Bitcoin Is Not A Popular Medium-Of-Exchange

To investors, Satoshi Nakamoto published the bitcoin whitepaper on October 31, 2008. The paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” In the abstract, Nakamoto writes this as his first sentence:

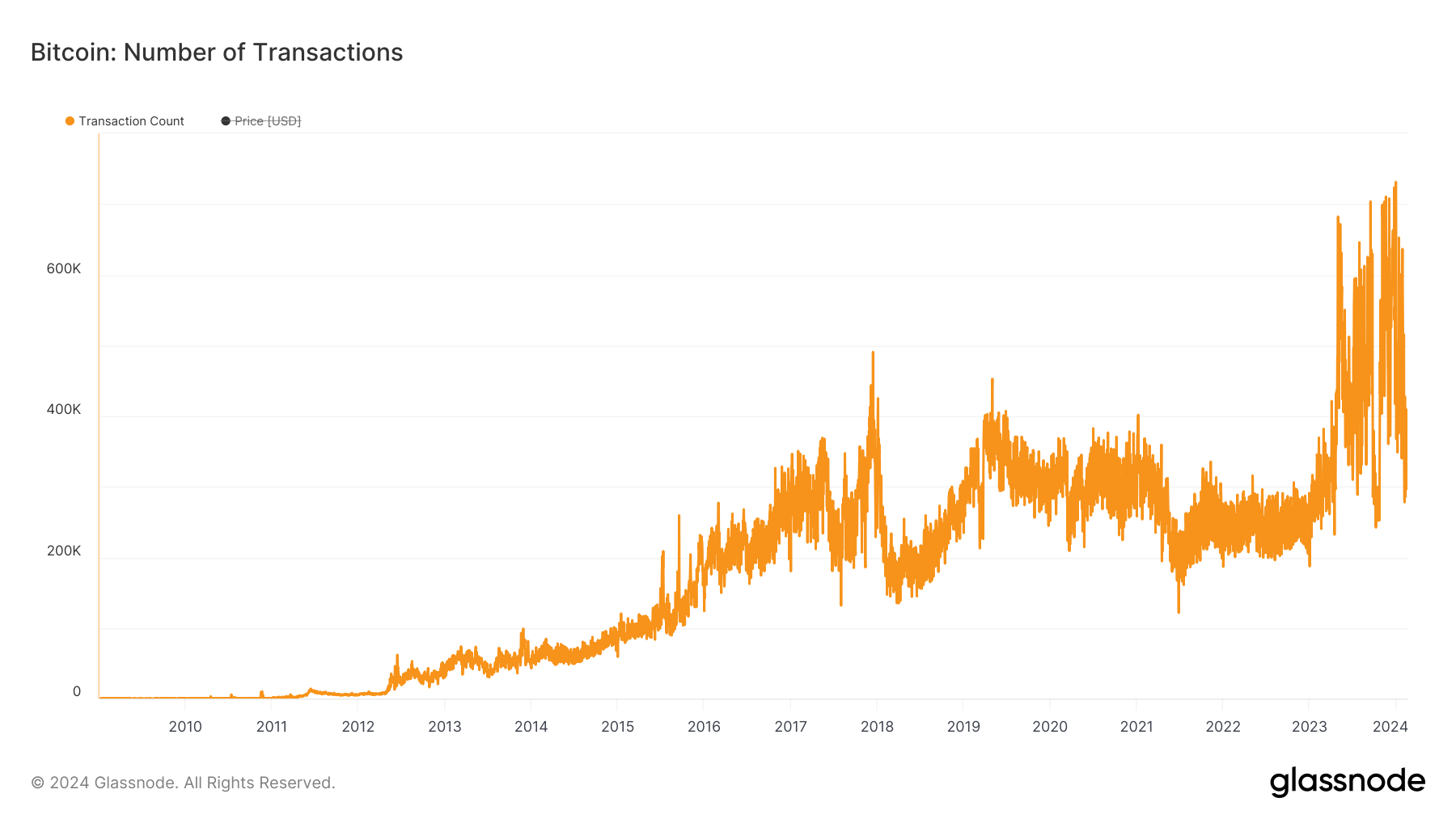

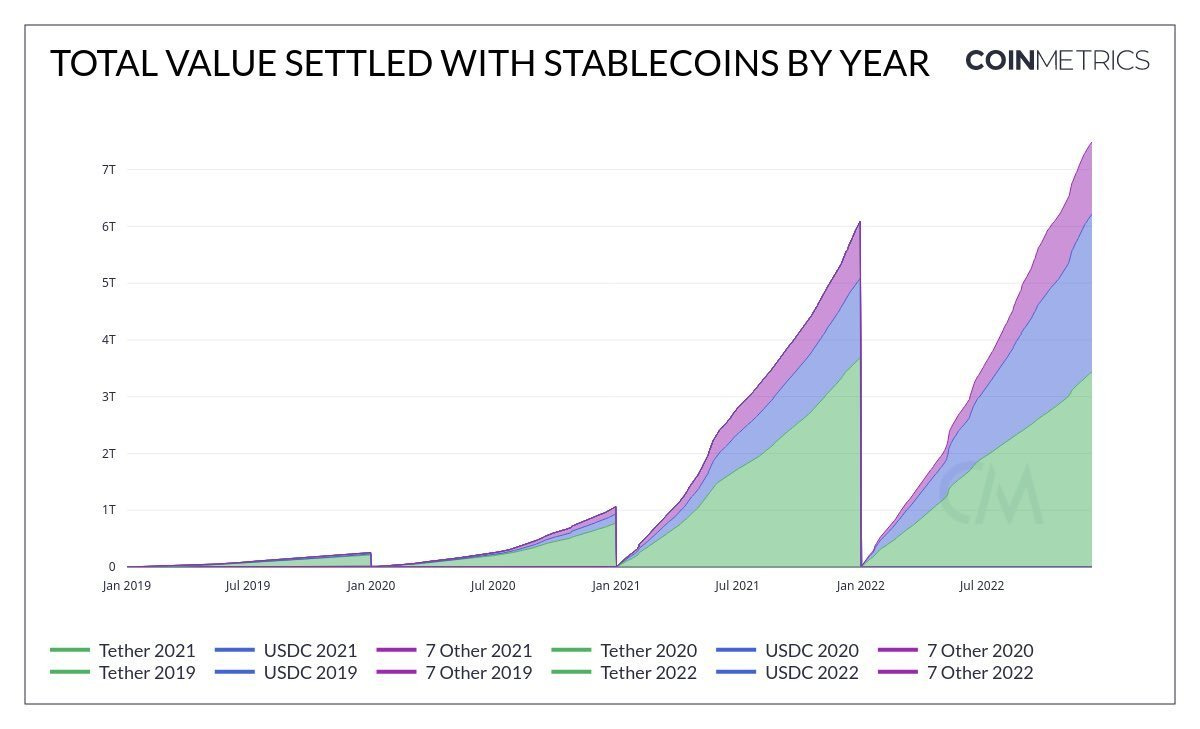

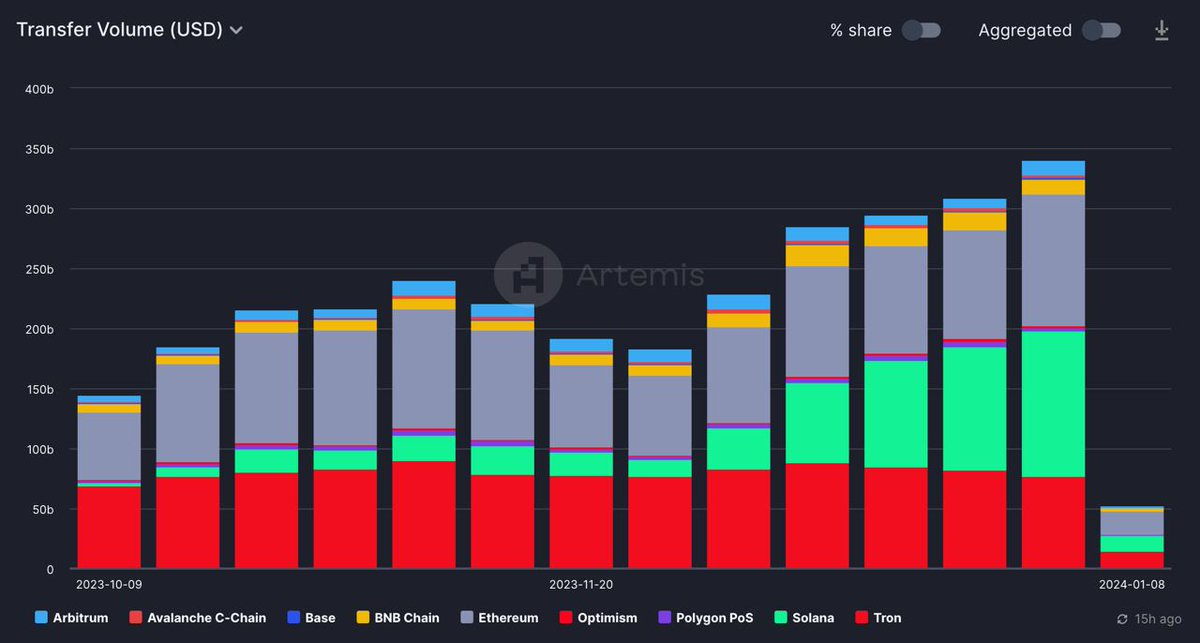

The promise of bitcoin has been that it will replace fiat currencies for store-of-value AND medium-of-exchange. It is obvious that hundreds of millions of people are using bitcoin as a store-of-value, but the medium-of-exchange vision is becoming harder to see with each passing day. On the store-of-value front, bitcoin is a trillion dollar asset that has approximately 80% of the circulating supply which has not moved in the last 6 months. If you expand the timeline out to 1 year, the percentage of coins being held for the long-term is approximately 70%. Why would you sell an asset that is likely to appreciate in price in the future? You wouldn’t. This is the same reason that people hold real estate or gold. The assets appreciate as the dollar, which the asset is priced in, gets devalued. In order for any asset to become electronic cash (translation: medium-of-exchange), it must first become a store-of-value. So bitcoin has checked that box. The next step is to get users of bitcoin to transact with it to purchase goods and services. This happens in certain situations, but it has not become the dominant use case for bitcoin. In fact, other digital assets have become the de-facto asset for peer-to-peer transactions. Let me explain. It is true that the total number of transactions on bitcoin’s layer one blockchain have continued to increase over time. Today the number hovers per day between 300,000 transactions and 600,000 transactions. This means that the transaction rate — the number of transactions per second — has also been increasing at a similar pace. To put these numbers in context, Visa does 750+ million transactions per day and 8,750 transactions per second. Paypal does ~ 74 million transactions per day and 850 transactions per second. The Paypal comparison is probably better because it was founded within 10 years of bitcoin’s launch (1999) and has about the same number of users as bitcoin (less than 500 million people globally), yet Paypal’s transaction volume is almost 150x higher on a daily basis. Bitcoin’s challenge was historically thought to be the slow and expensive experience to send transactions. Enter the Lightning Network. This peer-to-peer layer two allows people to send transactions directly between each other without waiting for the layer one. But this technical improvement has not yielded the transaction volume explosion that many predicted. It is not that the technology can’t handle the transaction volume (it can handle millions of transactions per second), but rather the consumer preference is to transact using a different asset. I have long told people not to spend their bitcoin. Many people have given me a hard time about this over the years. We don’t accept bitcoin for almost any of the products and services that we have built over the years. I don’t want people to spend a currency that is going to appreciate in the future. It makes no sense to spend bitcoin for goods and services if you can avoid it. The majority of bitcoiners appear to agree. Not only are they holding their bitcoin and driving the circulating supply highly illiquid, but stablecoins have become the asset of choice for people in the crypto community. You can see the increasing usage every year from launch through 2022 (note: the trend continues into 2024 but I was having difficulty creating the right chart to show it): Stablecoins are doing more than $300 billion in weekly transaction volume, which puts it on a more than $15 trillion annual transaction run-rate. Why is this number important? Because Visa does $15 trillion in annual transaction volume. So while everyone was expecting bitcoin to become the electronic peer-to-peer cash, stablecoins were able to seize that opportunity so far. Now you may wonder if this is just a first-world development. Maybe people in the developing world prefer bitcoin over stablecoins? Former NFL star and successful entrepreneur/investor Russell Okung tweeted over the weekend:

Castle Island’s Nic Carter followed this commentary up with what he calls the Orange Man’s Burden:

Stablecoins are the winners in the peer-to-peer electronic cash competition. This does not mean that the situation will stay this way. While unlikely, bitcoin could catch up and surpass stablecoins in the future. But right now, the global market is suggesting that bitcoin is a great store-of-value in the world and stablecoins are the more popular medium-of-exchange. This nuance is important to understand because only independent thinkers will be able to change their mind when presented with these new facts. Don’t fall into the rigidity of the bitcoin religion imposed by the loudest hardcore maximalist. Although their intentions are commendable in an effort to bring bitcoin to the world, it spells disaster when they ignore the realities of the market. Bitcoin doesn’t need to become the most popular medium-of-exchange asset in order to drive more economic value in the future. Bitcoin is likely 10x better than gold in terms of portability, divisibility, transparency, predictability, security, etc. This should lead to at least a 2x higher market cap over a few decades, so being the digital gold would still have about 20x more upside available to bitcoin holders if that outcome comes to fruition. Economic actors do not spend a currency that will appreciate hundreds or thousands of percent in the future. The limitations for bitcoin as a medium-of-exchange are not technical, but rather a game theory that highlights bitcoin’s future success in price could be it’s worst enemy as a spendable currency. I’m not selling my bitcoin, but I am also not spending it. Spending bitcoin is a form of selling. So if the hardcore maximalists truly believe bitcoiners don’t sell bitcoin, we should ask why they are selling their bitcoin for goods and services? :) Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Darius Dale is the Founder & CEO of 42Macro. In this conversation, we talk about global liquidity, quantitative risk management model, bitcoin, other assets, and macro environment conditions. Listen on iTunes: Click here Listen on Spotify: Click here Will Global Liquidity Push Bitcoin To All-Time Highs? Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Government Says People Better Off Now, Yet People Disagree

Monday, February 19, 2024

Listen now (3 mins) | Today's letter is brought to you by Sidebar! Ready to supercharge your career in 2024? Sidebar is an exclusive, highly curated leadership program designed to propel you to new

Can The Average Person Retire By Buying Bitcoin Today?

Tuesday, February 13, 2024

Listen now (4 mins) | READER NOTE: Today is a free email to everyone. I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a

The Bitcoin ETFs Are Sounding The Alarm

Monday, February 12, 2024

Listen now (5 mins) | READER NOTE: Today's letter is exclusive for paying subscribers of The Pomp Letter. I have unlocked the first half of the letter for everyone, but if you want to see the full

Shrinkflation Has Seeped Into The Housing Market - What You Need To Know

Thursday, February 8, 2024

Listen now (6 mins) | Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by

Is Ethereum Going To Be The AOL of Crypto?

Wednesday, February 7, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these