The Signal - The grounds read grim for coffee

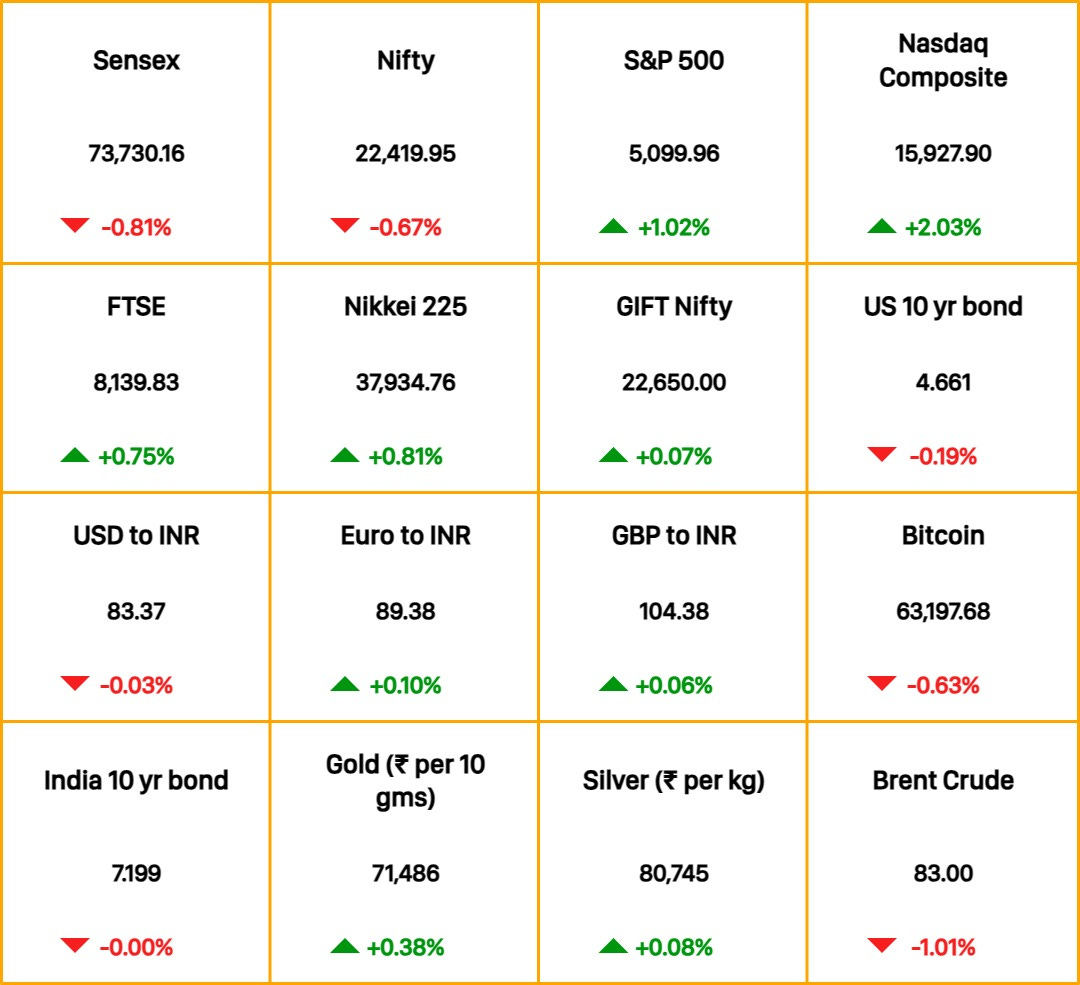

The grounds read grim for coffeeAlso in today’s edition: Indian output craves Chinese inputs; Loan shortage coming upGood morning! Maverick billionaire Elon Musk stood Prime Minister Narendra Modi up last week saying he had “very heavy Tesla obligations”. The Tesla chief has slunk off to China instead to meet the top brass there to push for full-self-driving vehicles and permission to process local data outside the country to train autonomous driving algos. Planespotters locked on to a private Gulfstream jet, which Musk often uses, heading towards Beijing. These are indeed heavy duties. 🎧 The Ozempic effect on India's pharma landscape. Also in today’s episode: the ongoing challenges facing TikTok in the US. Tune in on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. The Market Signal*Stocks & Economy: Foreign portfolio investors sold Indian equities worth nearly $720 million in April. The sale came after a net inflow of over ~$4 billion in March. The Business Standard reports that the sell-off was likely triggered by juicy US bond yields, which have now reached 4.7%. Asian markets opened higher on Monday as traders count down to the Federal Reserve meeting this week. Oil prices fell due to US inflation data, which hurt prospects of interest rate cuts and boosted the dollar. The GIFT Nifty indicates a positive start for Indian indices. COMMODITIESWake Up And Smell The CoffeeMisfortune elsewhere in the world was supposed to be an opportunity for Indian coffee growers but no one looked at the weathercock. Indian farmers predominantly grow the robusta variety—the legacy of an arabica price crash in the early aughts—whose prices have risen dramatically after crops failed in major farming regions such as Brazil, Vietnam, and Indonesia that account for 40% of the global output. The lucky turn, however, is fast fizzling out. Robusta, the staple bean in instant coffee, is a water guzzler, and the hills of Karnataka and Kerala where bulk of it is farmed, are running out of it. Some Indian growers are projecting a robusta yield shortfall of at least 30% this year. Add to that rising costs of packaging and transportation, and the edge of the precipice shows up right away. Read the full story at The Core. PODCASTTune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy. Today, he speaks to Yashwant Deshmukh of C Voter about lower turnouts in Phase 1 and 2 of India's 2024 general elections and the voter ID problem. Also in today’s episode: sugar crop check and outlook with Rahil Sheikh of MEIR Commodities. TRADEMake In India Leans On Made In ChinaIndian industry cannot live without China, it seems. India’s imports from its bigger neighbour grew 2.3 times faster in the past 15 years than shipments from other countries, according to a report from think tank Global Trade Research Initiative (GTRI). In absolute terms, India’s exports to China have stood still at around $16 billion for five years, while imports surged from over $70 billion in FY19 to $101 billion in FY24, 98.5% of which were industrial products. For instance, nearly 30% of all industrial chemical and pharmaceutical input imports come from China. That share rises to 38.4% for electronics and 39.6% for machinery. The telecom, plastics, textiles, ships, glass, paper, and several other industries too depend heavily on Chinese imports. India’s performance-linked incentive scheme has triggered investments in sectors such as electronics and energy storage, but hasn’t performed well in others such as drug making. BANKINGSoon, Bank Loans May Dry UpWill Indian banks become tight-fisted when companies and projects need money the most? Quite likely, according to S&PGlobal Ratings. The rating agency’s director for South and South-east Asia Nikita Anand said banks might be compelled to slow down loan growth as deposit growth will decelerate. Anand expects credit growth to slow by two percentage points in FY25 from 16% in FY24. Every bank’s loan growth was 2-3 percentage points higher than deposit growth, forcing them to temper the former.

FYIStop, please: About 200 shareholders of ICICI Securities, the broking services arm of ICICI Bank, have approached the National Company Law Tribunal against the company’s move to delist from exchanges. Beware: China’s central bank has warned of a Silicon Valley Bank-type of situation developing in Chinese regional banks. Ready but waiting: India and Oman are on the verge of signing a trade agreement but it will have to wait until a new government takes over after June 4. Coup brewing: Knives will be out for British Prime Minister Rishi Sunak should his Conservative Party lose local elections next week as rivals prepare assault. Port politics: Sri Lanka hands over “world’s emptiest airport” near China-operated Hambantota port to a joint venture owned by Indian and Russian companies. THE DAILY DIGIT72,000The net decline in headcount at India’s top six IT services companies in FY24. (The Economic Times) FWIWPresident has a ball: The White House Correspondents’ Association dinner usually is the chance for the occupant of the house to not only freely hobnob with Washington’s political journalists, but also to attack opponents. Joe Biden was not going to be the one to miss the opportunity. He roasted rival Donald Trump, calling him “sleepy Don”, and portrayed himself as a grown man “running against a six-year-old”. Referring to Trump’s criminal trial over allegedly cooking records about paying to buy adult movie star Stormy Daniels’ silence, Biden said, “Donald has had a few tough days lately. You might call it Stormy weather”. Wicked Joe. The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Migrant labour marches into the line of fire

Saturday, April 27, 2024

Indian migrant workers have a long history of repression and poor treatment. In 2024, nothing has changed. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Apple’s playing ball

Friday, April 26, 2024

The iPhone maker is going deeper into live sports, particularly football (or soccer). But it has a long way to go before becoming a destination ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Diamonds are not forever

Friday, April 26, 2024

Also in today's edition: Tight pockets, still; AI fatigue is here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Music to Spotify’s ears

Thursday, April 25, 2024

Also in today's edition: Much ado about mosquito repellants; The days of dirt-cheap data are numbered ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What Zoho has that Google doesn’t

Wednesday, April 24, 2024

Also in today's edition: Bajaj hops on a new ride; Chinese bank sanctions incoming ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Topic 30: Everything You Need to Know about Knowledge Distillation

Wednesday, March 5, 2025

This is one of the hottest topics thanks to DeepSeek. Learn with us: the core idea, its types, scaling laws, real-world cases and useful resources to dive deeper

😎 Bustin' out budget benchmarks

Wednesday, March 5, 2025

Benchmark data by industry plus free budget templates View in browser Masters in Marketing You know that riddle that goes around the tubes now and then? “The poor have it. The rich need it. And if you

🦅 I should've done this sooner

Wednesday, March 5, 2025

Experimenting is good. Working with people that know there stuff is better | Practical ways to convert leads through cold outreach

$120k/Year with a small audience?

Wednesday, March 5, 2025

If you're wondering how to build a thriving business while staying authentic and leveraging the power of SEO and YouTube... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Founder Weekly - Issue 675

Wednesday, March 5, 2025

March 05, 2025 | Read Online Founder Weekly (Issue 675 March 5 2025) Welcome to issue 675 of Founder Weekly. Let's get straight to the links this week. Mr. Wonderful Lost Out on $400 Million… Will

How advertisers unlock measurable outcomes for performance-based campaigns

Wednesday, March 5, 2025

Scaling performance advertising beyond search and social

Your Practical Path to Marketing Automation

Wednesday, March 5, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo We're halfway through the week, Reader, how's your marketing strategy

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🕵️♂️ The “Write to Your Former Self” Growth Hack

Wednesday, March 5, 2025

PLUS A referral growth loop that fuels itself and a funnel that actually converts.

Communities Are The Rage

Wednesday, March 5, 2025

With centralized social media showing many of us how NOT to build community, people and brands are turning to community platforms to build out their own slice of the Web. Marketing Junto | News &