Fee War on Bitcoin ETF Has Begun - Plus 12 Predictions

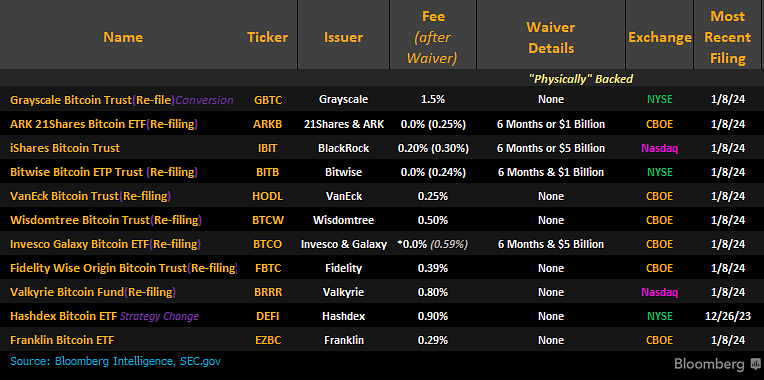

Today’s letter is brought to you by Cal.com!What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in Cal.com and we use it instead of Calendly. Cal.com is the leading open-source scheduling platform, which gives you the same superpowers of efficiency previously reserved for elite corporations & tech gurus. Top performing teams choose Cal.com to increase business productivity, get insights on their team, and their automated workflows. Stop wasting your time with scheduling software that doesn’t work. Use technology to make your life easier. The best part? Set up is quick, easy, and you will never go back to your boring calendar tool. Exclusive for Pomp Letter subscribers/Pomp Podcast listeners, use code “POMP” for $500 off when you set your team up with Cal.com. Save time. Save money. Use Cal.com. To investors, The bitcoin spot ETF approvals will be announced this week. The final decisions will likely come on Wednesday with trading to commence before the end of the week. In preparation for that event, each ETF administrator must reveal what their management fee for the respective funds will be. Those numbers have started to come in this morning and there is only one way to describe what is happening — the fee war has begun. Grayscale’s GBTC has been the goliath in the room for years. They managed tens of billions of dollars in the largest bitcoin fund in the world. That trust structure had a 2% management fee, which is more than double the average ETF fee. The argument was that bitcoin was more expensive to manage, so the fee was justified. In reality, Grayscale had a monopoly in the US on the publicly traded bitcoin funds. They could charge whatever they wanted. This was an amazing business for them and they likely will never get the credit they deserve for the incredible work they did to educate, and onboard, so many investors to the digital currency. Competition is coming fast and furious though. Grayscale revealed this morning that their management fee will drop to 1.5% once they convert the trust structure to an ETF. While a 25% reduction in their management fee may sound large, this will leave Grayscale significantly higher than almost all of their competition. Here are some of the other management fees that ETF providers have revealed, according to James Seyffart from Bloomberg: These numbers are coming out very quickly this morning, so any changes or updates will not be included in my analysis. Another area of “fees” is the bid/ask spread for these ETFs. According to Bloomberg’s Eric Balchunas, the expectation is that any ETF with healthy volume the spread will only be 1-2 basis points. That won’t be a big deal for almost all investors in these ETFs. But something more interesting is happening with these fee wars on the ETF. Van Eck advisor Gabor Gurbacs points out that it will “cost less to hold a Bitcoin ETF for a year than a single trade on Coinbase.” So the ETFs may actually create a drop in transaction fees for the crypto exchanges as well, not just the crypto-native asset management firms. He goes on to highlight a potential downside to these low fees on the ETF applications:

These are important points to keep in mind as the ETFs are approved and scaled. Now many of you have emailed me questions about what I expect to happen with the bitcoin ETF, so here are a few simple predictions:

It will be interesting to see what I get right and where I am wrong. Predicting the future is hard. Regardless of what happens, the long-term outlook of bitcoin remains a positive one. Hope you all have a great start to your week. I’ll talk to you tomorrow. -Anthony Pompliano Darius Dale is the Founder & CEO of 42Macro. In this conversation, we talk about global liquidity, Wall Street investors on bitcoin ETF, Macro Weather Model on asset prices in 2024, and more. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here My CNBC Appearance From Yesterday - Bitcoin Welcomes Wall Street To The Party Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Thoughts On The Bitcoin ETF That No One Is Talking About

Thursday, January 4, 2024

Listen now (3 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

The Trade Of Our Generation

Wednesday, January 3, 2024

Listen now (4 mins) | To investors, The US national debt crossed over $34 trillion yesterday, which is the highest it has been in history. This all-time high milestone is not one to celebrate. Charlie

The State of Bitcoin Heading Into 2024

Tuesday, January 2, 2024

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Powerful Technology Is Moving Into The Hands Of Retail Investors And It Will Revolutionize Markets

Friday, December 29, 2023

Listen now (4 mins) | To investors, This is my last letter to you of 2023. I figured I would leave you all with some alpha on how to put yourself in a better financial position during the new year.

Asset Prices Are The Crouched Lion Approaching Their Prey

Thursday, December 28, 2023

Listen now (5 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these