The stragglers: a look at the losers in New Jersey

The stragglers: a look at the losers in New JerseyNew Jersey analysis, Evolution’s Asia factor, Q1 promo analysis +More

Just another candle chasing a spark. Bringing up the rearGranular fever: As the longest-standing petri dish of US sports betting and iCasino, it was a boon to market observers to be given a more granular dataset by the New Jersey Division of Gaming Enforcement for March.

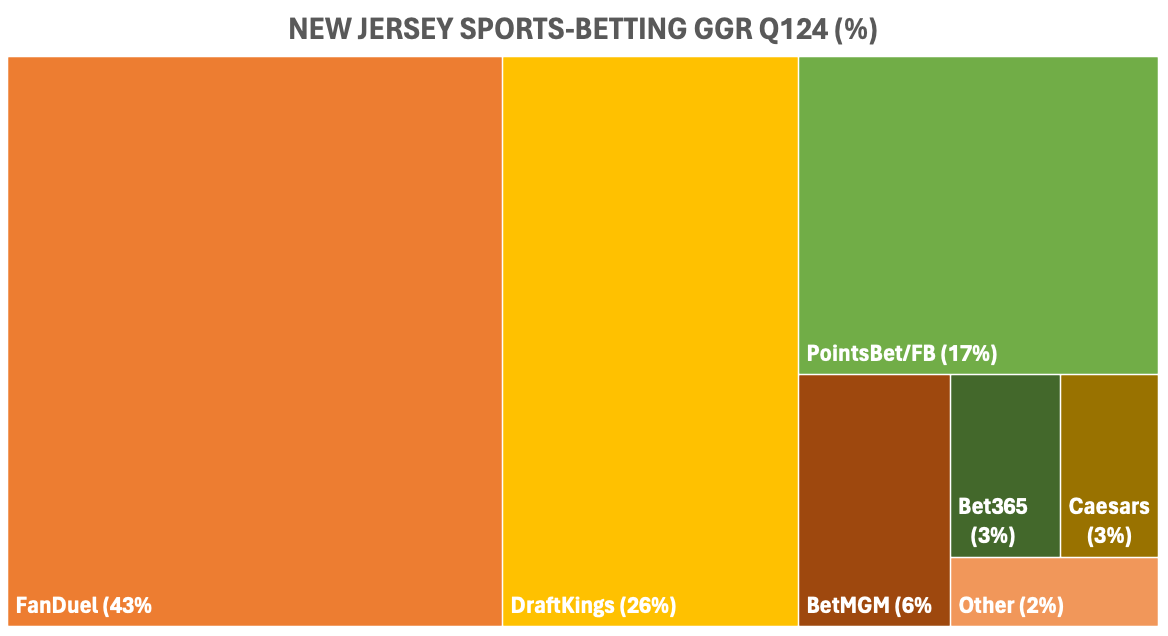

Three’s company too: As a recap, the new data presentation from New Jersey only confirmed what we already knew about the top of the market, namely the dominance of FanDuel and DraftKings, at least throughout Q1.

🥧 GGR in New Jersey in Q1 by operator Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Breaking down the othersWheat and chaff: While the data confirmed what we knew – i.e. FanDuel and DraftKings’ market leadership – it also more clearly defined how badly the losers are performing lower down the ladder. Sporttrade: The first of the betting exchanges in New Jersey, which operates under a skin from Bally’s Atlantic City, is clearly struggling to expand beyond an initial toehold. In March, Sporttrade generated a negative GGR of $188k, which wiped out its accumulated gains from the first two months of the year of $168k and left it $20k in the hole. Betway: Listed parent company Super Group put its US operations under a strategic review in early March, and the New Jersey data indicates just why it is considering its options. The OSB operation made a GGR loss of $115k in March, which more than swallowed up the gain of $108k in the first two months of the year and left it nursing a Q1 loss of slightly more than $7k.

Unibet: Kindred has, of course, just this month pulled the plug on its New Jersey operation and it feels akin to kicking an old dog to point to its performance in Q1, but still… The business managed a GGR profit of $79k in March and a $266k positive outcome for Q1.

Prophet Exchange: The second P2P betting exchange is, in truth, faring no better than rival Sporttrade. Its GGR for March stood at $81k, which at least means it was able to recover from the $35k of losses in January and February, leaving it with a positive Q1 GGR total of $46k. Tipico: A look at Tipico’s numbers perhaps explains why it is thought to be on the verge of selling its US sportsbook backend and presumably shutting up shop in the US altogether. In March, the operation in New Jersey managed a GGR of $292k, which added to the $826k from the first two months of 2024, leaves it with a positive GGR of $1.1m.

Prime: It is far too early to pronounce on Prime Sportsbook’s likely impact in New Jersey after it only got the OK to launch at the tail end of March. All eyes will be on the numbers for the next few months to see how it fares in only its second state after Ohio. BetParx: With a footprint in Pennsylvania, Michigan, Ohio and Maryland alongside New Jersey, it might sound harsh to suggest this is one of the stragglers. However, the sports-betting data shows it’s barely keeping its head above water in the Garden State with a positive GGR of $232k in March and a Q1 total of $627k.

SuperBook: The Las Vegas-based SuperBook has been in operation in New Jersey since August 2021, hoping to target the ‘sharp’ audience, but it is yet to make much of an impression. GGR in March amounted to $131k, helping to make up for the minor $9k loss in January and February and leaving it a Q1 total of $121k. Tier 2 challengersAside from the actual Tier 2 or BetMGM, Caesars and now Fanatics, several brands are pushing to establish a position behind the leaders. Hard Rock Bet: Having only launched in August, Hard Rock is still in the early stages not only in New Jersey but also nationally. As such, the poor March outcome with a GGR of only $7k is merely a blip even just in terms of the quarterly GGR of $1.5m. ESPN Bet: Also clearly in the early days of a national push, ESPN Bet only appears among the others due to a poor January and February. In March it generated GGR of $4.3m, leaving it in fifth position. Bet365: Another in the camp of ‘definitely not leaving’ is bet365. It also embarked on a multi-state challenge in the US, yet may be hoping to improve the outcome in New Jersey where revenue in March came in at $3.1m, bringing Q1 to $9.8m. Add in iCasino GGR in March of $1.3m and a Q1 total of $3.5m. iCasino onlyThere are also several iCasino-only operators where the calculations over the worth of New Jersey will be different without the costs associated with running a sportsbook.

The bottom lineFacing facts: For some of those above, whether to stick it out or follow Kindred/Unibet down the exit path is a question that is likely to become acute over the seasonally slower summer months.

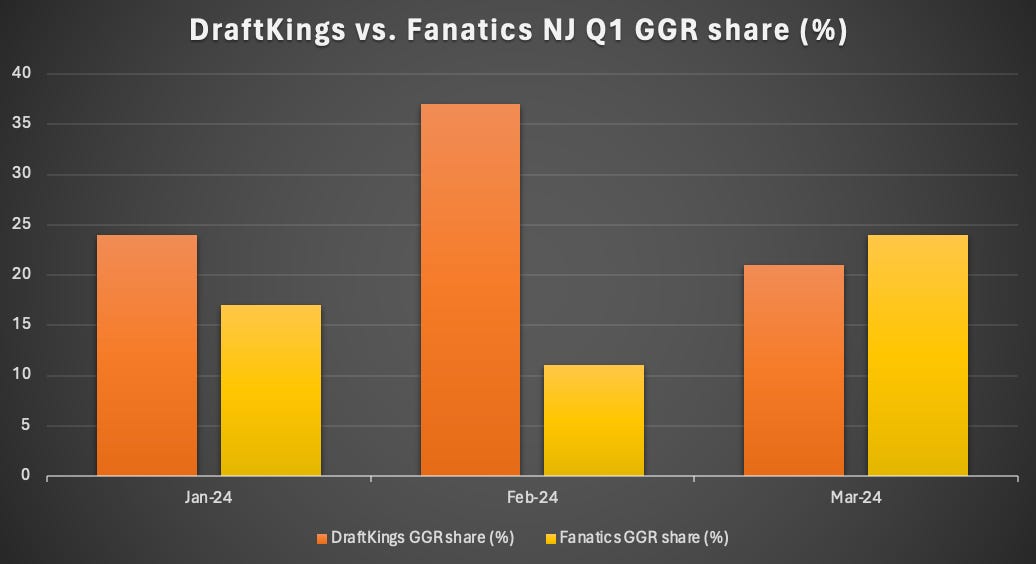

Our top seven sports betting MarTech must-haves The industry ballooned to a whopping $63.53 billion in 2022. And guess what? It's predicted to grow, with an 11.3% CAGR from 2022 to 2031. Of course, this digital gold rush has brought about intense competition amongst sports betting companies, and the demand for software that revolutionises and enhances the player experience has soared. In the sports betting arena, having the right arsenal of tools isn't just helpful — it's the key to success. We've scouted the digital playing field and handpicked seven tech champions that will elevate your game to hall-of-fame status. See here: https://www.trafficguard.ai/blog/ultimate-tech-stack-for-sports-betting-marketers DraftKings vs. Fanatics – NJ editionBoys keep swinging: The team at Jefferies produced a telling graph looking at the DraftKings and Fanatics swingometer in New Jersey in Q1. As can be seen, there have been some significant month-on-month swings, which, as reported previously by EKG, appear to be driven by a small number of VIPs that have switched from DraftKings to Fanatics. Evolution in AsiaCan’t rely on you: Evolution saw its revenues break through the half-a-billion euros mark in Q1 to €502m, confirming the live casino and games provider’s remarkable ascent to the very top of the iCasino tree.

East rising: It is indeed a remarkable ascent. In Q1 of 2020, Asia was worth just €20.8m to Evolution or 18% of total revenues of €115m. Four years on, that total has grown to €198m or 39% of total revenues.

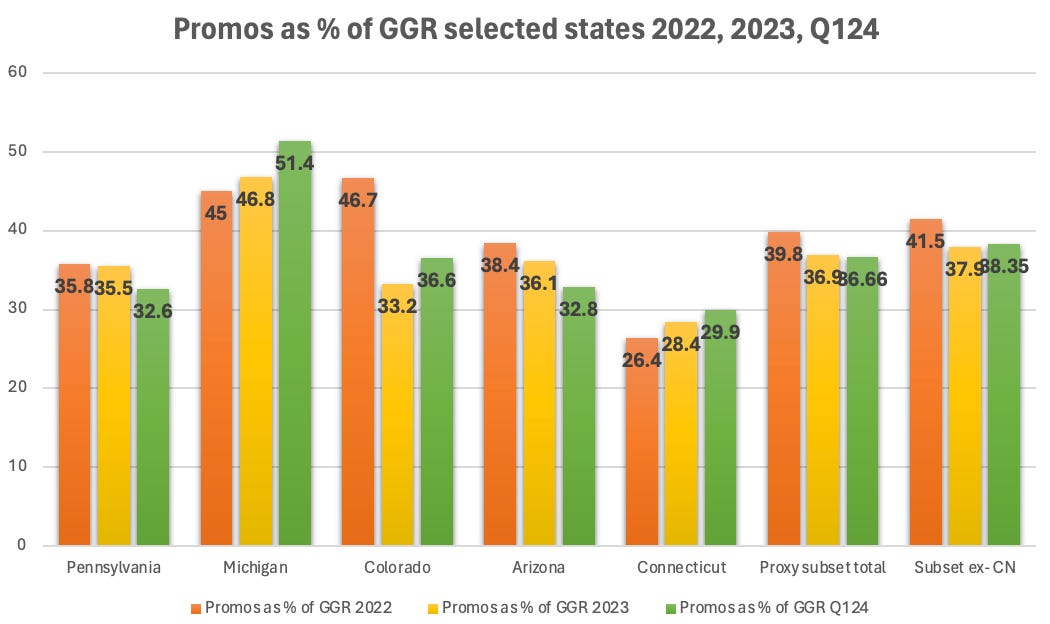

The promo debateSlice and dice: The extent to which the promotional environment is in any sense becoming less competitive is a hotly debated topic. Adding further insight is a slice of research from Deutsche Bank, which analyzes the data from the select cohort of states that publish promotional data.

Fall guys: The DB team showed how between 2022 and 2023, promotional intensity did drop across the five states from 39.8% of GGR to 36.9%, with the decline largely ascribed to a drop off in Arizona from over 38% to just over 36% and a more substantial fall in Colorado from nearly 47% to just over 33%.

It is also worth noting that when Connecticut is stripped out – where promo levels are far less than elsewhere due to the market effectively being a straight duopoly of FanDuel and DraftKings – it stood at nearly 38% vs. 37%.

💵 The promo giveaways continue into Q124 Calendar

Let’s Get Results. InclineBet’s specialist digital marketing services, including high-performance UA, CRM, Creative and Branding for clients in global regulated markets, are backed by data analytics and measurable results. With our deep market focus and unrivaled expertise, we build brands and help you acquire high-value customers and maximize lifetime value. We give you a competitive advantage. Learn more. incline.bet An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Scoop: Tipico ‘set to sell’ its US platform

Monday, April 29, 2024

Tipico's US platform sale, Novig shuts in Colorado, GLP on deal flow, startup focus – SBC First Pitch +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Investors not buoyed by weather-beaten Boyd

Friday, April 26, 2024

Below-estimate Boyd, Betsson earnings recap, Churchill Downs' derby date, Gambling.com shares watch +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ESPN Bet ‘can lay claim to No. 3’ in OSB

Wednesday, April 24, 2024

ESPN Bet's Tier 2 opportunity, Evolution's Asian success, Kindred's holding pattern, Kambi earnings review +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Room at the top: price holds key to Tier 2 competitors

Tuesday, April 23, 2024

HoldCrunch price data analysis, Games Global IPO prospectus, Vegas visitation +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NJ iCasino will ‘soon be bigger than Atlantic City’

Monday, April 22, 2024

New Jersey analysis, analyst takes – Bally's, Penn, 888, shares watch – Melco Resorts, startup focus – the Tenth Man +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How to Write a Job Description

Wednesday, December 25, 2024

A deep dive into a job description that speaks to the deepest longings of the human spirit.

🎄 Recap: 21 Episodes of AI 101 Guide

Wednesday, December 25, 2024

Take some time to learn or refresh the key concepts, techniques, and models that matter most

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?