Government Says People Better Off Now, Yet People Disagree

Today’s letter is brought to you by Sidebar!Ready to supercharge your career in 2024? Sidebar is an exclusive, highly curated leadership program designed to propel you to new professional heights. Sidebar’s approach to level-up your career is focused around small peer groups, a tech-enabled platform, and an expert-led curriculum. Members say it’s like having their own Personal Board of Directors. 93% of members say that Sidebar has made a significant difference in their career trajectory.

Nothing propels your career trajectory like a robust peer group. Learn more at sidebar.com, and join thousands of top senior leaders from companies like Microsoft, Amazon, and Meta who have taken the first step towards accelerating their career. To investors, Treasury Secretary Janet Yellen participated in an exclusive CBS interview last night about the US economy. When asked whether she and President Biden were happy with how inflation is going right now, Yellen said the following:

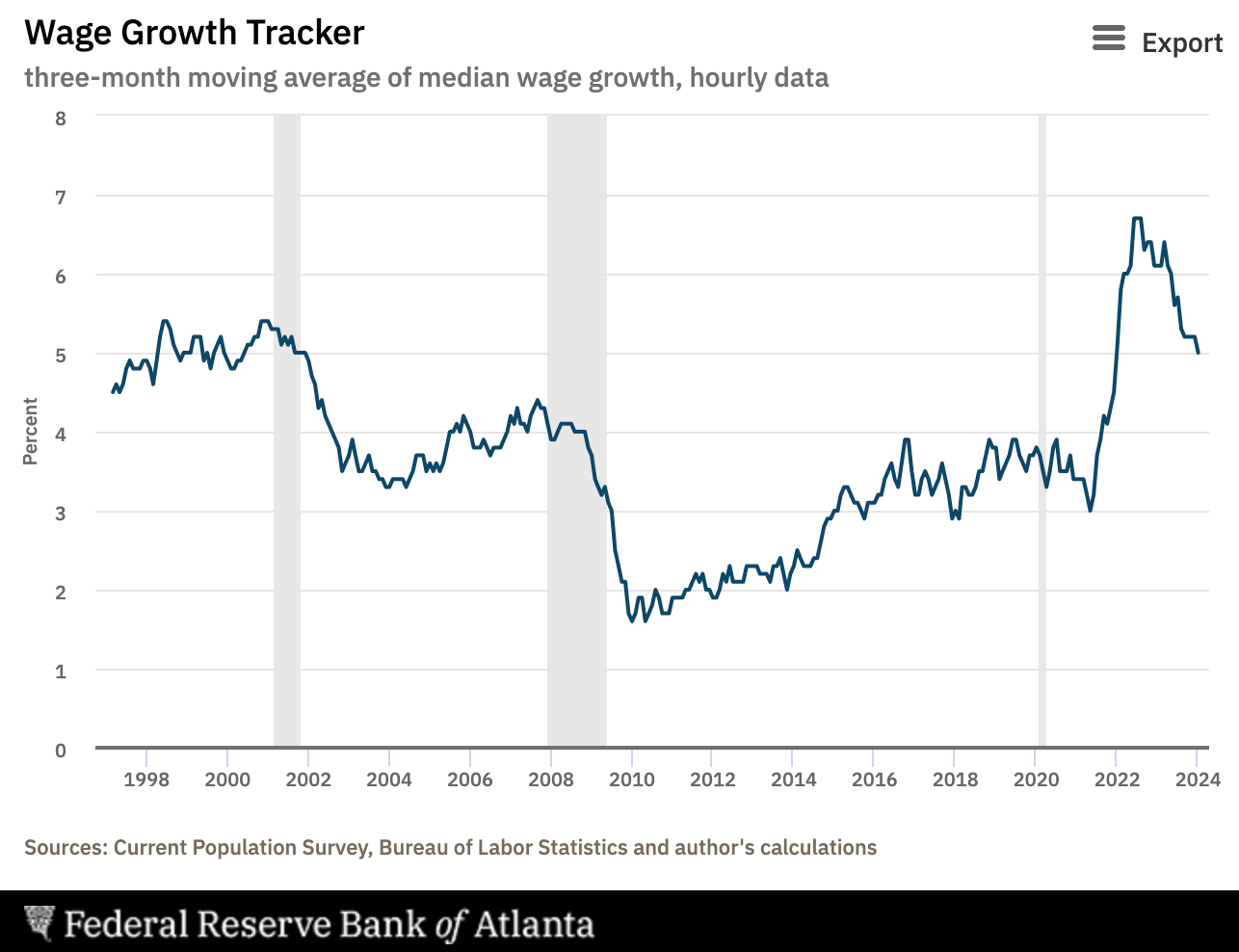

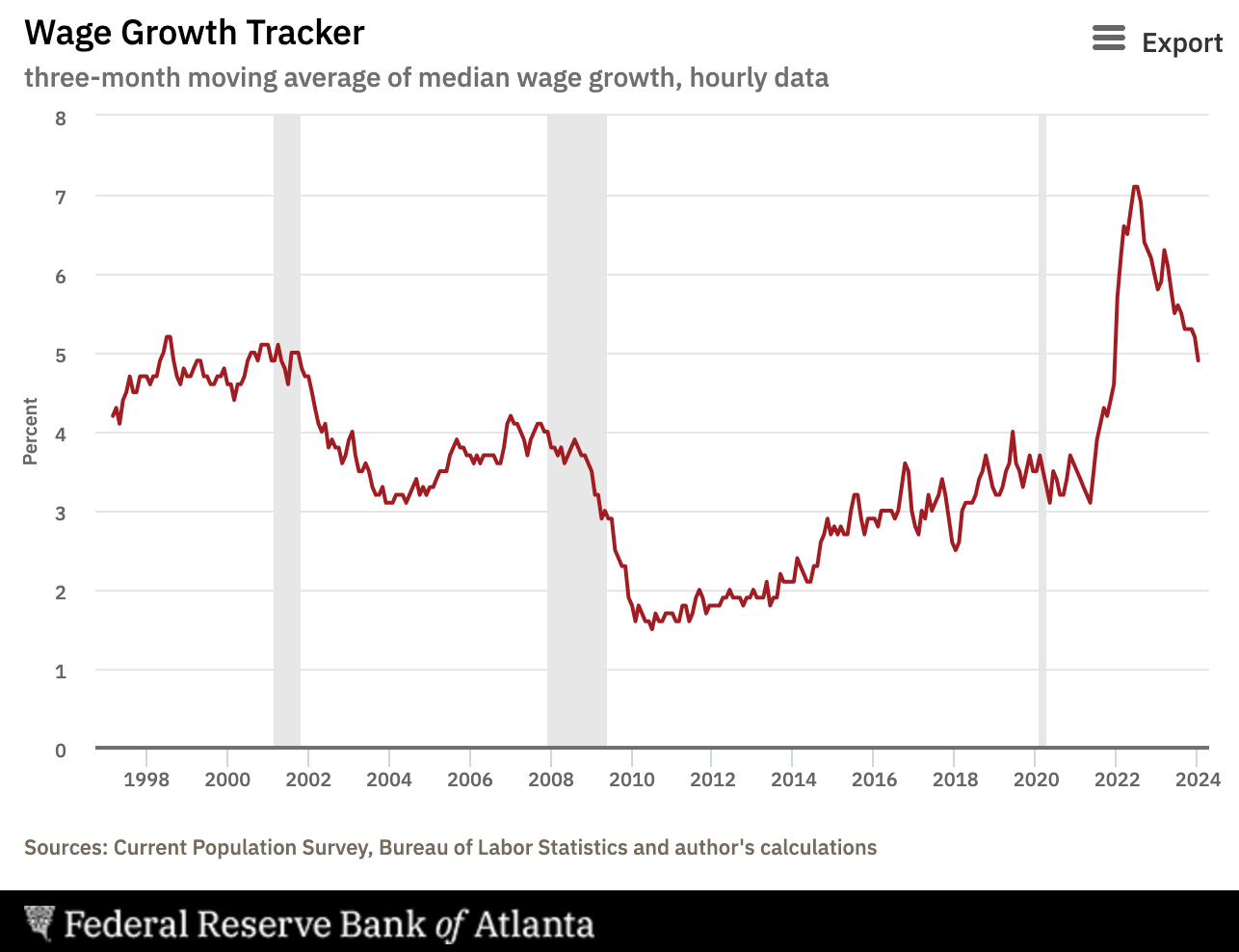

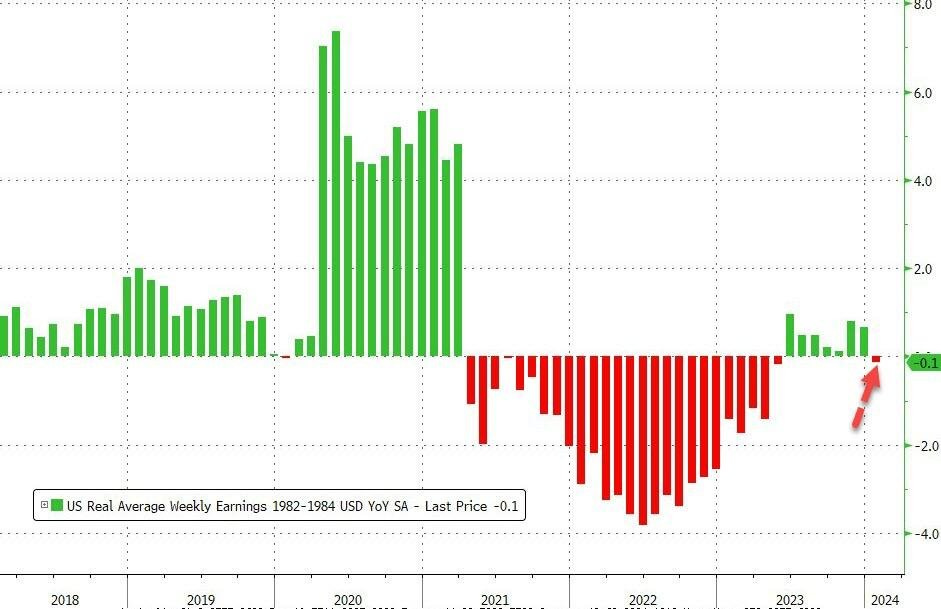

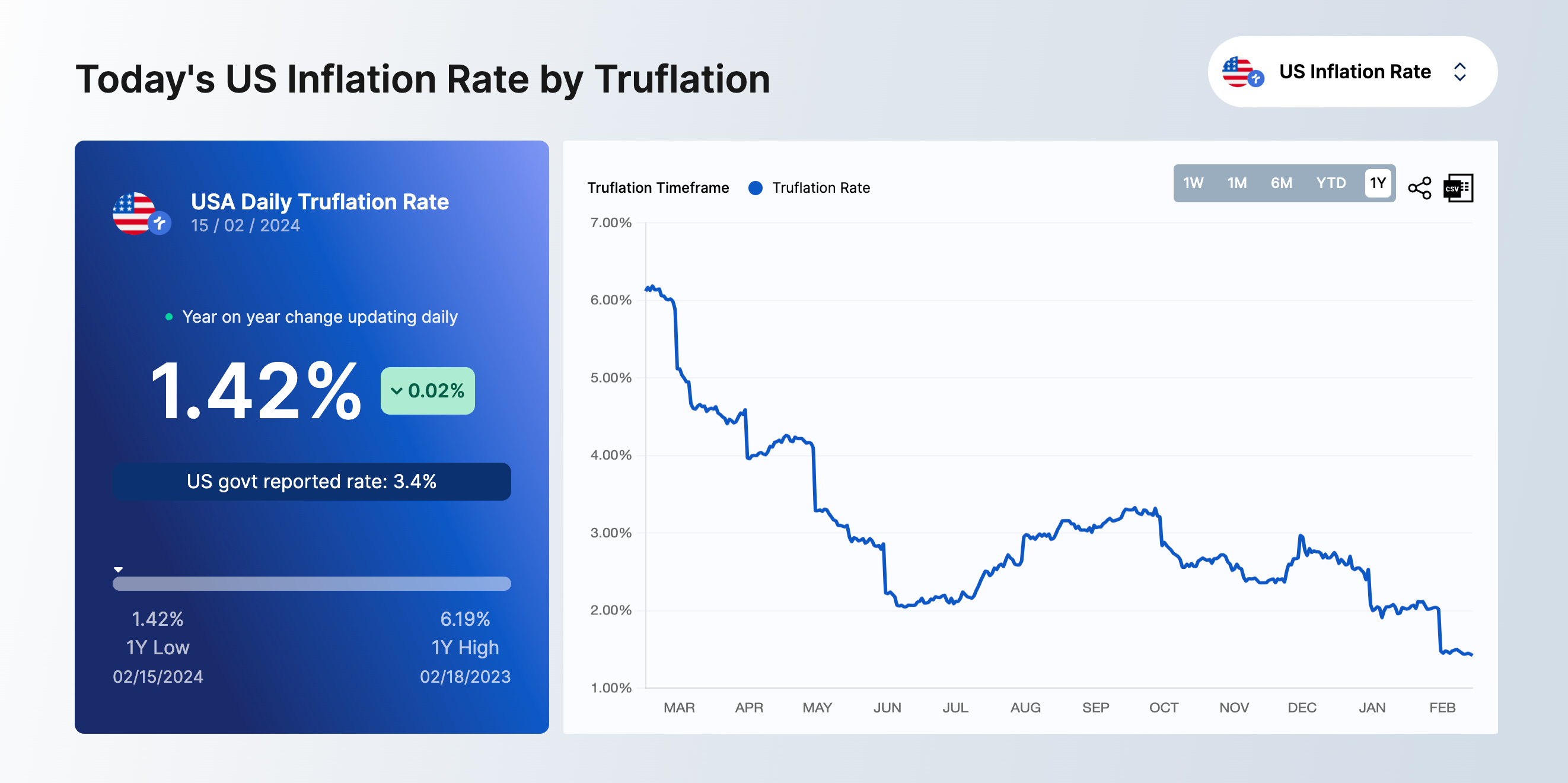

This seems like a difficult talking point to continue reiterating because majority of the population disagrees. Only 14% of American voters say they are better off financially under the current administration. So 86% of citizens believe they are the same or worse than when Biden took office. To Yellen’s credit, wages did rise from 2020 to 2022. Just as the price of goods and services increased with higher inflation, wages went up too. But as inflation has come down, wage growth has come crashing down too. Here is the overall unweighted wage growth since the 1990s from the Federal Reserve Bank of Atlanta: The same wage growth decline is present for hourly workers as well. The trend has not discriminated in who it is affecting. So why is this important? Wage growth is slowing and it appears that things are going to erode for many citizens. We can use real wage growth as a measurement to understand the difference between inflation and wage growth. Here we can see that Americans experienced negative real wage growth for majority of 2021 and 2022. Real wage growth had improved for 7 straight months as inflation year-over-year came down to more manageable levels. But with the re-acceleration of inflation in the January 2024 numbers, real wage growth has turned negative again. This spells disaster for the average citizen. For approximately 2 years, Americans saw inflation outpace the growth in their wages. The prices that were increased are not going to come back down, plus the current annualized inflation rate from January’s number is over 3.5%, so unless an employer is planning to give employees a 4-5% raise each year it will be unlikely that wages can keep up. Secretary Yellen, President Biden, and others want to tell a story of a strong economy that is creating more opportunity for the population. Words fall on deaf ears though if the story is not true. The countdown has begun till the election. They have less than 9 months to get things turned around or many voters will enter the ballot box and vote based on their wallets. Cut rates. Print money. Get liquidity into the system. Make voters flush with cash. If you wanted to enhance President Biden’s chances of winning in November, that would be the playbook. The Fed and Treasury claim to make decisions regardless of the political outcomes, but we will see what happens in the coming months. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Lexy Franklin is the Founder & CEO of Sidebar, and a former Facebook employee who has tons of lessons learned from one of the greatest companies in all of Silicon Valley. In this conversation, we talk about professional development, future of work, importance of small groups for career growth, lessons from Facebook, and how Sidebar can accelerate your career. Listen on iTunes: Click here Listen on Spotify: Click here Former Facebok Exec Explains Product To Help Get Promoted Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Can The Average Person Retire By Buying Bitcoin Today?

Tuesday, February 13, 2024

Listen now (4 mins) | READER NOTE: Today is a free email to everyone. I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a

The Bitcoin ETFs Are Sounding The Alarm

Monday, February 12, 2024

Listen now (5 mins) | READER NOTE: Today's letter is exclusive for paying subscribers of The Pomp Letter. I have unlocked the first half of the letter for everyone, but if you want to see the full

Shrinkflation Has Seeped Into The Housing Market - What You Need To Know

Thursday, February 8, 2024

Listen now (6 mins) | Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by

Is Ethereum Going To Be The AOL of Crypto?

Wednesday, February 7, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

The Chinese Are About To Give A Gift To The World

Tuesday, February 6, 2024

Listen now (3 mins) | READER NOTE: I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these