Hot in Enterprise IT/VC - What’s 🔥 in Enterprise IT/VC #424

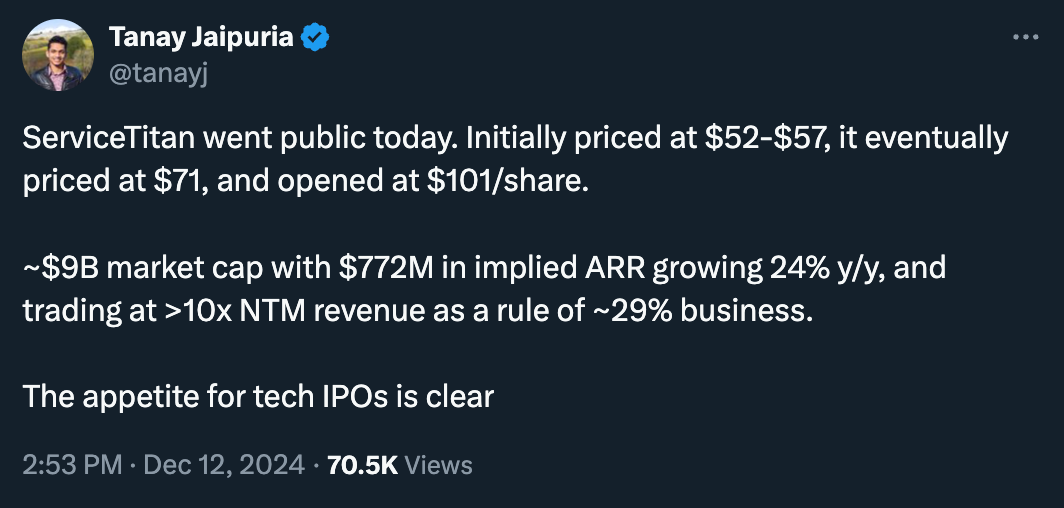

What’s 🔥 in Enterprise IT/VC #424SaaS T2D3 (Triple-Triple-Double-Double) over for now? Do we have a new AI bar - QQTD(Quintuple-Quadruple-Triple-Double) or QQ?? as we don't know if this is sustainableI’m back from a long week in London visiting portfolio companies, meeting new founders, and speaking at a VC Summit hosted by one of our LPs, Vintage Investment Partners. The overall mood was electric 🔌 and when hanging with some of my peers in the VC industry, the question of insane valuations kept coming up. Are these sustainable and are they real? Or did we not learn from ZIRP? Before sharing my thoughts, let's begin with an image from the streets of London – could there be a more perfect city to get you in the holiday spirit? Speaking of the holiday spirit, let’s all be thankful for ServiceTitan’s IPO! This may be the holiday gift we all needed heading into 2025 - the 10X NTM multiple for a company losing money 🤔. The lack of liquidity is a topic we certainly hit on the “State of Seed Panel” at the Vintage Summit. I believe this is me going down the rabbit hole discussing the barbell-ification of Inception rounds or seed, a topic I’ve written about extensively. Either you have first-time founders who want to raise as little as possible to get started like a CrewAI in our portfolio - initial round of $2M before raising a total of $18M including the most recent Series A. Or you have second- and third-time founders raising, well, as much as they can to an extent - let’s call this the jumbo-ification of Inception with rounds >$10M and upwards of $20M+. Smaller seed firms need to clearly pick a swim lane- do I compete on small rounds only or go head-to-head with the multistage firms leading these $8-10-20M rounds? Well, you know my answer - if you have the will and brand and experience, then by all means you should compete with the larger funds and back those second and third timers…as long as you think the valuation premium at Inception leads to that elusive, HUGE multi-fund returning outcome. If interested in deeper thoughts on this topic, check out the recent podcast I did on Turpentine VC with Erik Torenburg.

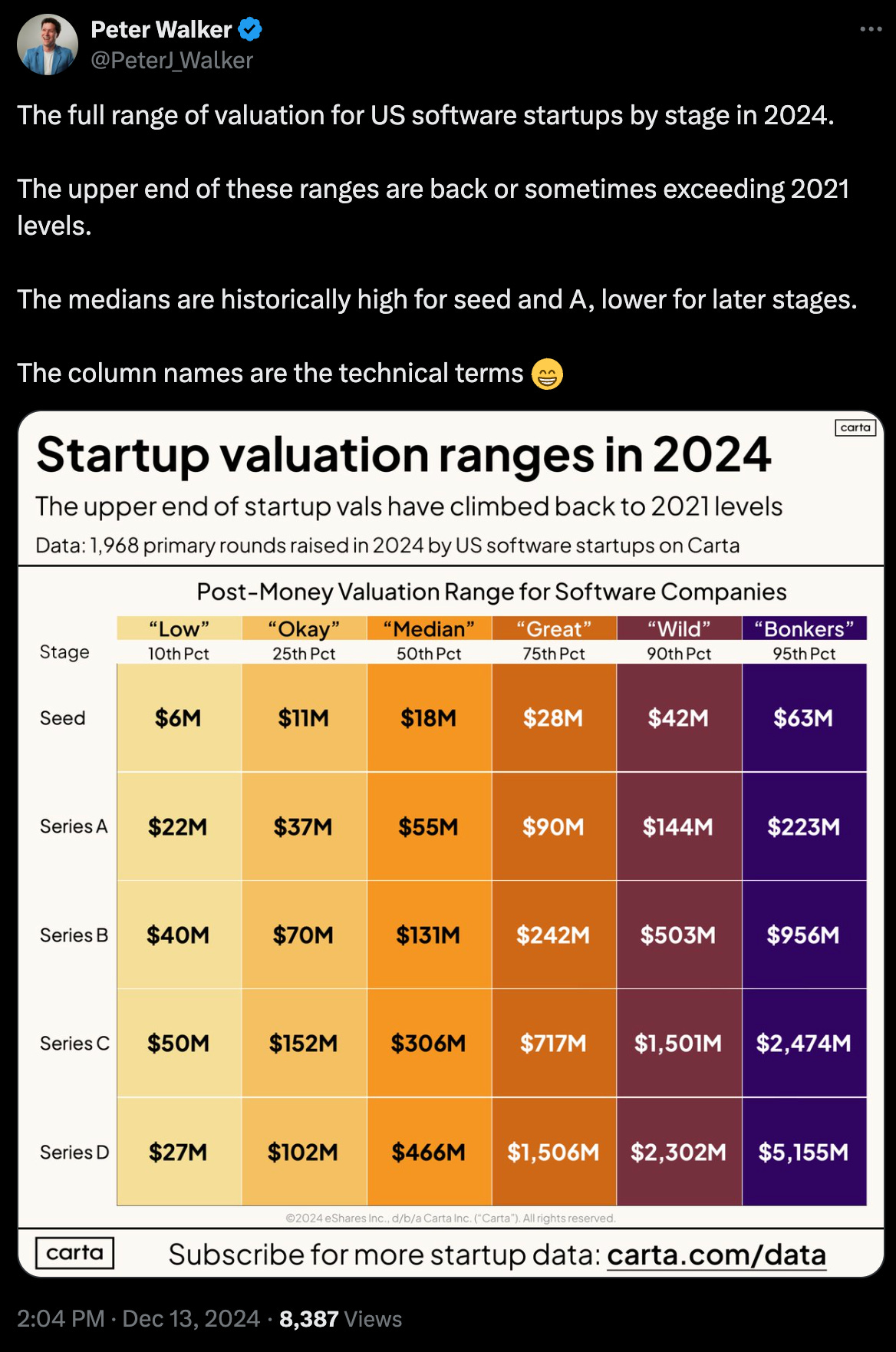

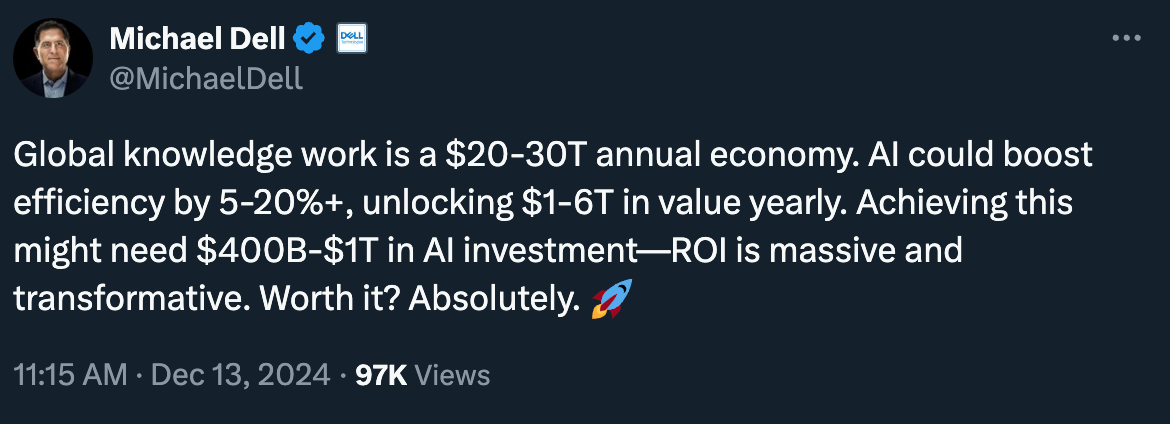

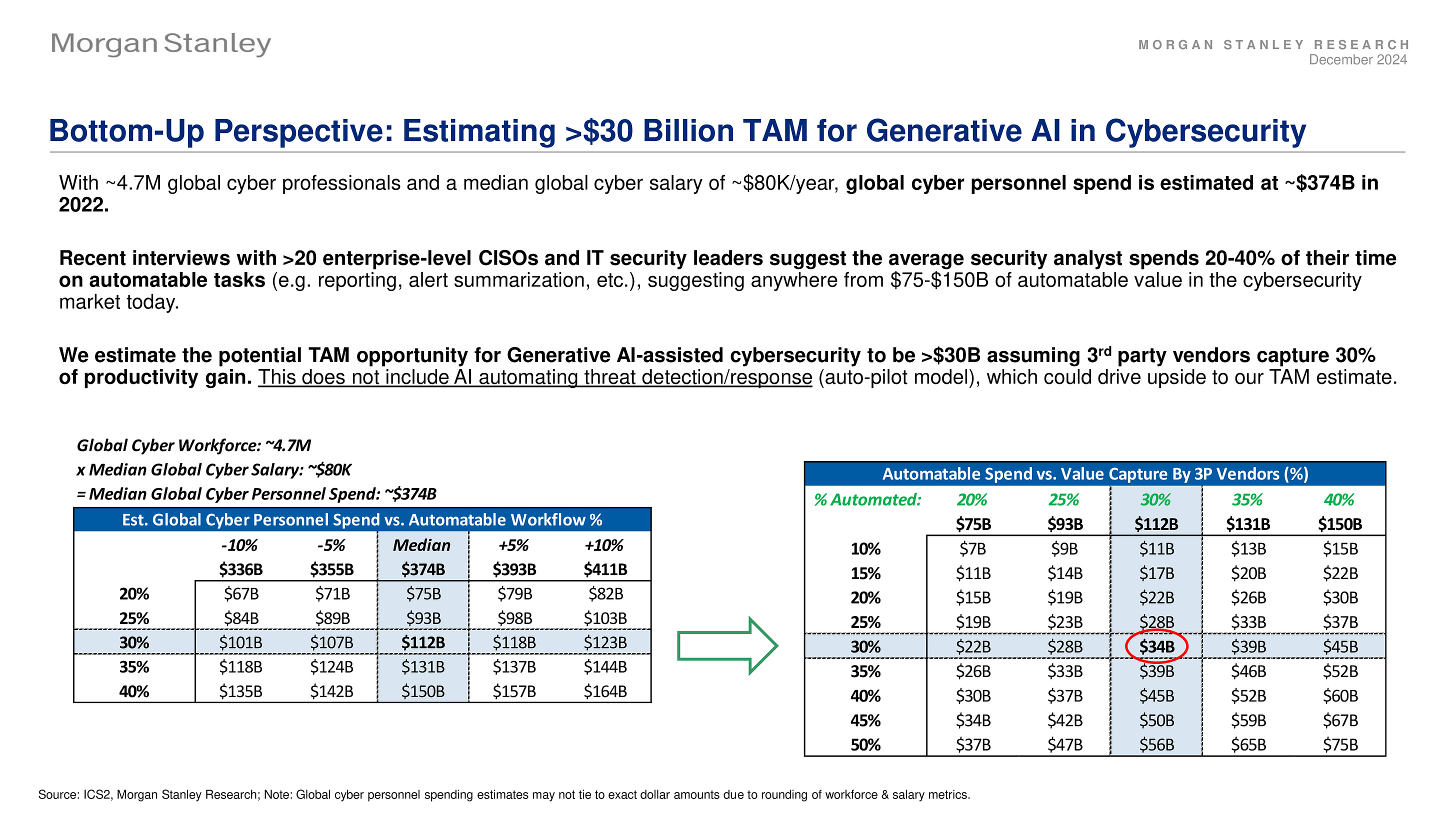

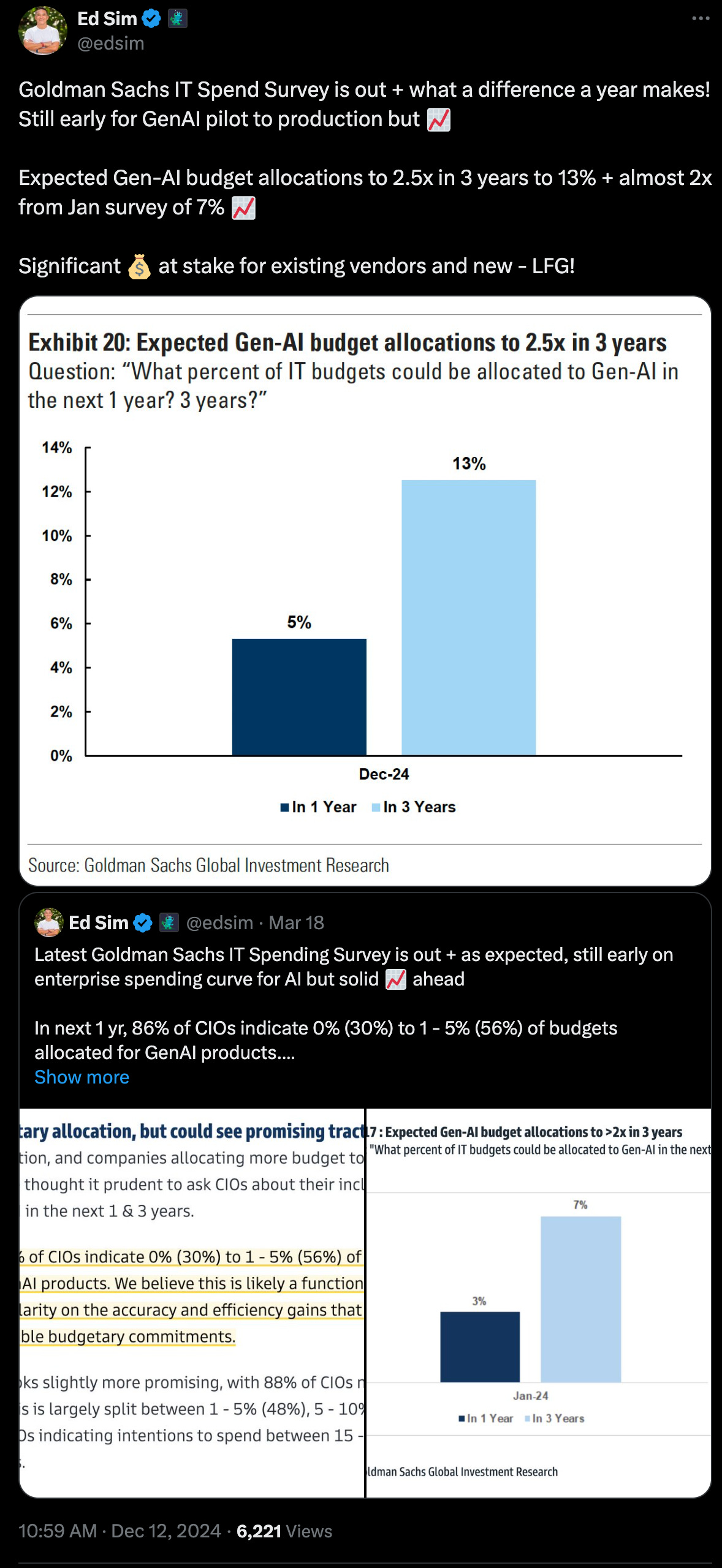

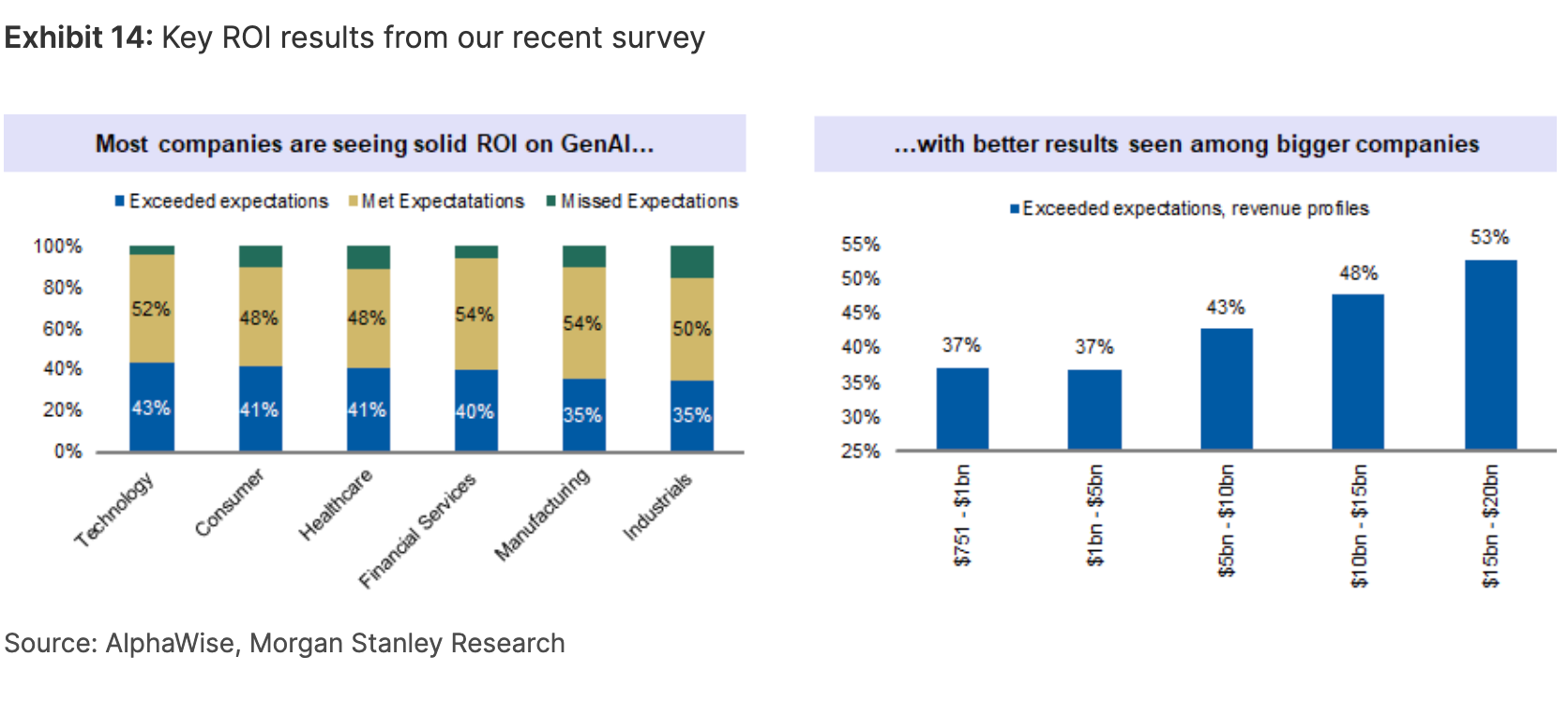

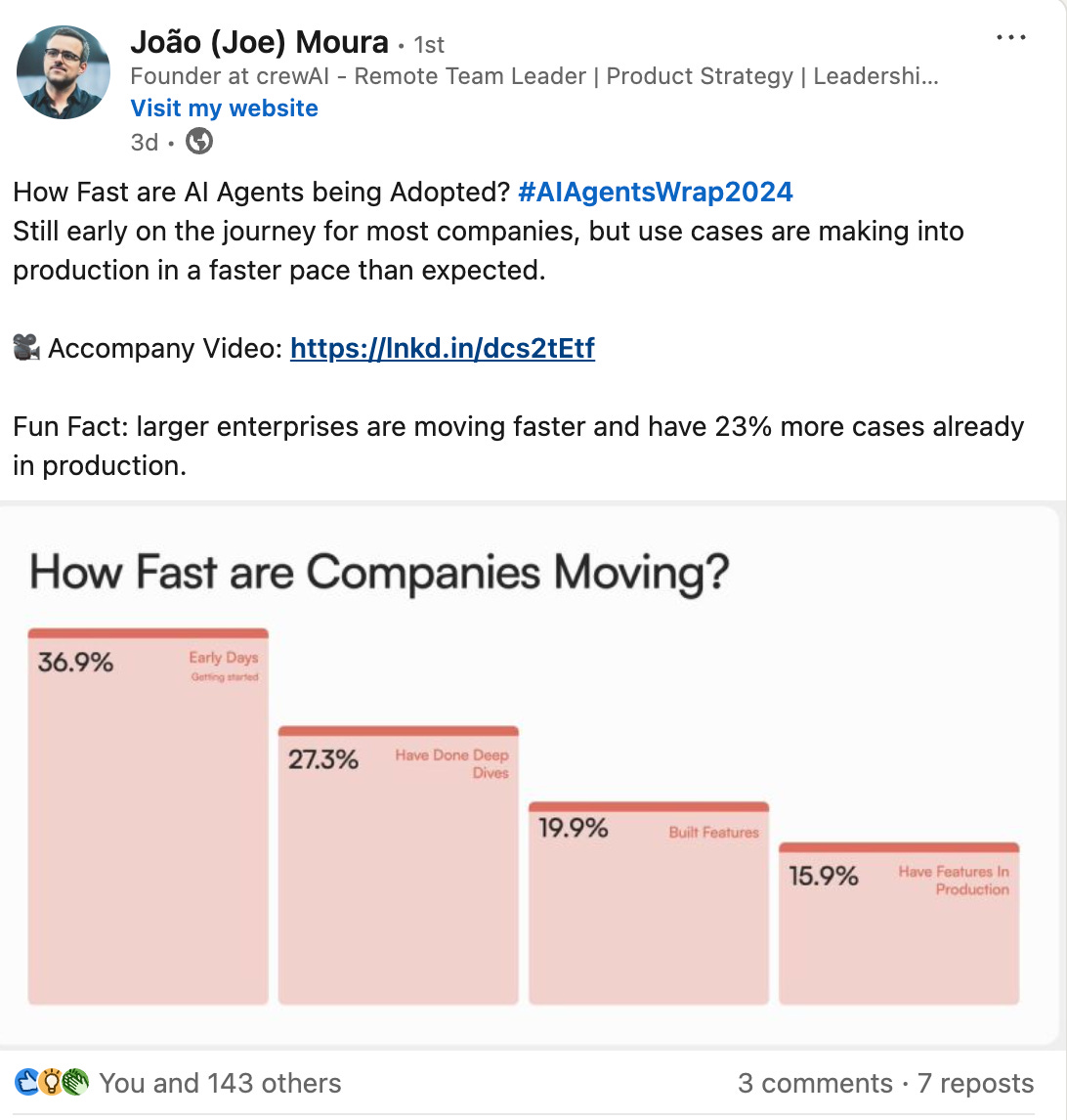

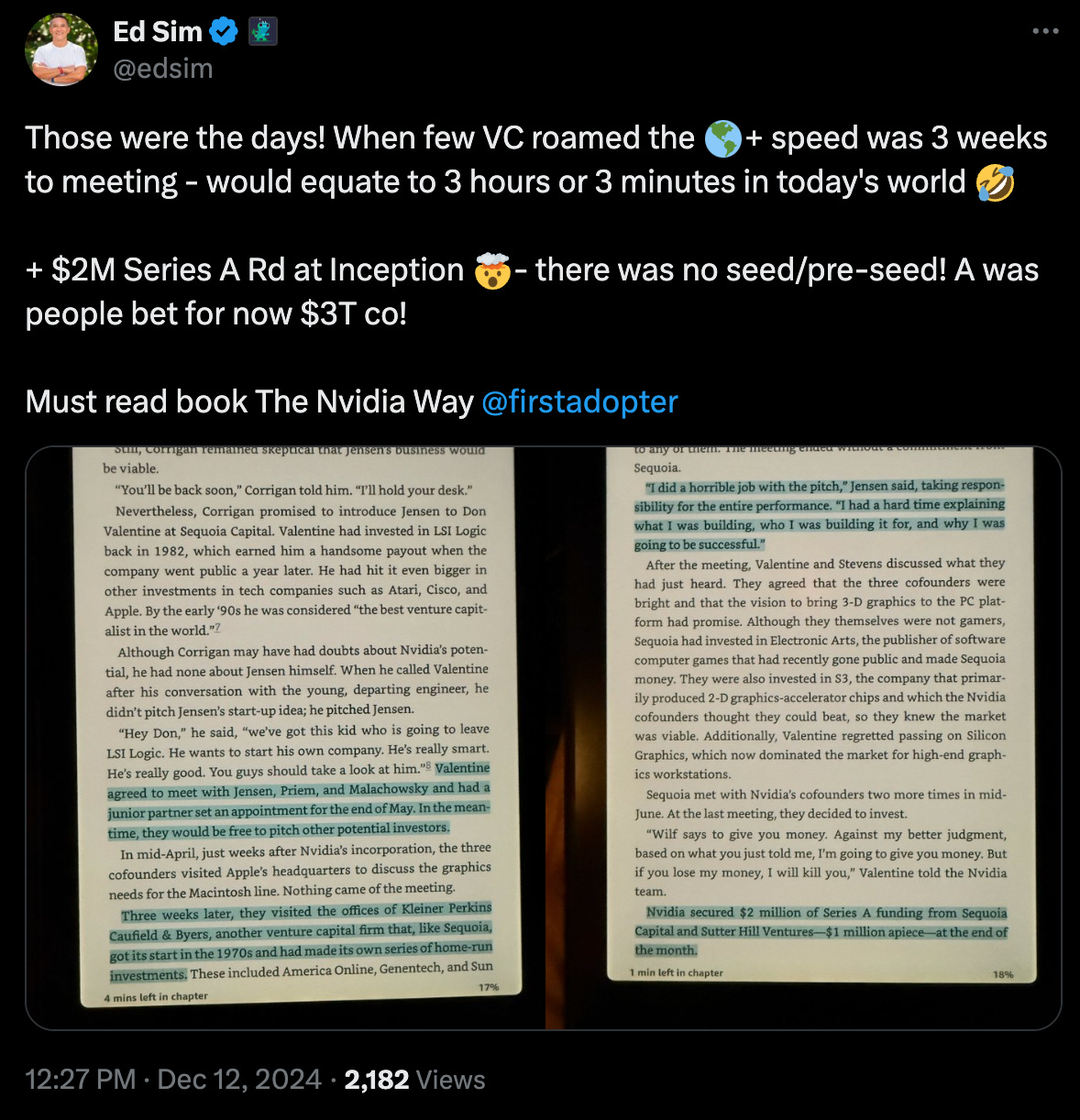

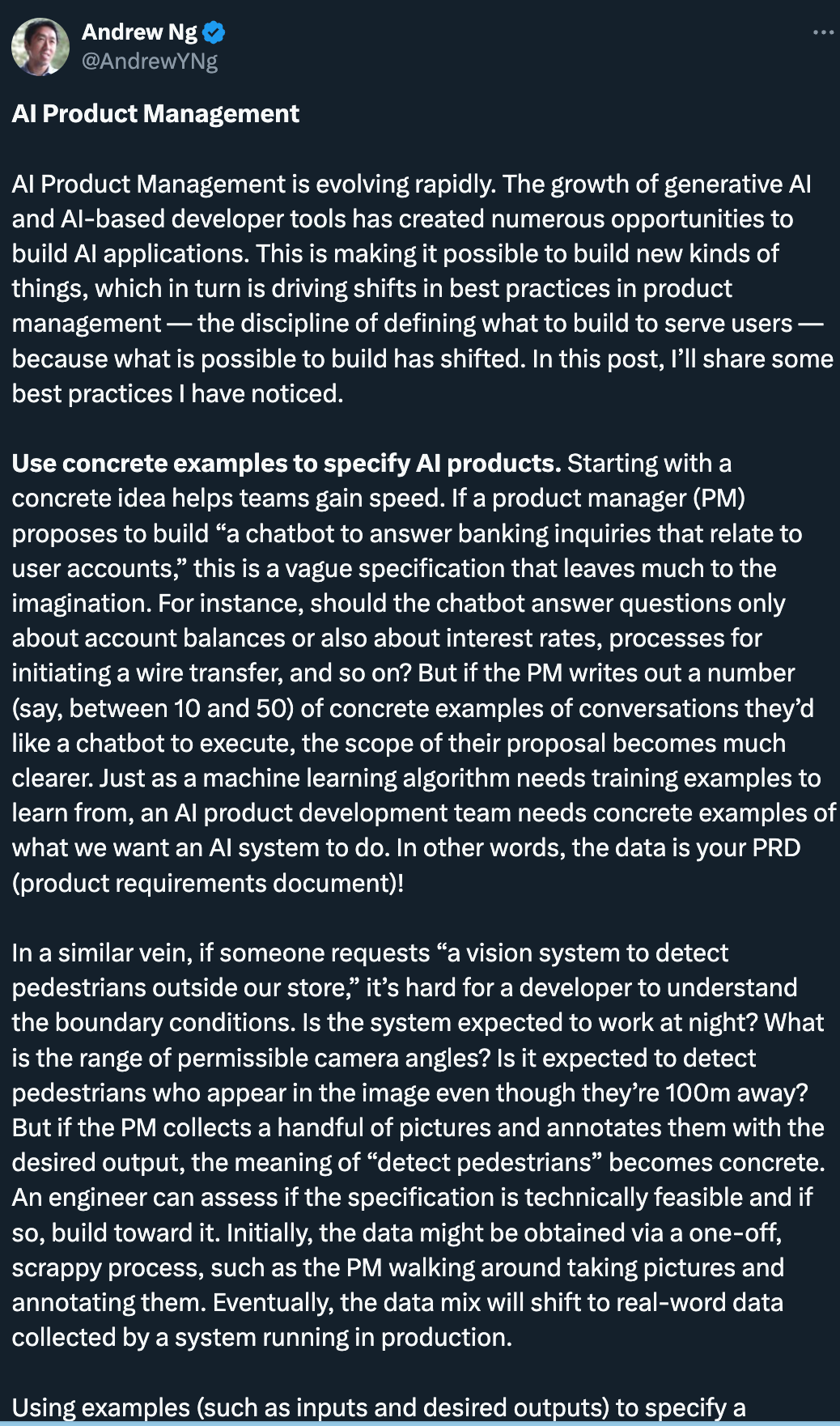

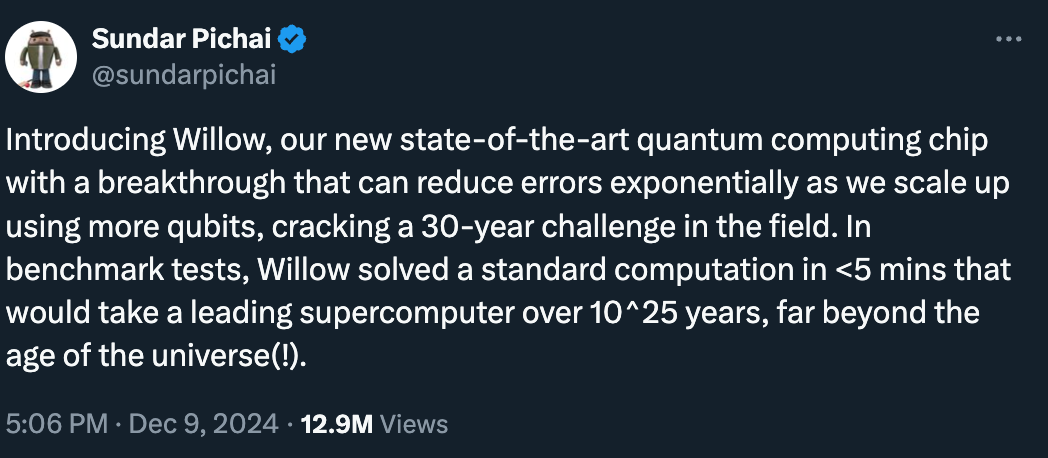

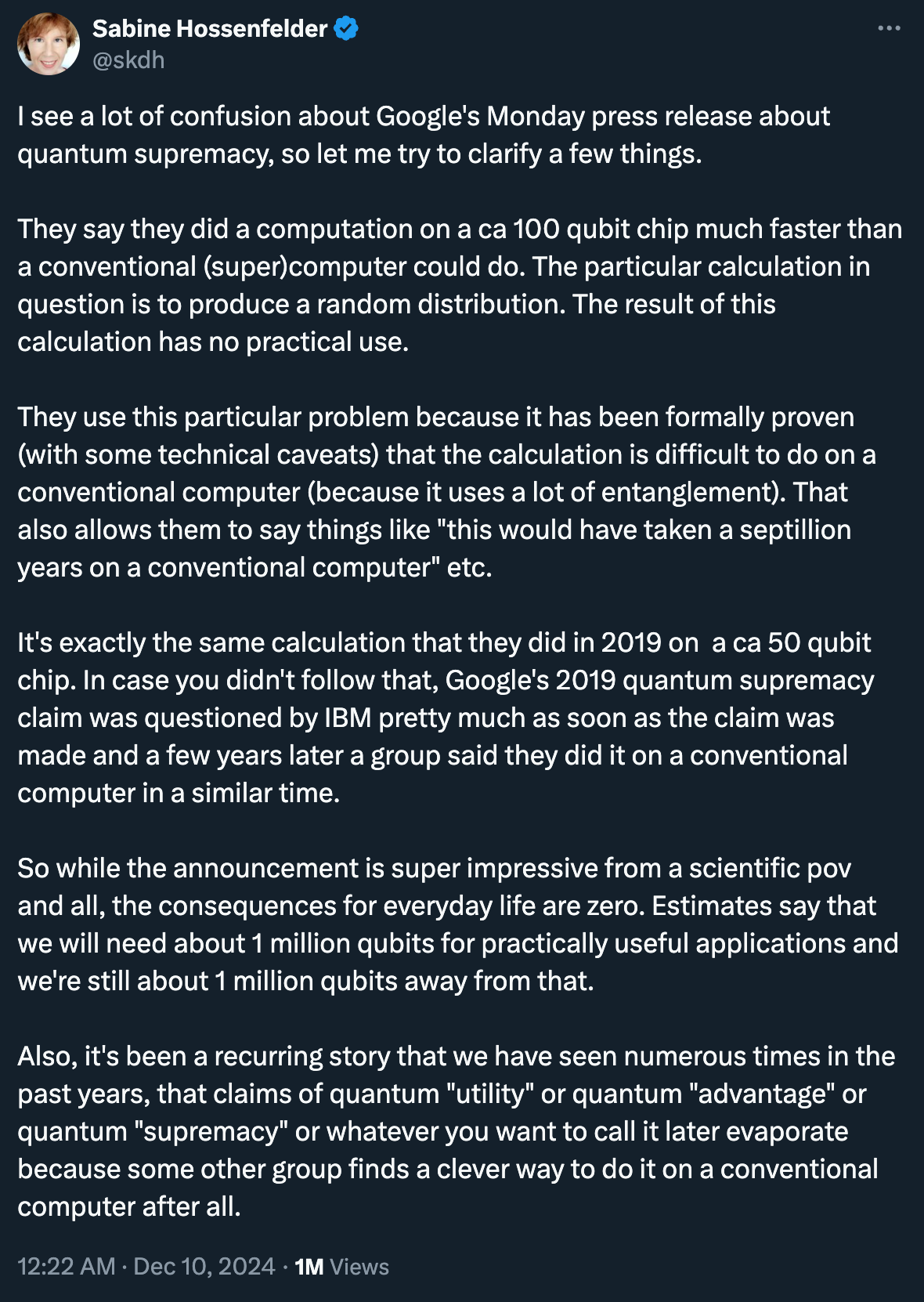

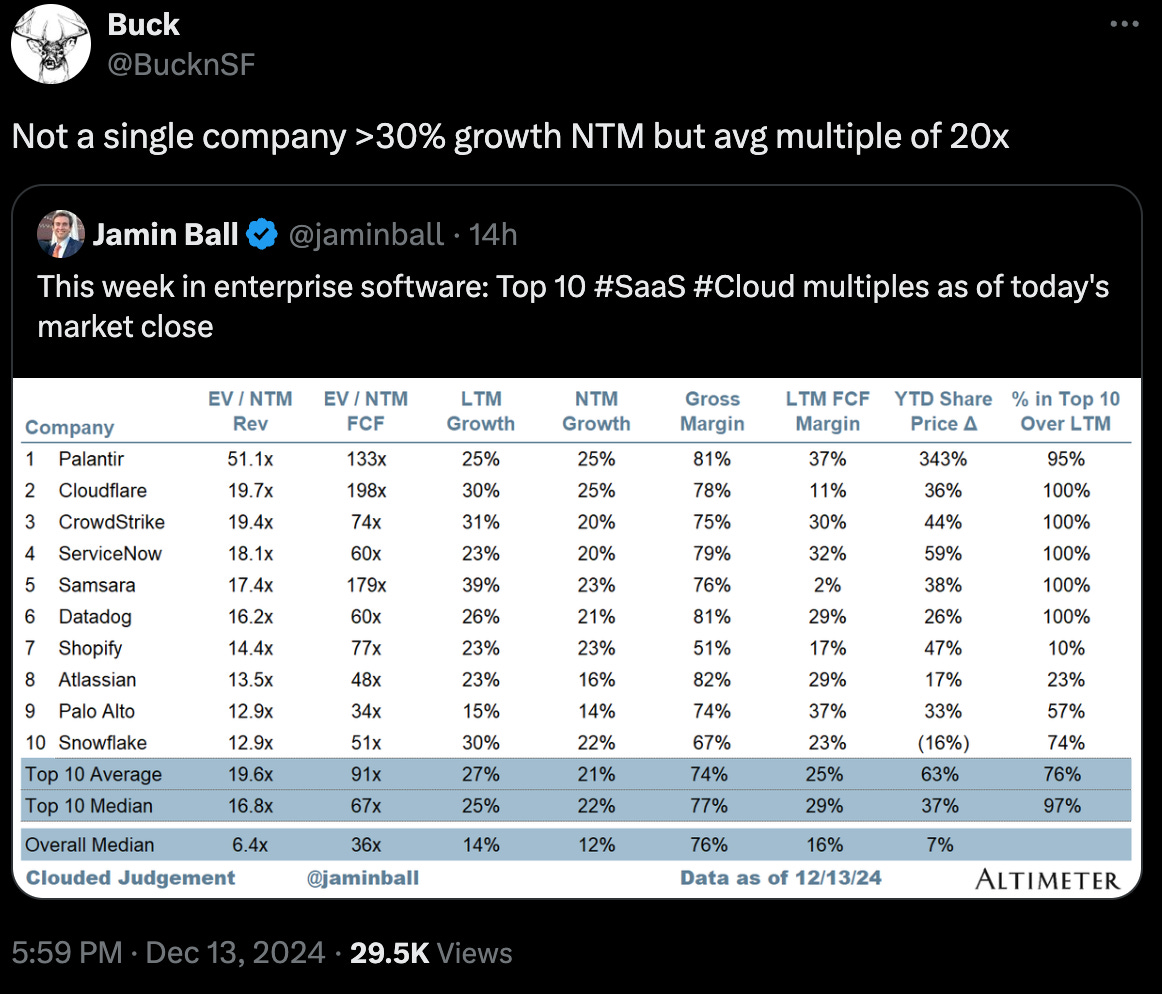

While not the destination and just part of the journey, the question on many founders’ and investors’ minds is are these massive A round valuations insane or justified and why are they happening? At the end of the day, it comes to down to belief - what is the evidence at this stage that will allow me to believe the outcomes 10+ years from now will be Ginormous - it’s either the people or the execution and when it’s both, then holy cow. Since multistage firms are moving earlier and earlier in the lifecycle and aggressively racing to be first on the cap table, they can just come in at the A which is still early and pay up. Just look at the “bonkers” valuations from Pete Walker. Whether this all becomes true in terms of real DPI and 100x liquidity is a question we will all have to learn over the next 5 to 10 years. One other thought - on the “executing mad” side of the world, the elusive Triple-Triple-Double-Double used to be the gold standard for SaaS startups. My friend Neeraj Agrawal from Battery Ventures coined this term back in March 2015 - here’s the original post if interested. But based on the data points below, those days seem to be long over - perhaps we should have a new term for AI startups. I believe we’re entering the world of Quintuple-Quadruple-Triple-Double or QQTD or will it be QQ?? as we don’t know how strong the lock-in effects are and it’s too early to determine churn. For example - growth "📈 but how sustainable? Bolt apparently getting term sheets at $1B post… Or… Or Anysphere - from $0-$4M-$48M in one of most competitive spaces for AI Coding Assistants Who’s right? IMO, this is the biggest question in venture - will these massive forward multiples be justified? If 👇🏼 is true, how much of this 💰 is captured by startups - if AI is just eating into existing SaaS that's nice and a titanic reshuffling of revenue between cloud software companies, but if what Michael Dell says becomes reality, if agents can eat into labor, then we have a massive 📈 ahead. Here’s an example - could agentic workflows and AI truly capture some of this labor value in cybersecurity (from Morgan Stanley December cybersecurity report) Math is $374B of personnel spend for cybersecurity professionals globally of which 20-40% could be automated which means $75-150B of value and assuming 30% capture of productivity gain from AI equals $30B alone 🤯! Now multiply this across a number of industries and you get what Michael Dell is talking about. Here’s more data to get you 🔥 up for an exciting 2025. According to Morgan Stanley, the ROI from GenAI is real and even stronger the larger the company! CrewAI shares some data here as well confirming the above - larger enterprises are moving faster and have 23% more cases already in production using the CrewAI framework! The urgency is there for agents! As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups#👇🏼 must read - The Nvidia Way by Tae Kim - some great anecdotes and big bets made while avoiding bankruptcy many times #💯 #great summary of what LPs (Limited Partners) who invest in venture funds #what’s trending with YC and a16z - FWIW, as Inception investors we don’t presume to see the future - we need the technical founders to tell us what they see, usually born out of many years of pain that they finally decide to automate - seeing lots of amazing founders now… #features that are remembered deliver are fun and delightful - Rahul from Superhuman (a portfolio co) shares how to build these Enterprise Tech#👇🏼 what’s ahead for LLMs from Ilya - watch this video #pretty insane demo of Google Gemini 2.0 #must read for anyone building AI into their apps…how to do AI product management to maximize results and also prototype and test without engineers - click below for full post #ways to price your AI Agents - FWIW Kustomer, a portfolio co, went to full “work-based pricing” with a price per conversation model - I still think way too early to tell what wins and will vary by industry and some of it becomes difficult to track like charging on a percentage of how much you save for someone… #OpenAI’s infra providers (The Information) #👀 Google Quantum is here - “solved a standard computation in <5 mins that would take a leading supercomuter over 10^25 years, far beyond the age of the universe 🤯” however, don’t be so alarmed #Why Google lab is called Quantum AI - what’s in store for the future? #cloud security is 🔥 as Upwind raised $100M at a $900M valuation - what’s most interesting to me is the article says it is up 3X from the initial seed round implying a $300M post-money Inception round! Upwind, unlike the Wiz, is all about runtime protection versus just posture management but of course that has all changed as Wiz bought Dazz #Great list from CRN on 10 🔥 Cloud and AI Security Startup of 2024 - congrats to port cos Protect AI and dope.security #how do AI coding assistant startups make 💰? Enterprises of course…here’s Codeium on some price changes and why enterprise means individual devs can get super cheap usage how about poolside - designed for enterprise from day 1 (see blog post on AWS partnership) poolside was built for enterprise from day 1 given our ability to deploy on our customers’ side, and our focus on prioritizing governance requirements and data privacy needs. At poolside we don’t use customer data to train our foundational models – and we can do so thanks to our approach to improve models via Reinforcement Learning From Code Execution Feedback, or RLCEF. It allows us to push past the limit of available code and reasoning data 1, generating synthetic training data at scale. This gives our customers the best of both worlds: sophisticated models in their developers’ hands, with the assurance that their most important asset – their data – stays private. #open source foundational models 🔥 #TradFi strikes back - I’m witnessing this first hand - who is going to provide all of the infra for them - wallets, staking, tracking, security? (Bloomberg) Markets#Multiples for Top 10 📈 but big difference during ZIRP era is profitability of these cos - that being said, growth is still valued more highly than profitability, but point is Wall Street is rewarding these best-in-class cos with premium multiples #🤦🏼♂️ 💩sign of the times What's Hot 🔥 in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot 🔥 in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What’s 🔥 in Enterprise IT/VC #423

Tuesday, December 10, 2024

How do CIOs/CTOs/CISOs from Salesforce, Blackstone, Paypal and Juniper think about partnering with startups + AWS re:Invent recap ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #422

Saturday, November 30, 2024

The continued rise of Jumbo Inception Rounds 📈, the importance of ball control 🏀 in winning rounds, and how Inception/seed firms need to decide what game to play and what fund size is right ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #421

Saturday, November 23, 2024

Thoughts from Goldman's PICC + optimism for 2025? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #420

Saturday, November 16, 2024

Why we wrote our largest initial Inception check of $12.5M in Tessl to build AI Native Software Development - what this means for Inception/seed fund sizing? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #419

Saturday, November 9, 2024

To believe or not to believe, that is the question - AI is eating software but will it also eat labor? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

⏰ 72 hours left - grab your seat and change your business forever

Thursday, March 27, 2025

We've taken the most game-changing, highly rated sessions and packed them into one powerful day. Hey Friend , The Ecommerce Product Sourcing & Manufacturing Summit Highlights goes live in just

SaaSHub Weekly - Mar 27

Thursday, March 27, 2025

SaaSHub Weekly - Mar 27 Featured and useful products todo.vu logo todo.vu todo.vu combines task and project management with time tracking and billing to provide a versatile, all-in-one productivity

81 new Shopify apps for you 🌟

Thursday, March 27, 2025

New Shopify apps hand-picked for you 🙌 Week 12 Mar 17, 2025 - Mar 24, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Draft Orders automatically removed after 1 year of

🧠 This Week in GrowthHackers: AI Advances, SEO Strategies & Market Shakeups

Thursday, March 27, 2025

Key updates from OpenAI, Databricks, and Tesla—plus tools and how-tos to sharpen your growth edge..

Investors Guides: The Full Series + Exclusive Cheat Sheet

Thursday, March 27, 2025

Tactics from 50 elite investors on finding breakout companies, winning deals, and constructing enduring firms. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

the drug R&D playbook

Thursday, March 27, 2025

AI is rewriting the rules across the entire R&D pipeline. here's what you need to know. Hi there, The drug R&D playbook is being rewritten. Join CB Insights' Senior Analyst, Ellen Knapp

Sneak Peak Of My Latest Podcast & PH Hunt

Thursday, March 27, 2025

Hey everyone 👋 how have you been? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

That magic moment

Thursday, March 27, 2025

Read time: 57 sec. You ever had a moment where something just clicks? Zach, one of our AI Build Accelerator members, dropped this message in Slack the other day: “Had a pretty surreal moment yesterday.

📂 NEW: Factory Models

Thursday, March 27, 2025

👀 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Today's featured projects in 10 words

Thursday, March 27, 2025

Today's projects: Copyshake • Alpha Sender • Level Up Game Plan • PhotoJoy • AuthoredUp • TAG • WebToApp • Mitzu • Interior AI 10words Discover new apps and startups in 10 words or less Copyshake: