Bitcoin Enters Price Discovery - New All Time High

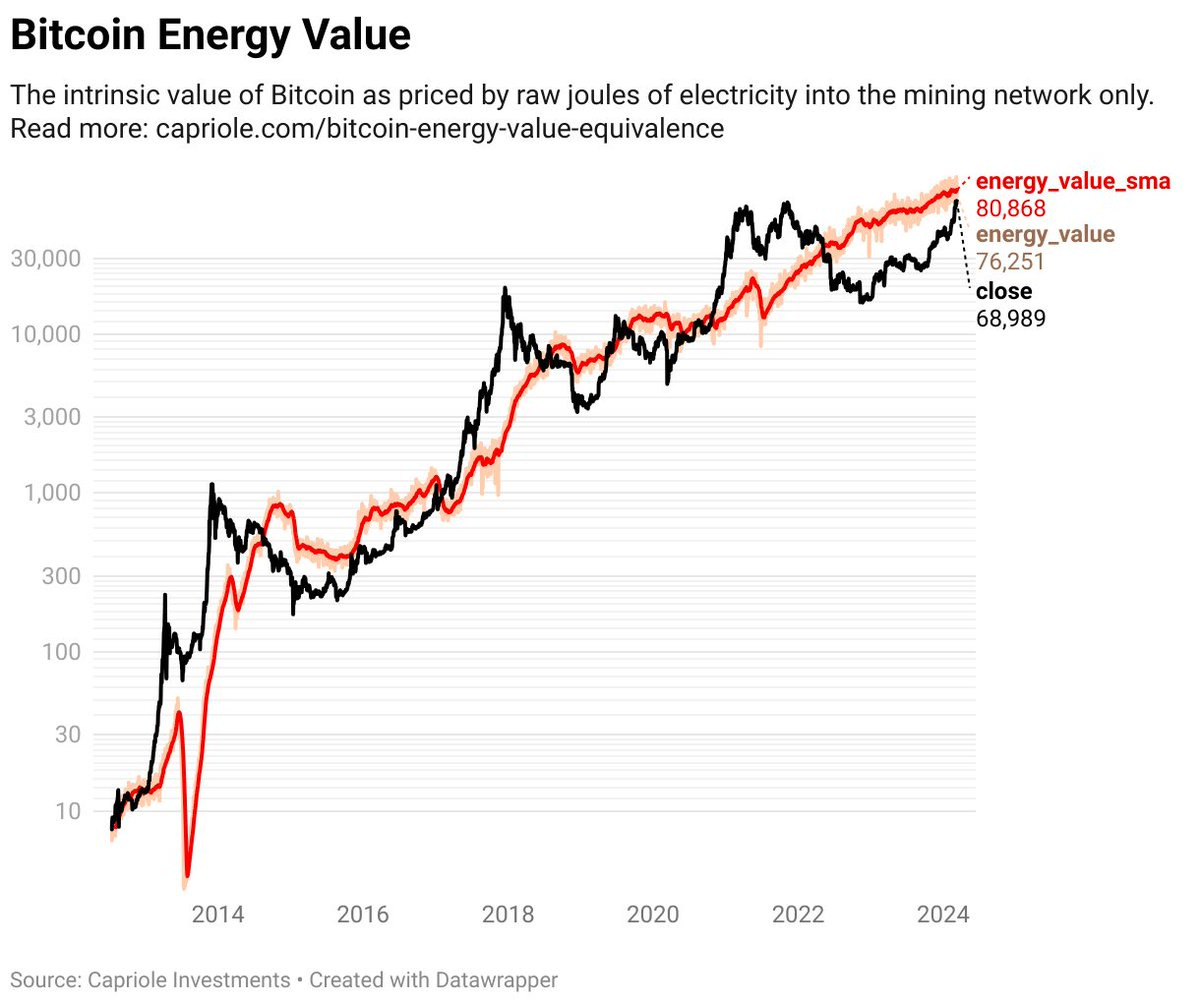

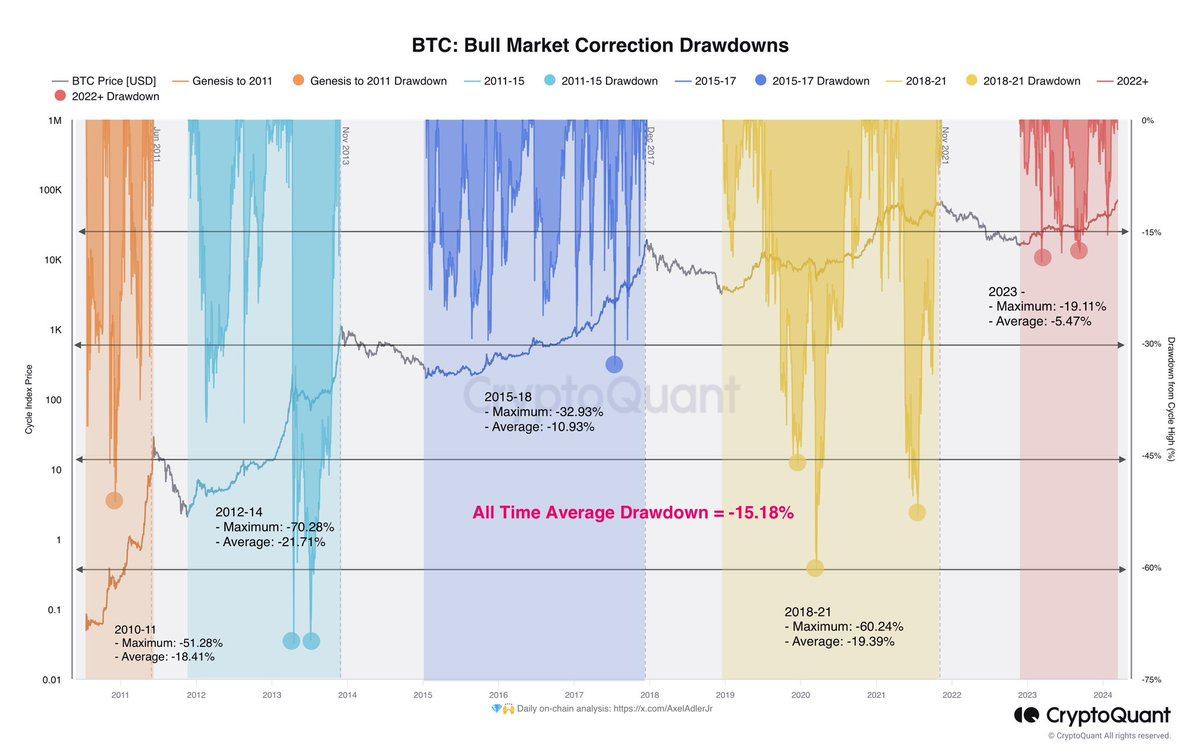

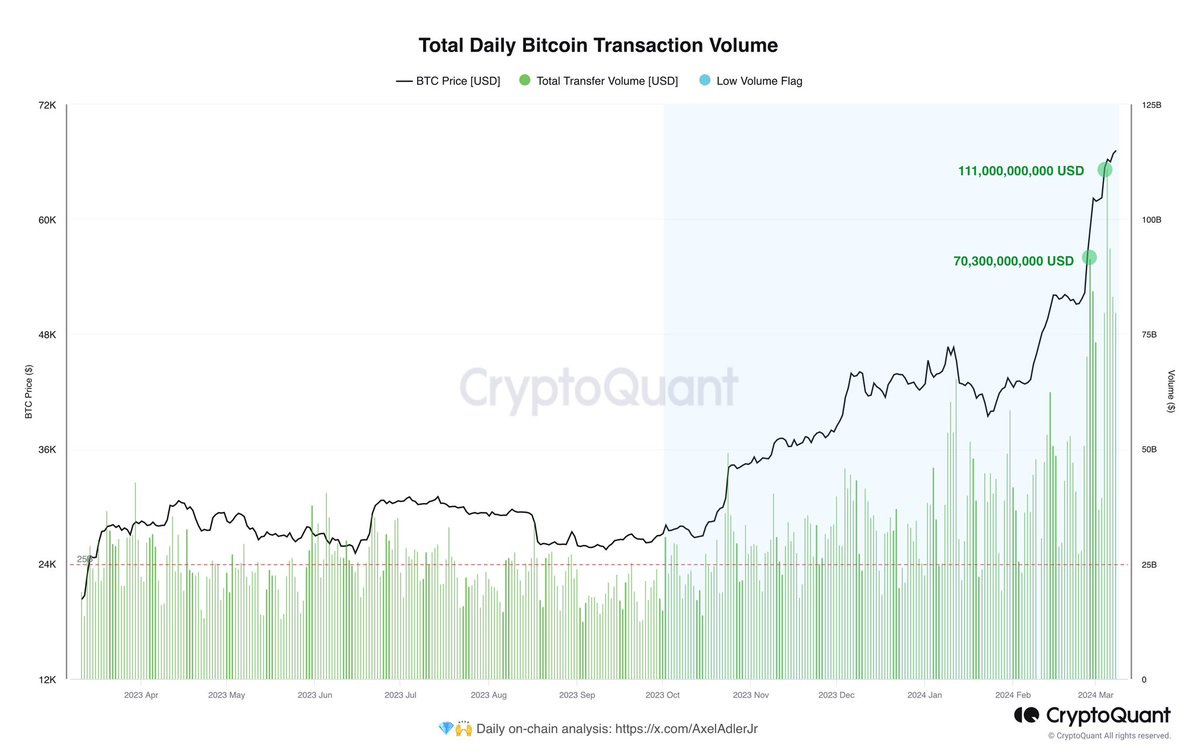

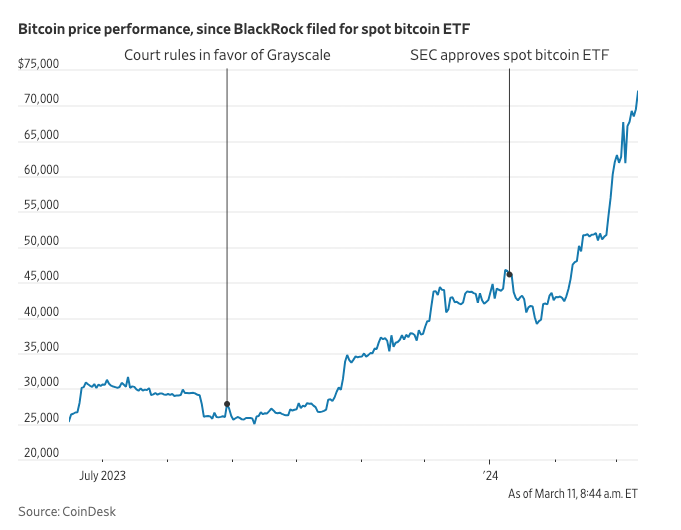

Today’s letter is brought to you by Bitcoin Investor Day!I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for sophisticated Wall Street investors who are interested in bitcoin. Speakers include Cathie Wood, Mike Novogratz, Anthony Scaramucci, Mark Yusko, Head of Digital Assets at BlackRock, Bitwise CEO, Head of Research at Fidelity & VanEck, and many more. Tickets are only $50 and the venue is incredible. This will be one of the highest quality bitcoin conferences of the year. See you there! To investors, Bitcoin hit a new all-time high of $72,000 this morning. As Balaji Srinivasan highlighted, the digital currency has now hit a new all-time high in every currency in the world. In many recent conversations, investors from the traditional finance industry have asked me “what is the value of bitcoin today?” They are specifically referring to the difference between price and value. One way to think about this is through bitcoin energy value. As Capriole Fund’s Charles Edwards points out, bitcoin’s energy value currently sits at approximately $81,000. Regardless of the true value of bitcoin, the price has been acting in a different way than past market cycles. Bitcoin analyst Alex Adler Jr explains the risk of correction in this bull cycle by saying, “the average drawdown [in this cycle] is -5.47%, and the maximum is -19.11%. Compare this with past cycles and the all-time average drawdown of -15.18% to make informed decisions about your investments.” Adler also shows “starting from October 2023, the volumes of daily transactions show growth, with the peak occurring on March 5 with a volume of $111 billion. The figure is simply huge, as some island nations have a smaller annual GDP.” It is unprecedented for bitcoin to reach new all-time high prices before the halving. Given that we are less than 50 days away from that supply shock, it is hard to construct a bearish narrative through the end of 2024. We can see that two events over the last year led to bitcoin’s rise and my guess is that the halving will be the third event on this chart in hindsight. The spot bitcoin ETFs are still buying hundreds of millions of dollars of bitcoin per day. Microstrategy is pouring in hundreds of millions of dollars every few weeks. Most of the distribution platforms, such as Morgan Stanley, have not been turned on yet, but rumors are they have been racing to make the asset available to their clients. And President Trump said on CNBC this morning that bitcoin has too many use cases now, so he would find it difficult to ban. The funny thing about bitcoin is that it is immune to the noise. The network continues to produce block-after-block of transactions, regardless of what is happening in the world. Bitcoin didn’t care when the price was crashing and the bears were dancing on graves. Bitcoin doesn’t care today when price is surging and the world feels under-allocated to the asset. Hard money is eating the world. Investors are realizing that they need the asset in order to be prepared for an uncertain future. Eventually everyone comes to the same conclusion. Hope you have a great start to your week. I’ll talk to you tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. John Egan is the Head of Crypto at Stripe. In this conversation, we talk about the crypto industry and how Stripe is interfacing with the technology, what they have been building, how their products work, bridging the gap between Web2 and Web3, stablecoins, and more. Listen on iTunes: Click here Listen on Spotify: Click here How Stripe Is Building For Bitcoin & Crypto Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Decentralized, Open-Source Technology Is Immune To Geopolitics

Thursday, March 7, 2024

Listen now (4 mins) | To investors, Liza Lin wrote a story in the Wall Street Journal this morning titled “China Intensifies Push to 'Delete America' From Its Technology.” It clearly

History Shows Bitcoin's Volatility Is Net Positive

Wednesday, March 6, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

Bitcoin's Price Has Doubled Quickly After Every New All-Time High

Tuesday, March 5, 2024

Listen now (3 mins) | To investors, Bitcoin almost broke the previous all-time high of $69000 yesterday. It came within $500 and has since retreated from the milestone. Given the persistent demand for

The First Public Pension Funds To Buy Bitcoin Are Up 10x Now

Monday, March 4, 2024

To investors, I spoke this weekend at a conference focused on the intersection of economics and American leadership. Those two topics rarely go together. Economics is reserved for the nerds and

The Financial World Is Starting To Understand Bitcoin

Wednesday, February 28, 2024

Listen now (3 mins) | To investors, There is something special happening in the bitcoin market right now. It feels like the global financial world has started to understand what the asset is and why it

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these