The National Debt Promises You Lots Of Investment Opportunities

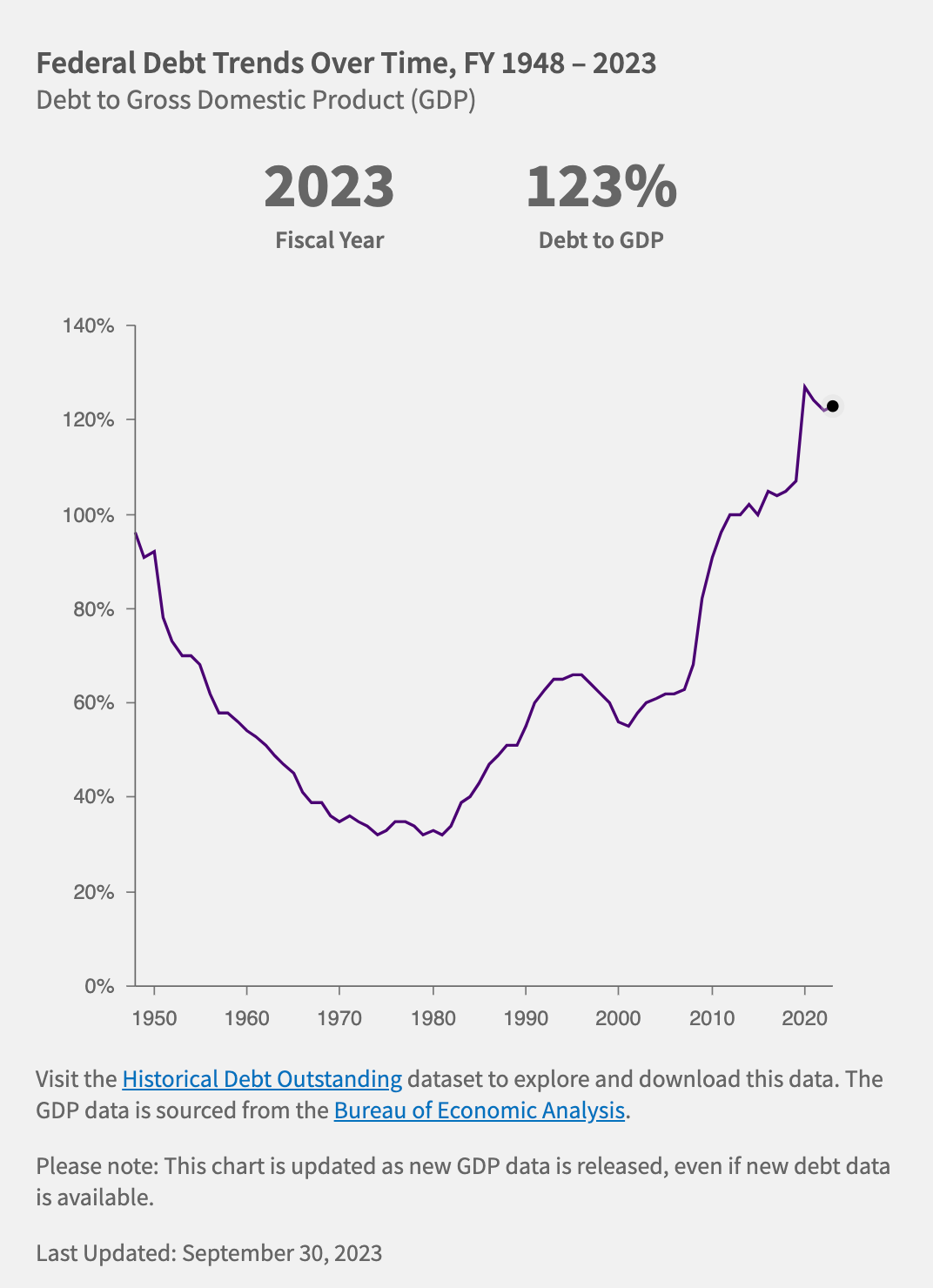

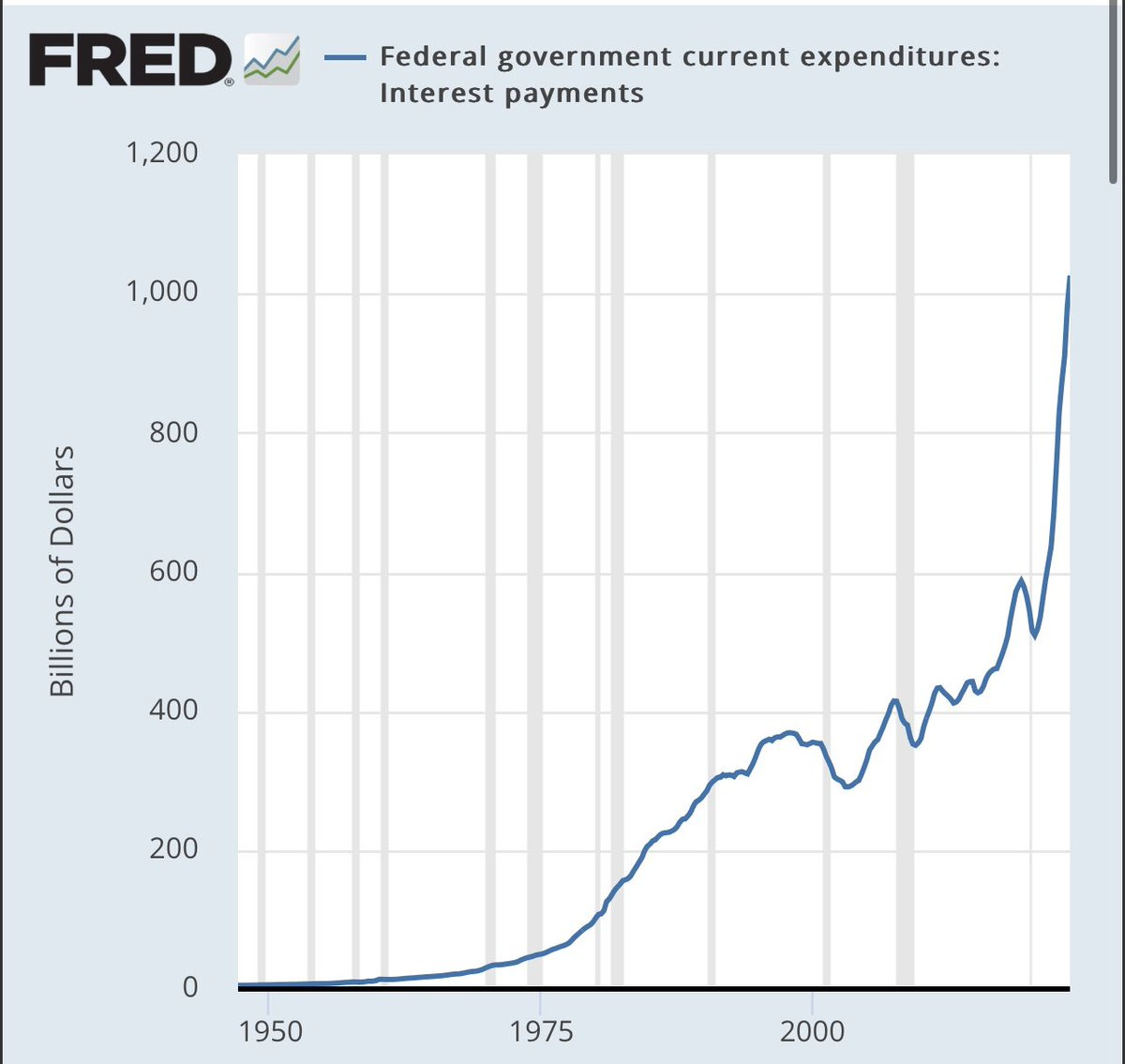

Today’s letter is brought to you by Espresso Displays!I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop. So I started to use a second screen and it seems to have fixed the issue. It took awhile to evaluate many different screens — Espresso Displays was by far the best one. I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself. Any reader of The Pomp Letter who orders one this week will get a great deal. Highly recommend! To investors, The national debt continues to be a topic of discussion for finance leaders around the world. Whether the conversation is happening at Davos or at The Future Investment Initiative Institute, there is a growing concern that the debt has become unsustainable. I spent last night digging into the current state of the national debt and here is what I found. First, we have officially crossed over $34 trillion. That is a big number. We are now adding more than $100 billion per month to the already outrageous situation. According to the US government, “over the past 100 years, the U.S. federal debt has increased from $403 billion in 1923 to $33.17 trillion in 2023.” That chart is wild to see, but it doesn’t even include the almost $1 trillion of additional debt since the end of Q3 last year. Another way to look at the debt is as a percentage of GDP. We can see that the country was able to swing this ratio in a positive direction for much of the 1960s and 1970s, but since the 1980s we have been headed in the wrong direction. Today the debt-to-GDP stands at more than 120%. The issue here is not just how big the debt is, but also how expensive it is to hold this debt. The US government is now paying more than $1 trillion per year in interest payments. This number has gone parabolic in the last four years. With interest rates remaining high, there is no relief in sight either. The higher this interest payment, the worse off Americans are. The Peter G. Peterson Foundation writes “higher interest costs could crowd out important public investments that can fuel economic growth — priority areas like education, R&D, and infrastructure. A nation saddled with debt will have less to invest in its own future.” The organization also highlights the fact that the government is predicting things are only going to get worse in the next decade or so — “The Congressional Budget Office (CBO) projects that the U.S. government will run trillion-dollar deficits over the next 10 years, resulting in a cumulative deficit of $20.3 trillion between 2024 and 2033.” This is the new normal. A highly indebted society that will have to borrow more money in the future to fund the payments of the existing debt. Add in the fact that the US needs more debt to fund the multiple proxy wars overseas, to address the crisis at the southern border, and to fulfill the increasing demands from the various entitlement programs that have been promised to aging Americans. These facts guarantee two things — the government will continue to seek new ways to increase taxes on its citizens and the government will debase the currency over the long run to monetize the debt. Both of these are negative things in my opinion. But they may as well be written in stone at this point. The government has no other choice. As investors, we must spend time thinking critically about how to allocate capital to benefit from these trends. It will likely be the difference between driving attractive performance or not. There will be various stocks to buy or store of value assets like bitcoin, but there will also be tons of private market opportunities like senior citizen living centers that are paid by the entitlement programs. The world is changing. Stay on top of the facts so you can predict where value will accrue. Evolve or die. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Today’s episode is a joint podcast with the team at Reflexivity Research and the team at Elementus. From Reflexivity, we have Will Clemente (Founder). From Elementus we have, Max Galka (Founder & CEO) and Alex Mologoko (Head of Research). This conversation covers a brand new massive report covering year-in-review of 2023 of everything that happened on-chain. Topics include bitcoin rally, open interest, wallet activity, inscriptions, stablecoins, and more. Listen on iTunes: Click here Listen on Spotify: Click here On-Chain Year In Review for 2023 Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

On-Chain Audits & Rules Are Going To Dominate Future

Thursday, January 25, 2024

Listen now (4 mins) | Today's letter is brought to you by Frec! The wealthy have used a secret strategy to make money and save on taxes for decades — direct indexing and tax-loss harvesting. The

The New Players Won't Act Like The Old Players

Wednesday, January 24, 2024

Listen now (2 mins) | To investors, The new capital flowing in the crypto industry from Wall Street and traditional investors will not behave like the capital that has been here for years. Let me

Price Is Trying To Distract Everyone

Tuesday, January 23, 2024

Listen now (3 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

What If The Fed Already Won The Fight Against Inflation?

Monday, January 22, 2024

Listen now (5 mins) | Today's letter is brought to you by ResiClub! ResiClub is the leading publication for the residential real estate market. Housing affordability is the worst that it has been

Podcast app setup

Sunday, January 21, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these