Coin Metrics - Bitcoin's Halving Aftermath

Bitcoin's Halving AftermathBitcoin's 2024 Halving was the most consequential in its history, kickstarting a new token protocol & stress-testing balance sheets across a multi-billion dollar industryGet the best data-driven crypto insights and analysis every week: Bitcoin’s Halving AftermathBy: Parker Merritt & Tanay Ved Key Takeaways:

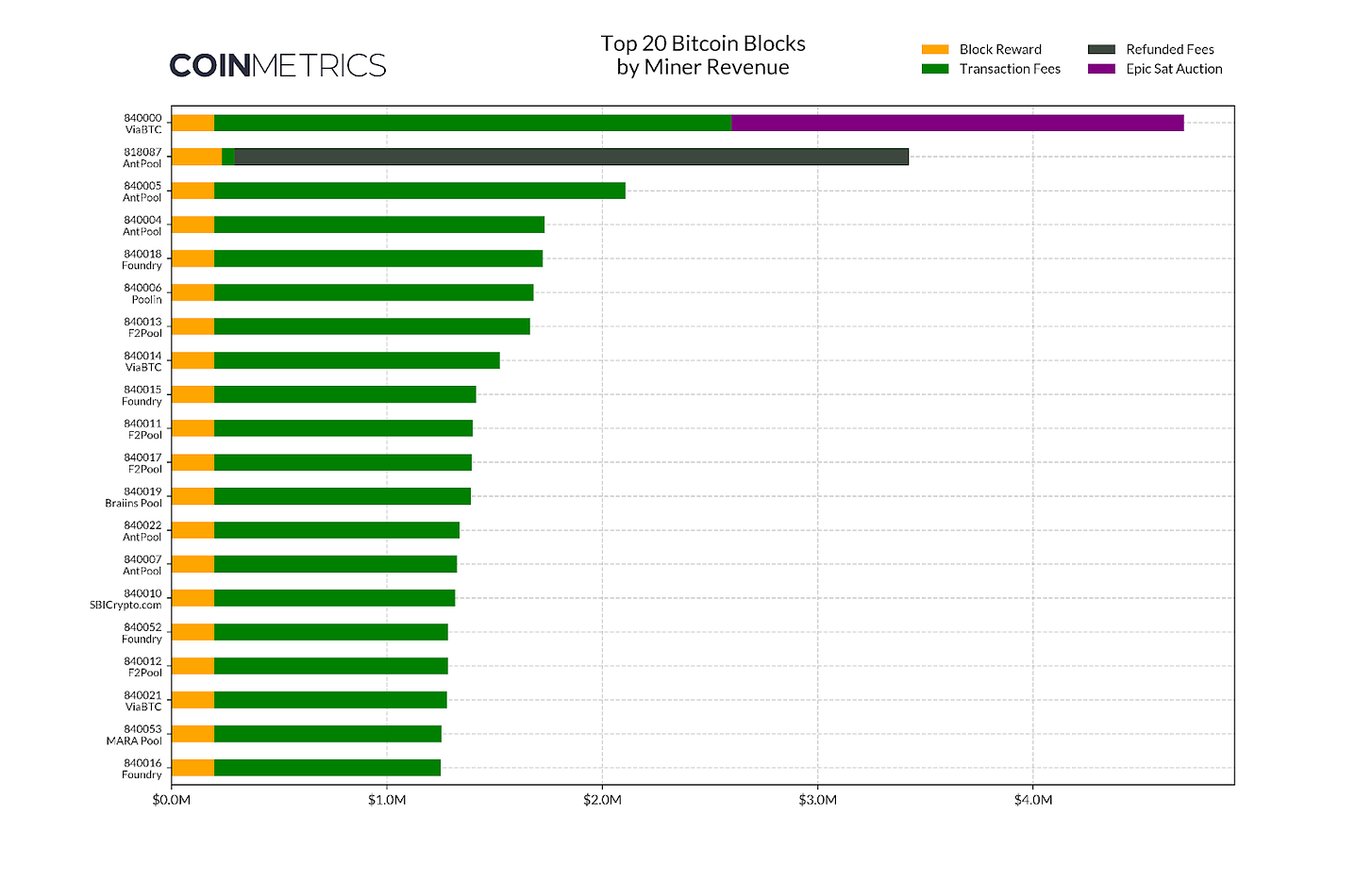

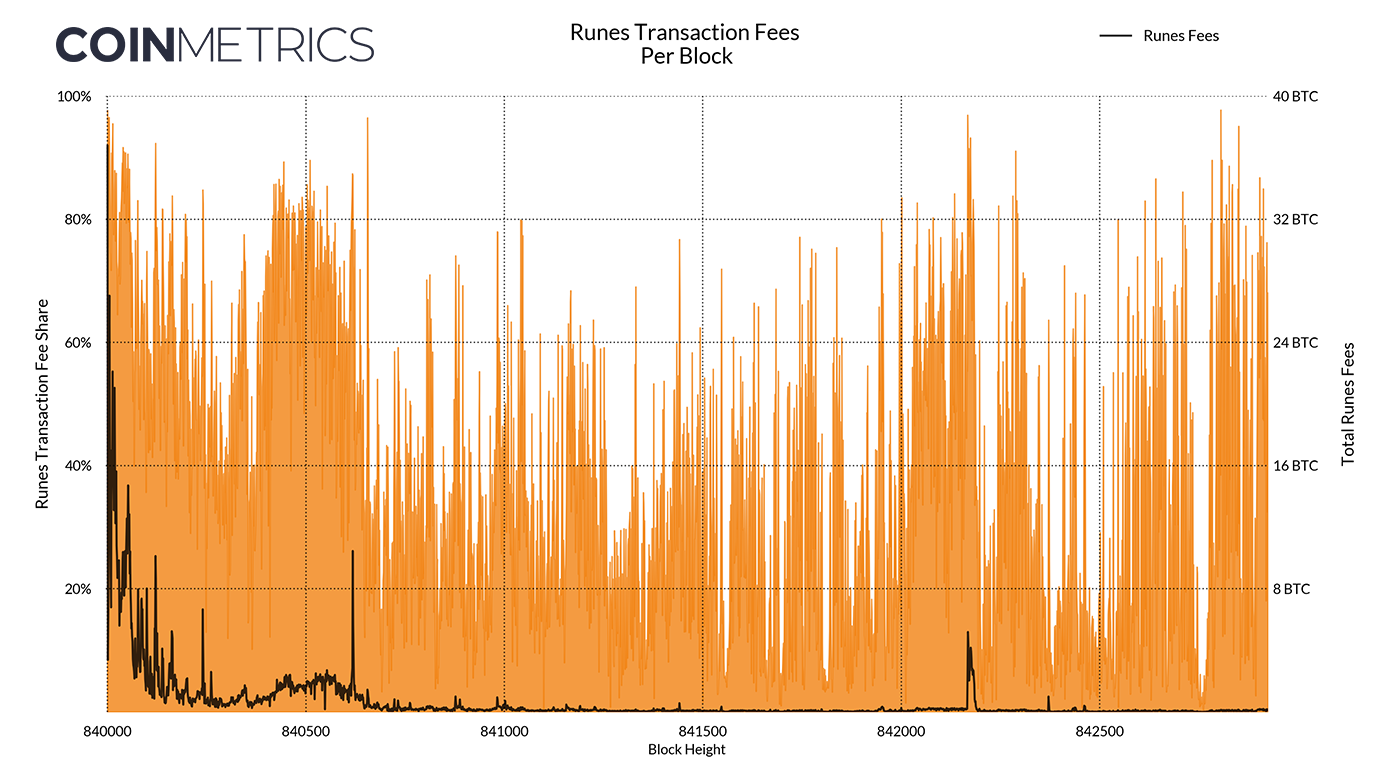

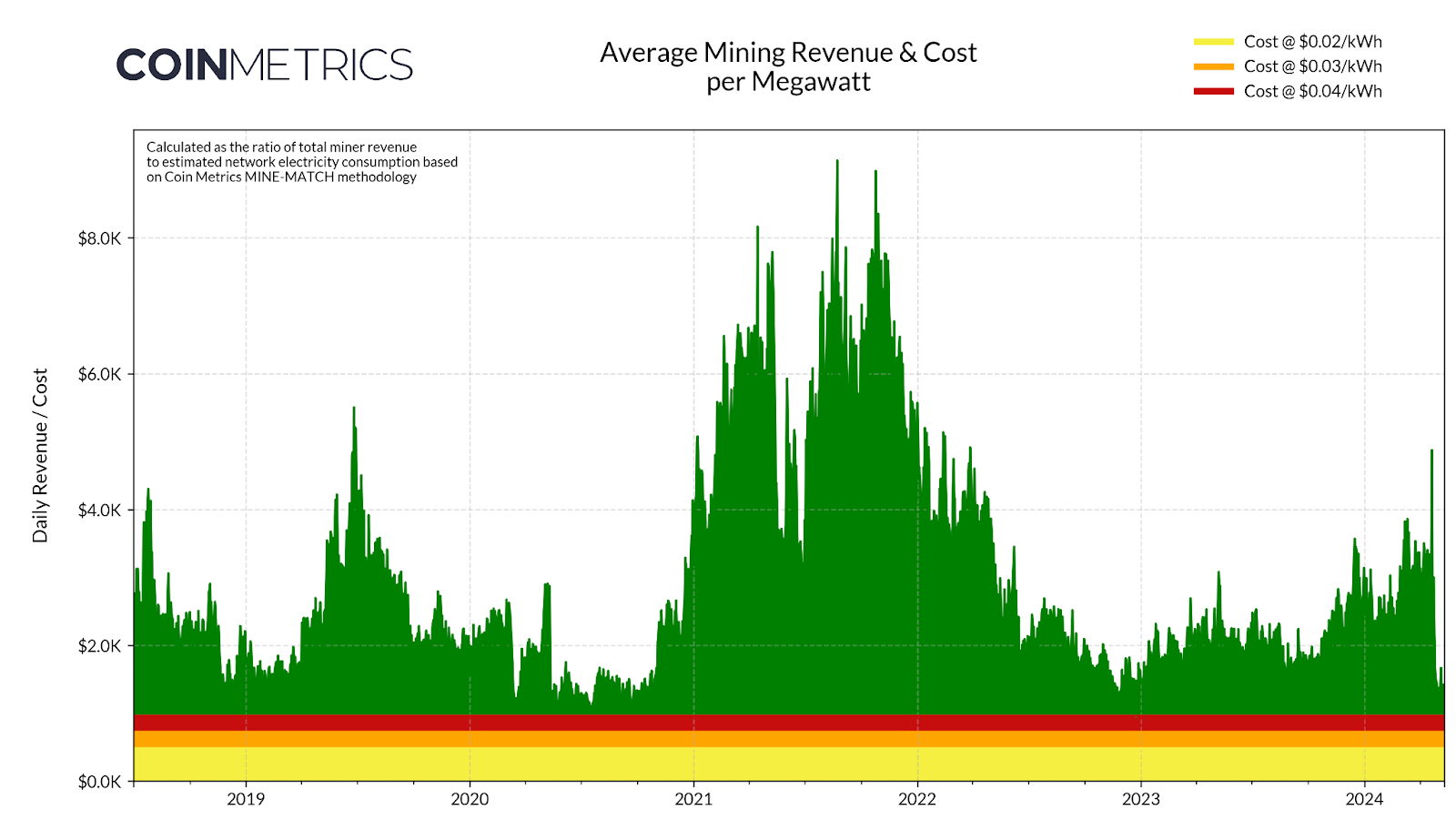

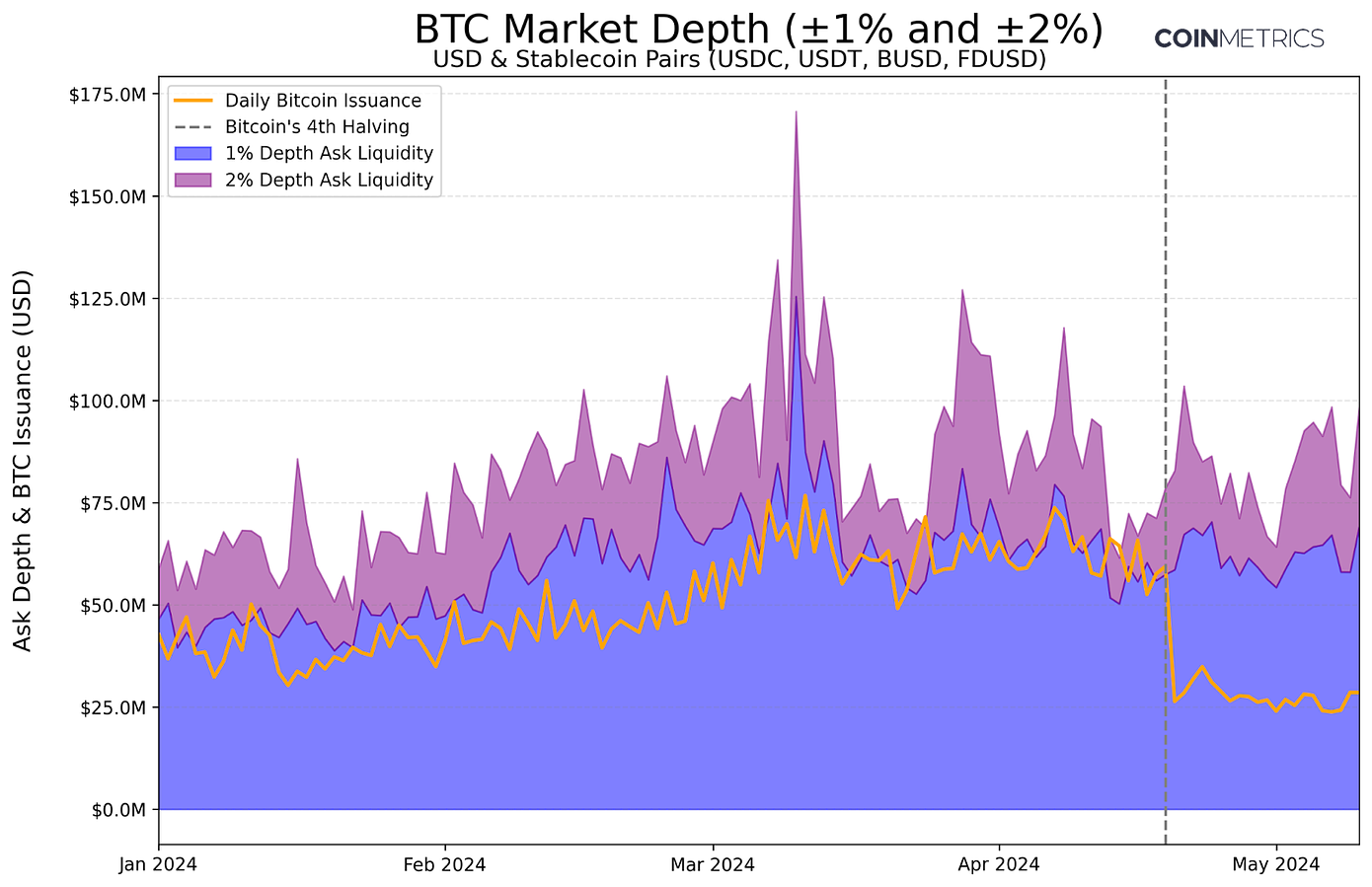

IntroductionAdhering to its predetermined monetary policy, Bitcoin underwent its 4th Halving at block 840,000, cutting block rewards from 6.25 BTC to 3.125 BTC. With far-reaching implications for miner economics, mining pools, and the Bitcoin ecosystem as a whole, understanding the post-Halving landscape is crucial. This week’s State of the Network examines the aftermath of Bitcoin’s most recent block reward Halving, building on our previous analysis in SOTN Issue 255. Halving ShruggedThe Halving is the most well-telegraphed event in the crypto industry, with a hard-coded emissions schedule setting Bitcoin’s issuance rate in stone since the network’s genesis. Still, leading up to the Halving, there were plenty of open questions—can the mining industry weather the change? Will transaction fees offset the cut in mining revenue? What are the implications for the broader Bitcoin community? Though the block subsidy was predictably slashed 50% on block 840,000, mining revenue concerns were temporarily alleviated by the flurry of fees that followed. Mining pool ViaBTC secured the biggest prize, earning 37.63 BTC in transaction fees thanks to a sudden influx of bids to secure an allocation of the epoch’s earliest block. Source: Coin Metrics ATLAS & Transaction Tracker Between a 3.125 BTC block subsidy and 37.63 BTC in fees, ViaBTC had already raked in a considerable amount of revenue by mining the Halving block—however, the block was especially lucrative thanks to the “Epic Sat.” In addition to enabling NFT-style collectibles, the Ordinals protocol proposes a (somewhat arbitrary) rarity rating for individual satoshis, the smallest subunit of Bitcoin at 0.00000001 BTC. While the market value of an individual sat is a fraction of a penny, an “Epic Sat” is designated as the first sat in a Halving block, giving it immense (subjective) value, as only four have been mined in Bitcoin’s history thus far. As the lucky pool to snag the Halving block, ViaBTC isolated the newly-minted Epic Sat and offered it for auction on CoinEx, an exchange operated by ViaBTC’s CEO. After a 3-day bidding war, the collectible sold for 33.3 BTC (~$2.1M), making block 840,000 the most valuable batch of transactions ever mined in Bitcoin’s history. The Epic Sat made a major contribution to ViaBTC’s earnings, but the string of blocks that followed continued to climb the ranks in terms of record-breaking miner revenue. With the exception of a massive “fat finger” fee mistakenly paid by Paxos in block 818,087—later refunded by AntPool— the top 20 blocks by total revenue (and 88 of the top 100) were all mined in the first day of Bitcoin’s 5th epoch. The Rune SagaSince their introduction in 2023, Ordinals & Inscriptions have been the major drivers of miner transaction fee revenues. On the Halving block, however, a new metaprotocol entered the fray. The Runes token standard (another invention of Ordinals creator Casey Rodarmor) officially launched on block 840,000, bringing a new wave of on-chain speculation to Bitcoin. From a technical perspective, Runes attempt to improve upon earlier efforts to bolt ERC-20 style fungible tokens onto the Bitcoin blockchain. While Inscriptions were originally designed to enable on-chain NFTs, tinkerers quickly repurposed the tech to create “BRC-20s,” embedding JSON-formatted text into transactions as a crude mechanism for creating & transferring tokens. BRC-20s like ORDI soon ballooned to billion-dollar market caps, earning listings on trading platforms like Binance & OKX. While popular amongst speculators, BRC-20s were widely derided for technical inelegance, bloating the blockchain & requiring complex indexing solutions. To bridge these gaps, Runes circumvent Inscriptions altogether, leveraging Bitcoin’s longstanding OP_RETURN field to encode compact token protocol messages. Within 24 hours of the Runes launch on March 20, Bitcoin hit a new daily record of 518.6K OP_RETURN outputs, later topped by 798.7K OP_RETURNs on March 23. Runes excitement was red-hot following the Halving, with 97% of fees in block 840,000 spent securing a spot as one of the earliest etchings. In the world of on-chain collectibles, there’s an aura of prestige associated with being one of the first projects to launch. The etcher of Rune 840000:1 (a.k.a. Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z) tipped miners 6.73 BTC for the 1st slot in the Halving block. This bet appears to have paid off, as “FEHU” is now the highest-ranking Rune by market cap at a valuation of $2.4B. The magnitude of Runes revenue has since dwindled, but remains a substantial contributor to miner income, accounting for ~50% of fees per block over the past week. Miners have earned a total of 2,000 BTC via Runes fees since the protocol launched on the Halving block. Nearly half of this total came in the first 24 hours of the Runes debut, with momentum plateauing less than 5 days later. However, Runes remain in their infancy, and miners have benefitted from small bursts in revenue as highly-anticipated projects come to market. On block 842,166, the winner of ViaBTC’s auction linked the Epic Sat to a new Rune called EPIC•EPIC•EPIC•EPIC, spurring a 4-hour spike in fees as speculators minted their share of 50M tokens. Despite setting records for fees at launch, Runes have since been written off as a flop, with waning interest failing to match the hype leading up to the Halving. Still, the Ordinals ecosystem took months to build out the infrastructure required for meaningful liquidity, and Runes are yet to be validated in the form of listings on major exchanges, trading largely on niche collectibles platforms. In the meantime, miners can’t hold their breath—revenue is declining to existential levels, requiring the industry to revisit assumptions about forward-looking profitability. Withering HashesIn the wake of the Halving, simple measures of revenue indicate the mining industry’s income remains relatively elevated, averaging close to $30M per day. However, total revenue leaves out an important consideration—miners are also spending considerably more on electricity. Based on Coin Metrics ASIC fingerprinting estimates, the network now consumes ~21.5 GW in power, up 2x over the past 2 years. Taking the ratio of mining revenue to power consumption, we get a better sense of miner income relative to their primary operational expense. Mining revenue per megawatt (MRPM) now sits at ~$1.3K daily, scarcely outpacing daily costs of $960/MW at an ultra-low power rate of $0.04/kWh. This places electricity-adjusted revenue at levels not seen since FTX’s collapse, underscoring just how tight conditions are for miners. Larger miners earn more revenue per MW (thanks to upgraded hardware) and have long-term contracts at lower power rates— nonetheless, MRPM indicates the “average” miner is experiencing immense financial pressure in the post-Halving era. Source: Coin Metrics Network Data Pro & MINE-MATCH A major concern leading up to every Halving is the sell pressure miners could introduce into the market. With a direct impact on revenues, miners may need to sell newly issued bitcoin or liquidate existing holdings to cover OpEx or fund expansion efforts, such as the acquisition of more efficient ASICs. Source: Coin Metrics Network Data Pro & Market Data Feed Between lower profits from halved rewards and increased electricity costs, financial pressure on miners has heightened. As evidenced by an 11.2% drop in weekly hashrate from 650 EH/s to 577 EH/s, miners are assessing the viability of their operations under tighter margins. However, Bitcoin’s recent -5.62% difficulty adjustment— the largest downward move since late 2022— will alleviate some pressure by easing the work required for mining new blocks. Source: Coin Metrics Network Data Pro ConclusionBitcoin’s reduction in issuance is crypto’s most predictable event, but the 2024 Halving was a notable affair for many reasons. Relative to past Halvings, mining has reached unprecedented scale, with multi-million dollar investments across hardware & infrastructure. With fees failing to offset the drop in the block subsidy, it’s questionable whether many large-scale operations can remain afloat. New protocols like Runes offer a glimpse at catalysts for boosted revenue, but these markets remain immature, leaving significant gaps in mining profitability assumptions. Regarding the Halving's impact on market structure, the adjustment has arguably been “priced in” for years. However, liquidity indicators show miner sell pressure is now subdued, with issuance well below the threshold required to meaningfully move BTC price. In any case, long-term impacts are yet to materialize— while no guarantee of future performance, Bitcoin’s most significant periods of appreciation often occur many months post-Halving. For now, the demand-side is back in the driver’s seat, with the Halving’s influence on crypto’s narrative receding into the rear-view. For more, make sure to check out our previous issues of Bitcoin mining reports. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Over the past week, the number of active addresses for USDT on Tron increased by 8%, while on Ethereum, it decreased by 8%. USDC on Ethereum witnessed a 6% rise in active addresses; however, supply declined by 1.2%, totaling 25B. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

The Usage & Evolution of Decentralized Exchanges (DEX’s)

Tuesday, May 7, 2024

Checking in on liquidity pools, trading volumes and adoption across Ethereum DEX's ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Measuring Exchange Quality And ‘Fake Volume’

Tuesday, April 30, 2024

Crypto data for the decentralized economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Layer-1 Landscape

Tuesday, April 23, 2024

A data-driven look across Layer-1 ecosystems ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s 4th Halving

Tuesday, April 16, 2024

Understanding the significance of halvings, impact on miners and bitcoin's price ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana Uncovered: An Introduction to the Solana Network

Tuesday, April 9, 2024

A data-driven overview of the Solana Blockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏