Not Boring by Packy McCormick - Pace Yourself

Welcome to the 1,282 newly Not Boring people who joined us over the holidays! If you haven’t subscribed, join 218,841 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Alto With Alto, you’ve got options. Its self-directed IRA platform lets you invest in a range of alternative assets across private equity, venture capital, real assets like farmland and fine wine, cryptocurrency, private startup angel deals, and more. Better yet, investing in alts with dollars earmarked for retirement means you can make long-term and tax-advantaged decisions. Here are the top three reasons why Alto is a no-brainer:

Plus, you can now also check out the new Alto Marketplace – the premier destination for discoverability-driven securities investing. As we start off the New Year, make a good decision and learn more about Alto. (Of course, IRA rules and regulations apply, and you should seek advice from a tax professional when making investments. Alternative asset investments are inherently risky and are intended for sophisticated investors.) Hi friends 👋, Happy New Year, Happy Wednesday, and welcome back to Not Boring! This is going to be a wild year. We’re only ten days in, and robots are cooking and making coffee, the US launched its first commercial robotic mission to the Moon, the SEC tweeted that the Bitcoin ETFs were approved and took it back, and Bill Ackman is waging war on the universities. Let’s get to it. Pace YourselfPace Yourself Every year, right around this time of year, people make predictions for the year ahead. It’s a ritual, a form of intellectual entertainment, and even a kind of synthesis: a chance to look back on everything that’s happened in human history, weighted for recency, and package it all up into a guess at what comes next. The fun thing about these predictions is that they are invariably wrong. Or, they’re right in the same way that a broken clock is, and as often. You should not bet your life savings on these predictions. So with that, I only have one prediction, so obvious as to be meaningless: This year will be crazier than last year. Until I receive disconfirming evidence, consider this an evergreen prediction. I’ve been making it practically since I started writing Not Boring, and I haven’t been wrong yet. All of the craziness can be discombobulating. I love the acceleration, but I get that change is scary, even when it’s good. The only times I can really remember crying, aside from deaths, is when I’ve had to move from one thing to the next: at middle school graduation, at high school graduation, at college graduation, moving from my first NYC apartment to my second. The funny thing, in retrospect, is that each thing I cried about moving on to became a thing I cried about moving on from. But it’s hard to grok that in the moment, because you know full well what you’re giving up but can only vaguely picture what you’ll gain. And because you forget that while the only constant is change, the important constants survive change. Anyway, check this out, from Stewart Brand, in his 2000 book, The Clock of the Long Now:

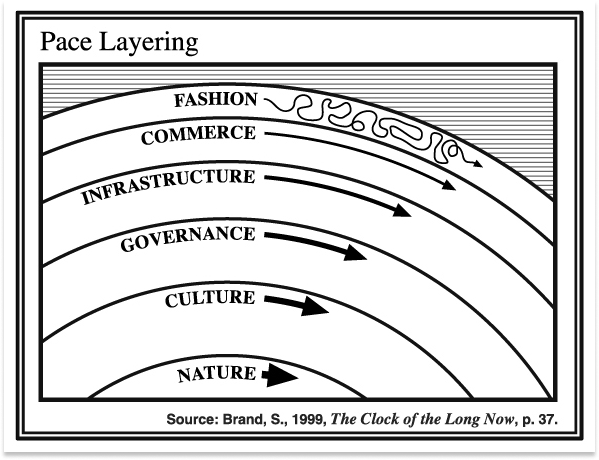

He wrote that 24 years ago, when I was in middle school. It’s almost perfectly relevant today. The layers of civilization Brand is talking about are Pace Layers, a concept he came up with in the late 1990s to describe “how complex systems learn and keep learning.” Maybe you’ve seen the graphic: The beauty of pace layers is that they can describe so many systems – from buildings to forests to technology to civilizations – because, as Brand wrote: “All durable dynamic systems have this sort of structure. It is what makes them adaptable and robust.” Some parts of a system move faster, and some things move slower, and that is good. Nature moves the most slowly, on the scale of eons. Fashion is practically disposable; it moves on the scale of months, weeks, days, or even hours. Each layer moves a little faster than the one below it, held in check by the one below it, and is sped up by the one above it, pushed by the one above it.

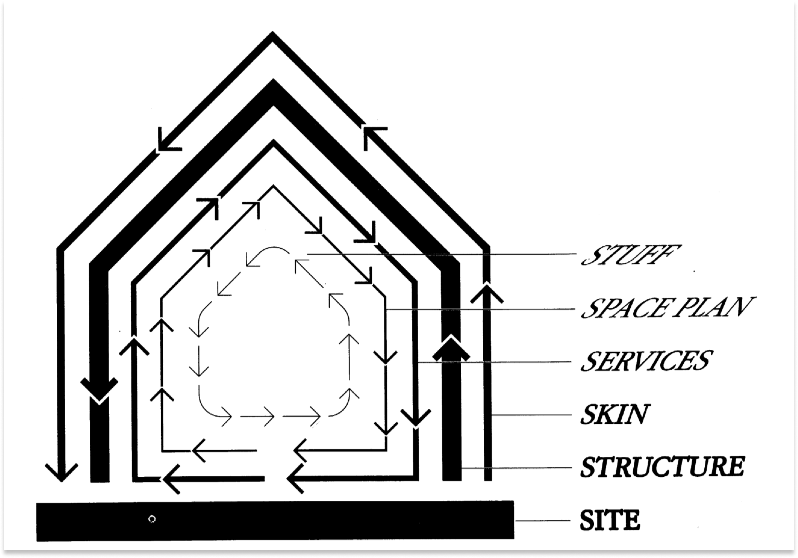

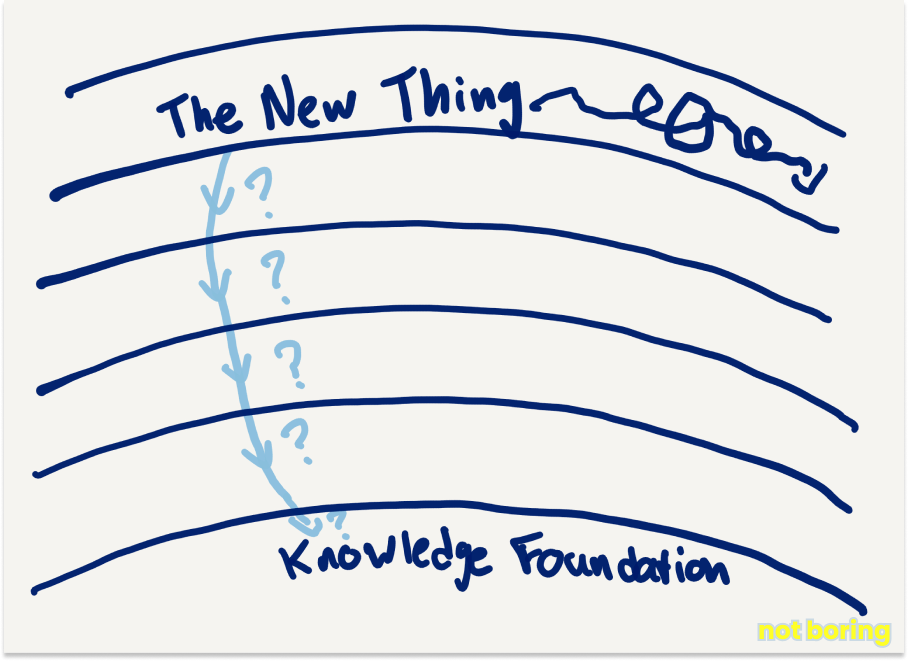

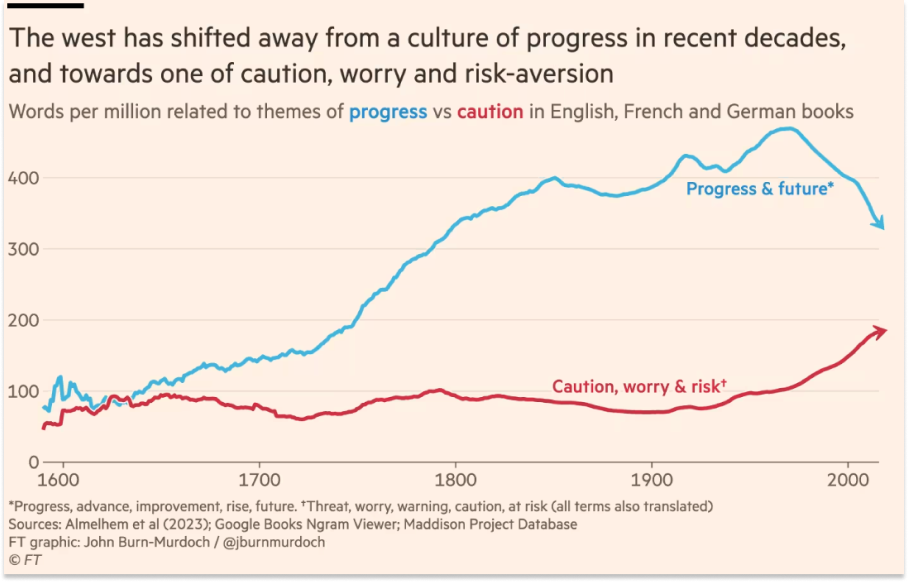

“In a durable society,” Brand writes, “each level is allowed to operate at its own pace, safely sustained by the slower levels below and kept invigorated by the livelier levels above.” The core concept – that things have different layers which move at different paces – scales up and down beautifully. Brand first discovered the framework that would become pace layers when he set out to figure out why architects design buildings that people detest. That question brought him to British architect Frank Duffy, who told Brand that “there isn’t such a thing as a building. A building properly conceived is several layers of longevity of built components.” Duffy called these layers Shearing Layers. So civilizations, buildings, what else? I’ve probably read Brand’s Pace Layering essay a dozen times over the past few years. I even read Brand’s How Buildings Learn, which introduced Shearing Layers, when, despite the fact that I know very little about Design or Construction, I was promoted to a role at Breather that oversaw the Design & Construction team. The concept grabbed me this time because as soon as I re-read it, I saw it everywhere. For one, there’s this thing I’ve noticed among a few people whose minds I really respect, that I’ve been trying to put into words. They’ve built a solid frame of knowledge and beliefs about the things that change more slowly on which they hang newer, faster-moving information in its proper place. The new thing that most people see as the main thing, they treat like a small thing in the context of a much longer, larger thing. Maybe it will impact the longer, larger thing – that’s where the action is! – but maybe it won’t. They don’t get swept up in the new thing, but they don’t dismiss it, either, and they certainly aren’t scared by it. By building a firm base of old ideas, they seem to enjoy new things and ideas even more, because they see where they fit in the bigger picture and realize how hard it is for a new thing to shake the old things up. Whether or not they’d call it this, I think they’re thinking in pace layers. I want to think more like that. I mainly write about things at the fashion, or new thing, layer, the “fast and small” that might “instruct slow and big by accrued innovation and occasional revolution.” Sometimes, like today, I write about the slow and big ideas that take place deeper in the stack, the things that change more slowly and have all the power. I focus more on small and fast, but as smaller things move faster and faster, I find myself drawn to big and slow to put small and fast into context. There’s this great passage in Haruki Murakami’s Norwegian Wood in which Nagasawa tells the book’s protagonist, Toru Watanabe, that he only reads books whose authors have been dead for at least thirty years. In it, Nagasawa says the famous line, “If you only read the books that everyone else is reading, you can only think what everyone else is thinking.” Nagasawa is half-right! I think the trick is to read the old stuff to form your own base layer of beliefs, the ones that change much more slowly, but to use that base to engage with new things from your own perspective. Not Boring is ostensibly a newsletter about business and technology, but as technology gets more powerful, and has a bigger impact on the other layers, what I write would be hollow without putting things into a larger historical, economic, and even philosophical context. The important thing is recognizing which layer of the stack we’re talking about. But certainly, pace layering applies to thinking about new businesses and technologies, too. Most of the businesses and technologies I write about operate at the top layer, although some, like energy, are much deeper. The odds are, many of the companies I write about will fail. I’ve been more drawn to hard startups doing new things in part because even if they do, they might impact the layers below them. I think one of the disagreements between me and crypto critics, for example, is that while we agree that many of the specific products and meme coins operating at the fashion layer are dumb, I believe that all of those fleeting experiments, taken together, have a real shot at improving the layers beneath them. I wrote about crypto as a laboratory for complex problems, and I think the more experiments we run at the top layer, the more of a shot we have to improve the commerce, infrastructure, and even governance layers beneath it. More generally, thinking in pace layers helps embrace variance and novelty at the top layer – the more crazy experiments the better! – because, as Brand wrote, “The division of powers among the layers of civilization lets us relax about a few of our worries.” The system operates in such a way that it’s really hard to break, and usually, only the really strong technologies and ideas can break through from the fashion layer down through the stack. If they survive that journey, we’re better for it. At the same time, despite the fact that I’m a red-blooded techno-capitalist, one of the things I might disagree with some people in tech is that I think strong institutions are really important. I want Harvard to figure its shit out. I agree with Noah Smith that it would be great if America had a bigger, better bureaucracy. Strong infrastructure and good governance provide freedom through constraint. Brand includes a relevant quote from historian Eugen Rosenstock-Huessy in his essay: "Every form of civilization is a wise equilibrium between firm substructure and soaring liberty." That doesn’t mean institutions are perfect by a long shot. Both the Biden Administration Executive Order on AI and the SEC’s stance towards crypto seem to be examples of governance trying to move at the speed of fashion, and that’s dangerous, because governance is stickier than fashion. The NRC’s half-century misregulation of nuclear is a prime example of what can go wrong when regulations are put in place based on the fashion of an era. But the system works pretty well. Tech can fight back, and it is. We can accelerate faster at the top layers because of the friction with the lower layers. Tech is like a kid with good parents: free to try new things and even fuck up sometimes in the knowledge that there’s a safety net. A more concrete example might clarify how a firm base creates room for freedom. There’s that Jeff Bezos question: “What’s not going to change in the next 10 years?” That’s like the Amazon equivalent of the nature layer. Of course, on top of that, Amazon employees try all sorts of things to deliver low prices, fast delivery times, and vast selection. Some of those things might be at the culture layer, in Amazon’s customer-obsessed, always day 1 mantras. Others will be at the infrastructure layer, in the form of new warehouses. Some will be at the commerce layer, like what gets included in the Amazon Prime subscription. And a whole lot will be at the fashion layer, button tweaks and deals and whatever else they can come up with to deliver low prices, fast delivery times, and vast selection. That’s pace layering. It’s not just that Amazon has a long-term focus, it’s that having a bedrock belief about what won’t change at the bottom, Amazon can move faster and experiment more at each layer up the stack. I could go on, but I promised myself that I would try to write shorter essays this year, so I’m going to wrap this up. Pace layering is a really useful way to look at the world as things speed up, and it works at a number of scales. Personally, I’m incorporating the concept in a few ways. Because I get so excited about everything happening on the top layers, I want to deepen my knowledge at the base layers. I’ve been drawn to religion recently. I read Pierre Teilhard de Chardin’s The Phenomenon of Man, now I’m reading Tom Holland’s Dominion, Paul Johnson’s Jesus: A Biography from a Believer is up next. Building that base frees me up to explore even weirder ideas in context: I spent a bunch of time diving into UFOs over the break. On the investing side, I’m starting to think about pace layers when I look at companies. Instead of forming theses on particular technologies or products, I want to form theses deeper in the stack and use those to put companies in context. One that I’m excited about, and will write about more deeply soon, is something I touched on in Tech is Going to Get Much Bigger: that the biggest companies built today are going to be the ones that use technology to dramatically improve margins in big categories, like Anduril is in defense. As I write Not Boring essays this year, I want to be more clear about which layer I’m writing about. Is this company or technology going to change everything immediately, or is it one that has a chance, if things go right, to earn a place deeper and deeper in civilization’s stack? A big theme will be turning curiosity into conviction: having a strong enough base that I can take even the wildest ideas seriously, and study them until I form a view on whether they’ll flitter away like most things at the fashion layer or whether they’ll be more lasting, despite short-term ups and downs. And finally, an evergreen challenge I’m working on is how to make the world more optimistic. Charts like this one from the FT keep me up at night: Optimism matters. Ideas matter. But yelling “Be more optimistic!” while pointing furiously at the things happening at the top layer misses some important context that I think an appreciation for the other layers can help fill in. Nothing is black and white. There are layers to this shit. The stronger our base, the faster we can accelerate. We’re in for a wild ride. Pace yourself. That’s all for today. We’ll be back in your inbox with a Weekly Dose on Friday. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #75

Friday, January 5, 2024

ALOHA, LNG, Weight-Loss Capsules, Meissner Effect?, AVC Predictions, Choose Optimism.

Weekly Dose of Optimism #74

Friday, December 22, 2023

Solar Surge, Nuclear Hermes, Self-Driving Labs, CAR-T, Retro Biosciences, AOM Season 1 Finale

Momentum, Consolidation, and Breakout

Tuesday, December 19, 2023

Lessons from 2023, the year the momentum stalled

Weekly Dose of #73

Friday, December 15, 2023

Nuclear AI, Approved CRISPR, Diabetes Implants, Morning Sickness, MDMA Application, FunSearch

LayerZero: The Language of the Omnnichain

Friday, December 15, 2023

A Deep Dive on the TCP/IP for Blockchains

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month