Not Boring by Packy McCormick - Anduril: Acquiring Prime

Welcome to the 205 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 212,148 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Mercury Mercury is banking engineered for startups. But they go beyond banking, providing the resources and connections startups need to become success stories. We’ve used Mercury at Not Boring since day 1…and frankly, it’s very rare I see a startup that doesn’t. The company just launched Mercury Raise: a comprehensive founder success platform built to remove roadblocks at every step of the startup journey.

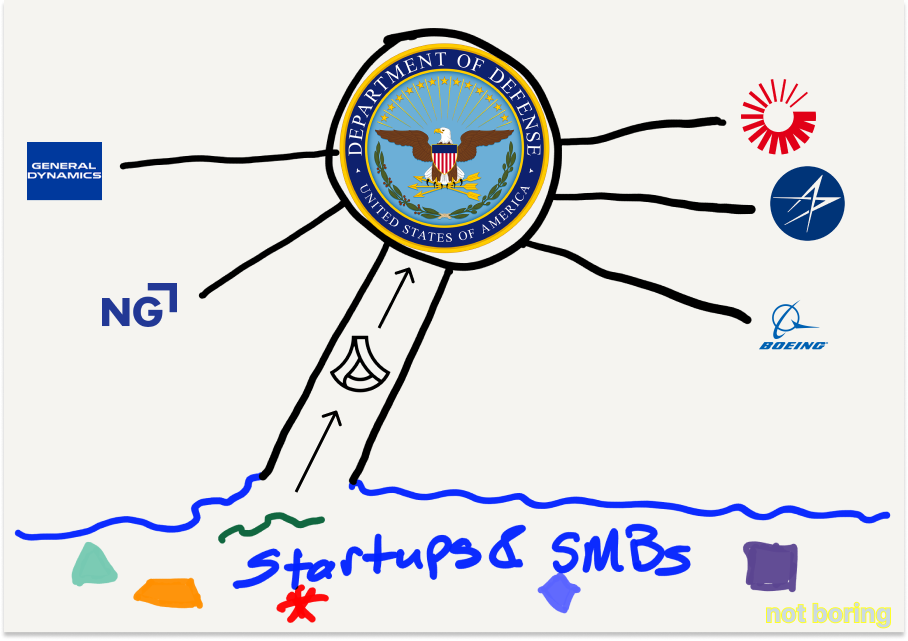

Navigating this whole startup thing can be hard and lonely – but with Mercury Raise you don’t have to go it alone. Hi friends 👋, Happy Tuesday! Fun one today. After starting its life as a controversial company for supporting the US military, Anduril has been proven prescient by the war in Ukraine, the growing threat of China, and its early ability to win contracts from the US and allied militaries. As a result, the company’s story has been told in numerous newsletters, publications, and podcasts. I’ll put the links at the end, and I highly recommend reading and listening to any or all of them for the full Anduril story. But for today’s essay, I wanted to focus on one piece specifically: Anduril’s acquisitions. Just six years old, Anduril has made a splash with five acquisitions since 2021. I wanted to understand why, and how, they do it. In the process, I learned a ton about the future of defense, Anduril’s ambitions to connect the old way of doing things with the new, and what it takes to build a generational Hard Startup. Full disclosure: I’m an investor in Anduril through an SPV we put together for Not Boring Capital’s LPs, and a big fan of the company, but this isn’t a sponsored deep dive. After their most recent acquisition, I asked them to tell me about their M&A strategy, and I’m excited to share what I learned with you. Let’s get to it. Anduril: Acquiring PrimeThe best way to think about Anduril is through the series of nested bets the company is making. Bet #1: The way humans fight wars, or more importantly deter each other from fighting wars in the first place, is changing: from large, expensive, exquisite hardware platforms to distributed systems of smaller, cheaper, more networked defense products. Bet #2: The United States Department of Defense (DoD) and its allies will be able to transition the way it buys capabilities to account for this new reality: from the DoD’s slow Planning, Programming, Budgeting, and Execution (PPBE) system to what Anduril Chief Strategy Officer Christian Brose calls a “Moneyball Military.” Bet #3: No incumbent in technology or defense is able to serve this new need: large technology companies that have the software chops have been incentivized to keep China happy and have shied away from defense, and the Defense Primes – the five leading contractors that provide major military systems, platforms, and services to the DOD – don’t have the software chops, the ability to recruit the people who do, or the incentive to move away from the cost-plus gravy-train. Bet #4: By investing in software R&D upfront, it will be able to better deliver the capabilities the DoD needs to fight the new kind of war, more cheaply: that its Lattice OS will let Anduril deliver more capable hardware products for less money, and that its advantages will compound with each new product it plugs in. Bet #5: Startups can develop the advanced technologies that DoD will need better than incumbents, and that Anduril can sell them into DoD better than the startups building them can: that it can serve as a pipe between the competitive capitalism of the startup and SMB defense tech ecosystem and the more centrally-planned DoD acquisition machine. Bet #6: This one is actually a series of bets Anduril makes every time it builds a new product, or acquires a company that does: that it will be able to sell that particular product into DoD and ultimately into large programs. The first three bets define the battlefield on which Anduril is fighting, and the second three define the company’s battle plan. Anduril, founded in 2017, doesn’t look like either a typical tech startup or a traditional defense contractor. It was born to fill the gap between the two worlds. Its mission is “transforming US & allied military capabilities with advanced technology.” The way I’ve come to think about the company is as a meta-version of Lattice. Lattice is Anduril’s software operating system. It serves as an integration layer between legacy defense systems, modern sensors and weapons, and Anduril’s own hardware, giving operators the ability to make faster, better-informed decisions. Similarly, Anduril the company aims to serve as an integration layer between old and new, between the traditional, centrally-planned way the DoD procures and deploys capabilities and the free market of startups and SMBs building cutting edge defense technology. In order to do that, and win its place among the Primes, Anduril needs to take risk, as its co-founder Palmer Luckey explained in a recent conversation with Politico:

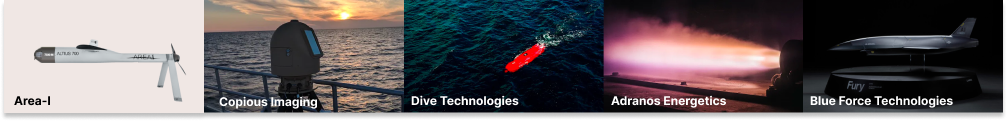

One of those risky bets is making acquisitions so early in its life. Over the past two and a half years, it’s put up its own capital to acquire five companies:

The most recent, Blue Force, turned heads in early September when Anduril unveiled the acquisition’s first fruit: Fury.  These haven’t been the acquihires or yard sales, but good ol’ fashioned 1+1=3 M&A transactions. They’re a part of a specific strategy, based on those six bets. I wanted to dig into Anduril’s M&A activity specifically because it stands out as a unique company-building strategy for such a young startup. After conversations with the team and dozens of hours of research, Anduril’s acquisitions have illuminated what makes Anduril tick, and why I think it has a real shot at becoming a sixth Defense Prime alongside Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics. Every successful company has a “thing.” Of all of the many things they do, there’s one that’s the secret sauce, the thing they do better than anyone else. SpaceX can get kilograms to orbit more cheaply than anyone else. Meta connects people. Google dominates search. ByteDance does addictive algorithmic feeds. Amazon is a logistics powerhouse. Microsoft sells software to enterprises. Anduril’s “thing” isn’t any of its particular products, or even its Lattice OS; its thing is its ability to sell modern defense capabilities into the DoD. That requires two broad capabilities:

While Anduril is relatively young, it’s worth noting that its leaders have run this playbook before. CEO Brian Schimpf, Executive Chairman Trae Stephens, and COO Matt Grimm were all early employees at Palantir, which built the “sell modern technology into DoD” playbook. If Anduril can continue to build trust with the DoD, acquire companies with the right capabilities at the right time, and sell them into increasingly large programs, it has the chance to inject some capitalism to the nation’s fight against our centrally-planned adversaries, and become a Prime in its own right. We’ll dive (pun intended) into the details of specific transactions, but to understand why Anduril acquires companies, we need to start by understanding the defense market. Defense is Weird“Defense is weird.” When I asked Adam Porter-Price, Anduril’s Head of Corporate Development and M&A, and Matthew Steckman, its Chief Revenue Officer, in separate conversations, why Anduril acquires companies, they both gave the same response. So what makes defense weird? In Christian Brose’s recent Hoover Institute paper, Moneyball Military, he describes the core weirdness at the heart of defense: the Planning, Programming, Budgeting, and Execution (PPBE) system that the DoD uses to define the “military capabilities the nation requires and how to validate, fund, and ultimately procure them.” Brose writes (emphasis mine):

Let that sink in. It’s certainly not something I appreciated. As the US faces threats from two centrally-planned economies, China and Russia, we’re doing so with a system modeled on theirs instead of leaning into our capitalist advantage. To fix that, Brose recommends splitting procurement in two: continue to use PPBE for traditional platforms and weapon systems, while establishing the Moneyball Military, generated through market creation, for “robotic vehicles of all sizes in all domains, constellations of small communications and intelligence satellites, and other commercially derived military systems.” While there’s growing support for something like Brose’s proposal among America’s military leadership, the DoD is a very large, slow-to-turn institution. So in the interim, Anduril wants to serve as the bridge between the two approaches. It needs to play by the rules of the PPBE on behalf of smaller defense tech companies, like an API into DoD. So what are the rules? Three are most relevant to understanding Anduril’s acquisitions:

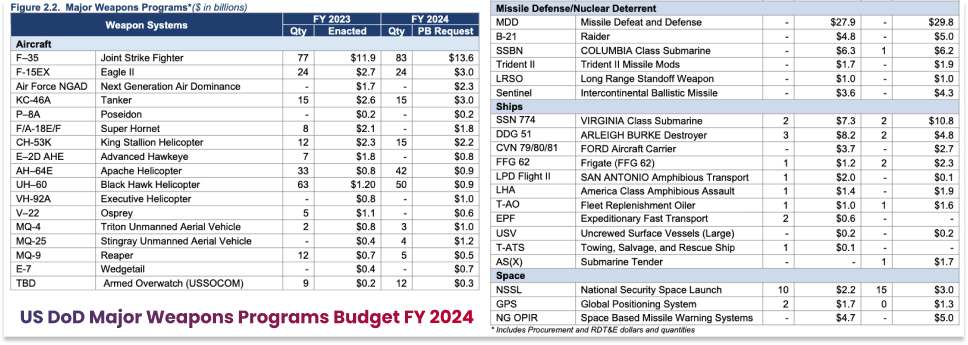

While JSF is the largest, it’s certainly not the only enormous program. Each year, Congress approves the Defense Budget, and it continues to grow. The Fiscal 2024 National Defense Authorization Act allotted an all-time high at $842 billion to the DoD, a record-setting $315 billion of which will go to procurement and research and development. It’s worth checking out this 2024 Defense Budget Overview presentation if you’re interested in the details. We’re spending $246.6 billion this year on Integrated Deterrence: $61.1 billion on Air Power, $48.1 billion on Sea Power, $13.9 billion on Land Power, $37.7 billion on Nuclear Enterprise Modernization, $29.8 billion on Missile Defeat and Defense, $9.0 billion on Long-Range Fires, $13.5 billion on Cyberspace, and $33.3 billion on Space and Space-Based Systems. Getting more granular, this table shows the 2024 Defense Budget Request per weapon system: Defense is a market with essentially one customer, which buys new things infrequently, telegraphs what it wants to buy, and when it does buy, commits an absolute ton of money for a very long time. In such a market, it’s critical to be “ready and geared up for a competition,” Steckman told me. “If you win, you get a big spike. If you lose, you get nothing.” But winning isn’t as simple as having the best technology at the best price. The Defense Primes spend a relative pittance on R&D compared to large tech companies, and they sell expensive platforms that regularly come in multiples over budget. No startup can saddle up to a competition with a fancy piece of technology alone and expect to win. This presents a challenge for both the DoD, which can’t always acquire the best solution for the job, and defense startups, which can’t simply compete on product like traditional startups can. It also presents an opportunity for a startup willing to put in the time and work to do all of the other things required to win. Competing as a new entrant with Prime ambitions means operating with a mix of long-term patience and short-term speed. To go back to our Lattice analogy, the platform Anduril is patiently building at the company level is trust with DoD. Trust in Anduril as a Network Effect“I haven’t listened to Brian’s podcast, although I’m sure it was amazing. Put that in the piece.” I was asking Steckman about the question Ben Thompson asked Anduril CEO Brian Schimpf on Lattice’s network effects, to which Schempf replied, “I think as we add more platforms, more sensors, more capabilities into this, everything gets more valuable, I think that’s spot on.” Instead of expanding on Schempf’s point, Steckman offered an alternative: “My view from the CRO perspective: the network effect to me is actually trust in Anduril.” Trust is critical to Anduril’s ambitions. Without it, Anduril won’t be able to weave Lattice OS into the fabric of defense, won’t be able to make its acquisitions pencil, won’t win large programs, and won’t have a shot at fulfilling its mission: transforming US & allied military capabilities with advanced technology. Building trust with the DoD requires a number of things. First, it requires a deep understanding of DoD’s needs. As Steckman explained to me, even the seemingly simple question of “Is it the right tech?” is not a simple one. “If you’re not fully informed, you might think something is a solve where it isn’t,” he said. “Often, the government isn’t buying a piece of new technology because it doesn’t solve the problem.” Getting to the point where you can develop a deep understanding is challenging in its own right. It means that the company needs to earn the right to see certain information, which means building up internal teams, technology, and processes to handle the security apparatus around sensitive information. It means being in Washington, DC and thoughtfully engaging with the community at the Pentagon or on Capitol Hill. It means understanding the current set of equipment, hardware, and software that exist so you know where the holes are and what you’ll need to integrate with. Plus, there’s a paradox at play: you have to have a history of working with the DoD to be able to sell to them in the first place. While DoD has tried to fix this by introducing startup-friendly programs like Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) and the Defense Innovation Unit’s Commercial Solutions Openings, among others, needing to go through these first can represent a speed bump that prevents small businesses from selling into large programs. Even then, the DoD is rightfully concerned about the health of the suppliers it buys from. It needs to feel confident that the company will be around to continue to supply the capabilities it’s contracted to supply. Here, the $2.3 billion Anduril has raised from top-tier venture funds like Founders Fund, a16z, Lux Capital, Thrive Capital, Valor Equity Partners, and 8VC helps. If you overcome all of that, you still have to show that your technology can integrate with the hodgepodge of current and future systems that all of the other pieces of technology that DoD acquires and operates, all of which have varying degrees of software sophistication, and most of which speak different languages. Integrating with old or poorly written software of any kind is difficult – I remember months’ long projects at Breather when we had to integrate with outdated building management systems, and that the engineers absolutely hated them – but it’s even more challenging when the stakes are so high. This gets to a core Anduril thesis: all incumbent defense companies are built around hardware platforms and treat software as an afterthought. But the company believes that approach is fighting the last war. For the wars of the future, according to Anduril, you need to start with a software platform that speaks to all sorts of hardware, and plug new hardware into that network as it emerges. This is where Lattice comes in. Lattice is the software network at the heart of everything that Anduril does. Its first product, Lattice for Command and Control, is designed to accelerate the “kill chain” by giving human operators information and interfaces designed to help them understand, decide, and act more quickly. Lattice for Mission Autonomy, released in May, is built to allow “a single human to control and coordinate a wide range of autonomous assets across the ocean, land, and sky.”  Lattice is designed to work with Anduril’s own hardware and to integrate with hardware and platforms built by other vendors. In an ideal world, military personnel use Lattice to coordinate all of their missions, consume synthesized information from sensors on every piece of hardware available, command fleets of autonomous machines, and make decisions out of harm’s way. But getting to that point takes trust. “We first proved the concept on missions like border security and air defense,” Schimpf says in the video above, “and today, Lattice is now automating the operations of hundreds of robotic systems deployed in tactical environments around the world.” That approach is built to design trust. Start with lower stakes missions, prove not only that Lattice works but that it delivers better capabilities, and then repeat on increasingly high-stakes missions. “The more government users see it working and delivering 2x, 3x, 10x capability, the more other government users will look at it and say, ‘I want it to do that for me’” Steckman explained. “That’s the flywheel: the more it’s out there and working, the more you get this interesting social effect on trust.” To build the software-like network effect that Schimpf and Thompson discussed, Anduril first needs the social network effect, the trust among customers, operators, and other vendors that Lattice can deliver better outcomes. But Lattice itself is just one piece of the company-level Anduril OS: the relationships, security apparatus, knowledge, engagement, and software that build trust with DoD and put the company in a position to win competitions as they come up. As Anduril OS continues to get stronger with time and experience, so too does the company’s ability to sell advanced technologies – the apps on Anduril OS in this metaphor – to US and allied militaries. As its flurry of acquisitions shows, the company seems to believe it’s now in a place where it can use Anduril OS as the bridge between the defense tech free market and the DoD’s PPBE. Anduril’s AcquisitionsI told you that this is a piece specifically on Anduril’s M&A strategy, and then I spent seven pages talking about the defense industry and how Anduril is building trust with its customers. That, I think, was necessary context. Anduril is in a position to acquire companies because it’s built up the hard-earned ability to sell their products to DoD better than the companies themselves could, and it has to acquire companies because of how the defense industry works. Specifically, acquiring companies allows Anduril to sell into competitions that it either knows are coming up or expects to come up based on the way the market is shifting. Hardware development can take time, and competitions often come up without enough advanced warning to go through that whole process, so for Anduril, acquisitions speed the route to market. As Steckman explained, “Because returns are so punctuated, and creating hardware takes many years to get right and to become trusted within a field, it is a way to accelerate your positioning against those big punctuated movements.” To date, the company has made five acquisitions across a range of capabilities:

It’s useful to look at a few of them specifically to understand Anduril’s process and rationale. Dive TechnologiesIn February 2022, Anduril acquired Dive Technologies, a Boston-based maker of autonomous submarines, or AUVs in defense parlance.  Dive fit the future model of war that Anduril is building against: smaller, cheaper, autonomous systems across all domains (land, air, sea, and space) coordinated through software. But part of the balance is figuring out which parts of that future will occur when. Steckman told me that Anduril asks two questions for all organic product development and acquisitions: “Is the problem urgent and can we solve it in less than 5 years?” Dive fit the bill on both fronts:

Porter-Price told me that Dive had done a lot of clever things from the hardware side, that its Dive-LD was good for the type of mission the US and its allies want to perform, and that there was “nothing like it in the market.” At the same time, Dive wasn’t ready to win large contracts on its own yet. Its autonomy software and ability to collaborate with other equipment in the water was far less developed than the hardware. So Anduril didn’t have a hardware product to sell against a capability it knew allied militaries would need, and Dive did, but didn’t have the ability to sell into military buyers or the software to deliver on its targeted autonomous capabilities. “Dive would have gotten there,” Porter-Price said, “but we sped up their timeline by 7-10 years.” On the flip side, Dive accelerated Anduril’s entry into a market where “customers are banging down the door.” Anduril acquired Dive, turned it into Anduril Maritime, and made Dive Founder & CEO Bill Lebo its GM. Within three months of the acquisition, the combined team hooked the Dive-LD into Lattice, came up with a plan for turning the pickup-truck-sized submarine into a school bus-sized version, and sold into a “$100 million co-funded design, development and manufacturing program for Extra Large Autonomous Undersea Vehicles (XL-AUVs) for the Royal Australian Navy.” By December, Anduril execs flew to Australia for the naming ceremony for the AUV. They call it Ghost Shark.  According to an excellent Reuters article, the Ghost Shark is part of a two-pronged advanced submarine approach the Australian Royal Navy is taking to meet the challenge of a rising China: on one side, 13 nuclear-powered attack subs that will cost $18 billion apiece and won’t finish being delivered until after 2050, on the other, “three unmanned subs, powered by artificial intelligence, called Ghost Sharks. The navy will spend just over AUD$23 million each for them – less than a tenth of 1% of the cost of each nuclear sub Australia will get. And the Ghost Sharks will be delivered by mid-2025.” That starkly illustrates the difference between the way things are and the way Anduril thinks they should be. Dive’s Australian contract may be the first of many. Japan, an island, is tripling its defense budget to become the third highest in the world next year to prepare for the threat from an adversary on their doorstep, and the program might also serve as a test run the US Navy uses to evaluate purchasing Dive-LD AUVs for its own fleet. With Dive, Anduril is skating where the puck is clearly heading and delivering capabilities, and revenue, now. Adranos Energetics“Our process takes a year,” Porter-Price told me when I asked about the lifecycle of an acquisition at Anduril. Each year, Anduril’s leadership team comes up with a shopping list, identifying areas that fit within programs they want to pursue. One such area on the shopping list was solid rocket motors (SRMs). After Northrop Grumman acquired Orbital ATK, the maker of the nation’s largest rocket motor, Boeing abandoned the ICBM business it’d been in with the Minuteman for half a century, citing the fact that the acquisition gave Northrop “an unfair advantage.” The Pentagon warned Congress of the dangers of SRM consolidation in 2017, and the FY 2024 DoD Budget, submitted in March 2023, notes that the Future Year Defense Plan (FYDP), essentially a five-year defense roadmap, “applies resources to address supply chain bottlenecks in … Solid Rocket manufacturing,” among others. It didn’t take much of a crystal ball to understand that the DoD would be willing to spend on solid rocket motors, and looking at how Anduril attacked that opportunity gives us a glimpse into its process. So SRMs were on the list, and Porter-Price and his team went shopping. He says they identified about ten SRM companies in the US and Australia. Then they met with each of them, did technical diligence, and “spent a lot of time on planes” getting to know everyone in the ecosystem. They honed in on three companies that were particularly good. None of these companies is for sale. No banker is shopping them. But none of them is stupid, either. “They know what it means when the head of corp dev comes to visit,” he admitted. One of the three companies Anduril was interested in was Adranos Energetics, which manufactures its SRMs in Mississippi. “I went to Mississippi seven or eight times with people on our team, we brought them out to California. Everyone wants to know what Palmer’s like,” Porter-Price said, “It’s uncomfortably like dating.” It’s important that both sides get to know each other. Many of these companies are bootstrapped. They’re the founders’ babies. And joining forces with Anduril means they’ll no longer be their own boss. In return, Anduril structures deals to incentivize founders with significant ownership in the combined company, which they need to earn by coming to work and often running divisions. This is a long-term relationship. At a certain point, they have a discussion on a couple different paths they can follow:

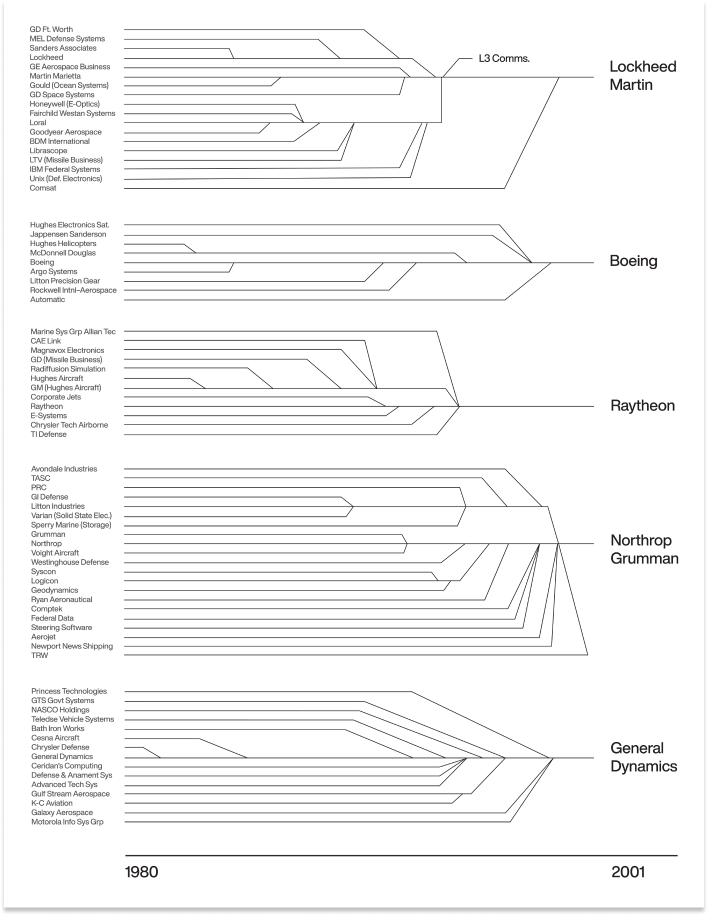

In Adranos’ case, they decided to become one company. At that point in the process, Porter-Price explained, Anduril “puts together a compelling package for the founding team” and wants them to bring their whole team with them, and then they go fast. Typically, they go from LOI to execution in 60 days, although it can take longer in some cases, like it did with Adranos, because greater diligence was required because agencies like the ATF expect you to be careful with rocket motors. In June, Anduril announced its acquisition of Adranos. In the announcement, Anduril said that it would become a “merchant supplier of solid rocket motors to prime defense contractors delivering missiles, hypersonics, and other propulsion systems,” and not a direct contractor itself. That highlights the versatility of Anduril’s approach: while it wants to become a Prime, it’s willing to go where the opportunity is to build up its capabilities, solve a critical need for the DoD, and grow its business. Anduril is bringing the Adranos team in-house and investing in building out its manufacturing capabilities in Mississippi in order to increase its output to thousands of SRMs per year. In a world of high-volume, attritable drones and a need to increase our weapons production capacity, that should be a valuable capability to offer. Blue Force TechnologiesBuild or buy? In an M&A discussion, that’s a key question. Does it make more sense to develop the product in-house, or are we better off acquiring a company that already makes it? Anduril does both. It developed Lattice, Sentry Towers, and Ghost Drones in-house, and it’s currently either exploring or developing a number of new capabilities. But obviously, it’s also willing to acquire companies when that makes more sense. So I asked Porter-Price how the company decides when to build or buy. “It comes down to the open window,” he explained, and offered the Blue Force Technologies deal as an example. Blue Force has been working on what would become Fury, the Group 5 autonomous aerial vehicle (AAV), for four years, as Joseph Trevithick and Tyler Rogoway lay out in an excellent history in The Dive, The Rise of Fury. Fury is exactly the type of system that Anduril believes represents the future of deterrence and warfare. Group 5 AAVs are the largest and most capable class of military drones, often comparable in size and function to manned aircraft, and can be used in training – as pilotless “red air” aggressor jets against which pilots simulate battle – or in surveillance or even combat missions, flying autonomously in formation with manned fighter jets. And it’s exactly the type of product the military has increasingly said it wants to purchase. In March, Secretary of the Air Force Frank Kendall detailed the service’s plans for Collaborative Combat Aircraft (CCA), saying that the Air Force was conducting planning based around a notional fleet of around 1,000 advanced drones with high degrees of autonomy, like Fury, along with 200 Next-Generation Air Dominance (NGAD) stealth combat jets. The Air Force plans to pair F-35s, for example, with advanced drones. In August, Deputy Secretary of Defense Kathleen Hicks announced a program named Replicator that plans to field thousands of attritable (expendable and low-cost) autonomous platforms, like Fury, that are “small, cheap, and many” in order to overcome China’s biggest advantage, mass: “more ships, more missiles, and more people.” This is exactly what Anduril, and most vocally Brose, has been calling for for years, and it’s happening now. Steckman told me that Anduril had a sense that these specific competitions would be coming, but also “knew in a more macro sense that this class of technologies was going to permeate all of the services.” They also knew that a Group 5 jet would take a long time to develop. Porter-Price made a similar point, telling me that Blue Force had been working on the aircraft with the Air Force for four years, and that the Air Force loves them, but at the same time, Blue Force didn’t have the ability to invest in autonomy software, talk to other fighter jets, or manage complex software integrations with F-35s. “Anduril can.” The two teams agreed they’d be more competitive together – Blue Force providing the hardware and Anduril providing the software, DoD sales infrastructure, and balance sheet – and decided: “Let’s accelerate.” In September, Anduril announced that it had acquired Blue Force Technologies. Group 5 AAVs, like autonomous subs and solid rocket motors, represent an urgent problem that Anduril can solve within five years. Like Dive, Blue Force was an opportunity to accelerate both sides’ time to market by years and deliver the military better capabilities, sooner. In all three cases, Anduril put its own capital – cash and equity – at risk, buying companies and spending money before winning competitions with the expectation that being early comes with significant advantages, particularly for a new entrant. It’s the kind of bet that Anduril is uniquely positioned to make. Venture Capital Shaped Holes and Wall Street WeeniesM&A is not a novel concept in the defense industry. Its modern structure is defined by the consolidation that emerged from “the Last Supper,” a 1993 dinner at which Deputy Secretary of Defense Bill Perry told the CEOs of the largest defense contractors that the military would be spending less money going forward and urged them to consolidate. They did. Dozens of smaller defense contractors became five Defense Primes: Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics. But Anduril is hoping that it’s able to approach M&A differently enough, for long enough, to get a seat at the Prime table. This isn’t wishful thinking; it’s structural. When Breaking Defense’s Aaron Mehta asked Palmer Luckey when he planned to take the company public, Luckey gave one of my favorite founder interview question answers in a long time (emphasis mine):

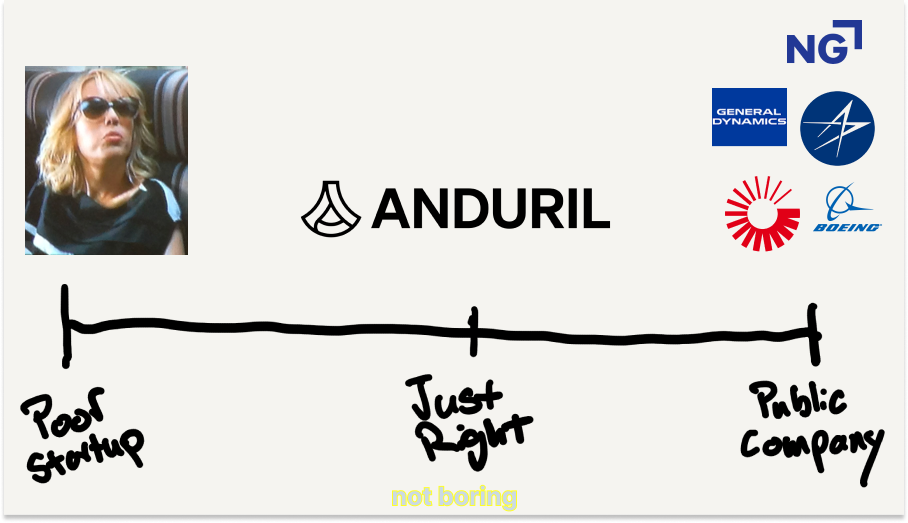

The answer is great because what founder-who-wants-to-eventually-go-public in his right mind calls his future shareholders “Wall Street weenies,” but also because it illuminates the goldilocks position that Anduril is in when it comes to acquiring advanced technology companies: it’s well-funded enough that it can make meaningful acquisitions, but privately held enough that it doesn’t need to justify its investments in the same way public companies do. Anduril fits the venture capitalist hole. As mentioned earlier, it has raised $2.3 billion from top-tier venture funds like Founders Fund, a16z, Lux Capital, Thrive Capital, Valor Equity Partners, and 8VC, most recently in a $1.48 billion December 2022 Series E that valued the company at $8.48 billion. That gives it a healthy enough balance sheet to make customers comfortable, and it also gives it a warchest of cash and equity priced by good investors post-downturn with which to acquire companies. And because it doesn’t yet need to be the right shape for Wall Street weenies, it’s able to make acquisitions that the Defense Primes and other large contractors can’t, at least not without upsetting shareholders. That gives it some advantages because it can acquire companies early, before there are specific contracts or competitions in place. Married with the company’s educated belief in the way the market is moving, it can make bets that larger companies can’t. Steckman told me that while the benefits of being early apply to anyone in the space, it’s a particularly important advantage for a smaller company. First, it lets you shape requirements. The earlier you are, the more closely you can work with customers to shape requirements that ultimately determine how they acquire the capability. The earlier you are, the more you can become the thought leader if you do it right. “You can push your own conviction out to the world, to your customers, and if you prove it through analysis and data and they agree,” he explained, “sometimes the customer will acquire the exact thing you have.” Second, being early lets you shape the narrative, not in a fluffy way, but “with a lot of math and physics.” It lets you go to the customer and say “We’ve thought about this, done mathematical modeling and simulation, and here’s what we believe. But we also know we could be wrong. Let’s talk about your problem and modify the analysis.” A high-integrity, low ego approach can go a long way. Anduril hasn’t been shy in sharing its narrative, backed by experience and expertise. Brose’s writing – both his essays and his book, The Kill Chain, describe a future of warfare that they believe would be good for the country and good for Anduril. Third, being willing to go early lets Anduril buy companies that public competitors can’t. As Steckman told me, “It’s hard for a large company to buy an asset and say they can’t forecast, but the way Anduril is structured allows them to make unique bets on a thesis.” Porter-Price admitted that he’s “spoiled in this job”:

Imagine a public company Head of Corp Dev telling that to a Wall Street weenie! That said, Porter-Price added that they do pay very in-market prices, they’re just not hamstrung by EBITDA multiples. “If we believe the revenue story,” he explained, “we can be flexible and put together a compelling package for the seller.” For now, that’s an advantage over the Primes. Like the VCs that back Anduril, Anduril itself can invest in companies early. But that will change. Porter-Price said that he’s increasingly running into the Primes on the companies they’re looking at as the larger companies start to grok the Anduril playbook. But they’re still hamstrung by bureaucracy, slowness, and public market incentives, which he believes means Anduril will still win these for a while. But, he acknowledges, it won’t last forever: “They know that there just aren’t that many great companies.” So the race is on. Can Anduril prove itself quickly enough to get big and convince Wall Street weenies that its financial model makes sense before the Primes get nimble and compete for the great companies? Can Anduril become a Prime before the Primes become Anduril? Prime TimeAnduril is a Russian doll fighting to help America’s defense industry plan in a less Soviet way. The company is making a series of nested bets on the future of war and the role it can play in bringing it about. The DoD needs to shift to distributed systems of smaller, cheaper, more networked defense products, and Anduril is betting that it can serve as the Lattice-like integration layer between the DoD’s centrally-planned PPBE system and the free market of startups and SMBs that produce the advanced technology it needs. To do so, its building and acquiring technologies to take advantage of open windows during which it might be able to sell those technologies, coupled with Lattice, into large programs. Those windows exist within a larger window: the period in which Anduril is the only logical buyer for the technologies it believes will make the difference in the conflicts to come. For now, it’s brilliantly counter-positioned against the incumbent Primes. Five times in the past two and a half years, this has meant acquiring companies in order to speed their time to market. My hunch is that we’ll see Anduril lean even harder into acquisitions versus in-house development in the years to come, for a couple of reasons:

Of course, the situation is fluid and things will change. Primes might appreciate the threat and begin competing for the companies Anduril wants to acquire. The DoD itself might listen to Brose and begin buying large quantities of attritable, consumable, autonomous hardware directly, lessening the need for Anduril to acquire those companies. In that case, Anduril will adapt. The more I learn, the more I think viewing Anduril as a meta-version of its products is useful. Just as its products enable operators to close the kill chain by understanding, deciding, and acting more quickly, Anduril itself can be defined by this continuous process of understanding, deciding, and acting. What’s brilliant about Anduril’s acquisitions to me isn’t necessarily any of the specific companies they’ve acquired, but how cohesively its M&A strategy fits with the realities of its current position and future ambitions:

Normally, a writer might frame that list as “6 M&A tricks you can learn from Anduril,” but the takeaway for other startups shouldn’t be, “Do M&A like Anduril does.” It should be, “Do strategy like Anduril does.” If you really want to build a generational company, strategy really matters. Anduril is a singular company, and its strategy works because the company’s leaders have crafted it for the specific mission at-hand. That shouldn’t be a surprise. Richard Rummelt’s strategy kernel - diagnosis, guiding policy, coherent actions – is essentially a longer-range version of the kill chain – understand, decide, act. No startup I’ve encountered has been more clear-eyed and thorough in its diagnosis, or followed it through more fully into a guiding policy and coherent actions than Anduril has. Instead of building a large, hard-to-turn, exquisite platform, Anduril has chosen to build its company as a network that’s constantly taking in new information and using it to adjust in real-time. That’s why, even as the Primes begin to move to where Anduril is today, I expect that the company will be able to respond more quickly to the changing defense landscape of the future. So will Anduril become the sixth Prime? Steckman doesn’t think they’re quite there yet, but he believes they’re getting close. They’re finally getting invited to sit next to the Primes at big events, getting mentioned in the same breath as those century-old stalwarts. 2024, he thinks, is going to be a big year:

On the meta level, that’s the real benefit of being early and nimble. Anduril has been able to position the company for where it believes the market will be in ten years. It’s doing things that are hard for public Primes to do – investing in software R&D upfront, acquiring companies before they’re generating meaningful EBITDA, taking risk on new products instead of banking on the certainty of cost-plus – that position it for what’s to come. If Anduril does become a Prime, it won’t look like the other five. It doesn’t plan to build exquisite platforms like manned fighter jets or multi-billion-dollar aircraft carriers. It realizes that fighting the adversary on their own terms is a losing strategy. When I asked what was next on the shopping list, they told me they’re looking at space. If they go up there, I would imagine their products look more like swarms of cheap, smart, distributed systems, like Array Labs, than the multi-hundred-million-dollar satellites the government and Primes have traditionally built. The future Anduril envisions will be distributed and connected by software. Breaking into a massive industry dominated by powerful incumbents and changing it from the inside requires making risky bets against a clear vision of the way things should and will be, and adjusting as new information and opportunities arise. I’m betting that Anduril will pull it off. Further Reading and Listening on Anduril

Thanks to Dan for editing, and to Matthew, Adam, and Sofia for letting me see inside the Anduril M&A machine. That’s all for today. We’ll be back in your inbox with the Weekly Dose on Friday. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #62

Friday, September 29, 2023

Big Tech Roundup, Animal AI, Nuclear Microsoft, Helion, Frank the Tank

Array Labs: 3D Mapping Earth from Space

Tuesday, September 26, 2023

Satellite Clusters and the Quest for the Holy Grail of EO

Weekly Dose of Optimism #61

Friday, September 22, 2023

Zuck Clusters, AlphaMissense, Lasker Awards, Permitting Action, Nuclear Re-Opening

The Gang Captures Washington

Tuesday, September 19, 2023

Fighting Back Against Regulatory Capture for a Better Future

Weekly Dose of Optimism #60

Sunday, September 17, 2023

Breakthrough Prizes,K2-18 b, Building Stuff in America, Nougat, MDMA, Lithium Treasure

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month