SURPRISE: What If The Fed Has To Raise Interest Rates Instead Of Cut Them?

Today’s letter is brought to you by Bitcoin Investor Day!I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for sophisticated Wall Street investors who are interested in bitcoin. Speakers include Cathie Wood, Mike Novogratz, Anthony Scaramucci, Mark Yusko, Head of Digital Assets at BlackRock, Bitwise CEO, Head of Research at Fidelity & VanEck, and many more. Tickets are only $50 and the venue is incredible. This will be one of the highest quality bitcoin conferences of the year. See you there! To investors, The consensus across Wall Street is that inflation has dropped and the Fed is ready to start cutting interest rates. Investors have positioned themselves to benefit from rising asset prices. The central bank is preparing to wave the victory flag. The media can’t stop writing about the elusive “soft landing.” But what if the consensus is wrong? This is an idea that Bianco Research founder Jim Bianco and I discussed yesterday in our recorded conversation. Neither one of us believe that interest rate hikes is the likely scenario, but it is hard to ignore that the odds are becoming higher with each passing month of new data that we receive. According to Bianco, here is a refresher on what has occurred so far:

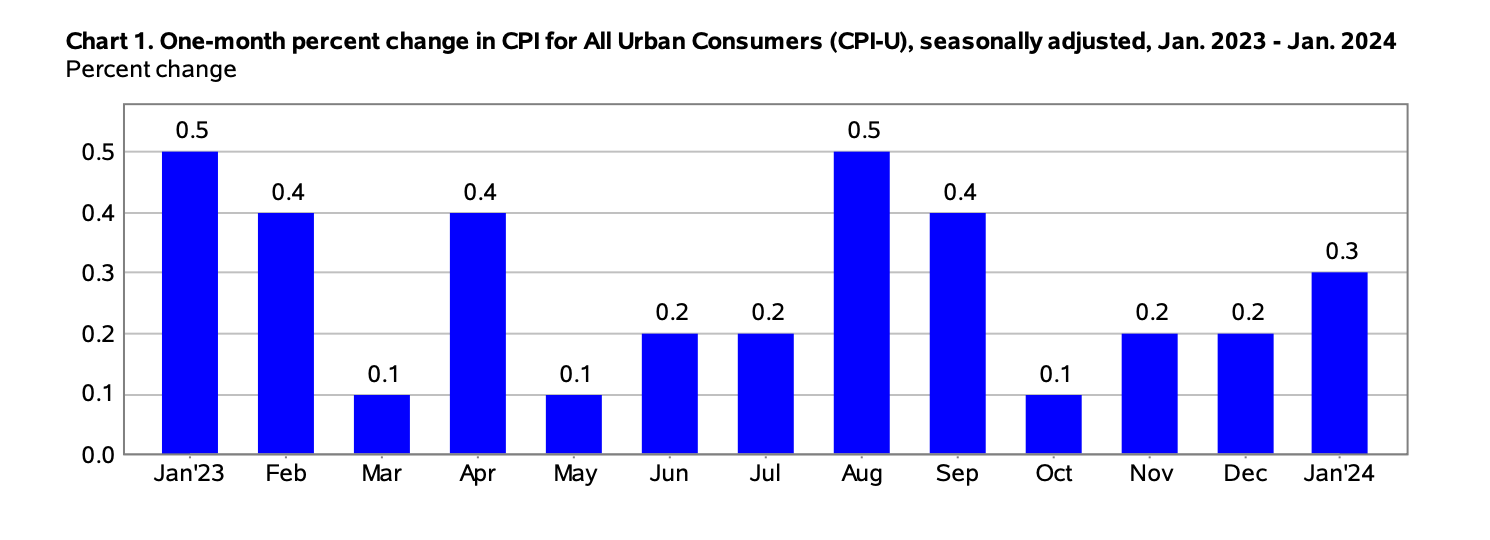

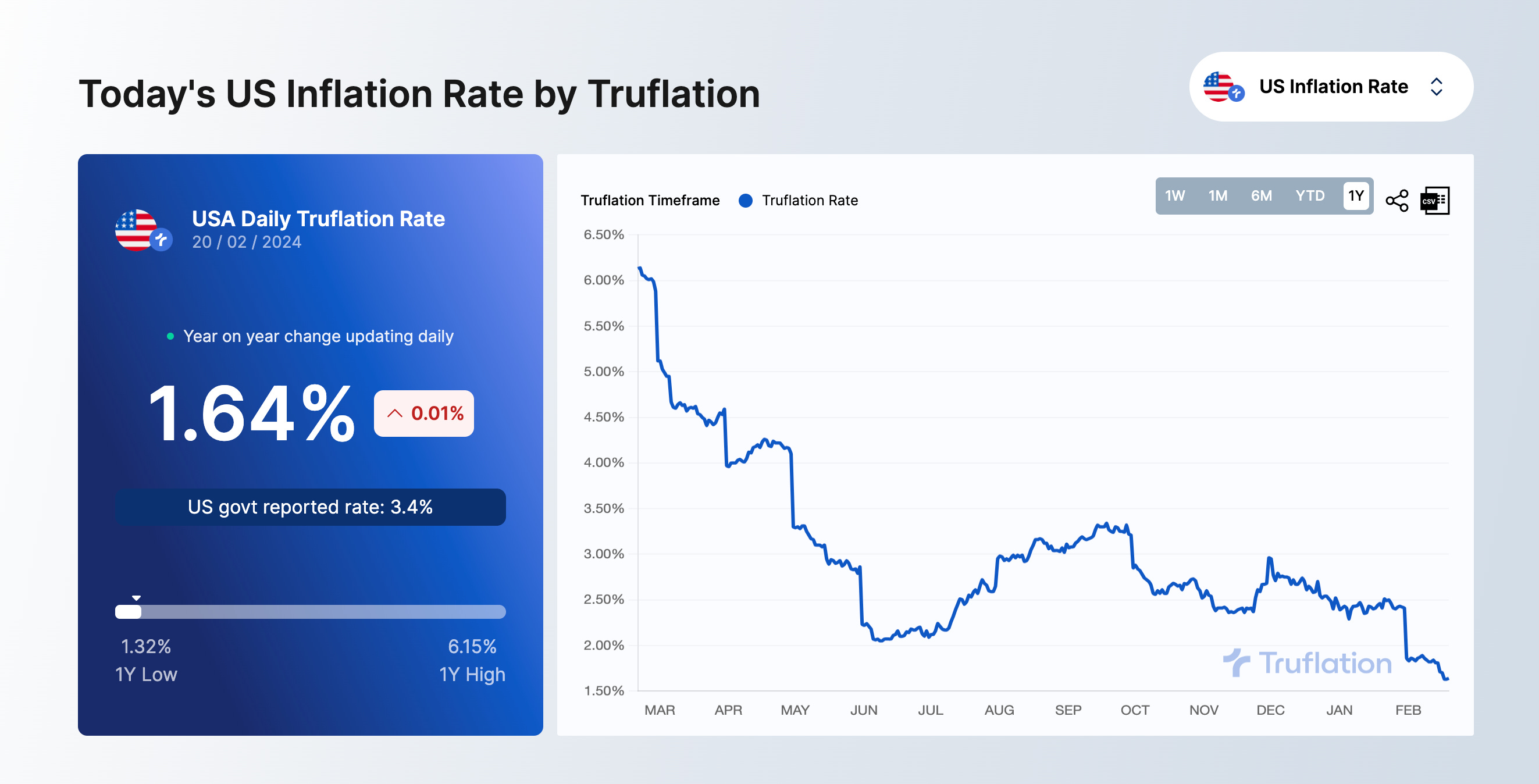

This degradation of confidence on how many interest rate cuts, and how quickly they will occur, is a direct response to the concerning inflation data that has been reported for the last 2-3 months. You can see in this chart from the BLS report of January’s inflation measurement that the month-over-month change has been accelerating for the last 3 months. The higher that monthly inflation goes, the harder it becomes for the Fed to justify cutting interest rates. One of the worst things that could happen for the central bank is a re-acceleration of inflation right before we finally cross the finish line of the inflation fight. This would not only be devastating to Chairman Jerome Powell’s legacy, but it would also create significant damage in the US economy. Consumers would be hurt by higher inflation and investors would be caught offsides since majority of them are prepared for asset prices to rise on the perceived incoming interest rate cuts. So why are so few people talking about potential interest rate hikes? Bianco highlights a little known fact — the central bank of New Zealand has been one of the leaders over the last few years in global monetary policy. He said:

This information will be shocking to many people. It was to me. But it makes sense. A small country has an easier time thinking independently than a large, globally important country because the smaller country has less scrutiny and pressure. If inflation is not going away, and it is continuing to accelerate month-over-month at a rate close to 4% annualized, central banks would continue increasing interest rates. However, the problem now is that the Fed told the market that they were done hiking interest rates. Market participants don’t want an unreliable Federal Reserve. They rely on the Fed to do what they said they were going to do. The Fed violated this once already in the last four years. They told the market that the interest rates were going to stay near 0% for years. By the time the central bank began hiking interest rates at the fastest pace in history, market participants found themselves completely unprepared. Remember when regional banks were failing on a daily basis? That was a direct result of the Fed doing something other than what they had said they were going to do. So now the Fed has backed themselves into a corner — they told the market that the interest rate hikes are done. The fight against inflation is almost won. Be prepared for multiple interest rate cuts in 2024. It would be very unfortunate if inflation remains sticky and the Fed has to change their mind. But with each passing day, those odds are getting higher. I am not prepared yet to argue that it is likely the Fed is going to hike interest rates, but I believe the odds to be much higher than most of the market thinks. That spells opportunity and potential disaster depending on how you look at it. Keep your eye on the inflation data and start thinking critically about how the Fed may respond if the data gets worse. It could help you see around the corner before everyone else. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Jim Bianco is the President and Macro Strategist at Bianco Research. He also has an ETF, called the WisdomTree Bianco Fund (WTBN). In this conversation, we talk about the pros and cons of bitcoin ETF, similarities to the gold ETF, centralized ownership of bitcoin, macro economy, federal reserve, interest rates, and more. Listen on iTunes: Click here Listen on Spotify: Click here Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Bitcoin Is Not A Popular Medium-Of-Exchange

Monday, February 19, 2024

Listen now (6 mins) | To investors, Satoshi Nakamoto published the bitcoin whitepaper on October 31, 2008. The paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” In the abstract,

Government Says People Better Off Now, Yet People Disagree

Monday, February 19, 2024

Listen now (3 mins) | Today's letter is brought to you by Sidebar! Ready to supercharge your career in 2024? Sidebar is an exclusive, highly curated leadership program designed to propel you to new

Can The Average Person Retire By Buying Bitcoin Today?

Tuesday, February 13, 2024

Listen now (4 mins) | READER NOTE: Today is a free email to everyone. I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a

The Bitcoin ETFs Are Sounding The Alarm

Monday, February 12, 2024

Listen now (5 mins) | READER NOTE: Today's letter is exclusive for paying subscribers of The Pomp Letter. I have unlocked the first half of the letter for everyone, but if you want to see the full

Shrinkflation Has Seeped Into The Housing Market - What You Need To Know

Thursday, February 8, 2024

Listen now (6 mins) | Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these