Coin Metrics - The Story of Ethereum Staking So Far

The Story of Ethereum Staking So FarUncovering Ethereum's staking ecosystem, from "The Merge" to "Shapella", the rise of liquid staking tokens (LSTs) and beyondThe Story of Ethereum Staking So FarBy: Tanay Ved & Matías Andrade Key Takeaways:

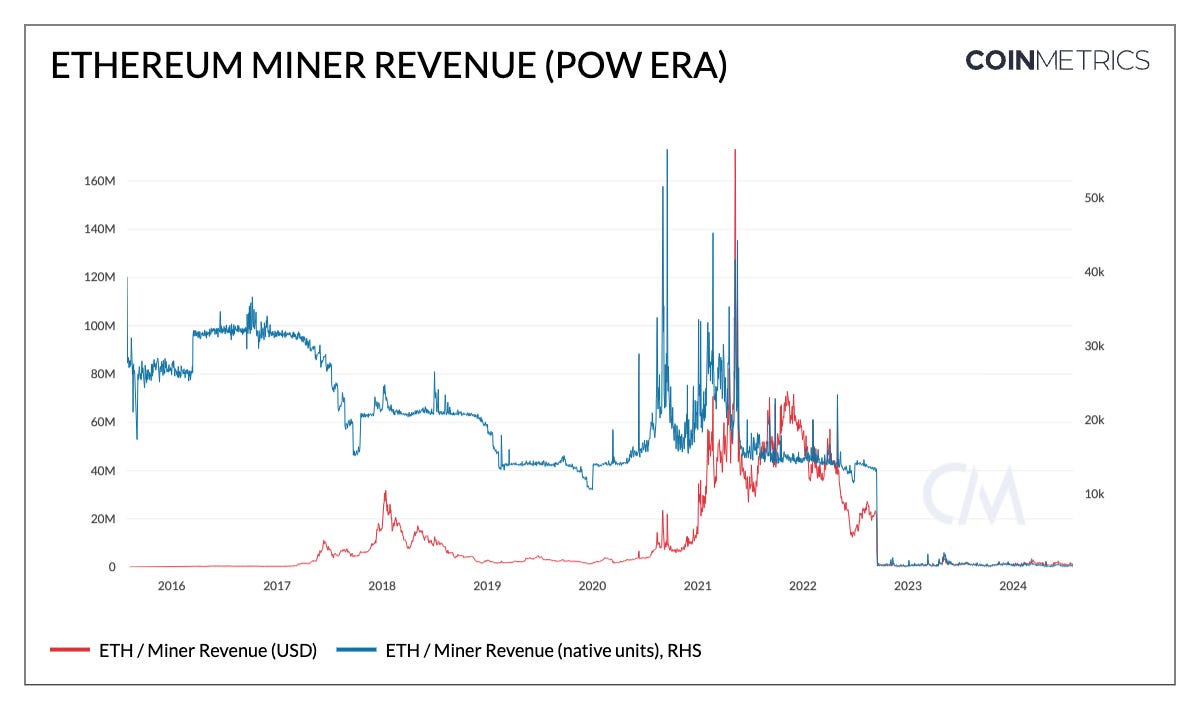

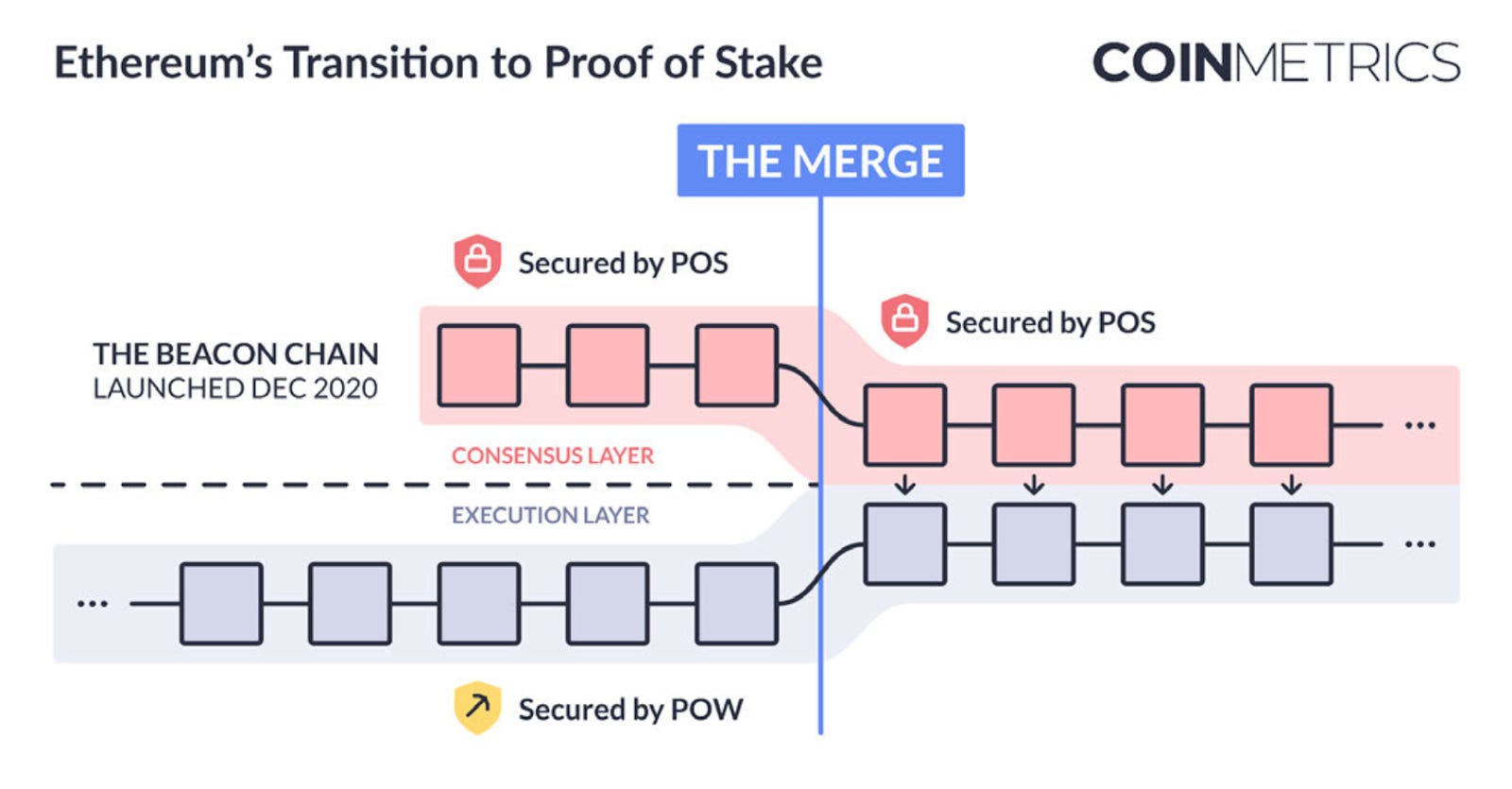

Brief Background on Ethereum StakingStaking is the beating heart of proof-of-stake (PoS) blockchains like Ethereum. With its transition from a proof-of-work (PoW) network to proof-of-stake (PoS) in 2022, participants are now required to commit ‘stake’ by depositing a minimum of 32 ETH as collateral to become an active validator on the network—the central economic actor in this system. Staking is fundamental to how the network reaches consensus—a process whereby network participants (validators) propose, verify and attest to new blocks on the blockchain, with the value of staked assets contributing to its economic security. A validator's stake serves as an economic incentive for participants to act in the best interests of the network. On the one hand, validators are rewarded with Ether in return for doing these duties honestly, or risk having their stake penalized or slashed for malicious behavior. IntroductionIn light of spot Ether ETFs going live on July 23rd, and the regulatory clouds surrounding staking, we believe it’s important to understand the fundamental role staking plays within the Ethereum network. In this issue of Coin Metrics’ State of the Network, we uncover Ethereum's staking journey so far, understanding how the $115B+ staking ecosystem emerged, developed and where it’s headed. From the transition to PoS with The Merge, to withdrawals with Shapella, the emergence of liquid staking and restaking and most recently, the introduction of spot Ether ETFs—staking is undoubtedly one of the central pillars of Ethereum's roadmap, making it pivotal to the entire ecosystem. End of the PoW Era (2015 - 2022)Ethereum’s genesis block was recorded on July 30th, 2015. For more than seven years since, the chain was secured by a proof-of-work (PoW) consensus mechanism. Similar to how the Bitcoin blockchain functions today, this entailed large clusters of hardware including general processing units (GPUs) and eventually application-specific integrated circuits (ASICs) which expend computational resources to find the hash of a nonce. The miner that found a valid nonce, would then broadcast the new block to the chain, being rewarded in the form of block rewards (issuance of ETH) and fees for the transactions included in a block. However, as network difficulty (computational effort needed to find the nonce) increased, the energy resources consumed by miners grew even larger. In as early as 2016, Vitalik Buterin advocated for Ethereum to switch to proof-of-stake (PoS) to address bottlenecks such as energy consumption, scalability and network sustainability to position Ethereum for future growth. This marked the end of Ethereum miners giving way to validators. Introduction of the Beacon Chain (2020)In October 2020, the staking deposit contract was deployed on the Ethereum execution layer. This was the gateway to participants who wished to stake their ETH, whether through self-hosted infrastructure (solo staking) or through staking as a service providers like Figment, pooled staking platforms such as Lido & RocketPool or centralized-exchange staking programs that eventually emerged. Source: Coin Metrics Network Data Pro

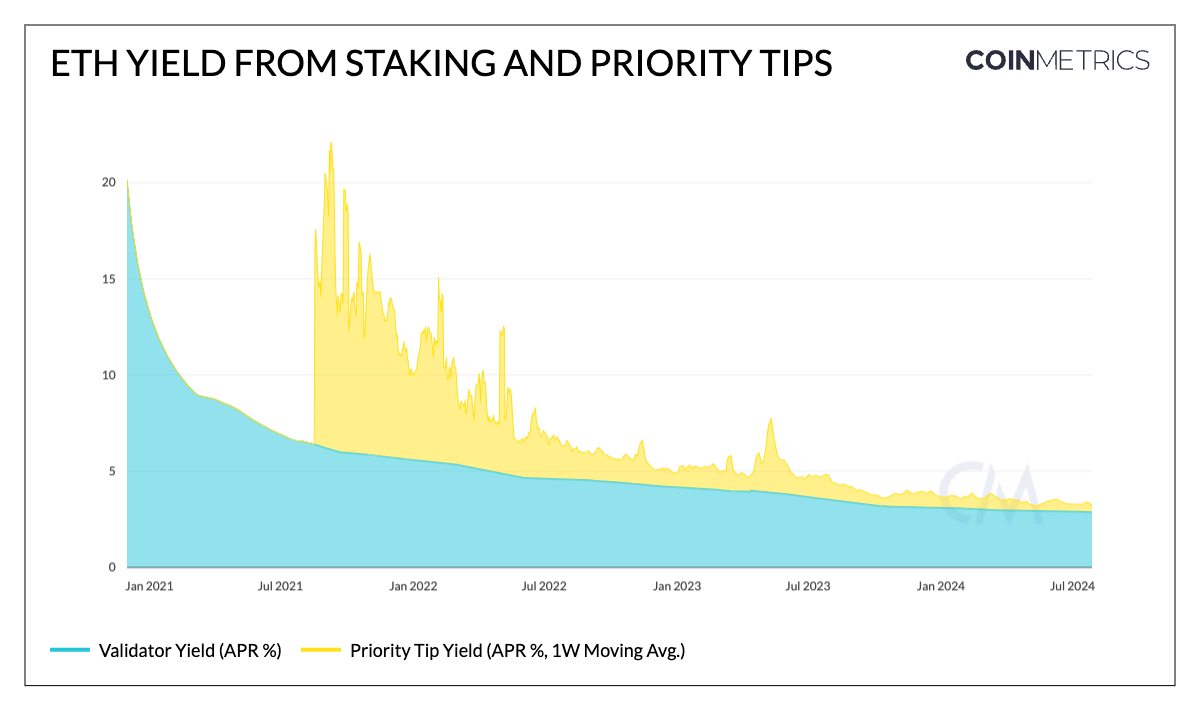

In December 2020, the Beacon Chain (also known as the Consensus Layer) was launched as a parallel blockchain to Ethereum's mainnet, adopted through EIP-3675. It marked the first step towards transitioning from Proof of Work (PoW) to Proof of Stake (PoS). This chain was specifically designed to handle the PoS process, managing validator balances, duties (attesting & proposing new blocks) and incentives (rewards & penalties) to achieve consensus. This laid the groundwork for the eventual merging with the mainnet, the layer that hosts a vast array of smart-contracts and dApps powered by the Ethereum Virtual Machine (EVM). The Merge: Transition to PoS (2022–Present)The integration of Ethereum’s two disparate systems, the “Execution Layer” (also known as mainnet) and “Consensus Layer” (also known as the Beacon Chain) is now widely recognized as “The Merge”. This represented the official switch to using the Beacon Chain as the engine of block production. Miners were no longer the means of producing valid blocks. Instead, in proof-of-stake, validators adopted this role and are now responsible for proposing blocks and processing the validity of all transactions. In return for these duties, they earned rewards via newly issued ETH, transaction fees that users voluntarily pay as “priority tips,” and maximal extractable value (MEV). As covered in our report: Mapping out the Merge, the shift to PoS brought about significant changes to Ethereum’s validator and monetary economics. Under PoW, Ethereum’s daily issuance was ~13.5K ETH, an annual inflation rate over 4%. However, with the changes implemented in EIP-1559, introducing a base fee burn mechanism and priority fees which go to validators, ETH’s daily issuance is closer to 0, with a current annualized inflation rate of 0.67%. The Rise of Liquid Staking DerivativesAt the time, certain bottlenecks existed in Ethereum’s PoS system that prompted the rise of pooled staking providers and liquid staking tokens (LST’s). Some of these problems included:

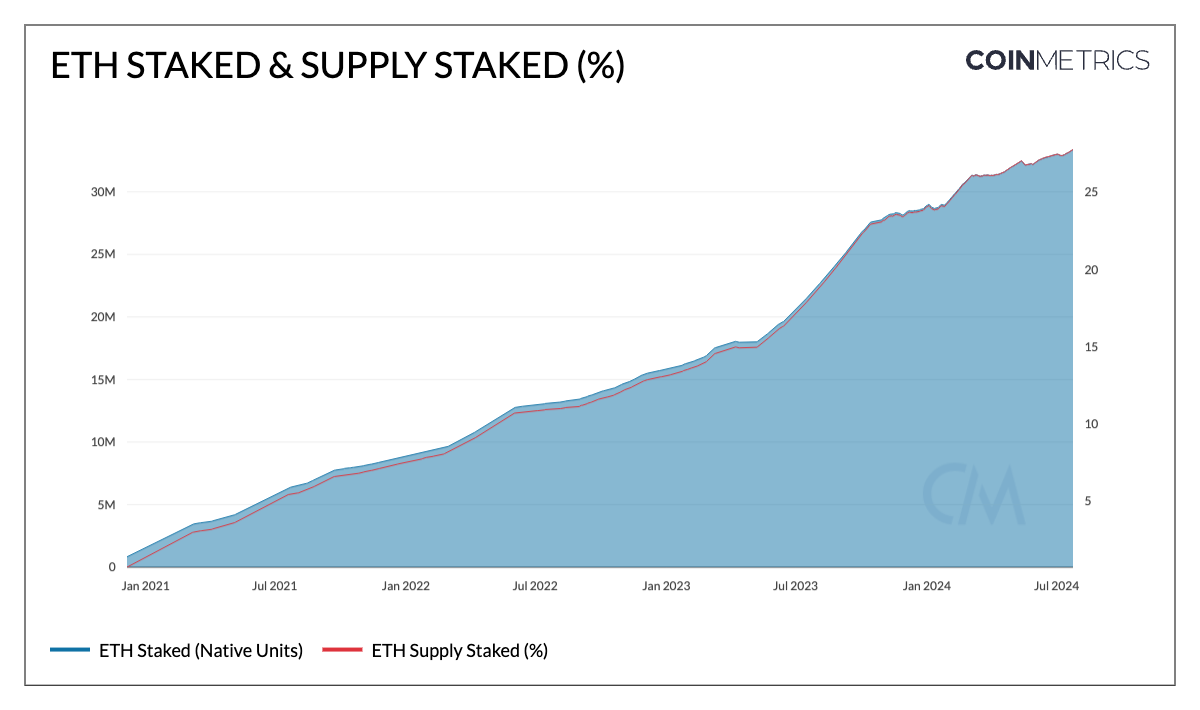

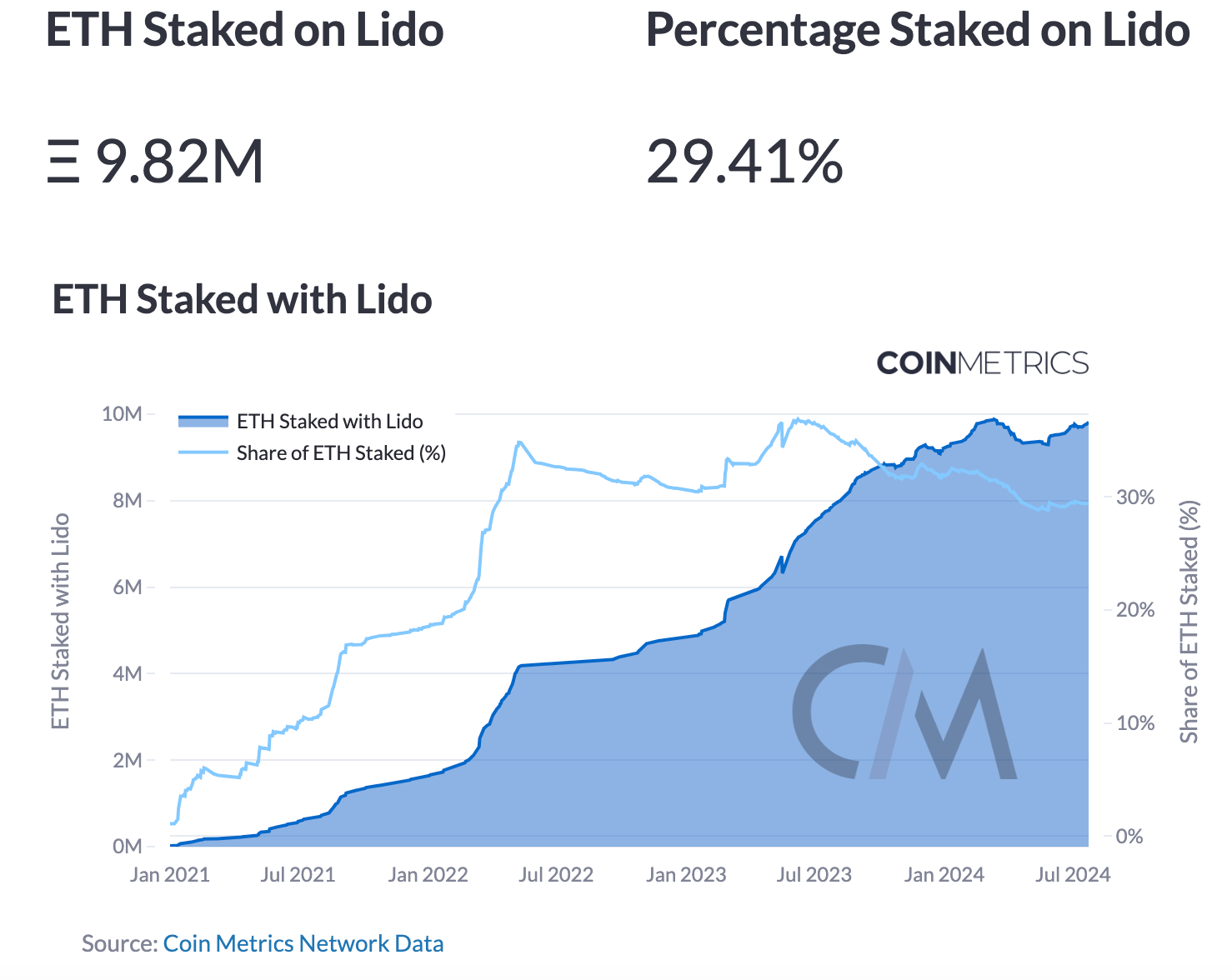

As a result, several pooling solutions such as Lido, Coinbase and RocketPool emerged, capitalizing on this lucrative opportunity. They enabled users to participate with any denomination of ETH, managing node operation by accumulating deposits across users to create a validator on the beacon chain. Users were provided with a liquid receipt token representing the underlying staked assets—known as a liquid staking token—which earned staking rewards without being “locked”. Ultimately, this lowered the barriers to entry for staking, fueling the growth of the sector and allowed a larger participant base to secure the Ethereum network. Source: Coin Metrics Staking Dashboard

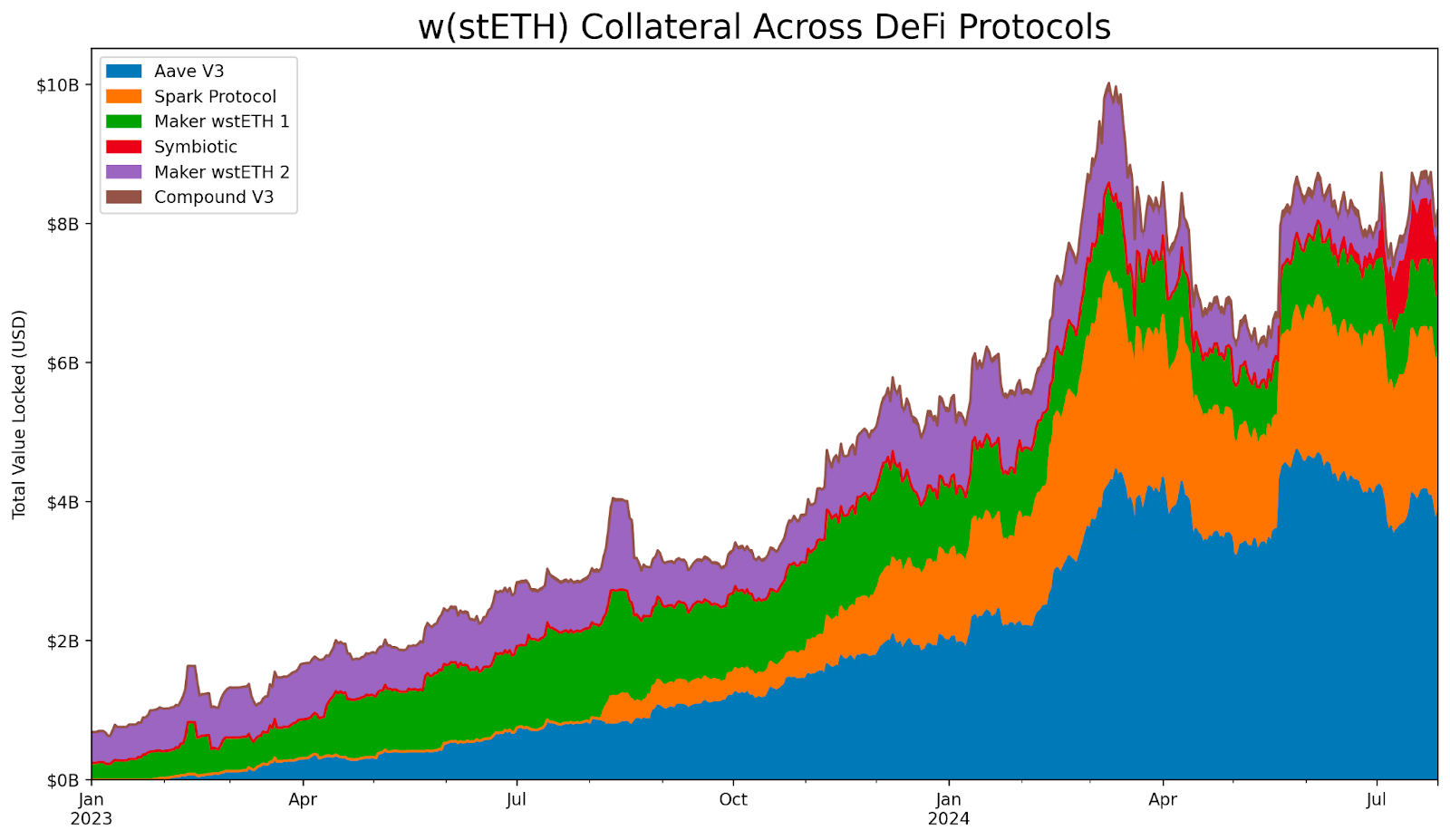

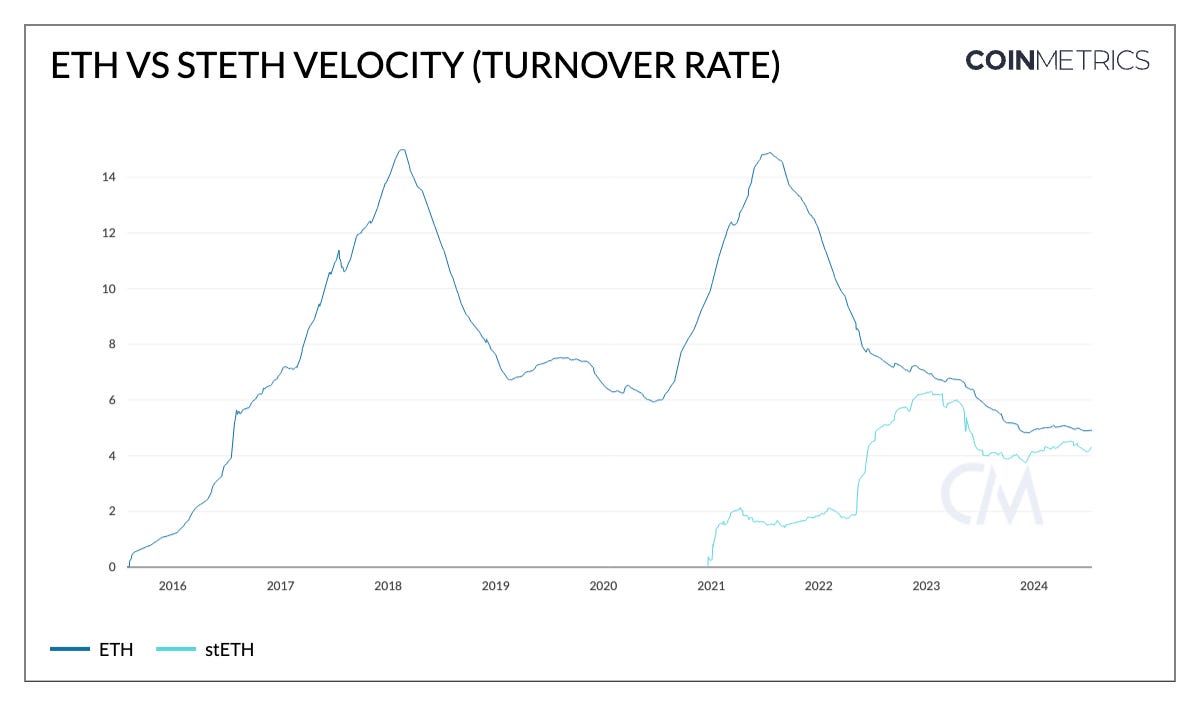

In addition to making participation more accessible, pooled staking fueled the utility of liquid staking tokens (LSTs) in the wider on-chain ecosystem. LST’s like stETH and wstETH (wrapped-staked Ether) issued by Lido have garnered significant network effects being widely utilized in decentralized finance (DeFi) applications, whether as collateral on the largest lending protocols or as liquidity on decentralized exchanges (DEX’s). Source: Coin Metrics ATLAS

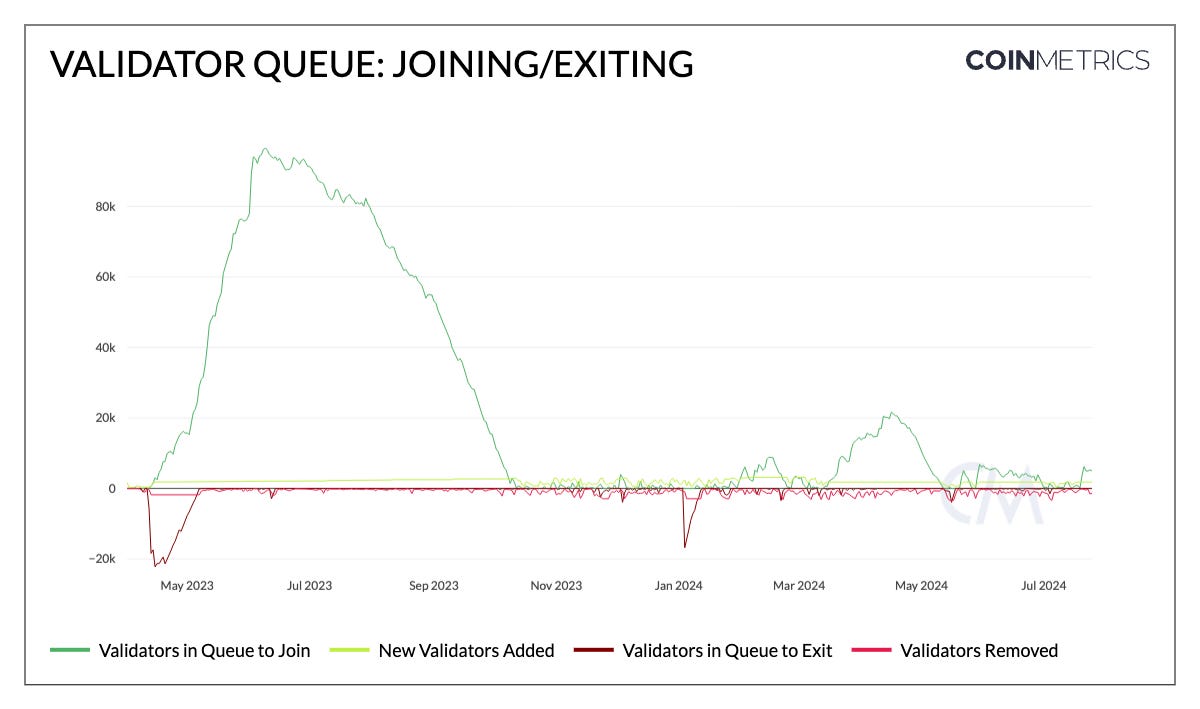

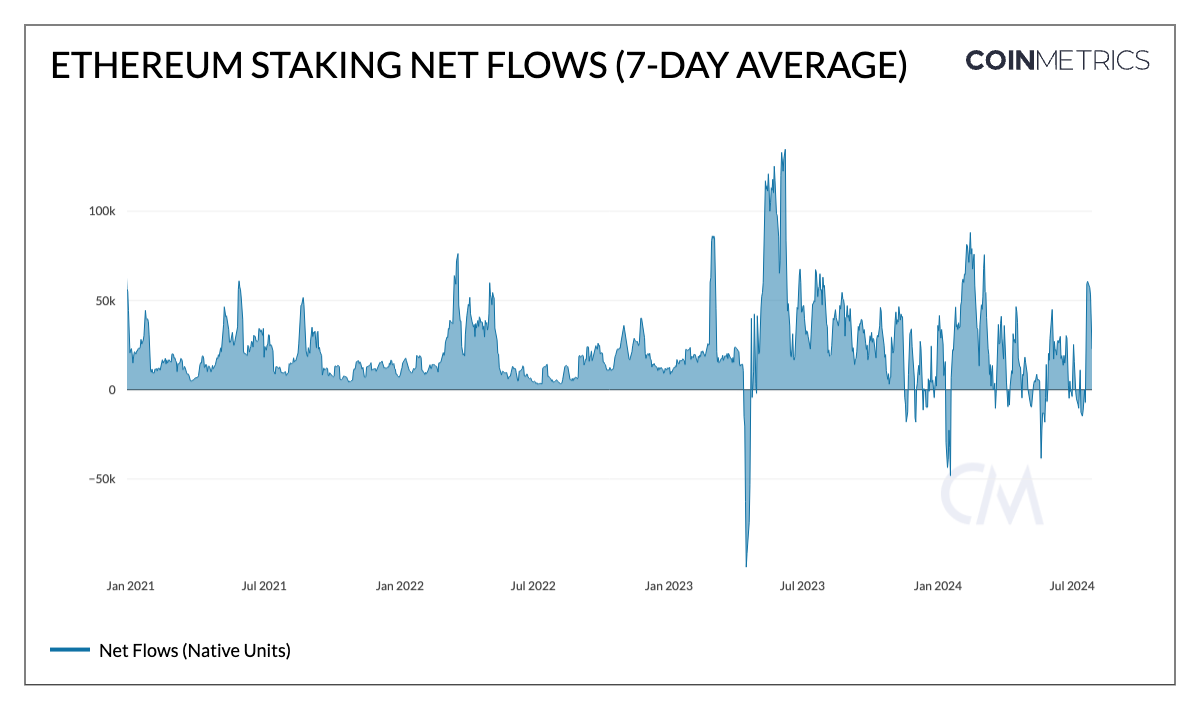

Shapella: Withdrawals Enabled (2023)The arrival of the Shanghai and Capella upgrade on April 12th 2023 (dubbed Shapella), closed the loop on staked ETH, eventually enabling redemptions from the Beacon Chain. Validators were now able to enter and exit the PoS system subject to a validator queue and churn limit (a cap on how many validators can be activated per epoch, currently set to 8 through EIP-7514 in Dencun). Source: Coin Metrics Network Data Pro

While the validator entry queue may have flattened out relative to last year, deposits of staked ETH continue to outpace withdrawals. Since the Shapella upgrade, 30M ETH has been deposited to the consensus layer, while 17M ETH has been withdrawn. The discrepancy seen between a lower number of validators in the entry queue and increasing deposits may be partially explained by the popularity of liquid staking, resulting in a growing amount of ETH staked without adding validators directly. Source: Coin Metrics Network Data Pro The Emergence of RestakingWith the launch of EigenLayer mainnet in 2023, restaking has quickly become one of the fastest-growing verticals in the crypto ecosystem. While staking ETH secures the Ethereum network, restaking allows the same staked assets to secure external services built on Ethereum, such as oracle networks, data availability layers, bridges and other middleware using either natively staked ETH or liquid staking tokens (LSTs). This innovation helps emerging protocols bootstrap security without the high costs of sourcing their own validators. Restaking unlocks greater capital efficiency of staked ETH and extends Ethereum’s security model across the broader ecosystem. However, it also introduces risks in managing staked assets and liquid representations of restaked assets (LRTs) across various networks with different risk profiles. Although still nascent, the restaking landscape has expanded beyond Ethereum to other chains like Solana, with new entrants like Symbiotic and Jito restaking showcasing its growing significance. The Launch of Spot Ether ETFsThis brings us closer to today—with the launch of spot Ether ETFs commencing last week. While this is exciting news for the market, the current structure of Ether ETFs prevents issuers from participating in staking activities. This represents an opportunity cost for investors who would forego an additional ~3% in the form of staking rewards, a key component of staking. Validators are incentivized to participate in the consensus process by being rewarded in the form of ETH issuance, priority tips and maximal extractable value (MEV), which are derived from the consensus layer (CL) and execution layer (EL). The current ETH staking annual percentage rate (APR %) excluding MEV, stands at just over 3%. While this may impact investor demand for ETFs, it has sizable ramifications for the Ethereum network, such as:

Source: Coin Metrics Network Data Pro Any decision to incorporate staking rewards would require a careful consideration of these factors to balance network security and economic sustainability of the Ethereum ecosystem. What’s on the Horizon?Ethereum’s staking ecosystem has come a long way since “The Merge” and its future direction hinges on a multitude of converging factors. In light of Ethereum’s staking ratio exceeding 25% of total supply and the number of validators crossing the one millionth mark, researchers and the community alike are considering altering Ethereum’s issuance curve and increasing validators' max effective balance. These proposals stem from the concerns around ETH’s growing staking ratio and centralization tendencies around staking pools, with incentives favoring liquid staking tokens over plain ETH. Additionally, increasing the validators max effective balance from 32 ETH to 2048 ETH is being considered to control the exponential growth of the validator set, reducing overhead for the consensus layer. Source: Coin Metrics Network Data Pro The growth of liquid staking & restaking, the arrival of spot Ether ETFs, regulatory developments around staking and potential changes to validator & issuance dynamics present a complex, interconnected landscape that will steer Ethereum’s PoS system for the years to come.

Coin Metrics UpdatesThis quarter’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

The Launch of Ether ETFs

Tuesday, July 23, 2024

A look into ETH ETF fees, Grayscale funds and demand & supply dynamics heading into Ether ETF Launch ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Charting the Course to Mt. Gox Repayments

Tuesday, July 16, 2024

Coin Metrics' State of the Network: Issue 268 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q2 2024 Wrap-Up

Tuesday, July 9, 2024

A data-driven overview of events shaping digital asset markets in Q2–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q2 2024 Mining Data Special

Tuesday, July 2, 2024

Our quarterly update on Bitcoin mining, focusing in on transaction fee spikes, public miner M&A, and ASIC efficiency improvements ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Mastering Crypto Derivatives

Tuesday, June 25, 2024

Explore how derivatives can transform your crypto trading strategy with indirect exposure, risk hedging, and market efficiency capitalization. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏