The Pomp Letter - Will We Repeat The Great Inflation?

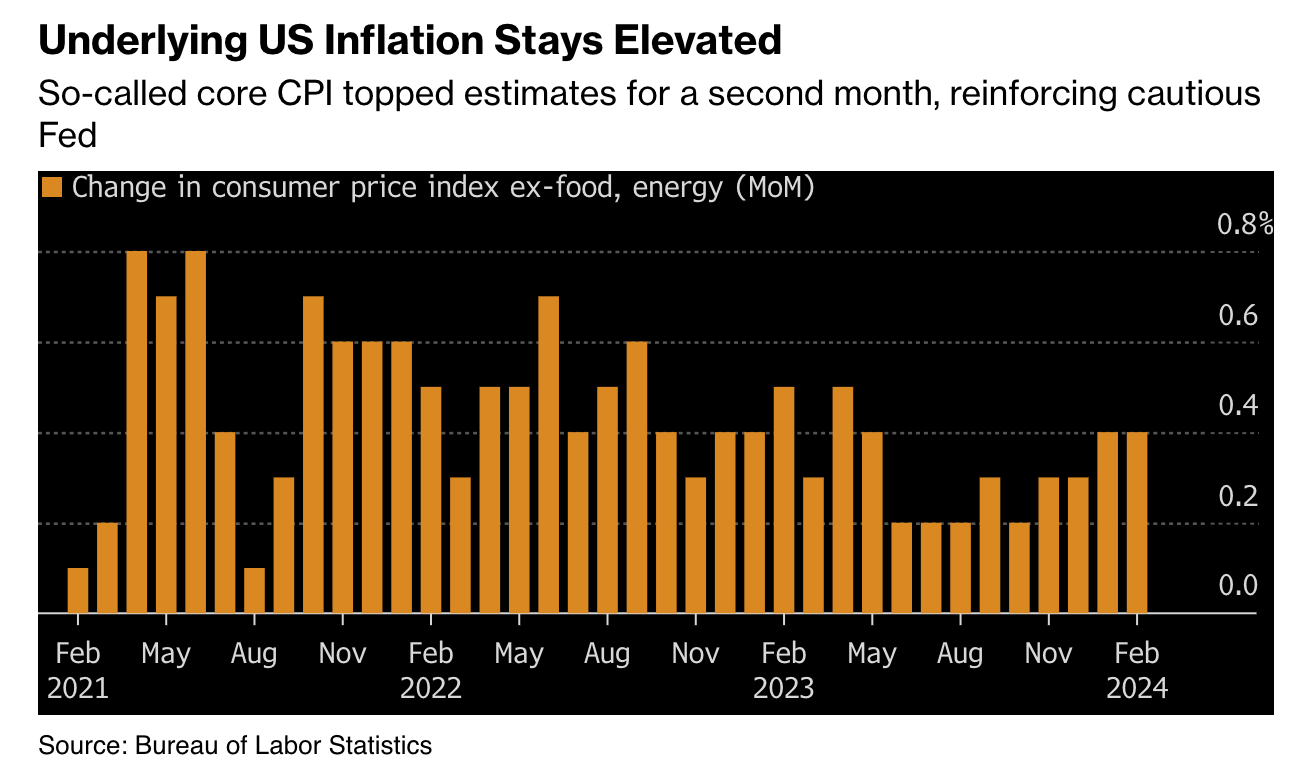

Today’s letter is brought to you by Espresso Displays!I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop. So I started to use a second screen and it seems to have fixed the issue. It took awhile to evaluate many different screens — Espresso Displays was by far the best one. I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself. Any reader of The Pomp Letter who orders one today will get $100 off before midnight. Highly recommend! To investors, Inflation is becoming a big problem again. February’s core CPI numbers show that month-over-month inflation growth has been accelerating since October 2023. Augusta Saraiva writes, “the so-called core consumer price index, which excludes food and energy costs, increased 0.4% from January, according to government data out Tuesday. From a year ago, it advanced 3.8%.” Ken Griffin, the founder of Citadel, sees this rise in inflation as a key reason why the Federal Reserve should not rush to cut interest rates. Griffin said the following at a conference yesterday:

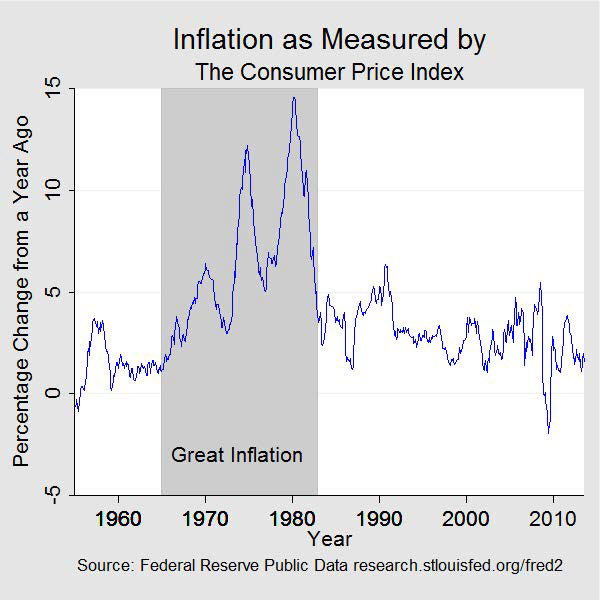

It makes sense that people would be spooked if the Federal Reserve became unpredictable or volatile in their decision-making. But the truth is that the Fed shouldn’t be worried about their reputation at this point — they have a much bigger problem on their hands with the potential resurgence of inflation. Unfortunately, we have a historical example of what could happen. The Great Inflation of 1965 - 1982 had an initial surge of inflation, followed by what seemed to be inflation falling to manageable levels, before inflation resurged to even higher levels of pain and destruction. Michael Bryan, who served at the Federal Reserve Bank of Atlanta, describes that time period with the following paragraph:

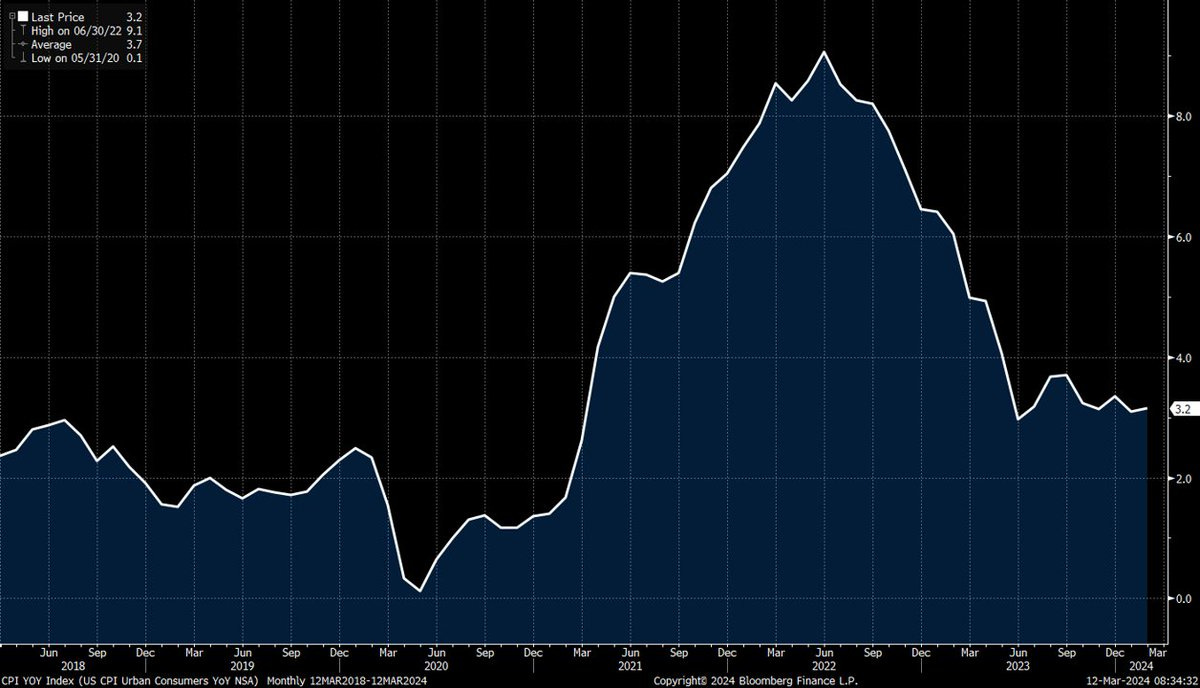

It would be catastrophic to endure another two decade period of mismanagement to the degree we saw during The Great Inflation. While I don’t think our future is that bleak, it wouldn’t be surprising to see inflation continue to return with a vengeance. Ben Hunt posted this chart and said, “Friends, every month I make the same post. Inflation stopped going down 8 months ago. Wage and price inflation is embedded well above target. I don't know why this is so hard to understand.” Again, not exactly what you want to see if the Fed has been telling you that inflation should continue to come down and will be under control shortly. This chart seems to show a new average inflation number post-pandemic that is noticeably higher than pre-pandemic levels. As Lisa Abramowicz from Bloomberg explains, “the Atlanta Fed's gauge of sticky inflation has risen to about 5% on a 3-month annualized basis. Inflation is moving in the wrong direction for the Fed, so it's interesting that the market's base case is still that the Fed is going to cut rates by about 100bp by January 2025.” So rather than scratch your head asking yourself why bitcoin and the stock market are at all-time highs when interest rates are over 5%, you should probably ask yourself why these assets aren’t higher given how crazy things could get if inflation mounts a comeback. Let’s hope for everyone’s sake that inflation will be slayed, but don’t hold your breath for it to happen. Hope you all have a great day. I’ll talk to each of you tomorrow. -Anthony Pompliano Darius Dale is the Founder & CEO of 42Macro. In this conversation, we talk about inflation, small business optimism, bitcoin, stocks, energy, global liquidity, and macro environment. Listen on iTunes: Click here Listen on Spotify: Click here Bitcoin and Stocks at All-Time Highs - But Things Are Still Bullish? Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Bitcoin Enters Price Discovery - New All Time High

Monday, March 11, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

Decentralized, Open-Source Technology Is Immune To Geopolitics

Thursday, March 7, 2024

Listen now (4 mins) | To investors, Liza Lin wrote a story in the Wall Street Journal this morning titled “China Intensifies Push to 'Delete America' From Its Technology.” It clearly

History Shows Bitcoin's Volatility Is Net Positive

Wednesday, March 6, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

Bitcoin's Price Has Doubled Quickly After Every New All-Time High

Tuesday, March 5, 2024

Listen now (3 mins) | To investors, Bitcoin almost broke the previous all-time high of $69000 yesterday. It came within $500 and has since retreated from the milestone. Given the persistent demand for

The First Public Pension Funds To Buy Bitcoin Are Up 10x Now

Monday, March 4, 2024

To investors, I spoke this weekend at a conference focused on the intersection of economics and American leadership. Those two topics rarely go together. Economics is reserved for the nerds and

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these