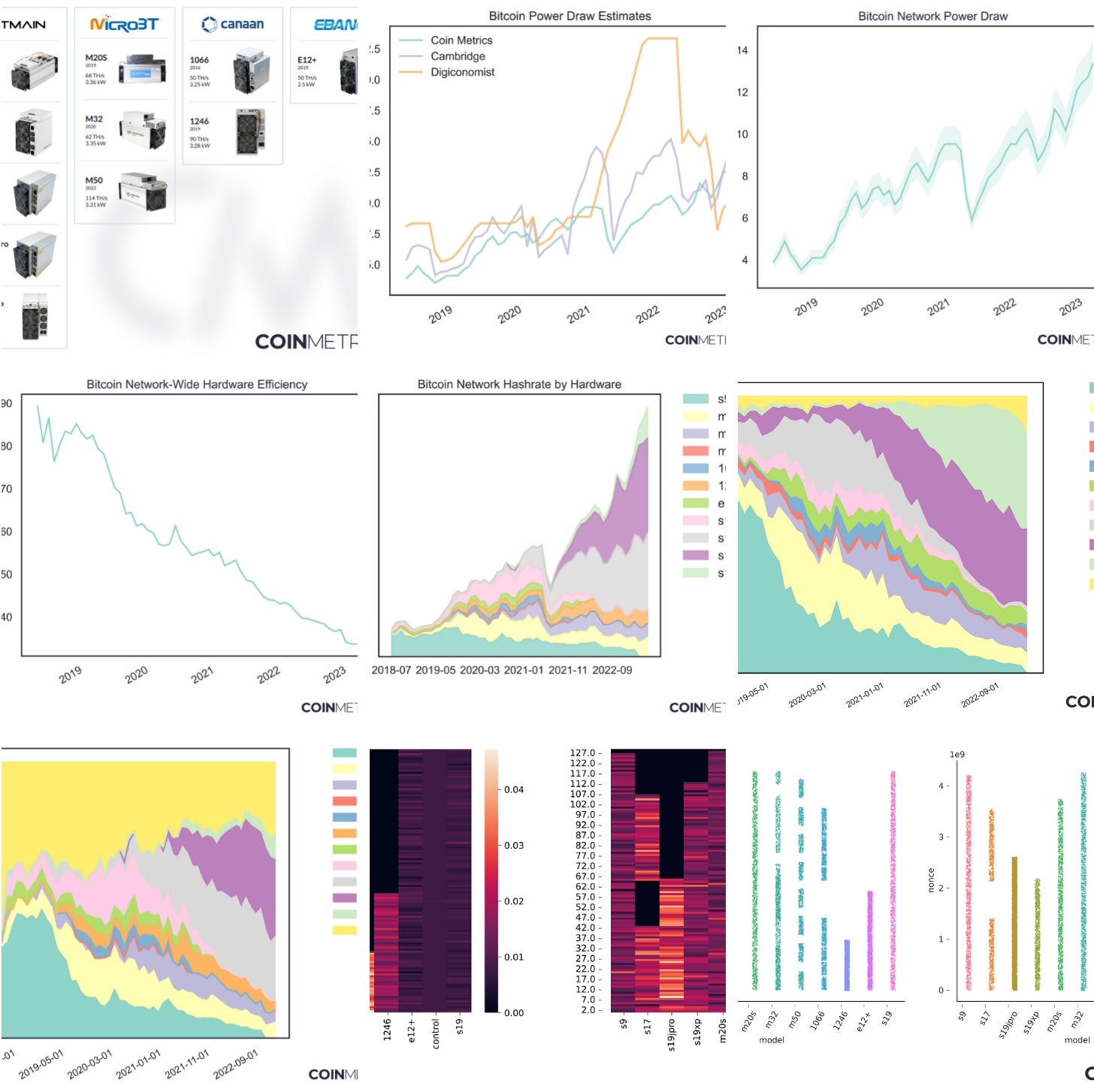

Estimating Bitcoin's energy consumption with greater confidence

Coin Metrics’ State of the Network: Issue 210

Monday, June 12, 2023

Token Unlocks & Free Float Supply Shocks in Digital Asset Markets

Coin Metrics’ State of the Network: Issue 209

Wednesday, May 31, 2023

Zooming out at digital asset market caps, returns, sector correlations & volatility

Coin Metrics’ State of the Network: Issue 208

Tuesday, May 23, 2023

Tracking the Soaring Demand for Staking Ethereum

Coin Metrics’ State of the Network: Issue 207

Tuesday, May 16, 2023

Reviewing the liquidity landscape of the digital assets market

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏