| In JC’s Newsletter, I share the articles, documentaries, and books I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! If you like it, please share it on social networks! Share 💡JC's Newsletter

👉 George Stalk Jr.: Competing Against Time - The Knowledge Project (Farnam Street) ❓ Why am I sharing this article? It is always survival mode, whatever your situation as a company. I agree with “Know your cost better than your competitors know their cost” “Be faster than your competitors at providing your customers [with] what they want, when they want it, and where they want it.” How to incorporate time-based competitive advantage? Increase speed, remove dead time Simplify our product line with the bundle, and one level of service but allow for several coverages with unified back-end. How to reduce overhead?

The example of FedEx is a good example of how to simplify messaging. Compare ourselves objectively with competitors. Have a long-term obsession Always play offence.

A continuous battle: Well, all my clients were either winning and trying to preserve their winning position, or they were having trouble, maybe even losing and trying to survive. It was very much a survival mode, whether they were winners or losers.

Attributes of companies who win: These companies put the edge in competition, and the results showed in terms of their bottom line, their growth, and their market shares. The one that always works is “Know your cost better than your competitors know their cost” because most people don’t know their cost. They think they do. They know the cost that gets between the revenues and the profit line. Those are all averages, and they don’t go behind the averages. If you go behind the averages, what people will discover is that some things cost more than they thought they did and some things cost less. Some customers are more profitable and some are less profitable, and if you know your costs better than your competitor[s] know their costs, you can do nasty things. Gain market share, because you would understand how … your costs work…. The high-volume customer produces a whole bunch of economies to scale and reduces cost. But that all gets lost in the averages, so that’s a big winner.

One [strategy] that works very well is “Be faster than your competitors at providing your customers [with] what they want, when they want it, and where they want it.” If a company can do that two or three times faster than its competitors, it’ll usually grow two to three times faster and it’ll be twice as profitable. Hardball M&A [mergers and acquisitions] was another [strategy]. Buying companies to round out a competitive position or extend one. One client was in the medical devices business. Their second-best competitor was beginning to grow, and so they just bought them out.

I think Amazon’s a good example, where Jeff Bezos says, “Your gross margin is my target.”

Simplify culture: ➡️ Simplify messaging. Wake-up calls: If somebody says, “My culture is built around serving the customer best,” and I’m working with this company, they have to prove to me that, relative to the competitors, they can do that. People often use these descriptions of the culture without any quantitative representation. If the culture’s not being responsive, one of the fastest way[s] to make them responsive is to do the competitive comparisons. Demonstrate to people that somebody is doing what they think they’re doing well much better than they’re doing it, and that’s usually a big wake-up call. If people observe that wake-up call and take the actions and follow through, they can produce pretty dramatic results, but that’s not an easy path I just described.

Changing the mindset: Long-term obsession: Always play offense: Time-based-competition: The one-sentence description of time-based competition or competing against time is giving your customers what they want, when they want it, where they want it, faster than your competitors can do it. It starts with the customer and says, “How do I get what they want to them faster than competitors?” That’s the essence of competing against time. If one introduces time as something that can be managed alongside a cost, then a whole bunch of things pop out, gain visibility, that don’t when time is not included as a variable. Those things can be things like the price premium a customer will pay for faster delivery [or], as it turns out, the lower-capital requirements that resulted. If I compare two factories, one that is twice as fast as another factory, the one that’s twice as fast usually has faster working-capital terms, … higher productivity, and lower cost. People get to that point because they’ve looked at cost and time. It’s not time instead of cost; it’s cost and time. In fact, it’s cost, time and quality because if [one is] looking at an organization through the lens of time, one will see where the quality problems are. Because anytime one has a quality problem, whether it’s manufacturing or in an information business, it means rework. Anytime you have rework, it means lost time. And so for people to be as fast as the competitors, they have to be higher quality because they don’t get to speed.

Why do I have to do things faster? It’s actually just taking out all of the dead time.

➡️ Simplify our product line with the bundle, and one level of service but allow for several coverages with a unified back-end. Well, if we come back to the Japanese and Ford example. We have a Japanese factory that was three times as complex, half the size, and twice as productive. The product went through that factory 10 times faster than through the Ford factory—10 times faster. The 20% productivity advantage was about a 20% cost advantage, which is a big number for an automotive component. But the time advantage was 10 times.

Wausau was one of the early applications of that, which I can compete with next-day delivery versus delivery every two weeks. And if I could have next-day delivery to the merchants, that allowed the merchants to order more frequently and operate with less capital. That’s where the advantage kicked in. And so that’s where cost and time worked out. We added cost to the process to get time out the other side, but the time benefits were so overwhelming that the cost didn’t really matter anymore.

Most often what we see is that if you could speed up a factory or any kind of process by a factor of four—in other words, I take 20% of the time, 25% of the time I used to take—… [the] cost position is about 20% lower because I take out overhead. Overhead doesn’t speed things up; overhead slows things down. But overhead comes out because I’m being intelligent about how I manage, not because I’m just slashing the overhead. These factories are simpler to manage even though they’re more complex because the management’s pushed down onto the floor. There’s a lot of autonomy pushed onto the floor because it’s organized and managed to run by itself.

➡️ Reduce overhead ➡️ What is the equivalent for us? They use something called “flowcasting” at Canadian Tire, which means [that] on a daily basis, they’re looking at each element of their supply chain and trying to figure out how it’s doing, where the variances are. And then, where they have problems, they throw people at it and get it fixed, even though they don’t own that step of the supply chain. So imagining variances is a mindset that’s going to be very challenging for people to achieve if they haven’t achieved a time mindset to begin with. I think it’s the next wave.

➡️ What is our supply chain?

👉 BuzzFeed Shutters News, Startups and the R&D Tax Credit (Stratechery) ❓ Why am I sharing this article? I concluded in that Article that the only sustainable future for publishers was to build models that went around Aggregators, because to depend on them was unsustainable. What is clear, though, is that the only way to build a thriving business in a space dominated by an Aggregator is to go around them, not to work with them. For manufacturers it means building relationships with retailers other than Amazon and building brands that compel customers to go elsewhere

👉 Netflix Earnings, Netflix’s Movie Strategy, Accretive Ads (Stratechery) ❓ Why am I sharing this article? Our ads plan already has a total ARM (subscription + ads) greater than our standard plan. Hulu, meanwhile, generates an estimated $10/subscriber in advertising on its ad tier (which costs $6/month).

👉 The Unified Content Business Model (Stratechery) ❓ Why am I sharing this article? New York Times: I shouldn’t have been so quick in that 2015 Article to dismiss the New York Times: last year the company had $2.3 billion in revenue; $1.6 billion from subscriptions, and $523 million from advertising (the rest was from “Other”, including licensing, affiliate referrals, live events, etc.). Moreover, the advertising business, at least according to New York Times CEO Meredith Kopit Levien, is compelling precisely because it’s attached to a subscription business; from a Stratechery Interview: We have painstakingly built an ad business that we as a growing subscription-first business can feel really proud of, and painstakingly built a business where the ad business runs on the same high octane gas as the subscription business. That is registered, logged in, highly engaged qualified audience who spend a lot of time with our product and where we get a lot of signal in privacy-forward ways, non-intrusive ways about what’s interesting to them.

👉 Lyft’s Founders Exit, Uber Driver Improvements, Wrong About Aggregation (Stratechery) ❓ Why am I sharing this article?

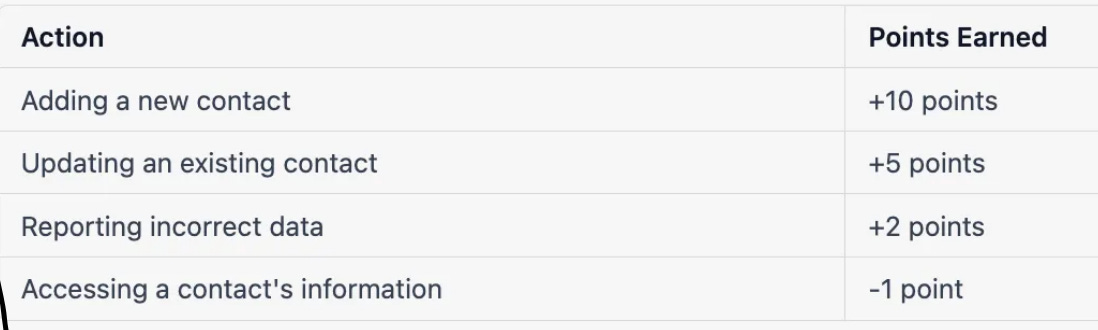

👉 The Give-to-Get Model for AI Startups (Bottom Up by David Sacks) ❓ Why am I sharing this article? Jigsaw is largely forgotten today, but its so-called “give-to-get” model could be perfect for AI startups that need to obtain rich proprietary datasets to train their models. Jigsaw’s crowdsourcing model revolved around a points system. Users could create a free account on Jigsaw’s platform by contributing their own business contact information. They could also add new contacts to the database to earn points, which they could then spend to see contacts posted by others. Users who didn’t want to contribute their own data could purchase points. Jigsaw also encouraged users to verify the accuracy of contact information in the database by rewarding them with points for each correction made.

Medical and health data: AI models can greatly benefit from access to diverse patient data, such as electronic health records, medical imaging, and genomic data. Users (patients or healthcare professionals) might be willing to share anonymized data in exchange for points, which could then be used to access AIdriven health insights, personalized treatment suggestions, or early disease detection.

👉 Amazon, Friction, and the FTC (Stratechery) ❓ Why am I sharing this article? Amazon forced consumers to “[t]ake a look back at [their] journey with Prime” and presented them with a summary showing the Prime services they used. Amazon also displayed marketing material on Prime services, such as Prime Delivery, Prime Video, and Amazon Music Prime. Amazon placed a link for each service and encouraged consumers to access them immediately.

👉 PGR-Compounders case ❓ Why am I sharing this article? Importance of scale and direct distribution to win. “Underwriting Profit Leads to Negative Cost of Capital” Have an artist for each year 🙂 Interesting story of their price war, how they went through it and never accepted it again

Moats: Progressive decentralizes the management of its business lines to a local product manager. For example, they will hire a recent MBA student to go take over Iowa Motorcycle insurance, and give that individual P&L responsibility with an “up or out” expectation Combination of scale and direct distribution results in a ~1,000-1,500 bps cost advantage over the industry average

Underwriting Profit Leads to Negative Cost of Capital: By generating a profit on its underwriting activities Progressive is essentially paid by its customers to invest the Company’s growing float This dynamic results in significant financial leverage and uniquely attractive (negative!) weighted average cost of capital

Fun: Go-to-market: Progressive has maintained a leading market share in independent agents since the 1990s. This is surprising considering (1) Progressive has built a competing direct business, and (2) Progressive pays independent agents below market commissions How do they get away with it? Progressive has long provided independent agents with valuable technology and workflow solutions that increase their productivity Independent agents know that progressive is the fastest to provide a binding quote, and that their technology simplifies approval processes to eliminate back-end paperwork for the agent

Price war: 2000: State Farm engages in a “price war” to reverse market share losses In 1999/2000, State Farm attempted to reverse the downward trajectory of its market share and engaged in a price war Progressive responded to State Farm, pivoted away from their “96” rule (changed the profit objective to be over the life of a policy vs. 96 in each year), and ultimately absorbed increased losses. This was the first, and last time that Progressive would act as a price follower in the industry. After 1999 progressive reinstituted its traditional “96” profit objective During this time, Glenn Renwick made the controversial move to increase rates and shortened policy duration, both pre-empted competition and limited market share gains in the short term, but set the company up for meaningful share capture beginning in 2002 when loss-making competitors had to adjust

It’s already over! Please share JC’s Newsletter with your friends, and subscribe 👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! | |