Not Boring by Packy McCormick - In Defense of Strategy

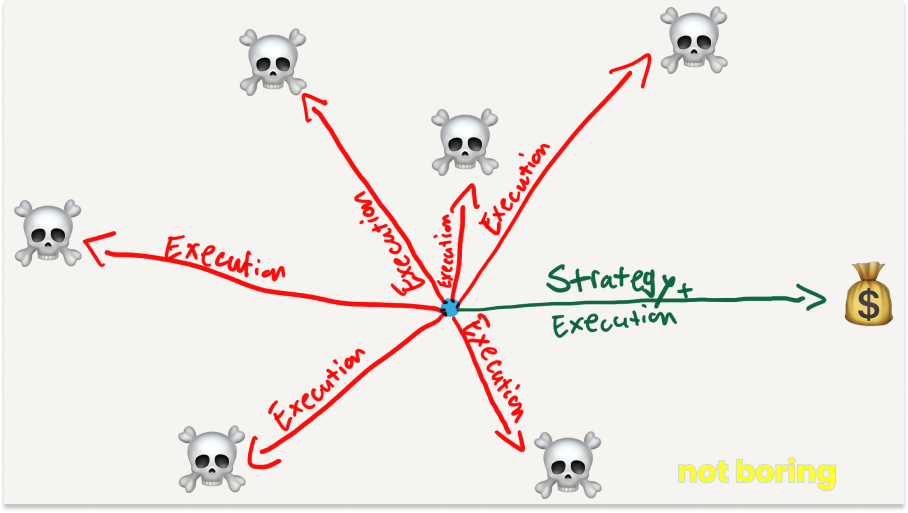

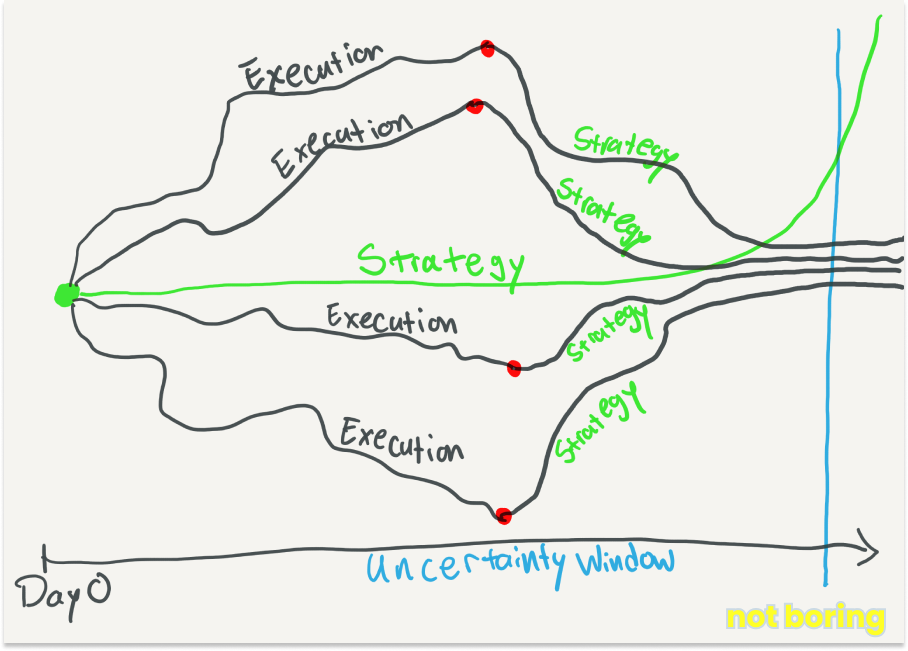

Welcome to the 579 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 208,497 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Slack What’s the first thing founders do when starting a company? Buy a website domain? File incorporation docs? Add “Stealth” to their LinkedIn? Nope. The first thing founders do is start a new Slack Workspace. Why? Because Slack is where thoughtful work gets done quickly. Slack sent us a bunch of ad copy to include here, but this is a product I know and use every single day so I’m going to tell you why I like the product. Partner Management. You know when you have a longstanding partner – it could be an agency, consultant, supplier – and you have dozens of poorly labeled emails threads going with them? Yeah, just skip all of that and get your closest partners added to your Slack channel, either as a member or via Connect. Find what you need, share what you know. From files to photos to conversations, everyone can access any message that’s ever been shared in public channels, so they have all the information they need to make decisions and move work forward. Crtl+f makes the world go round. Connect instantly with huddles. Fun fact, Dan and I have never scheduled a video meeting. But we huddle all the time. With huddles you can talk, video chat, or share your screen instantly with anyone in your Slack. Right now, you can save 50% off your first 3 months of Slack Pro. Hi friends 👋, Happy Tuesday! Last week, we talked about moats and uncertainty. The takeaway from that one is that, “New startups have a limited window of time during which they’re protected by the cover of uncertainty to dig moats, and if they don’t dig them by the time others catch on, their excess profit will be competed away and they’ll struggle to achieve a good outcome.” At the end, I left you with a little cliffhanger. I said we were going to talk about strategy. So this week, we’re going to talk about strategy. Let’s get to it. In Defense of StrategyThere’s a belief in tech that execution is all that matters, that strategy is for wimpy MBAs. That belief is wrong, and I have the scars to prove it. Before Not Boring, I worked at a flexible workspace startup called Breather. I’ve written about my time there before. We ran a well-oiled machine across 500 spaces in 10 markets with bookings by the hour, non-stop operations, the best tech in the industry, and an NPS consistently in the 70s and 80s. We were great at some things and bad at other things, but one thing was undeniable: we could fucking execute. And yet, we failed. After raising $120 million, we sold for $3 million in 2021. What killed Breather wasn’t a lack of execution. It was bad strategy. Execution without strategy is wasteful and tragic. Just as “Companies that have the best products, most talented people, and fastest growth are precisely the ones for which moats are most important,” companies that are the best at execution are precisely the ones for which strategy is most important. They’re the only ones that have a shot. The better you are at execution, the faster you can run in any direction. A good strategy helps you run fast in the right direction. Execution is necessary but not sufficient. Strategy isn’t sufficient either, but it is necessary. For some reason, though, it’s a badge of honor in tech to shit on strategy. Well, I am here to defend strategy. Strategy is the difference between playing startup and building an enduring business. I’ve racked my brain (and Google, and ChatGPT) for examples of startups that have achieved $10 billion+ outcomes without a good strategy, without moats in place by the time their success became obvious, and I just can’t come up with any. If startups need to dig moats before their uncertainty runs out, strategy is how they do it. If moats are the what, strategy is the how. Every startup has a window of time during which they must simultaneously build something worth defending and build defenses around it. For new startups, strategy is deciding how to use the window wisely. It’s about directing your limited resources towards digging moats before you’ve removed enough uncertainty to attract serious competition. Like moats, strategy is often thought of as something that bigger companies need to worry about, when they have to coordinate thousands of people and defend against dozens of competitors. Most of the strategy literature is written for those bigger companies, and most of it is overkill for startups. That doesn’t mean that strategy is more important for big companies than for startups. The opposite is true: strategy is highest-leverage at Day 0, when all paths are available. I made strategy look too clean in that graphic. Under conditions of uncertainty, your strategy will need to change as you learn and as the situation evolves. But crafting a strategy upfront lets you throw all of your limited resources in one direction from the start, build the strengths you need to win in the market you’ve chosen, and hopefully, if things go just right, compound all the little actions you take in the course of building your business into something real and defensible by the time your uncertainty window closes. If you use the uncertainty window to execute blindly for a while before crafting a strategy, you’ve both wasted precious uncertainty time and made decisions – hired people, signed customers, taken on outside capital – that will make it harder to change direction when you decide you must. This all seems kind of tautological. Few would disagree that it’s better to execute in a direction than not. And done right, that’s what strategy helps do. So why does strategy get such a bad rap? Bad StrategyMost capital-S Strategy, as it’s taught and practiced by people who call it Strategy, is Bad Strategy. When Ben Rollert and I told Breather’s exec team that we were going to spend Christmas break 2017 coming up with a strategy to improve our margins in the face of competition from WeWork and Knotel, our CTO, Ben Nevile, told us to read Good Strategy Bad Strategy by Richard Rumelt. Great rec. It’s my favorite strategy book because it was so easy to put into practice, and because I recognized so many of the characteristics of bad strategy. Here are a few:

Before Breather eventually fell victim to bad strategy, Ben and I came up with a good strategy (if I do say so myself). I’ll explain it once we’ve covered good strategy, but for now, I’ll say that our gross margins improved from -25% to +25% in six months by doing something competitors couldn’t easily match. Then we brought in a new CEO, who brought in a new exec team, in 2019. A couple weeks into their tenure, Ben and I presented our strategy at an exec team offsite. We were like two minutes in when we got cut off: “Why? Why do we need a strategy? This is a big market, we don’t need to worry about moats. We have a brand. That’s what Apple has. Our space plan model is the strategy.” Mistaking a Goal (the space plan model) for Strategy: ✅ Failure to Face the Challenge: ✅ Ignoring Competition: ✅ Thinking a Good Brand is a Brand Moat: not in the book, but a common mistake ✅ Comparing Your Company to Apple: lol All that bad strategy in 34 words! Impressive! Doing Bad Strategy and calling it Strategy gives the whole thing a bad name, and scares people away from the simple and necessary work of crafting a Good Strategy. Good Startup StrategyRumelt doesn’t give a one-sentence definition of strategy in the book, but if he did, it would look something like this: A strategy is a high-level plan to achieve one or more goals under conditions of uncertainty, designed through recognizing the challenge (diagnosis), setting a direction to overcome it (guiding policy), and detailing steps to implement the policy (coherent actions). Those three pieces — diagnosis, guiding policy, and coherent actions — form the strategy kernel. By combining the strategy kernel with what we discussed in When to Dig a Moat, we can come up with something a little more tailored to early stage startups. A startup can’t be expected to have moats in the early days, but it should have a strategy in place that gives it the best chance of having them in place by the time the uncertainty window runs out. The best time to craft a strategy is before you start the company; the second best time is now. Strategy isn’t set in stone. It should evolve as the facts do, and as the startup learns by doing. A startup’s strategy should actually evolve faster than a larger company’s because there’s so much uncertainty and such a high rate of learning, and because a startup is still nimble enough to change course as needed. A rough way of thinking about what should change is that the diagnosis should be the most stable, the guiding policy should be relatively stable, and the coherent actions should be the quickest to adapt to new information. Let’s take each in turn. Diagnosis

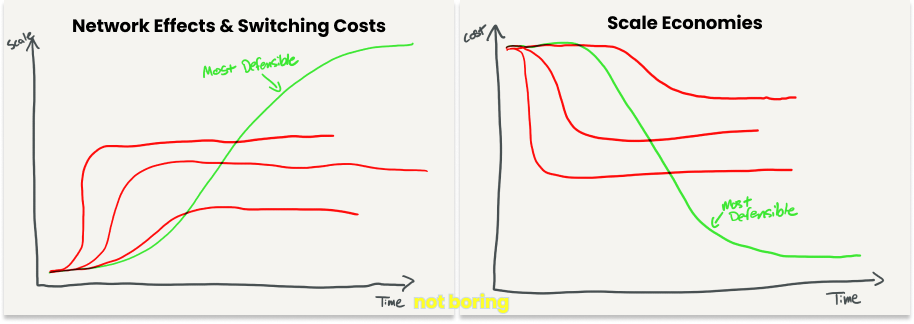

A good diagnosis is the most important piece of the strategy kernel for a startup. Getting it right is the highest leverage thing you can do, so we’ll spend most of our time here. Every founder does some form of diagnosis before starting a company. They survey the landscape of available products and unmet customer needs, and evaluate their own abilities and the inputs available to build a better solution. This shows up in pitch decks as the “Problem” and “Solution” slides, and in investor conversations as the answer to “Why now?” My brother Dan started Create because he noticed a wide gap between the public perception of creatine and the very positive research on its effectiveness, realized that well-branded gummies would be a more palatable form factor than powders for most consumers, and recognized that his experience at Away, Parade, and Not Boring gave him the right skillset to build the brand. A little over six months in, he’s at a $6 million run rate. It seems to have been a good diagnosis. Most startups stop there, but a good startup diagnosis needs to go further. First, startups need to honestly assess how obvious their product is and how hard it is to build. This is what we talked about in When to Dig a Moat. Estimate a starting uncertainty window, a rough guide for how soon you’ll face competition, how quickly you’ll need to dig moats, and how deep they’ll need to be. Because the uncertainty window depends on the progress a company makes, it’s more useful to think about this in terms of milestones than time: “By the time we’ve proven X, competitors are likely to attack.” That’s when you should have early moats in place. Then, startups need to understand which moats, which of Hamilton Helmer’s 7 Powers, are available in the market they’re attacking. Picking the right moat for your market is crucial. As Dan Hockenmaier, who runs strategy and analytics at Faire put it: “Most of the value is picking a lane that’s going to lend itself to defensibility.” If you’re building a physical product, you might focus on scale economies. If you’re building a SaaS product, you might focus on switching costs. If you’re building a social app, you’ll probably focus on network effects. It’s important to be a student of history here. Optimism is an important trait in a founder, but realism skewing towards pessimism is the right state of mind for a diagnosis. The first moat you reach for might not survive deeper scrutiny. Take social apps. Understand why the last 1,000 failed before convincing yourself you’ll be the one to crack network effects. Or marketplaces. Hockenmaier notes that, “Network effects are overrated for marketplaces. They are usually not enough to drive defensibility on their own. They take too many lessons from single-sided network effects and ignore the challenges with dual-sided networks.” Look instead to scale economies or switching costs. Aim for moats with non-linear returns, where being 2x or 10x bigger provides outsized benefits. Hockenmaier looks for “asymptoting curves that take a long time to asymptote.” The goal is finding moats where you stay steps ahead thanks to non-linear returns. Airbnb picked the right asymptoting curves – more supply kept delivering more defensibility. When Wimdu tried to compete with it in Europe, Airbnb won because its scale drove cross-border network effects. Airbnb picked a business in which getting to scale fast mattered, and then got to scale fast before the window closed. Looking for curves that take a long time to asymptote is a good rule of thumb when evaluating network effects, switching costs, and scale economies in any industry: once you’re running in the right direction, how far can out-executing your competitors take you? No matter which industry you’re entering, if you get to this point in the diagnosis and the best potential moat you can come up with is brand or process power, you might be in trouble. Both take a very long time to develop, if they do at all, and when they do, it’s often through some emergent magic. Cornered resources are also tricky, but not impossible, to acquire. So before you launch, and definitely before you raise money, figure out whether you think you can create scale economies, switching costs, maybe network effects, or mayyybe cornered resources before your uncertainty window closes. But what if that’s not enough time? What if you’re entering a market that already has competitors? My favorite power – counter-positioning – might be able to help. Counter-positioning isn’t a forever moat, but it can be really useful in extending your window until you can dig one. Ramp counter-positioned beautifully in corporate cards. I wrote about it here and here. Not every idea has a viable path to defensibility. That’s OK. It’s better to toss the idea or decide to bootstrap after a couple weeks of researching and writing than it is to spend years of your life and millions of dollars of other peoples’ money going the venture-backed route on something that you know ahead of time will probably fail. Knowing what game you should be playing is strategy, too. Finally, if the founders see a path to defensibility, they need to determine the one or two most important challenges to address head-on. Based on your diagnosis, what is the most critical solvable problem facing your company? Identify that upfront, and craft your strategy around solving it. These will be different for every business and every industry. In The Crux, Rumelt talks about Elon Musk realizing that launches were too expensive to ever get humans to Mars, identifying reusability as the most important issue to solve for affordability, and throwing all of his early resources at reusability. Sometimes, the challenge will be so big that it’s worth throwing everything at solving it before worrying about anything else. SpaceX didn’t develop Starlink, which gives it unbeatable scale economies, until a decade into the company’s life. The uncertainty and difficulty of its rocket capabilities gave it a big enough headstart that it didn’t need to worry about long-term moats too early. Often, though, it’s useful to identify two challenges to start attacking immediately:

With that, you’ve completed the diagnosis. You understand the competitive landscape, the why now, roughly how long of an uncertainty window you’ll have, which moats you need to have in place when it runs out, and the couple of core challenges you’ll need to address. It might seem like a lot, but at the end of the diagnosis, you’ve sanity-checked your idea and simplified a ton of complexity into just a couple of obstacles to overcome. Now it’s time to translate that work into decisions about how your company will operate. Guiding Policy

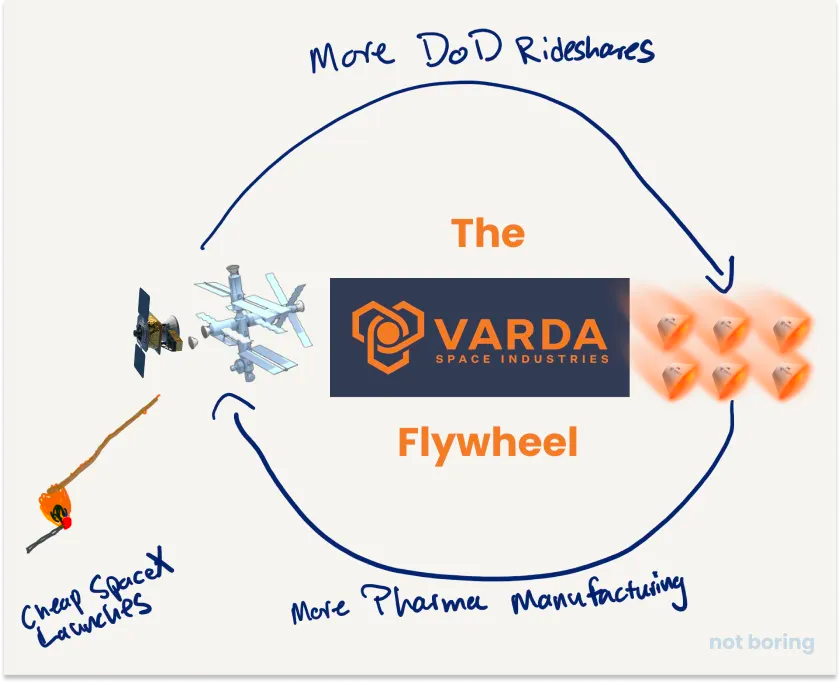

A good guiding policy flows from the diagnosis: it’s where you figure out how to overcome the obstacles you’ve identified “by creating or drawing upon sources of advantage.” A lot of the things that startups think that they need instead of a strategy are actually just the guiding policy. If a startup’s advantage is that it can ship faster than incumbents, speed can be a part of the guiding policy. If its advantage is that it can target a growing niche too small for an incumbent to care about and ride it to greatness, like Stripe did with startup developers, focusing on that niche at the expense of other opportunities can be part of the guiding policy. Startups come pre-loaded with very few strengths. There are the generic ones, like speed and focus, and whatever strengths the founders bring with them, but for the most part, they’re blank slates. The beauty of the guiding policy for startups is that they’re free to choose which strengths they want to develop based on the diagnosis. Varda, which I wrote about in June, is a beautiful example of a diagnosis informing a guiding policy with an eye towards defensibility. Delian Asparouhov started Varda after realizing declining launch costs could make space manufacturing economics work. His diagnosis: Varda needed to excel at manufacturing, returning payloads, and selling. Focusing on both commercial and government customers could help it gain advantages and develop scale economies. Varda's guiding policy flowed directly from this diagnosis:

The beauty of Varda’s strategy is how focused and aligned everything is: get to scale faster than anyone else to drive down costs. Varda doesn’t have moats yet, but with everything it does in the course of operating its business, it’s digging them. Coherent Actions

Every startup has limited resources. It can only spend so much money, hire so many people, and take so many actions before the money runs out. A good diagnosis and guiding policy channels and coordinates those limited actions so that they can compound on each other. Good strategy can actually free startups up to move faster by making it clear exactly what the company wants to do, and for whom, and giving autonomy to the talented people it hires by letting them select their own coherent actions that fit within the strategy. A clear strategy from the top allows more independent decision-making at all levels. This, finally, is where execution comes into play. Execution absolutely matters, but it’s only effective if it’s guided in such a way that it addresses the one or two things that remove uncertainty and defend the business once the uncertainty is removed. I planned to spend most of the essay on coherent actions, on the idea that they’re the equivalent of compound interest for startups, but once I started writing, I realized that if you get the diagnosis and guiding policy right, coherent actions flow in the course of execution. And coherent actions So I’ll show you how it worked at Breather instead. Good Strategy at BreatherDiagnosis In late 2017, Breather operated roughly 400 spaces in ten markets after expanding way too quickly based on incorrectly analogizing ourselves to Uber (every startup’s strategy is unique!). We set a goal to add a space every day, and we did it, even if it meant adding spaces that weren’t ideal. That left us with too many spaces that didn’t fill up and lost money. As a result, our gross margins across the network sat at -25%. At the time, we only let customers book hourly bookings up to a full day through our app. Customers were asking us if they could rent spaces for longer periods – a month or more – but we told them that’s not what we do. Better-funded competitors like WeWork and Knotel focused exclusively on these relatively longer bookings, and we didn’t want to compete with them directly. Doing the hardest and least lucrative bookings, we developed a unique set of strengths. Our operations team could turn a space in 30 minutes. Our data science team could dynamically price spaces based on real-time demand signals. Our design, construction, and launch teams were used to high-volume, short timeline space launches. Users booked through an app, on-demand, and accessed the space with their phone. They used spaces for a number of different use cases – meetings, brainstorms, focused work, events – often requiring different configurations. We coordinated everything through our in-house backend system. Based on those strengths, and the clear margin challenge, we identified a couple of core challenges to focus on.

With that diagnosis in-hand, we set out a guiding policy. Guiding Policy Our guiding policy was simple: offer growing startups a network of flexible spaces that grows with their needs instead of one single office. To do that, we would make every space in our network available for as little as an hour and as long as a year, priced in real-time based on demand. If a space was underperforming as an hourly space, we could make it available as a monthly office for a lower price than our competitors: turning a space from negative to breakeven improved the network’s margins, and pushed its demand into nearby strong-performing hourly spaces, juicing their margins. If a customer rented a space for a month+, we could offer them discounts on nearby spaces, allowing them to spend less on a permanent space and flex up when they needed more room to host an important meeting, have a sensitive conversation, or a place to work when they traveled to another one of our markets. Instead of viewing each space independently, we viewed the whole network as one big office that responded to our customers’ needs on-demand. Coherent Actions Actually pulling that off was insanely difficult and required intense execution from the team. As just a few examples, we needed to:

Each one of these actions alone, or in the hands of competitors, wouldn’t have done much good. Together, they built a machine that had a momentum of its own. There were a thousand more things that the team did to put the new strategy into action, but that gives you a flavor. Half the battle was being clear about what we were trying to do, and why, and pointing out that we were the only ones who could do it. The vast majority of the coherent actions that the team took didn’t come from Ben and I; they came from the team. That year was the most exhilarating of my six at Breather. We moved so fast. People stayed at the office late and cheered every time a gong ring announced a monthly booking. And it worked. Our margins flipped from -25% to +25% in six months. WeWork and Knotel didn’t respond, and we were able to steal customers from them. They were still much bigger than us, but we offered something unique. Unfortunately, we didn’t get the chance to see whether the strategy would have created long-term defensibility. We threw it out when the new exec team joined in 2019, focusing solely on plain vanilla monthly bookings. Who knows if our strategy would have been enough to overcome the headwinds in a brutal market, or if we could have raised enough money to continue competing. Breather may have failed even if we had kept executing this strategy. It was a competitive market and our competitors were willing to spend like drunken sailors. Good strategy, even paired with strong execution, isn’t a guarantee of success. But strong execution without a good strategy is a road to nowhere in an F1 car. Don’t ignore strategy. Read Good Strategy Bad Strategy, 7 Powers, and Productive Uncertainty. Take the time to honestly diagnose the situation, come up with a good guiding policy, and focus your company’s limited actions so that they build on each other. Keep refreshing it as you learn more. Have fun solving the puzzle. Running a startup is going to be hard no matter what. Execution is hard. So don't just execute. Plot a course, forge advantages, build strengths. Create something enduring. Strategy comes down to choices. The first choice is whether or not to have a strategy. Founders can bet on brute force execution alone. Or pair execution with strategy to tilt the odds. When uncertainty looms, strategy lets you see the path before competitors do. It might just give you the time you need to succeed. Thanks to Dan for editing, and to Dan Hockenmaier for the conversation! That’s all for today! We’ll be back in your inbox on Friday with the Weekly Dose. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #52

Friday, July 21, 2023

South Park AI, Llama 2, Geothermal, Alzheimer's, Molecular Manufacturing

When to Dig a Moat

Tuesday, July 18, 2023

Uncertainty, Success, and Defensibility

Weekly Dose of Optimism #51

Sunday, July 16, 2023

Are We Back?, Hard Things, Charm Industrial, Astranis, x.ai, Regfluencers

Praise Elon

Tuesday, July 11, 2023

Elon is Killing Twitter to Save Us All

Weekly Dose of Optimism #50

Friday, July 7, 2023

Great Work, Hydrogen Demand, Texan Renewables, CEQA, USA

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month