The Pomp Letter - Depression Or Dog Coins To A Trillion

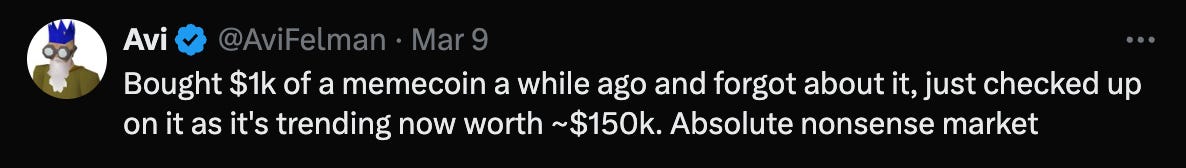

To investors, There is one phrase that has been seared into my brain over the last few months — “Depression or dog coins to a trillion.” This sentence was shared with me by Asymmetric’s Joe McCann during an interview where we discussed the current economic situation in America. Joe’s comment was meant to highlight the difficulty that the Federal Reserve is facing. The central bank can keep interest rates at the current level in an attempt to cool off some of the craziness in financial markets, especially since stocks and crypto are at all-time highs, but that would risk pushing the larger economy into a recession (note: depression sounds scarier for the shock effect of his comment). No one wants a recession. The alternative option is for the Fed to cut interest rates and stimulate the economy. Under this scenario, dog coins go to a trillion dollar market cap. In Joe’s phrase, dog coins are a proxy for the insanity that is playing out in the edges of financial markets. If you scroll Twitter/X for a few minutes, you see numerous people talking about how much money they made by buying some stupid name cryptocurrency coin. As Avi Felman points out here, the market makes no sense. Serious investors know that these assets have zero real world utility, nor do they have any fundamental value. The only reason that the memecoins are going up-and-down in value is because humans love to gamble. They love the promise of getting rich quickly. But the history of finance has taught us how this ends — it is fun in the short-term and disastrous in the long-term. That won’t stop people from speculating on these new coins. To put the velocity of this trend in context, Ram Ahluwalia highlighted that 2,500 memecoins were created on Solana in a single hour. Think of how insane that number is. This is exactly what Travis Kling means when he talks about financial nihilism. Here is how he defined that phrase in a recent article:

That sounds about right. People feel like there is no other option than to speculate in markets, regardless of how small the probability of this strategy working. Hope is not a math equation, but it sure feels good if you are desperate. Speaking of desperation, remember the Fed is in a similar situation as individual Americans. They have a $34 trillion debt hanging over their head and no clear path to solving problem. If the dollar continues to be debased, the insanity of financial markets continues. If the Fed stops debasing the dollar, the US possibly defaults on the debt. Heads you lose, tails you lose. Gamblers run the casino in either scenario. So what is going to happen moving forward? This may shock you, but the central banks and governments are going to have to enter the corners of financial markets. The Fed is not going to buy dog coins, but we are starting to see larger governments become interested in bitcoin. This morning a report surfaced from Arjun Kharpal with the following information:

This doesn’t mean that GPIF is going to buy bitcoin, but it does mean that it is at least willing to evaluate the prospects of doing so. Remember, depression or dog coins to a trillion. The game has changed. Asset allocators now have to consider a range of possibilities that they previously would have only laughed at. You can either stand in the way of the macro problems and get steamrolled, or you can join the insanity and position yourself to benefit from the macro tailwinds. Slowly, but surely, more organizations are realizing that they may have no choice. To conclude, the story of the crypto market right now is bitcoin and memecoins. They live at opposite ends of the risk spectrum, but that is what everyone is focused on. The natural barbell separates the logical capital allocators from the speculators and gamblers. But both groups seem to be winning at the moment, so we shouldn’t be surprised that this degree of success is attracting more people. Let’s just hope the memecoins don’t end in misery, because then there will be a lot of people who wish they had simply stuck with bitcoin. Have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Arthur Hayes is the Co-Founder of BitMEX and CIO of Maelstrom Fund. In this conversation, we talk about bitcoin, macro environment, banks, Microstrategy, Altcoin ETFs, stablecoins, various playbooks different nations are using, bull market predictions, portfolio construction, and more. Listen on iTunes: Click here Listen on Spotify: Click here Arthur Hayes: Bitcoin Is Going To $1 Million Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Long-Term Bitcoin Holders Are Beginning To Sell

Monday, March 18, 2024

Listen now (3 mins) | To investors, Bitcoin holders that previously showed strong-hands are starting to sell their bitcoin. This shouldn't be a surprise — as the price of bitcoin rises, some

El Salvador Owns More Bitcoin Than We Thought

Friday, March 15, 2024

Listen now (3 mins) | To investors, The bitcoin spot ETFs have sucked all the air out of the room over the last two months. With more than $60 billion collectively in the various ETFs and more than $1

Will We Repeat The Great Inflation?

Wednesday, March 13, 2024

Listen now (3 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

Bitcoin Enters Price Discovery - New All Time High

Monday, March 11, 2024

Listen now (3 mins) | Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for

Decentralized, Open-Source Technology Is Immune To Geopolitics

Thursday, March 7, 2024

Listen now (4 mins) | To investors, Liza Lin wrote a story in the Wall Street Journal this morning titled “China Intensifies Push to 'Delete America' From Its Technology.” It clearly

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these