Understanding Staking Yields and Economics on Ethereum & Solana

Understanding Staking Yields and Economics on Ethereum & SolanaContextualizing staking yields, inflation, and network economics on Ethereum & SolanaGet the best data-driven crypto insights and analysis every week: Understanding Staking Yields and Economics on Ethereum & SolanaBy: Tanay Ved & Matías Andrade Key Takeaways:

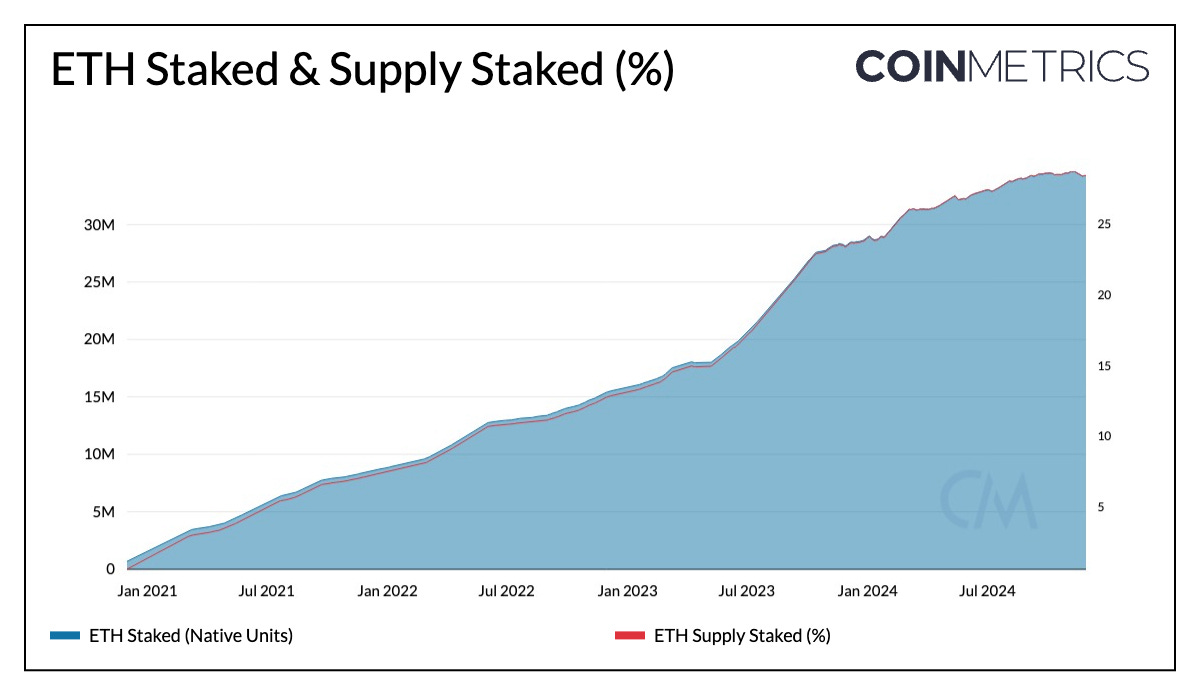

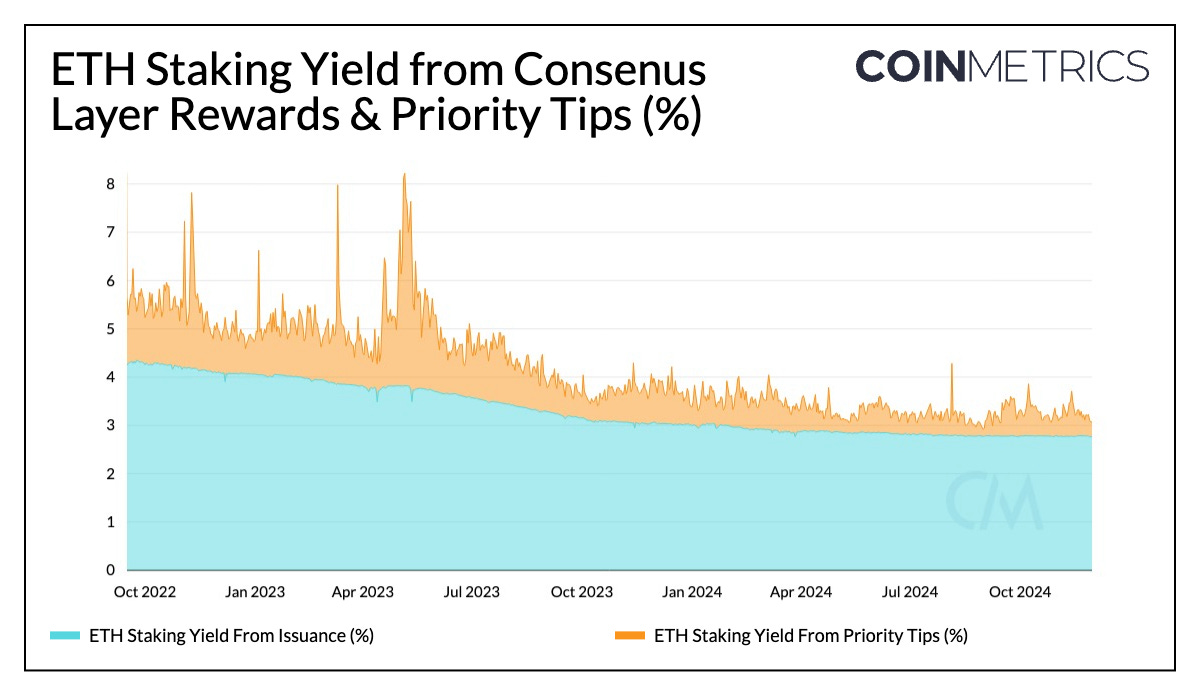

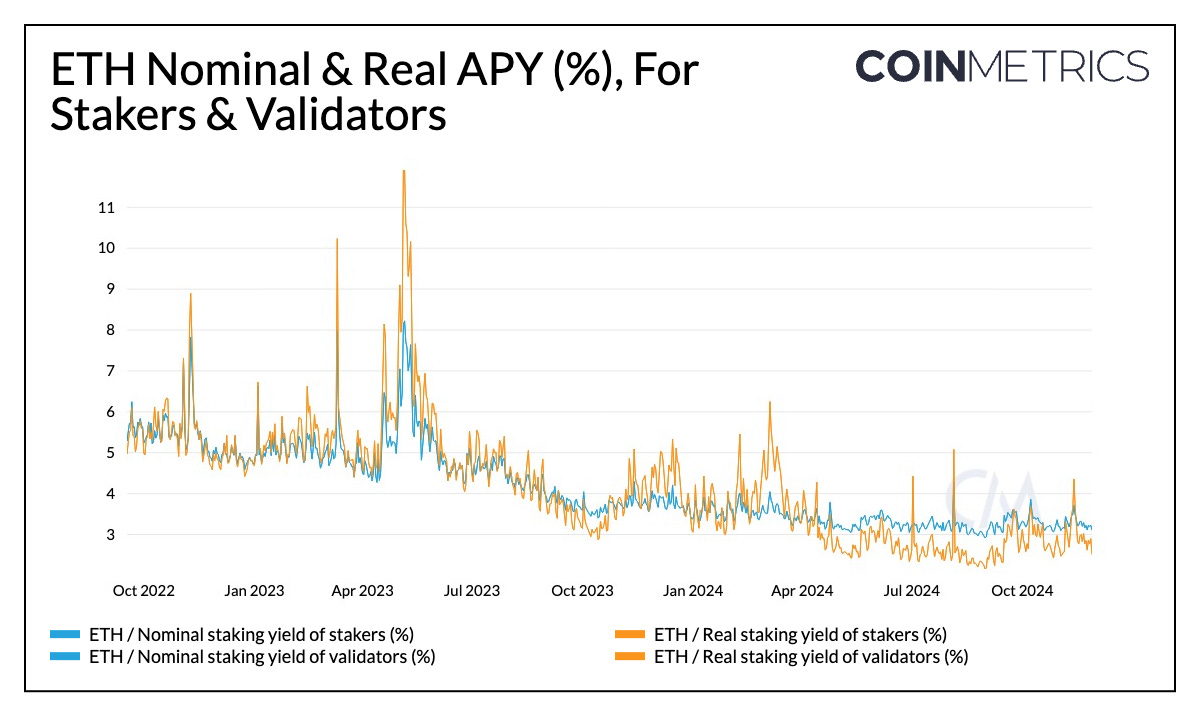

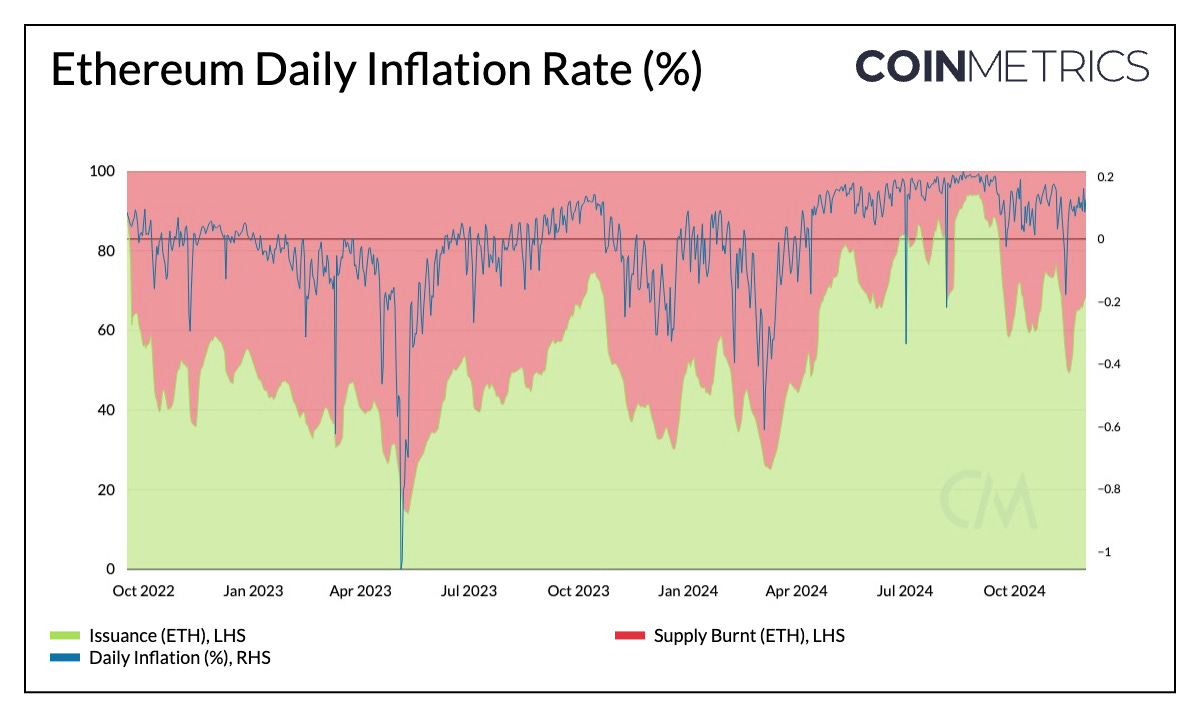

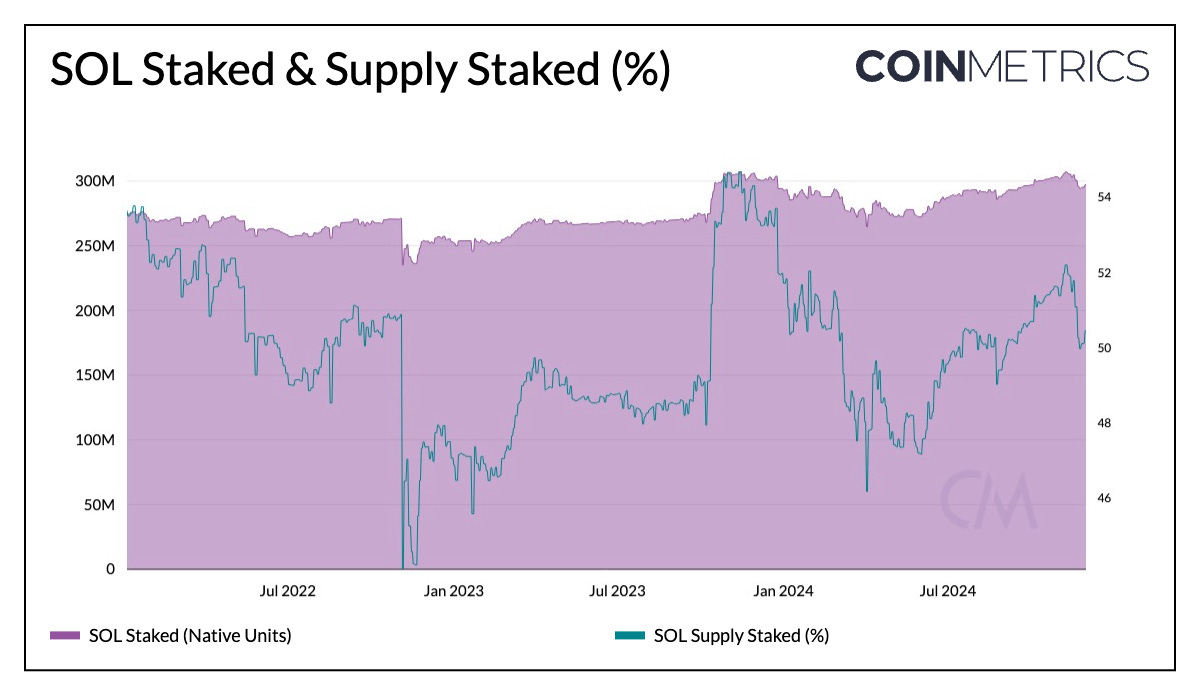

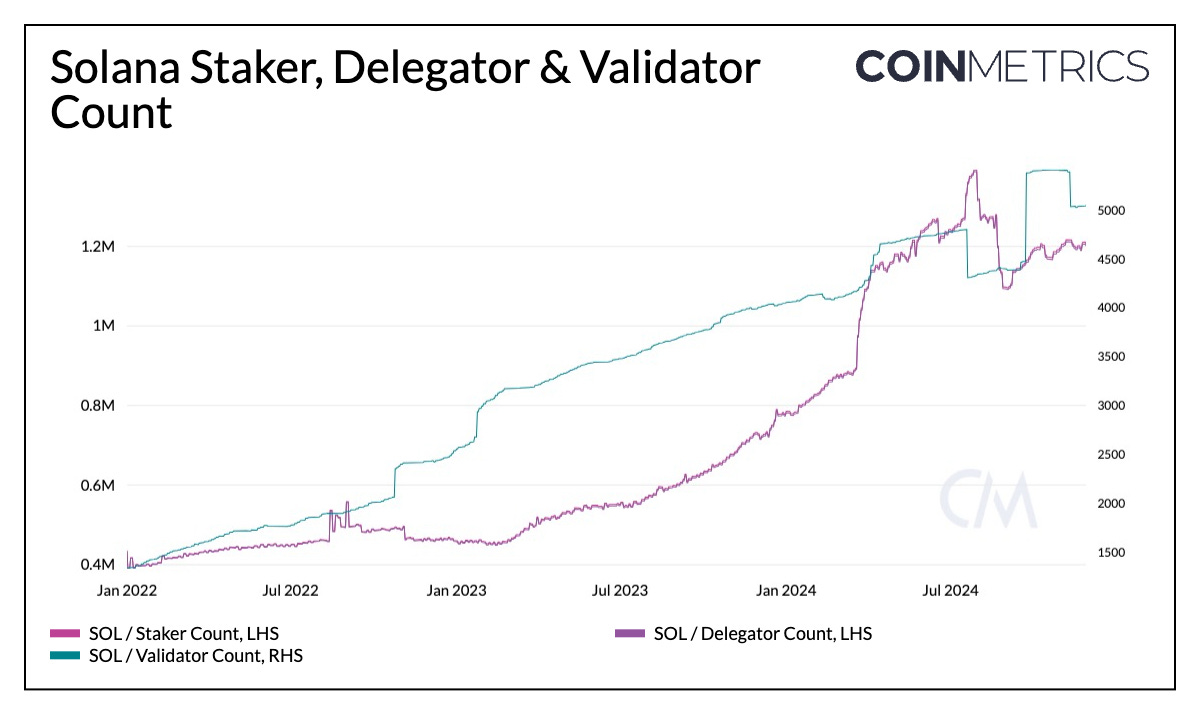

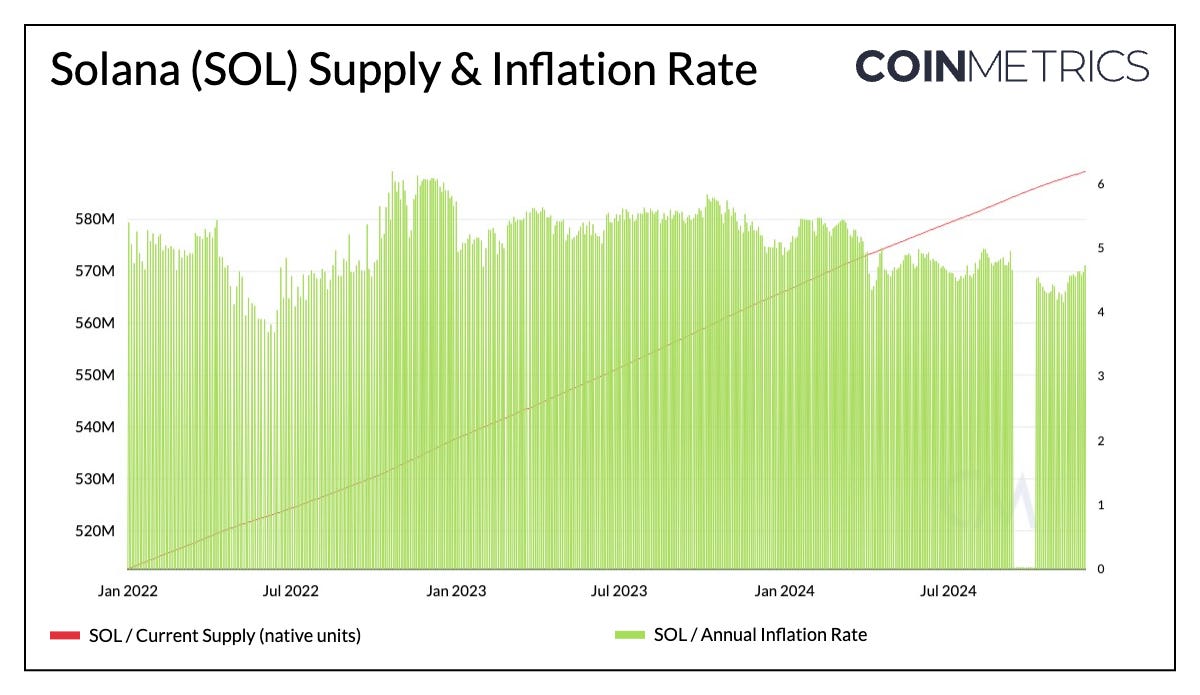

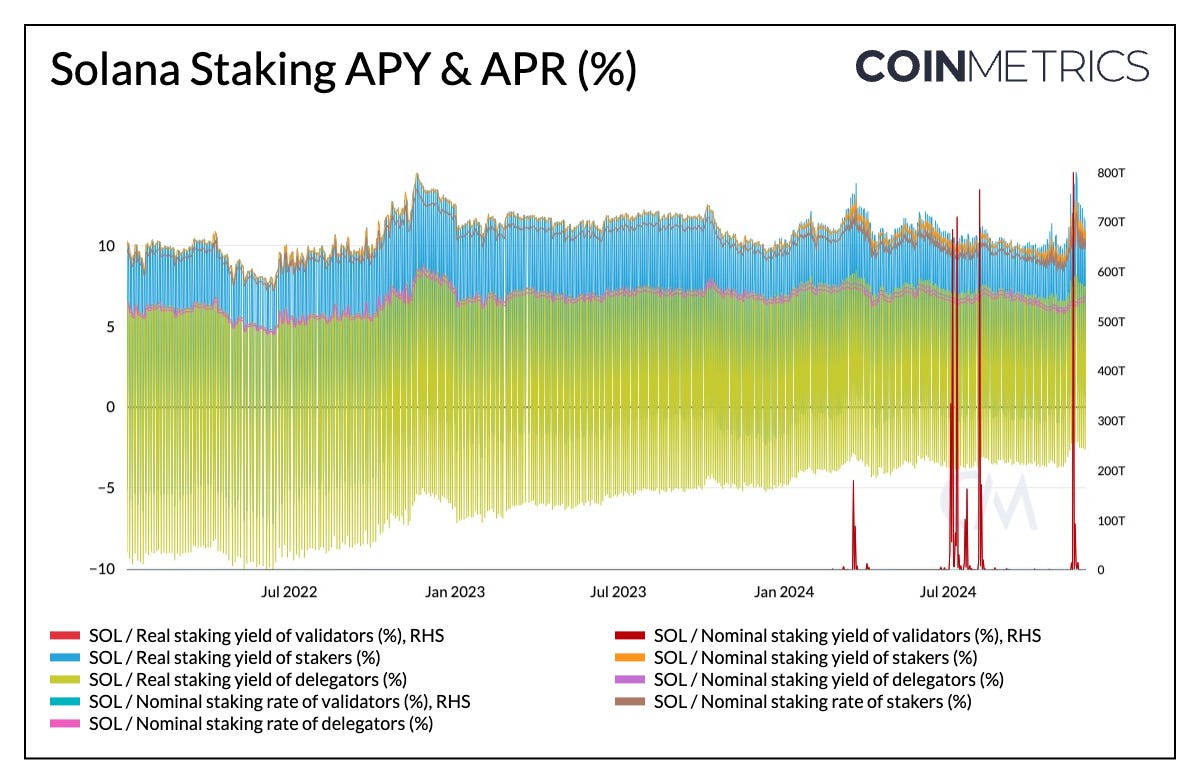

IntroductionEthereum and Solana are the two largest proof-of-stake (PoS) blockchain networks, each adopting different approaches to achieve consensus and secure their ecosystems. Both rely on staking, requiring participants to commit their native tokens, ETH or SOL, to validators who play a critical role in maintaining network integrity. To incentivize honest participation, stakers earn staking rewards, aligning their actions with the network's best interests. This yield enhances their appeal as cash flow generating assets, serving as the benchmark rate in the on-chain economy analogous to US Treasury bonds in traditional finance. In this week’s issue of State of the Network, we examine Coin Metrics’ new staking yield and inflation metrics to understand Ethereum and Solana’s staking mechanics and network economics, contextualizing their staking ecosystems. Ethereum Staking OverviewSince the introduction of the Beacon Chain (Consensus Layer) in December 2020, there is now 34.4M ETH staked on the Ethereum network. 28% of ETH’s current supply of 120.4M is staked (also referred to as the staking ratio), while 72% percent remains unstaked, in smart contracts and externally owned accounts. While Ethereum’s staking ratio grew rapidly from 14% to 28% after the Shapella upgrade, it has remained around 28% as demand for staking has cooled down. Source: Coin Metrics Network Data Pro To become a validator on the Ethereum network, participants must contribute 32 ETH as collateral or provide smaller denominations of ETH to staking pools or exchanges that manage the operational aspects of staking. This 32 ETH is also known as a validator's maximum effective balance, which is slated to change to a maximum of 2048 ETH in the upcoming Pectra upgrade. Ethereum currently has 1.07M active validators, a figure expected to decrease as validator consolidation occurs. Breaking Down Ethereum Staking YieldToday, the nominal ETH staking yield stands at 3.08%, while the real (inflation-adjusted) yield is 2.73%. Ethereum’s base staking yield has decreased over time as the amount ETH staked has increased. These rewards are derived from two primary sources, reflecting Ethereum’s modular design: Consensus Layer rewards and Execution Layer rewards. Consensus Layer rewards are earned by validators for their role in securing the network, including attesting to and proposing new blocks. These rewards are funded through newly issued ETH, contributing to the network’s inflation and form a more predictable source of revenue. Execution Layer rewards, on the other hand, are tied to the variability in blockspace demand, consisting of priority fees and Maximal Extractable Value (MEV). During periods of heightened activity, such as the increase in blockspace demand in March, real staking APY spiked to 6.2%, and over 5% on August 5th, 2024, driven by higher priority fees and therefore, execution layer rewards. Source: Coin Metrics Network Data Pro ETH Staking Yield as the On-Chain Benchmark RateStaking yield can be evaluated in nominal or real (inflation-adjusted) terms to assess returns from participating in Ethereum’s consensus process. This helps stakers or investors understand their true rate of return and compare it to holding unstaked ETH. More broadly, ETH staking yield serves as a benchmark rate for the on-chain economy, similar to how U.S. Treasury bond yields are referenced in traditional finance. It offers a way for comparing risk-free rates and staking yields, highlighting opportunities across on-chain and off-chain ecosystems. Source: Coin Metrics Network Data Pro This staking yield could further enhance ETH's appeal in investment vehicles like ETFs, as easing regulations potentially pave the way for staking based ether ETFs. ETH staking yield also underpins several DeFi primitives, such as liquid staking tokens, which serve as yield bearing collateral, as well as stablecoins such as Ethena’s USDe, and the restaking ecosystem (e.g., EigenLayer). Source: Coin Metrics Network Data Pro There is a close interplay between Ethereum’s economic design and staking incentives, which are shaped by network activity, transaction fees and ETH’s inflation rate. Higher network activity on mainnet and Layer–2’s increases transaction fees, which leads to more ETH being burned through the EIP–1559 mechanism, resulting in deflationary periods. When burning exceeds issuance, the inflation-adjusted yield becomes more attractive. Ethereum currently has a daily inflation rate of 0.00096%, annualized to 0.35%, as issuance slightly outpaces the burn. Solana Staking OverviewSolana operates under a “delegated proof-of-stake” (DPoS) consensus mechanism. This allows SOL to be staked by both validators and delegators (SOL holders who contribute their stake to validators). Together, these tokens form the validator’s “stake,” which determines their influence in the consensus process and their ability to validate blocks. In contrast to Ethereum, Solana has no minimum balance requirement to participate in staking. This low barrier to entry contributes to its relatively high staking ratio of 51%, with 297M SOL actively staked out of a current supply of 589M. Active stake is computed based on validators and delegators earning rewards in the most recent epoch, excluding those who did not receive rewards or exited prior to epoch end. Source: Coin Metrics Network Data Pro As a result, there are 1.22M stakers on Solana, of which 1.21M are delegators. However, the number of validators is substantially lower, at 5048 validators. This likely stems from the fact that running a Solana validator requires high performance infrastructure and a large SOL stake. The network operates on a leader-based consensus process, where a single validator is assigned to process blocks based on a rotating schedule. Leadership is determined by stake-weight, ensuring validators with more stake have greater influence. Source: Coin Metrics Network Data Pro Solana Inflation and Staking Yield DynamicsSolana uses an inflationary model to distribute staking rewards, issuing SOL every epoch (roughly 2-3 days). This leads to the “spiky” nature of new issuance seen below in the chart. Inflation began at 8% in 2021, is set to decrease by 15% annually and currently stands at 4.7%. Staking yields are primarily derived from inflationary rewards distributed on this schedule, supplemented by 50% of base fees, all priority fees, and MEV. It's also worth noting that 92% of all stake on Solana utilizes the Jito validator client, which provides validators with additional, out-of-protocol economic incentives through tips. While Solana has also seen growth in liquid staking with protocols like Jito and Marinade, their adoption remains less prevalent compared to Ethereum. Source: Coin Metrics Network Data Pro Solana nominal staking APY is currently 11.5%, while real (inflation-adjusted) APY is 12.5%. These yields have risen recently, driven by a surge in priority fees in November as network activity picks up on Solana. As shown in the chart below, delegators earn a lower yield (~6.7 currently), receiving rewards only from new issuance, whale validators benefit from issuance, fees, commissions charged to delegators and their self-staked SOL. This structure highlights the additional incentives for running a validator, which comes with higher operational costs, favoring validators with the largest stake. Source: Coin Metrics Network Data Pro ConclusionEthereum and Solana's staking mechanisms reflect their different design philosophies. Ethereum’s modular architecture separates execution and consensus, while Solana’s delegated proof-of-stake (DPoS) model integrates these functions with high-performance infrastructure. This leads to Solana having lower validator counts but a higher staking ratio, driven by a low barrier to entry for delegators. As the Ethereum and Solana network mature, their staking ecosystems and economic models will evolve, shaping network usage, issuance, and staking yields to meet the growing demands of their ecosystems. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

MicroStrategy’s Bitcoin Mega Strategy

Tuesday, November 26, 2024

Analyzing MicroStrategy's Bitcoin holdings, acquisition strategy, and its role as a leveraged proxy to BTC. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Data-Driven Update on Stablecoins

Tuesday, November 19, 2024

An update on the stablecoin landscape, growing supply and stablecoin trading volumes, on-chain usage and yield generation ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Election Bull Run From the Perspective of Options Markets

Tuesday, November 12, 2024

An analysis of options to take a closer look at the election bull-run that brought BTC prices to $85000 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crypto Market & Polymarket Dynamics Heading into Elections

Tuesday, November 5, 2024

Coin Metrics' State of the Network: Issue 284 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Polymarket and the Power of Collective Intelligence

Tuesday, October 29, 2024

Coin Metrics' State of the Network: Issue 283 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏