The Financial World Is Starting To Understand Bitcoin

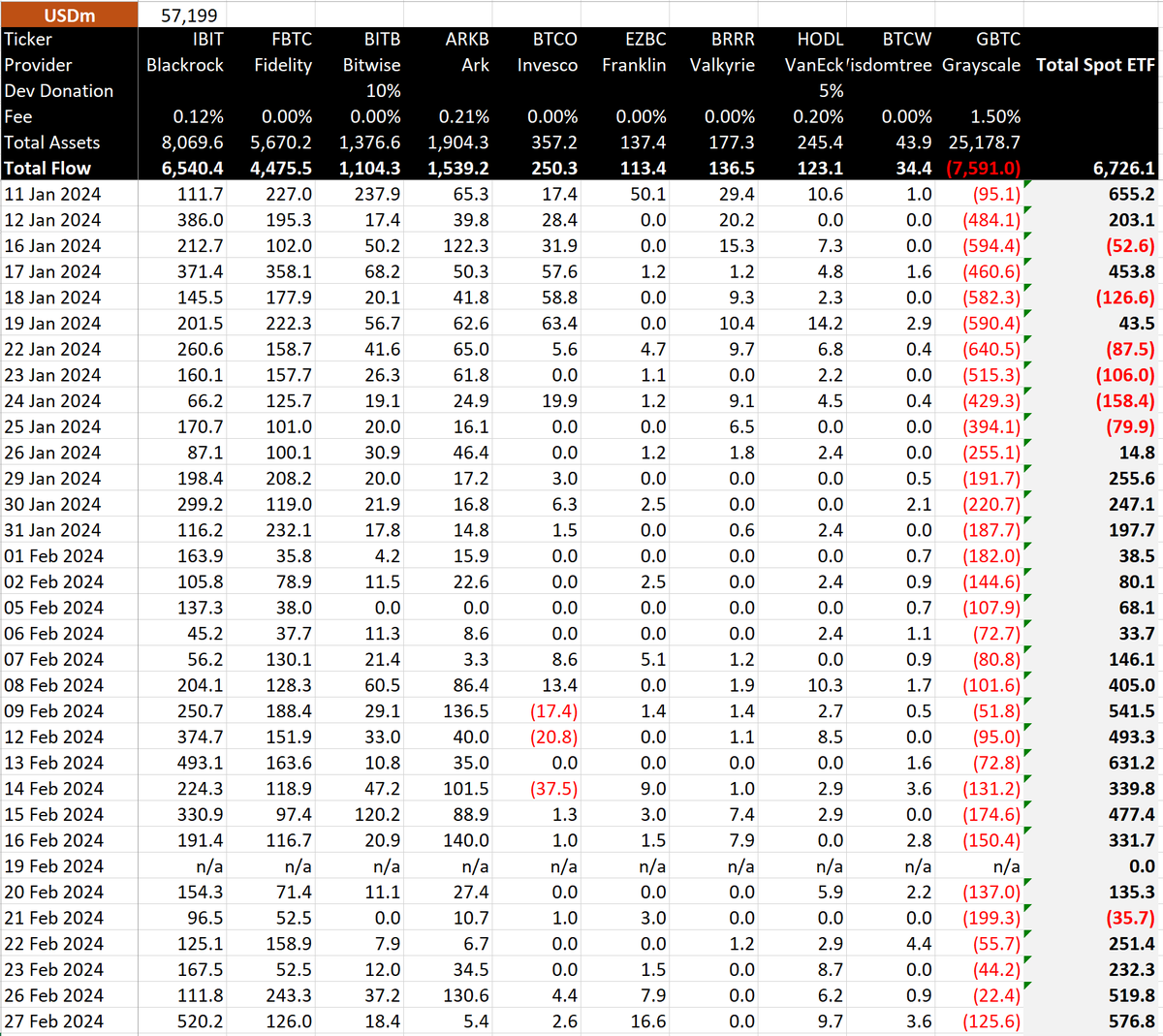

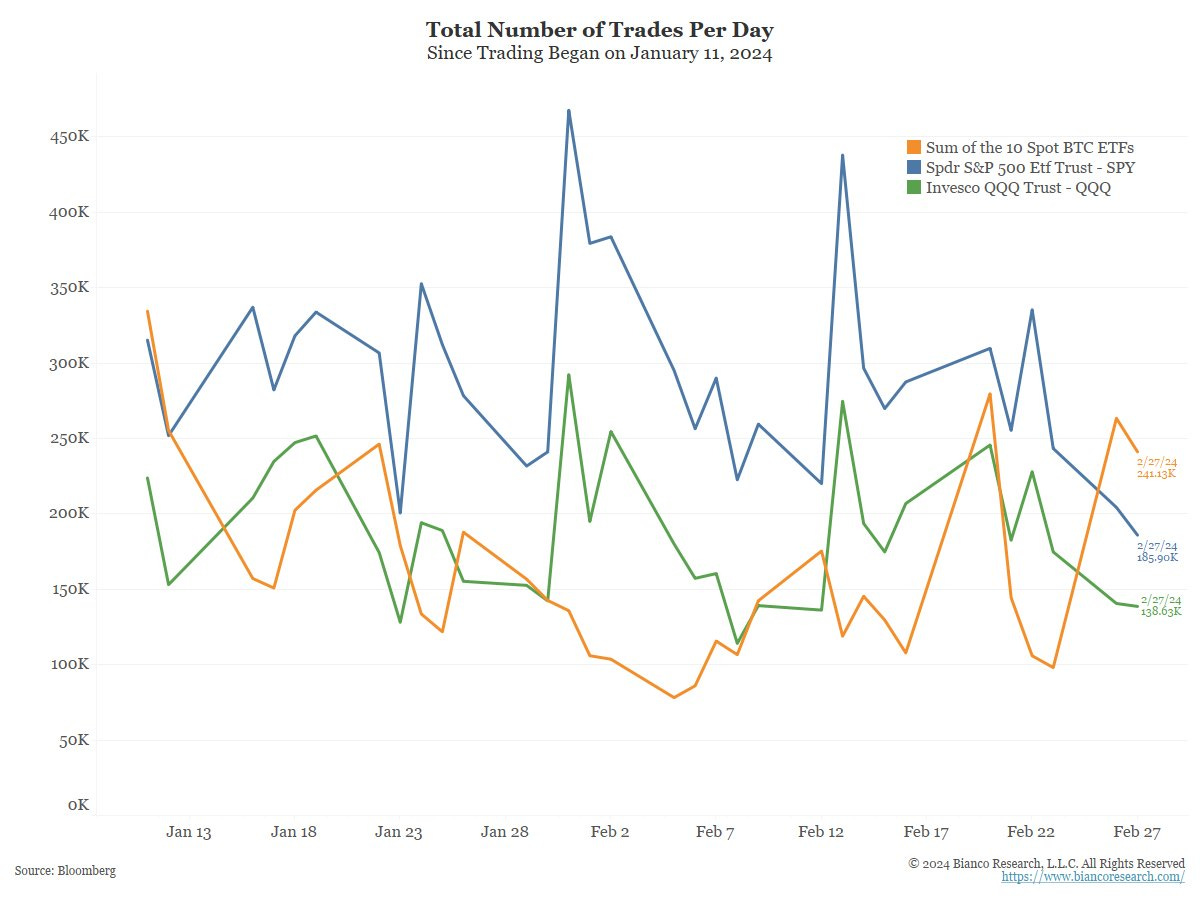

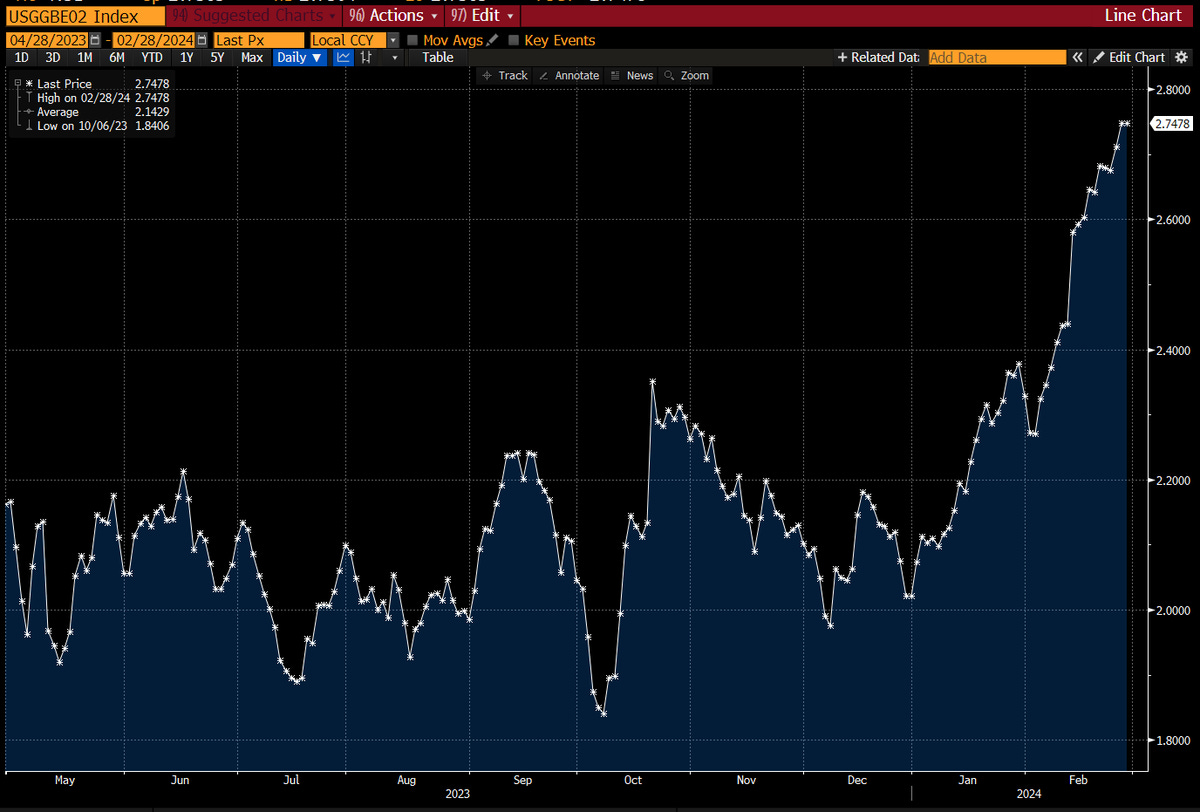

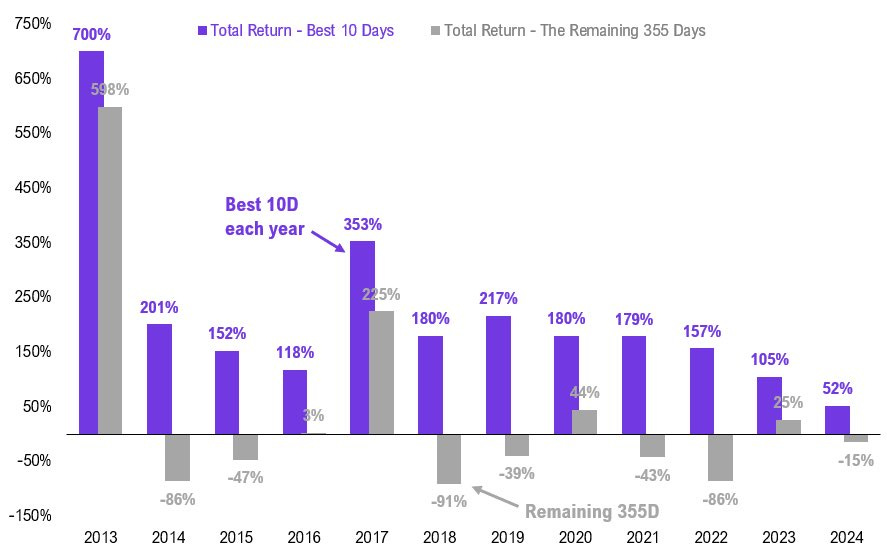

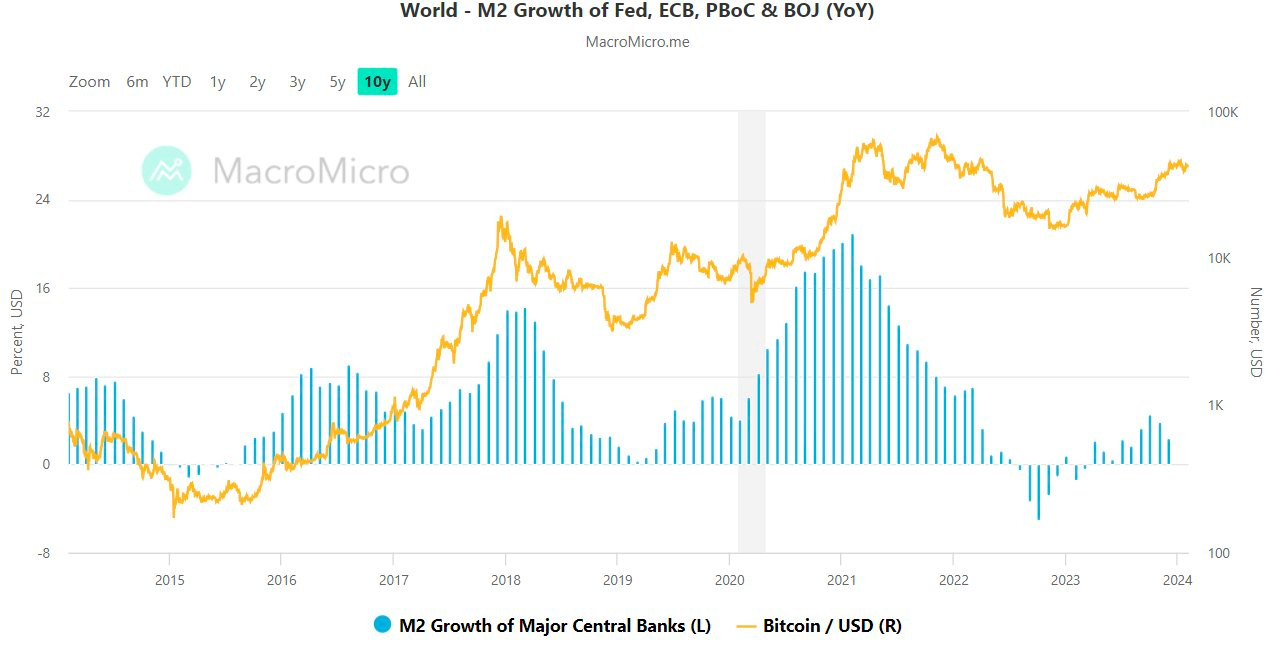

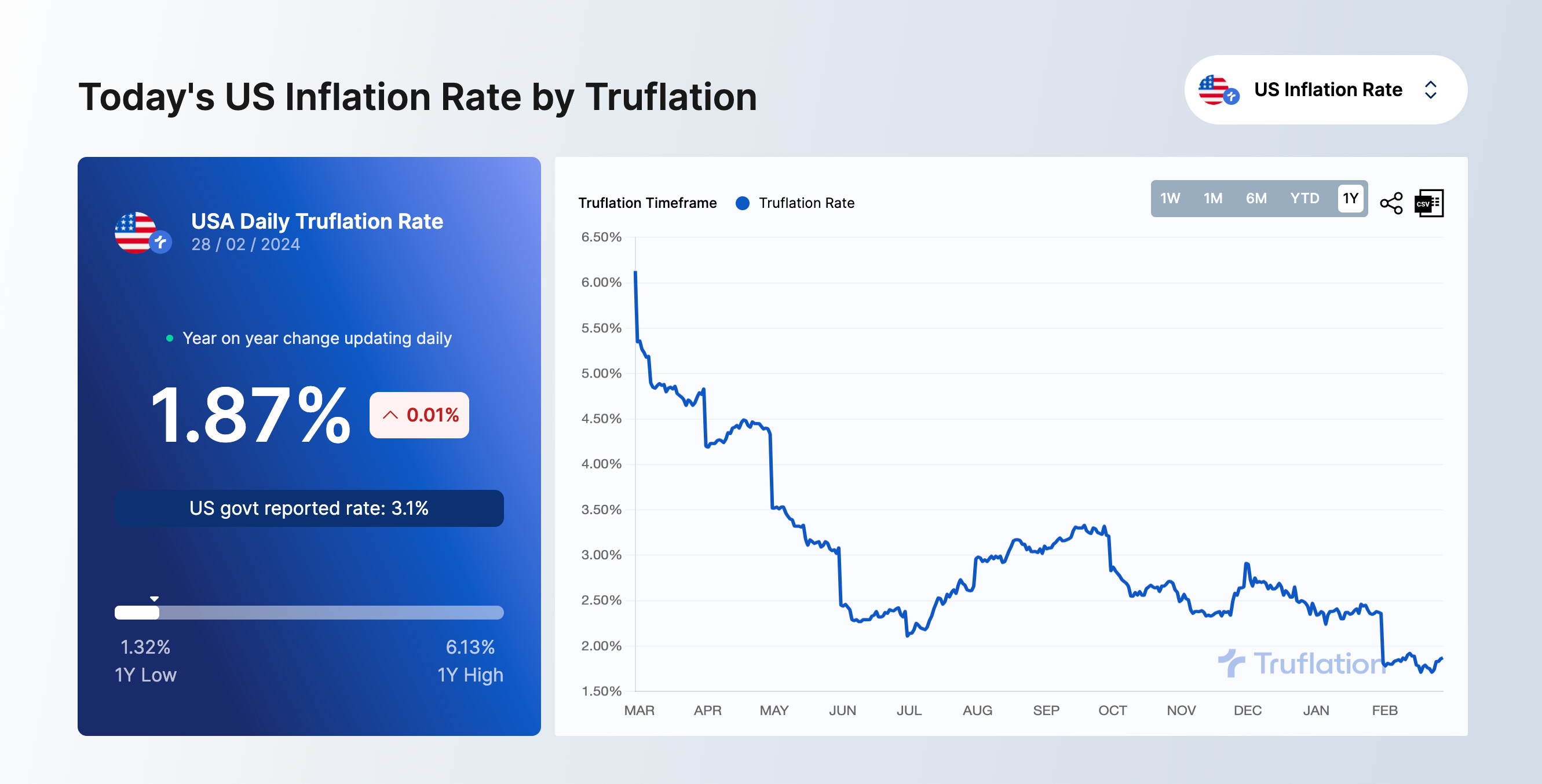

To investors, There is something special happening in the bitcoin market right now. It feels like the global financial world has started to understand what the asset is and why it is important for them to own it. We are not talking about small retail investors or family offices, but rather large institutions who want to invest hundreds of millions or billions of dollars to bitcoin. There was $576 million of net inflow yesterday to the bitcoin spot ETFs according to BitMex Research. Investors put $520 million into Blackrock’s IBIT fund alone. These are incredibly large numbers. But inflows are not the only area where you can see the demand from Wall Street. Jim Bianco created this chart to show the number of individual trades in the bitcoin ETFs compared to SPY or QQQ. Eric Balchunas pointed out “there were more individual trades yesterday in the bitcoin ETFs than there were in SPY or QQQ. And this is before they have options and/or are available on many advisory platforms.” That is wild. Why are so many people buying bitcoin? As I mentioned in yesterday’s letter, the risk of inflation is looming on the horizon. Bloomberg’s Lisa Abramowicz quantified this when she said “traders are betting on substantially stickier inflation in the US for the next few years. Breakeven rates on 2-year notes are current at 2.75%, the highest level in almost a year.” There are not many places to hide in public markets if you think inflation is coming to make a serious comeback. The increase in demand for bitcoin has created a reflexive response. The higher the price goes, the more interest there is in the asset. Balaji Srinivasan highlights “bitcoin has passed all-time highs in 30+ countries, including China and India.” When price runs aggressively as it is doing right now, many people tell themselves that they will wait for a pullback. It makes them feel better if they can buy bitcoin at a price that they previously saw it trading for. The problem is that it can be nearly impossible to time a volatile market. According to Fundstrat’s Tom Lee, if you miss the 10 best days of Bitcoins return each year, you miss majority of the return. The ultimate example of “time in the market is more important than timing the market.” Humans are not built to time markets. Our fear and greed emotions get the best of us. My thought process has always been to let the best performing asset over the last 15 years continue to do its thing. It will go up, it will go down, and it will go sideways. But over a long enough time period, bitcoin seems to go up because it serves as an index for global liquidity. And the governments can’t help themselves — they’ll continue to print money, manipulate interest rates towards zero, and make sure there is liquidity is sloshing around forever. Hope you have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Alex Tapscott is the author of a new book, "Web3: Charting the Internet's Next Economic and Cultural Frontier." Alex has been in the bitcoin and crypto industry for a long time. In this conversation, we talk about the current adoption of bitcoin, AR/VR, NFTs, metaverse, Web3, regulation, and how artificial intelligence plays into all of this. Listen on iTunes: Click here Listen on Spotify: Click here OG Bitcoiner Explains What He Is Excited About Now Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Bitcoin Is Sounding The Alarm On Inflation

Tuesday, February 27, 2024

Listen now (6 mins) | Today's letter is brought to you by Crypto Academy! Do you want a job in the crypto industry? My team and I have been working with the top HR teams in the industry to create a

There Are No Winners In An Inflation Fight

Monday, February 26, 2024

Listen now (4 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

You Won't Believe These Stats About The Market

Thursday, February 22, 2024

Listen now (3 mins) | To investors, Investing is an endless pursuit of learning. No matter how much you think you know, there is always something new around the corner. The world is dynamic. The future

SURPRISE: What If The Fed Has To Raise Interest Rates Instead Of Cut Them?

Tuesday, February 20, 2024

Listen now (4 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

Bitcoin Is Not A Popular Medium-Of-Exchange

Monday, February 19, 2024

Listen now (6 mins) | To investors, Satoshi Nakamoto published the bitcoin whitepaper on October 31, 2008. The paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” In the abstract,

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these