Coin Metrics’ State of the Network: Issue 232

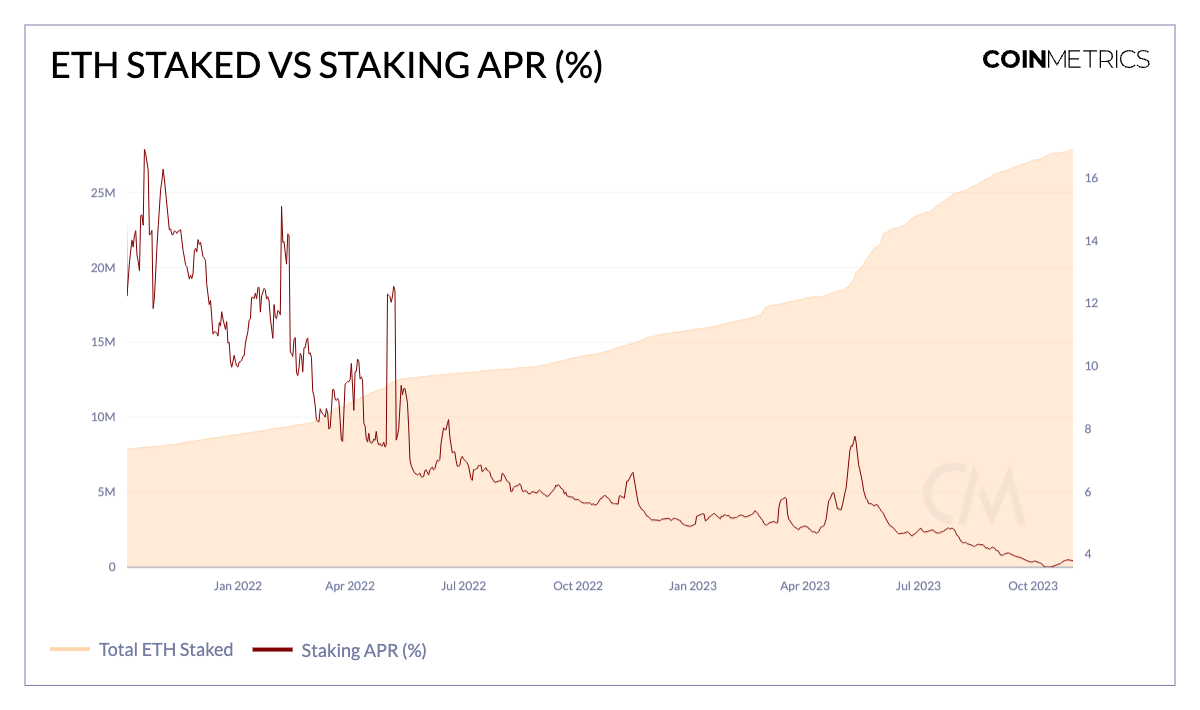

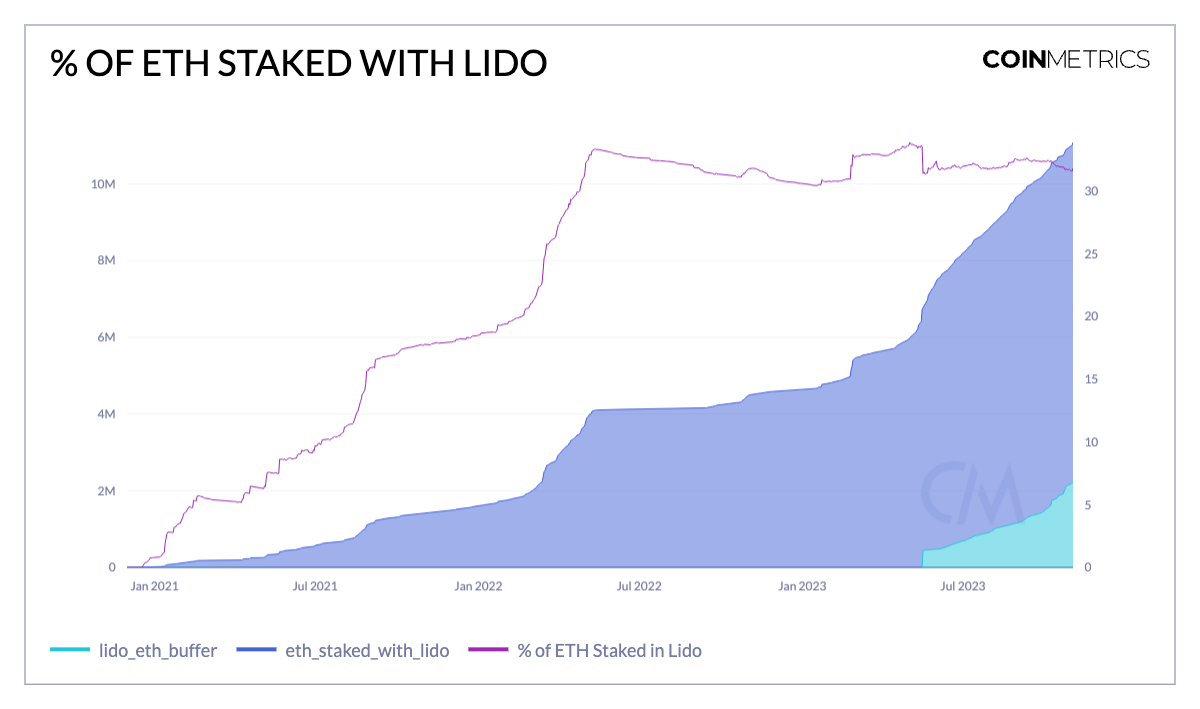

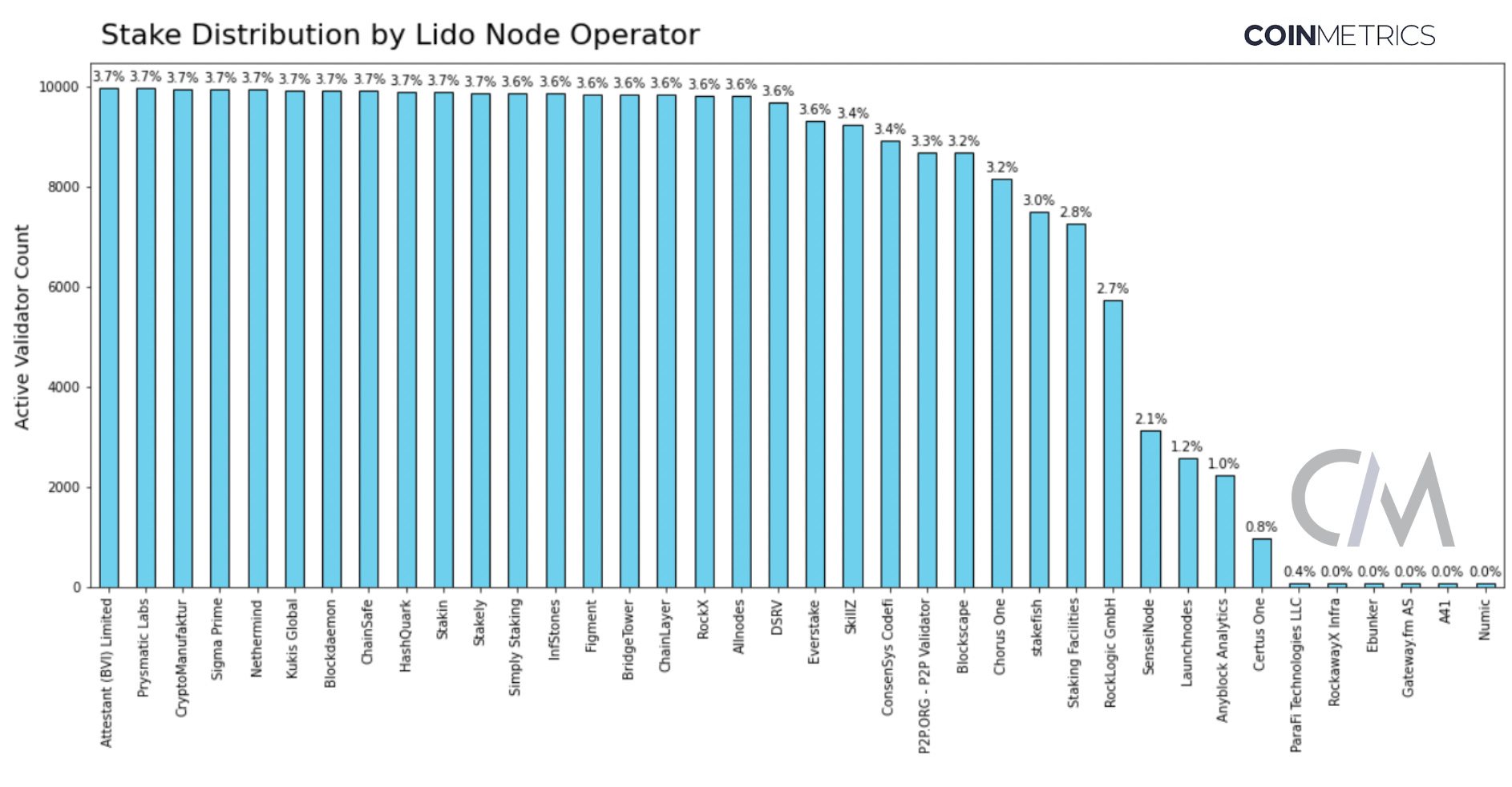

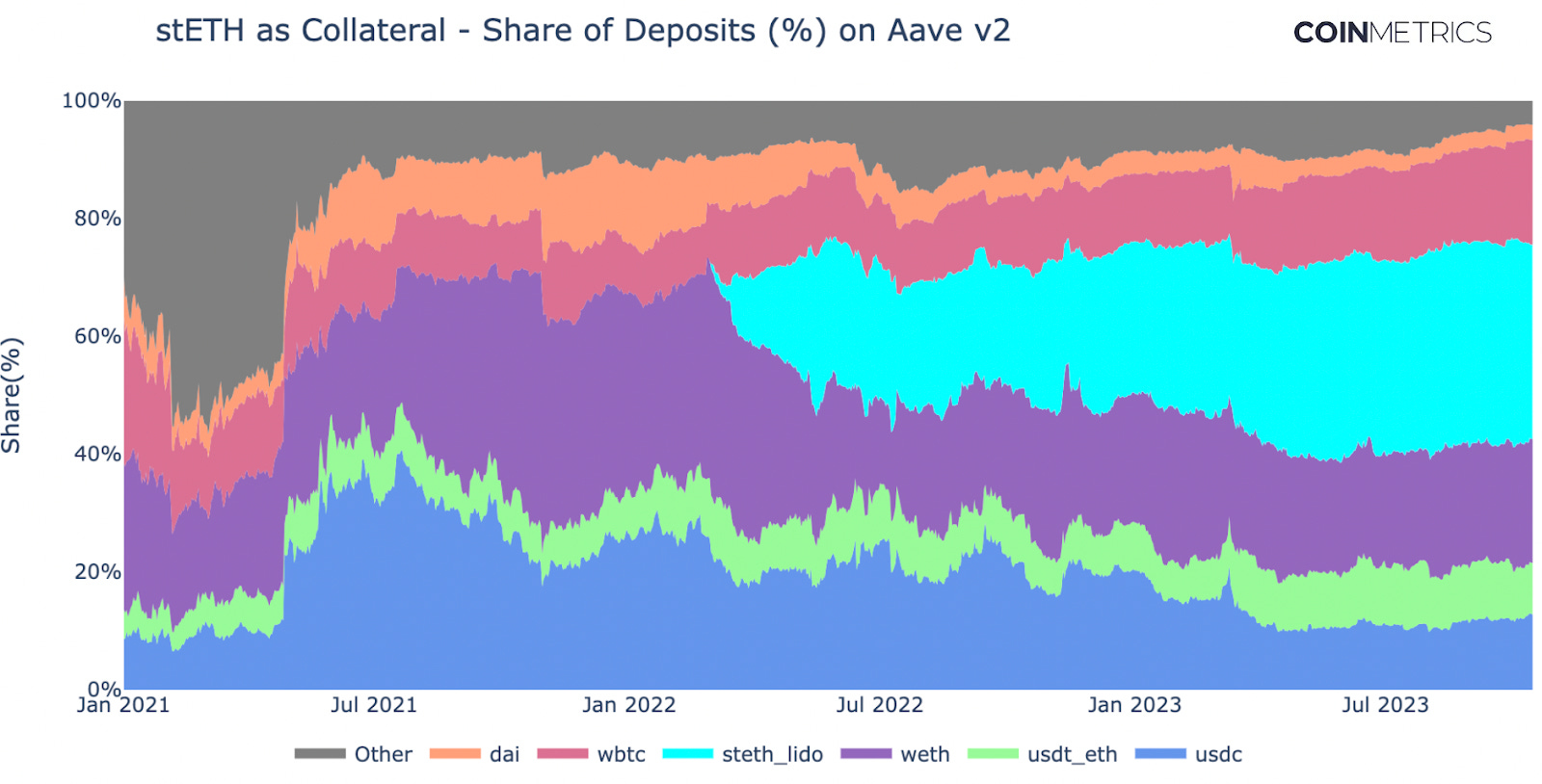

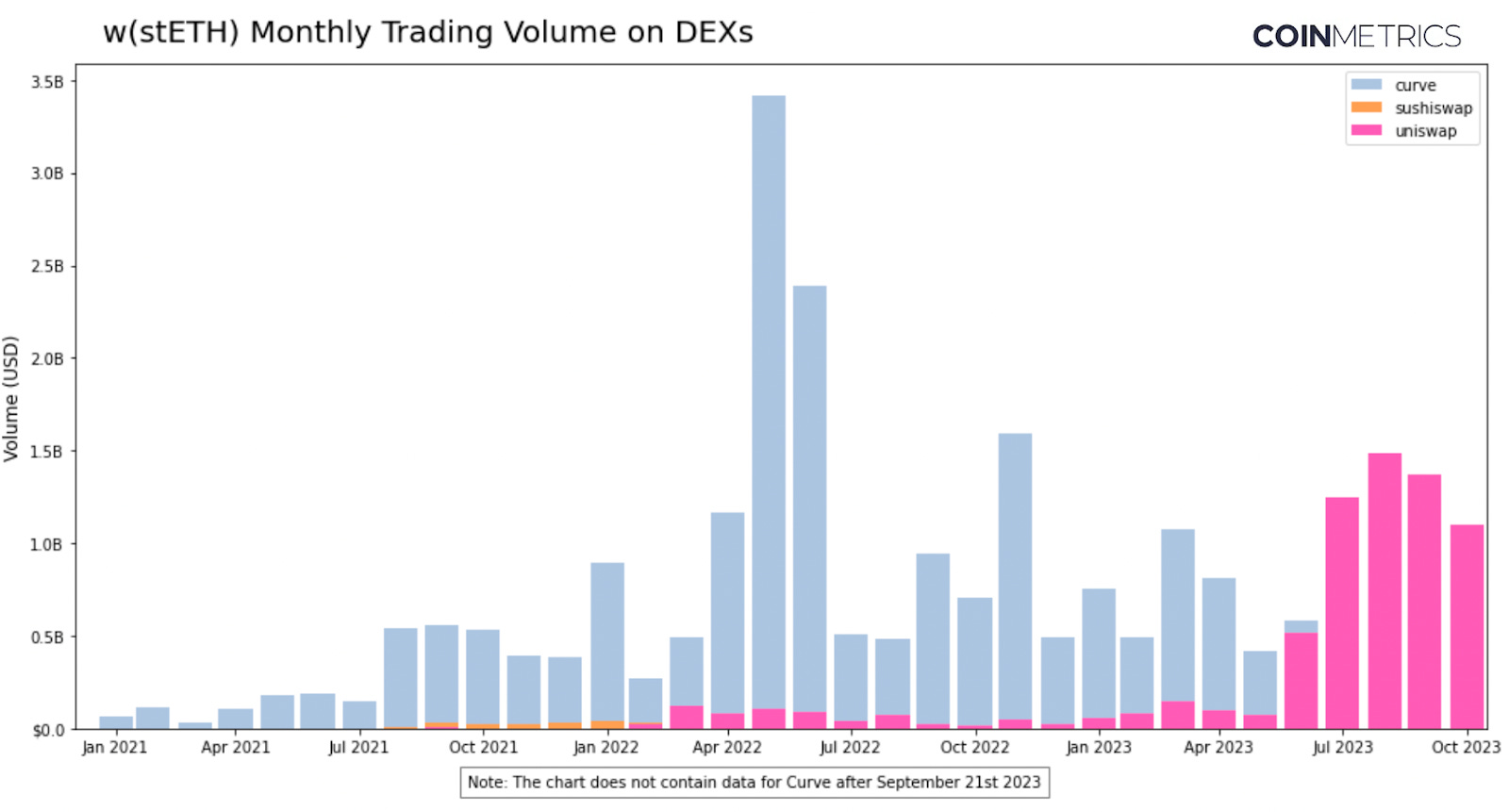

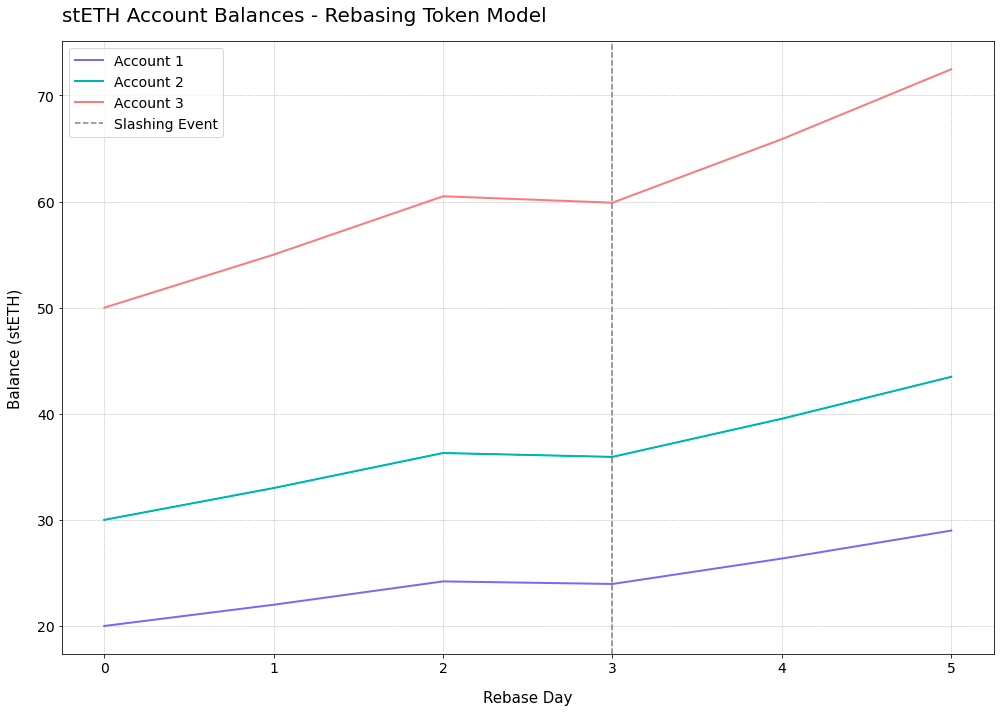

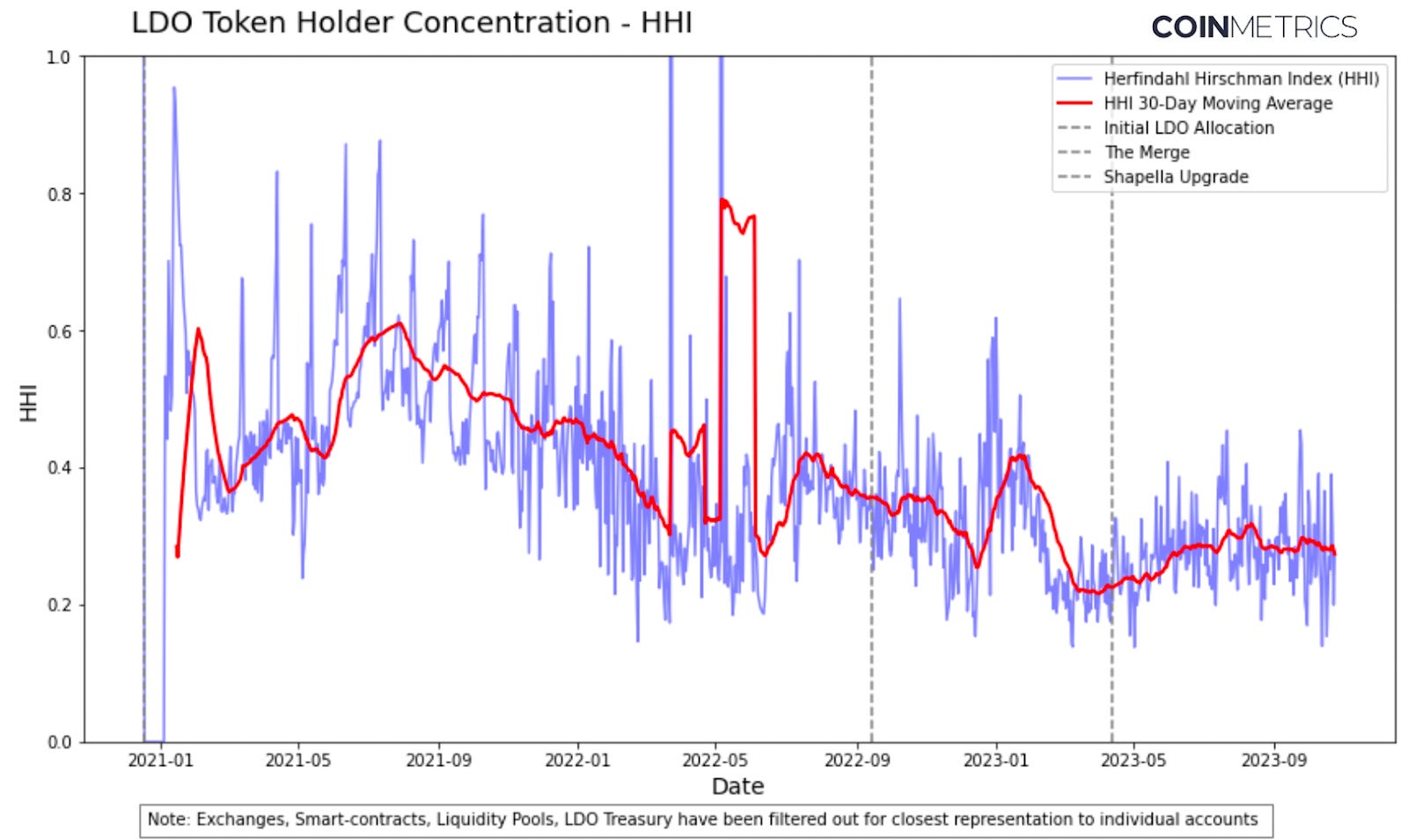

Get the best data-driven crypto insights and analysis every week: Ethereum Staking Through the Lens of LidoBy: Tanay Ved IntroductionThe evolution of the Ethereum network towards a Proof-of-Stake (PoS) blockchain has ushered in crucial changes for its key participants and underlying economic systems. This transformative shift, often referred to as “changing the wheels of an airplane mid-flight” has now positioned staking as the backbone of Ethereum consensus. The successful completion of “The Merge”, followed by the “Shapella” upgrade, has resulted in an entire industry emerging around staking. With approximately $40B assets staked and a growing ecosystem of stakeholders, it's crucial that we understand the current make-up of this landscape and delve into key players wielding notable influence over the industry. In this issue of Coin Metrics’ State of the Network, we dive into Lido—the largest player within the staking economy—and understand the state of its liquid staking token (stETH), governance token (LDO) and underlying node-operator composition. With this analysis, we seek to address Lido’s prominence in the liquid staking landscape—an increasingly contentious topic for the Ethereum community. The State of Ethereum StakingBefore we start diving into the depths of Lido and stETH (staked ETH), however, it’d be helpful to understand Ethereum staking stands today—especially against the macro-economic backdrop of monetary tightening and rising interest rates. Source: Coin Metrics Formula Builder As of October, around 27.9M ETH (23% of current supply) or $40B in value has been staked on the Beacon Chain, highlighting the rapid growth of staking since the Shapella hard-fork. However, for now, this accelerated adoption seems to have slowed down, as showcased by the emptying validator entry queue. This slowdown can also be attributed towards the decrease in Ether staking APR from over 5.5% during the Merge to 3.5% as of October, as a function of a large number validators entering the network and lower transaction fees. In comparison, the US 10 Year treasury yield is currently at 4.67%, introducing a significant opportunity cost in the advent for safer and higher yields. A change in these conditions, however, could lead to a shift in this outlook—making on-chain yields attractive once again. A Look into Lido’s DominanceLido plays a significant role in the staking economy, allowing for democratized access to staking. At its core, the protocol brings together capital providers (i.e., ETH stakers/delegators) and infrastructure providers (i.e., node-operators), allowing users to deposit any amount of ETH rather than the 32 ETH required to be a validator. When a user deposits ETH into Lido’s smart contract, funds are pooled and outsourced to a curated set of node-operators that run the required software and hardware. As a result, delegators receive”‘stETH”— a fungible claim on their ETH deposits minted at a 1:1 ratio. Out of the total 27.6M ETH staked, ether staked through Lido is at 8.9M ETH or $16.8B in total value locked, making it the largest liquid staking and decentralized finance (DeFi) protocol. In percentage terms, this equates to about 32% of all ETH staked—a metric that’s been under the spotlight as Lido’s market share hovers around one-third of all ETH staked, resulting in re-surfacing concerns around centralization. Source: Coin Metrics Network Data The concerns stem from the notion that if a liquid staking protocol, or its underlying node-operators exceed critical thresholds of total ETH staked, it can increase the likelihood of undesirable outcomes for the Ethereum network due to increased centralization. This could be in the form of censorship, coordination in maximal extractable value (MEV) extraction or unfair slashing (penalties), and other forms of manipulation like time-bandit attacks for the purposes of personal gain. However, it's important to note that Lido does not operate as a single entity; instead it’s composed of 38 node operators subject to a maximum threshold of stake, with servers being distributed geographically to maintain jurisdictional dispersion of the validator set. Source: mevboost.pics Arguably, the governance process overseen by the Lido DAO (decentralized autonomous organization) presents a greater (potential) risk to the protocol than its share of staked ETH. We’ll explore the role of governance in a subsequent section below. The debate over Lido’s dominance has amplified recently, with proponents arguing that Lido enhances accessibility to staking, while crediting its success to free market dynamics and the robust network effects of stETH. Conversely, its skeptics worry about the potential for centralization due to its growing influence—urging for Lido to self-limit its growth—while also exploring alternatives such as embedding staking more directly into the Ethereum network itself. Although the reality of this situation is more nuanced and likely lies somewhere in between this spectrum, it's evident that a balance between accessibility and decentralization is essential to maintaining Ethereum's core principles and long-term health. stETH Network EffectsLido’s first mover advantage coupled with the introduction of native yields through stETH, its liquid staking token, has garnered large network effects for the protocol. These characteristics have resulted in a winner-takes-most dynamic, creating oligopolistic market structure around liquid staking. stETH is one of the most crucial pieces within the Lido ecosystem, allowing users/stakers to “delegate” their Ether to secure the network (participate in consensus) in exchange for a tokenized representation—i.e., a derivative—of their underlying stake. This token not only presents a native form of yield, but also unlocks additional utility as it can be traded, exchanged, borrowed against or used for liquidity purposes while simultaneously earning staking yields—a key value proposition of liquid staking. stETH as CollateralSource: DeFi Balance Sheets stETH and its wrapped version (wstETH) have grown to be the largest form of collateral backing loans on several decentralized finance (DeFi) platforms and their iterations including Aave, Maker and Compound. As illustrated above, the total share of deposits on Aave v2 is composed of 33% stETH, growing rapidly since its introduction on the platform. Over the same period, wrapped ETH (WETH) saw its share decrease from a high of 39% to 21% currently. Its growth is fueled by the yield and capital efficiency of stETH, which presents an opportunity cost compared to holding or using plain ETH. These properties have also led to an array of emerging products utilizing stETH as a primary collateral base for overcollateralized or synthetic stablecoins. These products are complementary to others like sDai, sFrax and USDM, bringing yields from public securities, such asUS Treasuries, on-chain. stETH on Decentralized & Centralized ExchangesSource: Coin Metrics Market Data & Coin Metrics Labs stETH also has a presence as a quote pair in secondary markets like decentralized and centralized exchanges, allowing users to gain exposure to the token and its staking rewards. Additionally, having significant liquidity on automated market makers (AMM’s)—such as Curve Finance & Uniswap—has helped facilitate liquid trading of the asset. As seen above, stETH has historically benefited from its large presence on Curve, with monthly trading volumes peaking close to $3.5B in May 2022. Recently though, this seems to be waning as Uniswap begins to capture more liquidity and trading volume. Liquidity on centralized exchanges has generally been lower in comparison, however, there seems to be an uptick on venues like OKX and Huobi. stETH Token–Rebasing MechanismThe stETH token follows a “rebasing” mechanism. This has crucial implications for users of Lido as well as applications featuring the stETH token. At a fundamental level, rebasing tokens like stETH are designed such that the token’s supply or a user's balance of staked ETH increases in proportion to the underlying asset. In this case, as a user supplies ETH (underlying asset) to Lido, stETH (derivative asset) increases in tandem as staking rewards are earned. Therefore, users don’t need to make any accompanying transactions to see changes reflected in their staking balance. Rebasing Function: The stETH rebasing function can be visualized at a high level as seen below. For example, we can consider 3 hypothetical accounts with initial staked amounts of 50, 30 and 20 ETH respectively. On a daily basis, an oracle reports daily stats from the Beacon Chain regarding the total Ether pooled amongst validators. This total increase or decrease (in the case of validators being slashed) in total pooled Ether and accrued rewards are reflected in a user’s account balance at the end of each daily rebase—similar to increasing balances in a traditional savings account. Although this results in a user-friendly experience, it means that applications that cannot support rebasing tokens are required to onboard a non-rebasing version to enable compatibility. This has led to the introduction of the wrapped staked ETH token (wstETH) which features on several protocols like Maker, Aave v3, Compound v3 and Uniswap V3. Lido DAO Governance & the LDO TokenAs alluded to earlier, governance is a major piece within the Lido protocol. The Lido DAO, governed by LDO token-holders, have “root” access to certain critical aspects of the protocol. This includes the ability to make smart contract upgrades, manage node and oracle operator registries, their associated withdrawal keys and oversee the Lido treasury. These privileges and the highly concentrated nature of LDO token holders are leading to worries around the Lido governance layer as a potential attack vector. As a result, proposals around dual-governance have been introduced, allowing stETH holders to veto decisions made by LDO holders with the aim of creating balance in the current power dynamic. Source: Coin Metrics ATLAS & Address Tagging Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Bitcoin active addresses rose 3% while Ethereum active addresses declined 2% over the week. Daily active Bitcoin addresses hit 1.14M on November 5th, the highest one-day total since September 15th. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 231

Tuesday, October 31, 2023

Unpacking the Forces Behind the Market Rally

Coin Metrics’ State of the Network: Issue 230

Tuesday, October 24, 2023

Navigating the Liquidity Landscape: Insights into Digital Asset Markets

[Report] Coin Metrics’ State of the Network: Issue 229

Thursday, October 19, 2023

Coin Metrics ⨉ Bitcoin Suisse—Exploring Supply Transparency

Circle's Silver Lining: Unpacking USDC's Supply Drop in an Era of Rising Rates

Tuesday, October 10, 2023

Circle & USDC in an Era of Rising Rates

Coin Metrics’ State of the Network: Issue 227

Tuesday, October 3, 2023

A data-driven overview of the events from Q3 2023

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏