Coin Metrics - Introducing Exchange Flow Metrics

Get the best data-driven crypto insights and analysis every week: By: Matías Andrade Cabieses & Tanay Ved Key Takeaways:

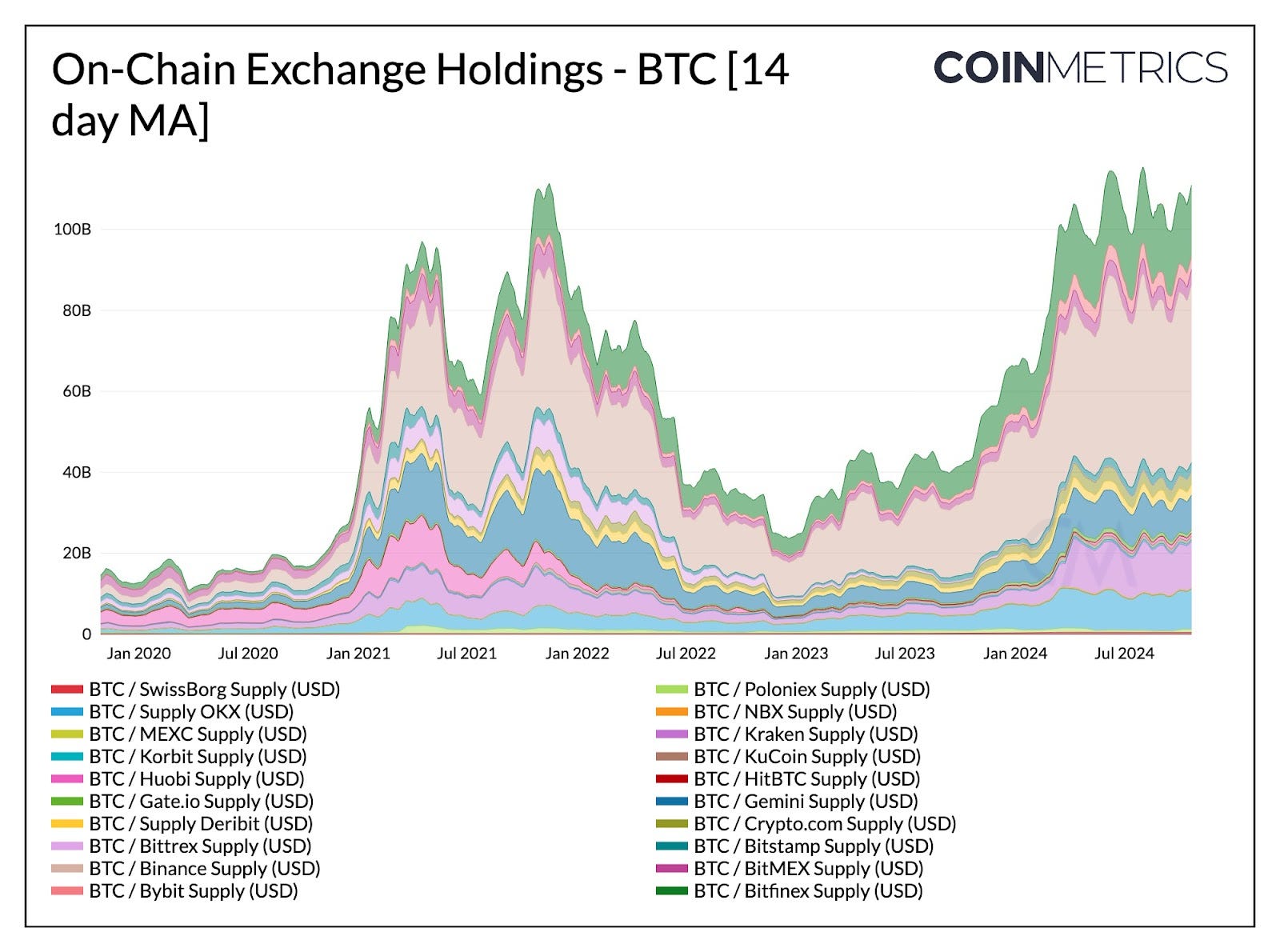

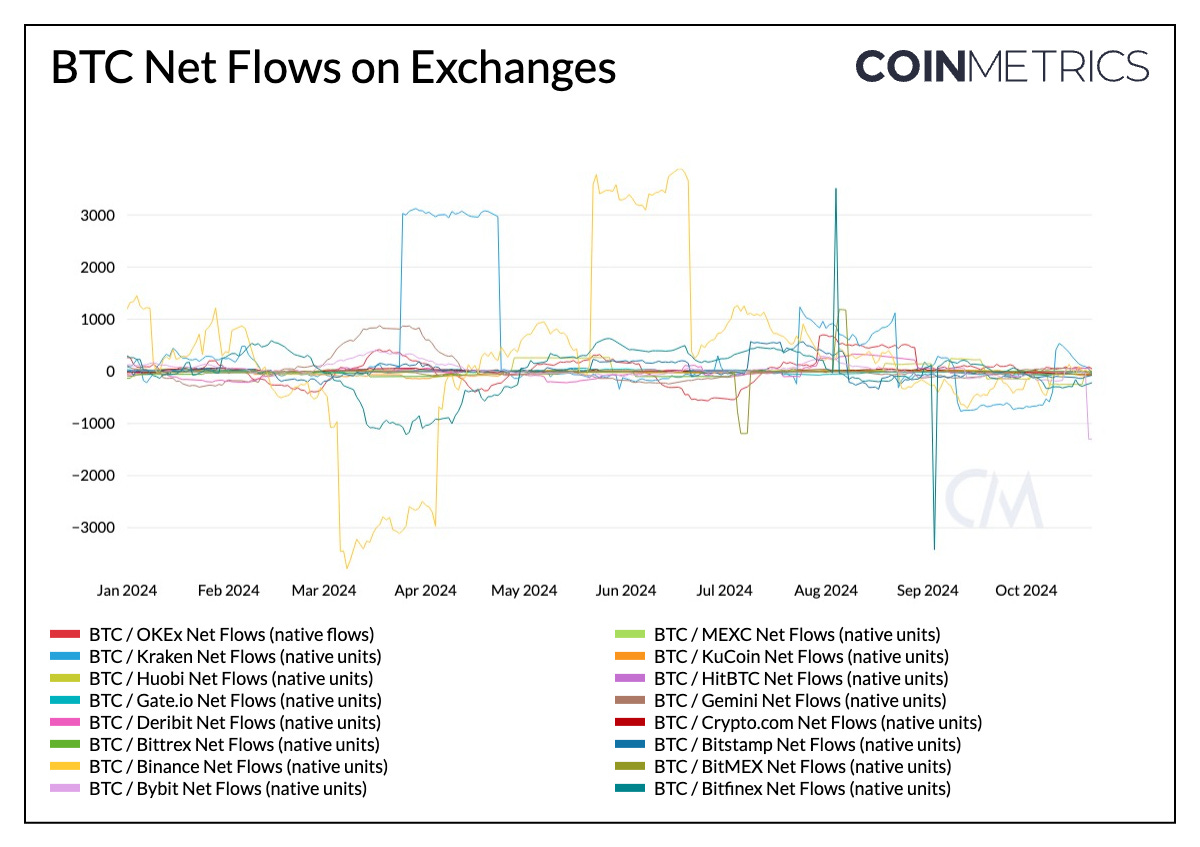

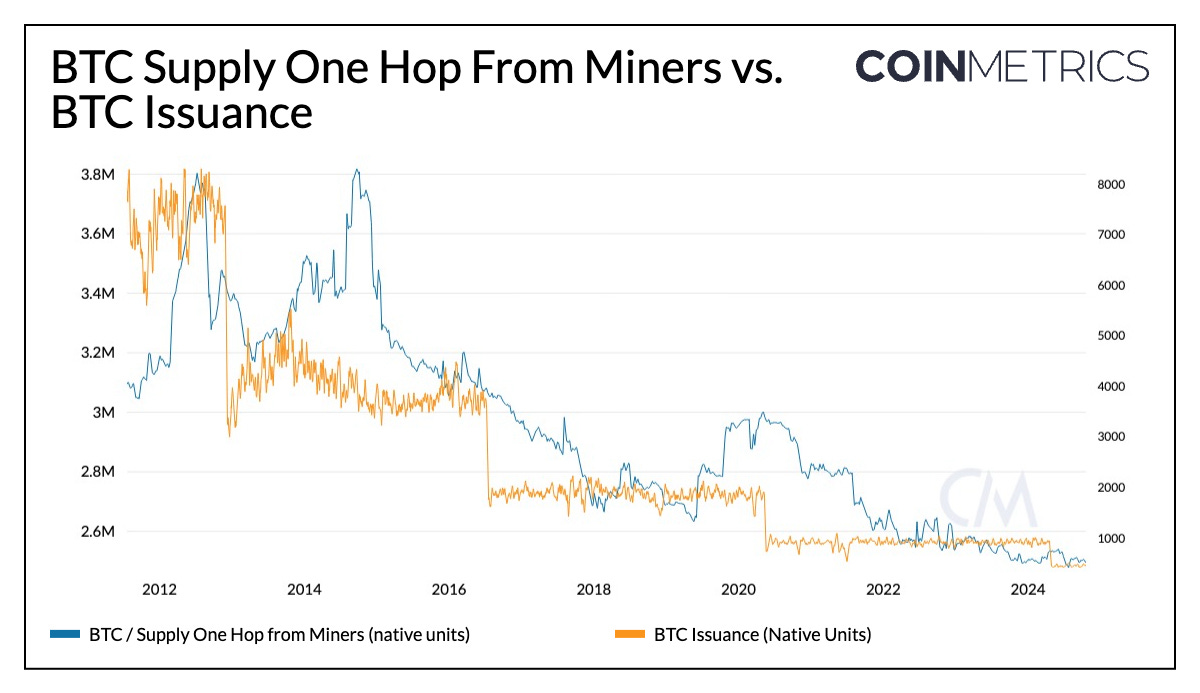

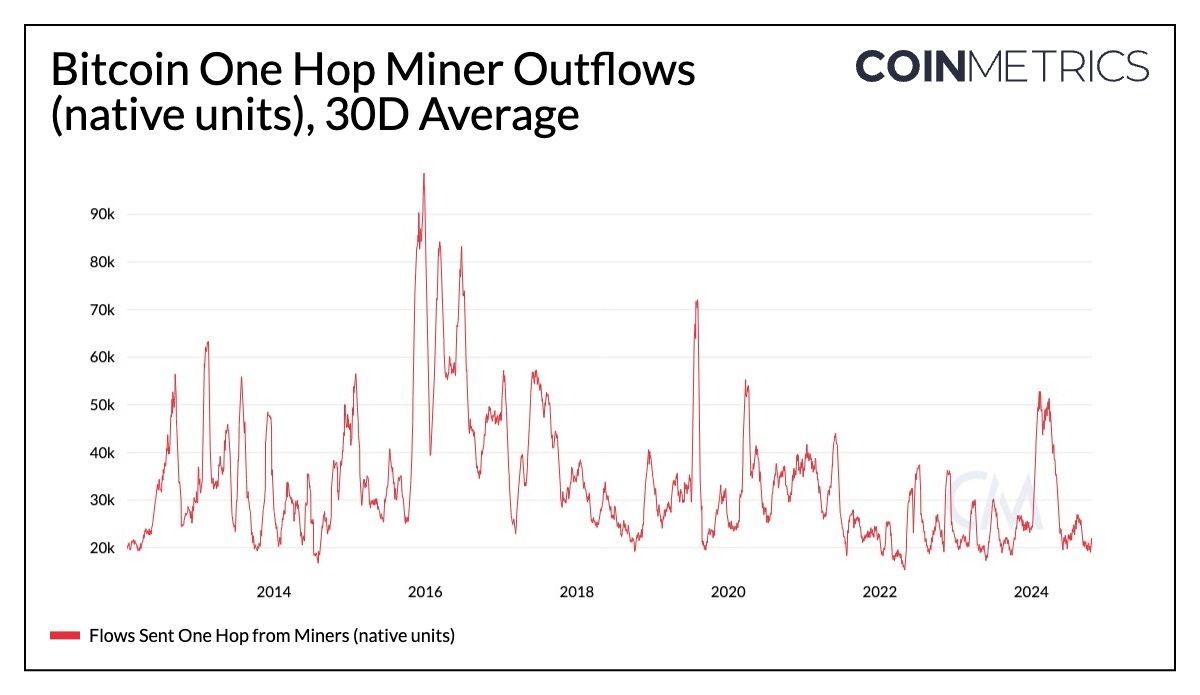

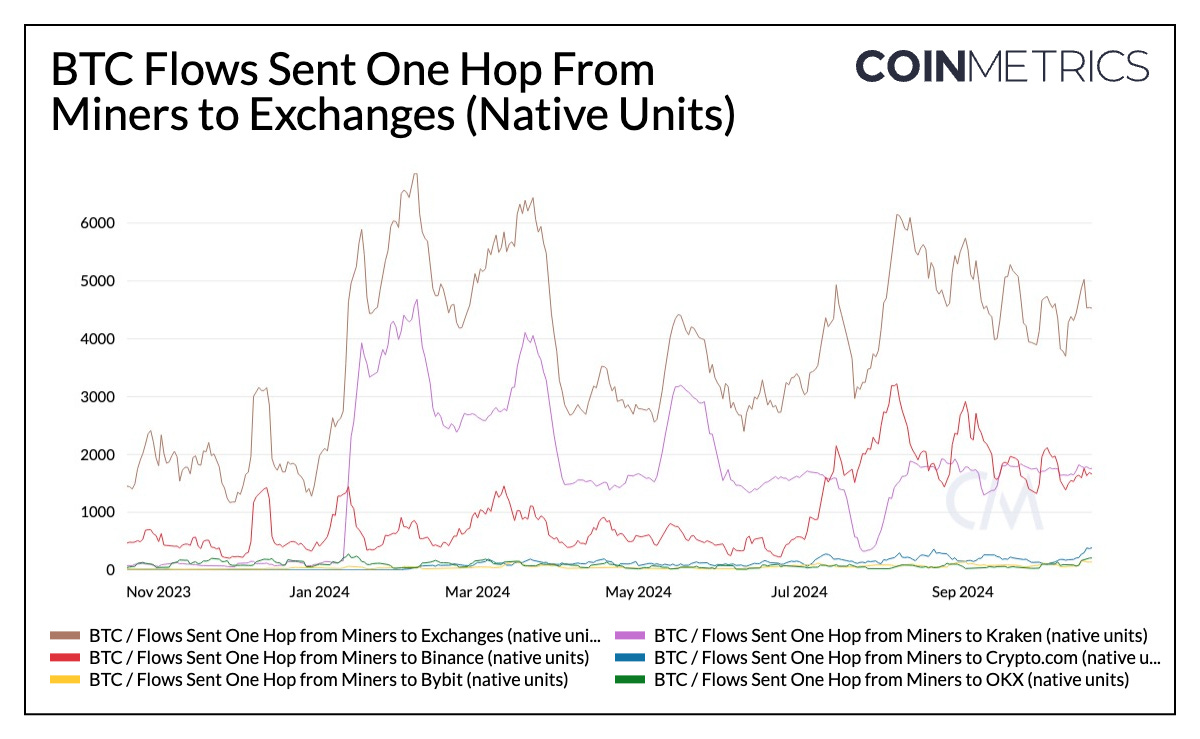

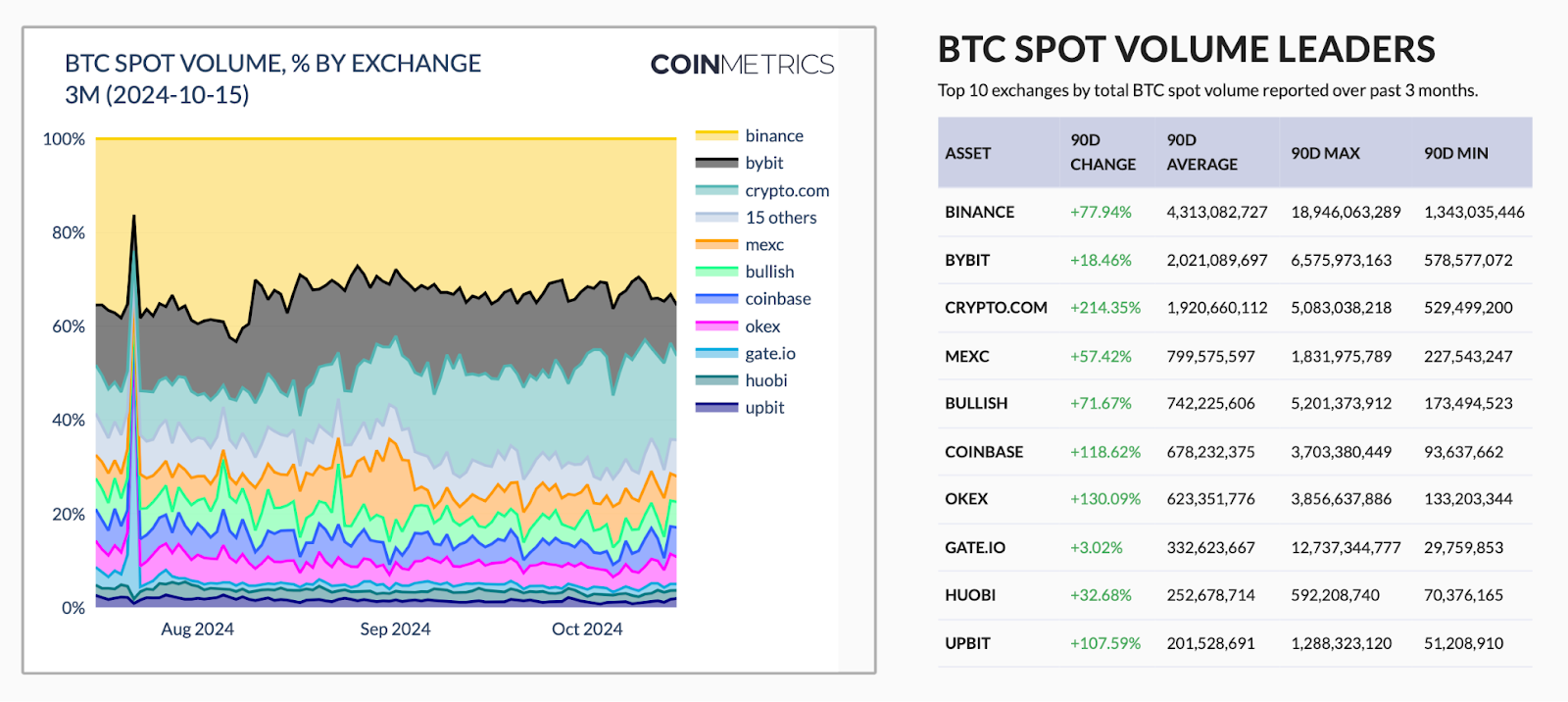

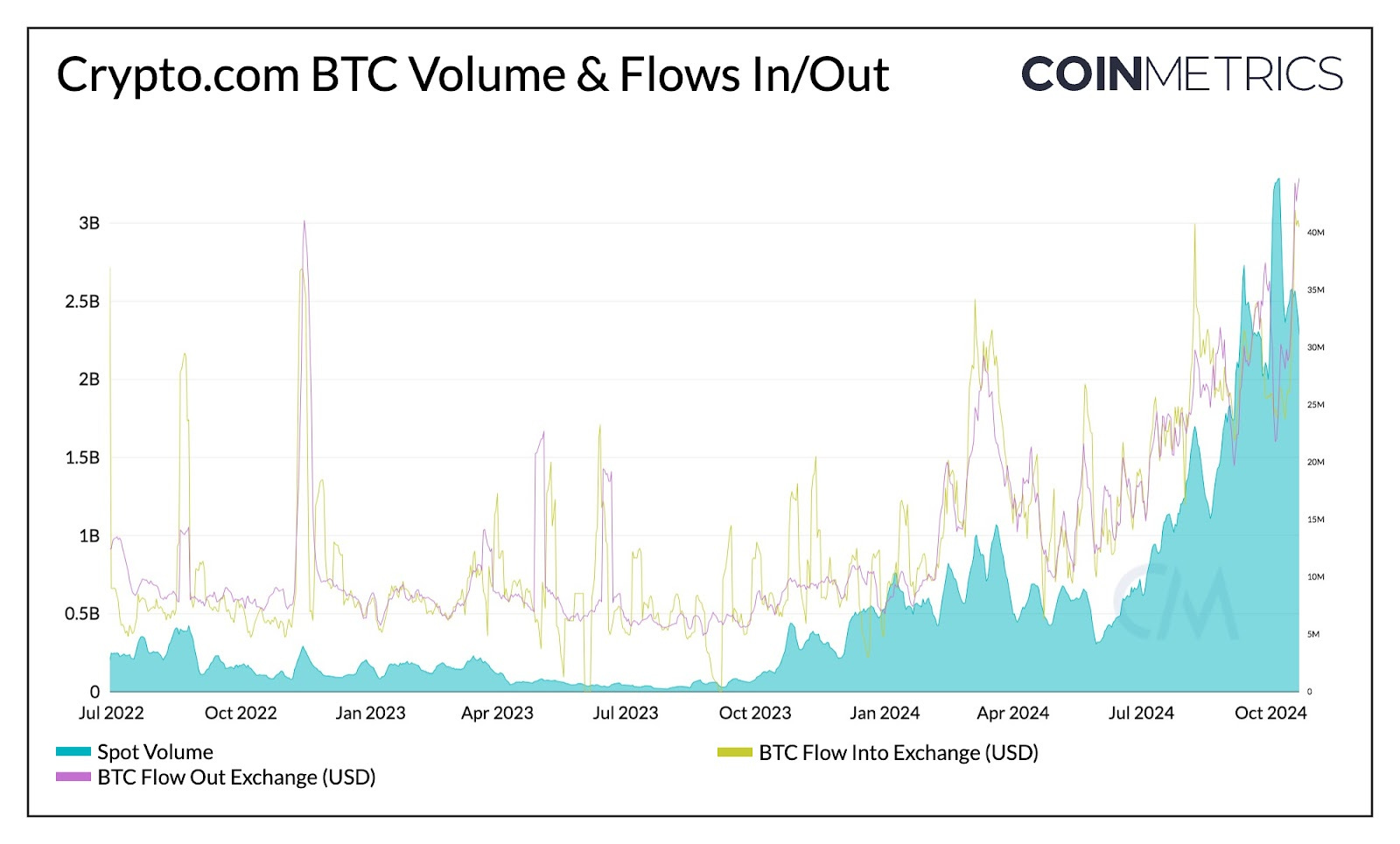

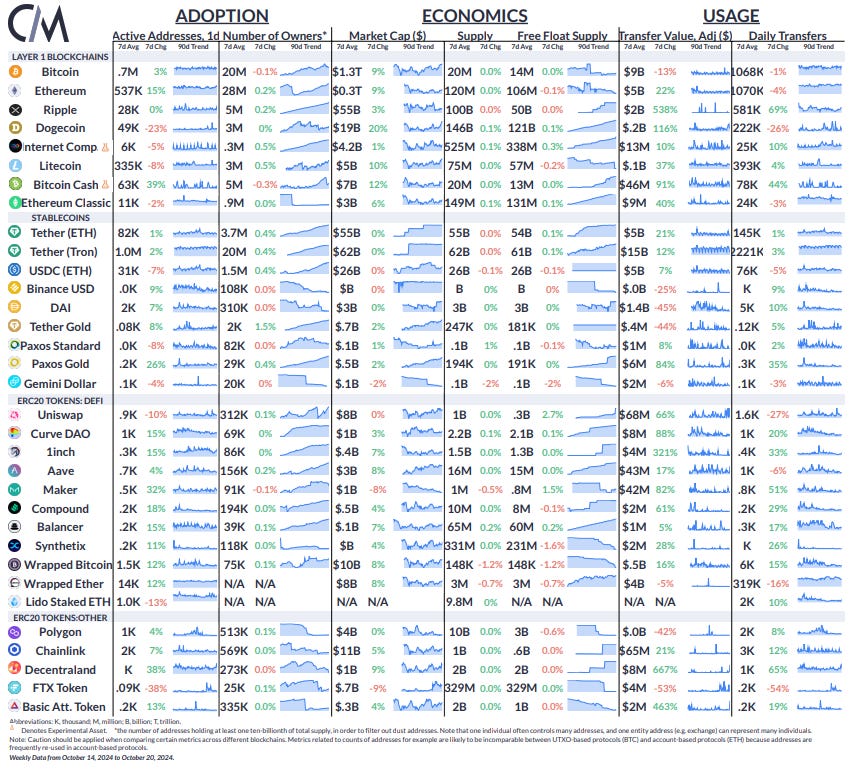

IntroductionThe inflows and outflows of BTC and ETH to and from exchanges offer a window into the broader cryptocurrency ecosystem. By analyzing these exchange flows, we can gain valuable insights into investor behavior, market liquidity, and the overall health of the digital asset market. This information can be particularly useful for traders, investors, and market analysts seeking to make informed decisions about exchanges and the broader digital asset market, and identify potential trends or market signals. In this week’s issue of Coin Metrics’ State of the Network, we explore our new product that analyzes flows of Bitcoin (BTC) and Ethereum (ETH) to and from centralized exchanges. Understanding the dynamics of these exchange flows can provide crucial insights into the market sentiment, trading activity, and potential price movements of these digital assets. In the following sections, we discuss the insights that can be gleaned from the analysis of BTC and ETH exchange flows. We explore the historical trends, seasonal patterns, and key events that have influenced the movements of these assets across exchanges. Flow Metric OverviewThe exchange flow metrics introduced by Coin Metrics track the inflows and outflows to various cryptocurrency exchanges, including in/outflows from miners, net balances and also the total supply of assets held by these exchanges. These metrics cover exchanges such as Binance (BNB), Crypto.com (CRO), Deribit (DER), Gate.io (GIO), Huobi (HBT), Kucoin (KCN), Korbit (KOR), MEXC (MXC), NBX, OKX, and Swissborg (SBG) and others, encompassing 20 exchanges in total. The specific metrics provided include inflows and outflows for each exchange, both in the native token and USD, for both BTC and ETH. There are also miner inflow and outflow metrics, tracking the movement of funds to and from miners for each exchange. The net balance metrics show the net position for each exchange in both the native token and USD. Additionally, the dataset includes transfer count metrics, which provide the number of transfers into and out of each exchange. Finally, the supply metrics detail the total supply of the native token and USD for each exchange. Source: Coin Metrics Network Data Pro Net flow metrics illustrate the movement patterns of Bitcoin across major exchanges, providing a clearer view into market participant behavior. The metrics are particularly valuable for monitoring significant market events such as Mt. Gox creditor repayments (which have been postponed to October 2025) and notable flow variations visible in periods like the March-April Binance movements and August Bitfinex spike, helping participants track movements that influence overall market dynamics. Source: Coin Metrics Network Data Pro Miner Flows to ExchangesBy examining flows, we can better understand miner behavior with regards to Bitcoin’s halving cycles—helping identify periods of BTC accumulation or distribution. While “0-hop” addresses typically identify mining pools as direct recipients of mining rewards (new BTC issuance and transaction fees), “1-hop” addresses often represent individual miners to whom pools distribute earnings. To dive deeper into the relationship between these entities, check out “Following Flows V: Pool Cross Pollination”. Source: Coin Metrics Network Data Pro Therefore, activity of 1-hop addresses can help gauge miner sentiment and their influence on market supply and demand. With BTC’s block subsidy halving and issuance reduction roughly every 4 years, there’s a long term decline in BTC supply held 1-hop from miners, currently at 2.5M BTC. This suggests that miners are retaining less of their newly mined coins and potentially distributing them due to economic pressures or for operational strategies with each halving. Source: Coin Metrics Network Data Pro As a result, BTC total flows sent 1-hop from miners and to exchanges have seen an uptick this year, with a high of 59K and 6.8K respectively. Interestingly, the rise occurs 2-3 months before and after the halving, as miners may be securing profits or building cash reserves in anticipation of slashed revenues or gradually realizing the full economic impact of the halving. A notable increase stems from Kraken, representing over 85% of inflows in February as well as Binance, accounting for a high of~3200 BTC (a 60% share of inflows) in early August. Source: Coin Metrics Network Data Pro Crypto.com Volume GrowthA recent trend in exchange dominance has been taking place over the last few months, with Crypto.com increasing their market share of spot BTC traded volume quite significantly, by over 200% over the last 90 days, this now puts it on the top 3 BTC spot volume leaders tracked by Coin Metrics. Source: Coin Metrics State of the Market One of the ways we can use the new flow metrics is to validate whether the activity taking place in an exchange is organic. By comparing the spot BTC volumes traded (in USD) and the BTC flows (similarly priced in BTC), we can gain valuable insights into the nature of the market activity. Flows, which represent the net movement of BTC in and out of an exchange, are directly aligned with the underlying trading volumes. If the flows are in line with the volumes, it suggests that the activity is organic, meaning that the trades are driven by genuine market demand and not by artificial or manipulative practices. Conversely, if the flows and volumes are misaligned, it could indicate the presence of non-organic activity, such as wash trading or other forms of market manipulation. Source: Coin Metrics Market Data Feed & Network Data Pro By analyzing the relationship between flows and volumes, investors and analysts can better understand the health and dynamics of the cryptocurrency market. This information can be particularly useful when assessing the reliability of price movements and trading activity, as it helps to distinguish between genuine market activity and potentially artificial or manipulated behavior. By focusing on the organic nature of the market, investors can make more informed decisions and mitigate the risks associated with non-organic activity. ConclusionThe analysis of Bitcoin and Ethereum exchange flows metrics provided by Coin Metrics offers a powerful tool for investors, traders, and market analysts to gain crucial insights into the cryptocurrency ecosystem. By understanding the dynamics of inflows and outflows, miner behaviors, and the relationship between trading volumes and organic market activity, stakeholders can make more informed decisions and better navigate the complexities of the digital asset market. The comprehensive data and metrics presented in this report illustrate the value of data-driven analysis in the rapidly evolving cryptocurrency landscape, empowering market participants to identify trends, mitigate risks, and capitalize on emerging opportunities. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro The market capitalization of Bitcoin and Ethereum saw a 9% increase over the past week, as Bitcoin rallied towards $70K for the first time since July. Ethereum’s daily active addresses rose by 15%, while several other ERC-20’s experienced heightened activity amid strong market momentum. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

An Overview of the Flow Blockchain

Sunday, October 20, 2024

A data-driven overview of the Flow Blockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Mining Data Special

Tuesday, October 8, 2024

Get the best data-driven crypto insights and analysis every week: ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Wrap-Up

Tuesday, October 1, 2024

A data-driven overview of events shaping crypto markets in Q3–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Real World Assets (RWAs) & Tokenization

Tuesday, September 24, 2024

Coin Metrics' State of the Network: Issue 278 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Crypto Universe Through the Lens of datonomy™

Tuesday, September 17, 2024

Coin Metrics' State of the Network: Issue 277 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏