Coin Metrics - MicroStrategy’s Bitcoin Mega Strategy

MicroStrategy’s Bitcoin Mega StrategyAnalyzing MicroStrategy's Bitcoin holdings, acquisition strategy, and its role as a leveraged proxy to BTCGet the best data-driven crypto insights and analysis every week: MicroStrategy’s Bitcoin Mega StrategyBy: Tanay Ved Key Takeaways:

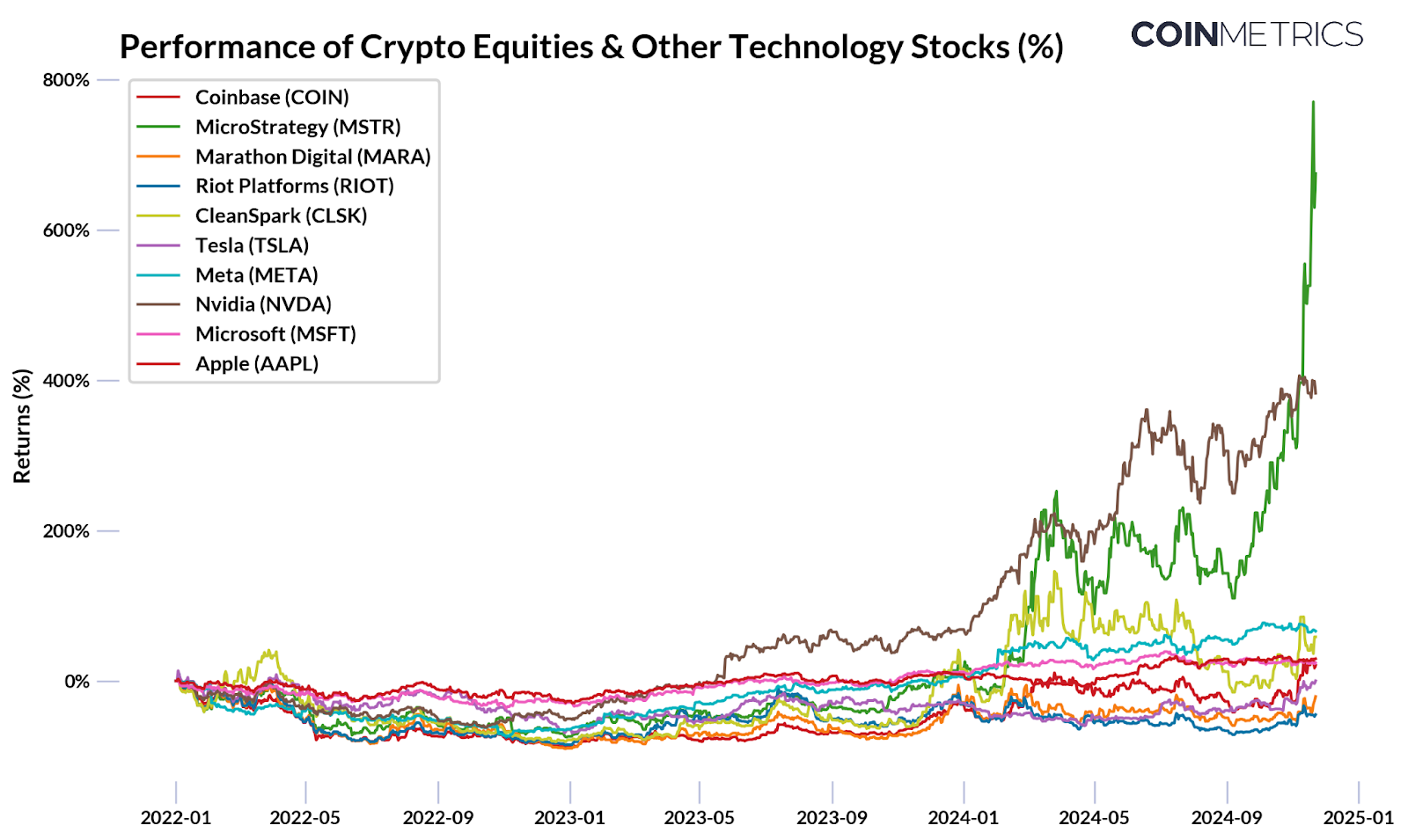

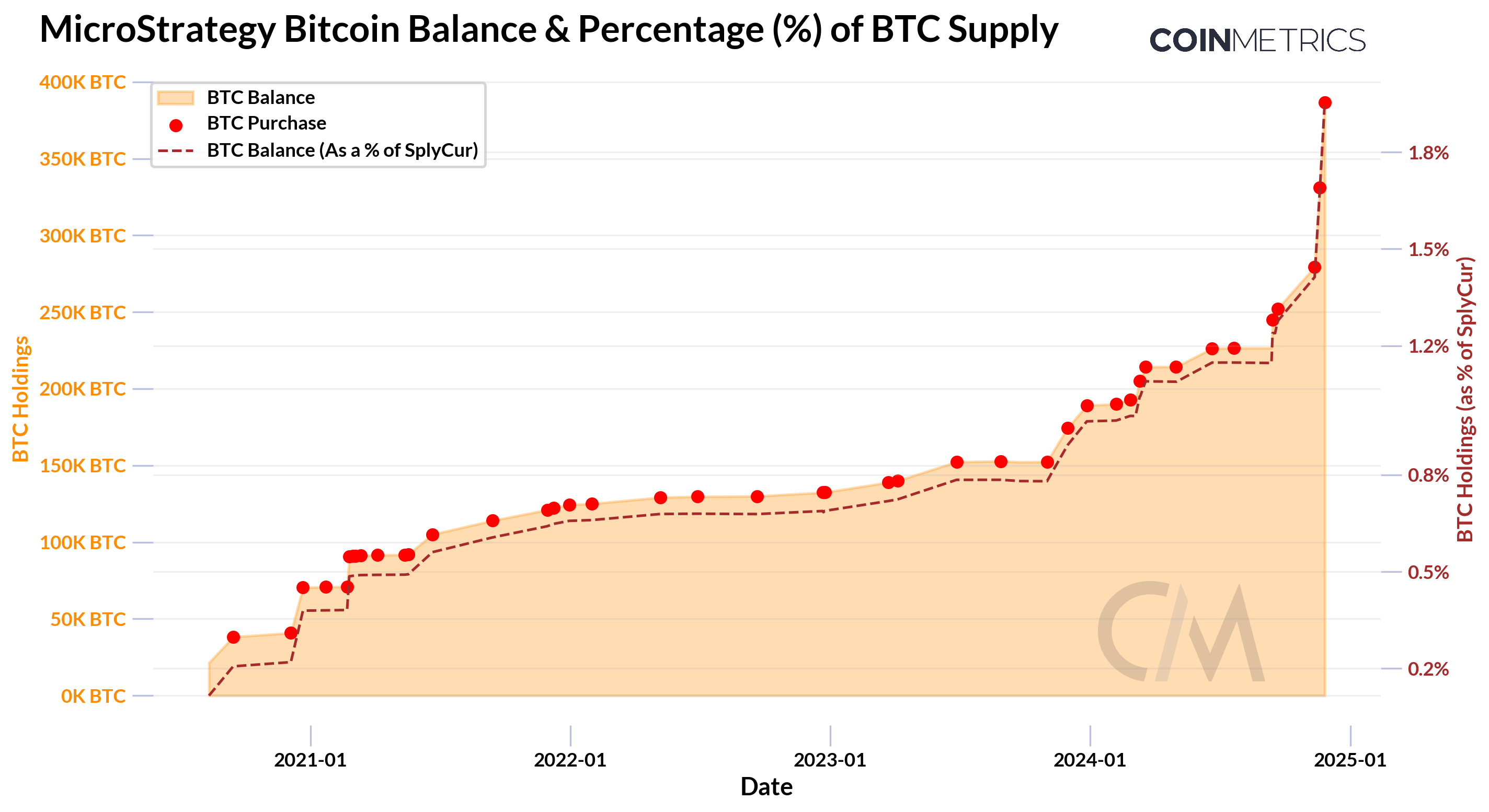

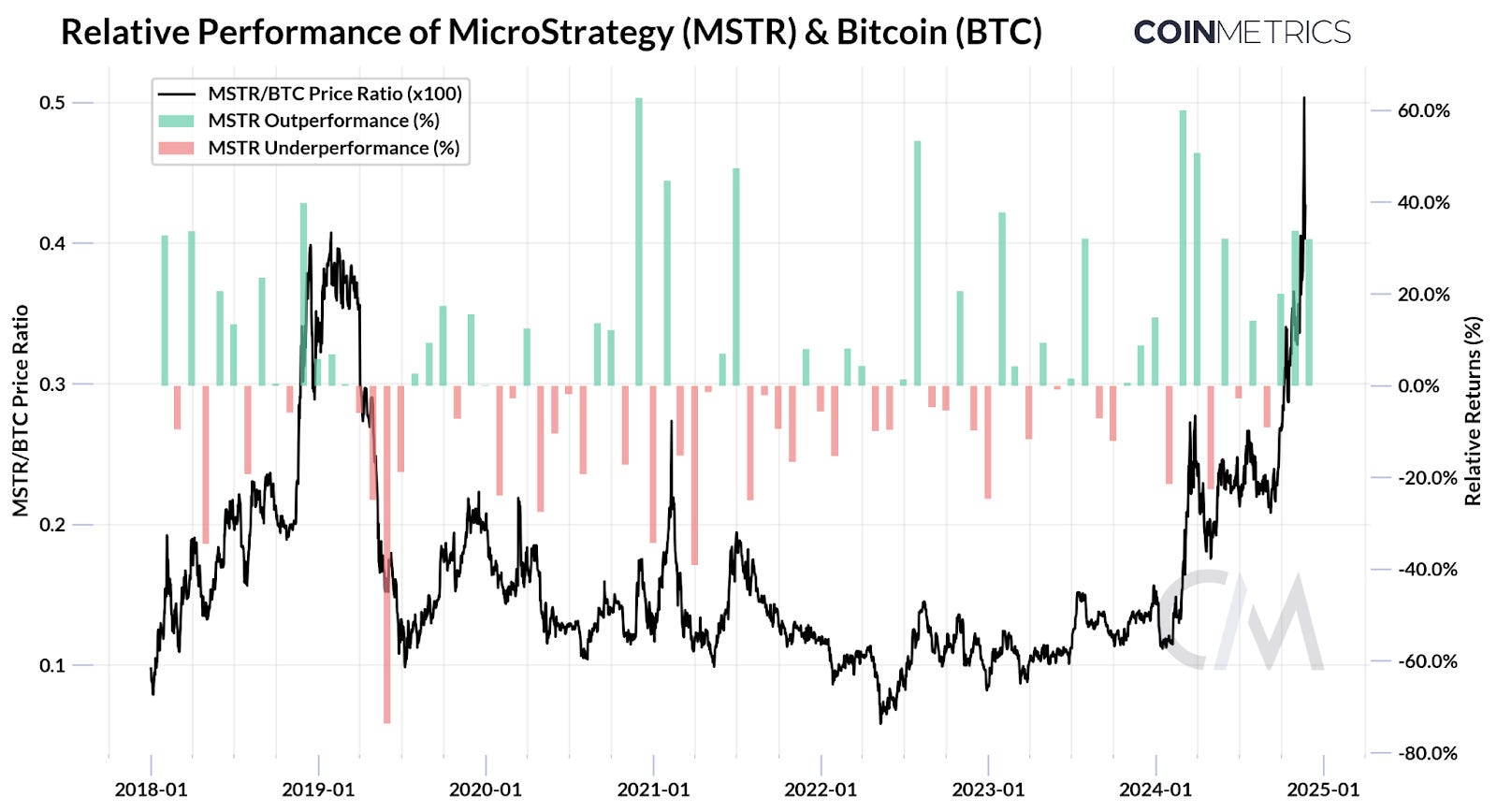

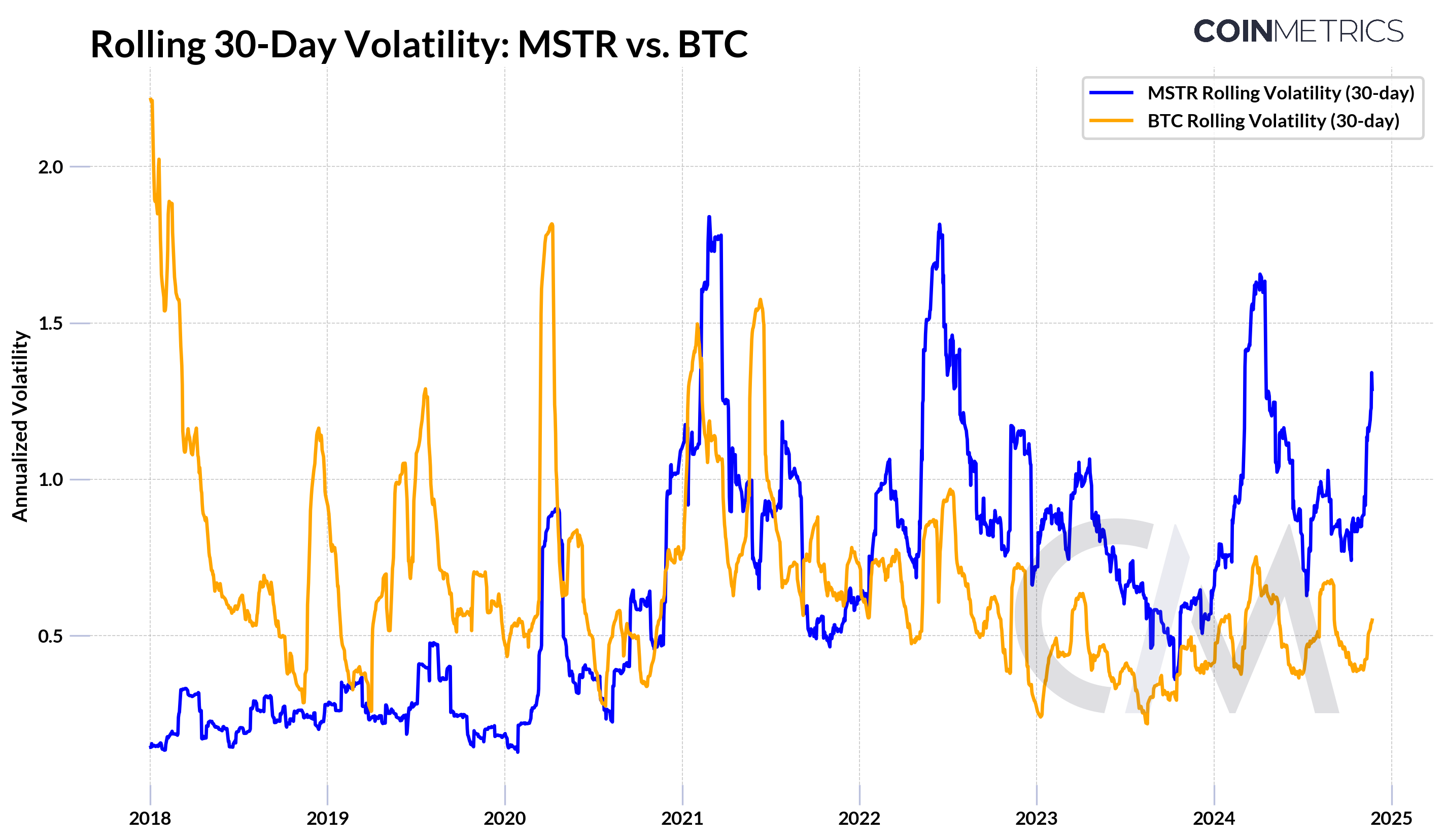

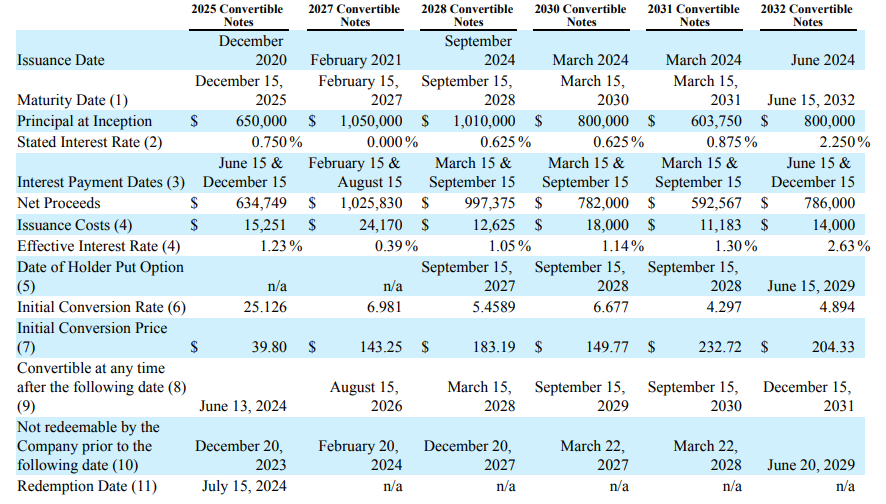

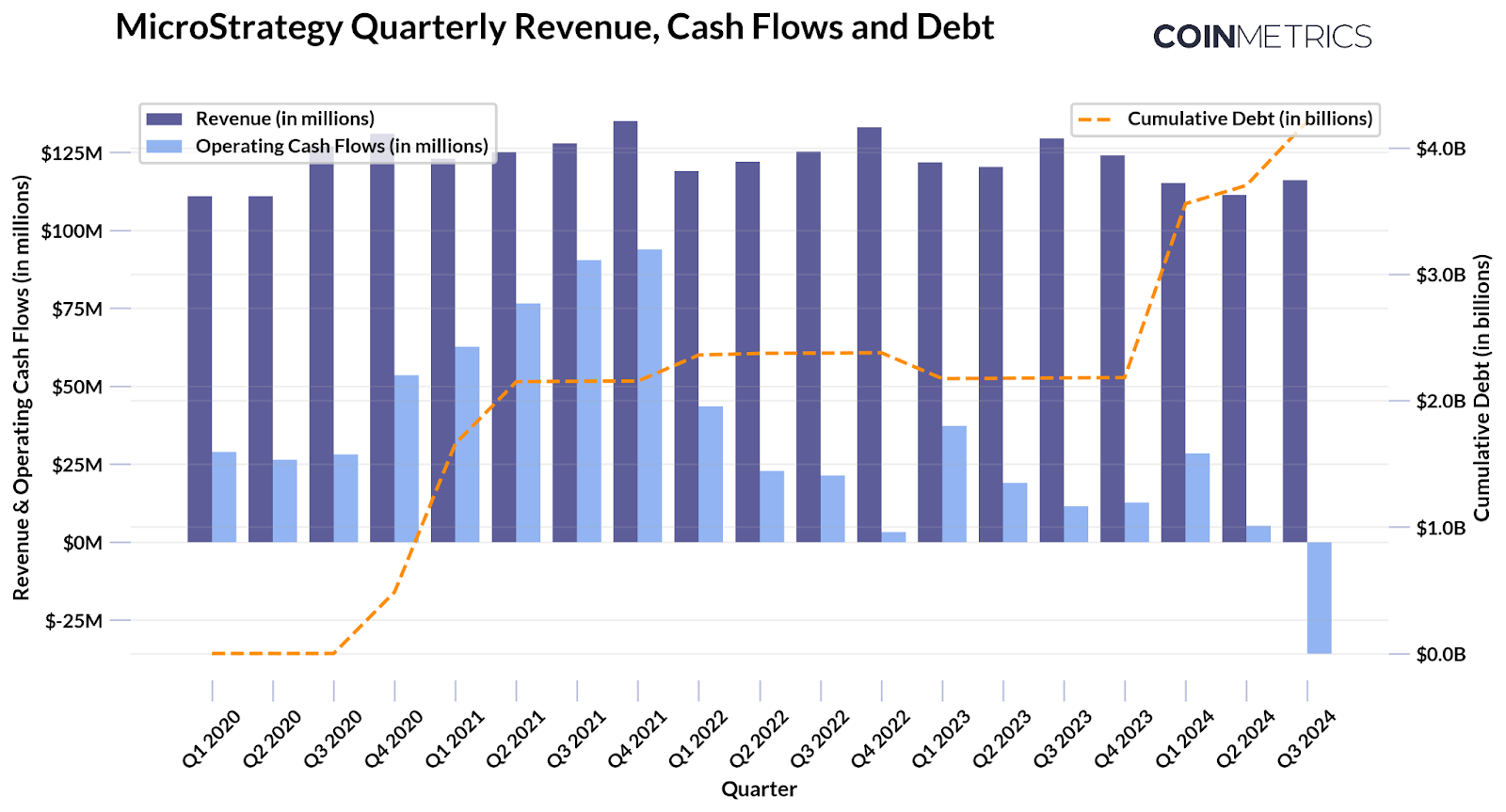

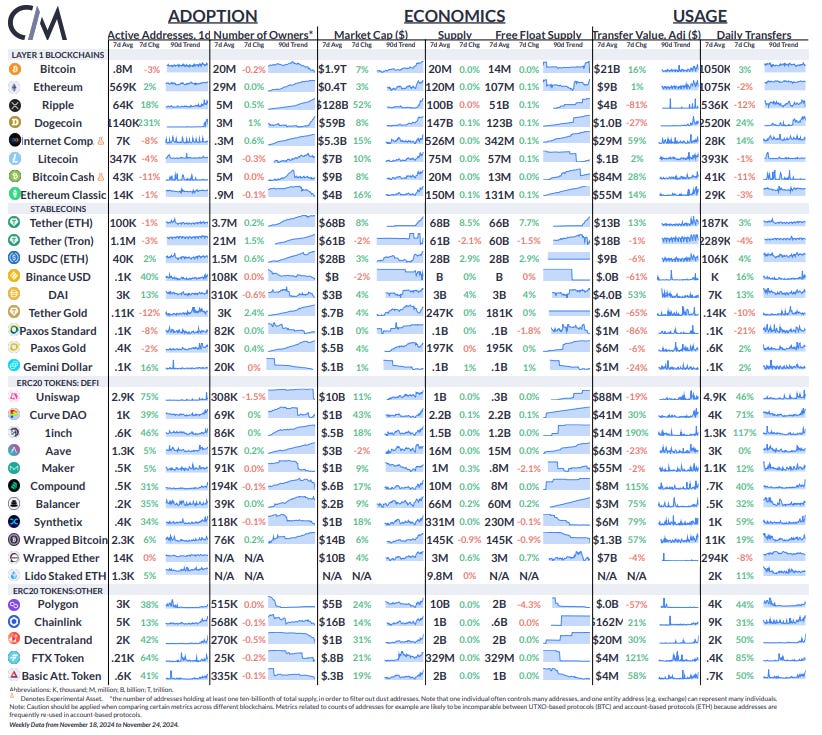

IntroductionBitcoin’s post-election momentum has pushed it toward the $100K mark for the first time in its 15-year history. While much of its supply remains self-custodied, Bitcoin’s growing maturity has unlocked more accessible investment avenues, including “crypto equities”—publicly traded stocks that provide exposure or a proxy to Bitcoin and other digital assets via traditional brokerage accounts. These range from Bitcoin miners like Marathon Digital (MARA) to full-stack operators like Coinbase (COIN) and MicroStrategy (MSTR), the largest corporate holder of Bitcoin with 386,700 BTC in its treasury. The launch of spot Bitcoin (BTC) and Ether (ETH) ETFs this year has further broadened institutional access. In this week’s issue of Coin Metrics’ State of the Network, we analyze MicroStrategy’s performance, its Bitcoin holdings, and its role as a leveraged proxy within the crypto equities landscape, exploring its acquisition strategy and the risks and rewards of its approach. The Crypto Equities LandscapeMicroStrategy has emerged as the best performing stock in the S&P 500, with returns exceeding 700% since 2022 and 488% year-to-date. Its performance far outpaces major crypto equities and technology stocks like Coinbase (COIN) or Nvidia (NVDA), driven by its unique role as a “Bitcoin treasury company”. Therefore, the strategy behind its performance warrants a closer look. Source: Google Finance MicroStrategy: A Software Business or Bitcoin Accumulation Machine?Some may be surprised to learn that MicroStrategy was founded in 1989 as an enterprise software company specializing in business intelligence. However, in August 2020, co-founder and then-CEO Michael Saylor made a bold pivot, adopting Bitcoin as the company’s primary reserve asset as part of a "new capital allocation strategy." This transformed MicroStrategy into a Bitcoin accumulation machine. Four years later, it has become the single largest corporate holder of Bitcoin, with 386,700 BTC (valued at ~$36B) and a market cap of ~$90B. MicroStrategy’s bitcoin holdings far outpace other corporate treasuries, holding 12x more than miners like Marathon Digital (MARA) and 34x more than Tesla (TSLA). Source: Coin Metrics Network Data Pro & BitBo Treasuries With their most recent purchase of 55,500 BTC on November 24th, MicroStrategy now holds 386,700 BTC at an average cost basis of $56,761, representing ~1.9% of Bitcoin’s current supply. Only Bitcoin spot ETFs surpass this, collectively holding ~5.3% of the supply—three times more than MicroStrategy. This strategy has effectively transformed MicroStrategy into a Bitcoin investment vehicle, serving as a leveraged play on Bitcoin. Michael Saylor has himself described the company as a “treasury operation securitizing Bitcoin, offering 1.5x to 2x leveraged equity.” As shown in the chart below, MicroStrategy’s performance relative to Bitcoin reflects this approach, amplifying gains during rallies and losses during downturns. Source: Coin Metrics Reference Rates & Google Finance This leveraged approach inherently drives higher volatility for MSTR compared to BTC, often amplifying BTC’s price movements by 1.5x to 2x. Beyond its Bitcoin exposure, MicroStrategy’s stock price is also influenced by broader equity market trends and investor sentiment toward Bitcoin, making it a high-risk, high-reward proxy for the asset’s performance. Source: Coin Metrics Market Data Feed & Google Finance How does MicroStrategy Finance its BTC Purchases?How is MicroStrategy able to fund its massive Bitcoin purchases? The cornerstone of its strategy lies in borrowing money to buy bitcoin by issuing convertible bonds. These are a type of fixed-income instrument that act as a hybrid between debt and equity, which can be converted into a set number of the company’s shares at a future date and predetermined price. By offering these convertible notes in fixed-income markets or directly to institutional investors, MicroStrategy has been able to raise cash to scale its Bitcoin holdings rapidly, often with remarkably low borrowing costs. These bonds are attractive to investors because they offer the potential for equity conversion at a higher price than the issuance price, effectively functioning as a call option with demand further amplified in bull markets MicroStrategy’s growing Bitcoin treasury. This creates a reflexive loop: higher BTC prices drive a higher premium on MSTR shares, enabling the company to issue more debt or equity, which funds additional BTC purchases. These purchases add to buying pressure, further lifting Bitcoin prices—and the cycle continues, reinforcing itself in a bull market. Source: Microstrategy Q3 2024 Earnings The table above highlights MicroStrategy’s outstanding convertible notes, which mature between 2025 and 2032. They also recently raised $3B through another convertible bond offering due in 2029 with a 0% interest rate and 55% conversion premium , bringing its total outstanding debt to over $7.2B. Are There Risks to MicroStrategy’s BTC Strategy?While their strategy has thus far brought tremendous success, one question remains: “What could go wrong? Is this another bubble waiting to burst?” With MicroStrategy’s market capitalization near ~$90B and their Bitcoin holdings valued at ~$37.6B, the company now trades at a significant premium of ~2.5x (250%) to its net asset value (NAV). In other words, MicroStrategy’s shares are priced at 2.5 times the value of their underlying Bitcoin treasury. This steep valuation premium has drawn scrutiny from market participants, raising questions about how long it can remain elevated and the potential consequences if it were to collapse or turn negative. Participants are also attempting to take advantage of the premium on MSTR equity by shorting MSTR stock and buying BTC as a hedge. The stock has attracted ~11% in short interest, reducing from ~16% in October as some short positions are closed out. To assess the risk of MicroStrategy potentially liquidating part of its bitcoin holdings and the implications of a declining MSTR/BTC price and NAV premium, turning to the health of its legacy software business may provide a better idea of its ability to service these levels of debt. Source: MicroStrategy Quarterly Earnings as of Q3 2024 While quarterly revenues for the legacy business have been relatively steady since 2020, operating cash flows show a declining trend. Meanwhile, cumulative debt has grown significantly since 2020 reaching $7.2B, driven by the issuance of convertible notes to fund Bitcoin acquisitions, speeding up during bullish market conditions. This reflects the company’s reliance on Bitcoin’s appreciation to maintain financial stability. Despite this, the relatively low interest costs on these bonds are likely serviceable by the software business. If bondholders convert their notes into equity at higher share prices upon maturity, much of the debt would resolve without requiring cash repayment. However, if market conditions deteriorate and the premium on MicroStrategy’s shares erodes, the company may need to explore alternative strategies to meet its obligations ConclusionMicroStrategy’s bold approach highlights Bitcoin’s potential as a corporate reserve asset. By leveraging its large Bitcoin chest, the company has amplified its market performance, establishing itself as a unique proxy to BTC. However, this strategy carries inherent risks tied to Bitcoin’s price volatility and the sustainability of equity premiums, warranting closer attention as market conditions evolve. MicroStrategy’s model could inspire broader adoption—not only among corporations but potentially at the sovereign level, further cementing Bitcoin’s role as a store of value and superior reserve asset. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Over the past week, Ripple’s (XRP) market capitalization grew by 52%, reaching $128B. Daily active addresses for Dogecoin (DOGE) rose by 231%, while activity increased across the board for several ERC-20 tokens. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

A Data-Driven Update on Stablecoins

Tuesday, November 19, 2024

An update on the stablecoin landscape, growing supply and stablecoin trading volumes, on-chain usage and yield generation ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Election Bull Run From the Perspective of Options Markets

Tuesday, November 12, 2024

An analysis of options to take a closer look at the election bull-run that brought BTC prices to $85000 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crypto Market & Polymarket Dynamics Heading into Elections

Tuesday, November 5, 2024

Coin Metrics' State of the Network: Issue 284 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Polymarket and the Power of Collective Intelligence

Tuesday, October 29, 2024

Coin Metrics' State of the Network: Issue 283 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Introducing Exchange Flow Metrics

Tuesday, October 22, 2024

New metrics tracking exchange-flows in BTC and ETH ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏