State of the Network’s Q4 2024 Mining Data Special

Get the best data-driven crypto insights and analysis every week: State of the Network’s Q4 2024 Mining Data SpecialBy: Matías Andrade Key Takeaways:

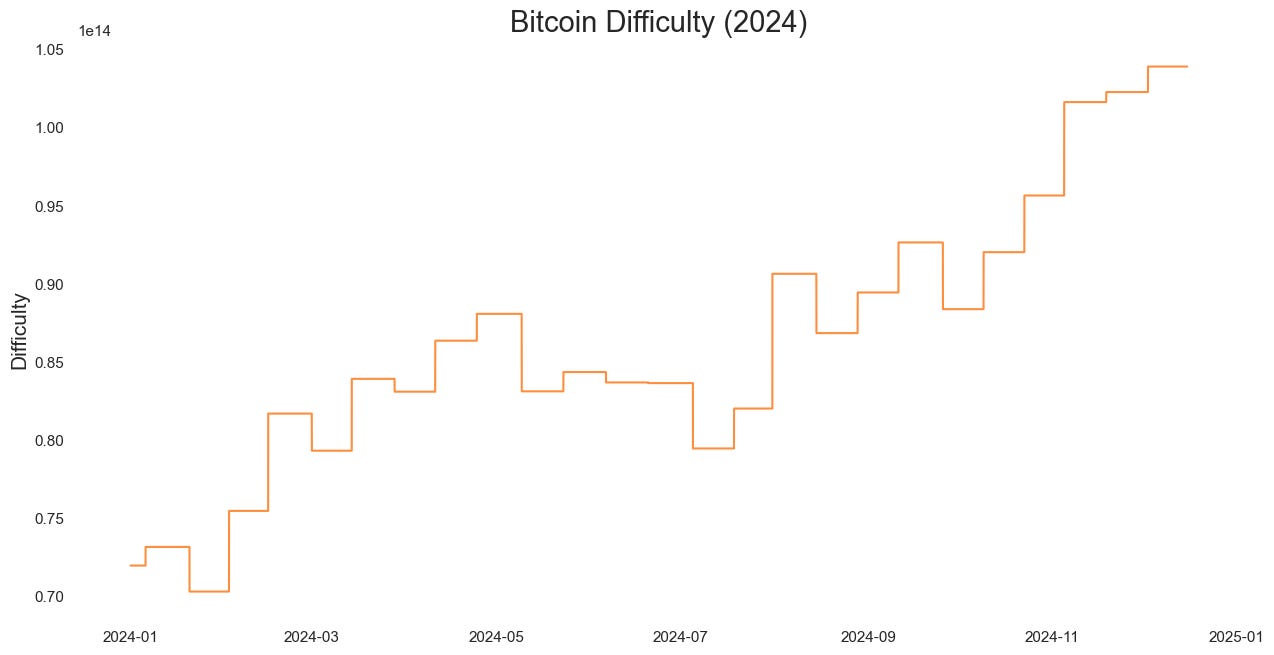

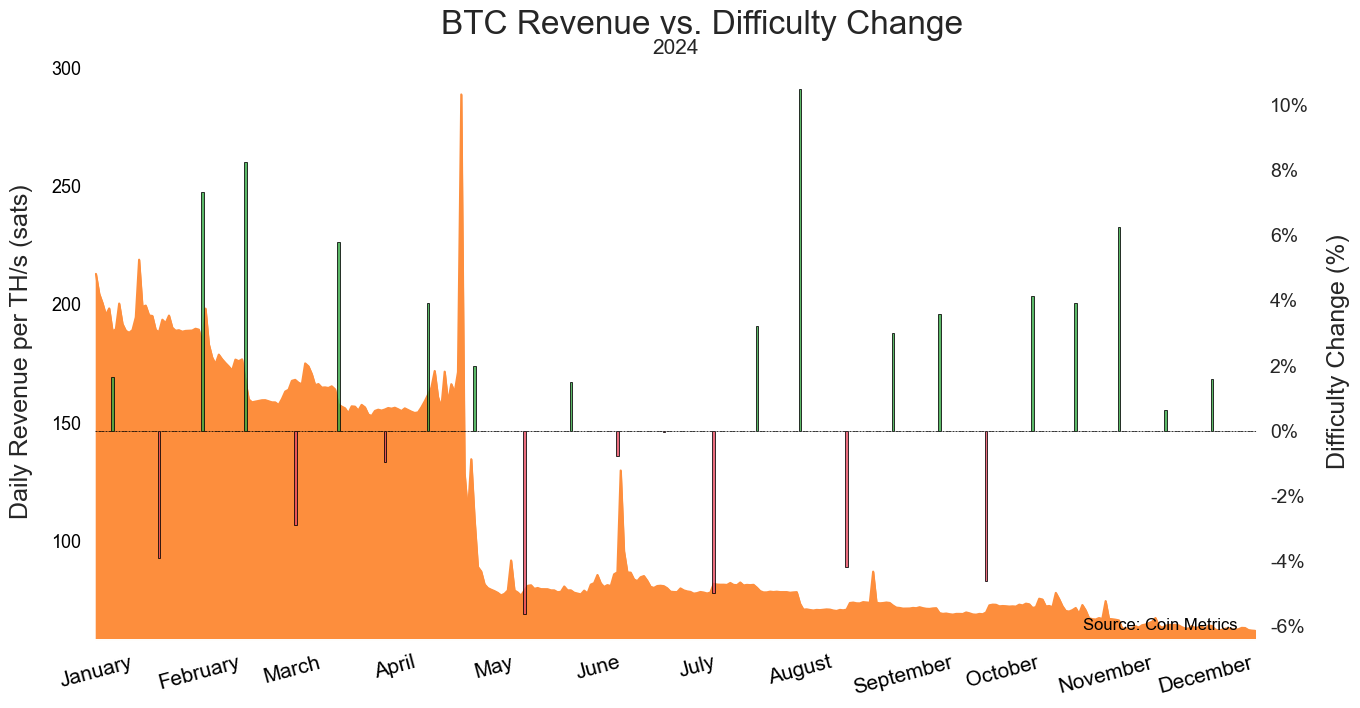

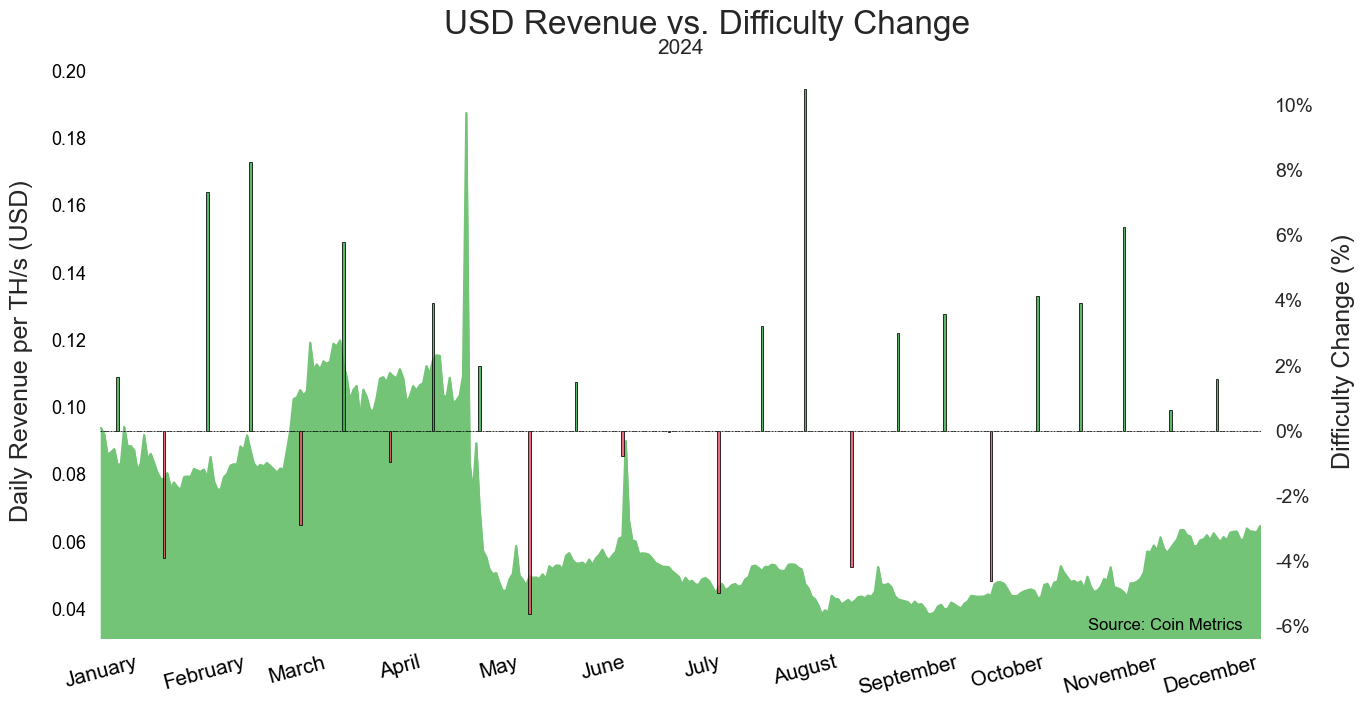

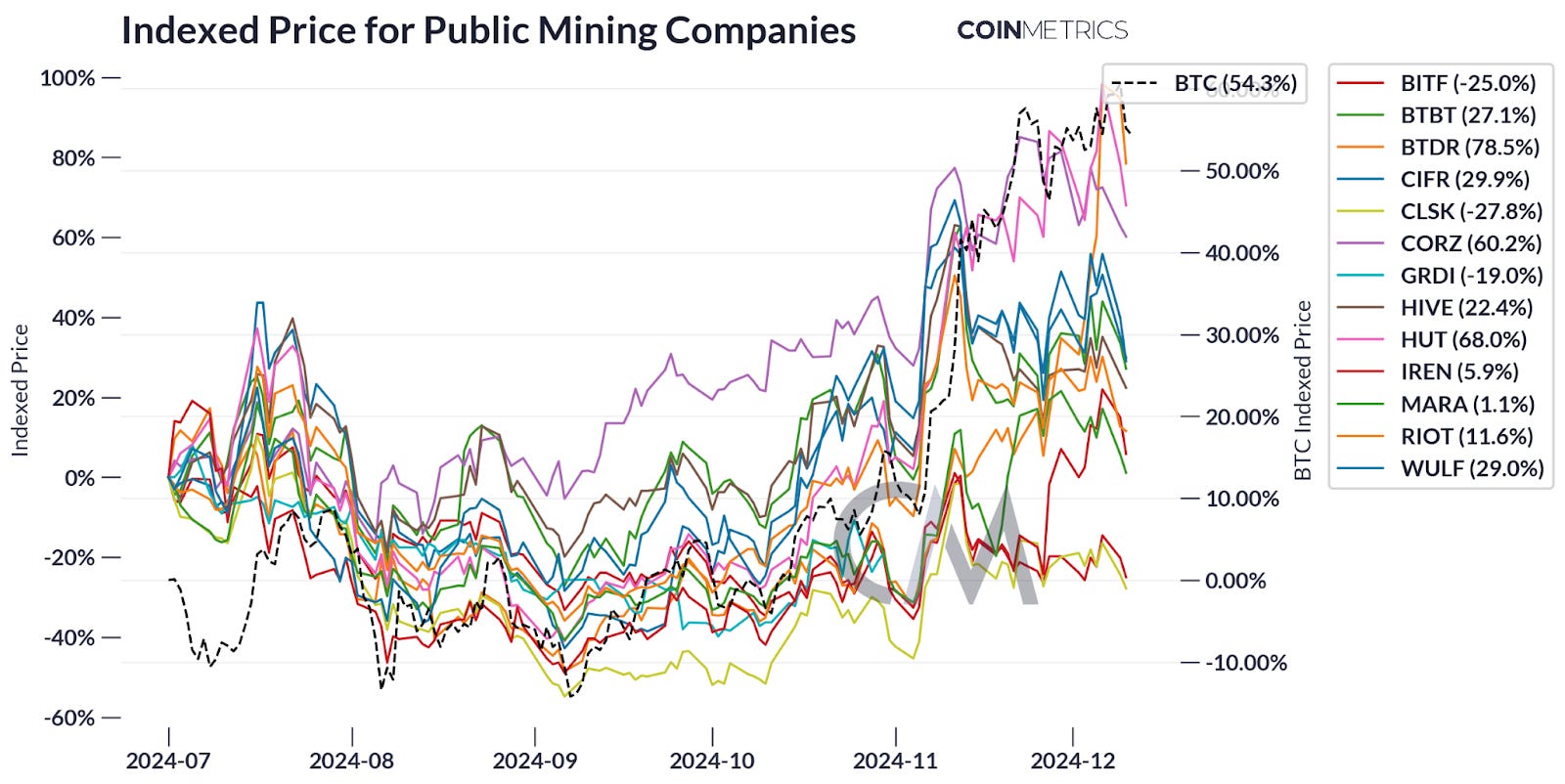

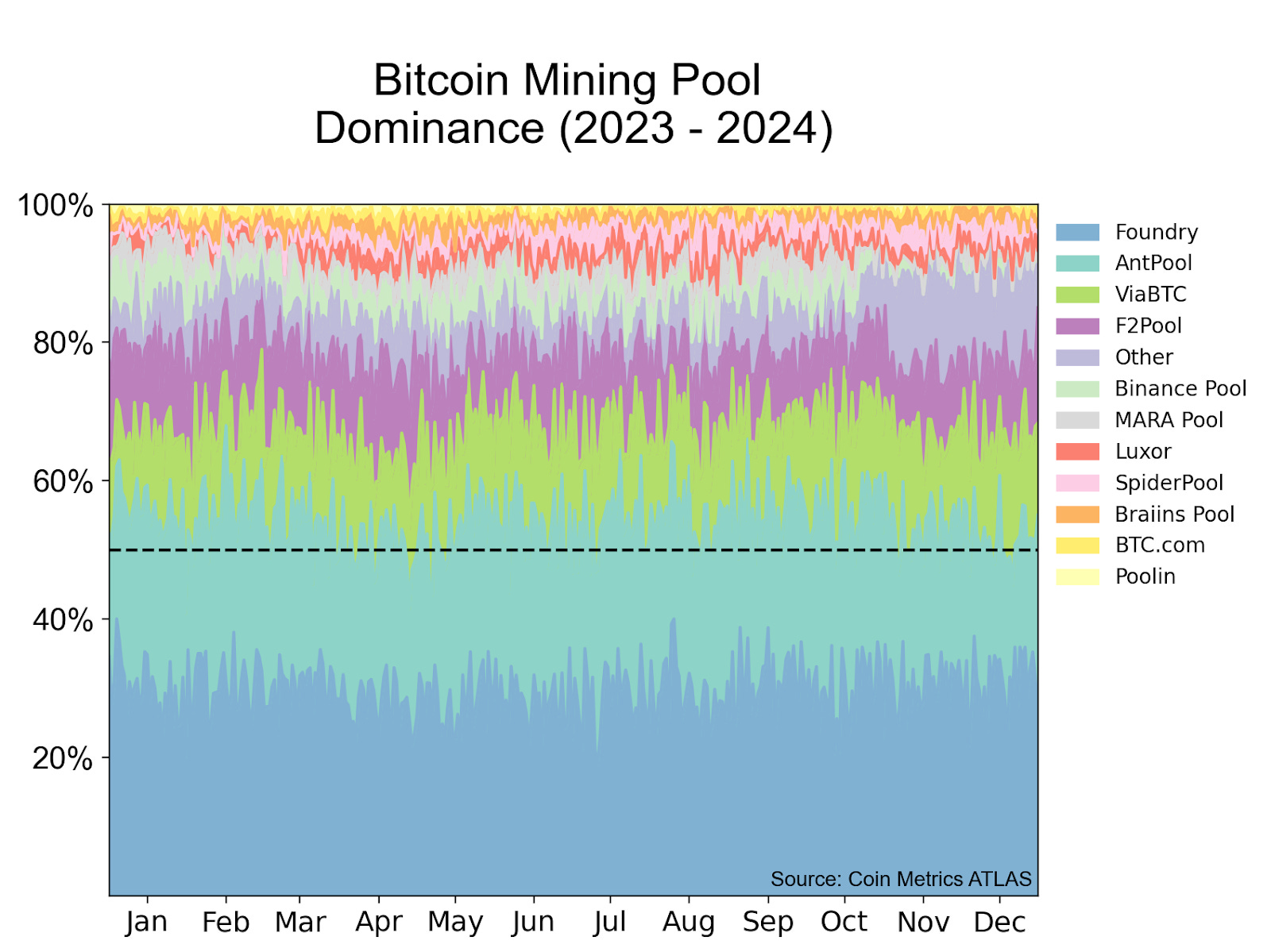

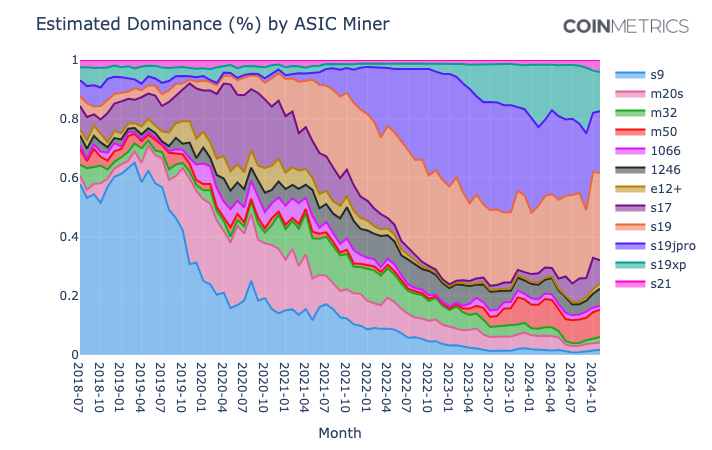

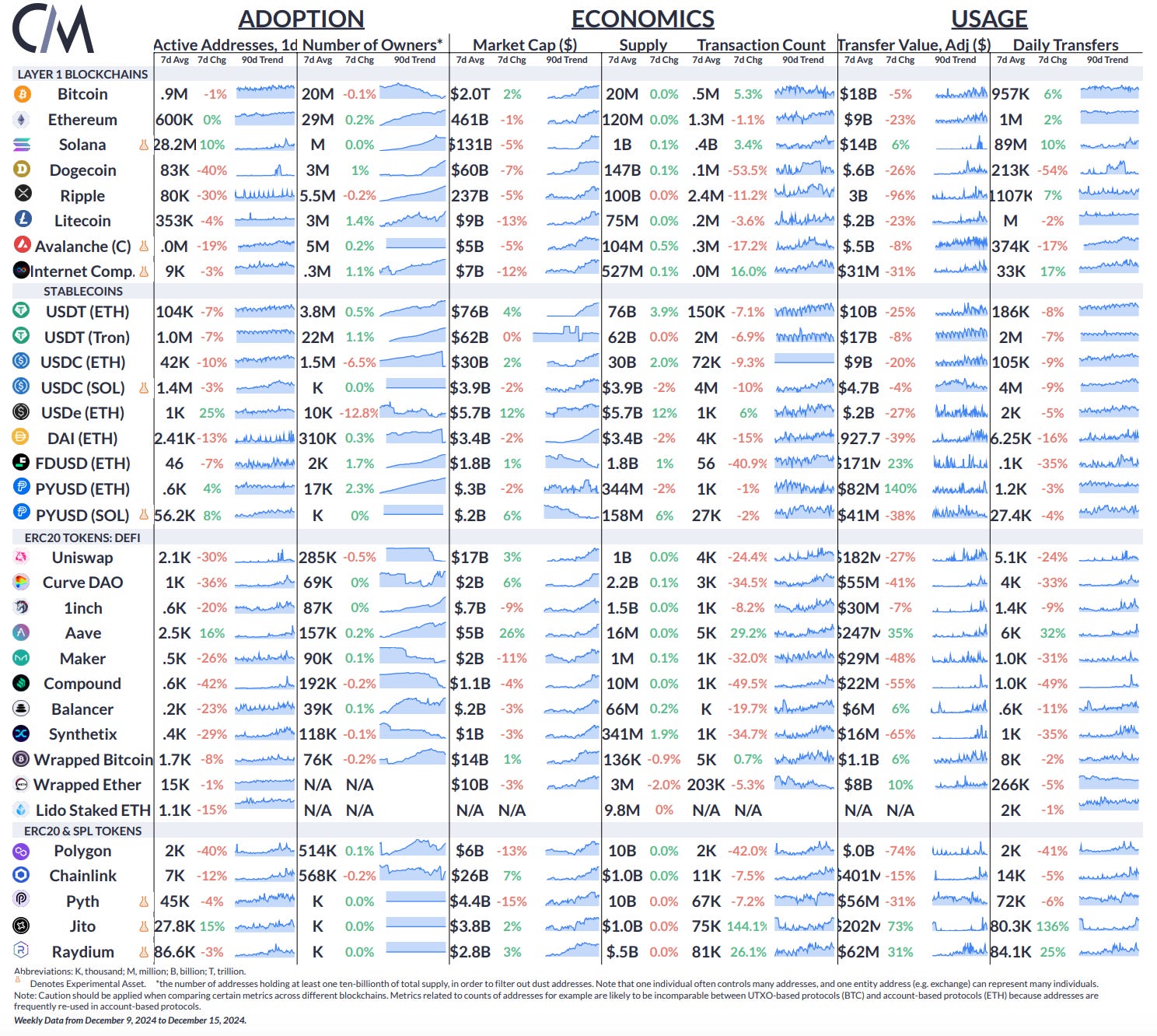

IntroductionThe global bitcoin mining industry has become a complex and geographically dispersed landscape, with miners constantly seeking out the most favorable conditions to power their energy-intensive operations. Unlike the idealized vision of a borderless, 24/7 cryptocurrency network, the reality on the ground is that bitcoin mining activity is highly sensitive to factors such as regional energy policies, climatic conditions, and even cultural preferences. In this week’s issue of State of the Network, we’ll take a deep dive into the shifting patterns and trends shaping the bitcoin mining industry around the world. Through a detailed analysis of data on bitcoin’s hash rate and mining difficulty, we’ll uncover the distribution of mining power and how it has evolved over time, taking advantage of some of the unique insights powered by Coin Metrics data. The Halving RetrospectiveOne of the most significant events in the Bitcoin ecosystem is the periodic halving of the block reward, which occurred most recently on April, 2024. This highly anticipated event, which takes place approximately every four years, cuts the reward received by Bitcoin miners in half, effectively reducing the new supply of BTC entering circulation. As expected, the 2024 halving had a significant impact on the Bitcoin mining industry. Our analysis of mining difficulty adjustments, shown in the chart below, reveals a sharp increase in the months leading up to the halving as miners raced to maximize their rewards before the cut. Source: Coin Metrics Network Data Pro The reduction in block rewards has directly impacted the revenue earned by Bitcoin miners, as illustrated below. Our data shows a clear drop in BTC-denominated revenue per terahash (TH/s) of mining power immediately following the halving, as miners had to contend with earning half the previous reward for each block they successfully validated. Source: Coin Metrics Network Data Pro While the BTC-denominated revenue declined, the recent rally in Bitcoin’s price to over $107,000 has partially offset the impact, as shown below. The USD revenue per TH/s of mining power has recovered somewhat, though it remains below the pre-halving levels, as miners face the challenge of maintaining profitability with reduced block rewards. Source: Coin Metrics Network Data Pro These trends highlight the resilience and adaptability required of Bitcoin miners in the face of the network’s programmed supply adjustments. As the industry continues to evolve, miners will need to optimize their operations, seek out the most cost-effective energy sources, and leverage technological advancements to remain competitive in the ever-changing landscape of cryptocurrency mining. Public Bitcoin Mining CompaniesThe performance of publicly traded Bitcoin mining stocks has shown strong correlation with Bitcoin's price movements, but with notably higher volatility. As Bitcoin has reached new all-time highs in 2024, mining companies have experienced significant price appreciation, though their trajectories have varied based on factors like operational efficiency, debt levels, and mining capacity. Key mining companies like Marathon Digital Holdings (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) have seen their stock prices surge several hundred percent from their 2023 lows. However, this appreciation hasn't been uniform across the sector. Companies with stronger balance sheets and newer, more efficient mining equipment have generally outperformed their peers. Since July 2024, as seen in the chart below, the greatest earners were Hut8, Bitdeer, and Core Scientific, appreciating 68%, 78.5% and 60.2% respectively. Source: Coin Metrics Market Data Feed & Yahoo Finance Several factors are driving this price action. Mining companies have high fixed costs in terms of equipment and electricity, meaning that increases in Bitcoin’s price can lead to greater improvements in profitability. This explains why mining stocks often exhibit greater volatility than Bitcoin itself, which appreciated in value by 54.3% during the same period. The Bitcoin halving event is impacting valuations as investors price in both the reduction in mining rewards and the historical pattern of price appreciation following previous halvings. Finally, many miners held onto their mined Bitcoin during the crypto winter, essentially operating as leveraged plays on Bitcoin’s price. As Bitcoin’s value has increased, these holdings have significantly appreciated, strengthening their financial positions. It’s important to note that these stocks face unique risks beyond Bitcoin’s price movements. Energy costs, equipment obsolescence, and regulatory concerns can significantly impact their performance. Additionally, competition in the mining space continues to intensify, potentially pressuring margins even in a rising Bitcoin price environment, which could lead to M&A activity and consolidation in the mining industry. ASIC DistributionBitcoin mining hardware evolution can be tracked through analysis of nonce patterns in mined blocks, providing insight into the technological progression and security characteristics of the network. Each ASIC manufacturer implements distinct approaches to nonce scanning, creating identifiable signatures that allow researchers to determine which machines are likely responsible for mining specific blocks. This methodology, pioneered and refined by Coin Metrics, has become a crucial tool for understanding the composition of Bitcoin's mining ecosystem. Source: Coin Metrics’ MINE-MATCH The data reveals several significant transitions in mining hardware dominance over the past six years. Antminer S9s, which dominated until 2019-2020, have been almost entirely phased out as the network underwent a major technological upgrade cycle. The current landscape is dominated by the S19 series machines, including the XP, JPro, and standard versions, which collectively represent the majority of network hashrate. This transition demonstrates the rapid pace of efficiency improvements in mining hardware, as operators continuously upgrade to maintain competitiveness in an increasingly industrial mining landscape. ConclusionThe impact of the 2024 halving event, which reduced miner rewards by 50%, has had a significant effect on the profitability and operations of Bitcoin miners globally. While the drop in BTC-denominated revenue per terahash of mining power was immediate, the recent surge in Bitcoin’s price has helped offset some of the negative impact, allowing miners to maintain a degree of profitability. However, the industry continues to face challenges in adapting to the network’s programmed supply adjustments. As the Bitcoin ecosystem continues to evolve, the mining industry will need to demonstrate resilience, adaptability, and a keen eye for optimizing operations to stay ahead of the curve. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Over the past week, Ethena introduced USDtb, a new stablecoin backed by BlackRock’s BUIDL fund. USDe continued its ascent, with a 12% increase in market cap on Ethrereum to $5.7B. The market valuation of Aave (AAVE) and Chainlink (LINK) grew by 26% and 7% respectively, on the back of purchases from Donald Trump’s World Liberty Financial (WFLI). Transaction counts for Jito (JTO) and Raydium (RAY) on Solana increased by 73% and 31% respectively. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Where in the World is Crypto Trading?

Tuesday, December 10, 2024

Exploring the Kimchi premium, regional exchange activity, and crypto seasonality. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Understanding Staking Yields and Economics on Ethereum & Solana

Tuesday, December 3, 2024

Contextualizing staking yields, inflation, and network economics on Ethereum & Solana ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

MicroStrategy’s Bitcoin Mega Strategy

Tuesday, November 26, 2024

Analyzing MicroStrategy's Bitcoin holdings, acquisition strategy, and its role as a leveraged proxy to BTC. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Data-Driven Update on Stablecoins

Tuesday, November 19, 2024

An update on the stablecoin landscape, growing supply and stablecoin trading volumes, on-chain usage and yield generation ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Election Bull Run From the Perspective of Options Markets

Tuesday, November 12, 2024

An analysis of options to take a closer look at the election bull-run that brought BTC prices to $85000 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏