The First Public Pension Funds To Buy Bitcoin Are Up 10x Now

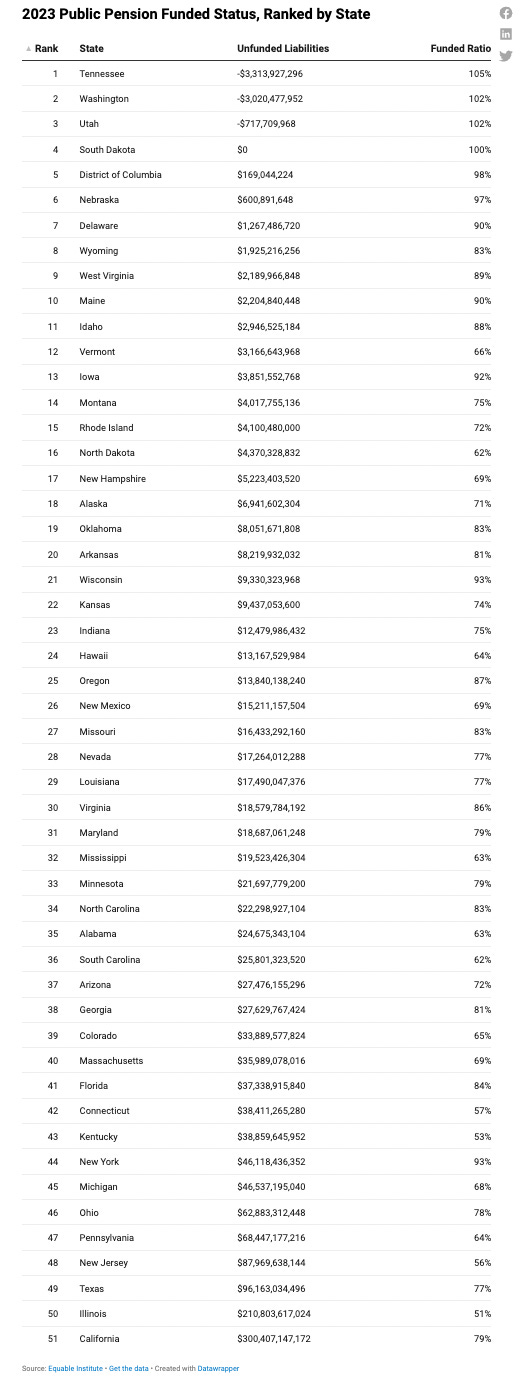

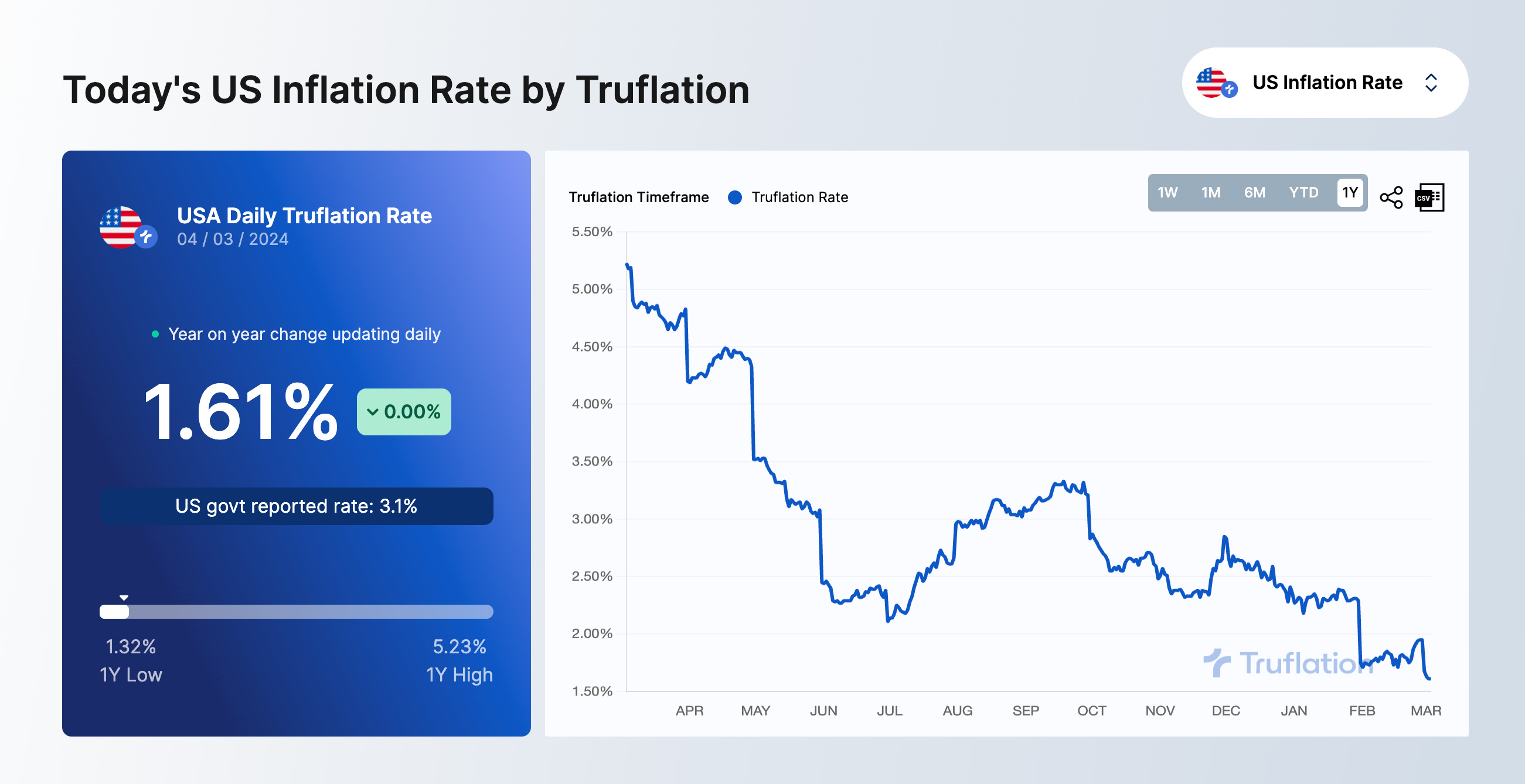

To investors, I spoke this weekend at a conference focused on the intersection of economics and American leadership. Those two topics rarely go together. Economics is reserved for the nerds and politics is reserved for the power hungry. But we must recognize that these two topics are more intertwined than we previously admitted. The American economy is in a precarious position. Asset prices are rocketing upwards, inflation won’t go away, and interest rates have already been increased at a record pace. The average consumer is pretending to hold it all together by spending unprecedented amounts on their credit cards and the dollar has been devalued nearly 20% since the start of 2020. Great leadership is needed in times of turmoil. We need incredible leaders in the White House, at the Fed, and in both Congress and the Senate. Some of you will say that great leadership is already in these positions, while others will explain how unfit the current leadership is for the moment. Regardless of which side of the fence you fall on, it is obvious that it will take strong leadership to guide us out of this mess. One area where we have seen crisis before is in the funding of US public pensions. According to Equable, here is how bad the situation has become:

This is a time-bomb waiting to go off in the economy. Millions of people are preparing to retire, yet the government won’t have the money to help when they are needed most. Thankfully, a number of the CIOs at these public pensions realize they need to do something different. This includes allocating capital to areas that have been previously ignored — private equity, venture capital, bitcoin, etc. In December 2018, I wrote to this group in a letter titled “Every Pension Fund Should Buy Bitcoin” with an explanation on why every public pension fund should purchase bitcoin. Here was my logic:

I continued in the same letter and explained that the pension funds only needed to put 1% of their assets into bitcoin to have a material impact:

Not many pension funds acted on my argument. Thankfully, there were two pension funds that did though — the Fairfax County Police Officers Retirement System and the Fairfax County Employees’ Retirement System. They were the first public pension funds to get exposure to bitcoin through a blockchain-dedicated fund that my partners and I managed. The CIOs of those pension plans, Katherine Molnar and Andrew Speller, will never get the credit they deserve for having the vision and courage to make a bitcoin allocation in 2018/2019. The average purchase price of the Fairfax pension funds’ bitcoin position in early 2019 was under $6,000 per bitcoin. This means that the first public pension funds in America to get bitcoin exposure are up more than 10x on their bitcoin allocation. Why is this important? If every state pension fund had bought 1% exposure to bitcoin when I wrote the letter, the list of fully funded state pension funds would have jumped from only 4 to at least 14 state pension funds. That is more than a 300% increase in the number of fully funded state pension funds. This doesn’t count the impact that would have occurred on the hundreds of other pension funds in America is they had all put a 1% allocation into bitcoin too. We can’t change what has already happened, so we have to look forward. There are many people who will argue that pension funds shouldn’t buy bitcoin today because the returns have already been captured. I disagree with this thought process. It is true that past performance does not indicate future performance, but the current fundamentals and market structure of bitcoin, specifically the drastic imbalance in supply and demand, should lead to a continued outperformance in the asset for the next few years. The first public pension funds to invest in bitcoin are up more than 10x on their allocation to the digital currency. A few other public pension funds (Houston Firefighters, etc) have made small investments in bitcoin over the last three years. But we are nowhere near actual adoption by these asset allocators as a material percentage of their industry. My expectation is that this under-allocation to the best performing asset of the last 15 years will change now that the bitcoin ETFs are available to these pension investment teams. Time will tell how impactful the allocation will be on performance returns. Regardless, there are tens of millions of Americans who may need bitcoin in their pension fund to ensure they are paid the amounts that have been promised them. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Darius Dale is the Founder & CEO of 42Macro. In this conversation, we look at their Weather Model and what it is telling us about stocks, bonds, bitcoin, we also talk about global liquidity, inflation, and impact of politics on financial markets. Listen on iTunes: Click here Listen on Spotify: Click here Bitcoin Continues To Look Bullish Against Macro Backdrop Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Financial World Is Starting To Understand Bitcoin

Wednesday, February 28, 2024

Listen now (3 mins) | To investors, There is something special happening in the bitcoin market right now. It feels like the global financial world has started to understand what the asset is and why it

Bitcoin Is Sounding The Alarm On Inflation

Tuesday, February 27, 2024

Listen now (6 mins) | Today's letter is brought to you by Crypto Academy! Do you want a job in the crypto industry? My team and I have been working with the top HR teams in the industry to create a

There Are No Winners In An Inflation Fight

Monday, February 26, 2024

Listen now (4 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

You Won't Believe These Stats About The Market

Thursday, February 22, 2024

Listen now (3 mins) | To investors, Investing is an endless pursuit of learning. No matter how much you think you know, there is always something new around the corner. The world is dynamic. The future

SURPRISE: What If The Fed Has To Raise Interest Rates Instead Of Cut Them?

Tuesday, February 20, 2024

Listen now (4 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these