Coin Metrics - A Data-Driven Update on Stablecoins

A Data-Driven Update on StablecoinsAnalyzing growth in stablecoin supply, trading volumes, on-chain usage, and yield generationGet the best data-driven crypto insights and analysis every week: A Data-Driven Update on StablecoinsBy: Tanay Ved & Matías Andrade Cabieses Key Takeaways:

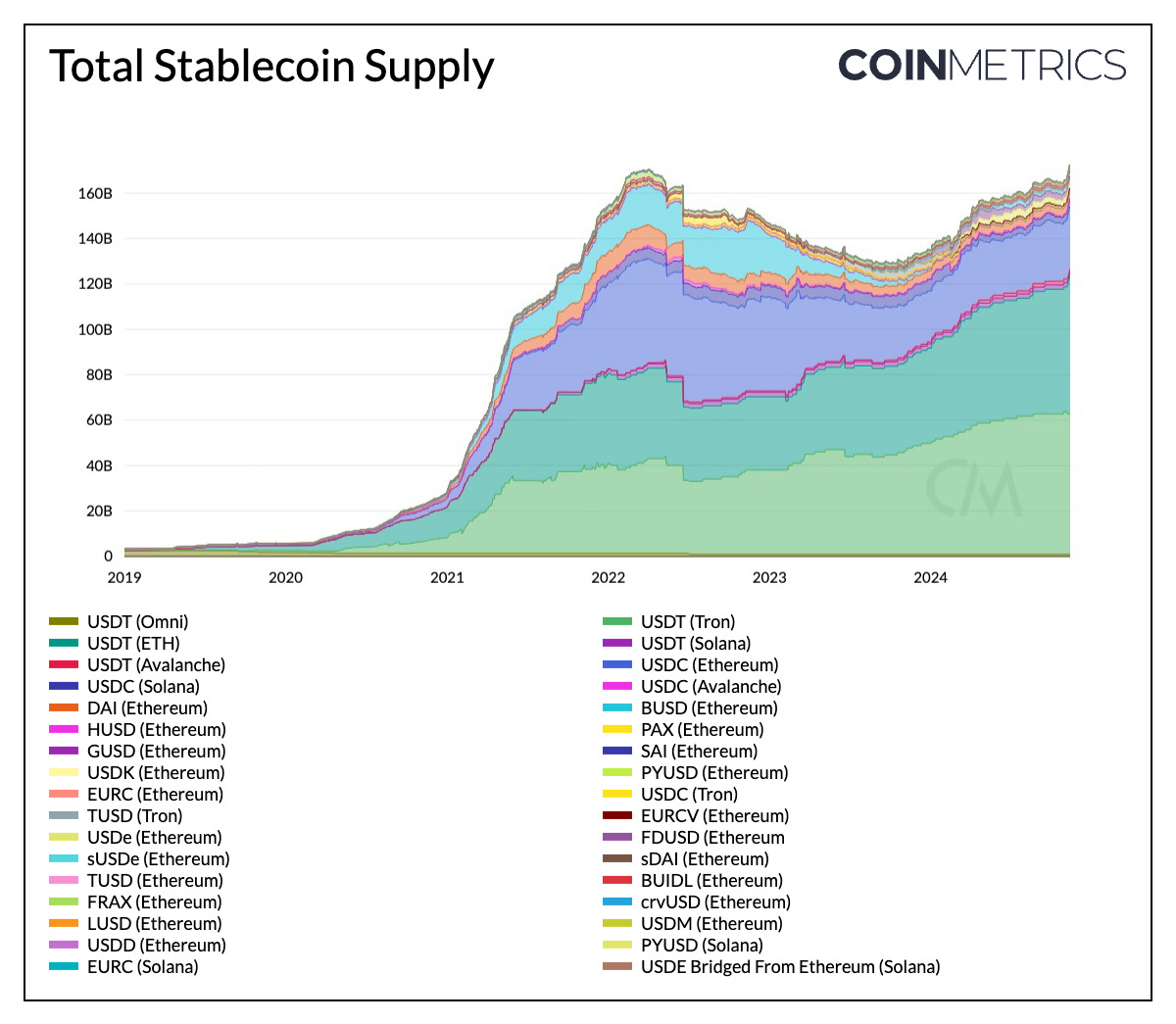

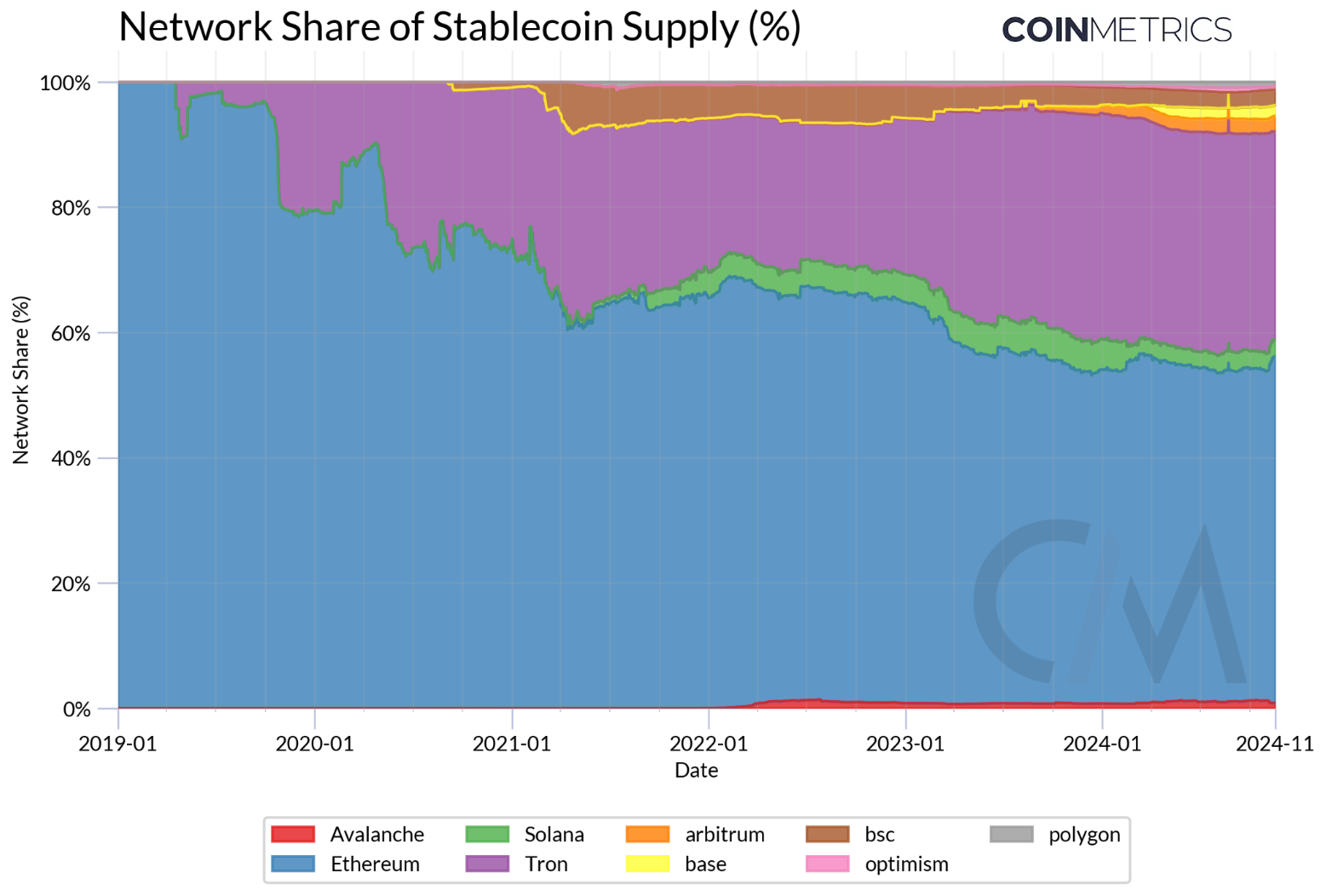

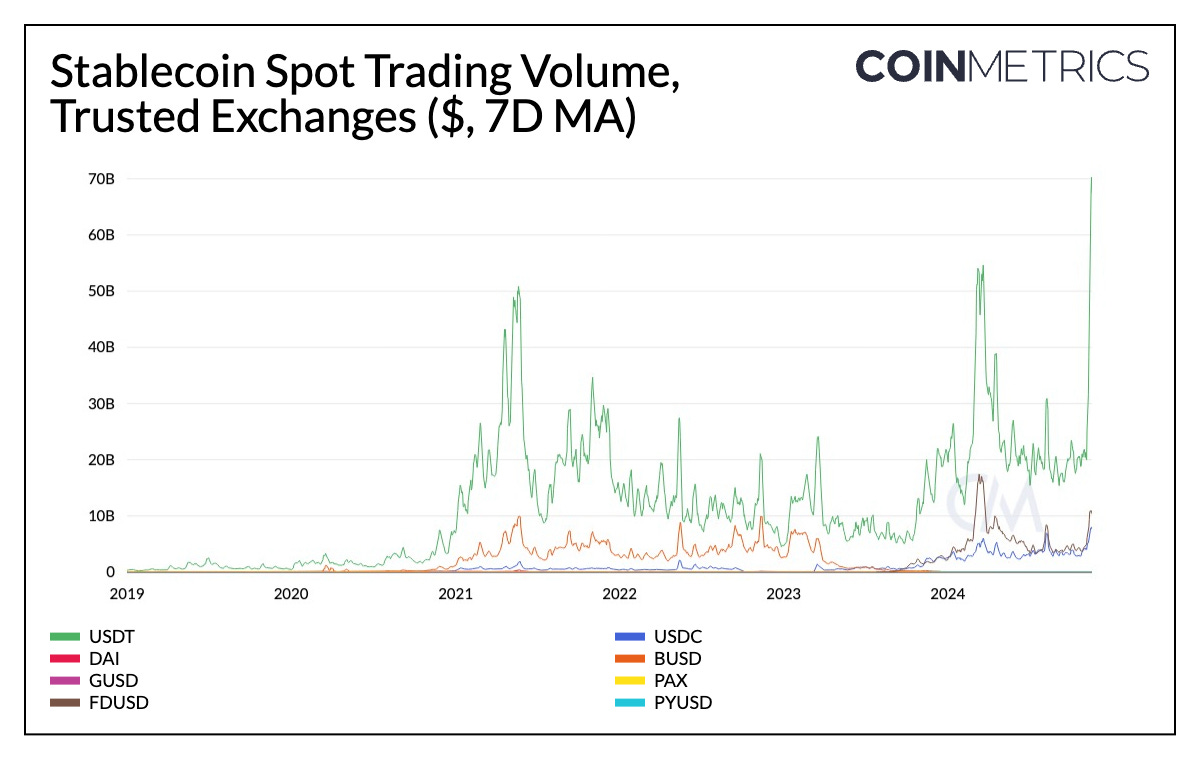

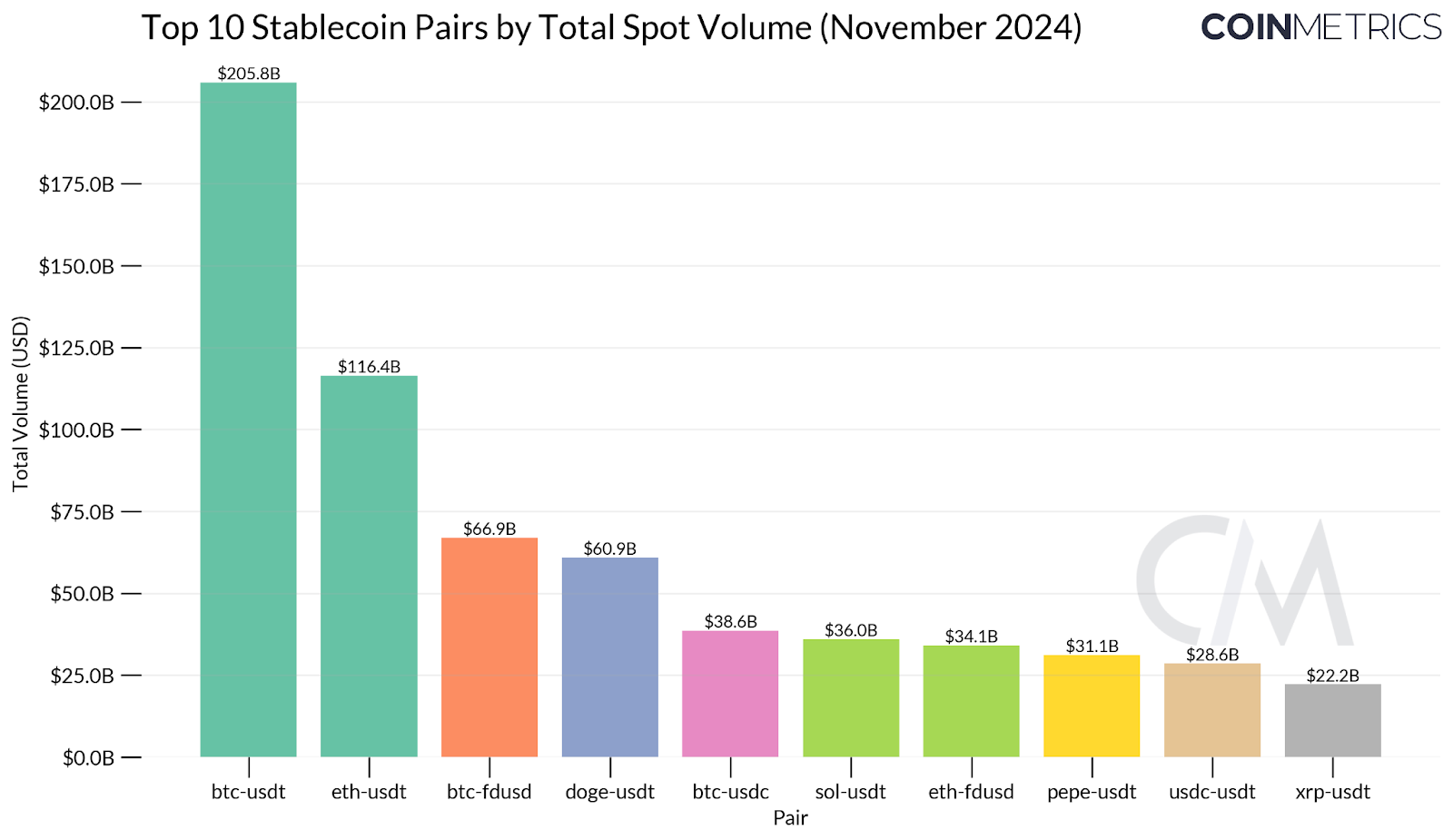

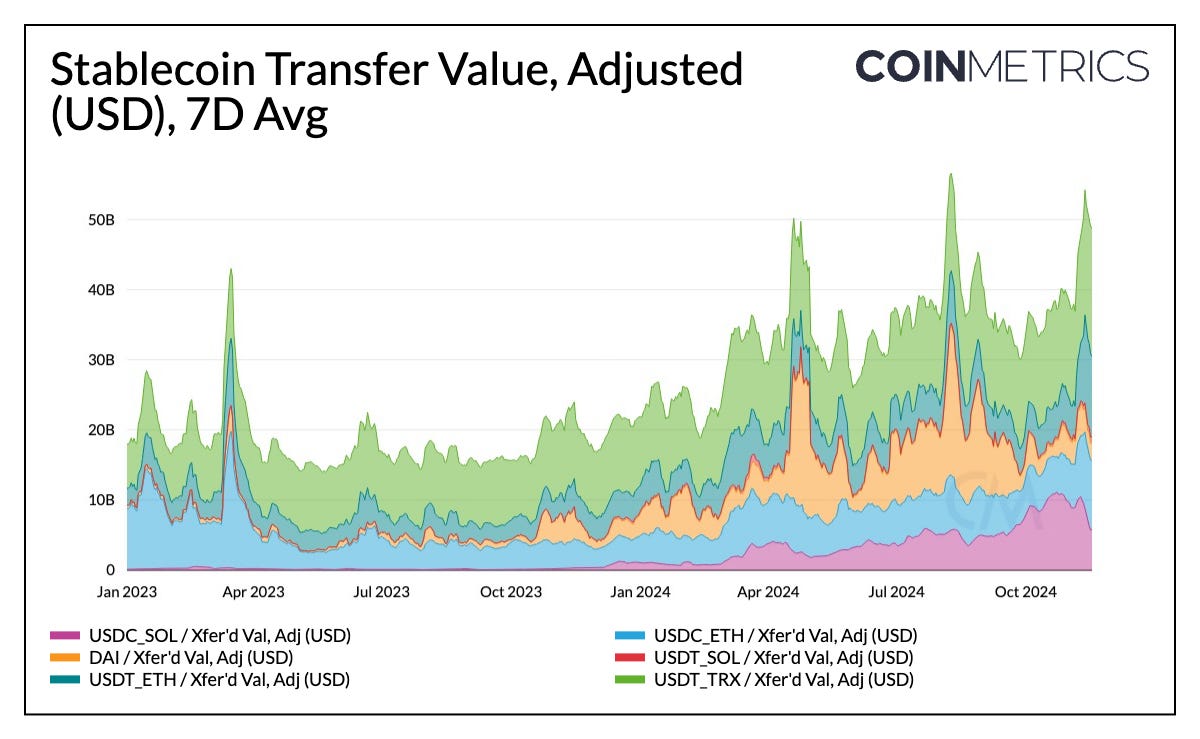

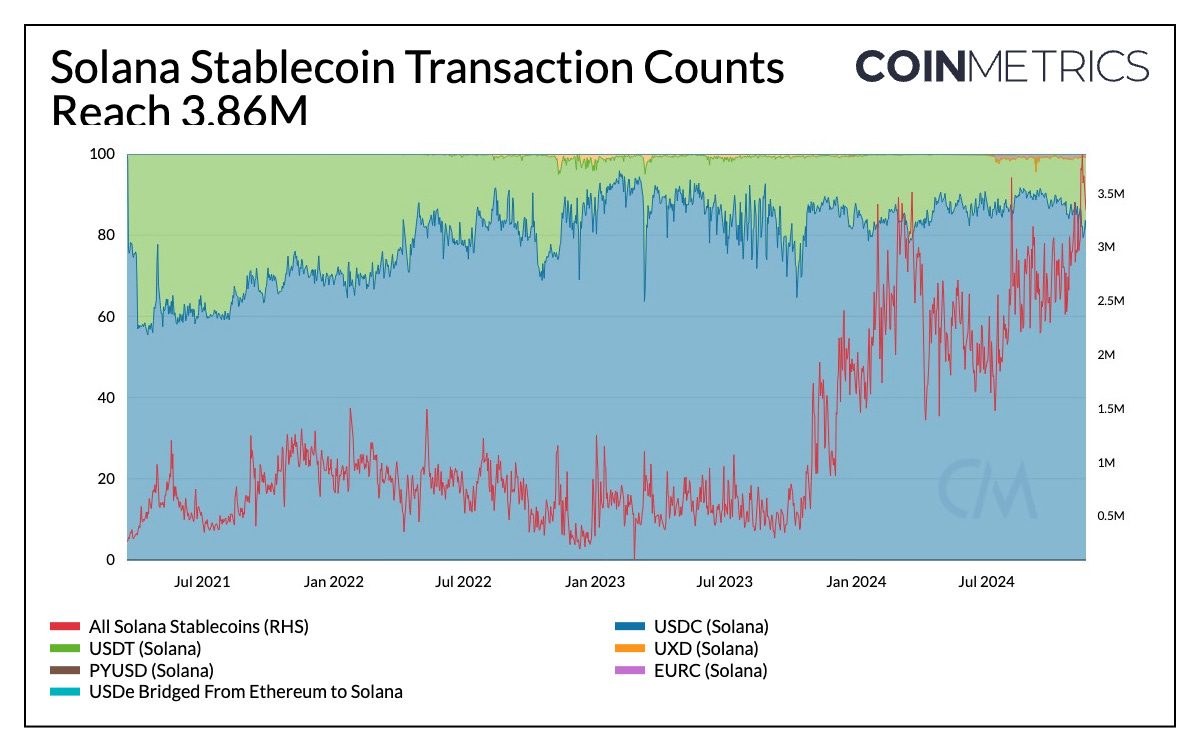

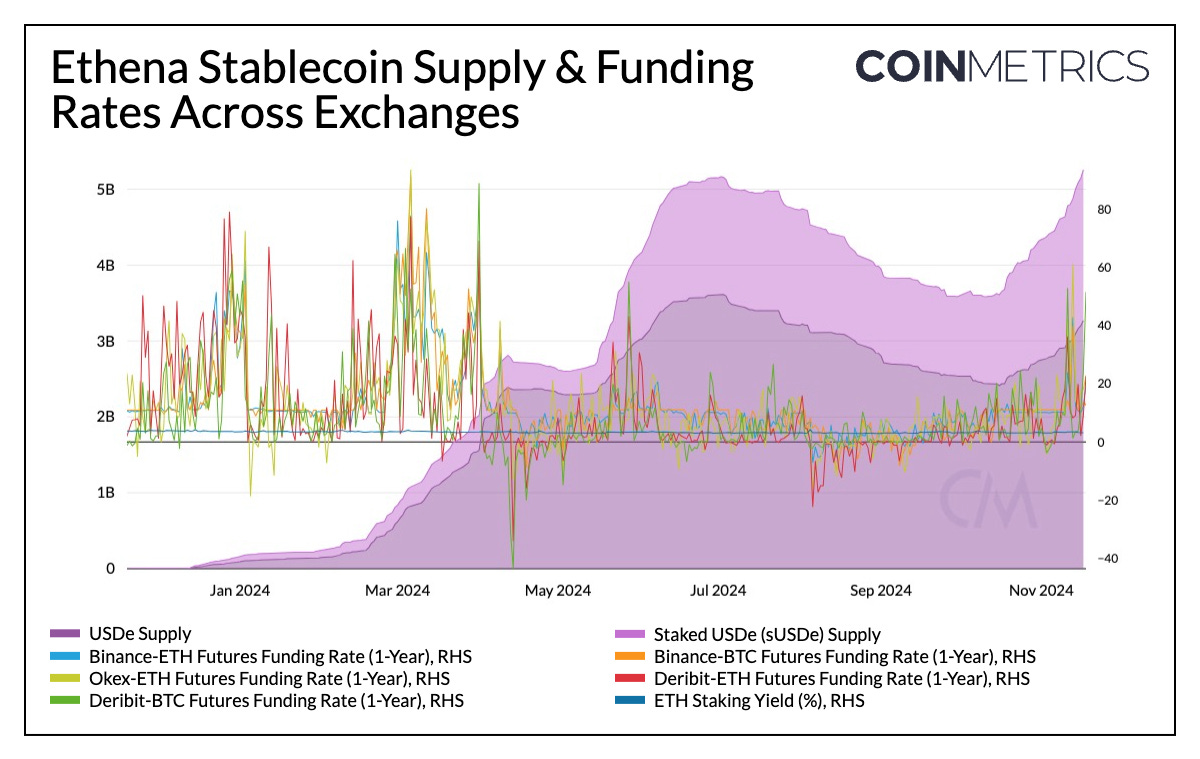

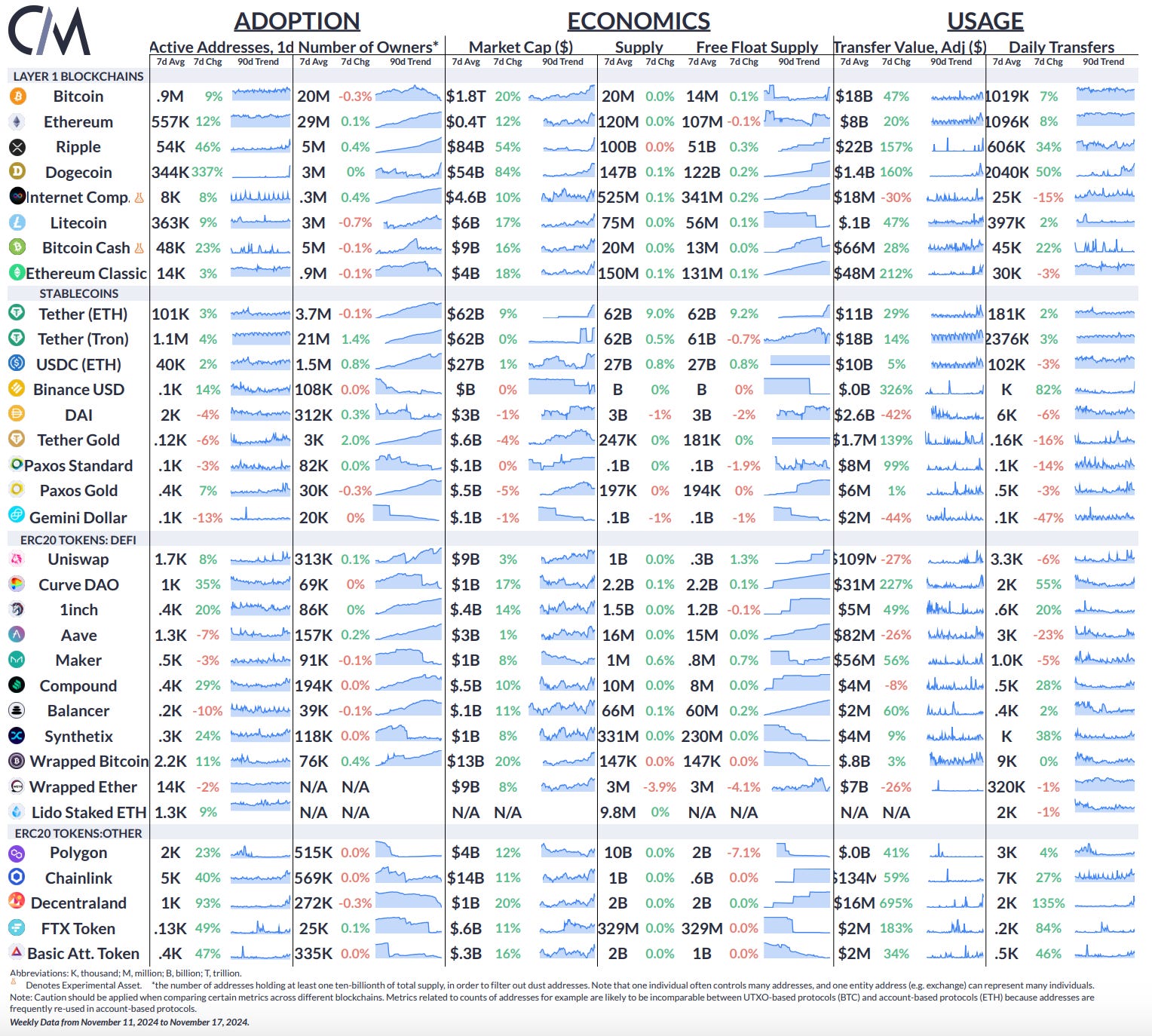

IntroductionAs the crypto market enters a bullish phase, stablecoins have resumed their ascent, with over $189B in stablecoins issued. This influx suggests an environment with growing liquidity, as users position themselves to capitalize on appreciating prices and emerging opportunities in the on-chain ecosystem. Mergers and acquisitions in the crypto space have heated up, further boosting the sector’s momentum with Stripe’s acquisition of Bridge—a stablecoin payments platform—for $1.1B in October, and Coinbase’s acquisition of Utopia Labs. Stablecoins continue to be a central theme across the financial landscape, promising to be the backbone of FinTech, payments and the global financial system. In this week’s issue of Coin Metrics’ State of the Network, we take a data-driven dive into the stablecoin sector, exploring its pivotal role as a medium of exchange in bull markets and analyze on-chain adoption across key metrics. Stablecoin Landscape OverviewThe stablecoin landscape continues to expand in depth and breadth. Following the remarkable profitability of incumbents like Tether, there has been no shortage of traditional financial and crypto-native issuers, resulting in a constant influx of stablecoins entering the market. At the same time, stablecoins are establishing a wider footprint cross-chain, especially as alternative Layer–1 and Layer–2 ecosystems mature. As a result, Coin Metrics’ stablecoin coverage has expanded to over 35 stablecoins and counting. Source: Coin Metrics Network Data Pro With a total supply of $125B, Tether’s USDT continues to maintain the lion's share of stablecoins issued with a 66% market share. Circle’s USDC is second to follow, with $36B in total supply and a 19% market share. In terms of networks, Ethereum is the largest blockchain by stablecoins issued, home to $104B (55%) of total stablecoin supply. Tron continues to maintain a substantial 33% in network share of stablecoin supply, driven primarily by USDT. Solana and Ethereum Layer-2 networks (Arbitrum, Base, Optimism) collectively represent ~7.5% of the total stablecoin supply, reflecting their growing but still emerging stablecoin ecosystem. Source: Coin Metrics Network Data Pro & Coin Metrics Labs Stablecoin Volumes Surge Amid Market UpswingAs one of its earliest use-cases, stablecoins have provably garnered utility in their role as a medium of exchange, both in bull and bear markets. In an upwards trending market, stablecoins are a bridge through which users can gain exposure to other tokens in the ecosystem, serving as a source of liquidity essential to facilitate on-chain and trading activity. In market downtrends or during periods of volatility, they also serve as a store of value or means of savings, enabling users to store wealth or earn yield from on-chain and off-chain sources. This makes stablecoins essential under various market conditions, geographies and time-zones. Source: Coin Metrics Market Data Feed With the crypto market’s rise post-election, stablecoin denominated trading volumes across exchanges crossed $120B as trading activity ramped up. Of this total, Tether’s USDT accounted for ~80% or $95B in spot volumes recorded on November 12th. First Digital USD (FDUSD) also gained significant traction, spiking to $16 billion in daily spot volumes (~17% of the total), while Circle’s USDC reached $11 billion, marking its highest weekly average spot volume to date. Source: Coin Metrics Market Data Feed We can further drill down into specific stablecoins and crypto-assets that drove activity in November. Large-cap assets like BTC, ETH, and SOL, alongside memecoins like DOGE and PEPE, feature prominently among the top 10 pairs by trading volume across exchanges. While the dominance of majors is unsurprising, the influence of memecoins suggests heightened retail participation as BTC establishes new price highs. Consequently, the “Specialized Coins” sector in datonomy™, which consists of meme coins, privacy coins, and remittance coins, emerged as the top-performing sector, delivering 63% returns over the past 30 days. On-Chain Economic Activity & UsageWhile stablecoins play an influential role as a medium of exchange and source of liquidity on exchanges, they are also fundamental to non-trading use cases, such as facilitating transactions and settling economic value on-chain. Stablecoins serve as an ideal instrument for consumer and B2B payments, remittances, saving wealth, or to seek economic stability and access to financial infrastructure, especially in emerging markets. With the help of some on-chain metrics, we can better understand how stablecoin driven economic activity has evolved over time, and the extent to which they influence usage on different public blockchains. Source: Coin Metrics Network Data Pro The weekly adjusted transfer volume involving transfers of native units between distinct stablecoin addresses exceeded $50B in November. Of this, $18.2 billion (38%) originated from USDT on Tron, and $12.3 billion (23%) from USDT on Ethereum, both setting record highs for transaction volume. USDC on Ethereum and Solana also demonstrated greater traction, with a growing trend in transfer volumes. Source: Coin Metrics Network Data Pro Notably, stablecoin transactions on Solana hit an all-time high of 3.86M in November. USDC continues to be the stablecoin of choice on Solana, representing 83% of all stablecoin related transactions on the network. As a result of Solana’s low transaction fees, USDC on the network has a median transfer size of $20, compared to $1,400 on Ethereum. This contributes to Solana’s higher transaction count, with 3.86M stablecoin transactions in November, substantially higher than Ethereum’s 230K transactions despite Ethereum’s deeper stablecoin liquidity. There are several other metrics we can leverage to understand stablecoin activity on-chain, including the supply held by smart contracts and externally owned accounts (EOAs), stablecoin velocity (turnover), active addresses, the number of addresses holding more than a specific amount of stablecoins, and supply distribution. These metrics can be explored further through this stablecoin dashboard created with our charting tool. Demand for Yield: Higher Funding Rates Drive Ethena's GrowthAnother avenue that drives demand for stablecoins is the provision of yield, which can serve as a form of passive income or risk management in both bull and bear markets. To compete on adoption with giants like Tether & Circle, several stablecoin issuers incentivize stablecoin growth by passing on interest to holders, enhancing their store of value properties. This spans various approaches and risk profiles, from passing a portion of yield generated on off-chain real-world assets (RWAs) such as US Treasuries or on-chain collateral assets like staked ETH or in some cases, revenue generated from operations tied to on-chain protocols (in the case of protocol issued stablecoins). Ethena has brought a relatively new approach to yield generation for its synthetic dollar—USDe, dubbed the “Internet Bond.” It combines hedging strategies on centralized exchanges with staking rewards to generate yield while maintaining peg stability. Crypto-assets are used as collateral (BTC, ETH), to open short positions in perpetual futures markets, aiming to benefit from positive funding rates. In combination with the funding and basis spread, Ethena passes on the yield from ETH staking rewards in the form of a interest-bearing token—sUSDe. Source: Coin Metrics Network Data Pro Notably, there is a close relationship between USDe supply and ETH funding rates across exchanges. The supply of USDe and staked USDe (sUSDe) has grown in environments with positive funding rates and declined or stagnated when funding rates turned negative. Interestingly, Ethena recently announced plans to launch USTb, a new stablecoin collateralized by BlackRock’s tokenized US Treasury fund, BUIDL. This stablecoin is intended to function as a backing asset to USDe, helping manage risk during periods of market volatility that result in weak funding rates. As the stablecoin that has grown the most since Q3, Ethena is well-positioned to capitalize from rising funding rates. ConclusionStablecoins remain a cornerstone of the digital asset ecosystem, driving liquidity, facilitating payments, enabling on-chain economic activity, and serving as a tool for savings and wealth preservation. Based on several metrics, stablecoins continue to display growth in adoption and usage, proving their widespread demand and utility. s stablecoins gain traction, regulatory clarity in areas like reserve transparency and issuance standards will drive innovation across the ecosystem and fuel the growth of stablecoin-related businesses. With positive regulatory efforts advancing in the U.S. and globally, the stage is set for the next phase of stablecoin growth, potentially rewiring the financial ecosystem. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Post-election market momentum continued over the past week, with the market cap of Bitcoin and Ethereum increasing by 20% and 12%, respectively. Active addresses for Dogecoin surged by 337%, while its market cap rose by 84% to $54B. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

The Election Bull Run From the Perspective of Options Markets

Tuesday, November 12, 2024

An analysis of options to take a closer look at the election bull-run that brought BTC prices to $85000 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crypto Market & Polymarket Dynamics Heading into Elections

Tuesday, November 5, 2024

Coin Metrics' State of the Network: Issue 284 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Polymarket and the Power of Collective Intelligence

Tuesday, October 29, 2024

Coin Metrics' State of the Network: Issue 283 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Introducing Exchange Flow Metrics

Tuesday, October 22, 2024

New metrics tracking exchange-flows in BTC and ETH ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

An Overview of the Flow Blockchain

Sunday, October 20, 2024

A data-driven overview of the Flow Blockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏