The Pomp Letter - This Is A Bitcoin Drawdown For Ants

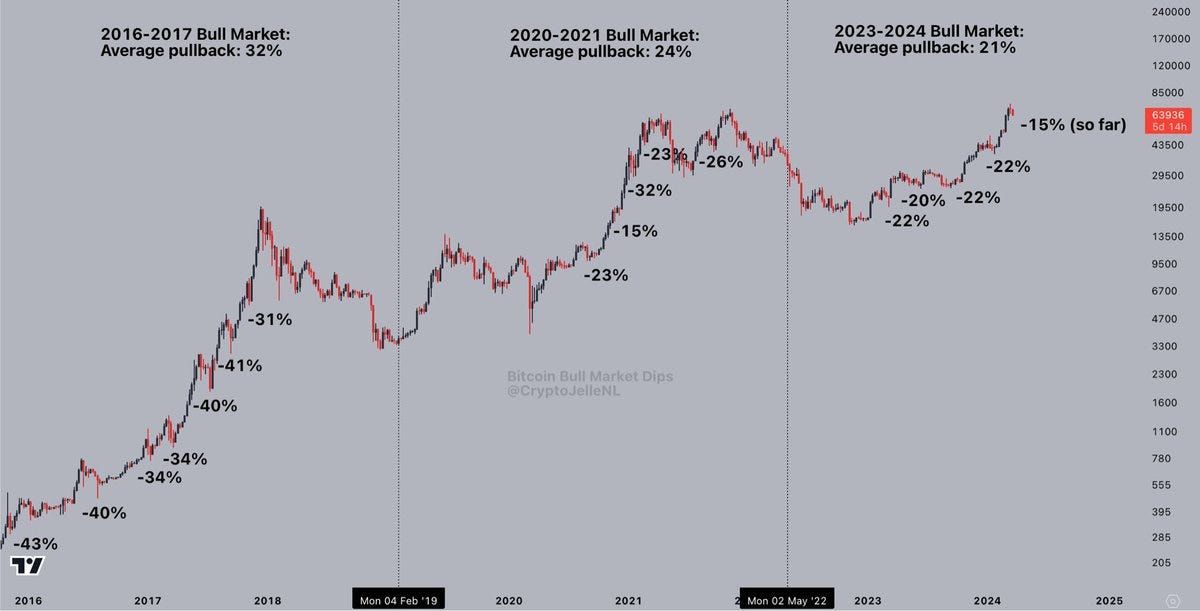

Today’s letter is brought to you by Bitcoin Investor Day!I am hosting the first Bitcoin Investor Day in New York City this Friday in New York City. It is an annual meeting for sophisticated Wall Street investors who are interested in bitcoin. Speakers include Cathie Wood, Mike Novogratz, Anthony Scaramucci, Mark Yusko, Head of Digital Assets at BlackRock, Bitwise CEO, Head of Research at Fidelity & VanEck, and many more. Tickets are only $50 and the venue is incredible. This will be one of the highest quality bitcoin conferences of the year. See you there in 2 days! To investors, Bitcoin hit an all-time high price over the last 10 days, but now many people are wondering why the price of the digital currency is dropping aggressively. We have seen Bitcoin go from over $72,000 to as low at $61,000 in the matter of 5 days. That sounds horrific, right? Is the bull market over before it even began? Did something break in the market? Should investors make different decisions with their portfolio? Hold on. Everyone take a deep breath. There is no reason to panic. Let me explain. Bitcoin is currently experiencing a drawdown of ~ 15% from the recent high. While this may seem like a large percentage, it is actually quite small compared to what we have seen in previous bull markets. As I mentioned on Bloomberg yesterday, this is a drawdown for ants. Seriously, that was my message. You can watch the full segment here:  Alex Thorn, Head of Research at Galaxy, points out that the last two bull markets have consistently seen many similar drawdowns. In 2017, there were 13 different drawdowns of more than 12% as the price ~ 20x throughout the year. In the 2020-2021 bull market, there were at least 13 different drawdowns of 10% or more. To take the analysis even further, this current drawdown is not even the worst drawdown of the current bull market. You can see in this chart from analyst Jelle that there have been four drawdowns of at least 20% so far in 2023 - 2024. On the left side of the chart above, there were 7 pullbacks of at least 30% in the 2017 bull market. In the middle, there were four drawdowns of 23% or more. And the average drawdown in each bull market, including the current one, is 21% or higher. Bitcoin is a volatile asset. If you want to enjoy volatility to the upside, you have to stomach the volatility to the downside. Wall Street is being introduced to a truly free market asset. There are no hours of operation. There are no circuit breakers. This asset trades based on global supply and demand. It goes up a lot. It goes down a lot. But over time, it has continued to outperform almost every other asset in the world. A common phrase in finance is to “know what you buy.” Bitcoin isn’t your grandpa’s stock index. This is a new digital asset that is being re-priced by hundreds of millions of investors around the world. Volatility is necessary to get to where we are going. And the best part? The great investors seek out volatility. They understand that asset prices don’t go up in a straight line. It is understood that you don’t try to trade assets like this. You simply buy them and hold on. And that has been a great strategy for bitcoin over the years. I don’t see that changing any time soon. Take a deep breath. Drawdowns are normal. This one is a drawdown for ants. The world will keep spinning. Bitcoin will keep producing block-after-block of transactions. And we’ll likely be back to new all-time highs before you know it. Hope everyone has a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Mark Yusko is the Founder, CEO & CIO of Morgan Creek Capital Management. In this conversation, we talk about bitcoin, ETFs, macro environment, opportunities, memecoins, and future outlook of the industry. Listen on iTunes: Click here Listen on Spotify: Click here Mark Yusko on Institutional Demand for Bitcoin Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

This Is A Bitcoin Drawdown For Ants

Wednesday, March 20, 2024

Today's letter is brought to you by Bitcoin Investor Day! I am hosting the first Bitcoin Investor Day in New York City this Friday in New York City. It is an annual meeting for sophisticated Wall

Depression Or Dog Coins To A Trillion

Tuesday, March 19, 2024

Listen now (5 mins) | To investors, There is one phrase that has been seared into my brain over the last few months — “Depression or dog coins to a trillion.” This sentence was shared with me by

Long-Term Bitcoin Holders Are Beginning To Sell

Monday, March 18, 2024

Listen now (3 mins) | To investors, Bitcoin holders that previously showed strong-hands are starting to sell their bitcoin. This shouldn't be a surprise — as the price of bitcoin rises, some

El Salvador Owns More Bitcoin Than We Thought

Friday, March 15, 2024

Listen now (3 mins) | To investors, The bitcoin spot ETFs have sucked all the air out of the room over the last two months. With more than $60 billion collectively in the various ETFs and more than $1

Will We Repeat The Great Inflation?

Wednesday, March 13, 2024

Listen now (3 mins) | Today's letter is brought to you by Espresso Displays! I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these