Coin Metrics - Unwrapping Wrapped Assets & wBTC

Unwrapping Wrapped Assets & wBTCWrapped Bitcoin (wBTC) custody transition, BitGo business model and DeFi usageGet the best data-driven crypto insights and analysis every week: Unwrapping Wrapped Assets & wBTCBy: Tanay Ved Key Takeaways:

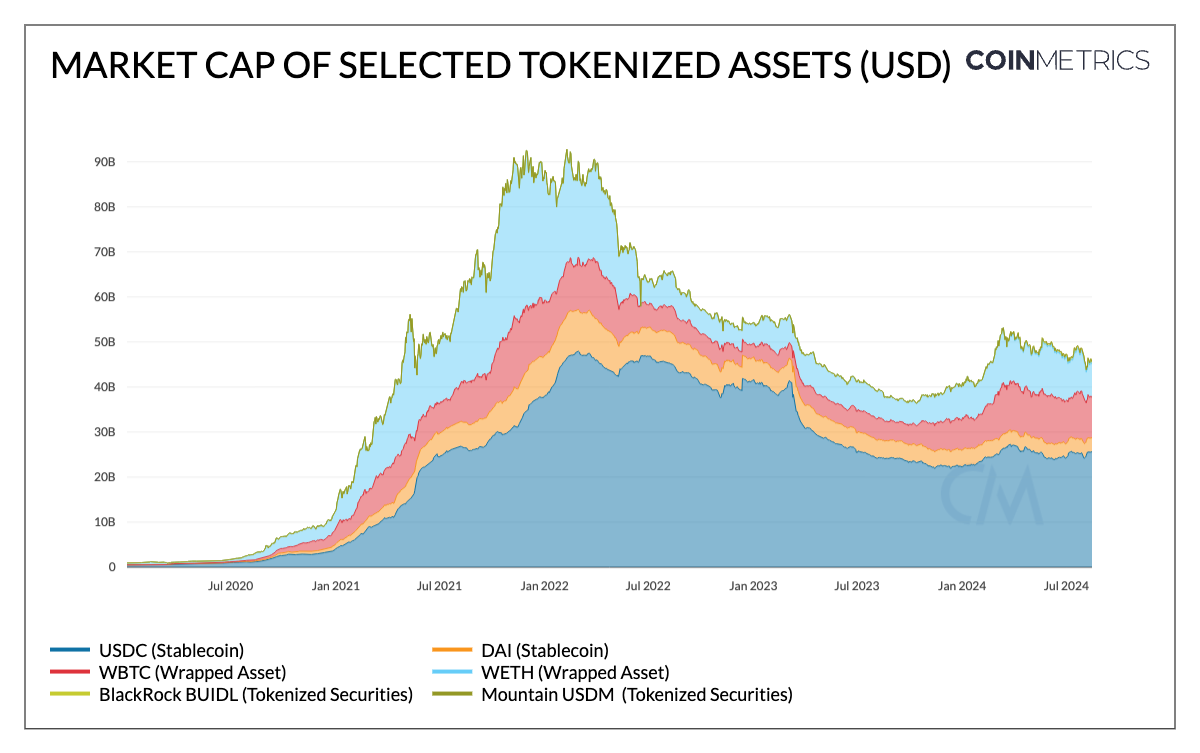

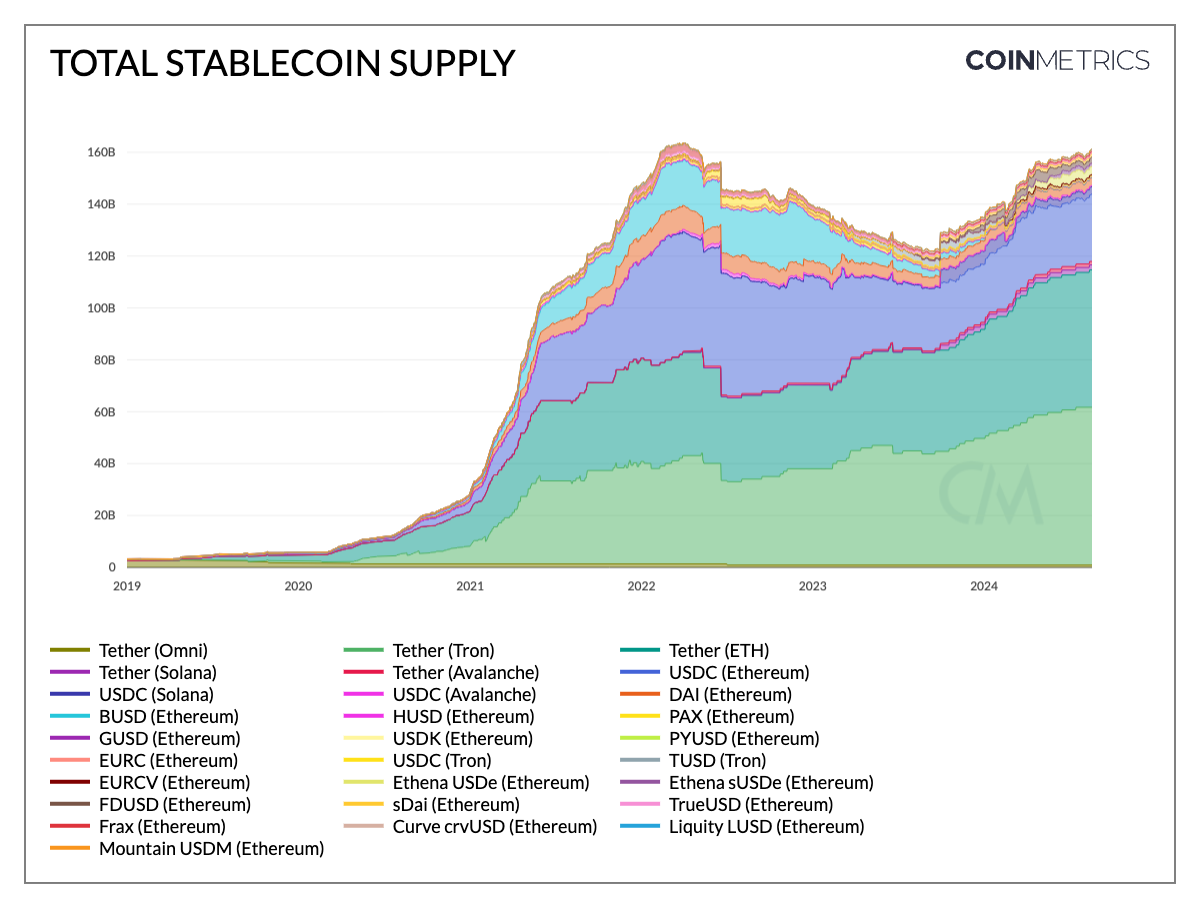

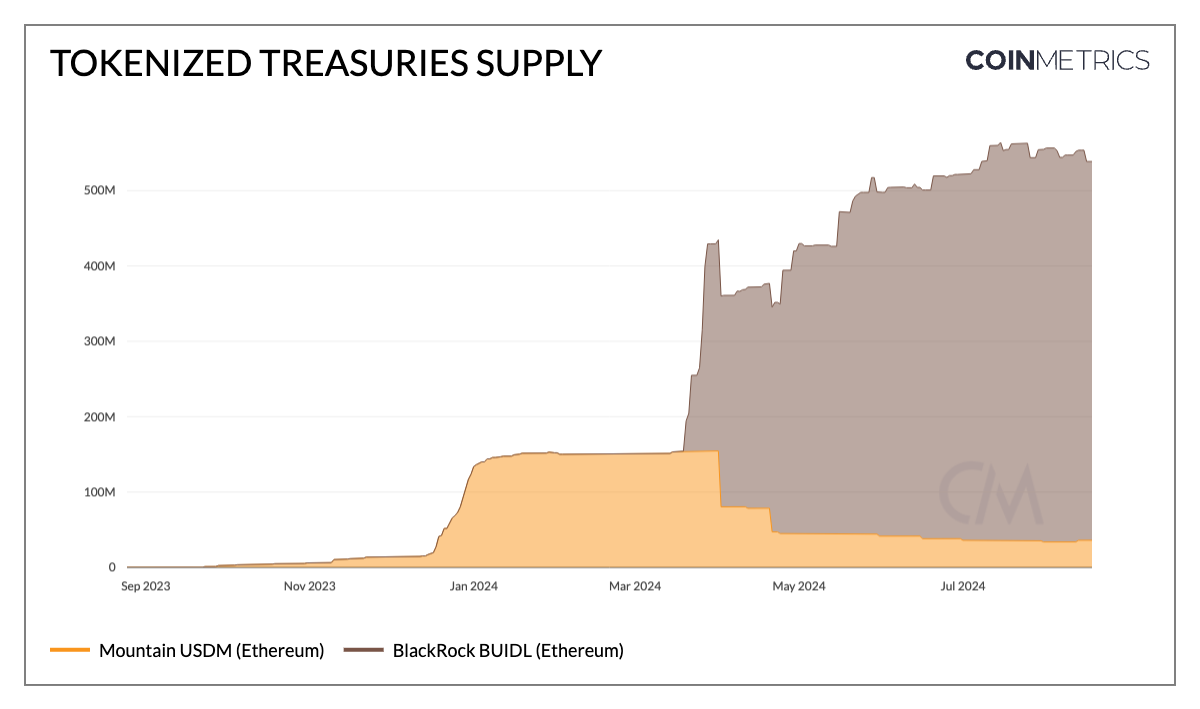

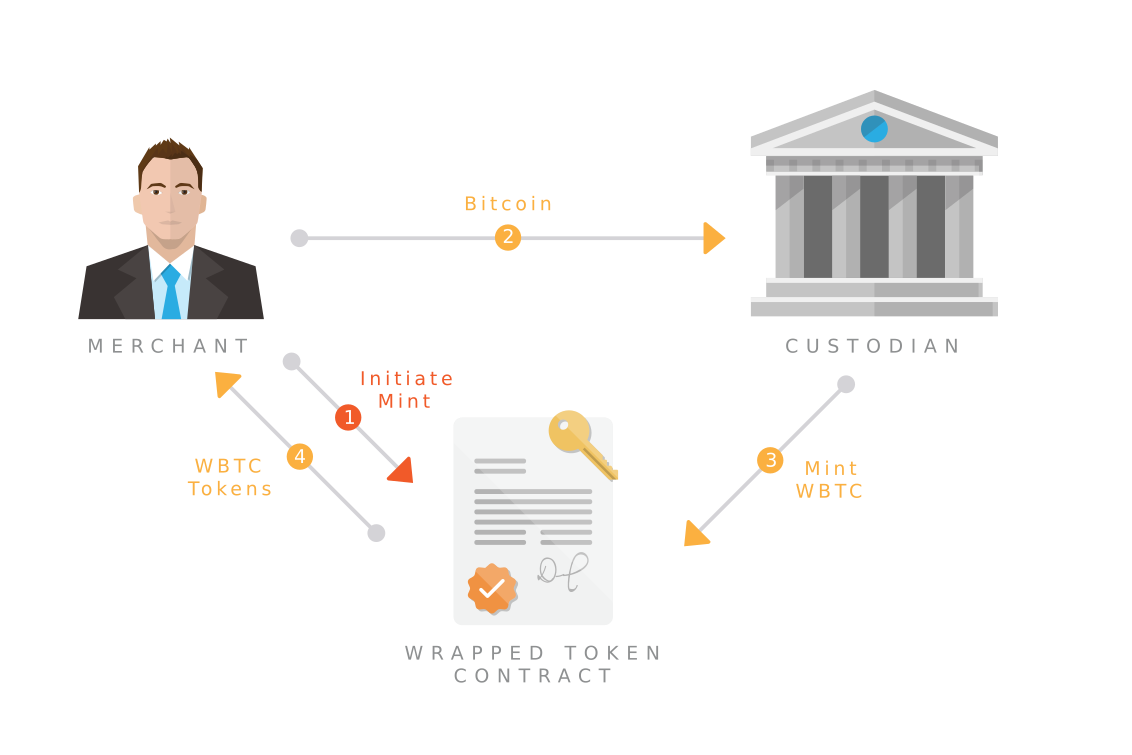

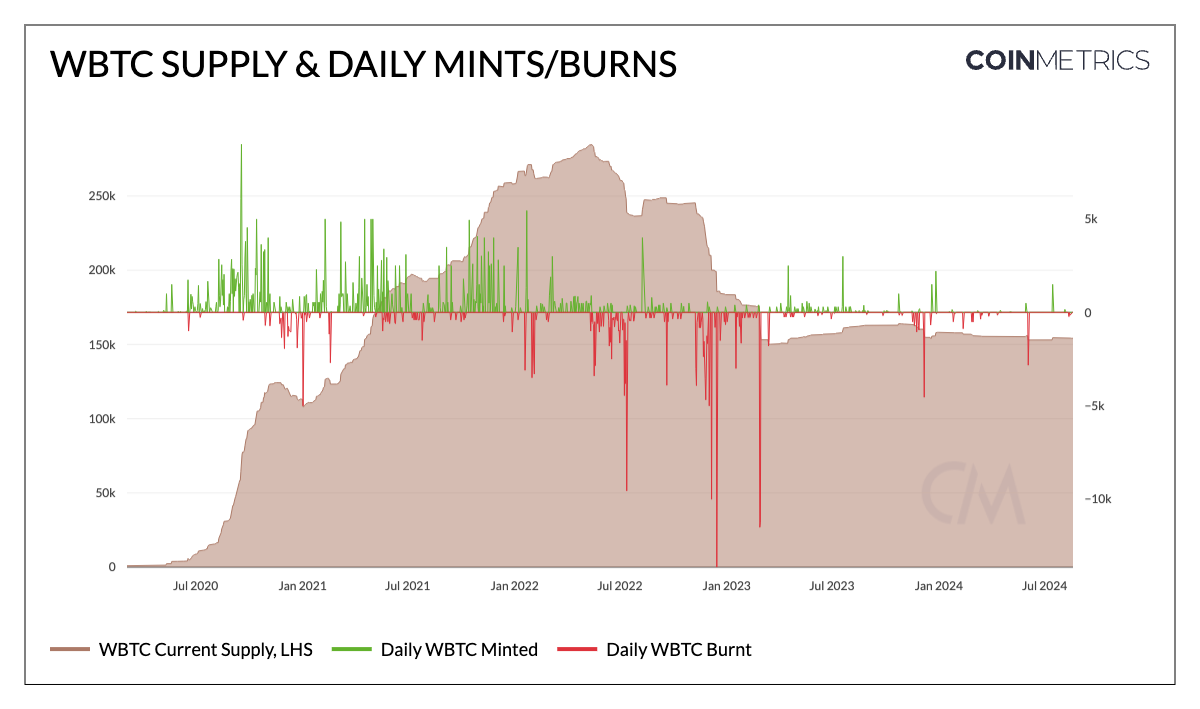

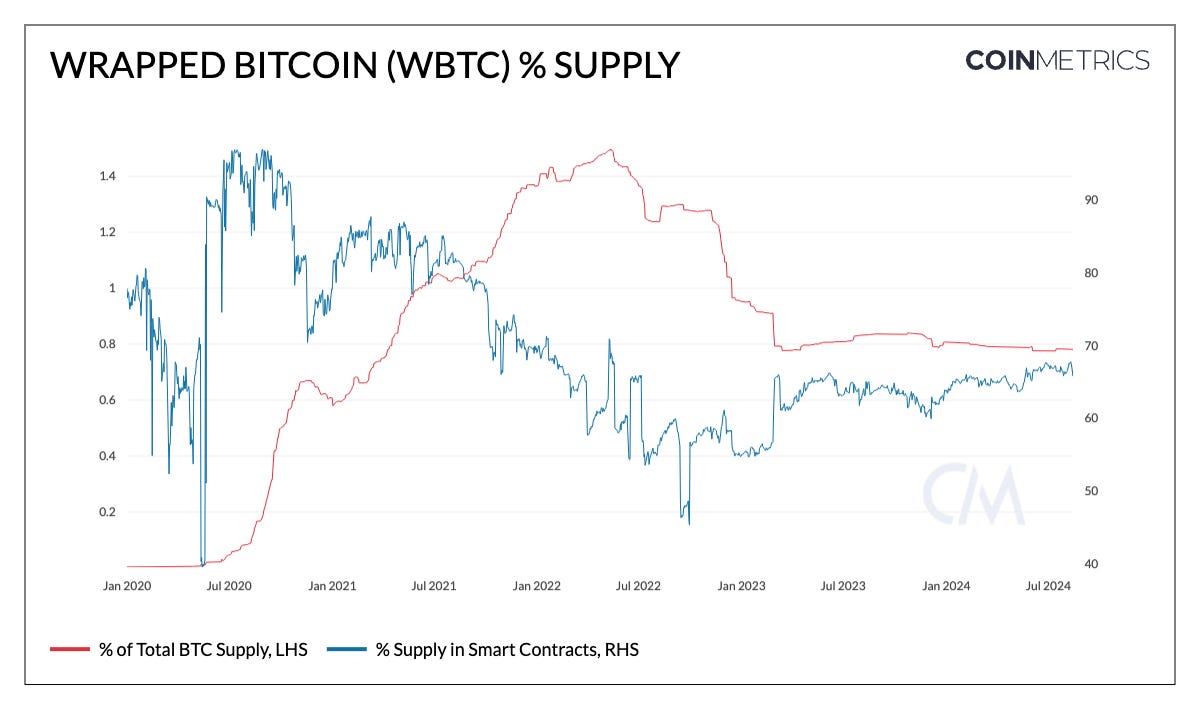

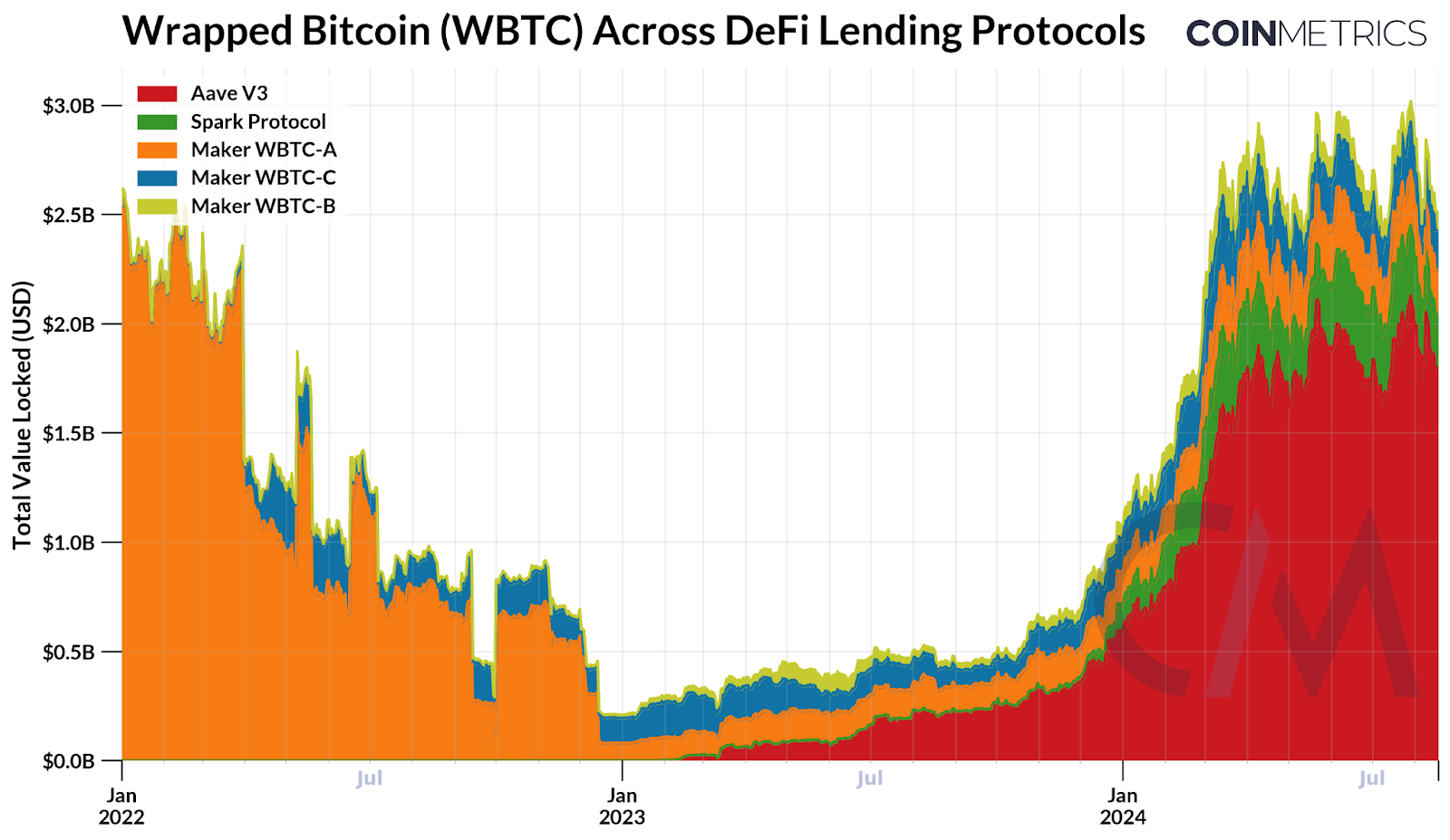

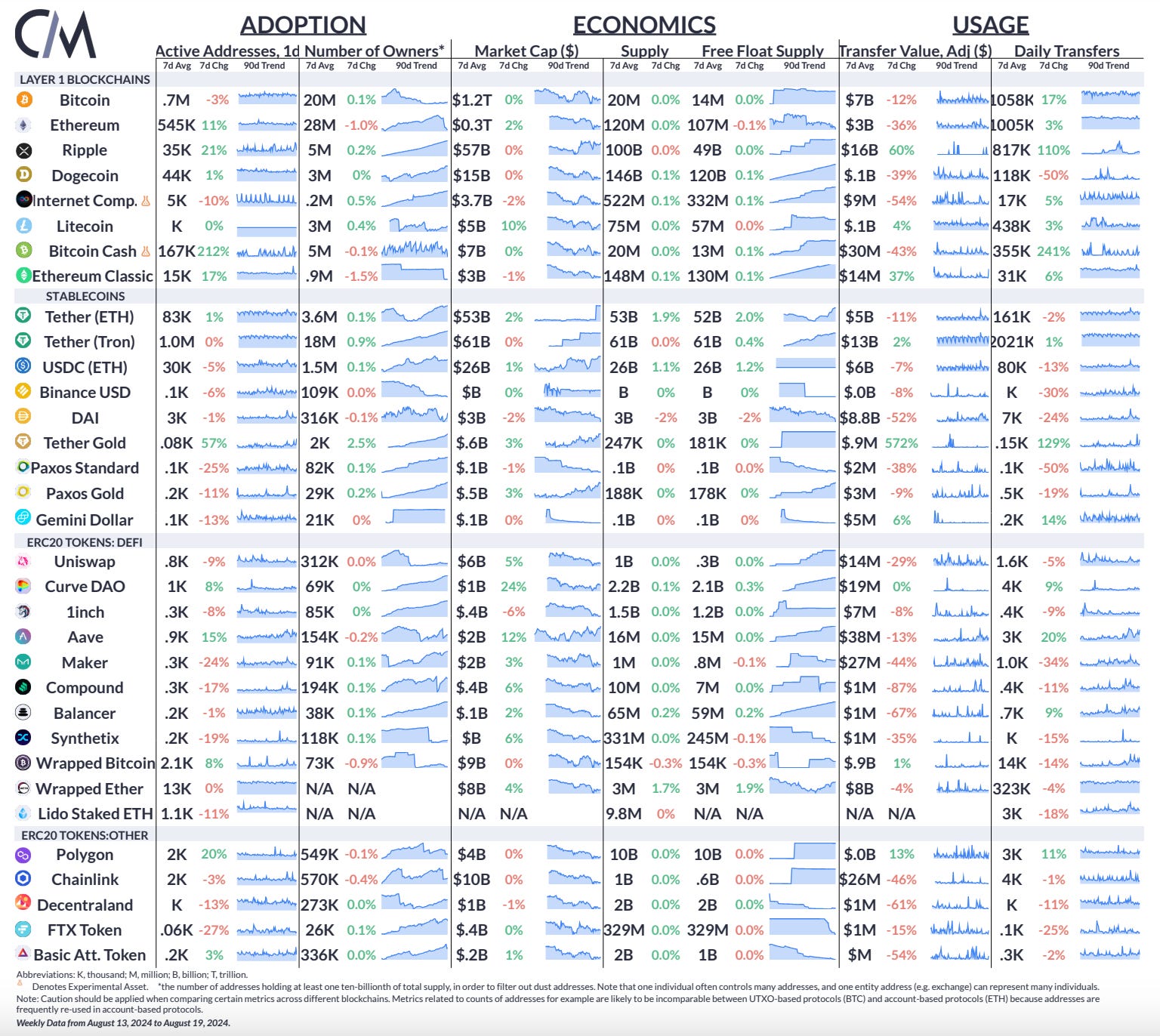

IntroductionAs the addressable market of the crypto ecosystem has expanded, so has the need for tokenizing various forms of value and assets on public blockchains. Today, the asset class consists not only of pure digital assets like bitcoin (BTC), but also tokenized representations of underlying assets, ranging from cryptocurrencies (i.e, BTC, ETH) to fiat currencies like the US Dollar and now traditional financial instruments like government securities. This has given rise to a spectrum of sectors such as wrapped assets, stablecoins and tokenized public securities, enhancing the interoperability and utility of crypto-assets. In this issue of Coin Metrics’ State of the Network, we contextualize the role of tokenized and wrapped assets within the crypto ecosystem, spotlighting wrapped bitcoin (WBTC) amid its upcoming custodial restructuring from BitGo. The Universe of Tokenized & Wrapped AssetsThe universe of tokenized assets has expanded substantially, encompassing wrapped assets, stablecoins and real world assets (RWAs). While serving different purposes, these can be grouped under the broader umbrella of tokenized assets due to their shared characteristic of representing the value of different underlying assets. Source: Coin Metrics Network Data Pro Wrapped Assets: Wrapped assets are tokens that represent another cryptocurrency’s value, allowing for interoperability across blockchain networks. For example, wrapped bitcoin (WBTC) is an ERC-20 token representing bitcoin, enabling holders to use it within the Ethereum ecosystem. This category also consists of tokens like wrapped Ether (WETH), an ERC-20 representation of ETH, wrapped liquid staked Ether (wstETH), representing staked ETH through Lido and others like wrapped BNB (wBNB). WBTC and WETH are the largest wrapped assets today, with a market capitalization of $9.1B and $7.6B respectively. Source: Coin Metrics Network Data Pro Stablecoins: Stablecoins tokenize fiat currencies like the US Dollar or the Euro or in some cases, a basket of crypto and traditional assets. For example, USDT and USDC are pegged to the U.S. dollar, with each stablecoin backed by cash-equivalent assets held in issuer reserves to maintain a 1:1 value ratio. We’ve seen the emergence of various categories of stablecoins, from fiat-backed to crypto-backed and others, with USDT and USDC making up a combined market capitalization of ~$148B. Source: Coin Metrics Network Data Pro Tokenized RWAs: While relatively in their infancy, tokenized assets include a range of RWAs beyond cryptocurrencies, such as treasuries, private credit, commodities and more. For instance, BlackRock's recently launched USD Institutional Liquidity Fund (BUIDL) tokenizes cash, repurchase agreements and US treasuries of various maturities, providing qualified investors with access to traditional investment opportunities and enhancing liquidity in traditional markets. BUIDL is the largest in this category, with an estimated market capitalization of $517M. The Mechanics of Wrapped Bitcoin (WBTC)Wrapped assets are created by locking a cryptocurrency on its native blockchain and issuing an equivalent token on another blockchain. This process spans various models, from centralized approaches using custodians and merchants, to relatively more permissionless solutions utilizing direct smart contract interactions or a network of participants to reduce potential points of failure. A prime example is Wrapped Bitcoin (WBTC), a joint initiative started in 2019 by REN, Kyber and BitGo. WBTC employs a decentralized autonomous organization (DAO) that manages the addition and removal of custodians and merchants, controlled by holders of keys to multi-signature contracts. BitGo serves as the primary custodian for WBTC, maintaining custody of the bitcoin that collateralizes WBTC tokens, while merchants act as intermediaries, facilitating minting and burning. Merchants lock up BTC with BitGo, initializing the minting of WBTC which is represented on an Ethereum account in the form of an ERC-20 token with a 1-to-1 backing. This allows for use of bitcoin in Ethereum based products and services such as DeFi without compromising on BTC liquidity. The original BTC can also be redeemed by returning WBTC to the custodian's Ethereum account, from which it is burned out of circulation. Despite the range of bitcoin wrapping solutions that exist today, each with its tradeoffs, WBTC's custodial model has emerged as the most widely adopted. Currently, 154K bitcoins (valued at ~$9B) are under custody and 98K Ethereum addresses hold a positive balance of WBTC. WBTC’s Custodial Transition & BitGo’s Revenue ModelOn August 9th, BitGo announced plans to restructure WBTC's management through a joint venture with BiT Global, with a transition period of 60-days. The new structure aims to diversify custody and cold storage across multiple jurisdictions, expanding from the current US-based model to include Hong Kong and Singapore. Notably, this partnership will closely integrate with Justin Sun and the Tron ecosystem, influencing WBTC's management by granting BiT Global access to 2 of the 3 private keys to multi-signature contracts for oversight. Traditionally, BitGo has earned revenue by charging a fee on WBTC minting and burning operations. This fee typically ranges from 0.4% to 0.5%, varying based on transaction size and market conditions. These operations are transparently auditable on WBTC's order book and block explorers. For instance, in one transaction, BitGo, as the custodian, received 52.17193124 BTC. However, the corresponding mint transaction requested by the merchant shows only 52.08845615 BTC were minted, implying a ~0.16% fee as revenue for BitGo. Source: Coin Metrics Network Data Pro While this restructuring may expand BitGo's reach in Asian markets, it could also affect its revenue model. Sharing custodial responsibilities with BiT Global for WBTC may lead to changes in fee distribution and collection methods going forward. WBTC in DeFi: Utility and Risk Management Amid Custodial ChangesWrapped assets are essential building blocks in the decentralized finance (DeFi) ecosystem. They enhance liquidity, interoperability, and usability of cryptocurrencies across disparate blockchain networks and their applications. As a result, the average transfer size for WBTC as compared to BTC is almost 7x larger, with the typical WBTC transfer at $76K vs. $11K for BTC. While WBTC represents ~0.8% of bitcoin’s current supply of 19.7M, a large chunk, approximately 67% of its supply, resides in Ethereum-based smart contracts, providing evidence of its use in DeFi. Source: Coin Metrics Network Data Pro WBTC, among other wrapped and derivative assets, is widely used as collateral on DeFi lending platforms to borrow other assets or earn interest on liquidity, while also being tradeable across DEXs. It forms a substantial source of revenue for protocols like Maker, SparkLend, and Aave v3 as a result of the interest paid on debt against WBTC. A total of ~50K wrapped bitcoin (currently worth ~$3B), lies in borrowing and lending protocols on Ethereum. Source: Coin Metrics ATLAS In light of WBTC’s custodial transition, the governance bodies (DAO’s) of prominent DeFi lending platforms proposed various risk management strategies to mitigate risk within their ecosystems. The Aave DAO decided to not make any significant changes to their markets at this moment. With roughly 34,000 BTC (~$1.9B) sitting on Aave V3’s total market size of $14B, the DAO did not make decisions to offboard WBTC itself, with risk manager Chaos Labs indicating it generates ~$6M in annualized revenues for the protocol. MakerDAO, however, took a more decisive stance. They executed a proposal to phase out WBTC from both Maker and SparkLend platforms, aiming to mitigate risk for the Dai stablecoin. Driven by perceived risks associated with WBTC's new operational structure, this action has resulted in changes to debt ceilings and stability fees for WBTC vaults. Consequently, users can no longer take WBTC-collateralized loans, effectively limiting its use within these protocols. ConclusionThe custodial restructuring of WBTC into a joint venture, while aimed at geographical diversification, has raised concerns across the crypto ecosystem. Given WBTC's significant role in the on-chain ecosystem, this transition has brought custodial and operational risks to the forefront, spurring increased interest in permissionless alternatives like Threshold BTC (tBTC) and new entrants like Coinbase's cbBTC. As the effects of this change unfold, DeFi protocols and other stakeholders are likely to implement risk mitigation measures—especially as a wider array of tokenized assets make their way into the interconnected on-chain ecosystem. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Daily active addresses for Bitcoin decreased by 3%, while activity on Ethereum increased by 11% over the past week. Ripple saw a 60% rise in transfer value (adjusted) and 110% jump in transfer count capping off a strong week of price-action for XRP. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Futures Falter, Funding Flips

Tuesday, August 13, 2024

Stability of Decentralized Finance ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

An Update on Crypto Markets & Coinbase Q2 2024 Earnings

Tuesday, August 6, 2024

Analyzing recent events gripping crypto markets and Coinbase Q2 2024 earnings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Story of Ethereum Staking So Far

Tuesday, July 30, 2024

Uncovering Ethereum's staking ecosystem, from "The Merge" to "Shapella", the rise of liquid staking tokens (LSTs) and beyond ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Launch of Ether ETFs

Tuesday, July 23, 2024

A look into ETH ETF fees, Grayscale funds and demand & supply dynamics heading into Ether ETF Launch ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Charting the Course to Mt. Gox Repayments

Tuesday, July 16, 2024

Coin Metrics' State of the Network: Issue 268 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏